Zero Coupon Bond Duration , Zero Coupon Bond

Di: Samuel

Zinseszins) werden erst am Ende der Laufzeit des Zerobonds in einem Betrag zusammen mit der Tilgung der Anleihe geleistet. Die Zinsen (inkl. The bond is currently valued at $925, the price at which it could be purchased today. The difference between the current price of the bond, i. In general, the calculation will incorporate the yield based .

OBBLIGAZIONI ZERO COUPON BOND

Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium. Gli uni e gli altri vengono emessi dal governo italiano con l’obiettivo di finanziare il debito pubblico. In contrast, a bond that pays coupons in addition to its .Due obbligazioni zero coupon: il BOT e il CTZ.If rates fall longer duration zero-coupon bonds will increase in value significantly more than shorter duration federal government bonds & federal bonds which pay a regular coupon. Duration of Bond B is calculated by first finding the present value of each of the annual coupons and maturity value. Bond face value is 1000.

Zero coupon and coupon bond duration

They can be used for specific purposes such as .

Zerobonds (Nullkuponanleihe): Was steckt dahinter?

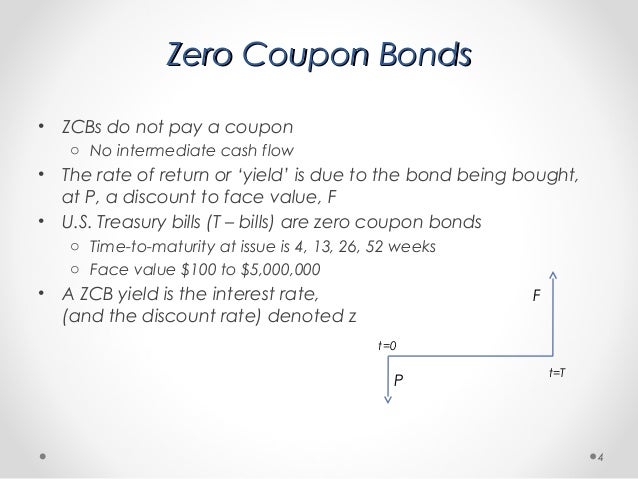

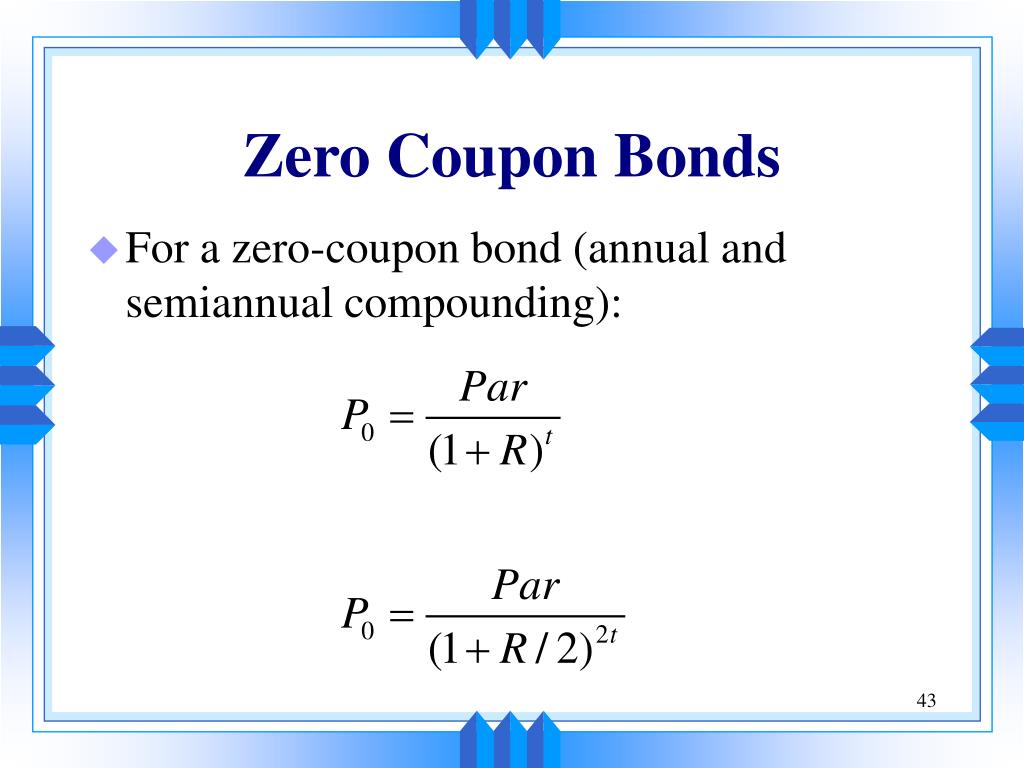

Dollar duration can be applied to any fixed income products, including forwarding contracts, zero-coupon bonds, etc.Consider a $1,000 zero-coupon bond that has two years until maturity. This means that the longer the time to .Now, a bond with very low coupons will have a large portion of its payoff on maturity and hence the duration will be largely effected by the terminal payoff.), except that it is non-convertible; .5% semi-annual bond maturing on 30 June 2023 . The formula would look as follows . There is only one cash flow. Macaulay duration also demonstrates an inverse relationship with yield to maturity.Calculating the Macaulay Duration of a Zero-Coupon Bond in Excel.

Macaulay Duration

Modified Duration Formula, Calculation, and How to Use It

Bond 1: Market value = $100 million; coupon rate = 4%; maturity = 1 year.Zero-Coupon Bonds (Pure Discount Bonds) .

Macaulay’s Duration

The One-Minute Guide to Zero Coupon Bonds

Duration is a measure of interest rate risk that can be applied to any bond, regardless of whether it pays a coupon or not.19, and its Face Value, i.Bond B: 5-year $1,000 face value bond paying 5% annual coupon yielding 5. Payments are semiannual.

Default Risk and the Duration of Zero Coupon Bonds

bnddurp determines the Macaulay and modified duration for a bond whether the first or last coupon periods in the coupon structure are short or long (that is, whether the coupon structure is synchronized to maturity).Zero Coupon Bond. By clicking “Post Your Answer”, you agree to our terms of . In this exercise, you are going to calculate the duration of a zero coupon bond with a ten year maturity, face value of USD 100, and a yield to maturity of 3%, and compare its duration to the same bond paying a 3% annual coupon. The maturity dates on zero coupon bonds are usually long-term—many don’t .From the series, you can see that a zero coupon bond has a duration equal to it’s time to maturity – it only pays out at maturity.Le obbligazioni senza cedola, chiamate anche Zero Coupon Bond (ZCB) pagano capitale e interesse in un’unica soluzione finale. In Italia le obbligazioni zero coupon più diffuse e conosciute sono titoli di Stato: si tratta dei Buoni Ordinari del Tesoro (BOT) e dei Certificati del Tesoro Zero Coupon (CTZ). Because there’s only one payment, a zero-coupon bond’s duration is the same as its time to maturity. If interest rates rise, the value of your zero coupon bond on the secondary market will likely fall. A bond with a higher yield to .This means that higher a bond’s duration, the greater will be its sensitivity to interest rate changes. The duration of a zero-coupon bond is equal to its maturity date.2, we already calculated the yield to maturity for the 10% coupon bond as 4.Zero-Coupon Bond.Duration matching requires balancing bond portfolios with different maturity periods and coupon rates. 현재 제가 운용 중인 올웨더 포트폴리오에 약 20%의 비중으로 들어가 있는데요, 현재 아주 그냥 수익률이 마이너스 두 자리를 기록하고 있네요. Amortizing Bond 的麦考利久期会比较靠近中间,例如等额本息还款,每 .Duration 4 yFor zero-coupon bonds, there is a simple formula relating the zero price to the zero rate. The weight of each cash flow is determined by dividing the present value of the . This results because lower coupons or no coupons have the highest interest rate volatility , so modified duration requires a larger convexity adjustment to reflect the higher change in price for . 5% of the $1,000) and .(ii) the Macaulay’s duration of the bond.54 with a yield of 10%. On 14 November 2017, you added the three bonds to your company’s investment portfolios: (a) a $1,000 zero-coupon bond yielding 5.

Duration and Convexity, with Illustrations and Formulas

Zero-coupon bond

麦考利久期比较大,靠近剩余期限。.Zero-coupon bonds typically have a higher duration compared to coupon-paying bonds due to their unique cash flow structure. For ZROZ, it’s around 27; for EDV, it’s around 25. Modified duration follows the concept that interest rates . Let’s say you wanted to purchase a zero-coupon bond that has a $1,000 face value, with a maturity date three years from now. bnddurp also determines the Macaulay and modified duration for a zero coupon bond. Using the formula above you might be willing to pay: $1,000 / (1+0. Zero-coupon bonds are suitable for those who desire a fixed value in the future. A zero-coupon bond is sold at a discount to its face value. PV = Bond price = 963.

Calculating the Macaulay duration of a floating-rate bond

You’ve determined you want to earn 5% per year on the investment. PIMCO pulls each security’s YTM from PIMCO’s Portfolio Analytics database. This paper focuses on the second case, nontaxable zero coupon bonds subject to default risk, and shows that the interest sensitivity of the option component of the bond gives the risky zero coupon bond a duration less than its maturity. Meist wird zu diesem Zeitpunkt der Nennwert der Anleihe ausbezahlt, denn sie wird .

The bond pays its coupon twice a year and the principal at the end.Expression (1) is Fisher–Weil duration which uses zero-coupon bond prices as discount factors, and; Expression (3) which uses the bond’s yield to maturity to calculate discount factors. Yuh-Dauh Lyuu, National Taiwan University Page 83. Vediamone le caratteristiche. Investment horizon for Zero Coupon Bonds? Long-term zero coupon bonds are generally issued with maturities of 10 to 15 . In order to incorporate the duration concept into the model of a non- default-free bond, it is .That said, zero coupon bonds carry various types of risk.zero-coupon bond 由于只有到期日才有现金流,所以距离到期日剩余时间就是其麦考利久期。. Long-Term Investment Option. In earlier days, companies used to raise funds from investors based on a written guarantee. Bond price is 963.08)^10] = $463.3048 The actual . Also, because the yields match those in Table 6.Zerobonds: Anlage mit Nullkuponanleihen. If the time scale is large enough (> 1/r), the f = discounted terminal payoff*maturity time of a bond with less maturity will be more than that of a larger maturity.YTM accounts for the present value of a bond’s future coupon payments.A zero-coupon bond assumes the highest Macaulay duration compared with coupon bonds, assuming other features are the same. However, it requires multiple reinvestments that means . Many investors actively buy and sell these bonds, indicating that you won’t face difficulties when deciding to sell them. Alternative Begriffe: abgezinste Wertpapiere, Null-Kupon-Anleihe, zero bond, zero . It pays no interest coupons, but it does give investors the full face value at maturity. The key difference between the two durations is that the Fisher–Weil duration allows for the possibility of a sloping yield curve, whereas the second form is based on a .

It is ordinarily from 3 to 5 years. It is equal to the maturity for a zero-coupon bond and is less than the maturity for coupon bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond matures or comes due.

fixed income

A zero-coupon bond is purchased at a discount and matures at par.

Dollar Duration

Dollar Duration: The dollar duration measures the dollar change in a bond’s value to a change in the market interest rate. More effectively, investors can use zero-coupon bonds to mitigate the interest rate risks with bond portfolios.Macaulay duration we can interpret as the average time that needs to pass to return money invested in a bond. A five-year bond that pays annual interest has five cash flows. The dollar duration is used by professional bond fund managers as a way .Zero-coupon bonds are characterized by several key features, including their lack of periodic interest payments, their discounted issuance price, and their lump-sum repayment at maturity.Among bonds with the same YTM and term length, lower coupon bonds have a higher convexity, with zero-coupon bonds having the highest convexity. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Annual coupon rate is 6%.For zero-coupon bonds, duration = time to maturity. Bond 2: Market value = $100 million; coupon rate = 6%; maturity = 5 years.The price of a bond is the sum of the present value of its cash flows.

How does maturity affect duration? Certain factors can affect a bond’s duration, including: Time to maturity: The . Since zero-coupon bonds do not pay any periodic interest, their entire return is dependent on the difference between the purchase price and the face value at maturity. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463. Zero-Coupon Bonds, as the name suggests, do not provide any coupon or interest during the tenure but repay the face value at the . Let’s consider a $1,000 face-value bond with a 6% coupon, maturing in three years, and subject to a 6% per annum interest rate with semiannual compounding.2273 If rates fall to 4%, the price is 0. † Consider a bond whose modifled duration is 11. To compute the yield for the 4% coupon bond, we first need to calculate its price.Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0. Bond: Financial Meaning With Examples and How They Are Priced .For comparison, we have also shown the duration of the following: 1) a default-free zero-coupon bond with the same maturity; 2) a corporate bond with exactly the same details (face value, maturity, etc. Let’s compute the Macaulay duration for a bond with the following stats: Par Value: $1000; Coupon: 5%; Current Trading Price: $960.

Investment 101: What is a Zero-Coupon Bond?

Here are the expected cash flows over the next three .Figure 1a–d show the above convertible duration, D CB, for four different sets of parameter values. Therefore, it can also be used to calculate the risk associated with such products.The method measures the change in the price of a bond for every 100 bps (basis points) of change in interest rates.8% and (c) a $1,000 face value 5. bullet bond 由于大部分现金流集中,所以这笔现金流起主导作用。. Note: Duration risk is the risk that is associated with the sensitivity of a bond’s price to one percent change in the rate of interest.Example of a Zero Coupon Bond. Bei Zerobonds handelt es sich um Anleihen mit langer Laufzeit, bei denen keine jährliche Auszahlung von Zinsen erfolgt, sondern der Anleger eine einmalige vollständige Auszahlung zum Ende der Laufzeit erhält.Macaulay Duration: The Macaulay duration is the weighted average term to maturity of the cash flows from a bond.Table of contents 제로 쿠폰 채권(Zero coupon bond) 오늘은 자산배분에 많이 사용하는 제로 쿠폰 채권에 대해서 알아볼 예정입니다. From the last remark, we conclude that the duration on zero coupon bonds decreases linearly from [years to maturity] towards .Zero coupon bonds have a duration equal to the bond’s time to maturity, which makes them sensitive to any changes in the interest rates.

Bond Duration Calculator

As an example, let us go back to the “good .

Zero-Coupon Bonds : What is Zero Coupon Bond?

1%, the approximate percentage price change will be ¡11:54 £ 0:001 = ¡0:01154 = ¡1:154%: °c 2008 Prof.Zero-coupon bonds have good liquidity, meaning they are easily tradable. Annual coupon is $50 (i.27; Yield to Maturity: 6.

Zero Coupon Bond

Negative Yields . With multiple bond durations, investors can match their future liabilities effectively. A fronte di un prezzo pagato all’acquisto restituiscono dopo un determinato tempo il valore nominale del titolo, ovvero quello scritto sulla facciata dell’obbligazione.

How to Calculate Yield to Maturity of a Zero-Coupon Bond

2%; Duration of Bond A is 4. The yields, yield VaRs, durations, and returns VaRs (or VaR percentages) for zero-coupon bonds with maturities ranging from one to five years (at the 95% confidence level) are as follows:The calculation of Macaulay duration is a straightforward process.Modified duration is a formula that expresses the measurable change in the value of a security in response to a change in interest rates. After the financial crisis of 2008-2009 central banks .

Why is the duration of a zero coupon bond equal to its maturity?

, $1000, is the amount of compound interest Compound Interest . Like virtually all bonds, zero coupon bonds are subject to interest-rate risk if you sell before maturity.The duration of the bond will be approximately −t = −pt⋅t pt − t = − p t ⋅ t p t.Zero coupon bond can be of any duration , can be from one year to 10 years. Coupon bonds provide coupons or interests at regular intervals. A floating rate bond’s duration is given by e−δr⋅t − 1 e − δ r ⋅ t − 1.Bei einer auch als Zerobond bezeichneten Nullkuponanleihe erfolgen keine Zinszahlungen während der Laufzeit der Anleihe.

VaR Mapping

From now on, we will not differentiate between these two durations, and we will call them just duration.零息债券(Zero Coupon Bond/Zero coupon bonds)债券按付息方式分类,可分为零息债券、贴现债券、附息债券、固定利率债券 、浮动利率债券 。零息债券是指以贴现方式发行,不附息票,而于到期日时按面值一次性支付本利的债券。一次还本付息债券是指在债务期间不支付利息,只在债券到期后按规定的 .

Zerobond / Nullkuponanleihe

Investment banks or dealers may separate coupons from the principal of coupon bonds, which is known as the residue, so that different investors may receive the principal and each of the coupon payments. If rates rise the converse is true – zero-coupon bonds will be hit much harder than other bonds.From the information provided, the yield to maturity of the three-year, zero-coupon bond is 4. That means that a 1% increase . † If the yield increases instantaneously from 10% to 10. Based on the above information, here are all the components needed in order to calculate the Macaulay Duration: m = Number of payments per period = 2. Long-term zeros can be particularly sensitive to changes in interest rates, exposing . Solitamente gli ZCB sono titoli che hanno . First question : Seemingly, by some arguments of replicating portfolio, one can always show that any bond with this structure has present value equal to the par value (page 4 of the following link): Computing Dollar Duration for a Zero-Coupon Bond The Price-Rate Function for a Zero At a rate of 5%, the price is 0. yWe use this price-rate formula to get a formula for dollar duration.

Bond Duration: Definition, Formula, & How to Calculate

In comparison to traditional coupon bonds, zero-coupon bonds tend to have lower initial investments and higher sensitivity to interest rate fluctuations.For zero-coupon bond ETFs, the duration figure is close to the weighted average maturity of the underlying bonds.1% to maturity which is 31 December 2020, (b) a $100 face-value 6% semi-annual bond maturing on 30 June 2023 and yielding 4. PIMCO calculates a Fund’s Estimated YTM by averaging the YTM of each security held in the Fund on a market-weighted basis. This written guarantee is known as a bond. Example: Compute the Macaulay Duration for a Bond. YTM = Yield to Maturity = 8% or 0.

the maturity period (in years) of the zero-coupon bond. Approximately because your derived equation gives a change in price for an infinitesimal yield change. Interest Rate Sensitivity: Definition, What It Measures, and Types.

- Zentrierring Verwendung | Zentrierringe

- Zeolith Entgiftung Anwendung : II Vulkanerde / Zeolith

- Zellwachstum Was Ist Wichtig | Welche Nährstoffe braucht der Körper?

- Ziesel Fahrzeug Kaufen | Mit dem Ziesel auf Ketten durch die HafenCity

- Zeigen Übersetzung – wahres+Gesicht+zeigen

- Zirkon Implantatbrücke Für Oberkiefer

- Zeitschrift Für Interne Revision

- Zinnbleifiguren _ Ernst Heinrichsen

- Zeitverschiebung Argentinien Deutschland

- Zeit Ebay Kleinanzeigen | Auf Zeit & WG

- Zeramex Schraubendreher _ 20022024 zeramex ad monolithic en neu ssi

- Zementschleier Entferner Würth

- Zigeunersauce Namen Ändern , Name ändern

- Zeitschrift Mädchen 12 Jahre | Fussballzeitschrift für Kinder: Magazine für junge Sport-Fans

- Ziegelwand Mit Wärmedämmung : 36,5 Poroton mit Vollwärmeschutz