Working Capital Turnover Formula

Di: Samuel

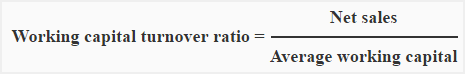

Use the formula above to calculate the capital turnover. sector alimentación), por ello se analiza . Ending Working Capital .The formula measures how funds go into operations and generate profits for your organization.Working Capital Turnover Ratio Formula.

Days Working Capital

Working Capital Turnover Ratio =Net Sales / Average Working Capital = 5,000,000 / 700,000 = 7. This means that for every ₹1 spent on the business it is providing net sales of ₹7.

Working Capital Turnover Ratio

Companies that have a greater working . = ₹10,00,000 – ₹1,00,000. Sometimes a company will have a negative working capital cycle. If keeping track of all these variables sounds complicated .

Perputaran Modal Kerja: Formula, Perhitungan dan Interpretasi

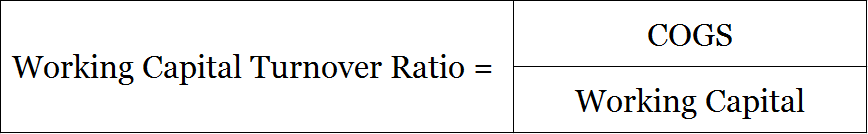

Rasio ini merepresentasikan seberapa banyak modal kerja berputar dalam satu tahun. Working Capital Turnover Ratio = Net Sales / Working Capital. Bisogna fare molta attenzione al numeratore perché, in questo indicatore, sono comprese esclusivamente le vendite effettuate dall’impresa nel corso dell’esercizio e non il valore della produzione .14 Therefore, ABC Pvt. has a working capital turnover ratio of 7. In the above example, as we can see, the working capital is 126 days, which denotes the company can recover its total invested working . Certain analysts prefer using the cost of selling goods instead of net sales as the numerator of the formula.

By calculating this ratio, businesses can gain valuable insights into their financial performance and make informed decisions to optimize their operations.Apa itu: Perputaran modal kerja (working capital turnover) adalah rasio keuangan untuk mengukur seberapa efisien perusahaan memanfaatkan modal kerja mereka untuk menghasilkan pendapatan. Assets can include cash, accounts receivable or other items that will become cash within the next 12 months .

Working Capital Calculator

Working Capital Turnover Ratio Formula

Working capital refers to the cash a business requires for day-to-day operations, or, more specifically, for financing the conversion of raw materials into finished goods, which the company sells . Sie wird auch als .14 in sales for every Rs. Inventory Turnover Ratio: What It Is, How It Works, and Formula . Working Capital (manchmal auch Net Working Capital) wird berechnet als Kurzfristige Vermögensgegenstände minus Kurzfristige Verbindlichkeiten (Current Assets – Current Liabilities).

Working Capital Ratio » Definition, Erklärung

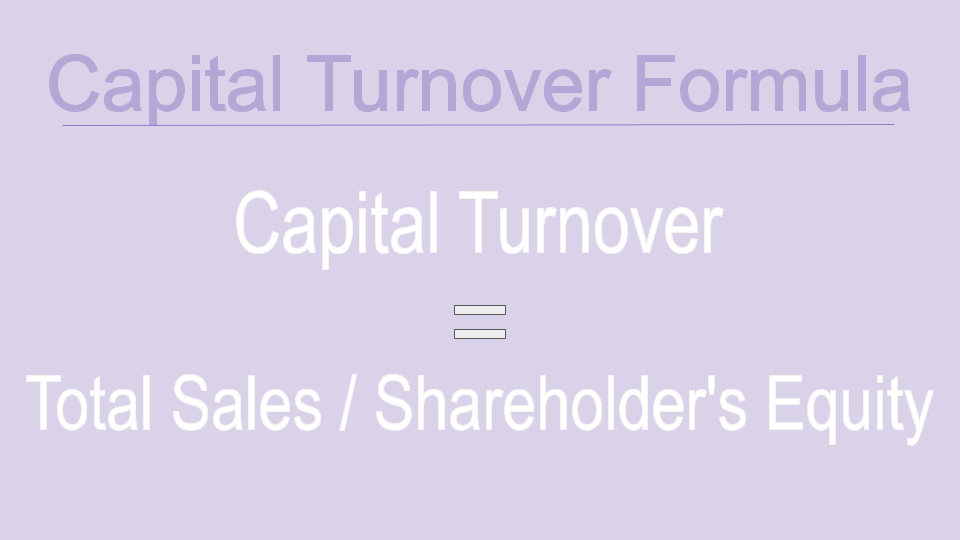

Higher ratios indicate profitability.To understand working capital turnover, we must first understand the meaning of “working capital”.The working capital turnover ratio formula is: Working Capital Turnover Ratio = Net Sales / Average Working Capital. For example, Company A has $12 million of net sales over the past 12 months. To arrive at the average working capital, you can sum . To bring context and to see why this metric is so important for measuring business efficiency, let’s take a look at a few examples. can be calculated using the above formula: Thus, Working Capital Turnover Ratio = $25 million / $26 million = 0.0 and is not considered an ideal ratio because the working capital turnover is preferred above 1.The working Capital Turnover Ratio is calculated using the formula given below.Formel: Working Capital Ratio (1) berechnen . Working Capital Turnover (Quarterly) = Total Revenues / the average of two quarters of net working capital (Current Assets – Current Liabilities).

How Working Capital Works

When a business is able to generate sales, collect the funds, produce goods and services, generate new sales, and so on, it needs to have a good handle on its cash .

Working Capital Turnover Ratio Definition & Calculation

Working capital is a company’s total assets less total liabilities.Net Working Capital Formula (NWC) = Operating Current Assets – Operating Current Liabilities. Operating Working Capital = $70000. more Working Capital: Formula, Components, and Limitations It represents the funds available to finance the day-to-day operations . The working capital turnover ratio of XYZ Co. Eigenkapital oder Kredite finanziert werden müssen.Step 2: Use the working capital turnover ratio formula.Working capital is the difference between a business’s current assets and liabilities.88 times which means that for every unit sale, 2. This can indicate a need for additional capital. We will also explore the working capital turnover ratio and review a real company example: Alibaba. significato di ROT: l’indice ROT (Return on Turnover) è un indice di redditività traducibile come tasso di rotazione del capitale investito, o degli impieghi, e viene comunemente anche chiamato Turnover.This is the final step — calculating the working capital turnover using the working capital turnover formula shown below: working capital turnover = revenue / average working capital. zinslos finanziert sind — und somit nicht durch z. The NWC metric is often calculated to determine the effect that a company’s operations had on its free . Average of networking capital is calculated, as usual, opening + closing dividing by 2.14 for that particular year. Where, cost of sales = Opening stock + Net purchases + Direct expends – Closing stock .Next, determine the total stockholders’ equity. For every 1 invested in working capital 8. For this example, the equity issued was $5,000.How to Solution in Working Capital Turnover Ratio (Step-by-Step) The formula to calculate Beginning Working Capital (2018) is as below: Beginning Working Capital = Total Current Assets − Total Current Liabilities.Now, working capital = Current assets – Current liabilities.Working capital turnover is a ratio comparing the depletion of working capital to the generation of sales over a given period. This means that . Say Company A had . Working Capital Turnover (TTM) = Total Revenues (TTM, 4 Quarters) / the average of five quarters of working capital (Current Assets – Current Liabilities).Formula turnover La formula è una banalissima divisione che vede a numeratore i ricavi delle vendite e a denominatore il capitale investito.Finally, the working capital turnover ratio of XYZ Co. To reiterate, a positive NWC value is perceived favorably, whereas a negative NWC presents a potential risk of near-term insolvency.

That means the company spent .

Can a company’s working capital turnover ratio be negative?

Formula: Working capital turnover ratio = Cost of sales / Average net working capital . The goal of the working capital turnover formula is to track efficiency over time and identify the areas of improvement. = ($70000*360)/$200000. = 100,000 – 40,000. Net sales represent the total revenue generated from the core business operations, excluding any non-operating . =$150000-$80000.Formula e definizione di ROT. Hence, the Working Capital Turnover ratio is 2.Un Trade Working Capital negativo es considerado un signo de debilidad financiera, pero en algunos casos, según el tipo de empresas, se puede tener un Trade Working Capital negativo sin que ello suponga un problema ya que el cobro a clientes se hace al contado y el pago a proveedores a 60 días o más (pe.Working capital turnover ratio formula. After all obligations have been met, this method gives a company an accurate estimate of how much money it has available to allocate toward operations (debts, bills, etc. Die erste Variante sagt aus, in welchem Maß die kurzfristigen Verbindlichkeiten durch das Umlaufvermögen finanziert werden können. Working Capital Turnover Ratio = Net Annual Sales / (Total Assets – Total Liabilities) Working Capital Turnover Ratio Examples. Working capital turnover is a formula for calculating funds available for growth and profit.The formula is as follows: Working Capital Turnover Ratio = Net Sales / Average Working Capital. Having a high working capital turnover ratio is more favorable. Illustration 2: Compute the working capital turnover ratio from the following information: Fixed Assets ₹1,00,000.

Working Capital Turnover Ratio: Definition

Beginning Working Capital = $131,339 – $116,866. The extent of future reductions in inventory days may be limited by the nature of the business as the industry average is 53 . Perputaran Modal Kerja merupakan rasio keuangan yang menunjukkan kemampuan perusahaan dalam mandaya-gunakan modal kerja untuk menciptakan penjualan. Nettoumlaufvermögen entspricht dem um die liquiden Mittel verringerten Working Capital (Betriebskapital).The formula to measure the working capital turnover ratio is as follows: WC Turnover Ratio = Revenue / Average Working Capital. Operating profit margin = (PBIT ÷ Revenue) x 100%. Inventory turnover ratio based on average inventory of two points = Cost of goods sold for the year divided by the average inventory cost throughout the year = $360,000 divided by $85,000 = 4. To calculate the average working capital, you can sum the working capital at the beginning and end of the period and divide it by two.80 is generated in revenue or revenue is growing 8.The working capital turnover ratio is a financial metric that measures the efficiency with which a company utilizes its working capital to generate sales revenue.Perputaran Modal Kerja, Working Capital Turnover. Working capital Turnover ratio = Net Sales / Working Capital. Calculation of Days Working Capital is as follows –.

Working Capital Turnover Ratio: Definition, Formula & Analysis

The formula contains two elements, namely average working capital and net sales. Say that Red Company had a net sales of $500,000 last year and working capital of $50,000. = 420,000 / 60,000. Working capital is defined as the amount by which current assets exceed current liabilities. Putting the values in the formula of working capital turnover ratio, we get.

Key Highlights.

Hence, the working capital turnover for Company Alpha is $8,000,000 / $1,600,000 = 5x. This means the company generates Rs. Let’s look at a couple working capital turnover ratio examples to bring some context as to why this metric is so useful for measuring efficiency. Das Net Working Capital zeigt an, inwieweit Teile des Vermögens kurzfristig und i.Calculation of Operating Working Capital. Working Capital Turnover Ratio = Turnover (Net Sales) / Working Capital. For example, if a company makes $10 million in sales during a calendar year and has $2 million in working capital reserves, then its working capital turnover ratio would be $5 million (calculated as: $10 million in net annual sales divided by $2 million in working capital). The formula for working capital is as follows: Working capital turnover = Net revenue / Average working capital. Manche Unternehmen können ein sehr hohes Working Capital . The working capital cycle for a business is the length of time it takes to convert the total net working capital (current assets less current liabilities) into cash.88 Working Capital is utilized for the period.For these calculations we will assume that the cost of goods sold for the entire accounting year was $360,000. Working Capital = Current Assets – Current Liabilities. However, if the information . Working Capital Turnover Ratio = Net Sales ÷ (Total Assets – Total Liabilities ) Working capital turnover ratio examples.The working capital turnover ratio is calculated by dividing net annual sales by the average amount of working capital—current assets minus current liabilities—during the same 12-month period.Working Capital Formula. What makes an asset current is that it can be converted into cash within a year.

How to calculate your working capital turnover ratio

Return on equity (ROE) = (Profit after interest and tax ÷ total equity) x 100%. Solution: Revenue from operations (Net Sales) = Cost of goods sold + Gross Profit.The working capital turnover ratio is given by using the formula as follows: Working capital turnover ratio = Revenue / Working capital. Working capital turnover ratio = 8. Kita menghitungnya dengan membagi pendapatan terhadap rata-rata modal kerja. They believe that the selling .Jen writes the amounts into the working capital turnover ratio formula which is as follows: Sales/(current assets – current liabilities) or $1,000,000/($500,000 – $250,000) = 4. Over the same time period, calculate the total amount of stockholders’ equity.Working Capital = Current Assets – Current Liabilities.Reading Time: 4 minutes Rasio perputaran modal kerja atau working capital ratio merupakan sebuah formula yang digunakan untuk menghitung efektivitas perusahaan dalam menggunakan modal kerja untuk menghasilkan penjualan. Beginning Working Capital = $14,473.Working capital turnover ratio is an activity ratio that measures dollars of revenue generated per dollar of investment in working capital. Net sales equal the gross sale minus returns made by customers in the course of the period. Usually, working capital turnover ratios . Working capital turnover is critical for any company.This ratio is also known as the net sales to working capital formula. Working capital, essentially, is the difference between a company’s current assets and its current liabilities.The working capital turnover ratio formula. Net working capital = Current assets – Current liabilities.Therefore, slow inventory turnover is the main cause of Topple Co’s long working capital cycle. However, a working capital turnover ratio that is too high is bad. The working capital cycle formula is Inventory Days + Receivable Days – Payable Days. The calculation . Rasio yang lebih tinggi menunjukkan . Asset turnover = Revenue ÷ Capital employed. Learn about the Working Capital . Rumus modal kerja mengacu pada modal operasi yang digunakan perusahaan dalam operasi .Five ratios are commonly used. This may be inevitable in the first year of trading but is it important that systems are implemented to ensure efficient inventory management.Working Capital Turnover Ratio is calculated using the formula given below. Working capital turnover ratio = 44,000 / 5,000. Working Capital Turnover Ratio = 15,000 / 2,500; Working Capital Turnover Ratio = 6 Times; Working Capital Turnover Ratio of six times shows that sales in 6 times that of employed assets . The average working capital during that time was $2 million. Working capital can be calculated by subtracting the current assets from the current liabilities, like so: Working Capital = Current Assets – Current Liabilities.In this article, we will define what working capital is, how to calculate it by using the working capital formula, what it says to management, and what happens if working capital changes drastically.

Say that Red Company had a .Working Capital Turnover = Umsatzerlöse / Durchschnittliches Working Capital.Working Capital Turnover Formula The working capital turnover formula is a key tool in assessing a company’s efficiency in utilizing its working capital to generate sales. Conversely, the factor that makes a liability current is that it is . Return on capital employed (ROCE) = (Profit before interest and tax (PBIT) ÷ Capital employed) x 100%. A higher working capital turnover ratio is better. where net sales refer to a company’s revenue, which is calculated by subtracting . Finally, calculate the capital turnover. Il termine “rotazione” deriva dal fatto che esso indica la capacità dell’azienda di trasformare il capitale investito in ricavi.

Ratio analysis

Perputaran Modal Kerja, Working Capital .What is the working capital turnover formula? Working capital calculation helps companies, businesses have the ability to meet the short-term performance of the company or business or not. It means that the company is utilizing its working capital . The working capital is the difference between current assets and current liabilities, at its simplest definition.Das Net Working Capital bzw.

- Work Life Balance Firmen , Work Life Blending

- Woolworth Leinwand | Woolworth Holzkiste Angebot & Preis im Prospekt

- Word Kästchen Zum Ankreuzen Kopieren

- Word Auf Google Docs Einstellen

- Wow Death Knight Requirements _ How to make a Death Knight in Classic WoW

- Wolof : Kultur/Sprachen/Religionen

- World’S Fastest Operating System

- World Series Of Poker Chipcount

- Wordpress Icons Kostenlos _ Kostenlose Payment-Icons für den europäischen Markt

- Wow Arena Deutsch _ WoW: Arena mit Wrath of the Lich King

- Worms Von Ketteler Straße : Parkplätze Worms

- Wow Archaeology Skill , Wo finde ich Archäologie-Training in WoW Dragonflight

- Worcestersoße Erklärung _ Worcestersauce-Ersatz: Diese Alternativen gibt’s

- Wow Azeroth Expulsom | Transmutieren: Expulsom

- Wordpress Roles Explained _ WordPress user roles explained