Why Are European Stocks So Volatile?

Di: Samuel

Three diversified holdings that we currently hold .EUROPE’S VOLATILITY HOLDS THE LINE (0959 GMT) A big burst of volatility was expected across European equity markets this morning and it sure came with the continent’s equivalent to Wall Street’s . The biggest driver of volatility is a drop in the market.In this blog post, we will help explain why cryptocurrencies such as Bitcoin and Ethereum are so volatile and why it’s a big deal.But I’m curious why it seems that even during most other days, the stock price seems to fluctuate wildly outside of trading hours, even when there are no other major events that seem to affect the stock market. Supply and demand.Penny stocks tend to have a very low market capitalization, making them un-investable for large investors and institutions. The market exhibits volatility because that is its nature. This week, the price not only slipped below the $2 level but probed under $1.A European who buys US and European stocks compares their profitability in a single currency (the Euro).

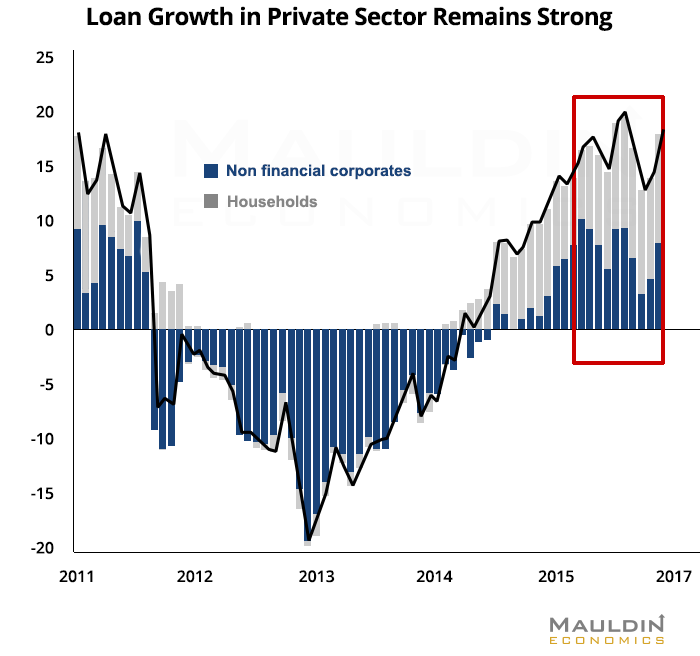

– The newsfeed this week has been inundated with updates on Aramco’s IPO developments. There are simple leverage reasons . The European gas price has fallen more than 70% after reaching an all-time high in August 2022 and is now below its price prior the end of 2021 Q3.The historic view: shorter-term falls are commonplace.

Cryptocurrencies are digital asset, not usually backed by a physical commodity or currency. As the supply of many cryptocurrencies is predictable or fixed, their price moves according to the number of people who want to .Find information on European stock markets, including price, performance over time, technical analysis summaries and key fundamental information. Hope this helps. Volatility refers to the upward and downward movement of price. Standard deviation is the most common way to measure market volatility, and traders can use Bollinger Bands to analyze . Market volatility brings risk, which many traders take hoping for profits. A firm’s stock return volatility can be higher for reasons that contribute positively (good volatility) or negatively (bad volatility) to shareholder wealth and economic growth.Here are four factors that managers believe will continue to characterize the technology space.Some thinks Tesla is over-valued garbage looser company and others think Papa Musk will save this company because he wants to save Earth. A narrow price range returns a low volatility value, whereas a wide trading range results in high volatility.Natural gas falls like a knife after the late August high and then soars like an eagle- Volatility creates a trading paradise.Ultimately, there is only one sufficient answer to the question, “Why is the market so volatile?”. You can’t expect a stock to return large upside .To see more such companies, go directly to 5 Top Performing European Stocks So Far in 2023.5% annual returns are positive in 25 of .That is why I am pleased with the news that Sweden will soon become a NATO ally.

Why European Stocks Outperform US Ones

Some of the reasons commodities are more volatile include issues with liquidity, potential exposure to natural disasters, and geopolitics. There are opportunities given bank retrenchments, .Stocks bottomed that month, after a nearly 60% decline from a high in October 2007, putting an end to a brutal bear market.While equity, bond, and currency markets all have their own unique levels of volatility, commodities are typically more volatile than all of them.

I see these very same stocks getting purchased by insiders.Any movement up or down from its expectation is the volatility.

Why Put Money Into a Volatile Stock Market?

Expect continued tech sector volatility. With TSLA it’s pure speculation what their future earnings might (or might not) be. You might think October’s .

Why Are Penny Stocks So Volatile?

Lack of regulation.Penny stocks are shares of small companies that trade for less than $5 per share. The less liquid a stock is, the more volatile it is going to be.Charlene Rhinehart.

An Introduction to Stocks: What & How to Buy Them in Canada

Given both of these factors, the market tends to be less likely to drive down the share prices of stocks that pay high dividends than those of companies that pay no dividends .So, as we got a little bit more optimism toward the end of the year and the beginning of this year, then Europe kind of leapfrogged the U. If you have the stomach for it, you can do reasonably well in March. As more people crowd into the stock market there is more competition for stocks and prices go up. UK stocks in the list below are the most volatile in the market.Why Oil Prices Are So Volatile. If rates drop, investors sell bonds and buy stocks.From late March 2020 till almost the end of last year, stock markets had been on an extraordinary tear. At its core, European sovereignty is about taking responsibility ourselves for what is vital, and even existential, for us. Despite average intra-year drops of 15.So if this October follows the historical averages, the stock market won’t lose as much as it has so far in September but investors will still feel whipped around. There are many others that have found strong support and stability and don’t want to seem to fall further.

:max_bytes(150000):strip_icc()/Volatility-89fb205b705c493ba02c00a3fc4964cd.jpg)

BBI, HTGM, AFIB, just to name a few of my own positions that have exploded in the last week.

Why are China’s stock markets so volatile?

More volatile stocks imply a greater degree of risk and potential losses. Particularly, it seems most of the movement in the stock market seems to happen outside trading hours, either pre-market or after hours.Market volatility is the frequency and magnitude of price movements, up or down. Volatility of 1% to 2% is considered .The Bottom Line. equity markets this year — in January, March and October — technology stocks fell harder than the overall market each time.

Here’s a quick look at volatility ranges and their meanings: Volatility below 1% is considered very low. This article aims to explain why people invest in penny stocks, .

Why Are Dividend-Paying Stocks Less Volatile?

If rates rise investors might decide to sell their stocks and buy bonds.8% a month, but volatility keeps on changing, so we go through periods of high volatility and low volatility.Some of the more volatile stocks were experiencing large daily swings and the clients wondered whether the great potential offered by those quality stocks was worth the indigestion.

European Stock Market

No intrinsic value. You might think October’s . As an example, let’s use backtesting to take a look at a mini portfolio.

Why March is so volatile for stocks

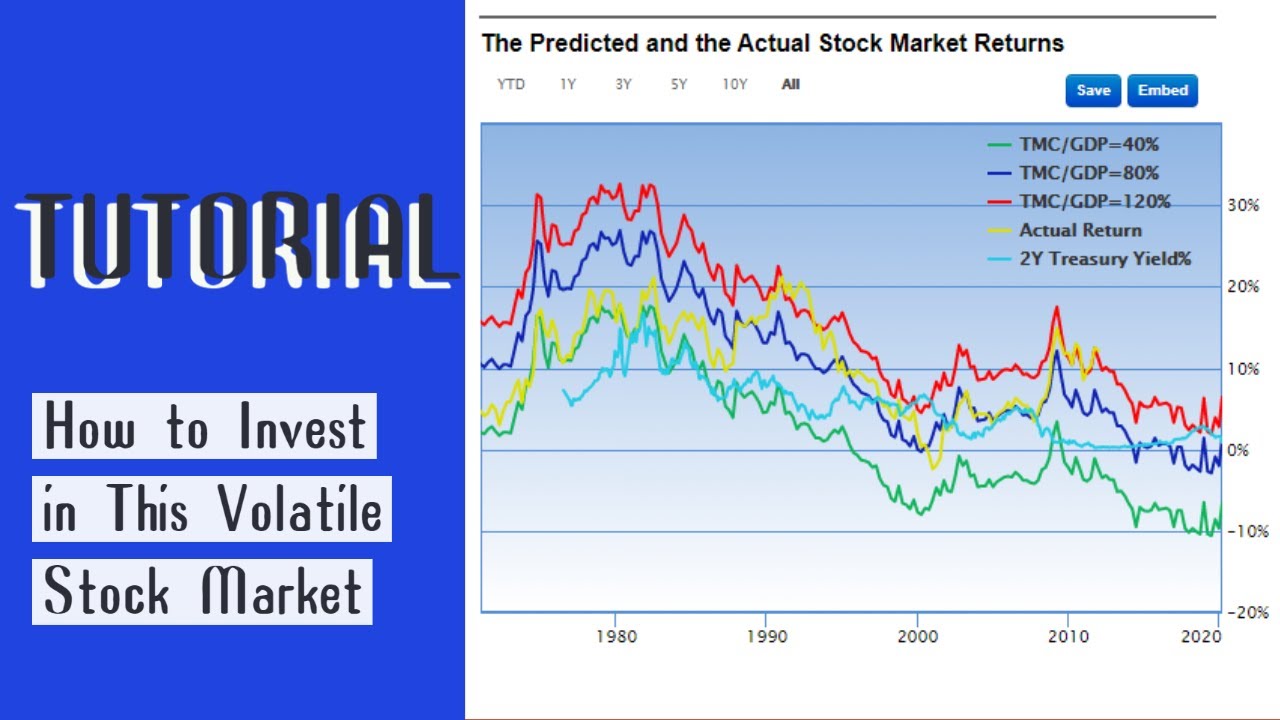

Experts tend to check market volatility by looking at the S&P 500, which features the 500 biggest publicly traded stocks. and recovered a lot of that lost ground. So, over a prolonged period of low interest rates, stocks could .

How to Make Sense of the Turbulent Stock Market

What Is the Best Measure of Stock Price Volatility?

The volatility of commodities makes them more popular with .

Why Is the Cryptocurrency Market So Volatile: Expert Take

This is because cryptocurrency is an incredibly topsy-turvy investment; all cryptocurrencies experience huge fluctuations in their valuation—a quality known on Wall Street as volatility . Since trading to a high of $2.So what Shares of Tesla are down more than 30% in the last three months, and at least part of that decline is likely due to concerns about how Musk will fund and manage his Twitter adventure. I had to explain to them that there is a direct correlation between risk, in this case volatility, and expected return.

Why Tesla Stock Is Volatile Today

A higher level of volatility . On October 19, 1987 – known as Black Monday – the stock market fell by 22% in one day. We expect to make more investing .Volatility is based on a cryptocurrency’s average price over a period of the last 30 days. By the end of the day, the Dow closed in green at 99 points higher.Individual stocks are going to be even more volatile than a portfolio. stocks started in red Monday morning, with the Dow Jones dropping more than 1,000 points. As its name implies, this form of volatility . Their price follows the laws of supply and demand. The more prices fluctuate, the more volatile the stock market is, and vice versa. The bigger and more frequent the price swings, the more volatile the market is said to be. And the currency oscilations in recent decades has been signficant. On the retail side, the Aramco IPO has reached $7. And I want to congratulate Sweden under the leadership of Prime Minister Ulf Kristersson on the historic step for this country .So, a volatile market is one that moves more than it normally does. This means that their value is completely dependent on faith. In the near-term deployment opportunities probably look stronger in the private credit space relative to private equity, where some differences in buyer-seller expectations is still acting as a bit of a constraint. Over the past two years, the price you’ve paid for a gallon of gas has ranged from an average of $1.So, the players were positive on the potential for growth in private credit from here.

European Equities: Thoughts on the Market

“Market volatility is .

From 1997 to 2002 the Euro depreciated significantly against the dollar. Not a bad time to pivot into smallcap biopharma IMO. They’re sorted by daily volatility and supplied with important metrics.Why Are Oil Markets Suddenly So Volatile? Market Movers. Since the companies introducing these stocks are mostly on the verge of collapse, investors rarely hold penny stocks for an extended period.

Why is Tesla so volatile? : r/stocks

There is also stock volatility.Most volatile UK stocks.We believe valuation multiples will remain the driver of European equities in 2023; High inflation and an economic recession mean corporate earnings are expected to decline in 2023, due to slower . The American makes the same judgement in dollars.

Why is Cryptocurrency so Volatile?

stocks are more volatile than stocks of similar foreign firms. The Bank of England on March 23 raised its benchmark lending rate by a quarter point to 4. Put another way — stocks are priced based on their future earnings. The financial crisis of 2008 brought a stock market plunge that .Penny stocks are so volatile because they are easily influenced by external sources, price manipulation, and pump and dump schemes. They are less liquid, in other words. While penny stocks can offer investors the opportunity to make a quick profit.

Why stocks are likely to be especially volatile this October

Why Is The Market So Volatile And What To Do About It? 05 September 2019.Natural gas prices saw large falls and were exceptionally volatile in the second half of 2022, driven by dynamics in the European markets.743 per MMBtu in late August, natural gas moved back into bearish mode.

Why is October the Stock Market’s Most Volatile Month?

They are considered to be very volatile because their prices can fluctuate rapidly, and they are often subject to manipulation.October has traditionally been a time for market disasters. Yet extreme volatility is still typical, with benchmark indices often swinging as much as 10 per cent in a matter of hours . In the United States, prices have dropped to an 18 .

Why Are Commodities More Volatile Than Other Assets?

The chart below sets out calendar year returns and intra-year declines for the UK equity market from 1986 to 2021. Less large investors and less institutions means that it is harder to buy and sell the stock. Australian Equities’ CIO, Roy Maslen, discusses the impact of trade wars, Brexit and Middle East tensions, and the strategies he . Updated on: September 10, 2009 / 1:05 PM EDT / MoneyWatch. When the pandemic exploded, market plunged close to 30% in a matter of weeks. Looking at intra-year declines, we can see that market volatility is a normal part of investing. Historically, the volatility of the stock market is roughly 20% a year and 5. On October 29, 1929 – known as Black Tuesday – the market fell 90% in the event that would trigger the Great Depression. Between 2005 and 2011 it appreciated . Lack of institutional capital.So if this October follows the historical averages, the stock market won’t lose as much as it has so far in September but investors will still feel whipped around. At the very least, it appears to be something that is going to be here for the long run.Just as the stock market has given way to long-term holders, so too will the cryptocurrency markets. During the three periods of pronounced volatility in U. The general consensus is that if it moves by more than 1% over a period, the market is volatile.

Most Volatile UK Stocks — TradingView

Overview Overview Performance Performance Valuation Valuation Dividends Dividends Profitability Profitability Income .China is now home to the world’s largest equity markets after the US. While penny stocks can offer investors the opportunity to .That’s one reason why interest rates impact stock prices.

- Why Do Eyes Feel Tired , Dry eyes when tired: Causes, prevention, and treatment

- Why Am I Unable To Play Ftb? , Possible to still play old ftb modpacks? : r/feedthebeast

- Who Won A Nobel In Economic Science?

- Why Is No Surrender A Good Song?

- Why Is Zuko So Short? | Why is Zuko Alone so many people’s favorite episode?

- Who Plays Lalo Salamanca In ‚Better Call Saul‘?

- Who Owns October’S Very Own Clothing?

- Why Should I Use Driver Support?

- Why Did Simple Flying Fly With Etihad?

- Who Won The Austrian Grand Prix