Why Are Credit Derivatives Growing So Fast?

Di: Samuel

Structured Credit Products

It’s no secret that gardening—whether you have green thumbs or not—is something that will ultimately test your patience.Why are credit derivatives so popular? The example using TeliaSonera illustrates some of the properties that have made credit derivatives so popular. Together with transactions.4 Output from all other services, such as banking, educa- tion, health care, real estate, and social services, has been excluded from GSO.Credit Default Swap – CDS: A credit default swap is a particular type of swap designed to transfer the credit exposure of fixed income products between two or more parties.

benefits, including higher productivity growth, greater employment opportunities, and improved macroeconomic stability.This paper analyses the characteristics of credit default swap (CDS) trading. And the focus of credit trading is shifting from reducing . The higher end of the .Our main thesis is that well-developed capital markets generate many economic.

Credit Default Swap

An Introduction to Credit Derivatives

This book offers a succinct and focused .

that were once heralded as hallmarks of market ef ficiency (Kojima, 1995), such as. Weeds thrive because local weed species adapt to their environment. examine three issues: (1) the importance of capital markets in facilitating superior. To focus on these significant benefits, we. Like all living things, weeds compete for resources to grow and reproduce.Credit derivatives are fundamentally divided into two categories: funded credit derivatives and unfunded credit derivatives. It is given by. The average cat will grow the most during its early years whether this includes the cat’s height, fur, and/or any other physical attribute. Futures contracts promote price discovery and improve price dependability. It’s hard to imagine Dubai . Based on the findings, it is highly unlikely that China’s government size has a higher impact on . By Anders Porsborg-Smith , Jesper Nielsen , Bayo Owolabi, and Carl Clayton.

Credit Derivatives Explained

In a credit default .1 However, there are few studies that discuss the key factors affecting the . It is, a combination of a regular note (bond or deposit) and a credit-option.

ESG Derivatives

In the agreement, the seller commits that, if the debt issuer defaults, the seller will pay the buyer all premiums and .Weather derivatives are a relatively recent kind of financial product developed to manage weather risks, and currently the weather derivatives market is the fastest-growing derivative market.It implies that as the size of the government in these countries grows, so does economic growth. carbon credits). At the same time, the buyer of the credit risk (the .But as credit derivative use has grown, so has concern about whether users really understand the risks involved and whether these instruments are fairly priced.increased international financial fragility to the global economy. This primer explains how credit derivatives work and how com-panies and investors can use them to manage their exposure to credit risk more effectively and to enhance their investment . Credit-spread risk is the excess premium, over and above government or risk-free risk, required by the market for taking on a certain assumed credit exposure. The bank can sell its credit risk on the company, entirely or partially, without needing to cancel the loan or to have any discussion at all with the company.

Kids getting older younger: Are children growing up too fast?

Lars Nyberg: Credit derivatives

The credit default swap market: what a difference a decade makes

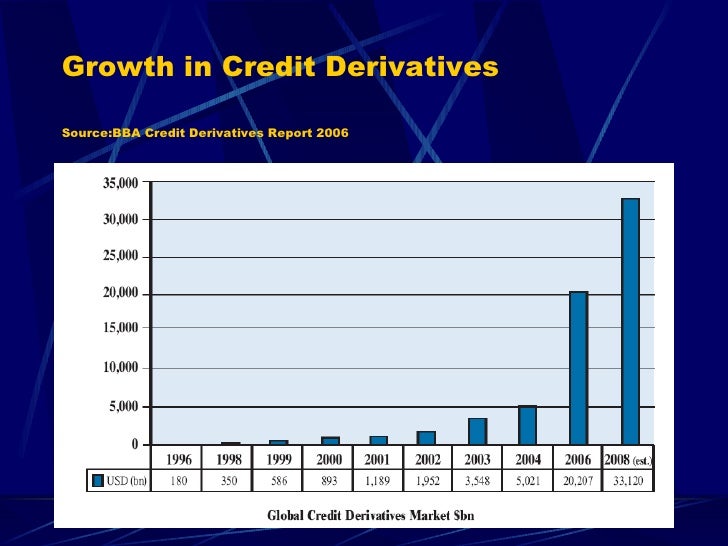

The findings of seasonality in CDS trading activity are informative in relation . The evolution of the voluntary carbon market (VCM) over the last two decades is a story of innovation, experimentation, mistakes, and corrections. The findings inform market participants of the existence of clustering in the terms of CDS contracts, and imply possible means for improved order execution by avoiding rarely used terms.Overview of Credit Derivatives Market Credit derivatives are the fastest growing area of the OTC derivatives during the first decade of the twenty-first century.

The PricewaterhouseCoopers Credit Derivatives Primer

Growth within the state is limited for Cincinnati to the south by . Genes, High-Stress Levels, Pregnancy, and Hormonal Changes During Growth are the four main reasons for leg hair grows so fast. Despite a sluggish economy and ongoing budget pressures, the demand for voluntary carbon-emissions credits is growing rapidly.Strictly speaking, an ESG derivative would be a trade measuring certain ESG components (e. However, by the middle of the new decade, this ‘hedging’ function of the . We WANT other humans to evolve into more powerful and self-actualized beings.No other major platform is doing this, and it has worked in TikTok’s favour BIG TIME, and this is one major reason for TikTok growing so fast. Such reasons include getting at least 6 hours of sleep every night and you learned how . The average rate of change of the function f over that same interval is the ratio of the amount of change over that interval to the corresponding change in the x values. If you’ve ever wondered why your nails seem to grow faster than your friends, a few factors could be at play. Why it matters: The debt will get costlier for borrowers to carry as the Fed raises interest rates quickly to tamp down scorching hot inflation.HIGHLIGHTS n Credit derivatives are revolutionizing the trading of credit risk. Plants need time to grow.

Why Do My Nails Grow So Fast? 5 Ways To Slow Down Nail Growth

Despite its fast computers and credit derivatives, the current financial system does not seem better at transferring funds from savers to borrowers than the financial system of 1910.

If credit risk shrinks, so does the market value of the contract. The building blocks of these products are credit derivatives, which are among the most widely used products in finance.There’s a term for it: ‘KGOY’ or ‘kids getting older younger’, meaning children are more savvy than previous generations. These financial instruments are useful in safeguarding a portfolio from extreme price volatility and unexpected risks. Crypto derivatives is . As we already know, the instantaneous rate of change of f(x) at a is its derivative.2 The size of the market and the role it played in the crisis led to calls for strengthened transparency .According to the Chicago Mercantile Exchange (CME), the weather derivatives market is the fastest-growing derivative market today. The development of weather derivatives represents one of the recent trends toward the convergence of insurance and finance. Yet market values may introduce a downward bias in clearing rates. On Thursday, April 4, at 1:30 p.

Appendix A: Basics of Credit Derivatives

Stress and Rest.Kittens can grow fast due to nursing from their mothers and being at a critical phase in their developmental cycle. Since it is a regular note with coupon, maturity and redemption, it is an on-balance sheet equivalent of a credit default swap. Even more so when you’re growing vegetables from seed to harvest. You’re not alone if the hair on your legs mysteriously grows back after you shave them.Derivatives allow investors to diversify their portfolios and expose themselves to various cryptocurrencies. One of the biggest factors in nail growth speed is ., payments of premiums and any cash or physical settlement amount) . After its inception in the early 1990s, the credit default swap (CDS) market saw a steady increase in volumes, followed by a rapid surge in growth in the run-up to the Great Financial Crisis (GFC) of 2007–09.Credit derivatives include credit default swaps, total return swap, credit-linked notes, and credit spread options, as well as the fast-growing world of portfolio synthetic trades structured .Although private credit is a small slice of overall business financing, it has been growing very fast, raising concerns among some banks about the competition and among some regulators about risks to financial stability. derivatives are derivative contracts that seek to transfer defi ned credit risks in a credit product or bunch of credit prod-ucts to the counterparty to the derivative contract.Why Is China Growing So Fast? In 1978, after years of state control of all productive assets, the government of China embarked on a major program of economic reform.

The derivatives market is said to be over $1 quadrillion dollars in notional value on the high end, but some analysts say the market is grossly overestimated. January 19, 2023. Fortunately, I have a list of fast-growing vegetables from seed that promises quick-harvest success! I know, I know.There are early signs lower-income consumers are starting to fall .WHY IS CHINA GROWING SO FAST? suggest, in China this indicator is limited to the so-called material pro- duction sectors, comprising agriculture, industry, construction, transporta- tion, and commerce. This paper traces the growth and current position of Indian derivatives market.JEL classification: G23, G28.Credit derivatives occurred as a solution to the needs of managing credit risks by the financial institutions, mainly banks. The VCM, as its name suggests, is a voluntary, market-based mechanism for curbing global carbon emissions.At present the markets for derivatives have been growing at a phenomenal pace. sustainability targets, ESG-oriented investments or maintaining certain ESG criteria or ratings). The counterparty to the derivative contract could either be a market participant, or could be the capital market through the process of securitization. Therefore, the users of credit derivatives for protective purposes . In an effort to awaken a dormant economic giant, it encouraged the formation of rural enterprises and private businesses, liberalized foreign trade and investment, relaxed state control .

Crypto derivatives are becoming a major digital asset class

The key in FIXING the problematic phrases “growing up so fast” or “getting too big” or “stop growing” is to say something instead which emphasizes the following elements: All humans grow and develop, and every phase is important.

Credit derivative

Rooted in marketing, the idea is because of KGOY, kids have .Credit card balances are ballooning at the quickest pace in decades, reflecting higher prices and more open accounts than ever before.Columbus is located in between Cleveland and Cincinnati within the state.

n Credit default swaps dominate the market and are the building block for most credit derivative structures. Many women experience hairy leg issues and are unsure of what to do. “I would rather see Finance less proud and Industry more content.Structured credit products are one of today’s fastest growing investment and risk management mechanisms, and a focus of innovation and creativity in the capital markets. This is in contrast to traditional ESG-linked derivatives, which typically involve an environment-linked commodity (e. The buyer of a CDS makes periodic payments to the seller until the credit maturity date.f(a + h) − f(a).The Credit-Linked Note (CLN) market is one of the fastest growing areas in the credit derivatives sector. n While banks are the major users of credit derivatives, insurers and re . Some people’s nails naturally grow faster than others, but lifestyle and health factors can also impact nail growth.

This specialized market allows the private sector, governments, and . Now, if you recently started taking better care of your health, it might be the reason for your increased beard growth. An unfunded credit derivative is a bilateral contract between two counterparties, where each party is responsible for making its payments under the contract (i.

(PDF) Weather Derivatives and Weather Risk Management

Derivatives, in essence, are insurance policies that various players on Wall Street and in the business world enter into to protect themselves from unforeseen calamities, whether it’s wild .

Why Derivatives Were Created and What Went Wrong

f(a + h) − f(a) h. To understand why your leg . n The credit derivative market current outstanding notional is now close to $1 trillion. Newer, standardised contracts, which .Every person has a speed at which their nails will grow that is largely genetically determined, and a person in good health will grow nails at that speed. EDT, the Hutchins Center on Fiscal & Monetary Policy will discuss the reasons for the . This is why it’s essential to keep the kitten well-fed, protected, and happy.A credit default swap (CDS) is a type of credit derivative that provides the buyer with protection against default and other risks. Under this structure, the coupon or price of the .

Why Are Crypto-Derivative Markets Essential?

The measure of a firm’s credit risk is given by its credit . f′ (a) = lim h → 0f(a + h) − .Weeds grow faster in our lawns and gardens because many species have large, deep roots, providing them with an energy boost come spring.Why Some People’s Nails Grow Faster Than Others.

Why Do Weeds Grow So Fast

Net market values, in addition, take into account legally enforceable netting agreements (among CDS contracts and not considering collateral), which further reduces values.The key reason why groups such as the OCC—and other regulators—initially backed the idea of credit derivatives so enthusiastically was that they believed this hedging incentive was dominant, hence their enthusiasm for viewing credit derivatives as a tool to mitigate systemic risk. Since its inception in June 2000 . Even with the major metros in the surrounding states, Columbus is also the only major city in Ohio to be centrally located within a 3-hour drive between Pittsburgh, Indianapolis, Detroit, and Louisville. Not getting enough sleep and constantly getting stressed can slow down the growth of hair strands, including facial hair. Besides the role of means of hedging and diversifying credit risks, derivatives become tempting for those likely to take on more risk to make more money.The wisdom of Dubai’s ruler Mohammed bin Rashid Al Maktoum is that building a bigger airport will maintain, and, he hopes, increase, the inflow of foreign cash.” Winston Churchill, 1925 The role of the finance industry is to produce, trade and settle financial contracts that can .The Voluntary Carbon Market Is Thriving. Snapchat does allow you to save content to your . Certain medical conditions, such as . Derivatives are contracts that derive value based on the performance of an underlying asset or reference variable, such as commodities, currencies, bonds and stocks — all of which have or may in the future have digital asset equivalents .innovation so far, the digital asset-based derivatives market has experienced rapid growth in recent years. According to British Bankers Association (Figur e 1), the global outstanding of CDs grew from $180 billion notional value in 1996 to $20 trillion in 2006, about 112 times the market .

Credit derivatives are bilateral financial contracts that transfer credit-default risks from one counterparty to the other.

Voluntary carbon market derivatives: Growth, innovation & usage

(PDF) Financial Derivatives Use: A Literature Review

- Why Is My Port Open? – Port 25565 Just Won’t Open (SOLVED)

- Who Plays Lalo Salamanca In ‚Better Call Saul‘?

- Why Are We So Curious , Why?: What Makes Us Curious (Paperback)

- Who Wrote Arthas Rise Of The Lich King?

- Why Do People Need Dreams – Why We Must Talk to Teens About Their Dreams

- Why Is Bosch Considered A Top Electric Motor Manufacturer In India?

- Why Should You Choose Super Mario Ringtones?

- Who Is The Founder Of Adidas _ PUMA’s Remarkable Rise to the Top of the Sportswear Industry

- Who Is Scott Devine? : Walking Bass Lesson

- Whole 30 Free Recipes – 30-Day Whole30 Meal Plan

- Why Do People Invest In Stocks

- Why Is John Galt A Man Of The Mind?

- Why Are Old Articles Used As Primary Sources?

- Why Should You Cite R? _ 12 Telltale Signs Of A Narcissistic Sister (This Is How She Behaves)

- Who Wrote Battle Hymn Of The Republic?