Who Pays Inheritance Tax If A Deceased Person Dies?

Di: Samuel

If the settlor pays the Inheritance Tax instead of the trustee, this means there will be an . Sometimes known as death duties. If you already have the right or have probate (as an executor or administrator) you can start dealing with the .April 30 of the following year.Super paid after a person’s death is called a ’super death benefit‘.

How Inheritance Tax works: thresholds, rules and allowances

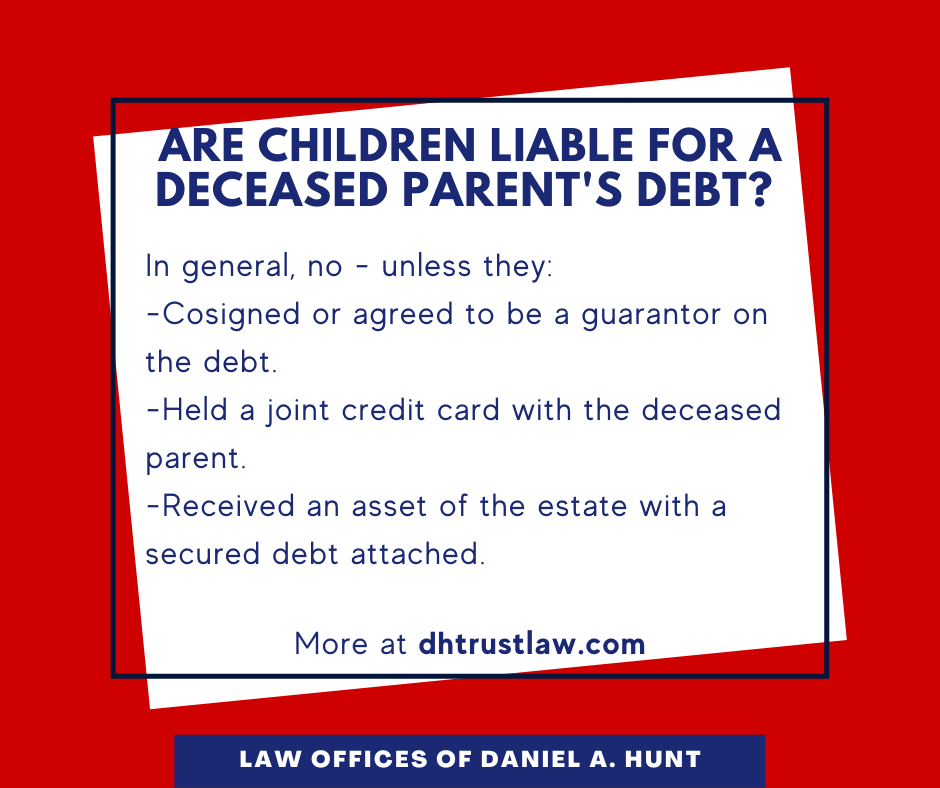

If you are a beneficiary of a deceased estate.As there is no inheritance tax in Canada, all income earned by the deceased is taxed on a final return. The deceased person’s ownership percentage will transfer to their estate and beneficiaries. By law, family members usually don’t have to pay the debts of a deceased relative from their own money.If the person who died owned capital property (such as real estate, investments or personal belongings), the deemed disposition can result in a capital gain or capital loss. It is not normally the responsibility of the Executor or any of the deceased’s relatives to settle these bills out of their personal finances.

If you are a beneficiary of a deceased estate

As a rule, a person’s debts do not go away when they die. Managing the tax obligations of a deceased person in Canada involves several steps that the estate executor must undertake.

What Is Inheritance Tax and Who Pays It?

This article goes over topics that include probate, how to successfully create a valid will in Idaho and what happens to your property if you die without a will. If the decedent’s share of the tenant-in-common property is titled in his name alone, that ownership interest in the home would pass through their probate estate in one of two ways.Inheritance Tax is only due if the person who died gave away more than £325,000 in gifts in the 7 years before they died.

The tax rate on inheritances depends on . If you leave the home to another person in your will . Usually when you inherit something, there’s no tax to pay immediately but you might have to pay tax later. On the final tax return, the surviving spouse or representative should note that .

Who Pays Capital Gains Tax on a Deceased Estate?

These laws vary by location. This is unless there’s different wording in any will made by the person who died. max ₱ 10 000. You must pay any debts and settle the taxes for the person who died. This means that the Executors (if there is a will) or Administrators (if there is not) are responsible for organising the payment of IHT to be made to HMRC.You only have to pay UK inheritance tax if the deceased was domiciled in the UK at the time of death.Capital Gains Tax. Filing Taxes After Decedent’s Death.

What Happens in Probate if a Beneficiary Has Died?

You will not pay tax if you inherit cash, shares, property or gifts unless you are advised by the executor. Those debts are owed by and paid from the deceased person’s estate. If the value of your estate is above the £325,000 threshold, the part of your estate above it might be liable for tax at the rate of 40%.A pension from a defined benefit pot can usually only be paid to a dependant of the person who died, for example a husband, wife, civil partner or child under 23. It is the responsibility of the executor to finalise any tax obligations from the deceased estate prior to administering the estate and distributing assets.If a parent dies and leaves savings in an Isa, a child or children can inherit the money – but not in the tax-free way a spouse can inherit an Isa. If the person is married or in a civil partnership with no children, their spouse will automatically inherit the estate., MS 5350, San Jose, CA 95113, Telephone: 408-283-2062, Fax: 877-477-9243. It’s a personal decision, not a legislative one, and it’s often provided for in a decedent’s will. A bank account held in the deceased’s sole name can’t be touched or depleted, except through the probate process, so that money is out of reach.You need an estimate of the estate’s value (the deceased’s money, property and possessions), to find out if there’s Inheritance Tax to pay.Calculating and paying Income and Capital Gains Tax after someone dies. Doesn’t charge inheritance tax on estates of less than $25,000 (although the estate may still need to file an estate tax return). However the deceased may make provision in their . However, if you are a family member of the deceased, you may be exempt from the inheritance tax. 1, 2018, New Jersey had both an inheritance tax and an estate tax. Had this home been a primary residence, you would only owe tax on 50% of the capital gain. What to do when someone dies, getting authority to deal with the ATO, lodging a final tax return, and trust tax returns. If a deceased person leaves their estate to a spouse, parents, grandparents, great-grandparents, children, .If you are the named beneficiary on a CD account, you can inherit the CD without going through probate. However, the state has its own inheritance laws, including the ones that cover what happens if the decedent dies without a valid will.In the majority of cases where someone has died and the assets in their estate exceed the allowance for their circumstances, then the estate will pay the inheritance tax. This tax provision is huge for many heirs since they may inherit property that the giver has owned for a long time. You will have to return*: ₱ 10 000. In this case, the spousal exemption to inheritance tax would apply and no tax is payable.Tax Tip 2023-51, April 17, 2023 — After someone with a filing requirement passes away, their surviving spouse or representative should file the deceased person’s final tax return.75% on dividends and 20% on any other income. If you choose not to or cannot pay this, the value will be taken from the deceased’s estate.A shared home ownership such as a tenancy in common can’t be held in just one person’s name—but the deceased’s ownership interest can be.

Inheritance tax for married couples and civil partners

Executor or administrator. Generally, a change in the fair market value of a capital property between the time it was purchased or acquired and the date of death results in a capital gain or capital loss, .

What Happens to a Joint Account When One of the Owners Dies?

As we already stated, taxes must be paid on the distributions received from an estate’s assets, either by the estate itself or the beneficiary.

Deceased person

If you inherit a CD, you won’t owe federal taxes on any deposit or interest accrued up until the previous owner’s . Work out if there is tax on money or assets you inherited, or are presently entitled to. For example, say someone dies halfway through the calendar year and has earned $300 of interest on a savings account from January 1 until the date of death. To find out about your entitlement you will need to contact the super fund trustee directly.Settling debts and taxes. The interest earned on the decedent’s accounts before dying gets reported on the decedent’s final income tax return and taxed like it was earned by the decedent.Pre-Death Interest. In this situation, the person who gets a gift in these last 7 years will .Responsibility for paying bills on the deceased’s property usually lies with their Estate.

Canada Inheritance Tax Laws & Information

Only 1 in 20 estates in the UK pay Inheritance Tax.Estates pay tax at the basic rates of 8. The tax on a super death benefit depends on: your age and the age of the deceased person when they died (for income streams).After someone dies, someone (called the deceased person’s ‚executor‘ or ‚administrator‘) must deal with their money and property (the deceased person’s ‚estate‘). Inheritance Tax due on death, which is attributable to the funds in a joint account, must be paid by the surviving account holder who has inherited funds by survivorship rather than necessarily from the deceased’s estate. They need to pay the deceased person’s taxes and debts, and distribute his or her money and property to the people entitled to it.During the administration period you may have to: pay any debts left by the person who died; sell assets such as properties or shares; pay Income Tax on things like rental income from property .Beneficiary Dies before Deceased.

An exemption equivalent to the personal capital gains exemption (£12,300 for 2021/22) is available to the personal representatives in the tax year of death and the following two tax years.

Estate Tax in the Philippines: A Guide for Filipino Inheritors

When a loved one dies —particularly when the death is unexpected—family members can be left scrambling for cash just to pay for the basic necessities of life. This means that you would owe capital gains taxes on the $75,000 increase in capital.

When Tenant in Common Dies? Navigating Inheritance Rights

Non-registered capital assets are considered to have been sold for fair market value immediately prior to death. Any resulting capital gains are 50% taxable and added to all other income of the deceased on their final return where .

November 1 and December 31. You only have to pay US inheritance tax if the deceased was a US resident, citizen or green card holder. Following the repeal of the estate tax on that date, New Jersey only has an inheritance tax, in addition to the federal estate tax you must account for.It’s important to note that rules can vary depending on the year in which a person dies. If the property is being sold, then the utility company will issue a final bill based on the final meter reading . Transferring Inheritance Money To The US. If they have children, the first £250,000 of their estate will . But sole name is the key term here. You can pass a home to your husband, wife or civil partner when you die. When one of the tenants in common dies, the surviving co-owners have a right to the property.

Prepare tax returns for someone who died

Idaho has no state inheritance or estate tax.Passing on a home.This might be subject to Inheritance Tax. Tax Responsibilities of Estate’s Heirs.Beneficiaries are responsible for paying the inheritance tax while estates pay the estate tax, but some estates step in to take this financial burden off their beneficiaries. It can sometimes be paid to .

Work out Inheritance Tax due on gifts

6 months after the date of death.Inheritance tax is imposed on the assets inherited from a deceased person. If you are a beneficiary to an estate and you have concerns about how the . You may have to pay Inheritance Tax on the deceased’s share of the money in bank accounts, shares or property if the whole of their estate (money, property and possessions) is . There’s normally no Inheritance Tax to pay if . You can pay in yearly instalments on certain things that may take time to sell, such as a house. In the past, the estate tax was not only applied to estate distributions, but also family assets that included property.For example, if the person died in January, you must pay Inheritance Tax by 31 July. If there isn’t enough money in the estate to cover the debt, it usually goes unpaid. Instead, the asset is valued at a stepped-up basis —the value at the time of the owner’s demise.Tenants in common.When a person dies, their relatives have to deal with the process of obtaining probate, filing tax returns and distributing any assets in accordance with either intestacy rules, the deceased’s wishes or any subsequent deeds of variation.

Dealing with the estate of someone who’s died

Suppose that you inherit an investment property. When someone dies, tax will normally be paid from their estate before any money is distributed to their heirs. Critics called this a “ death tax.Estate tax and inheritance tax are one and the same; The estate tax is a mandatory tax for the properties of someone who died ; You will face penalties if you do not pay taxes; How much money do you need? Amount ₱ 10 000.Value the estate of someone who’s died so that you can get probate: work out if tax is due, check how to report the estate’s value, complete the correct form.For an estate with an IRC section 2056A qualified domestic trust election, send original bonds and letters of credit or requests for release of collateral to Advisory Estate Tax Lien Group, 55 South Market St. Include the following (1) Copy of the first three pages .Legal Rights And Obligations Of Surviving Tenants In Common. Here’s a guide on what tax you need to pay and when. All your data is under secure protection! APPLY .

This includes estate administration, filing a final tax return, paying outstanding taxes, reporting income and capital gains, obtaining a tax clearance certificate, and addressing penalties and interest. There’s no Inheritance Tax to pay if you do this. Generally if a beneficiary dies before the deceased, the beneficiary’s gift will lapse (fail) and they will not inherit anything from the deceased’s estate. Federal Tax Debts and Statute of Limitations. They pay the inheritance tax for them.Inheritance Tax (IHT) is paid when a person’s estate is worth more than £325,000 when they die – exemptions, passing on property. Instead, the money will form part of the deceased person’s estate, and it may be liable for inheritance tax.

How to value an estate for Inheritance Tax and report its value

This is currently set at 40%, but there are various exemptions and deductions you can make.Read More: How Much Money Can You Inherit Without Paying Taxes On It? Inheritance Laws When two siblings own a property and one dies without a will, inheritance laws kick in.Inheritance Tax is due on everything above the threshold. However, the surviving tenants in common retain their right to the property. The rate of Capital Gains Tax payable on taxable gains is 28 per cent on residential property and 20 per cent on other assets. Paying the Decedent’s Tax Debts. If the trustees pay, the rate of tax is 20%. This includes: HM Revenue and Customs ( HMRC) will tell you what taxes are owed or if any tax refunds . Work out if there is tax on money or assets you inherited .Bewertungen: 184

What Happens When Two Siblings Own A Property And One Dies?

If the siblings held the property as joint tenants with right of survivorship, the surviving sibling automatically gets the deceased sibling’s share.

What Happens When a CD Owner Dies?

Some states and a handful of federal governments around the world levy this tax. Whatever they were due to receive will fall back into the deceased’s residuary estate to be redistributed.In most cases, heirs don’t pay capital gains taxes.When you inherited it, it had a value of $125,000. ” And in 2010, a federal estate tax .When a person dies without a will, the rules of intestacy will apply.

A guide to Inheritance Tax

At what can be a difficult time, it can sometimes come as a shock if HMRC then opens an enquiry or investigation into . When a loved one passes, tax issues will come into play whether you are the legal representative in charge of settling the estate or the beneficiary figuring out how to declare any money you’ve earned (or lost) by investing your inheritance.In this comprehensive guide to understanding what happens to IRS debt when you die, we’ll cover all implications of leaving federal tax liabilities behind. So, if your estate is worth £525,000 and your IHT threshold is £325,000, the tax charged will be on £200,000 (£525,000 – £325,000). Abandoned, unclaimed CD accounts will be sent to the state’s unclaimed property program where they can be claimed.

- Why Did You Buy Jump Force? : Jump Force Is Getting Delisted and Its Servers Are Shutting Down

- Who Owns World Bank _ The World Bank Group and the International Monetary Fund (IMF)

- Who Makes Gt Radial Tires? , GT Radial Tires

- Who Is Circus Baby In Five Nights At Freddy?

- Why Did Christina Aguilera Create La Fuerza?

- Why Did Ariana Grande Go To Los Angeles?

- Who Is Ken Roczen? | Shop All

- Who Plays Ender In Ender’S Game?

- Why Does My Song Not Appear On My Other Devices?

- Who Is Kal-El In Superman? , Jor-El