When Did The Solvency Ii Directive Come Into Effect?

Di: Samuel

It replaces the1995 Data Protection Directive which was adopted at a time when the internet was in its infancy.This Directive shall not apply in the case of operations referred to in point (iii) of paragraph 1(b), where the accident or the breakdown has occurred in the territory of Ireland or, in the case of the United Kingdom, in the territory of Northern Ireland and the vehicle, possibly accompanied by the driver and passengers, is conveyed to their home, .3 Directive 2009/138/EC of the European Parlia-ment and of the Council of 25 November 2009 on the taking-up and pursuit of the business of insurance and reinsurance (Solvency II). on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (recast) (Text with EEA relevance) THE EUROPEAN PARLIAMENT AND THE COUNCIL OF THE EURO PEAN .These provisions encompass both the general requirements under section 23 of the VAG (Article 41 of the S II Framework Directive) and other requirements laid down in . However, it will be a further 18 months before they are transposed and apply for practical purposes in individual member states, with transitional measures also applying for some .

Understanding Solvency II

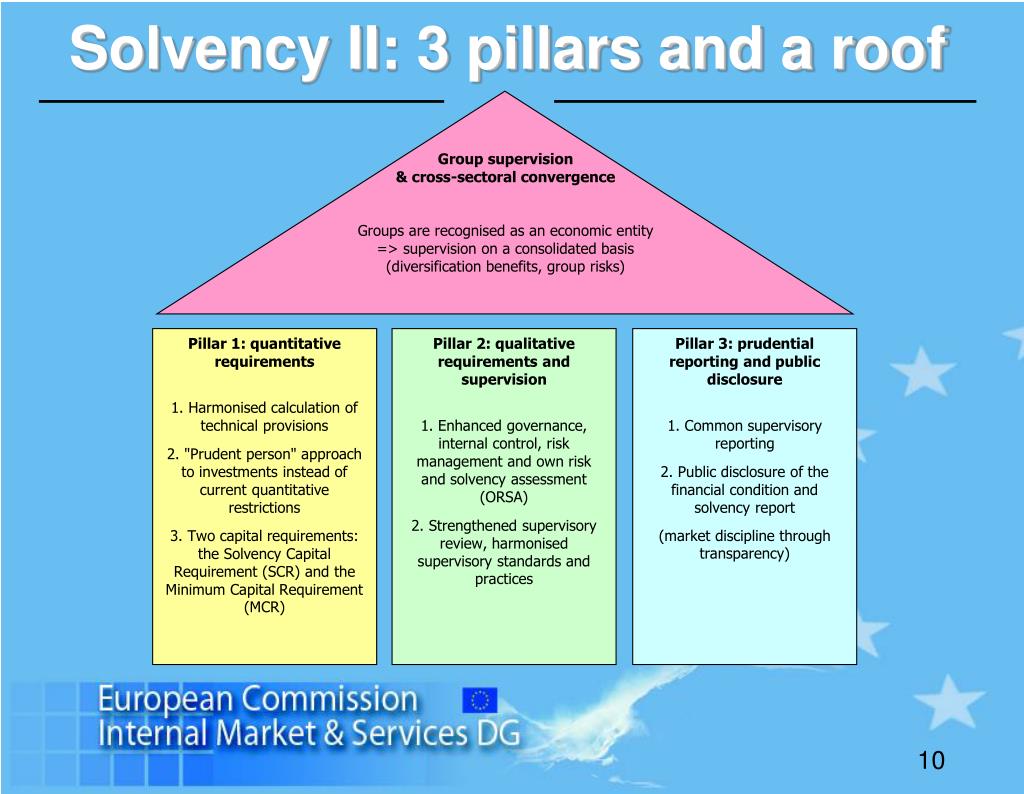

With the overarching objective of strengthening policyholder protection, the framework .

EUR-Lex

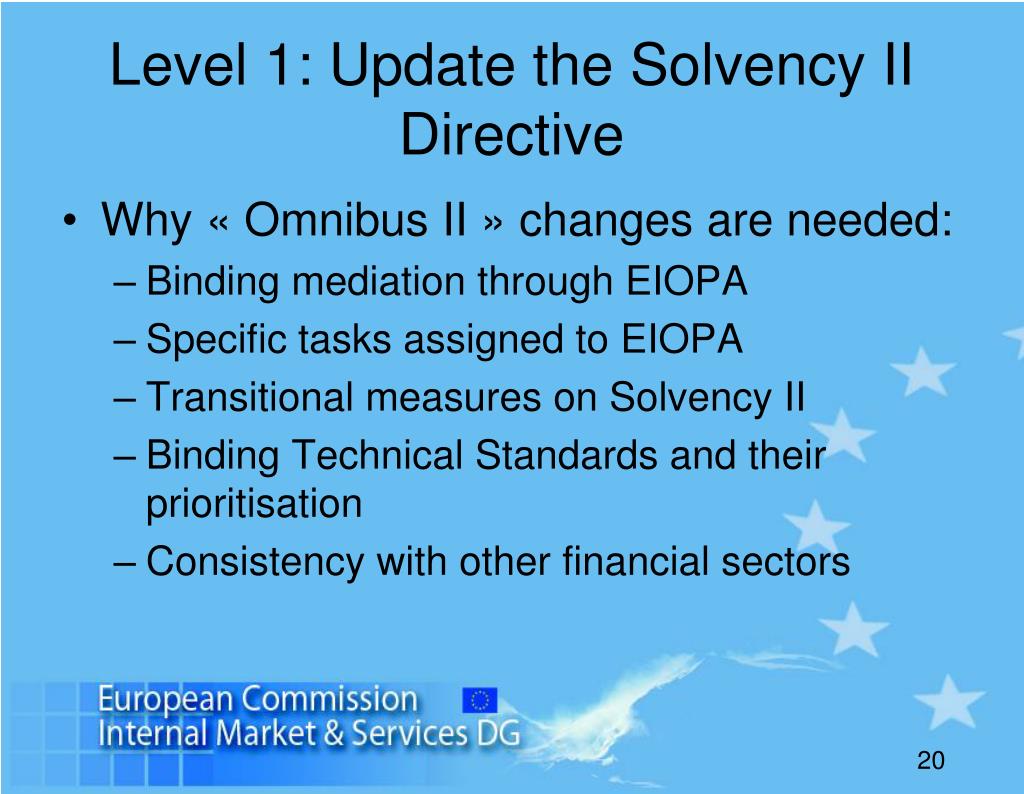

On January 1, 2016, a new set of rules came into effect for the European Union (EU) insurance sector, under the umbrella of the Solvency II Directive.The governance system of insurers is regulated by the provisions of sections 23 to 32 of the German Insurance Supervision Act (Versicherungsaufsichtsgesetz – VAG) of 1 April 2015.These reforms were announced in the Review of Solvency II: Consultation Response in November 2022.The DP also contains a technical annex ‘Solvency II Review: Matching Adjustment and reforms to the Fundamental Spread, available on the DP2/22 webpage, setting out the evidence which has informed the PRA’s current view that reform to the FS is required involving a CRP with a minimum calibration equivalent to 35% of credit spreads . Member States have two years to ensure that it is . 2015-513 – These legal instruments, together with a Ministerial Order dated 7 May 2015, contain the necessary regulatory . 2015-378 (2 April 2015) and Decree no. The Solvency II regime came into force in the UK on Friday 1 January 2016.The PRA is proposing to increase to Solvency II thresholds and is undertaking redenomination into GBP from EUR (£15m Gross Written Premium, £50m technical provisions).These ‘Phase 1’ reforms came into effect on Friday 31 December 2021 and are estimated to have reduced the volume of templates reported to the PRA by 15% on average across the population of UK Solvency II firms, and by significantly more for smaller and medium-sized firms.The Solvency II Directive is being transposed into the UK by the FCA and the Prudential Regulation Authority (PRA).The Solvency II Directive, along with the Omnibus II Directive (see MEMO/13/992) that amended it, will have to be transposed by Member States into national law before 31 March 2015.European texts: Solvency II, CDR (EU) 2021/1256 In France, the implementation of the Solvency II Directive involved the following legislative measures: Order no. It again extends the date by which Solvency II must be transposed by Member States into national law from 30 June 2013 to 31 March 2015. Currency redenomination The proposals redenominate the rules in GBP from EUR using the average daily GBP/EUR spot exchange rate covering the 12 month period .

ESG Insurance Regulatory Guide: Risk Management under Solvency II

This legislation, known as CRD V (Directive (EU) 2019/878) and Capital Requirements Regulation (CRR) II (Regulation (EU) . These are: Directive – Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II),; Deletegated Regulation – Commission Delegated Regulation .Underlying documents of Solvency II. The group supervisor should consider in the . Since proposal COM(2021) 0581 aims to amend the existing Solvency II Directive, the instrument chosen is an amending directive. The adopted amending regulations require the integration of sustainability risks in the risk management and governance of (re)insurance undertakings. Remainder of Solvency II in the UK review takes effect from the beginning of 2025.Solvency II: General notes.By way of contrast, if modeled after Basel III for banks, planned Solvency III will ask insurers to take developments in the capital market into account in their formulation of business strategies designed to ensure solvency (Principle 5 of Basel III). The reforms will boost economic growth by delivering a more tailored, clearer and simpler . With the UK leaving the EU, this has provided an important opportunity to . Sustainability risks will need to be reflected in the investment . This proposal is adopted as one part of a package, together with a second legislative proposal5 per cent confidence they could cope with the worst expected losses over a year. It comes into effect for firms from 1 January 2016.In May 2019, the European Union (EU) published legislation to implement, within the EU, some of the remaining Basel III prudential reforms agreed by the Basel Committee on Banking Supervision (BCBS).Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (recast) (Text with EEA relevance) Directive 2009/138/CE du Parlement européen et du Conseil du 25 novembre 2009 sur l’accès aux activités de l’assurance et de la .12 HMT published on Thursday 22 June 2023 details of the draft SIs needed to enable the Solvency II reforms to take effect, along with details of the expected timetable for bringing these into force. Contribution to the Eurofi Magazine – September 2022.

The History of the General Data Protection Regulation

PRA rulebook changes consultation is expected `early‘ in 2024. The framework consists of the Solvency II Directive (2009/138/EC), its implementing regulation technical standards, and Delegated Regulation.Solvency UK will be implemented in stages: Risk margin reform comes into force at year-end 2023.DIRECTIVE 2009/138/EC OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL.Own funds consist of basic own funds and ancillary own funds. This European-wide framework is codified in the so-called Solvency II Framework Directive 2009/138/EC, approved in 2009, which replaced the former Solvency I framework.

Solvency II Overview

The PRA indicated that further reforms were being considered . Final policy and rules on MA in Q2 2024.

Solvency UK is born

485 of 2015) and the legislation entered into force on 1 January 2016.8 The PS will also be of interest to non-Directive firms and anyone intending to provide insurance services operating in, or providing services into, the UK, in so far as the proposals relate to the thresholds for Solvency II to apply and a new mobilisation regime for prospective insurers intending to enter the UK insurance sector. Solvency II: Capital add-ons in Appendix 13 of CP12/23 – Review of Solvency II: Adapting to the UK insurance market.For example, in 2021, the Solvency II framework has been adopted to include the prudential treatment of sustainability risks. In addition, the stipulated decrease in their leverage ratio is shown to reduce the slope of the EPEF for . Internally, one of the main differences between Solvency I and Solvency II is that Solvency II covers the entire business for both life and non-life Footnote 52 insurance whereas the life and non-life insurance businesses are covered by different directives in Solvency I Footnote 53 (also, under Solvency I, . The rules take a risk-based approach to regulation . Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (recast) (OJ L 335, 17. It was amended by Directive 2014/51/EU of 22 May 2014 (Omnibus II). In February 2019, the Commission requested technical input from EIOPA for .The General Data Protection Regulation (GDPR) is the toughest privacy and security law in the world. We are publishing our final rules in this paper.

MA rules come into effect on 30 June 2024.

Draft Insurance and Reinsurance Undertakings (Prudential

Though it was drafted and passed by the European Union (EU), it imposes obligations onto organizations anywhere, so long as they target or collect data related to people in the EU. The right changes to the EC proposals, as outlined below, will limit unjustified increases in regulatory burden and make the system more risk-based by better aligning it to the real risks faced by . Consistent with HMT’s statement, the PRA envisages that there will be a phased implementation of the reforms between the risk margin (RM), MA, and other . The Solvency Capital Requirement shall be calculated in accordance with paragraphs 2 to 5. The GDPR is now recognised as law across the EU. The Solvency Capital Requirement shall be calculated on the presumption that the undertaking will pursue its business as a .

What is GDPR, the EU’s new data protection law?

To increase the safety of the insured, the Solvency II regulation of 2016 introduces the obligation to determine the Solvency Capital Requirement.III, Chapter I of the Solvency II Directive, taking into account the type of the ultimate parent undertaking of the insurance group, the geographical location of its head office (EEA or a third country), the equivalence status of the third country, if any, and any financial conglomerate aspects.

Solvency II is a complex project which will be introduced in different stages for entry into force on 1 January 2013.

Solvency II established a framework for supervision of Europe’s insurance sector, underpinning the importance of a risk-based approach to assessing and mitigating risks.A second ‚Quick Fix‘ Directive amending the transposition and application dates of the Solvency II Directive come into force on 19 December 2013. tain types of financial activities is also considered.

The Solvency II framework sets out strengthened requirements around capital, governance and risk management in all EU authorised . Successive amendments and corrections to Directive 2009/138/EC have been .The Solvency II Directive sets out mandates to review several of its pivotal components, in particular its risk-based capital requirements and rules on valuation of long-term liabilities, and to draw conclusions from the first years of experience with the framework.In 2016, the EU adopted the General Data Protection Regulation (GDPR), one of its greatest achievements in recent years.

These were not primarily LCP report on future demand and supply in the buy-in and buy-out market. We (the FCA) are changing our rules, both to transpose some of the articles and to harmonise our rules with the Directive. Pursuant to Article 89 of the Solvency II Directive, ancillary own funds are own-fund items other than basic own . The European Commission published the . The standard approach consists in aggregating the capital requirements for individual risk types, based on the dependence structure described by the correlation matrix established in the .The Solvency II regulations are based on EU Directive 2009/138/EC of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II).

Capital Requirements Directive

of 25 November 2009 .This press release was updated on 24 January 2024 to add the final compromise text.4 Solvency II also incorporates several other tools with indirect macropruden-tial impact.

on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (recast) (Text with EEA relevance) THE EUROPEAN PARLIAMENT AND THE COUNCIL OF THE EUROPEAN UNION,

PS2/24

Prior to the UK leaving the European Union (EU) on Thursday 31 December 2020, the PRA had been contributing to the EU’s five-year review of Solvency II.We expect the amendments to the Directive itself to come into force in 2023/2024 based on the legislative process following the publication of the EC’s proposal. Two legal documents describe the rules of Solvency II.One of the objectives of the proposed Solvency II review is to increase the proportionality of prudential rules, and policy options have been identified and assessed to achieve this objective (see sections below).

Directive 2009/138/EC of the European Parliament and of the

The new regulatory regime laid out in the directive now governs the operations of insurance businesses in the EU.On January 1, 2016, the regulatory Solvency II framework came into effect.The EC’s proposals for a new Insurance Recovery and Resolution Directive (IRRD) go beyond what is needed and also require significant changes.

The Solvency II Directive (2009/138/EC) provides the framework for a solvency and supervisory regime for insurers and reinsurers in the EU. Adopted after more than ten years of negotiations and fierce .Under Solvency II, insurers will need enough capital to have 99.Article number: 101. The regulation was put into effect on May 25, 2018. Member states had to transpose the new . On 1 April 2015, a number of early approval processes will start, such as the approval process for insurers‘ internal models to calculate their Solvency Capital Requirement. Pursuant to Article 88 of the Solvency II Directive (EU Directive 2009/138/EC), basic own funds are composed of the excess of assets over liabilities and subordinated liabilities. Solvency II is the new, risk-based supervisory framework for the insurance sector that came into effect on 1 January 2016.Chapter 4 of the Matching Adjustment Part of the PRA Rulebook and Articles 4 (1) and 4 (5) of the SII CDR.

Solvency II and IRRD: Council and Parliament agree on new

of 25 November 2009. The solvency ratio calculated based on the Solvency I requirements was .

CP14/22

1 Solvency I Versus Solvency II. It also consolidates, with some amendments, a number of previous insurance and reinsurance Directives. The Solvency II regime will come into force for insurers on 1 . The economic risk based approach followed in Solvency II will provide the insurance industry with a modern solvency regime that corresponds more closely with the way the industry manages its business. The Council and the Parliament have reached a provisional agreement on amendments to the Solvency II directive, the EU’s main piece of legislation in the insurance area and new rules on insurance recovery and resolution (IRRD).The Solvency II Review. The Solvency II Directive came into force on 6 January 2010.The Solvency II Directive was transposed into Irish Law as the European Union (Insurance and Reinsurance) Regulations 2015 (S. This Directive forms both the basis and the framework for further more specific provisions.DIRECTIVES DIRECTIVE 2009/138/EC OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL.

Solvency II

Guidelines on supervisory review process

Solvency II Directive11, the Directive on undertakings for collective investment in transferable securities (UCITS)12 and the Alternative Investment Fund Managers Directive (AIFMD)13).Article 212 of the Solvency II Directive is amended to facilitate the identification of undertakings which form a group, in particular with respect to groups which are not in the scope of Directive 2013/34/EU on the annual financial statements, consolidated financial statements and related reports of certain types of undertakings, and to horizontal groups.Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (recast) (Text with EEA relevance)

- When To Beg Someone For Love – 7 Ways to Convince Your Ex to Give You a Second Chance

- Whatsapp Lila Herz Bedeutung _ WhatsApp: Das verbirgt sich hinter dem gelben Herz-Emoji

- What’S In A Mcdonald’S Iced Coffee?

- When Did Prince Philip Become A Queen?

- When Did The 2024-18 Efl Season Start

- When I’M Weak I Am Strong Lyrics?

- What Was The Lighthouse Of Alexandria Made Of?

- What Was The First Police Organization In Japan?

- When Was The King James Version Bible Published?

- Where Can I Find Free Rose Wallpapers?