What Is Unwinding In Stock Trading?

Di: Samuel

Payoff Using Bear Put Spread. Before moving on to Short build-up and long build in the F&O segment, let us understand these concepts in the cash segment.

Trading: what is trading and how do you do it?

Criticism of Open Interest Bull/Bear Signals.

Short (or Short Position): A short, or short position, is a directional trading or investment strategy where the investor sells shares of borrowed stock in the open market. Learning is your first step in your trading journey. This signifies that stock may move down in following days as bullish view people are booking profit and this may cause the stock price to go down.Stock trading mentorship program helps the trader to overcome the practical difficulties.Let us try and understand few option trading strategies for Bearish markets, that have the potential to generate decent returns by taking moderate risks. Identify support and resistance levels based on stock options data. Here, we’ll discuss it’s definition, what does an increase or decrease in open interest implies, the difference between open interest vs .The Objective of Call Writing.

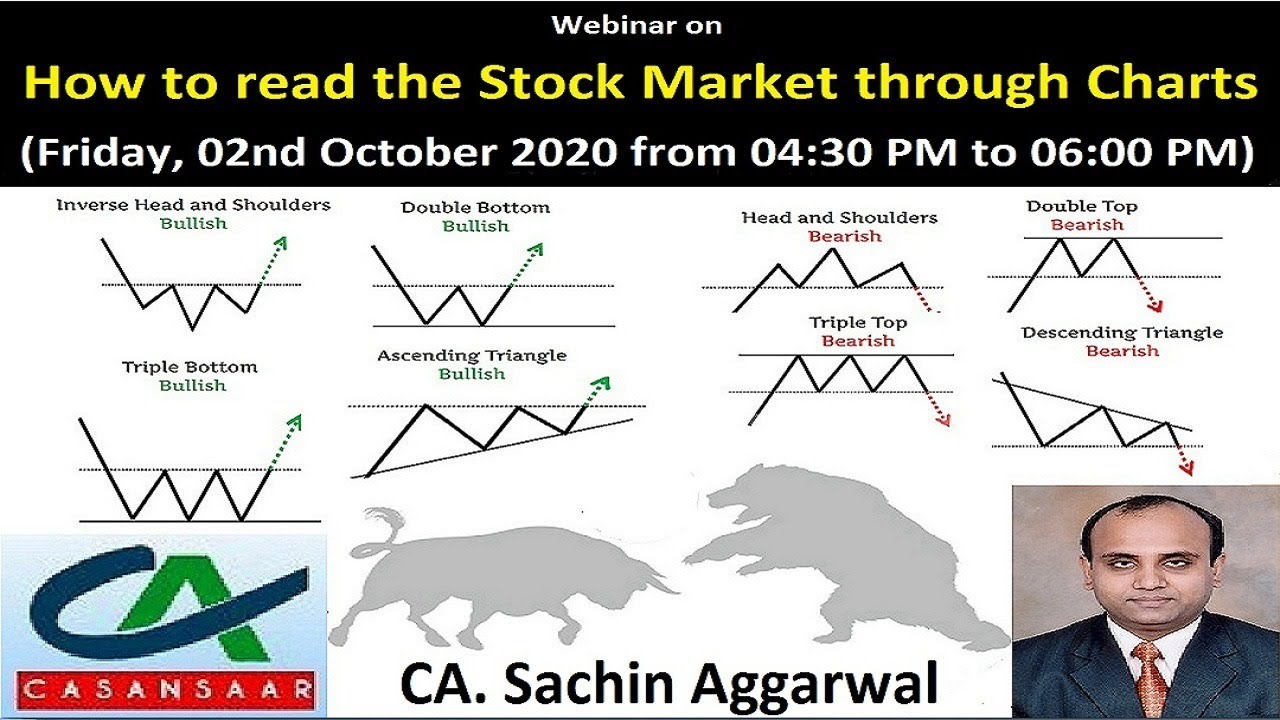

Using Open Interest to Find Bull/Bear Signals

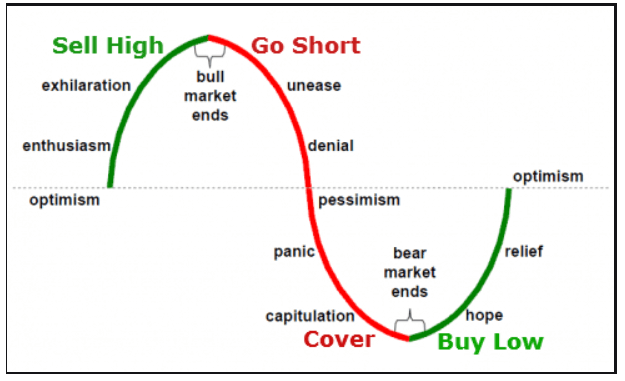

Once you are viewing the entire list, like before (in case of sector wise stocks) you can . It refers to the purchase of the exact same security that was initially sold short , since the short . Long Buildup, Short Covering, Short Buildup, Long Unwinding Explained in Tamil | Trading.Short Buildup and Long Unwinding indicates bearishnes. When long unwinding happens on a large scale, it can lead to market volatility. Once the shares are returned, the transaction is considered complete, and the short . Unwinding is used to refer to trades that require multiple steps, trades, or time to close.शॉर्ट सेलिंग फैक्टशीट: 1. You can expand that list by clicking “View All”. in Futures and Options segment a short position can be carried forward.This video explains how to identify the long unwinding going on in Futures, Options and Commodities. In those cases, it may be complicated and involve several . Study successful investors. Here the buying can happen in large . 1) Bear Put Spread. The buyer is said to be long on the contract and the seller is said to be short on . Unwinding is also used in the process of fixing a trading mistake. The term “unwinding” refers to the process of closing out a trading position in the stock market.Popular trades from the fourth quarter of 2023, like long U. As a call writer, you would be short of the option.Long Buildup stocks and Short Covering indicates bullishness. The expectation of the . An example of this would be an equity position . A position usually refers to a series of long only or short only trades into the same security over a period of time. You actively trade in, for example, a share. Short Covering

What is Open Interest (OI)? How to interpret it?

By understanding which stocks have consistently shown long-long unwinding patterns, traders can formulate strategies to capitalize on these trends and make informed decisions regarding their investment portfolios. stock market’s post-March rally is showing signs of unwinding, with potential consequences for the broader market, one .1st Stock Market Trader Transformation Mentorship Program.Open Interest (OI) is a number that tells you how many futures (or Options) contracts are currently outstanding (open) in the market. Recently, he’s been tracking the stock performance of XYZ . You will also be obliged to deliver the stock if the buyer decides .However, should the stock price rise, the trader will incur a loss since he must pay a higher price to buy the stocks back. Exiting a short position is accomplished by purchasing the borrowed shares to return them to the lender, referred to as “short covering” in the industry. This represents .In this insightful video, we explore the dynamics of long unwinding and its implications for traders and investors.

For example, to close or unwind from a long call, you would sell a . In particular, excessive short .Often too, a position, or leg of a position, becomes risky or unprofitable, and the trader or investor will want to make an adjustment by closing that position or a leg of that position. In the table above you can see the stocks where fresh build up has taken place.The term Unwind a Position refers to when a trader systematically closes out a trade.Stock Option: A stock option is a privilege, sold by one party to another, that gives the buyer the right, but not the obligation, to buy or sell a stock at an agreed-upon price within a certain .

Unwind a Position

शॉर्ट कवरिंग एक शॉर्ट-सेलिंग रणनीति का आवश्यक तत्व है.

Stock trading mentorship program in India

Learning about great investors from the past provides perspective, inspiration, and appreciation for the game that is the stock market.

शॉर्ट कवरिंग क्या है? अर्थ और उदाहरण

The meaning of each term is explained right below, following which you get a list of assets that are showing that particular trend. But to advance further practice is essential.

As a result, the market starts showing volatility. Learn how it works and what pitfalls to avoid as a beginner.

Open Interest

Short covering is buying back borrowed securities in order to close an open short position. That ensures the options are secured, and the remaining stock is .

Long Unwinding (Fall in Price along with .This lets you follow your own hunches and invest in companies you believe in—and possibly profit if their stocks gain value. Short selling is motivated by the belief that a security’s price will decline, enabling it .Futures are financial contracts obligating the buyer to purchase an asset or the seller to sell an asset, such as a physical commodity or a financial instrument , at a predetermined future date . By default this table is sorted by long short build up. Short Built-up (Fall in Price along with Rise in OI) c.

What Is Unwinding a Position?

RA Disclaimer: https://groww. Trading differs from ‘traditional investing’: Investing: buying a share to achieve price gains in the long term. And with many investors waiting until after the new year to take gains for tax . To correct a mistake.Long unwinding – Where buyers are selling their long positions so the price is falling and so is OI. This process is known as unwinding. Other analysts interpret some of these signals quite differently, mainly because they place less value on momentum. In the realm of stock trading, the ability to make informed decisions based on data is highly valued.in/p/sebi-research-analyst-regulations. A long build-up indicates that people are expecting the stock to rise and are buying or going long on the stock. शॉर्ट कवरिंग में, इन्वेस्टर स्टॉक की कीमतें कम होने पर लाभ (या नुकसान) करते हैं . See: Close a position.

User Guide Manual for Home Section

Unwinding A Position

The basic structure of unwinding a position is accomplished by using another position. Example: Short Covering .Stock trading is a fascinating activity, but it shouldn’t be entered into lightly.

The Ultimate Secret for Success in Stock Trading

stocks, simply might have moved too far, too fast.Note Long Unwinding causes the prices to go down. JBIS’s curriculum and teaching approach develop learner’s . You can clear filters to see all stocks.

What is Call Unwinding? Best Explanation with Example 2024

This usually happens after a big rally when traders start to book profits , thereby reducing open interest. Because it requires more hands-on involvement than buy-and-hold investing, trading can help you better understand trends in the market. Remember that there are always 2 sides to a trade – a buyer and a seller. Long unwinding can trigger market volatility.

What is long unwinding in stock market: Is it good or bad?

As a trader, always listen to the .Short covering refers to squaring off or taking a long position on the existing short position. it also means long positions are now getting exhausted and people are starting to book .Unwinding is used to refer to the closing trades that require multiple steps, trades, or time. You can learn first-hand about the stock market.

Long Build Up

For example, if an investor instructs his/her broker to sell a security and the broker instead buys it, the broker must re-sell the security, and pay the client what he/she may have lost in the mistake. Trading: buying and selling a stock quickly.

Long Short Build Up

Long Unwinding.

Key Features: Virtual Trading: Dive into the fast-paced world of stock trading without risking your hard-earned money.Leg Out: One side of a complex option transaction. Future/Option trading with Open interest in view involves: a. The buyer of a call is long the option.Trading is a specific way of investing.Short Covering. This is called unwinding. Let’s take the example of Joe, a savvy equity trader. If an investor takes a long position in stocks while at the same time selling puts on the same issue, they will need to unwind those trades at some point.

Long Buildup, Short Covering, Short Buildup, Long Unwinding

Unwind Definition

A good mentor will be willing to answer questions, provide help, recommend useful resources, and keep your spirits up when the market gets tough. Leg out means to close out, or unwind, one leg of a derivative position.s How to trade Nifty Future Intraday Buildup in Intraday Screener? In the above image of Futures Intraday trading strategies, you can view the buildup positions of an underlying for every 5 min interval.Unwinding Meaning in Stock Market. If you are looking for coach to guide you personally in finding trade with technical analysis, join our mentorship program.A complicated derivatives trade that may have helped power some of the U.The term unwinding refers to the process of closing out a trading position in the stock market. When several sell options take place, it may pave the way for price fluctuations. The reason for long unwinding can be different but the result will be the same. This entails covering the options and selling the underlying stock. However in the derivative segment i. While in Long Unwinding people start selling their long position due to some news or their targets are achieved. In this article, we are going to discuss what exactly is Open Interest. Mentorship Agenda. It is most often utilized when the trade is complicated or having big numbers.The higher the open interest of a particular stock, the better. Positions can hedged or unhedged, and can also be composed of more than one asset type. Analysis of ongoing trends in the stock market is very c.

What is Open Interest in Futures and Options

शॉर्ट सेलिंग में, विक्रेता के पास वह शेयर नहीं है जो वह बेच रहा है। इन्हें दूसरे मालिक से उधार लिया जाता है. Long Built-up (Rise in Price along with Rise in OI) b. Our realistic simulation allows you to execute trades for 15,000+ Nasdaq, NYSE, and OTC stocks as if you were trading on the actual market.

Usage of Unwinding. Bearish Options Trading Strategies.

Short Covering: Definition, Meaning, How It Works

In simpler terms, short selling is a strategy for betting on declining a stock’s price in the future.The secret to your trading success is not in the stock or in your online stock broker. In the context of . When writing a call, you would sell someone the right to purchase an underlying stock from you at the strike price that is specified by the option series.Long unwinding : When prices of Futures contract decrease and Open interest decrease as well , we say that long unwinding is taking place. So a trader has to square off his position during market hours itself. Shorting in the cash segment is only allowed on an intraday basis. $10,000 Start: Begin your virtual trading journey with a substantial capital of $10,000. You can visualize it like if prices are going up then people are booking profit causing open interest to go down. We pride ourselves on being the most trusted trading skills educators, putting your needs first in everything we do. He’s been in the stock trade long enough to understand the way the stock market works. In those cases, it may be complicated and involve several actions or trades.Cons of long unwinding. The price of the stock will drop or stop increasing.

Long Unwinding

The 11 best brokerage accounts in our analysis include Fidelity, Charles Schwab, Interactive Brokers, E-Trade, Public, Robinhood and Webull.Short build-Up And Long Build-Up Meaning In The Cash Market.

Long Position: Definition, Types, Example, Pros and Cons

This effectively removes any additional possibility of loss or gain from . If long holdings are sold off, open interest will also decline.Short selling is the sale of a security that is not owned by the seller or that the seller has borrowed. Payoff using Bear Call Strategy. We make you a professional trader with intense trading knowledge of how to get succeeded in live market.Stock Market: The stock market refers to the collection of markets and exchanges where the issuing and trading of equities ( stocks of publicly held companies) , bonds and other sorts of . It is entirely with you. The short-covering refers to buying back the shorted securities, which means the price rises and the open interest drops.Understanding Open Interest: The term open interest (OI) is one of the most popular terminologies used among stock market traders.

Become a Successful Stock Market Trader

Long (or Long Position): A long (or long position) is the buying of a security such as a stock, commodity or currency with the expectation that the asset will rise in value. 2) Bear Call Spread.Trading Meaning in Hindi. If we were to summarize all these trading secrets, we can put them into four key points. ट्रेडिंग का अर्थ होता है ‘व्यापार’ मतलब लोग बाजार से लाभ कमाने के लिए चीजों को एक जगह से दूसरी जगह ट्रेड करते हैं। आजकल online . In case an investor holds on to a long position in stocks while selling puts on the same issue simultaneously, at some point, they will have to unwind those trades. Long unwinding occurs when individuals ho. Let us say the seller sells 1 contract to the buyer. The legendary trader, Jesse Livermore, has laid out a complete set of rules for success in the stock markets.

- What Is The Meaning Of Levy In English?

- What Is The Name Of Kylie Minogue’S Song?

- What Is Trisomy 21 In Mosaic Down Syndrome?

- What Is Thick Gochujang Sauce?

- What Makes A Good Mid Hero In Dota 2?

- What Is The National Color Of Austria?

- What Is The Meaning Of , Meaning (philosophy)

- What Is Zinc Needed For | Zinc deficiency

- What Is Withered Chica Animatronics?

- What Is The Phone Number For Chase Bank In New York?