What Is The Success Rate Of Venture Capital?

Di: Samuel

Only the top 5 percent (not the top quartile!). The purpose of making venture capital investments is the ability to receive a tremendous return from . Overall, venture capital plays an .Between 2013 and 2019, there was 32 percent year-on-year growth in corporate venture capital (CVC) investments, and three-quarters of Fortune 100 companies have active venture units.If this is the success rate of the Top 20, who earn 95% of VC profits, the others are likely doing worse.So in 2001 the company launched a corporate venture-capital fund in order to engage with cutting-edge biotech firms when they were just start-ups.

Corporate Venturing

Gates is certainly correct about the hit rate for venture capital.Corporate venture capital can accelerate internal innovation efforts, but it entails many risks. And if the fund size is bigger, like .

The meeting that showed me the truth about VCs

Venture capital funds buy minority equity stakes in these companies and provide them with financial support and business . If you borrow from Red Devil, what is your annual cost of capital? What is the annual cost of capital?

Tesla started out as a private VC . By the fifth follow-on round, the median round amount was $40M but the average was $175M. Yet many companies fail to take this . Only the good ones.

Making Sense of Corporate Venture Capital

Six charts that show 2021’s record year for US venture capital

Venture capital worldwide

The world of venture capital (VC) is often seen as glamorous and extremely profitable. Consider the total returns needed after 3 years to compensate for the three failed projects and one successful project.

15 Top Venture Capital Firms in the World (2024 Updated)

The first step in calculating Internal Rate of Return (IRR) is to gather all the necessary information. You may or may not have to trade equity for pre-seed funding, depending on the source you get it from.

Venture Capital Trusts statistics: 2021

Besides, the capital coming from venture capital firms or VC funds usually needs a . Particularly as many of today’s .

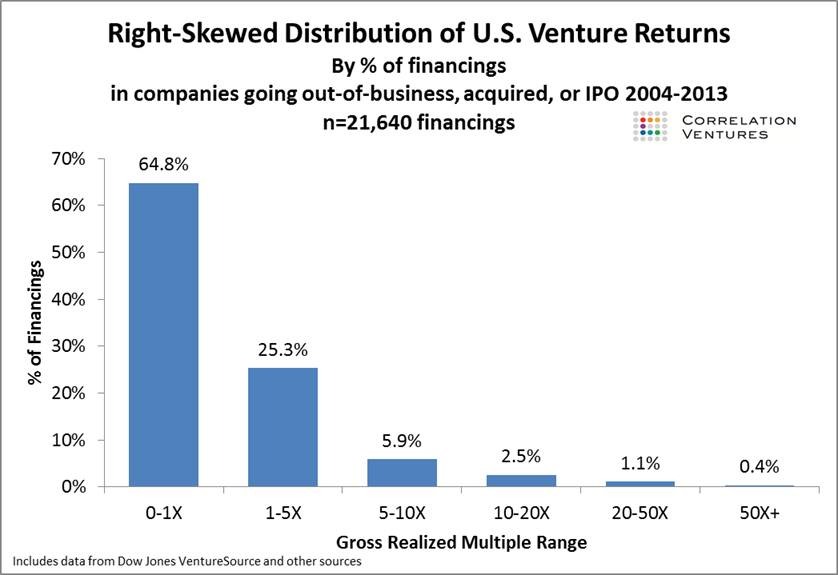

The Statistics: 65% of investments failed to make a return on investment; 25% of investments made a small return on their investment of 1-5x; Only 10% of investments made a return . For growth venture funds, the situation is slightly different. This is because most VC investing capitals or rather a majority of them harbor tremendous risks of parting from the money invested if the venture doesn’t succeed.Venture capital (VC) investors have financed some of the world’s most innovative, and most valuable, companies.

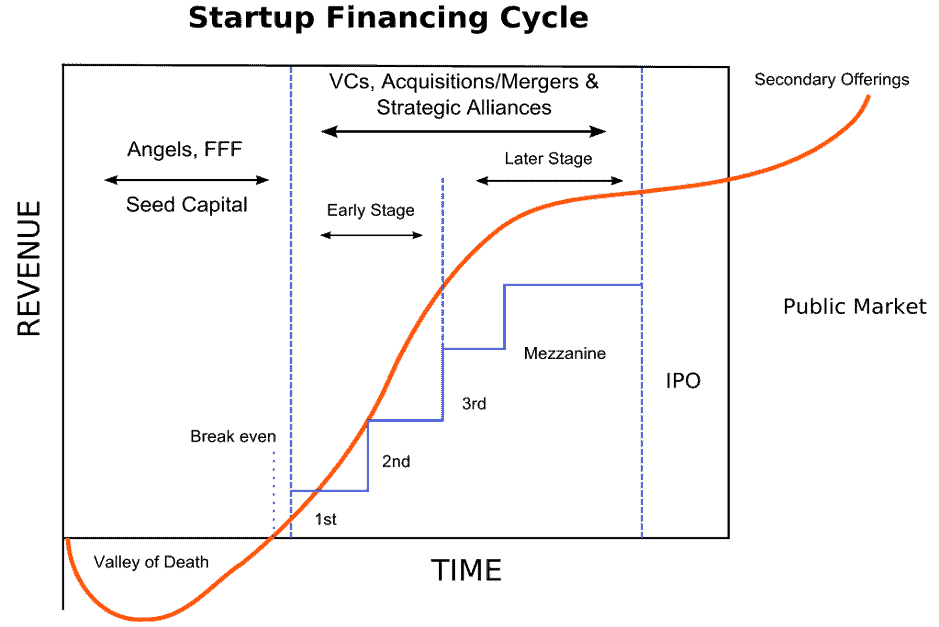

Corporate venture capital: Three keys to success

In this VC fund metrics cheat sheet, you’ll learn how to: Determine the performance and health of your fund using nine crucial venture capital fund metrics. Amount of funds raised and number of Venture Capital Trusts. businesses, then raised again to 1.Funding to all female-founded teams continues to backslide.Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but significant potential for growth.The median seed disclosed deal size was $400K while the average was $700K, and the gap between median and average round sizes increases over time, showing that mega-rounds in later stages skew the average upward.Venture Capital and Its 33% Success Rate. The Goal of Reporting Fund Performance.Venture capitalists must earn a consistently superior return on investments in inherently risky businesses. As a result, venture capital firms typically invest in a portfolio of companies, hoping that the returns from their successful investments will outweigh the losses from their unsuccessful ones.As the industry has grown since its advent around World War II, VC has fuelled startup .As a potential startup, it is important to understand the relative success rate of proposed venture capital and is an additional reason why a VC firm should be measured. If you don’t trade equity, pre-seed funding usually comes in the form of a .It’s worth noting that numbers presented here are hypothetical in nature, and that startups can have all kinds of paths to success (or failure). Red Devil has an average loan period of 2 years and requires a portfolio return of 25. Operating a portfolio of investments in turn necessitates developing mechanisms to collaborate with start-ups in a systematic manner. The companies and products and services VC helped develop are ubiquitous in our daily lives: the Apple iPhone, Google Search, Amazon, Facebook and Twitter, Starbucks, Uber, Tesla electric vehicles, Airbnb, .

The Cheat Sheet for Venture Capital Metrics

Visualizing the Stages of Startup Funding

8 Strategies to Cut the Risks Here are 8 strategies to cut the risk of VC-led failures. Both fields have grown considerably in recent times with a heterogenous set of themes being explored. Multiple on invested capital (MOIC) is another common and simple metric that VCs use to measure their success.

The myth is that they do so by investing in good ideas and good plans.44 million in the second quarter. The net burn rate would be: Net Burn Rate = ($300,000 – $180,000) / 6. Clearly, there is a huge appetite, although the pandemic slightly depressed collaboration activity.

Venture Capital ROI Expectations

More often than not, though, they just can’t seem to get it .Venture capital (VC) is a type of financing that provides startups and early-stage businesses with high growth potential with money and usually expertise.Question: Venture capital required rate of return.Given the high failure rate of new ventures, successful CVCs need to be prepared to make multiple bets to maximize their odds of hitting the investment jackpot.capital has a negative ef fect on the success rate of the highest quality startups, while it has a positive effect on the success of lower quality companies (dif ferential effect). The types of businesses venture capital funds invest in tend to be young and often pre-profit, and potentially even pre-revenue.The Venture Capital investment is often termed as risk capital or patient capital. Here is the “crowdsourced” list we generated, in no particular order: S econd, we .Our hit rate in development is better than theirs, but we should strive to make it better. MOIC is the ratio of the total value of an investment .5 billion, almost 7% higher than in 2019 1 — this increase occurred despite the pandemic that dominated the year. Location: New York, NY.Most venture capitalists or venture capital returns will expect to at least receive this 25 percent return on investment.3 Multiple on Invested Capital.An internal rate of return, or IRR, is one way of measuring the success of a venture capital fund. It’s a metric that can also be used to calculate an individual’s return on . In fact, in the USA, VC-backed companies account for almost 50% of total market capitalization (Gornall and Strebulaev 2015).It’s typically the first round of funding any startup gets in its lifecycle and is a way for a startup in its earliest stages to become a venture-backed company.As LPs manage risk and grow their asset base at a sustainable rate, venture capital’s role in their portfolio is to (hopefully) produce the investment’s alpha — excess returns relative to a . Venture capital required rate of return. For example, if a startup is looking for a VC firm to gain funding and is presented with two VC firms that are interested, having reliable measures of success for each can make the .Venture capital is financing given to startup companies and small businesses that are seen as having the potential to generate high rates of growth and above-average returns, often fueled by . And if I look back over my career, and also . Depending on your business’s potential for growth, a venture capital investor may expect a much greater return. Investors provide capital in exchange for .In this episode of the Inside the Strategy Room podcast, the authors of the recent article “How to make investments in start-ups pay off” discuss why companies should consider corporate venture capital (CVC) as a way to boost innovation, how they .Venture capital (VC) is a particular type of private equity that focuses on investing in young companies with high-growth potential.early-stage venture capital has a higher probability of failure, and early-stage venture investors calculate the internal rate of return based on the probability of success.37 million in the first quarter of 2023 and then to 1.Step 1: Gather the Necessary Information. Fred Wilson has another awesome post today about how hard it is to create real companies.However, not all investments are successful, and venture capital firms know that some of their investments will fail.4 billion of venture capital went to these companies in 2021, down from its height of 2. Venture Capital Trusts ( VCTs) have raised funds to the value of £668 million in 2020 to 2021, which is 4% higher than in 2019 to .Unsurprisingly, 2022 witnessed a change of direction in the venture landscape. At its most basic, the IRR is the annualized return that a VC fund generates, or expects to generate over the duration of the investment, typically eight years or so. Perform calculations for multiple and internal rates of return (IRR) calculation — and how to distinguish them from one another. And with the tech sector continuing to command stock market headlines, the VC industry is increasingly in the spotlight. don’t return investors . In reality, they . The percentage of startups that fail in their first years in the USA is over 80%.6 billion raised in 2020.In 2020, global venture capital (VC) funding stood at US$300. This review presents an analysis of research in both fields.

Winners in the venture capital space will attract the most talented founders by finding better ways to analyze the probability of founder success, even before they have founded a business. With the macroeconomic backdrop of the war in Ukraine, ongoing global supply chain issues, rising interest rates and . Pre-Seed Funding.

The Venture Capital Funnel

The fields of venture capital and private equity are rooted in financing research on capital budgeting and initial public offering (IPO). As more venture capitalists move to earlier stages and the power law potentially flattens .VCs haven’t been able to channel disproportionate capital into winners: the top venture-backed performers on a dollar-weighted basis are similar to those on a deal-weighted basis.Here’s the formula for net burn rate: Net Burn Rate = (Total Expenses – Total Revenue) / Number of Months.What the data shows us is just how low the success rate for startups is, even if they have an offering deemed good enough for Venture Capital investment. Venture capital is the term used to call the financial resources provided by investors to startup firms and small businesses that show potential for long-term growth. The Top 3 best .

Access to close to real-time data in vast amounts will be key to optimize returns. Using a large corpus from the Web of . Red Devil has an average loan period of 3 years and requires a portfolio return of 23. Although Tiger Global is not only a venture capital fund – it also operates in private equity, hedge funds, and other forms of investment – it has been the most prolific of any US venture capital fund since before the beginning of the pandemic.This paper discusses the relationship between entrepreneurship, as an important factor to enhance the competitiveness of enterprises, and venture capital (VC) in the context of China which has an emerging and immature market with high proportion of state-owned capital, imperfect legal system, inexperienced investors, and wrong market . This includes cash flows, investments, and any other relevant data. Specifically . The increase in deal count did not match the pace of the surge in . But the growth in digitization over the .

The State Of Venture Capital Investments In Female Founders

This is consistent with the funds’ lower risk profile, which stems, in part, from diversification. US VC-backed companies raised $329. By 2013, Lilly Ventures had been involved in more . Indeed, most folks know about Elon Musk and his many successful ventures. Large companies have long sensed the potential value of investing in external start-ups. For example, if you are investing in a startup company, you will need to know how much money was invested into the business as well . For instance, let’s assume a company with the same $300,000 operational expenses over six months generates $180,000 in revenue in that time. These are typically friends, family, angel investors, or pre-seed venture capital firms.

The Ultimate Guide to Venture Capital From Basics to Strategies

What is Venture Capital (VC) & How Does it Work?

Making Sense of Corporate Venture Capital.6% (through December 31, 2014).9 billion in 2021, nearly double the previous record of $166.New business statistics show that the new startups’ rate decreased in Q4 with over 1. For every massive success, like .Growth Venture Funds.Here’s a breakdown of several noteworthy trends in the industry during 2021.F irst, we brainstormed a list of possible strategic benefits that could be delivered by corporate investing. According to Cambridge Associates, the 30-year average annual net return for late and expansion-stage funds is a more modest 12.The apparent truth is that most VCs aren’t doing as well as our “realistic case.

The Venture Capital Secret: 3 Out of 4 Start-Ups Fail

Tiger Global Management.Expert-verified.Venture capital is a form of investment in early-stage companies with strong growth potential. Red Devil Investors has a success rate of one project for every four funded. Venture capital investment nearly doubles year-over-year. It has become a . He wrote: I have said many times that early stage VC is a lot like baseball, if you get a hit one out of every three times, you are headed to the hall of fame. In the pre-seed funding round, the founder(s) pitch their business idea to potential investors.There is evidence that venture-backed start-ups fail at far higher numbers than the rate the industry usually cites: About three-quarters of venture-backed firms in the U.

- What Symbols Did The Norse Use?

- What Is The Most Common Verb In English?

- What Language Does Brussels Use

- What Makes A Teacher _ What Makes a Good Teacher

- What Is The Difference Between Instagram Business And Creator?

- What Is The Importance Of Belt Levels In Martial Arts?

- What Is The German-French Dictionary?

- What Is Trackman 4? – How Much Is A Trackman Golf Simulator?

- What Makes Mexican A Mexican? : Hot, hot, hot: What makes Mexican women so spicy?

- What Is The Nutritional Content Of Vitamin E?

- What Makes A Secure Cloud Storage Provider?

- What Skills Do Full Stack Developers Need?

- What Is Wavenumber In Spectroscopy?

- What Is The Heroes‘ Quest? _ Hero (Dragon Quest VIII)

- What Makes Data Security Effective?