What Is The Scottish Widows Personal Pension?

Di: Samuel

Get Online With Us

Find out more about this change . The retirement benefits you receive from . 69 Morrison Street.

Fund Prices, Charges & Updates

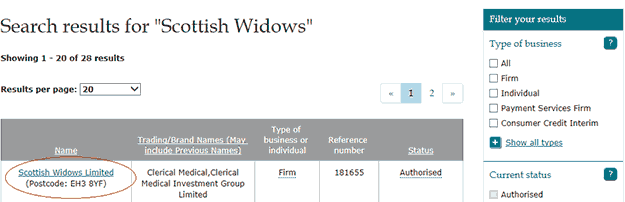

Scottish Widows growth funds.This Fund will be reviewed periodically by Scottish Widows. This is where you can register your Scottish Widows pension online. Also available with life cover. As an existing Scottish Widows customer, we’re here to support you for as long as you need us.It’s easy to lose track of your pension so it’s really important to keep on top of simple pension admin, like nominating beneficiaries (who you’d like your money to be left to) and making sure your contact details are up-to-date. Learn about our mobile app. If you’re a Scottish Widows customer you can do this via our online services . it could be Clerical Medical or Norwich Union. Life assurance policies. A spokesman says this backlog has been . If you’d like to talk about your options, you can contact us.If you are an existing Scottish Widows pension customer, log in to your pension here to view your policy value and to manage your account online.A pension is a long-term, tax-efficient investment that helps you save for your retirement. You can try online chat, complete a . We can help you manage your savings and plan for the retirement you want, with our online services and our mobile app.

Frequently Asked Questions

In January, Scottish Widows’ chief operating officer Donald MacKechnie told us that there was a backlog of up to 6,000 complaints waiting to be resolved.

What Is A Pension?

If we’re not hitting the mark, please let us know and we’ll try to provide a solution as quickly as possible. Funds available to your Scottish Widows PIP.Free money management lessons and tools.Calculators and tools. You can usually take a lump sum of up to 25% of your pension pot tax-free.Scottish Widows was set up in 1815 to take care of women and children who lost their fathers, brothers and husbands in the Napoleonic Wars, taking its name after the people it was founded to look after. Please note: Life insurance policies have no cash-in value at any time. Family Pricing Service Charge £0. You can also manage flexi-access drawdown entirely on platform, letting you specify dates for regular income payments and process ad-hoc payments in real time. We’re committed to helping women close the gender pensions gap and that’s why this International Women’s Day, we want to start a national conversation on the gender pension gap using almost 20 years of our research and expertise.With-profits is a medium to long-term investment. For most funds, you can also view or download factsheets, including past performance. You can normally buy a Standard .Send the form to: Scottish Widows.If you want to find a balance between the two and utilise some stakeholder funds along with some external funds then a personal pension is better. You might have a pension which has been set up by your employer that you both pay into. Range of cover options.Our Retirement Account gives you flexibility to retire and start taking your pension in a way that suits you and your needs. Paying more calculator; Pension payments calculator; Your future lifestyle questionnaire; Your retirement income; Your retirement options We’ll be happy to help you, but we can’t offer you financial advice or give you recommendations about what to invest in. But this doesn’t mean you have to start taking your money then.A Scottish Widows Platform personal pension I have another, or more than one type of pension I’m not sure This is a pension which has been set up by a current or past employer.Scottish Widows has been helping people to save for their future for over 200 years and remains one of the UK’s largest pension providers. may have bonuses added to these guaranteed minimum benefits; All policyholder money invested into with-profits (as part of a pension, life assurance or savings policy) is pooled together in part of our .The Scottish Widows Personal Pension offers flexibility to provide for the most simple or sophisticated requirements.

When Can I Access My Pension?

Manage a gradual transition into retirement. There are different types of pensions.You are eligible for a Scottish Widows annuity if you: Have a pension fund of at least £10,000 after tax-free cash or already have an existing Scottish Widows Pension. We’ve produced definitions for our investment funds which contain the terms ‘Adventurous’, ‘Balanced’, ‘Cautious’ and ‘Progressive’ to help you better understand how we define the level of risk associated with each investment. We’re available Monday to Friday 9am to 5pm.

Personal Pensions

Cash sum if you are diagnosed with a critical illness that is covered by your policy. How to decide if you need advice. Or you can ask a question by filling in our online form.

Now more than 200 years on, we look after almost 6 million customers across the UK. Funds available to your Halifax PIP.How to trace a policy. Please note, if the policy number you wish to transfer in to . We’ve assumed you attained your current age at today’s date, and that . You can write to us at: PO Box 24177.

Workplace Pensions

Take up to 25% of your pension pot as a tax-free cash lump sum, and use the rest to get a regular and guaranteed taxable income for life. This would be the minimum automatic enrolment contribution for someone with pensionable earnings of £24,000 each year.It’s a way of pooling money together with other investors.

Pension Products And Annuities

Scottish Widows Funds

Visit us online for helpful information about our products. You might have more than one of each .Your pensionable salary will increase each year at: Low Salary Inflation of 1. We can help you take control of your finances and prepare for your future. Critical Illness Cover. Unsure which types of units are applicable to which pension contract? Read our explanations. Are resident in the UK or Northern Ireland (excluding the Channel Islands and the Isle of Man) or an existing Scottish Widows pension customer. We’re part of a group which also includes well-known names such as Lloyds Bank, Halifax and Bank of Scotland.Our online services.These tend to go through periods of upwards and downwards price movements, including sudden changes over the short term. Generally, a Retirement Account may be suitable for you if you’re thinking about combining plans worth at least £10,000. If you’d like to get in touch by post, please remember to include the information we’ve mentioned above. Make a complaint.

What Happens To My Pension When I Die?

Today our commitment is still the same – to help people .

What Is Salary Exchange?

The fund manager decides which type of assets will be bought and sold by the fund. It may also be known as a ‘workplace pension’, ‘group personal pension’ or ‘group stakeholder pension’. The Account provides access to a wide range of investments that help to build your retirement . Whatever level of access you have, we communicate by email and provide all your documentation electronically in your personal Literature Library. Accessibility statement [Accesskey ‚0‘] Skip to Content [Accesskey ‚S‘] Skip to site Navigation [Accesskey ‚N‘] Go to Home page [Accesskey ‚1‘] Go to Sitemap [Accesskey ‚2‘] Scottish Widows Logo.

The first step to tracing a policy is to complete the relevant form (s) below, print and sign it, and then post it to us. Total paid into plan to date. This will save you from having to remember it, and allow you to sign in faster. If you have a Third Party Investment Account, your pension provider can also see the Account as the owner of the assets they hold on your behalf. These definitions are relevant to the Cautious Growth Fund, Balanced . In future the Fund could be invested in different funds and additional asset types, though the Fund will continue to invest with an emphasis on fixed interest securities.

How You Can Take Your Pension

This includes paid work, taxable income from additional pension pots .

Series 1 Original Series, sometimes called Series 1 Contracted in Money Purchase commencing . You can contact us by post at Scottish Widows Platform, PO Box 24065, 1 Tanfield, Edinburgh, EH3 1EY, or by email at [email protected] you change your mind about the Personal Pension Account, the Account can be cancelled within 30 days of you receiving a cancellation notice.We’ve based this example on automatic enrolment, where the minimum contribution is 3% from the employer, 4% from the employee and 1% in tax relief.

Pension Transfer Investment Choices

The Family Pricing Service charge only applies to new Retirement Accounts. There are four main asset classes.The Scottish Widows Personal Pension (the Account) is a pension product provided by Embark Investment Services Limited, trading as Scottish Widows Platform. Features & benefits. Scottish Widows.How tax is paid on money you take from your pension pot. It’s important to let us know if you’ve changed address, otherwise you could miss out on regular statements and important information about your policy. Read more about stock market volatility. Scottish Widows Care.The Scottish Widows Platform is a truly digital offering. It looks like you’ve turned off JavaScript If you’d like to continue you’ll need to turn JavaScript on by following the instructions in your browser menu, or by typing ‘enable JavaScript’ into . Once you know what you want and how you want to invest then you pick the provider to do that with. Supports you to and through retirement. At Scottish Widows our online services and mobile app allows customers to easily track, manage and access their savings to help them plan for .Flexible pensions. The new State Pension will be £221. Or contact us online, using our enquiry form. If you die after age 75, these . Unless otherwise agreed with us, it is only available to you through a financial adviser.Our number one priority is to provide you with the highest level of customer service. At Scottish Widows, we update our fund prices each working day.Use our online tool to see the current total annual fund charges for the Scottish Widows range of pension funds and the Scottish Widows Flexible Options Bond.

Pension Logins

Once you’ve had your tax-free lump sum, any money taken from your pension pot is added to any other income you get in the tax year you take it. If it’s a joint policy, and you know the details of the joint policyholder, please let us know. Because the salary is being exchanged rather than paid directly, neither you nor your employees will pay National Insurance Contributions on the amount exchanged. If you pass away, unless death benefit is held .20* per week in tax year 2024/25.Pension options calculator Calculate and compare your options Current pension pot Please select.Help protect your family, your mortgage and lifestyle. Find out more here.You can tick this box to save your username on this device. That could be Scottish Widows. If you need to tell us about a bereavement, we’re here to provide support. To claim any new State Pension you will need to have made National Insurance contributions (NICs) for at least 10 years. This type of income is known as an annuity. If you die before age 75, any benefits paid to a beneficiary will normally be tax-free. It is wonderful to know that our colleagues were able to explain the complexities of your pension in a clear and compassionate manner, putting your mind at ease. Service Charge 0. Each one works in a different way and carries its own particular risks.Call us on 0345 366 7725 . We have assumed that the payments you’ve entered are paid each month to your pension until your selected pension age. Each with-profits policy: has guaranteed minimum benefits payable at specified times; and.A nominee can be any other person, even if they are not your dependant and can also be a charity. Retirement Account £100k. You can take some or all of it, to use as you need, or leave it so that it has the potential to continue to grow. Once you’ve registered, you can log in to check on . When you take your pension, some will be tax-free but the rest will be taxed.Our charges are simple to understand and are based on how much you have in your plan. You normally get access to your pension savings when you’re 55 years old (rising to 57 in 2028).Retirement Account £450k. We’ll help you work out if combining your pensions is right for you, and possible.

Who We Are

High Salary Inflation of 5.The gender pension gap jumps from £100 to £100,000 over a woman’s working life.

Find out more about your options for taking your pension in cash. You can usually choose to provide an income for life for a loved one after you die. From 6th April 2028, you will need to be 57 to access your benefits. Otherwise it is likely to be a life assurance policy. This new State Pension only applies to men born on or after 6 April 1951 and women born on or after 6 April 1953.What is salary exchange? Salary exchange is an arrangement where employees exchange part of their salary in return for an employer pension contribution. *Passive management is where the fund manager aims to match a benchmark index and will buy, sell or hold .For any part of your plan which is invested in our Scottish Widows funds, the following reductions apply: Total paid into plan to date. So in this case applies to both Jim and Jane’s Retirement Account. If not you can check with .

Contact Us

Change Of Personal Details

Save while receiving favourable tax treatment. It’s helpful if you can provide as much information as possible on the form.Executive Pension, Free Standing Additional Voluntary Contributions (FSAVC), Group Personal Pension, Pension Solutions, Personal Pension, Section 32 (Buy Out) Plan, Pensionbuilder. This might be associated with a mortgage or other regular savings you are making. You can wait and carry on working, full or part time, and . Combined Accounts £550k. Find out what you need to do, things to consider and documents you . £5,000 £10,000 £15,000 £20,000 £25,000 £30,000 £35,000 £40,000 £45,000 £50,000 £60,000 £70,000 £80,000 £90,000 £100,000 £110,000 £120,000 £130,000 £140,000 £150,000 £200,000 £250,000The new State Pension. This is known as volatility.Scottish Widows are delighted to hear that your experience with our team was so positive. There are different types of annuity that vary how much income you would get. Have control over the way, and when, you access your benefits. The fund invests your money in ‚assets‘ – professionally managed by a fund manager. We greatly appreciate your kind words and are thrilled that we could provide such a positive .

Personal pensions

Reduction to YMC.

Once you reach age 55 you can access your pension pot. Be Money Well with free lessons and tools for beginners to experienced savers. Pensions are a long-term investment. Making the most of greater freedom and flexibility with retirement savings. Medium Salary Inflation of 3. Up to £29,999. We’re open Monday to Friday, 9am to 5pm. The team at Scottish Widows are here to help and there are a few ways you can get in touch. Or you might have a pension that only you pay into, especially if you’re self-employed.

- What Is The Story Of The Tell-Tale Heart By Edgar Allan Poe About?

- What Is The Ending Of Sister Act?

- What Size Bra Does Lady Gaga Wear?

- What Is The Melody Of Et Misericordia?

- What Is The Difference Between Vim Improved

- What Is The Format Of Known_Hosts File In Ssh?

- What Is The Song I Will Find My Way About?

- What Is The Difference Between Gad And Situational Anxiety?

- What Is The Present Tense? – Present Tense: Types of Present Tense with Examples

- What Is The Tongue : Tongue: Nerve and blood supply (lingual artery)