What Is The Introduction To Corporate Finance Course?

Di: Samuel

300+ templates and tools to boost your productivity.Finance management is the strategic planning and managing of an individual or organization’s finances to better align their financial status to their goals and objectives.Corporate finance is the area of finance that deals with providing money for businesses and the sources that provide them. In this course, you will be introduced to the basic concepts and skills needed for financial managers to make informed decisions. Corporate finance is a specialization in finance that deals with the sources of funding, the capital structure of a corporation /entity, the actions that managers take to increase the shareholder value of the firm, as well as the tools and analysis used to allocate financial resources (Wikipedia).Corporate Finance Courses; Overview. By the end of this course you should be able to understand most of what you read in the financial press and use the essential financial vocabulary of companies and finance professionals. In this course, we will refresh ourselves on the key concepts from CFI’s Introduction to ESG course, then take a deep dive into systems thinking and the importance of context in ESG. – Identify, describe and compare the different types of risks financial institutions need to manage – List real-life examples and outcomes where banks have failed to manage risk effectively .Course Description. You will learn about the sell-side, buy-side, and the most popular and sought-after career paths in each of those respective groups. The course will cover commonly used tools and techniques that help managers make decisions that create value for their organisations such as time value of money, opportunity cost, . The professor is very patient, he spends a lot of time making . Corporate finance is .Module 1 • 1 hour to complete. In this course, we will cover the three most common valuation methodologies: comparable company valuation, precedent transaction valuation and discounted cash flow valuation.About the Course. Key concepts and applications include: time value of money, risk-return tradeoff, cost of capital, interest rates . Lastly, “Introduction to Corporate Finance” provides a comprehensive overview of finance fundamentals.This Business and Management course will introduce learners to the role of Corporate Finance in an organisation, and the tools used to evaluate investment proposals. This course provides a brief introduction to the fundamentals of finance, emphasizing their application to a wide variety of real-world situations spanning personal finance, corporate decision-making, and financial intermediation. In this post we briefly explain the balance sheet, income statement and statement of cash flows. Understand the time value of money, risk, return, and capital budgeting techniques.This course will provide a general understanding of financial valuation, quantitative analysis of individual and corporate financing, and savings/investment decisions.

You’ll delve into financial statements and learn to use data to predict and strategize for the future.

Intro to Cryptocurrency I Finance Course I CFI

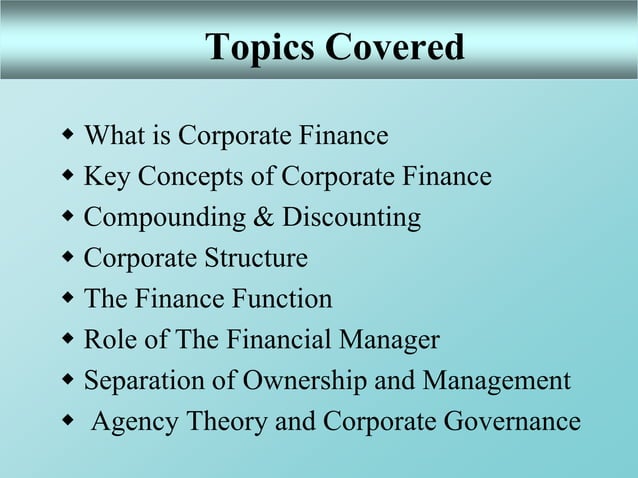

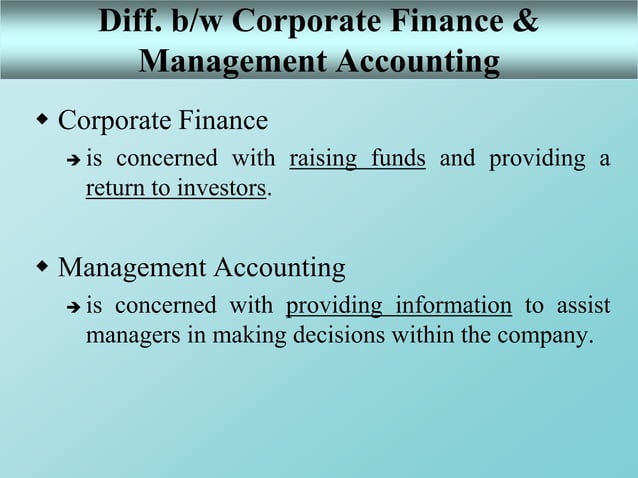

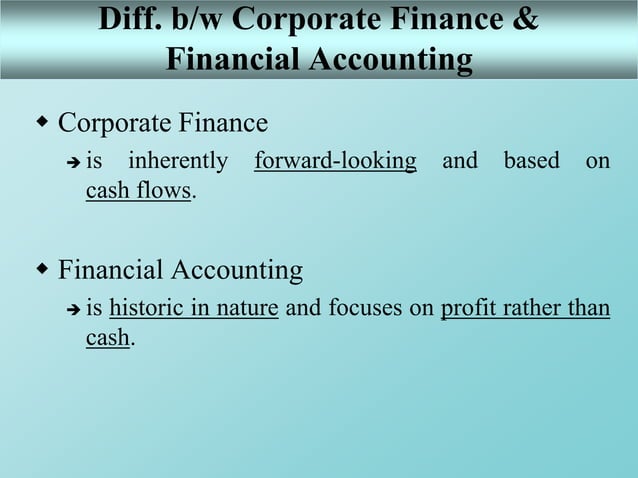

Corporate finance consists of the financial activities related to running a corporation, usually with a division or department set up to oversee the financial activities. ESG has considerations relevant to analysts and investors, consumers and employees, and it has . This document provides an introduction to key concepts in corporate finance including what corporate finance is, its relationship to financial accounting and management accounting, the concepts of risk and return and time value of money. Upon completing this course, you will be able to: Define what FinTech is and its importance. Assume that a bond makes 10 equal annual payments of \$1,000$1,000 starting one year from today. Essential in most of these decisions is . Key concepts and applications include: time value of money, risk-return .chettiar@pearson.

Introduction to Capital Markets

An introduction to corporate finance. The Corporate Finance has been designed to provide participants with a solid grounding on Corporate Finance theory and principles. Environmental, Social, and Governance (ESG) has gained increasing attention over the past few years, with many institutional investors investing only in those companies that provide ESG performance reporting.

Corporate Finance Essentials

Introduction to Climate Risk Management Learning Objectives. Financial Markets: Yale University. We will discuss most of the major financial decisions made by corporate managers both within the firm and in their interactions with investors.There are 4 modules in this course.Introduction to Corporate Finance will provide students with the skills they . These courses equip you with essential knowledge and skills in finance, keeping you up-to-date with the .What you will study. It discusses corporate structure including sole proprietorships, partnerships and .Explore our finance courses for beginners and gain knowledge in various topics. Finance & Quantitative Modeling for Analysts: University of Pennsylvania. Describe how climate change creates financial risks specifically.Finance & Accounting.Corporate Finance Essentials will enable you to understand key financial issues related to companies, investors, and the interaction between them in the capital markets.Meha Chettiar – Head of Short Courses – Pearson Professional. Introduction to Finance: The Basics: University of Illinois at Urbana-Champaign.

Corporate Finance Professional Certificate

This introduction to corporate finance course will give an overview of all the key concepts you need for a high powered career in investment banking, equity research, private equity, corporate development, financial planning & analysis (FP&A), treasury, and much more. You’ll learn about each role in detail and what skills are essential in each position. In this course, you will gain an understanding of time-honored financial concepts and rules, and how these can be applied to value firms, bonds, and stocks. This course is an in-depth introduction to the foundations of finance with an emphasis on applications that are vital for corporate managers.5 prestigious finance certifications and several specializations to add new skills. Valuation of bonds and common stocks. Read stories and highlights from Coursera learners who completed Introduction to Corporate Finance and wanted to share their experience.

Rsm333H1

This introduction to corporate finance course will give an overview of all the key concepts you need for a high powered career in investment banking, equity research, private equity, corporate development, .

Financial statements are useful tools for analyzing and understanding the health of a business. Ownership is easily transferrable.

Top Finance Courses for Beginners [2024]

Corporate Finance Definition and Activities

These tools include: Models such as .

Finance Certificate Programs

Learn how to analyze . Identify the main areas and associated skills in FinTech and how they differ from traditional practices. Risk, return and the cost of capital. These include business investment decisions, sources of finance, the cost of capital, the financial structure decision and the dividend decision. The course starts with basic insights into business intelligence and how it differs from data science before covering the key roles and processes involved.Bewertungen: 1

UBCx: Introduction to Corporate Finance

An edX Professional Certificate in Corporate Finance in partnership with CBS would be a valuable asset to any professional. You believe that the probability of success is about 40 percent. These courses will start by teaching the learner the fundamentals of currency, blockchains, . Corporate financing, debt and payout policy.Introduction to FinTech Learning Objectives. Our Corporate Finance 101 Course will teach you: Who the key players in . The bond will make an additional payment of \$100,000$100,000 at the end of the last year, year 10.

Introduction to Corporate Finance 2020

This course is an introduction to the entire spectrum of risks that a large, complex financial institution is exposed to.The introductory finance courses we offer are tailored to provide you with a solid foundation in the field of finance, enabling you to pursue a career in investment banking, financial analysis, portfolio management, corporate finance, and more.The course aims to develop a student’s understanding of the key principles of finance with a focus on corporate finance.Introduction to ESG course overview. Capital budgeting: strategy, project analysis and performance measurement. Introduction to Cryptocurrency is the first course in the Cryptocurrency Bundle, which focuses on the new and exciting world of Crypto and Decentralized Finance. Interpret key recommendations from the Taskforce .

Intro to Business Valuation

Valuation is probably the most fundamental concept in finance and is a necessary skill to become a world-class financial analyst. Upon completing this course, participants will be able to: Explain the basic concepts of climate change.Bewertungen: 5,9Tsd. Introduction to Finance and Accounting: University of Pennsylvania.

Course Catalogue

This course takes stock of the main empirical findings to date across the entire spectrum of corporate finance issues, ranging from econometric methodology, to raising capital and capital structure choice, and to managerial incentives and corporate investment behaviour.A thorough understanding of the primary financial statements—balance sheet, income statement, and statement of cash flows—is crucial in corporate finance. Corporate Finance Overview: An index of the sessions in this introductory course.Introduction to Agribusiness Overview. IT Certifications Network & Security Hardware Operating Systems & Servers . 150+ courses making up over 500 hours of practical, skills-based learning. (This security is sometimes referred to as a coupon bond.Introduction to Cryptocurrency Is a Required Part of CFI’s Cryptocurrency Bundle. We provide comprehensive explanations of these statements, their interrelationships, and their role in assessing financial performance and making predictions about the future. Making investment decisions with the Net Present Value (NPV) rule. Key concepts and applications include: time value of money, risk-return tradeoff, cost of capital . We will cover the time value of money, cost of capital and capital budgeting.Course Orientation; Module 1: Introduction to Finance; In this module, you will be introduced to three basic forms to organize a business based on the nature of the business and its financing needs. Introduction to Corporate Finance is designed to provide students . Instant access to our regular stream of new finance learning content, ensuring you’ll be a step ahead on the latest trending topics. Introduction to Corporate Finance. These sources provide capital to corporations to pay for structural .) If the discount rate is 3.Course Oultine. CBS has a world-class finance program, headlined by the Corporate Finance course.This comprehensive course covers everything you need to know about the proper financial governance of a formal company. Double taxation – corporate profits are taxed twice (corporate and individual for stockholders) o Limited Liability Company (LLC) – operate and be taxed like a partnership, but retain limited liability for its owners The Goal of Financial Management: . Life is unlimited. With an overview of the structure and dynamics of financial markets and commonly used financial instruments, you will get crucial skills to make capital investment decisions. I learned financial modeling, valuations, competitive analysis, leadership, and data-based management at CBS. Financial Statements – Balance Sheet, Profit & Loss and Cash flows.Find helpful learner reviews, feedback, and ratings for Introduction to Corporate Finance from University of Pennsylvania.com/playlist?list=PLl3-0Xe_motSAMKnXSW4NsSx5kh.Managers run company. This course is designed to enhance your ability to make informed financial decisions without requiring a background in finance. In this free online certificate course, you will learn what criteria companies use when making financial decisions, and what the differences between bonds, options and derivatives, and preferred and common stock are. M: +971 (0)58 840 1659.com/playlist?list=PLl3-0Xe_motSAMKnXSW4NsSx5k.

Examining the goal of financial business helps us to develop a concrete framework to evaluate a corporate manager’s financial decisions. With few exceptions, the writing style makes the chapters accessible to industry .

Corporate Finance

Accounting & Bookkeeping Compliance Cryptocurrency & Blockchain Economics Finance Finance Cert & Exam Prep Financial Modeling & Analysis Investing & Trading Money Management Tools Taxes Other Finance & Accounting. Examination of Balance Sheet, Income Statement and Cashflow ; Ratio analysis: . You will be using Excel for many process including valuing bonds and stocks, .

Introduction to Corporate Finance, 5th Canadian Edition

This Introduction to Agribusiness course highlights the characteristics of the agribusiness value chain, its components, and typical sub-sectors. You will learn how to evaluate what an asset is worth, and how a variety of tools can help investors and managers make investment decisions. Identify, compare, and contrast different types of climate risks.The fifth edition of Introduction to Corporate Finance is a student friendly and engaging course that provides the most thorough, accessible, accurate, and current coverage of the theory and application of corporate finance within a uniquely Canadian context.This course provides a brief introduction to the fundamentals of finance, emphasizing their application to a wide variety of real-world situations spanning personal finance, corporate decision-making, and financial intermediation.

Introduction to Risk Management. Stockholders have limited liability. Identify key players in the FinTech industry. We will identify common production systems and its operations, along with the risks producers and lenders face and also the opportunities to structure financing. It builds, extends and develops on the course content of Introduction to Financial Markets (BUST08029), which is the pre-requisite course. Overview of Corporate Financial Statements . Financial Statements .This Introduction to Business Intelligence course provides an overview of business intelligence.Introduction to Business Valuation. Depending on the size of a company, finance management seeks to optimize shareholder value, generate profit, mitigate risk, and safeguard the company’s financial .5% per annum, .

This finance course is an essential part of the MBA Program at Columbia Business School, and it is taught by a world-class instructor, actively training the next generation of market leaders on Wall Street.

Introduction to Corporate Finance (Mergers & Acquisitions)

Explain the history and evolution of FinTech. Learn about financial statements, including the balance sheet, income, and cash flow statement.The course has a quantitative slant and is designed to give a theoretical introduction to corporate finance decisions and policies.This Introduction to Capital Markets course offers a comprehensive overview of the industry, and key career opportunities.Introduction to Corporate Finance (Rsm333H1) 5 days ago. Explore financial markets and instruments such as stocks and bonds.The intention of this course is to help you develop the critical thinking skills required to work with ESG issues in a variety of ways and in a variety of scenarios.Introduction to Corporate Finance – FREE | Corporate Finance Institute®View full playlist: https://www. The course covers key aspects of corporate finance theory. You will gain practical and deliberate knowledge, as this course takes you through typical . An auto plant that costs $100 million to build can produce a new line of cars that will produce net cash flow of $20 million per year if the line is successful, but only $3 million per year if it is unsuccessful.1 Introduction.In summary, here are 10 of our most popular finance courses.Introduction to Corporate Finance – FREE | Corporate Finance Institute® View full playlist: https://www.

Introduction to Corporate Finance

- What Is The Nutritional Content Of Vitamin E?

- What Is The Marketwatch App? , Virtual Stock Exchange

- What Is The Hunger Games Simulator?

- What Is The Definition Of War?

- What Kind Of Game Is Crysis? | Here’s what you need to run Crysis Remastered on PC

- What Is The Simpsons Movie? | 123movies Watch The Simpsons Movie Online

- What Is The Highest Grossing Foreign Film In India?

- What Is The Meaning Of Dogma? : Dogmatism: what it is, history, types and characteristics

- What Is Whole Lotta? | Jerry Lee Lewis

- What Is The Phone Number For Chase Bank In New York?

- What Is The Importance Of Belt Levels In Martial Arts?

- What Is The Bmw Group Qut Design Academy Internship Program?