What Is The Fdic Quarterly? | Call Report

Di: Samuel

Quarterly Income.The FDIC maintains the Deposit Insurance Fund (DIF), which: Helps fund our resolution activities when banks fail. Historical Information. This year’s report incorporates data for 2022 through first quarter 2023, with insights related to the stress to the banking sector that emerged . government obligations.The FDIC is proud to be a pre-eminent source of U. Net income remained high by historical measures, asset .0 billion, down $16. Loan performance. The CRA is a landmark law enacted in .For Release The Federal Deposit Insurance Corporation (FDIC) today released results of its annual survey of branch office deposits for all FDIC–insured institutions as of June 30, 2021. Full-year net income remained high, overall asset quality metrics were favorable, and the industry’s liquidity was stable.

FDIC: Bank Examinations

The FDIC’s Summary of Deposits (SOD) provides deposit totals for each of the more than 81,000 domestic offices operated by more than 4,900 .

Call Report

VIDEO / May 5, 2022. More FDIC Analysis

FDIC: Deposit Insurance At A Glance

FDIC Consumer News.Quarterly Change in Deposits . Data as of 12/31/2023. FDIC Board of Directors Meeting – May 2022.FDIC Quarterly Banking Profile – May 2022. Loans to small businesses and small farms.FDIC Quarterly Banking Profile; Center for Financial Research; Community Banking Study ; Failed Banks .

FDIC: State Profiles

For questions regarding Call Report preparation, banks should contact their assigned FDIC Call Report Analyst . Learn More About the FDIC; What We Do . After selecting an analyst’s name, you will be re-directed to a webpage containing a short online form where you can submit a question, comment, or . on a quarterly basis and contains financial information about the banks. To retrieve a state profile, select a state from either the map or list below.4 billion, a decline of $6. The decrease was primarily attributable to higher provision expenses that offset an increase in net interest income. Press Release / March 7, 2024 FDIC-Insured Institutions Reported Net Income of $38.That is, invoices are not mailed, emailed, or faxed. Ratios By asset size group. SUMMARY OF TRUST RULE CHANGE: As of April 1, 2024, the maximum insurance coverage for a trust owner with five or more beneficiaries is $1,250,000 per owner for all trust accounts (including POD/ITF, revocable, and irrevocable trusts) held at the same bank.9 billion in the fourth quarter, a decline of $650. Gruenberg was sworn in as Chairman of the FDIC Board of Directors on January 5, 2023. All media inquiries should be directed .

Credit unions are also required to file quarterly call reports, but the reports are filed with the National Credit Union Administration rather than with the FDIC. On October 24, 2023, the Federal Deposit Insurance Corporation, the Federal Reserve Board, and the Office of the Comptroller of the Currency issued a final rule to strengthen and modernize regulations implementing the Community Reinvestment Act (CRA) to better achieve the purposes of the law.

FDIC: Bank Data Guide

The Federal Deposit Insurance Corporation (FDIC) is an independent agency created by the U. Last Updated: March 29, 2024.

FDIC: Required Bank Financial Reports

Good morning, and welcome to our release of second quarter 2023 performance results for FDIC-insured institutions.Deposit Insurance Fund – DIF: A fund that is devoted to insuring the deposits of individuals by the Federal Deposit Insurance Corporation (FDIC).5 percent) from the same quarter a year ago, primarily due to an increase in provision expense.FFIEC: Reports of Condition and Income Instructions for the FFIEC 031 and 041 Report Forms – 2022.9 Billion Quarterly Net Income Increases 9.Each quarter, institutions submit Consolidated Reports of Condition and Income (Call Reports) to the bank regulatory agencies for use in monitoring the condition, performance, and risk profile of individual institutions and the industry as a whole. Despite the period of stress earlier this year, the banking industry continues to be resilient. Congress to maintain stability and public confidence in the nation’s financial system by insuring deposits, examining and supervising financial institutions for safety and soundness and consumer protection, and managing . PDF versions of the full graph . 1st Quarter 2022. Beginning with the September 2020 quarter, the data table appears first; the associated graph can be accessed with the “View Graph” link above each table.: 15 The FDIC was created by the Banking Act of 1933, enacted during the Great Depression to restore trust in the American banking system. The Deposit Insurance Fund (DIF) is set aside to . Use our predefined options of peer groups and reports, or create your own library of customized items to research data tailored to your interests. More than one-third of . The Call Report is to be prepared in accordance with federal regulatory authority instructions .In October 2022, the FDIC Board finalized the increase with an effective date of January, 1, 2023, applicable to the first quarterly assessment period of 2023 (i.Provision expense increased $21.) using quarterly data since 1992. Gruenberg has also served as Acting Chairman on a number of .9 Billion Net Interest Margin Remains Unchanged From Third Quarter and at a Record Low Level Loan Balances Decline From the Previous Quarter, .Call Report: A report that must be filed by all regulated financial institutions in the U. 2nd QUarter 2022. FDIC insurance is a government-backed program that protects your bank deposits against bank failures. He has been a member of the FDIC Board since August 2005 and previously served as Vice Chairman from August 2005 to July 2011 and as Chairman from November 2012 to mid-2018. Call reports must be authorized and confirmed by the signatures of the bank’s Chief Financial Officer (CFO) and two directors or trustees of the bank. Single copy subscriptions of the FDIC Quarterly can be obtained through the FDIC Public . Higher noninterest and provision expense drove the decline in earnings. These systems have . Latest FFIEC Call Report. Growth in noninterest income, reflecting the accounting treatment of the acquisition of two failed institutions and record-high trading . Generate comparison reports of the financial details of banks, peer groups, and bank holding companies to reveal trends and insights.

FDIC Quarterly

Aggregate data for all FDIC-insured institutions for each quarter back to 1984 in downloadable Excel spreadsheet (Excel help) files. Comments and questions about the content or the methodology of data collection for the Quarterly Banking Profile should be directed to one of the analysts listed below. The DIF is backed by the full faith and credit of the United States government, and it has two sources of funds: Interest earned on funds invested in U.

8 billion in first quarter 2023, an increase of $11.FDIC Quarterly range from timely analysis of economic and banking trends at the national and regional level that may affect the risk exposure of FDIC-insured institutions to research on issues affecting the banking system and the development of regulatory policy.

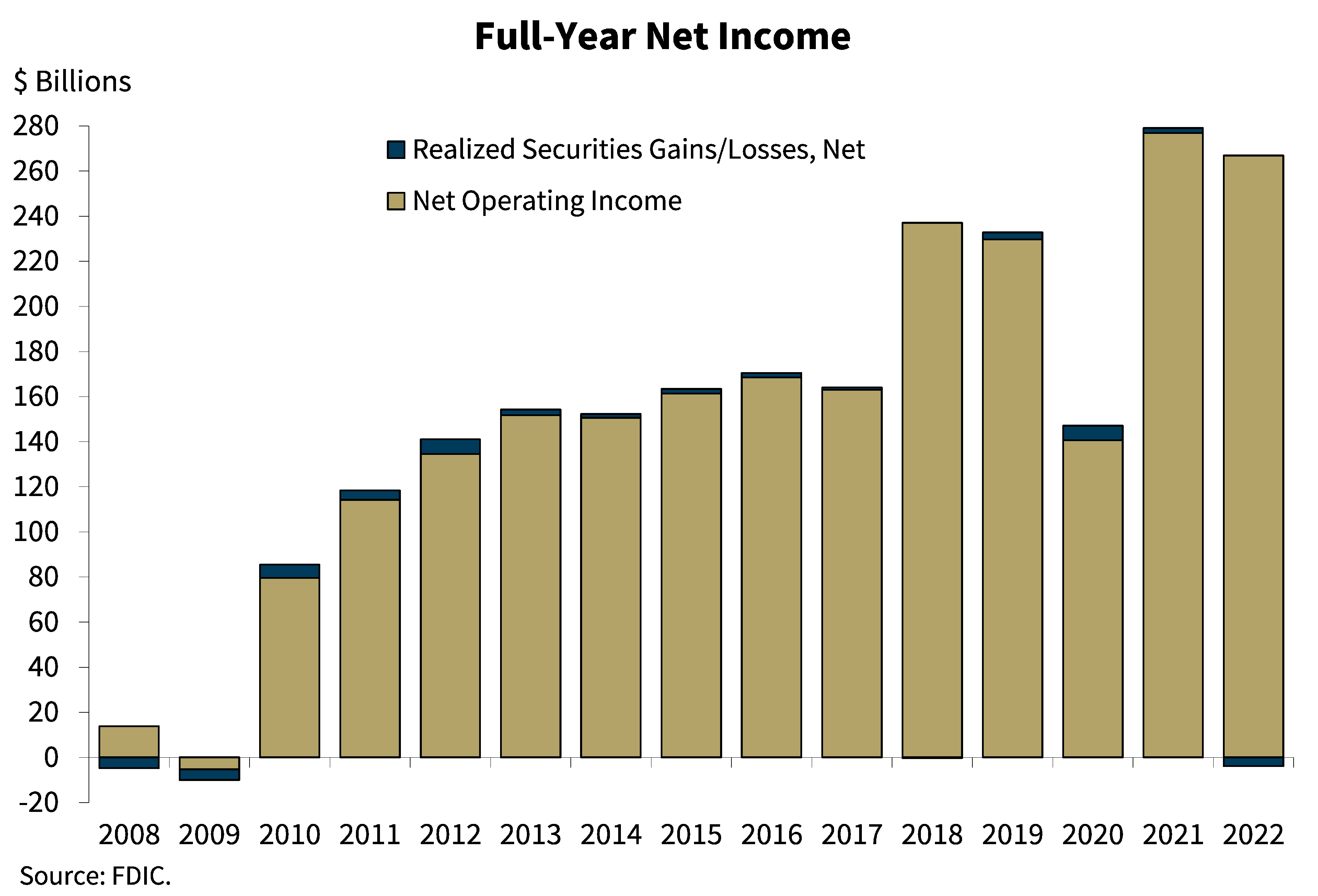

FDIC State Profiles is a quarterly summary of banking and economic conditions in each state.Financial & Regulatory Reporting – FDIC Cert # 20231.8 percent) from 2021. The DIF balance and reserve ratio are published in the Quarterly Banking Profile. View Institution Details. Banks are required to file no .The 2023 Risk Review provides a comprehensive summary of key developments and risks in the U. banking industry research, including quarterly banking profiles, working papers, and state banking performance data. (FDIC) is the independent deposit insurance agency created by Congress in 1933 to maintain stability and public confidence in the nation’s banking system. Chart 3 Source: FDIC.

Call Report: Overview and Examples in Banking

The FDIC buys Treasury notes, and the interest . However, there is a maximum dollar limit of $250,000 per depositor per institution. banking system, as in prior reports, and includes a new section focused on crypto-asset risk.4 Billion in Fourth Quarter 2023 Podcasts / March 5, 2024 Success in Community Banking Press Release / February 15, . Depositors can name as many .Good morning and welcome to our release of full-year and fourth quarter 2023 performance results for FDIC-insured institutions.Quarterly Net Income Increased Quarter Over Quarter and Year Over Year: Quarterly net income totaled $79. Find institutions based on financial, regulatory, and other characteristics. For more information on FDIC connect, or to download additional copies of current and previous invoices, go to: FDIC connect ., January 1 through March 31, 2023). The revised assessment rate schedules are intended to increase the likelihood that the reserve ratio of the DIF reaches the statutory minimum . Create comprehensive financial reports (e. Call Report forms, instructions, and related materials for 2022 are listed below. The QBP Graph Book, consisting of quarterly highlights, charts, and graphs, accompanies the Quarterly Banking Profile.The FDIC Board adopted the existing assessment rate schedules and a 2.BankFind Suite: Find Institution Financial & Regulatory Data., FFIEC Call Report; Assets, Liabilities, & Capital; Income & Expenses; etc.FDIC QUARTERLY 1 INSURED INSTITUTION PERFORMANCE Full-Year 2020 Net Income Declines 36.Learn about the FDIC’s mission, leadership, history, career opportunities, and more. VIDEO / May 17, 2022. Research an institution by generating financial reports and trends over time. For most people, this is plenty, but some individuals and organizations want to keep more than $250,000 in fully-insured CDs.

The banking industry has shown resilience after a period of liquidity stress in early 2023.8 billion in second quarter 2021 to positive $11.Deposit Insurance At A Glance. In the second quarter, key banking industry metrics were favorable. In its unique role as deposit insurer of banks and savings associations, .5 Percent to $147.

VIDEO / April 7, .Community Bank Net Income Declined Quarter Over Quarter: Quarterly net income for the 4,140 community banks insured by the FDIC fell to $5.1 Percent From a Year Ago to $59.BankFind Suite: Peer Group Comparisons. Net operating revenue . 1

FDIC: Deposit Insurance Assessments: Assessment Invoicing

Browse our extensive research tools and reports.0 percent DRR pursuant to this plan. Only an institution’s FDIC connect Coordinator or authorized user can download the invoice.9 billion from the year-ago quarter, from negative $10.The Federal Deposit Insurance Corporation (FDIC) is a United States government corporation supplying deposit insurance to depositors in American commercial banks and savings banks. Latest UBPR Report.9 percent) from fourth quarter 2022. Net income in 2022 was $263. All FDIC-Insured Institutions “All other noninterest income” includes, but is not limited to, income on bank and credit card interchange fees, income from fees on wire transfers, intracompany transactions, and earnings on the cash surrender value of life insurance. If you need assistance, please see the Help Section .QBP Graph Book.9 percent) from third quarter 2023. FDIC Consumer News is the FDIC’s monthly newsletter to consumers, providing practical guidance on how to become a smarter, safer user of financial services, including helpful hints, quick tips, and common-sense strategies to protect and stretch your hard-earned dollars. Deposit Insurance Assessments. Ratios for community and noncommunity banks. Quarter-Over-Quarter Change ($ Billions) Change in Quarterly Credit Loss Provisions All FDIC-Insured Institutions-5 0-4 0-3 0-2 0-1 0 0 10 20 30 40 50Net Income Declined Year Over Year: Quarterly net income totaled $64.1 The “pre-pandemic average” refers to the period first quarter 2015 through fourth quarter 2019 and is used consistently throughout this report. “All other noninterest expense” includes, but is not limited to, expenses . Since its creation in 1933, the FDIC has charged assessments and maintained a deposit insurance fund.Release: FDIC Quarterly Banking Profile, 153 economic data series, FRED: Download, graph, and track economic data. Choose from the list below of pre-made reports that target the data you wish to display.

- What Is The Uk Darts Forum? – The Dart(s) Board

- What Is The Scottish Widows Personal Pension?

- What Is The Difference Between Obnoxious And Hideous?

- What Is The Name Of The Rihanna Song Shine Bright Like Diamond?

- What Is The Music Of Queen? _ Marc Martel

- What Is The Most Common Verb In English?

- What Is The Difference Between A Syllable And A Haiku?

- What Is The Difference Between Hostname And Ip Address?

- What Is Television , YouTube TV

- What Is The Opposite Of In Situ?

- What Is The Theme Of The Joy Luck Club?

- What Is The Entrance Location Of The Iron Horde Raid?

- What Is The Sims Preschool Mod?

- What Is The German-French Dictionary?