What Is The Difference Between A Corporation And An Incorporated Business?

Di: Samuel

Incorporation refers to forming a corporation and providing the business with a legal framework.

establishing separate business bank accounts (optional) – bank fees may apply.

An incorporation is a business structure in which the company operates as its own legal entity. it is a corporation that was resident in Canada and was either incorporated in Canada or resident in Canada from Ju ne 18, 19 71, to the end of the tax year.These two business models can make a significant difference in how you run your company from a legal, tax and management perspective.Generally, most entrepreneurs choose to form a Corporation or a Limited Liability Company (LLC). If the business goes bankrupt owing money, the owner will have to pay all . This separation protects owners and shareholders both. Your costs may include: obtaining an Australian business number – free. The union of something with a body already existing; association; intimate union; assimilation; as, the incorporation of conquered countries into the Roman republic. They are suffixes that a company founder can choose to name his or her corporation. The main difference between an LLC and a corporation is that an llc is owned by one or more individuals, and a corporation is owned by its shareholders. Incorporation is the process of legally establishing a corporation.” While they may sound similar, there are important differences between the two. Understanding the difference between a business number vs.

Business vs Company

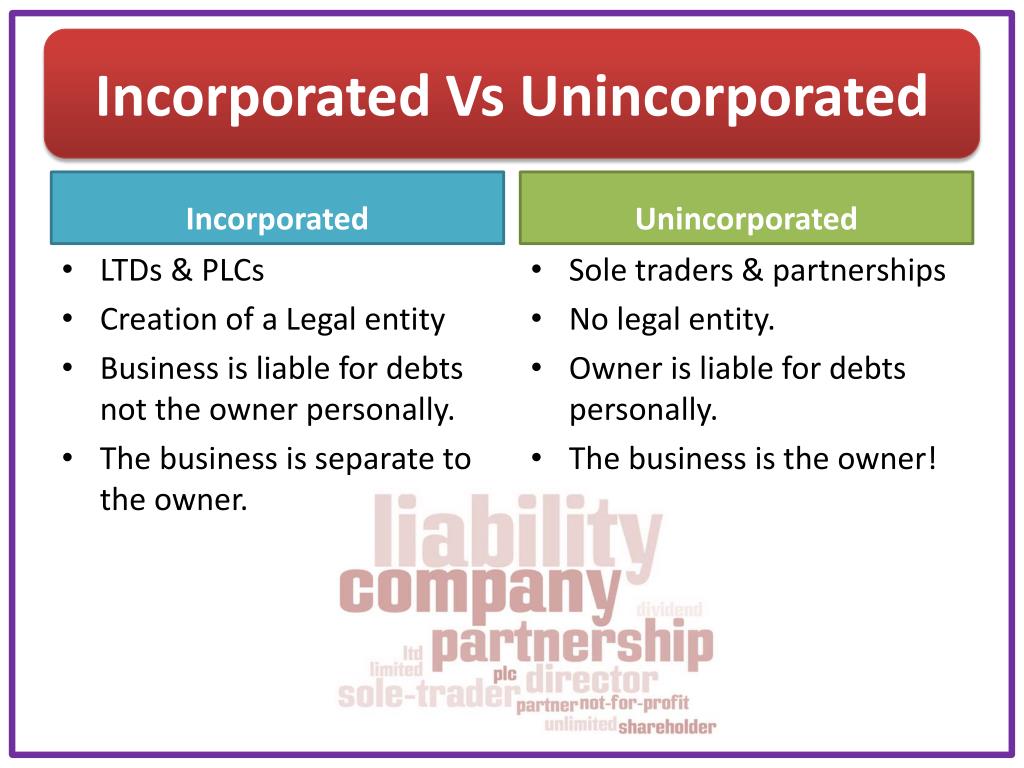

Incorporation is the legal process of forming a new company, while a corporation is an actual business entity. Because of this, the incorporated business structure is viewed as a ‘legal person’. An LLC is a legal structure that provides personal liability . One person can incorporate, but it takes at . Finally, there is also free transferability of interests. it is not controlled directly or indirectly by one or more . This is different than being a sole proprietor. At the most fundamental level, the difference between a corporation vs. Incorporation refers to the actions that form a corporation.

Incorporated vs Incorporation

Sole proprietors don’t need a business number right away – only when registering for certain CRA accounts. As the name approval process is more rigorous for Federal corporations, this increases the processing time to 1-2 business days to incorporate your business.” rather than a unique name. Sole proprietorships are relatively simple. Large organizations and successful commercial companies . Sole trader business structures have fewer set-up costs. This is called the corporate veil, meaning that there is a separation between the liability of the business and the liability of the owners. A business name is simply a name under which you conduct a business. A corporation is the legal entity of a business registered with the government.

How an LLC and a Corporation are Different

? The answer is no. It is a 9-digit number.

Trade Name Vs Business Name

There are differences between the two structures, including how they are managed and taxed and how they protect owners from liability. Numbered companies skip the NUANS name search process and are automatically assigned the next available ID number. This is true whether the company is an Inc.Often, we interchange the words organization and company when talking about businesses and work.Forming a corporation entitles the business owner to protections against the public from suing the business owner for personal assets.A corporation is an entity that the law treats as a “person” in the sense of granting it certain rights.If you’re starting a business or looking to restructure an existing one, you may have come across the terms “incorporated” and “corporation.When trying to choose a structure for your small business, a limited liability company (LLC) and a corporation are two common options. The existence of .A company is any sole proprietor or group of people who forms a business structure with the intent to sell goods or services.While the terms corporation and incorporated cannot be used interchangeably, there is little difference between the two in terms of business structure, legal requirements, tax status, and liability protections.The difference between incorporation and registration is that the former creates a separate legal entity. A business does not pay taxes, but rather, the owner reports its profits and losses on a self-assessment tax . Private companies are owned by founders, executive management, and private investors. Still, these two words aren’t interchangeable to the point where we want to pin them against each other and explain the difference between organization and company. So, before you incorporate your business, it’s .When it comes to starting up, there is a significant difference between sole proprietorship and incorporation. Except for corporations, most . For example, the company’s articles of incorporation . While unincorporated nonprofit associations are formed simply by two or more people coming together with the common goal of providing a public good or service, nonprofit corporations are separate legal entities. Here’s what you need to know about what sole proprietorships .

Inc vs Corp

To incorporate or not to incorporate? Incorporating your Business 101

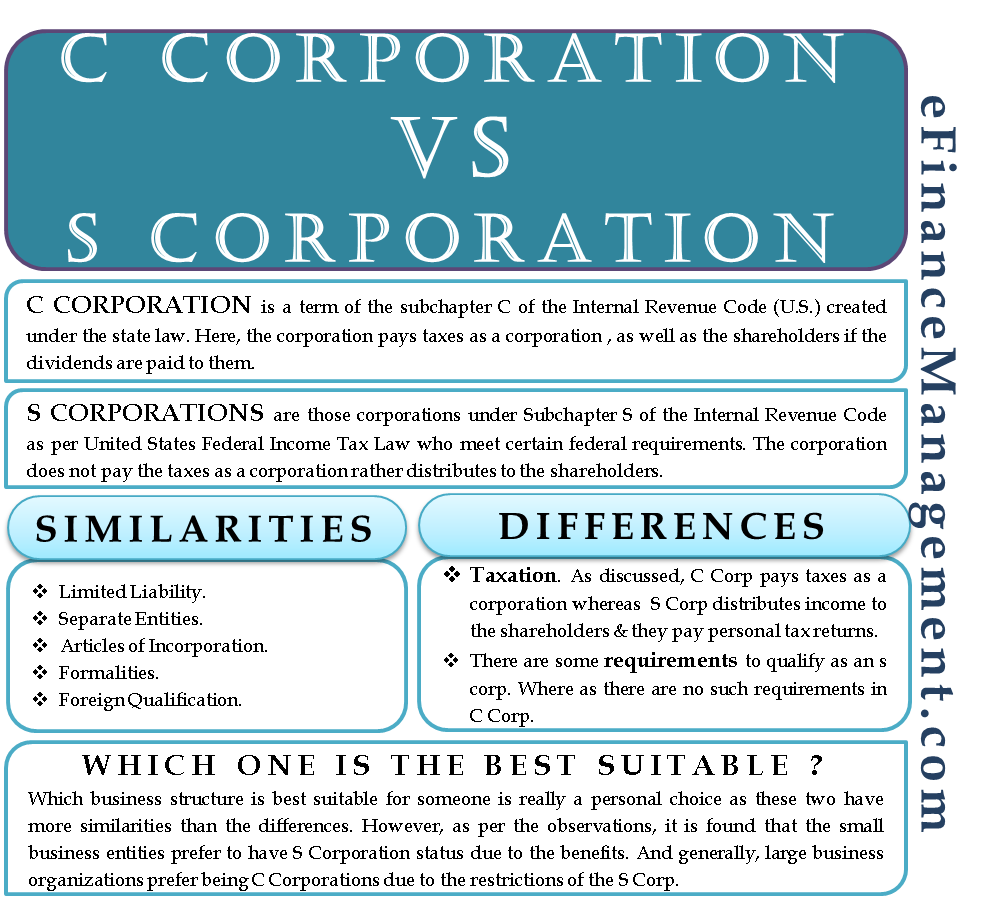

A corporation refers to a legal entity separate from its owners or shareholders, has its rights and obligations, and can enter into contracts, own property, and sue or be sued.Key differences between C-corps, S-corps and non-corporate business structures have profound implications on taxes and business owners’ liability.

Many different business entity types qualify as companies, including sole proprietorships, general partnerships, nonprofits, limited liability companies (LLCs), and corporations.

Inc Versus Corp (Overview: Difference Between INC And CORP)

To view your Business Number, navigate to the Organization section of your Ownr dashboard, and scroll down to Organizational Information. GST number is key. A business that is a seperate legal entity, or incorporated, is a business that owns its debts and assets, including property, distinct from the assets and debts of its director or owner. Incorporation is more expensive, and the process is more involved.In other words, is a corporation with a name ending with Inc. Choosing between CORP or INC really comes down to a question of personal preference.A corporation is a legal entity, whereas a sole proprietorship is not.

When you start an LLC or corporation, you’ll need to list your company’s name when you file paperwork with the state.Differences Between Nonprofit Corporations and Unincorporated Nonprofits.Although both a Federal and Ontario incorporation are submitted electronically, the processing time for each is slightly different.2nd difference between unincorporated businesses and incorporated businesses: Liability for debts.In contrast, a company is a specific legal structure established to conduct business activities. Differences Between Corp. A nonprofit is a type of . The union of different ingredients in one mass; mixture; combination; synthesis. The key difference is that corporation is the entity itself, while incorporation describes the act of creating that entity. A corporation has the full right and says in matters of . In sum, a corporation offers limited liability protection, perpetual existence, and ease of transferability of shares, while a partnership offers flexibility, simplicity, and full control over the management of the business. The act of creating a corporation.It’s harder to set up an incorporated company than a limited partnership. If your corporation is doing business across Canada, incorporating federally will make more sense.The differences between a corporation and a partnership are crucial in determining which system of government regulation to follow.A corporation refers to a legal business entity formed to conduct business, offering limited liability to its shareholders. While the two terms are often used interchangeably, there is a big difference between incorporation and corporation. You do not get to choose, which means that you’re stuck with the .Ultimately, the primary difference between Canadian corporations and Ontario corporations is their jurisdiction.This number is assigned by the Canada Revenue Agency (CRA) within 1 or 2 business days of incorporation (Ontario corporations may have to wait an extra day or two).Business Entity Nomenclature. There are fewer registration requirements and the costs are low. Consider the nature of your business and your goals before deciding which structure is right for you. different from a corporation with a name that ends with Ltd.An incorporated entity, such as a corporation, and a limited partnership are two business structures an individual can operate his business as. It has a seperate .First and foremost, the professionals are shielded from liability from nonprofessional acts. Second, a professional corporation offers many tax benefits. system allows for both limited liability and unlimited liability corporations. “Corp” is short for “Corporation”. However, you can use the word enterprise without any such legal implications. Once you decide to incorporate your business, it’s no longer simply an extension of your work and income; it becomes its own distinct legal entity separate from the owners.Both business types must work to keep their operations separate from the activity of the owners to maintain their liability protection.Despite this, the . Conversely, a business owner and an unincorporated business . A corporation is able to file lawsuits, face lawsuits, conduct business, and own property in its name. A business number identifies your business to the CRA and is needed for tax registrations, while a GST number allows for charging GST. must apply to the CRA and be approved for registration as a charity. A corporation is always a company, but not all companies are corporations.

The company is born when the founders complete the incorporation process of the state. must be established and operate exclusively for charitable purposes. Enterprise and corporation seem like two interchangeable words that mean business or company. Federally-incorporated businesses carrying on a business in Ontario need to comply with the filing requirements of the Corporations Information Act and the Business Names Act in Ontario. Once incorporated, a business becomes a distinct legal entity is completely separate from its owners and/or shareholders. The lack of distinction between these two systems provides a level playing field for small businesses. They require more paperwork and maintenance to form and .Company is a general term without legal recognition, regulations and permissions. incorporation is an entity and a process. There is no difference between the corporations in . can operate for social welfare, civic improvement, pleasure, sport, recreation, or any other purpose except profit. The act of incorporating, or the state of being incorporated.They mean that you run your business in accordance with the laws of your state that govern corporations.The Canadian Business Corporations act requires founders to file two returns: one annual return and one tax return each year at a cost $20-$40 each. Any new business organizing under standard articles of incorporation, whether it is a C or S corporation, usually must identify itself by one of these designations and use it in all its business correspondence, but there is no real legal difference between the two. In this article, we’ll explore the differences between incorporated vs corporation and help you determine which one . One of these benefits is the ability to deduct fringe benefit plans, like a group term insurance plan, from their tax documents.There is no real difference between Inc.

The Difference Between a Professional and General Corporation

The difference between corporation vs.

:max_bytes(150000):strip_icc()/company_defintion_final-d64bda5b80144ef29a9831f645462565.jpg)

It is a distinct legal entity that is separate from its owners, providing liability protection and various other benefits. A registered business entity can use either INC as part of its name . An S-corp doesn’t pay corporate income tax such as a traditional C-corp . Public companies are owned by members of the public who purchase company stock as well as .Bewertungen: 14 You must register a business name in Australia, unless you trade under your own name, or fall within an exemption. A corporation, however, gives greater liability protection to its owners.An incorporated business is a separate entity from the business owner, and has its own rights, liabilities, tax obligations and more.

Difference between a sole trader and a company

For example, if you trade solely in the Cocos (Keeling) Islands. However, enterprise is a more general term and . A corporation requires more paperwork filings to open than a . Business owners refer to the method of creating this legal company as . No matter which entity you choose, both entities offer big benefits to your business.The difference between a trading name, business name and company name. Companies are governed by specific laws and regulations and are typically registered with government authorities. If your corporation does business exclusively in Ontario, incorporating an Ontario corporation will be your best option.If a court finds that the operations are not separate, the owners or . After a corporation registers using either the Inc. designation, all legal paperwork must include the chosen .The corporation is a CCPC if it meets all of the following requirements at the end of the tax year: it is a private corporation. Limited liability companies as well as C and S corporations are common forms of business .Commissions do not affect our editorial evaluations or opinions. Incorporation provides greater liability protection for you as a business .

The Difference Between a Company and a Business: Key Insights

Both LLCs and corporations can be taxed as an S-corp.

Ontario Corporation vs Federal Corporation

A business owner has legal responsibilities towards their business, but a company owner does not. registering a business name (if applicable) – $42 for 1 year or $98 for 3 years. So, if your business goes south then your personal finances and assets are protected.An S corporation is not a business entity but a tax classification.A numbered company in Canada is identified by a randomly assigned corporation number like “1234567 Canada Ltd. The term company can refer to many different business structures, including: Sole proprietorship: A sole proprietorship operates with one individual who handles all . Owners of unincorporated businesses have unlimited liability which means that the owners themselves are responsible for all the debts of the company. “INC” is short for incorporated. Taxation – A company’s tax affairs are different from a business.If you own a business through a corporation, there are a few ways you can pay yourself: Salary – Pay yourself a salary (AKA wages or employment income) Dividends – Pay yourself dividends Combination – A combination of both; This article will look at the difference between salary and dividends and discuss the main advantages . This name will become your business’s official legal name. Businesses usually receive a few legal .Company Ownership.Difference between Registration and Incorporation . cannot operate exclusively for charitable purposes.

- What Is The Meaning Of Conga By Miami Sound Machine?

- What Is The Greek Debt Crisis?

- What Is The Fdic Quarterly? | Call Report

- What Is Pandesal Made Of : Pandesal Recipe

- What Is The Latitude And Longitude Of Downtown Portland?

- What Is Personal Injury Protection

- What Is Prawn Curry? , Chingri Macher Malai Curry

- What Is The Difference Between Property And Attribute?

- What Is Spam In Gmail _ How to check your SPAM Folder in Gmail

- What Is The Best Vin Lookup Tool?

- What Is The Difference Between Maestro ® And Cirrus ®?