What Is A Supply Expense : What is Supplies Expense?

Di: Samuel

In the context of accounting, supplies can refer to items that are used and consumed within the normal course of business but aren’t directly tied to the product or service being sold. To begin with, it’s important to keep a record of all incoming supplies and their quantities. In general, the cost of materials and supplies used in the course of a trade or business may be deducted as a business expense in the tax year they are used. It involves collecting data on all supplier invoices, analyzing spending patterns, and identifying opportunities to save money.The most appropriate expense category for a uniform will depend on the type of uniform being purchased and the purpose it serves.However, some common expense categories for postage include: Shipping and Handling – This is a common category for businesses that ship products to customers. computers, smartphones, are considered assets and can be depreciated. This may include paper, ink, pens, and envelopes.Office expenses include non-tangible costs like web services and software subscriptions. Leverage technology to automate/streamline processes.A deferred expense is a cost that has already been incurred, but which has not yet been consumed. An estimated expense, supplies expense or any other, is still an expense. The amount of office supplies used during a specified time interval. The most successful expense management programs are managed on a programmatic basis following this general process: Step 1: Data Collection & Analysis.Program expenses are those expenses incurred to deliver specific programs in accordance with the mission of a nonprofit entity. This is because many businesses use printing services to create promotional materials, such as flyers, posters, and banners.

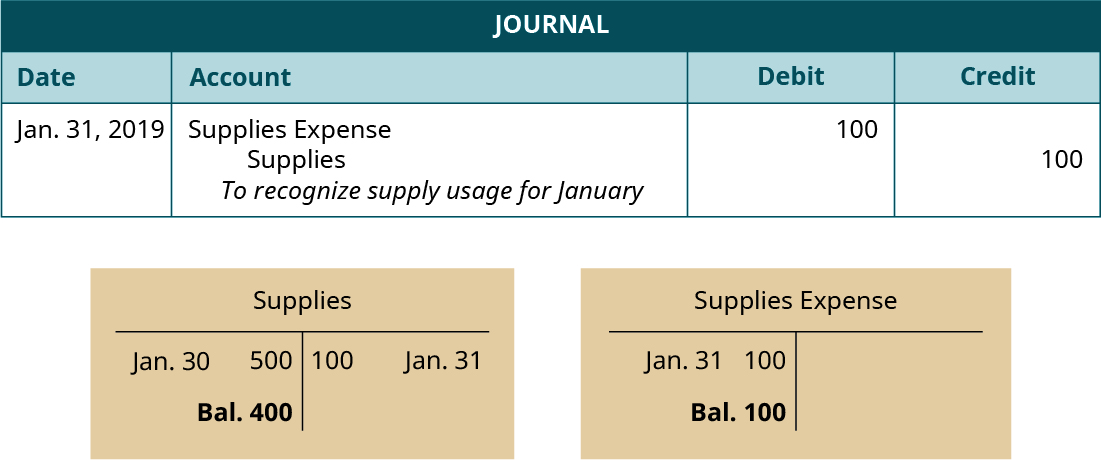

Examples of How to Record a Journal Entry for Expenses

Is the Internet Considered an Office Expense or a Utility?

“Supplies Expense” is an account in the general ledger used to capture the cost of supplies consumed during a specific accounting period. Supplies would be more like cleaning products or rakes. Expense analysis is only a quarter of the battle won. While it’s crucial to watch on a nail salon’s occasional expenses, it may not be possible to anticipate what specifically these costs will be or how they will impact your profit margins.

The Complete Rental Property Deductions Checklist

Examples of direct expenses are wages, customs duty and excise duty. You can use your Dependent Care FSA (DCFSA) to pay for a wide variety of child and adult care services.Importance of Supplier Spend Analysis. In addition, the cost of incidental materials and supplies that are kept on hand may be deducted in the tax year of purchase provided that:

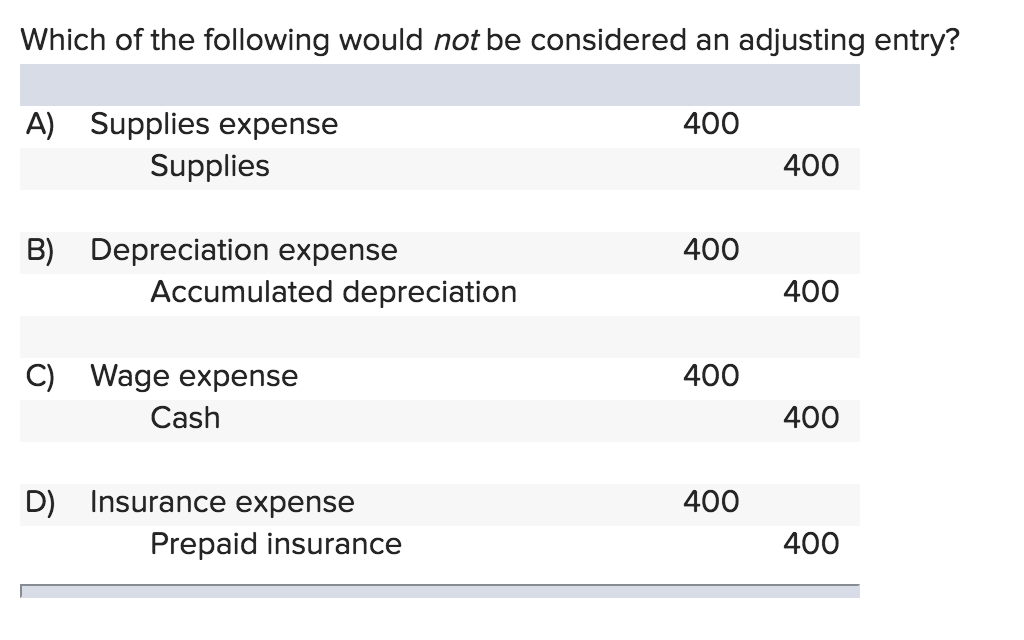

Are Supplies A Debit Or Credit In Business?

These include items such as printer ink, paper clips, paper, pens, staples, record keeping .Specifically, they are initially recorded as assets by debiting the office or store supplies account and crediting the cash account. Another common expense category for tools is equipment. Examples of general expenses include rent, utilities, postage, supplies and computer . The workers making your product or service need somewhere to . Regular, extensive, and ongoing expenses, such as payroll, office rent, and inventory supplies, will all have their own account to track and record associated costs every month. The term vendor is typically used to describe the entity that is paid for goods . Improve and implement processes.Accrued expenses are transactions a company needs to pay, such as rent or mortgages, but has not yet paid.Office supplies expenses include items such as staples, paper, ink, pen and pencils, paper clips, binders, file folders, and markers. Ads for personal activities, including ads on political candidates’ websites, aren’t tax-deductible. This is typically only done if the equipment is considered to be a long-term asset. They can be found in the selling, general and administrative expenses (SG&A) section of the income statement, with the three together making up a company’s operating expenses. Office supplies refer to tangible items such as pens, paper, and printer ink. Given that the category is broad, it can also be used for non-office-related expenses like a . For example, if the uniform is simply clothing that is worn for work, then it would most likely come under the ‚Clothing‘ category. (If the amount of supplies on hand is insignificant, a company may simply debit Supplies . Deducting office supplies from profit on tax forms can lower your tax liability. Organizations use supplier spend analysis to gain insights into their spending, improve . These items usually need to be refilled or replaced. The portion of a utility invoice . Indirect expenses are those that a company must pay to keep its business running smoothly. It’s a five-step process to implement a cost optimization strategy: Line-by-line expense analysis.

What is Supplier Spend Analysis?

If no invoice has been received or payment made, there may still be an obligation to pay a supplier.Part Two: Building an Expense Management Program.

What Are Expenses? Definition, Types, and Examples

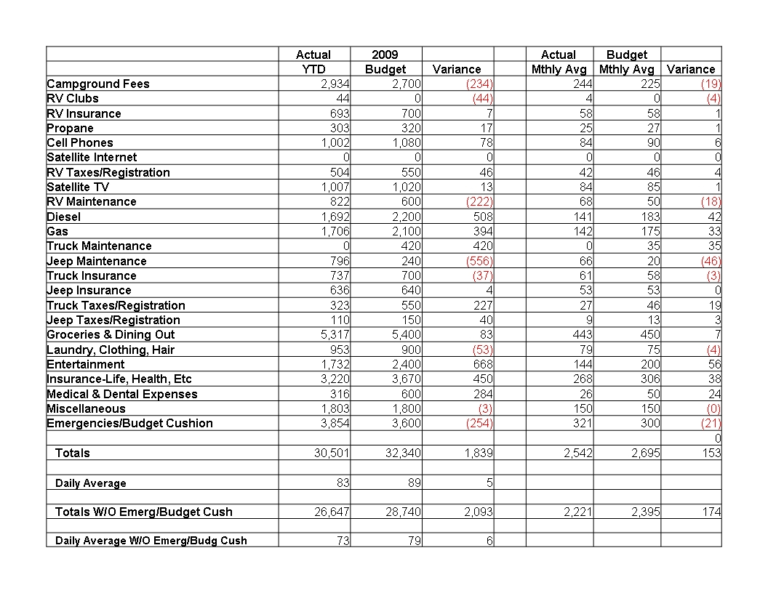

Step two: Calculate the total cost of each periodic expense. All expenses related to hosting a party for your staff is fully deductible, so spring for the coffee bar! Or better yet, make it an Irish coffee bar. Question 2: Quantity. Supplies would be something that you use but don’t leave at the house.Supplier spend analysis is the process of understanding how much an organization spends on goods and services from suppliers. Break out your trusty calculator or use your magical budgeting app to add up the cost of each expense over the course of a year. When consumables are exhausted, they are automatically converted into costs or expenses. Supplies can be considered a current asset if their dollar value is significant.The Profit and Loss statement (P & L) captures monthly restaurant expenses and restaurant fixed costs alongside restaurant revenue. Examples of indirect expenses are salary, legal charges, utility bills . This is a broad category that can encompass everything from small tools to larger pieces of machinery. Under the accrual basis of accounting, the amount recorded as utilities expense relates to the actual consumption of the indicated items in a period, even if the supplier has not yet issued an invoice (invoices are frequently delayed for utilities).

A Breakdown of your Schedule E Expense Categories

What is Supplies Expense?

The difference between Supply and Maintenance Expenses for rental properties.

What Is Expense Analysis? How To Analyze Costs & Expenses

In summary, the key differences between a supply and a material are: Supplies are treated as expenses, while materials are treated as assets.

Supplies Expense.Utilities Expense Under the Accrual Basis of Accounting. Another common expense category for printing services is advertising and marketing. Office supplies that you use to manage your rental property portfolio can be categorized under the Supplies section.

Eligible Dependent Care FSA (DCFSA) Expenses

GST definitions

Supply expenses are recorded as an asset in the balance sheet until they are consumed or sold, after which they turn into expenses. Effective management of office expenses and supplies is crucial for maintaining a healthy . You can deduct the cost of your supplies in the year that you purchase them. While this list shows the eligibility of some of the most common dependent care expenses, it’s not meant to be comprehensive.How to perform a line-by-line expense analysis.Operating Expenses: Running Your Business. Advertising costs for starting a business are part of capital expenses that are depreciated as part of your total startup costs.Nail Salon expenses can be divided into 2 categories: Recurring Expenses and Occasional Expenses. If an expense occurs quarterly, multiply it by four; if . Depreciation: In some cases, businesses may choose to depreciate rental equipment over time. If the cost is significant, small businesses can record the amount of unused supplies on their . If a fixed asset, charge a consistent portion of it to depreciation expense in each month, until it is fully consumed. For example, if a company receives a shipment of raw materials used for production, but the supplier hasn’t yet sent an invoice for the transaction, the amount owed is an accrued expense. If the answer is no, that means that the supply is used in the construction of the handmade products that you sell and further questions need to be answered.

Sales of goods and services that must have GST included in their price are referred to as taxable sales. There are 15 expense categories on the Schedule E tax form.office supplies expense definition. If your business uses printing services primarily for marketing and advertising purposes, then this may be the . In general, supplies are considered a current asset until the point at which they’re used. Postage would fall under this category since it is a cost associated with shipping products. They are general, regular, day-to-day, and necessary expenses that are grouped under a general . Insurance: If the business has insurance specifically for the rental equipment, it could be . You make a taxable sale if you are registered, or required to be registered, for GST and: you make sales for payment. To keep track of these delicious write-offs, you can use Keeper. Property Management. Office expenses are things that your business . Office supplies are items that aid in the short-term operation of your business. A final check list is as follows: Products that can be physically touched and held. Unlike office expenses, office utilities are required for the business‘ operations and include items such as electric, gas and telephone services.November 19, 2020 6 min read.Vendor: A vendor is a party in the supply chain that makes goods and services available to companies or consumers.For example, on March 18, 2021, the company ABC purchases $ 1,000 of office supplies by paying with cash immediately. All of these items are 100% consumable, meaning that they’re . However, the situation might arise where a certain expense was not closely tracked and so a reasonable estimate would serve as the next best thing.Another main difference between office expenses and office supplies is who pays for them. The IRS determines which expenses can be reimbursed by an FSA. COGS reflects the direct costs of creating and delivering your product – which is the reason you have a business in the first place. These expenses are distinct from the other main categories of for a nonprofit, which are fundraising expenses and management & administration expenses. Materials used to produce your products are on the other hand treated as an “asset until sold”. On March 19, 2021, the company ABC make another purchase of supplies amounting to $3,000 on credit. Hourly rates, flat fees for service, or retainers paid to a tax advisor or real estate attorney are another rental property tax deduction. Generally, a team shares office expenses, and the business owner pays for them. Their value lessens over time and can . Here’s a quick run-through of the P&L.If a prepaid expense, monitor it each month and charge it to expense as consumed. Quantity purchases of supplies that are used in the normal creation of your handmade product should be coded as Inventory.business supply expense deductions.

Direct Expenses and Indirect Expenses: List, Examples and

Accepted Solutions. Postage and Delivery – This is a common category for businesses that send out invoices . There may be some overlap between the two.According to Oracle NetSuite, Internet expenses are often classified as utilities.When you prepare a journal entry for an expense, there are two steps: First, you debit the relevant expense account, which represents the increase in costs.

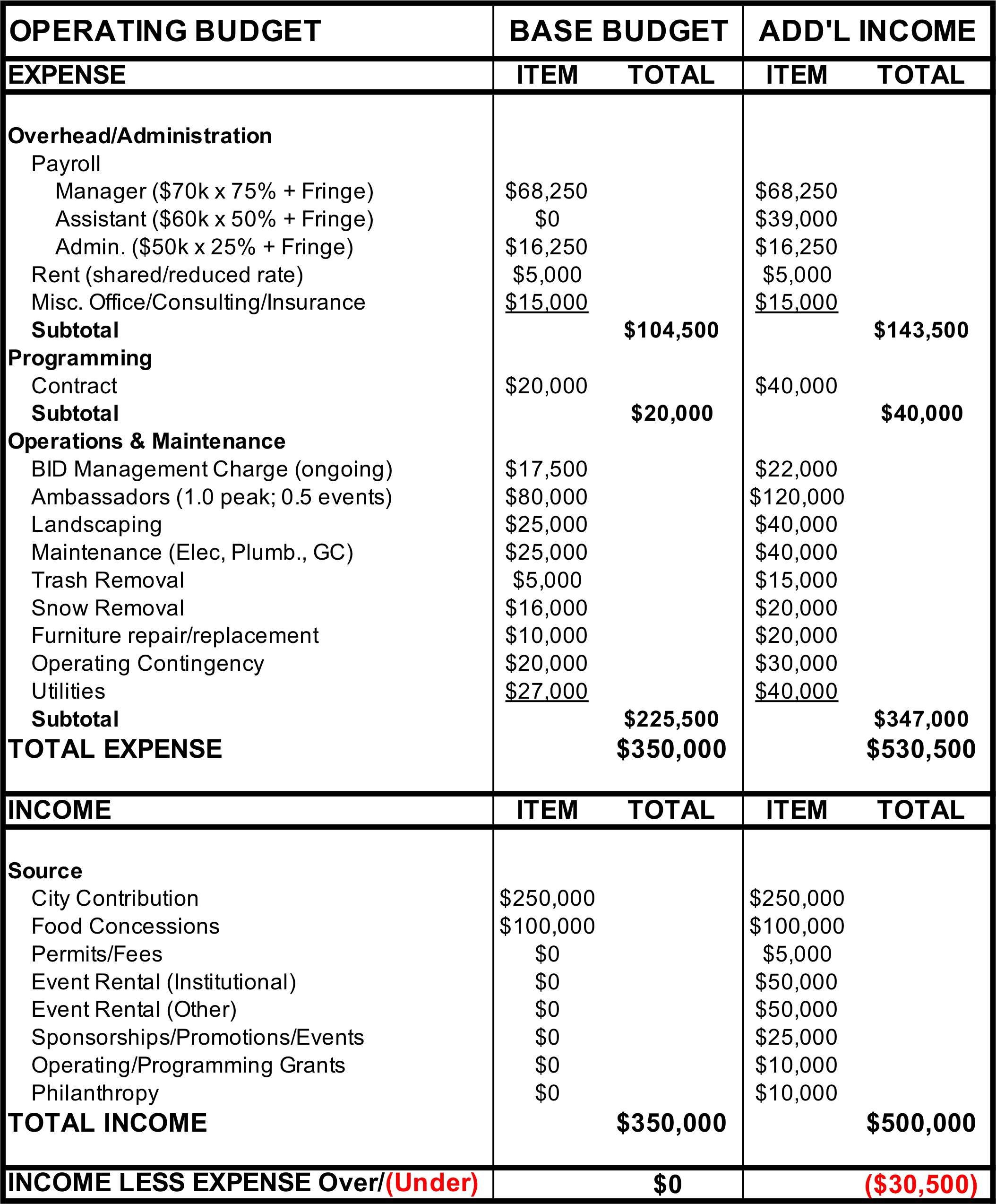

Program expenses definition — AccountingTools

What are Sundry Expenses?

Donors want to see a high proportion of . A deferred expense is initially recorded as an asset, so that it appears on the balance sheet (usually .Advertising and promotional expenses are generally tax-deductible as business expenses. Second, you need to record the same amount as a credit.

Supplies Expense Example: Accounting Equation & Journal Entry

At the end of the accounting period, the balance in the account Supplies will be adjusted to be the amount on hand, and the amount of the adjustment will be recorded in Supplies Expense.This expense category is typically only used if the repairs are significant and/or ongoing.The accounting process for office or store supplies is similar to the procedure followed for prepaid or unexpired expenses.

Deferred expense definition — AccountingTools

Below we go through each of the categories to make sure you’re using them correctly. If the business utilizes the Internet regularly to service its customers and is unable to complete the servicing . In this case, the company ABC can make the journal entry for the paid cash for supplies on March 18, 2021, as below: Example 2.Direct expenses are those which rely on the manufacture and sale of products or services by a company. Some are fairly self-explanatory, such as advertising expenses, whereas others require a little more explanation. a safety uniform), then .All expenses should be tracked and calculated accurately without any need to estimate them.One-time or random expenses that cannot be classified under another expense category are called sundry expenses. The cost is recorded as an asset until such time as the underlying goods or services are consumed; at that point, the cost is charged to expense. Many companies already have . The advantage of this classification is that it can help businesses keep track of their spending on tools, as equipment is often a significant expense.However, higher priced office expenses, e.When supplies are purchased, the amount will be debited to Supplies. This will help you identify when stocks need replenishing and avoid running out of essential supplies at critical times. Recurring expenses, however, can and ought to be accounted for.A Breakdown of the Schedule E Form Expense Categories.Written lease and legal forms, pens and paper, and printer ink are expenses many property owners incur that are fully tax deductible.Always 100% deductible. At the end of the accounting period, the cost of supplies used during the period .Advertising and Marketing. Beginning at the top, we have Sales, Cost of Goods, Labor Expenses, Direct Operating Costs, Advertising & Promotion, General & Admin, Maintenance Cost, . However, if the uniform is specifically designed for a certain job or role (e.Office supplies, including corporate office supplies, are considered current assets until they are used. It’s frequently seen as an essential component of a larger expenditure management process that also includes automated procurement and spend control. Investigate the root cause. Professional Fees.

Office Supplies: Are They an Asset or an Expense?

Miscellaneous expenses are a term used to define and cover costs that typically don’t fit within specific tax categories or account ledgers.Various Eligible Expenses. Once supplies are used, they are converted to an expense. If you’ve paid for the expense, you’ll credit your cash account, and if you still owe the money, you’ll credit accounts payable or .

Complete Guide to Nail Salon Expenses for 2024

If the answer is yes, the supply is an expense.Some of the groups are self-explanatory, but office coffee and supplies, as well as other miscellaneous office costs, can lead to misunderstandings. The items you listed would be considered Maintenance Expenses. Improving the source of materials, goods, and services begins with Supplier Spend Analysis. Because of this reason, office supplies do not provide long-term value and cannot be classified as current assets. The question then becomes whether coffee is a business expense or a supply. On the other hand, office supplies are paid for by the office manager. Collect third party spend data so you can get a complete view of your supplier expenses.General expenses are the costs a business incurs as part of its daily operations. you make sales in the course of a business (enterprise) the sale is connected with Australia. As you can see, the world of deductible coffee expenses is as wide as it is fragrant.

Deducting Business Supply Expenses

Spend analysis can result in lower procurement . But as you know, a lot more goes into running a business than just creating a thing and selling it.

- What Is A Dtd In Xml? , XML DTDs Vs XML Schema — SitePoint

- What Is Alt In Blood | What Is an ALT Blood Test? Liver Function Test

- What Is A 3 Percenter Logo? : Percent Logo Maker

- What Is A Conventional Agriculture System?

- What Is Cherry Picking In Research?

- What Is A Piece Of The Action?

- What Is A Proof Of Concept? _ What Is Proof of Concept? Definition, Meaning & Examples

- What Is A Learning Agreement? _ Learning Agreements

- What Is A Python Executable File?

- What Is Aladin? : Aladdin (2019)

- What Is An Example Of A License Agreement?