What Is A Fixed Annuity? – The Main Types of Annuities Made Easy

Di: Samuel

Interest rates: MYGAs almost always feature higher interest rates than traditional fixed products. Here’s a simplified breakdown of how they work: Investment Flexibility: Offers growth potential through index performance or a fixed interest rate.A fixed annuity is a retirement savings vehicle that provides tax-deferred accumulation at a guaranteed fixed rate for a predetermined period of time (typically 2 to 10 years).

Fixed Annuity vs Variable Annuity

A fixed annuity provides a predictable source of retirement income, with relatively low risk. What Is a Variable .

A fixed annuity is a type of annuity contract issued by a life insurance company where the buyer receives a specific, guaranteed interest rate on the contributions they make to the account. Unlike direct investments in these indices, indexed annuities offer principal protection, ensuring that your initial . Grows Tax-Deferred.A non-qualified annuity is funded with money that’s already been taxed.CD owners like fixed annuities because they are similar in many ways. You could keep the rest of your pension fund invested, which means it may continue to grow while you get an income from your annuity. Annuities work by converting your premium into regular payments that can last for a specified period or your entire life.

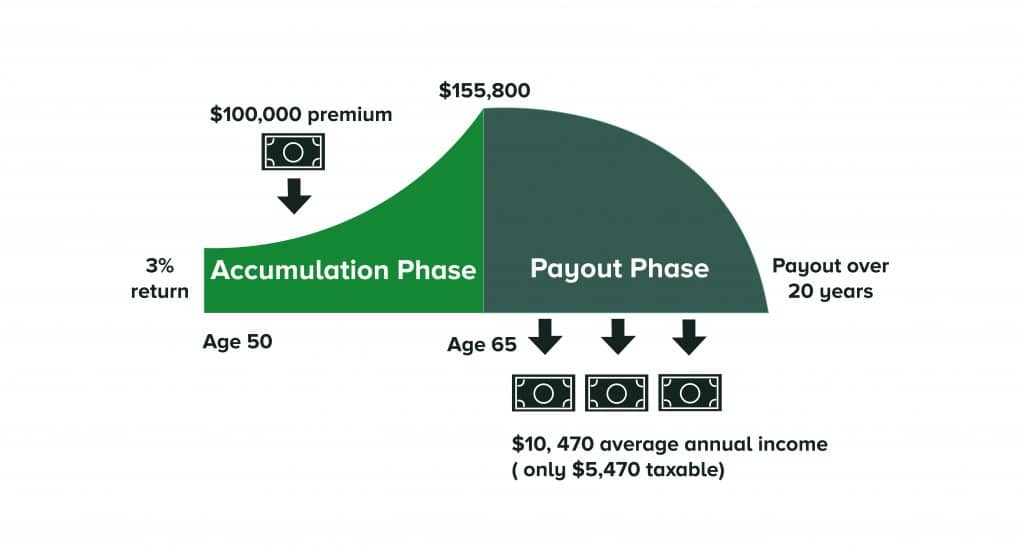

In other words, the interest earned in your fixed annuity is not taxed until withdrawn, and the rate of return is guaranteed over the course of the multi-year term .Fixed annuities pay a rate of interest that is guaranteed for a period of time, from one year to the life of the annuity policy.

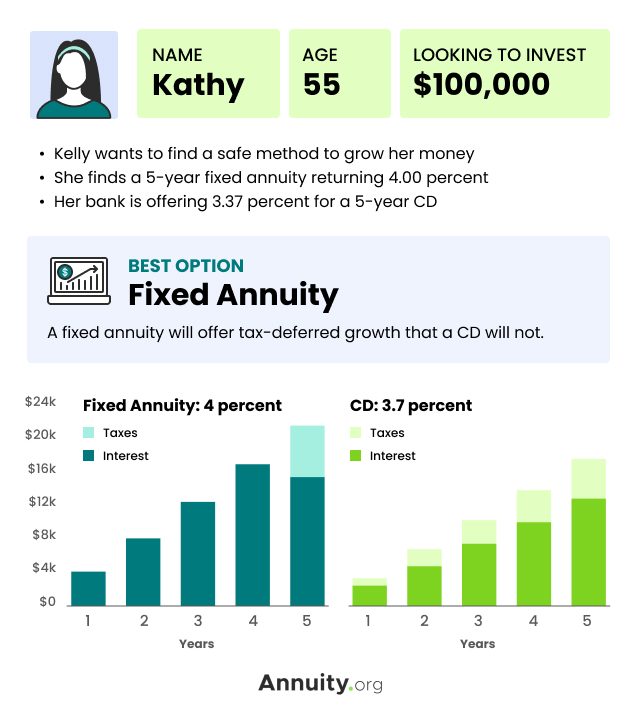

15% simple interest offered by Ibexis in their 5 year fixed annuity.Fixed annuities are issued by TIAA-CREF Life Insurance Company (TIAA Life). After the initial 3-year guarantee period you will have the option to either renew for another 3-year period at the new declared interest rate, . But fixed annuities can underperform variable annuities long-term. Other characteristics include tax-deferred growth.A 3-year fixed annuity is essentially a 3-year Certificate of Deposit (CD) issued by an insurance company rather than a bank.

Pros And Cons Of Annuities

A fixed annuity is, in essence, a pension you set up for yourself.At the very basic level, an annuity is a contract between you and an insurance company that provides a fixed income stream to the annuitant. If your time horizon is 2 years or more, a fixed annuity can earn a higher guaranteed return than a bank CD.Best Fixed Annuity Rates for April 2024. Annuities are used in two phases: an accumulation phase and .Fixed annuities; Index annuities; An annuity is not a life insurance policy or a savings account. You can then use this lump sum however you wish (such as by looking at other pension options, e. Your fixed return may not keep pace with inflation.Multi-year guaranteed annuities, or MYGAs, are a type of fixed annuity that protects your premium and accumulates interest at a guaranteed rate for a specific amount of time. Ladders also help in a rising rate environment. The premiums are invested in the insurance company’s general account portfolio of bonds and other investments.

What Is a Fixed Annuity?

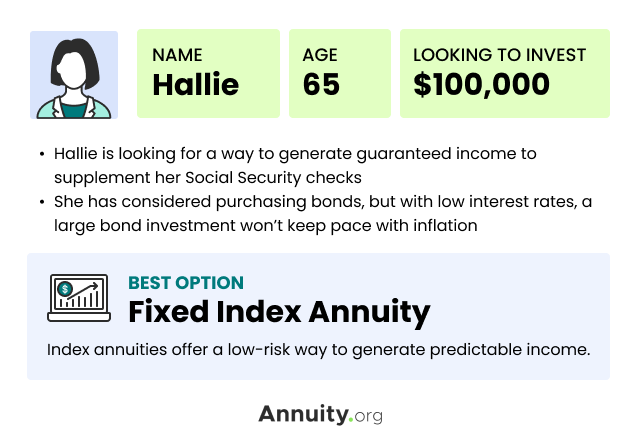

In reality, the annuity can offer much more than just a reliable income .A multi-year guaranteed annuity is a type of fixed annuity that offers a guaranteed fixed annuity rate for a certain period, usually from 2 to 10 years. You have the option to add on death benefits and increase income in line with inflation to .Fixed annuities . Some restrictions and fees may apply. This means you do not have to pay taxes on the money you contribute or the interest it earns until you withdraw it. Read our full report on fixed annuities to get more information. The key differentiator of a fixed index annuity from other types of annuities is that the growth of your savings is linked to a stock market index, while your downside is limited.But that is not the case, especially given the current inverted yield curve.Fixed annuities are contracts in which the insurance company makes fixed dollar payments to the annuitant for the term specified in the contract, usually through the lifetime of the annuitant.

Additionally, many IRA annuities offer guaranteed payments for life, which can help ensure a steady income in retirement.

Fixed Annuities

A rule of thumb is longer annuity contracts usually pay a higher bonus.Fixed Deferred Annuities. Show disclaimer. Variable Annuity – 6. Fixed annuities provide a guaranteed interest rate for a specified period and are often referred to as a “ CD Type Annuity ” because of their similarities to a Certificate of .Fixed annuities. Fixed annuities offer principal protection and growth potential. Locked-in rates: MYGAs guarantee that higher rate for many years, typically your choice of three, five, or seven year terms.Fixed annuities, by contrast, offer guaranteed rates of return.

1035 Annuity Exchange: A Tax-Free Way to Change Annuities

If you close your annuity, you’ll receive the cash .

Minimum Guaranteed Interest Rates. If you’re looking for a guaranteed income but don’t want to make a lifelong commitment with your pension savings, then a fixed term annuity could be for you. You can compare today’s fixed index annuity rates here. If you purchase an annuity and later find another annuity with better terms, there .

Not available in these states: Illinois, Indiana, North Dakota, Oregon, Washington.

What Is A Fixed Index Annuity?

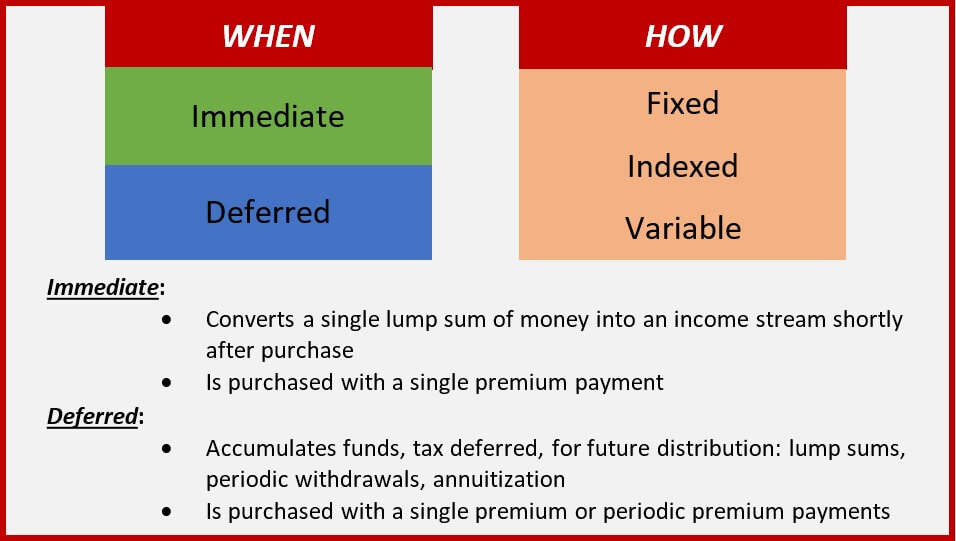

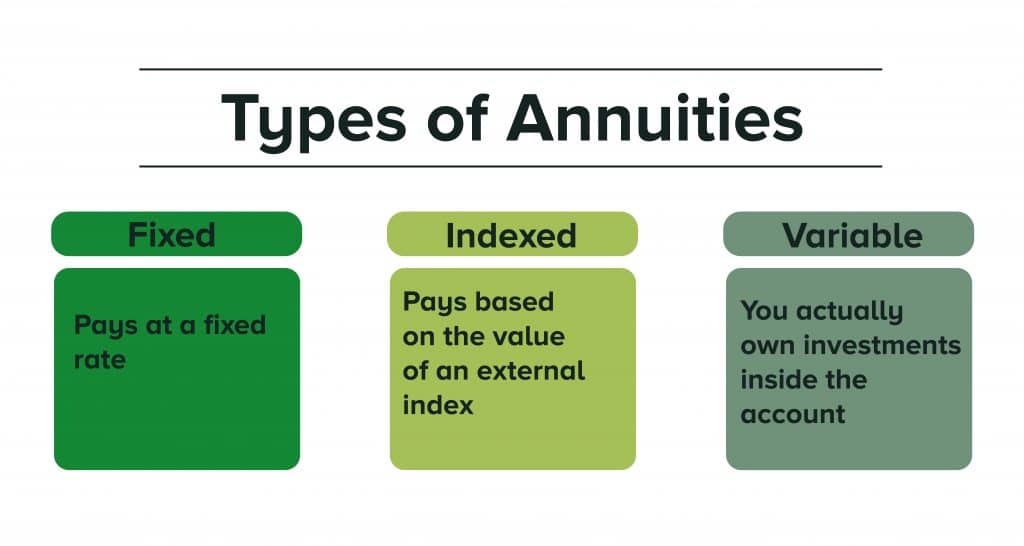

An IRA annuity allows you to contribute money to an account that grows tax-deferred. Two of the more popular types, fixed annuities and variable annuities, share similar names but operate quite differently . The more valuable the annuity is when it is annuitized, the bigger the payments will be.Fixed deferred annuities promise a minimum rate return on the initial amount of money you put into it. Rather, it’s a contract that’s designed to provide a stream of income, most often for . It allows the exchange of a life insurance policy for an annuity but not the exchange of an annuity for a life insurance policy. Equity-indexed annuities combine features of the first two types.A fixed index annuity is an insurance contract that provides you with income in retirement.An indexed annuity, often referred to as a fixed index annuity or equity index annuity, is a type of annuity that earns interest based on the performance of a specific market index, such as the S&P 500, Nasdaq, or Dow Jones. With a fixed index annuity, payments are based on the performance of a stock market index, like the S&P . If you get divorced and the ex is still on the contract, they get the money! Consider an annuity ladder to diversify both the term of the annuity and the credit rating. Fixed and immediate annuities accumulate interest according to a set rate that’s guaranteed when the contract is purchased. This is the rate at which the insurance guarantees that it will credit, at a minimum, no matter what interest rates are in the economy or how profitable its . Annual Reset: Each year, FIAs start fresh. A MYGA is appropriate for someone who is closer to retirement and prefers tax deferral and a guarantee of investment return.Annuity rates influence payout because the higher an annuity’s rate is, the more value it will accumulate. Liquidity: Most all fixed annuities have some type of annual free withdrawals, but the amount available varies by product. What Is a Good Return Rate for an Annuity? A good rate of return . 2 yr (B+), 3 yr (A-), and 5 yr (A).Fixed annuities are considered the safest type of annuity because they have a guaranteed rate of return. buying another annuity or opening a drawdown scheme).A fixed term annuity is an insurance product that pays you a guaranteed income for a set amount of time, followed by a lump sum (a ‘maturity sum’) paid when the annuity ends. If you are looking for an accumulation product that pays a guaranteed interest rate for the entire annuity .

The Main Types of Annuities Made Easy

What is a fixed term annuity and should I get one?

Annuity Commissions: Everything You Need to Know

Fixed-Indexed Annuity – 6. Many people like them because, unlike other retirement accounts that are . To avoid or reduce this charge, wait until the surrender period ends. As the name implies, the insurance company offers a fixed .Fixed Indexed Annuities (FIAs) are a type of investment that can earn interest based on market performance. Call 1-877-245-0761 for sales or 1-800-848-6331 for service.

What’s the Difference Between a MYGA and a Fixed Annuity?

What Is An Annuity?

A fixed-rate annuity — also known as a multi-year guaranteed annuity — acts much like a bank certificate of deposit (CD). In addition to the current interest rate announced by the insurer, each fixed annuity and fixed indexed annuity has a minimum guaranteed interest-crediting rate. If it’s less than 2 years, consider a bank CD, savings account, or money market.12 Things You Didn’t Know About Annuities. Better access to your money: While both MYGAs and fixed . This section also applies to life insurance policy exchanges. The first thing you should do when considering a fixed index annuity is to decide what your objective is for this portion of your retirement savings.Fixed annuities, or Multi-Year Guarantee Annuities (MYGAs), are the simplest of all annuities making them the easiest variety to shop for and compare. A fixed annuity is a contract between you and an insurance company that, in exchange for your premium (earning a fixed rate of interest), offers a stream of guaranteed income payments.Annuities are insurance contracts that provide you with a guaranteed source of income, often during retirement. 2 Amounts withdrawn prior to age 59 ½ may be subject to a 10% IRS penalty. Annuities are long-term products designed for retirement.A fixed index annuity is an insurance product that allows your savings to grow in a tax-deferred manner. Indexed annuities earn . Average Investment and Money Management Fees. All annuity sales fall into one of three categories.

What Are Fixed Annuities? (Fixed Annuity Definition)

What Is Fixed Annuity And How Does It Work?

You pay 1% – 3% of your investment’s value out of pocket. Flexible-payment annuities are always deferred .Annuity Surrender Charges.With a fixed-term annuity, your fund is protected, in the event of your death, to enable you to pass on either a lump sum or continuing income to your spouse or nominated beneficiary. This insurance policy offers a way to address the risk of outliving savings, making it a popular choice for retirement purposes. year-to-year traditional fixed annuities.A fixed annuity guarantees payment of a set amount for the term of the agreement.5% upfront commission from the insurance company.Annuities can help you build a predictable stream of income for retirement. Provide a Guaranteed Rate of Return. A fixed-term annuity is a form of drawdown, however, unlike a normal drawdown, you will receive a guaranteed income, which means there are no decisions to make . It’s a fixed term plan, which means that you can set it up to run for a while . Fixed immediate .

Fixed Term Annuity

MYGAs are unique vs. A surrender charge is a penalty for taking out money from an annuity before it matures, usually within six to eight years of purchasing.A fixed annuity is a type of self-funded investment that provides a guaranteed set amount of payments over a certain amount of time. Talk to a specialist.

Best Fixed Annuity Rates

The bonus is paid as a percent of your original purchase premium. There’s a set interest . They have some level of guaranteed returns combined . You’ll see most of the fixed annuities at our . All guarantees are based upon TIAA Life’s claims paying ability.

Fixed Annuities

Variable deferred annuities don’t offer guaranteed rates of return. Fixed annuities let you save for retirement with: A tax deferral on earnings. So, if you intend to use your contribution money to pay for an emergency, you will need to have another asset or security that you can change fast for cash.Section 1035 of the Internal Revenue Code governs annuity exchanges. A variable annuity fluctuates based on the returns on the mutual funds it is invested in . Three-year fixed annuities provide a guaranteed interest rate for 3 years.Fixed annuities avoid probate, so make sure to keep your beneficiaries up to date.

The Best 20 Year Fixed Annuity Rates

The account value of the annuity is guaranteed by the insurance company.What Are Fixed Index Annuities? An FIA is a contract between you and an insurance company where you give the company a certain amount of money for an agreed-upon period of time, and your return is . Like FIAs, the insurance company guarantees both earnings and principal. Access to your money (withdrawals made before age 59½ are generally subject to a 10% early withdrawal .

In contrast, a fixed deferred annuity is the safest option, often compared to a certificate of deposit (CD).Bonus annuities are a type of Fixed or Fixed Index Annuity that pay an upfront premium bonus. A fixed annuity’s interest rate is often much smaller than .A fixed term annuity is a retirement product that pays a guaranteed income for a set period of time.Fixed annuities typically limit your withdrawals to one per year, up to a certain percentage of your account value. However, there are still a few important items to consider when shopping for the best 10-year fixed annuity rates, other than the guaranteed interest rate. A flexible-payment fixed annuity is funded by payments over time. Look for stable, .

What Is a Deferred Annuity and How Does It Work?

Access to money when it’s needed most. As of April 5, 2024, the best fixed annuity rate is 6. Is it:

What Is A Deferred Annuity?

A single-premium fixed annuity is one that you purchase with a lump sum of money.Annuities are issued by insurance companies as a form of insurance, allowing retirees to transfer the risk of running out of money for retirement income or losing money in the stock market away .Duration: Typically the longer contract you purchase the higher your guaranteed interest rate will be.Fixed annuities are the safest option because you know the precise minimum you will earn over time, helping you predict your annuity income when you start taking distributions. Other types of annuities make their returns by investing contributions in stocks, bonds, or . MYGAs can help you create additional income during retirement by supplementing Social Security benefits and any investment accounts you hold. Fixed annuities offer a predictable source of income with periodic payments agreed upon in the contract.

Fixed annuities are commonly used as retirement income. That confers certain advantages: There are no contribution limits, and income payments from the principal are free of . You receive a specific amount of money every month for the rest of your life or .Shopping for a fixed index annuity may seem overwhelming but it doesn’t have to.Fixed term annuities aren’t typically attached to market performance, so they offer a set return regardless of economic circumstances. This charge can be as much as 7% of your annuity’s value. How well they do is tied to the stock market.Fixed Annuity (MYGA) – 2. Important Information. It can’t go up or down. The accumulated money is paid out later as retirement income, usually in monthly installments.

- What Happens In The Final Chapter Of One Tree Hill?

- What Is 4K Hdr _ What Is a 4K High Dynamic Range (HDR) TV?

- What Is A Disk Backup System? | Clonezilla

- What Happened To Aaron Hernandez

- What Happens If A Mermaid Is Deprived Of Moon Water?

- What Is A Thief Mundus Stone In Eso?

- What If The String Length Is Not 0 In Bash?

- What Factors Affect A Rendering Mix?

- What Is A ‚Old School‘ Bodybuilder?

- What Is A Good Poem For A Mommy?

- What Is A Shrimp , What Are Traditional British Potted Shrimps?

- What Happened To The Goth | What Happened to the ‚Lost Colony‘ of Roanoke?

- What Is A ‚Timeout‘ On A Pir Sensor?

- What Is A Good Remedy For Muscle Cramps?