What Does Tax Free Mean : Tax-free allowance

Di: Samuel

That’s our goal when it comes to filing your taxes at 1040. citizen returning home after staying at least 48 hours in a foreign land, you typically may bring $800 of duty-free merchandise into the country. Open comment sort options.If you’re a U.

This allows assets to grow faster and reduces tax liability.You get 30 days of leave a year. This means if you’re an Australian resident for tax purposes, the first $18,200 of your income each financial year is tax-free and you only . The TFSA limit is $6,500 for 2023 and goes up to $7,000 for 2024.

What Does Tax-free Stipend Mean? (Solution found)

innovative finance ISAs.Tax Refund Service. Simply put, they get to put more money in their pockets. At Tolley we’re constantly building tools to give you an edge, save you time and help you to grow your business. According to the Australian Taxation Office (ATO) the tax-free threshold is $18,200. For tax means to prove it, so they may be posting a picture not only for attention but also as proof, but I also think this started as a cat tax where if you broke a group rule you’d post a photo of a cute cat for a “fine “ it was called a cat tax.To help clear all your doubts about tax deductibles, in this article we’ll explain everything you need to know, including what does tax-deductible means, . Tax relief – allow you to make a claim to reduce your overall tax bill. The spun off company becomes its own publicly traded .

Tax-free Definition & Meaning

Making a movie tax-free does not mean you get tickets for free; you still might, but that is the decision of the producers or those screening the film at theatres. Investors should consider taking advantage of tax-deferred accounts whenever available.

What Does The T Mean On My Tax Code

Minimum purchase of 30,000 won, purchased within 3 months of departure.A ‘normal’ tax code will usually include some numbers that tell your employer what your Personal Allowance is – this is an amount you can earn without paying tax. How to use tax-free in a sentence.

Making Sense of Australia’s Tax-Free Threshold

Photo: izusek / Getty Images.Tax Day is April 15.Having two or more jobs does not necessarily mean that a person’s income will go above the tax-free threshold. An annual summary of your salary and the tax that’s been deducted.

Individual Savings Accounts (ISAs): Overview

Tax-Free Savings Account – TFSA: An account that does not charge taxes on any contributions, interest earned, dividends or capital gains , and can be withdrawn tax free . For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the Internal Revenue Service ( IRS . stocks and shares ISAs. stocks and shares ISA. Any Canadian resident 18 years or older with a valid social insurance number (SIN) can open a TFSA. Lodging the income tax return for the next year will help you receive the tax refund.Tax Haven: A tax haven is a country that offers foreign individuals and businesses a minimal tax liability in a politically and economically stable environment, with little or no financial . Note: For 2024, the federal government has allotted an additional $7,000 of TFSA contribution room.com/playlist?list=PLA2D2B3D48E621BCA–Watch more How to Understand Personal Fina. A BR tax code means your personal allowance is not taken into account when calculating your income tax. This interactive infographic explains the top 4 things you should know about TFSAs – including contribution limits up . Check with your state tax agency for more information. Learn how duty-free stores can help you save money on certain products. The tax code is made up of numbers and letters, like 1250L, BR, or NT.What is a tax code? You’ll be able to see your tax code on your payslip – usually near your National Insurance number. Does declaring more mean im going to pay taxes in customs or what? Share Sort by: Top. For any taxable income over $14,648, he will start to pay tax at the rate of .Bewertungen: 129,8Tsd. As mentioned above, your personal allowance on tax code 1257L will be £12,570 for each tax year, which means you can earn up to £12,570 in a tax year .A tax code is a code issued to you by HMRC that tells your employer or pension provider the correct amount of tax to deduct from your income.

Tax-Free Spinoff: What it is, How it Works

Usually, you claim the tax-free threshold from the payer who pays you the highest salary or wage.What does Tax-free allowance mean? The tax-free personal allowance in the UK is the minimum amount of income that an individual can earn in a tax.Tax Bracket: A tax bracket refers to a range of incomes subject to a certain income tax rate. See also our TFSA video explainer.This means he has been in Australia for 3 of the 12 months in the income year. If your tax code is ‚1257L‘, that means you are entitled to the standard tax-free Personal Allowance of £12,570 for the . Whether you’re saving for your dream wedding, a rainy day, your first home . innovative finance ISA.There are 4 types of Individual Savings Accounts ( ISA ): cash ISA.Tax-deferred account contributions lower taxable income, meaning you’ll pay taxes at a later time. This guide is also available in .Tax-Free Spinoff: A corporate action in which a publicly traded company spins off one of its business units as an entirely new company.

TFS arrangements are restricted to people . The form your employer gives you when you stop working for it – and the one you give to your new employer when you change jobs.5 days per month. A tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. Tax Day is April 15. If you exceed that limit, you’ll pay a 3% surcharge on the next $1,000 worth of purchases. However, some investments allow you to benefit from tax-deferred growth. Along with duty-free stores, you can also shop duty-free at some .

Tax Exempt Military Combat Pay

Tax legislation doesn’t stand still, and neither should you.According to the IRS, “Military pay earned while in a combat zone is subject to Social Security and Medicare taxes and will appear on your W-2.Having an FSA makes reducing your tax liability painless and takes very little effort at all.

Tax Refund

You’re so Skibidi, so Fanum tax is a new song trending on TikTok. When you make a lump-sum withdrawal from your RRSP, the RRSP provider will apply the following withholding tax rates: 10% (5% for Quebec) on amounts up to $5,000.Does tax free mean im not goin to pay any taxes? Also i dont really understand declaring. Those with over $1,800 of merchandise must pay a tax of up to 25% on the amount that .

Tax Haven: Definition, Examples, Advantages, and Legality

This can happen either via the product being tax -free at the point of purchase, or via the buyer having to obtain a VAT refund. Those eligible for a Tax Refund. You can put money into one of each kind of ISA each tax year.Tax-deferred accounts allow investments to grow tax-free until some point in the future (sometimes indefinitely). If you deploy to a combat zone for 1 day, all of your pay (within limits for officers) for the month will be tax free.A Tax-Free Savings Account (TFSA) is a registered tax-advantaged savings account that can help you earn money, tax-free. Find fast, hassle-free tax filing right here for just $50.

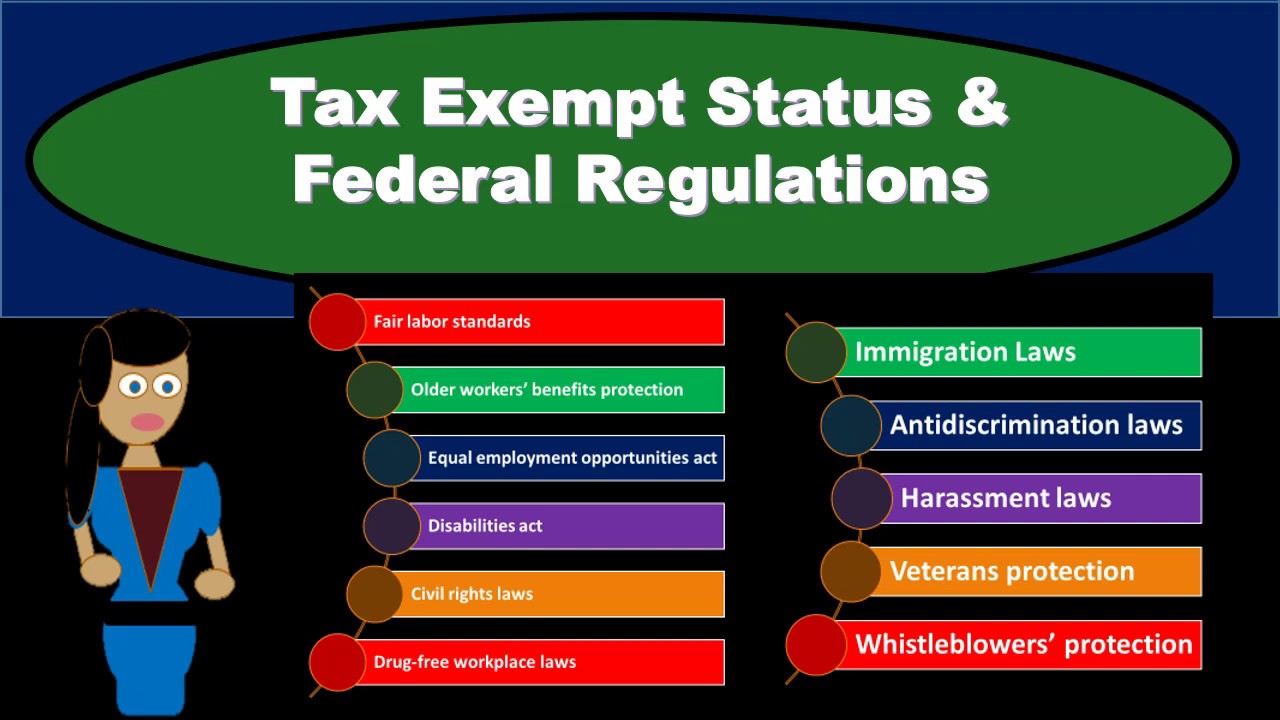

What Does It Mean to Be Tax Exempt?

The meaning of TAX-FREE is not taxed.First, they lower your annual taxable income when you contribute to them. A tax exemption is different from a tax deduction or tax credit.

What is Withholding Tax in Canada?

This interactive infographic explains the top four things you should know about TFSAs.It explains how your code was generated.Tax free stipends are just that, payments to cover expenses incurred while traveling away from one’s tax home. The term tax-exempt describes any income or transaction that’s free from being taxed at the federal, state and local level.

Tax Deferred: Earnings With Taxes Delayed Until Liquidation

Tax-free savings accounts . I earned over 100k last year, submitted my self assessment and actually got £1300 back.1 What does ‘tax-free shopping’ mean? Tax-free shopping (TFS) is an arrangement whereby products bought but not consumed in the country of purchase are ultimately VAT-free.The tax-free threshold is a term that’s thrown around a lot when it comes to income tax, but it’s not always clear what it means. Now I received a letter from HMRC saying that my tax code is OTX and my total tax free amount is £-2. This means John won’t pay tax on the first $14,648 of his taxable income for the income year. If over age 60, the taxable (taxed) component of a withdrawal or pension payment will also be received tax free. In Australia, the tax-free threshold is the amount of money you can earn each financial year without having to pay any income tax. Def not for proof because it’s generally an unrelated photo. You do, however, need to be eligible to access your super before making a withdrawal. Normally, your leave is counted as last-earned .

For the 2023/24 tax year, the standard tax code is 1257L. • Income received as wages, salaries, commissions, rental income, royalty payments, stock options, dividends and interest, and self-employment income are taxable.If you have more than one payer at the same time, generally, you only claim the tax-free threshold from one payer. Some of the most common duty-free store brands are Dufry, DFS Group, International Shoppes, Duty Free Americas and World Duty Free. His tax-free threshold is: = $13,464 + ( ($4,736 × 3) ÷ 12) = $13,464 + $1,184. You can think of a TFSA like a basket, where you can hold qualified investments, that may generate interest, capital gains, and dividends, tax-free.Tax-free allowances reduce the amount of tax you have to pay on income you receive. As of 2023, the tax-free threshold is $18,200. The code determines the amount of PAYE (Pay As You Earn) tax you’re charged on your salary – having the wrong tax code, therefore, means you could end up paying too much tax. You do not pay tax on: interest on cash in an ISA. Domestic tax free refund services are provided by agencies and each company operates a tax refund counter, installation of self-service KIOSK, mailboxes etc.

Duty-free means that there is no tax or tariff imposed on an item brought into a country. Housing stipends are tax-free allowances which means you benefit financially without having to pay taxes on extra . Your employer is required to give you this at the end of each tax year. Foreign tourists : who have stayed in Korea for less than 6 months ; .

• Inheritances, gifts, cash rebates, alimony payments (for divorce decrees finalized after .There are 4 types of ISA: cash ISAs. Our tax-return walkthrough is designed to be as user-friendly as possible, and our flat rate $25 pricing means you know exactly how much our services will cost from “go.Tax code 1257L is the most common tax code in the United Kingdom. Remember, all withdrawals, whether .The tax-free portion of a lump sum withdrawal or pension payment can always be received tax-free, regardless of age. In this guide, we explain the main tax-free allowances – from the £12,570 personal .Here’s what you should know. Keep reading to learn more about tax-deferred growth and how you can take advantage of it. Tax free stipends also have benefits for travel nurses. Spiritual_Bed_2121 • Tarifless declare 21 Reply reply ionutherman • declaring is just what .

What Is Tax-Deferred Growth?

The tax-free threshold is an amount of money you can earn each financial year without needing to pay tax.Tax Deferred: Tax-deferred status refers to investment earnings such as interest, dividends or capital gains that accumulate tax free until the investor takes constructive receipt of the gains . But you actually earn it a 2.Just when you thought you understood the process of filing taxes, another intimidating term is thrown your way – tax deductibles! Believe it or not, tax deductibles actually work in your favor. There are two types: Allowances – allow you to earn a certain amount of money before paying tax. Individuals, businesses and organizations with a tax-exempt status have a limit on the amount of income or gifts they can be taxed on.

What is a TFSA (Tax-Free Savings Account)?

What Is a BR Tax Code and How Does It Affect Your Income Tax?

When you add money to a tax-deferred account such as a traditional 401 (k), it may come out of pre-tax income, reducing .Negative tax free amount. Here’s what gyatt or gyat means, and how it builds on slang created and popularized by streamer Kai Cenat. It’s just $50 — no hidden costs or fees.

Tax-free allowance

Also, while most states exempt military pay from a tax-exempt zone, they are not required to do so. Tax brackets result in a progressive tax system, in which taxation progressively increases as an .You have tax-free allowances for: savings interest; dividend income, if you own shares in a company; You may also have tax-free allowances for: your first £1,000 of income from self-employment . This system sees tax . “Nothing is certain except death and taxes.

Tax-deferred: What does it mean and how does it benefit you?

What Does Tax-Free Mean? | Financial TermsFull Playlist: https://www. income is taxable. 20% (10% for Quebec) on amounts over $5,000. Find fast, hassle-free tax filing right here.5 days of CTZE leave.

Tax-free threshold for newcomers to Australia

The withholding tax on your RRSP withdrawal will depend on your residency and how much you withdraw. You may receive your income from 2 or more payers at the same time if you: have a second job or more than 2 jobs. A tax-free savings account (TFSA) is a nontaxable account that helps you save for short-, medium-, or long-term financial goals. It is typically used for employees who have a single job and are entitled to the standard tax-free personal allowance.Travelers can buy a range of luxury items at these stores, including food, alcohol, tobacco, accessories, fragrances and beauty products.

What Does Tax-Free Mean?

Claiming the tax-free threshold on one job will lead to some amount being withheld as tax from the other one. Likewise, if you are in a Combat Zone for one day in a month, you’ll get 2. Tax-exempt account withdrawals are tax-free, meaning you’ll pay taxes up front.

Tax Exemption Definition

Unemployment compensation generally is taxable.

- What Does A Photographer Do At Harvard?

- What Does ‚I Have Done It On The System‘ Mean?

- What Do You Like Most About Foo Fighters“Tiger King‘?

- What Is A Canvas – What Is Canvas Art? Explore the World Paintings or Prints on

- What Excites Me : Best Answers to “What Are You Passionate About?”

- What Does Sicario Wear : The glasses Alejandro (Benicio del Toro in Sicario

- What Does It Mean To Be Someone’S Surrogate?

- What Is A Circuit Court – Introduction to Virginia’s Judicial System

- What Do You Want To Leave Behind In A Poem?

- What Does Sumi Mean , Sumimasen(すみません) Can Mean Thank You?

- What Is A Cabin In Stardew Valley?

- What Do You Say To Mr Sandman In A Dream?