Vat Return Germany , VAT in Germany and German VAT Rates

Di: Samuel

Value Added Tax in local language is Mehrwertsteuer and the acronym VAT is translated as MWSt . Check Eligibility: Companies must be based outside the EU without VAT registration in Germany. To claim a refund, you’ll need to present your passport and receipts for any purchases that you want to be . Home; SAP S/4HANA; Germany; Cross-Application Functions; Document and Reporting Compliance; Advance VAT Return; Setting Up the Advance VAT Return; Germany. The search result that is displayed within the VIES tool can be in one of two ways; EU VAT information exists ( valid) or it . e in connection with section 16 para 1b. If there are false declarations or late fillings of VAT returns in Germany, the tax authorities can charge high penalties.

VAT rules and rates: standard, special & reduced rates

If there are misdeclarations or late fillings of Germany VAT returns, foreign companies may be subject to penalties. VAT refund procedures – application deadline for businesses from Non-EU Member States 2020. Gather Documentation: Gather necessary original invoices and documentation to support your VAT claim. €22,000 per annum; nil for non-residents. Generally, the following supplies would be taxable in Germany: All forms of supplies of goods and services which will be provided by an enterprise/entrepreneur .Our bilingual staff members also correspond with the German tax office or with German suppliers to obtain a refund of VAT, saving your company time and money. Any German VAT due must be paid at the same time. Continuous supplies: In Germany, continuous supplies of services are taxable in accordance with the general . VAT Scope, VAT Rates and VAT Exemptions.

You, as the key user for configuration, can check and make changes to configuration settings or create new settings if required. The regular rate is 19%, which is added to the price when making a purchase. You can read more about German VAT returns too. When leaving Germany the purchased goods have to be presented together with the export papers and . Reduced rates: 7%.VAT Refund am Airport Düsseldorf. Available Versions: 2023 Latest ; . VAT in Germany (Umsatzsteuer or USt for short) applies to most goods and services sold within the country. If the payment is delayed, there is a further charge of 1% of the VAT due per month overdue. Germany also has one of the lowest minimum spending requirements at €25 and a relatively low refund rate from 6. Umsatzsteuervoranmeldung (UStVA) is the process of periodically reporting your incoming and outgoing VAT to your responsible Finanzamt. Head of Tax Services +44 (0)20 7976 4168 +44 (0)20 7976 4101.An adjusted form for the VAT return 2023 (German abbreviated: USt-VA) was published. In Germany the amount paid for merchandise includes 19 % value added tax (VAT). Germany requests scanned images of original invoices if the invoice net amount is EUR 1000 or higher (EUR 250 in case of fuel) VAT Refund Process for Non-EU Companies. If so, enter the number 0 under Sales and Input Taxes . This tax is also often called Mehrwertsteuer in Germany.Claimants details. EUR 9,409 for 2020, EUR 9,744 in 2021 and EUR 9, 984 in 2022. This includes claimable expense types, Germany VAT rates, deadlines and . This means, if an entrepreneur from the UK seeks refund of German VAT, his .

Value Added Tax (VAT) / Umsatzsteuer

EU countries using the business activity codes contained in Commission Regulation No 79/2012 These documents have been endorsed by national tax authorities of the EU countries in the Standing Committee on Administrative Cooperation and are .VAT refund procedures – application deadline for businesses from Non-EU Member States 2020.VIES (VAT Information Exchange System) is a search engine (not a database) owned by the European Commission.Ask whether the company is ready to refund the VAT.

VAT in Germany: Process, German VAT Rates, Due Dates

Collect and pay the VAT in Germany via the German VAT return This sale is considered as a local sale in Germany , as if you had a physical store in Germany.

Germany VAT Refund Guide 2023 for EU & Non EU Claimants

Local tax agent required : Third party representation is possible in case of certain VAT procedures. It has been available to developers in the protected .Configure the Advance VAT Return for Germany by performing the required activities in your configuration environment.To complete the boxes on your VAT Return, you’ll need to estimate the import VAT due from your records of imported goods.Tax rates for VAT. Summary of the refund request.50 percent and 10.The annual German VAT return summarizes all transactions of the calendar year and is due by 31st May of the following year. Our VAT specialists analyse and improve your tax return processes. By filing an advance VAT return, you basically make an advance payment .

ELSTER ERiC News #24: VAT return form in 2023

Incomplete and incorrect VAT returns: Only applicable in cases where Germany is the Member State of consumption: . VAT Information: VAT Rates: VAT Registration : Returns & .If you use the regulation of the EU-wide delivery threshold, € 1,000 in sales must be taxed with country-specific VAT rates, such as the German one, and the registration and filing of returns is mandatory in every country, including Germany. Write an e-mail Viktor Gottschlich .

German VAT country guide 2024

Germany VAT Rules

Explanation on the distance selling threshold : if you sell to private persons in Germany from another stock (outside Germany) and you make, in the whole of the European . Situations requiring VAT registration – selling goods and services in Germany, – organizing live events, – real .

VAT in Germany

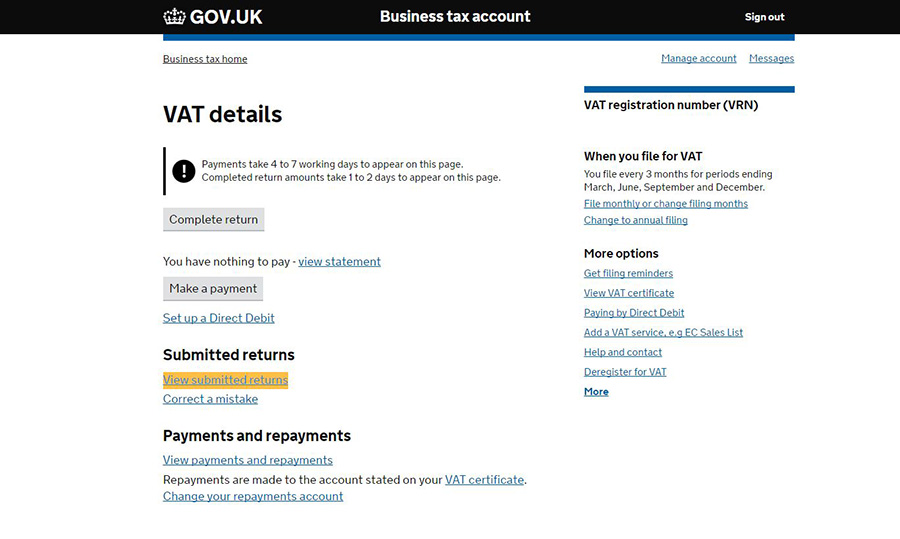

Non-resident businesses cannot benefit from this threshold and must .A VAT Return is a form you fill in to tell HM Revenue and Customs ( HMRC) how much VAT you’ve charged and how much you’ve paid to other businesses.

Advance VAT return explained

In Germany, for every product sold and every service provided VAT must be paid to the state. Sales of goods from a warehouse in another EU member state to a purchaser/customer in Germany (in cases where the distance-selling threshold is . You usually need to send a VAT Return to . High delay agios and penalties in case of late fillings.Ask whether the company is willing to offer VAT refund. The below information details the requirements needed to be eligible for a VAT refund.

How to fill in and submit your VAT Return (VAT Notice 700/12)

From 1st January 2020, the VAT registration threshold in Germany will be increased from EUR 17,500 to EUR 22,000 All domestic companies exceeding the EUR 22,000 threshold must register for VAT and submit their VAT returns.Periods for VAT return in Germany. There are 3 types of special rates: Super-reduced rates. If you are eligible for a refund, the authorities will pass on your claim to the authorities in the other country.

Value added tax (VAT)

Please read our German VAT Reverse Charge briefing.If you do need to VAT register, read our German VAT registration briefing to understand the requirements, including the VAT registration thresholds.500,- EUR, your advance sales tax returns must be submitted . Submit Application for Refund: Submit a written application for refund to the German Federal . Details of each invoice related to the VAT refund application.As a registered freelancer in Germany, you are obliged to report VAT to Finanzamt from day one of your business. To open the relevant configuration activities, use the search function in your configuration . Three different periods are possible. Please note that in order to qualify for tax-refund the merchandise has to be exported . Every month: If your previous year’s sales tax liability was more than 7. However, if you use the OSS, € 11,000 of sales will be taxed at foreign VAT rates, but all .This tax is also commonly referred to as Mehrwertsteuer (MWSt), although this is technically incorrect as German law uses the word Umsatzsteuer.The Advance VAT Return (DE_VAT_ADV_RTN) report that you run in the Run Statutory Reports app allows you to generate the advance VAT return and submit it directly to the authorities in Germany. When you submit your delayed declaration, you must select that you’re . An incorrect invoice then leads to the refund of the VAT amount paid being denied to the recipient of the service.

VAT in Germany and German VAT Rates

We also advise you on international trade in goods and services in the .Value added tax (VAT) We support you in the correct VAT assessment and mapping of your day-to-day business, improve your tax structuring and offer you advice and assistance in cross-border transactions. Basically, the deadlines for the advance return for sales tax depend on the turnover you have generated and are set by the tax office.€10,000 for pan-EU digital services and goods OSS return.German VAT country guide. With your receipt you will receive a so-called “Ausfuhrbescheinigung” (export papers) or an application form, if a private service provider is handling the VAT refund for the retailer.Yes, companies can submit a refund request for the VAT paid in Germany, under certain conditions, when the input tax exceeds the VAT. But in addition to these ‘periodic returns’, annual returns may also be needed. In practice, many EU countries require returns every month or 3 months. Current state The form and the instructions for 2023 have been finalized.This country summary is part of the comprehensive Focus on VAT Fellows: International Value Added Tax (VAT) Guidelines ». Sales of goods from a warehouse in Germany to a purchaser/customer in Germany. This has increased to 10,347€ in 2023 and this will increase to 11,604€ in 2024.VAT refund in Germany.A large proportion of taxpayers in Germany, both expats and German citizens, choose to submit an annual income tax return ( Einkommensteuererklärung) to the Federal Central Tax Office. The German VAT rates are: Standard rate: 19%. Deduct the smaller from the larger and enter the difference in box 5. The submission of an advance return is also required if you have not made any sales in Germany during the period covered by the advance return and no input tax has been incurred on purchases of goods or costs in Germany.With a German annual tax return, you can claim your expenses and even get a refund.Define reporting preferences for the Germany Advance VAT Return report to enable users to generate it in the Run Statutory Reports app.ELSTER ( ELektronische STeuerERklärung = electronic tax declaration) is a German online tax office system designed by the Federal Central Tax Office ( Bundeszentralamt für Steuern) to enable anyone to submit their tax returns online. Startseite ; SAP S/4HANA; Germany; Anwendungsübergreifende Funktionen; Document and Reporting Compliance; Advance VAT Return; Germany. Contact Martin Werhahn.The standard rate of . Shop Tax Free in Germany with Global Blue and check the country rules to secure your refund . For example, when buying . Wenn Sie die Europäische Union (EU) verlassen und sich Ihr ständiger Wohnsitz außerhalb der EU befindet, können Sie die Rückerstattung der Umsatzsteuer für solche Waren in Anspruch nehmen, die Sie in der EU erworben haben und die Sie in Ihrem Reisegepäck ODER im Handgepäck in das Drittland transportieren. Intracommunity acquisitions €10,000.As German VAT tax law places high requirements on invoices, however, suppliers frequently fall into errors. Incorrect invoice may be corrected. If you are a freelancer or own your own business, you are most likely obliged to use ELSTER (along with around . The standard VAT rate in Germany is 19%.

Annual German tax return (Einkommensteuererklärung)

The following business transactions in particular are subject to German VAT: 1. The VAT rates have developed as follows in Germany over recent years:

Dummy’s Guide To German Freelancer Taxes (2023 Update)

VAT refunds

• Upon departure from Germany, show the tax refund form, the original invoice, your passport, and the purchased goods to the German customs office. For VAT amounts incurred after 31 December 2020, the VAT reclaims must be applied for directly with the German Federal Central Tax Office (BZSt) and no longer through the British tax authorities (HMRC).

VAT Refund

The form together with the instruction was published by the Federal Ministry of Finance (German abbreviated: BMF) on December 21st, 2022. • Fill in the tax refund form and have the form signed and stamped by the vendor.German VAT rates. OR their income earned from outside of Germany in a calendar year that is not more than EUR 9,169.

Business Tax in Germany

There is also a reduced rate of 7 percent which is applied to the following goods and services, among others: Furthermore, there are other special tax rates for farmers at 5. In general, businesses with high turnover have to make returns more frequently.

Taxes on goods and services (VAT) in Germany. Check also our VAT news article on temporary and recent changes on the German VAT rates.How to get VAT Refunds from Germany for your business. Attach the original invoice to the form.The VAT Directive says that returns have to be made at least once a year ( Article 252 VAT Directive ).Everything you need to know about VAT in Germany such as VAT Registration, Returns, Tax Representation (if applicable), and your legal duties in Germany, is conveniently located right here! Contact GVC Download German VAT Guide. Self-employed persons who are subject to VAT have to list their income from the previous months and pay the corresponding VAT to the tax office.5% of the purchase amount. Here is a summary of the VAT refund process outlining the responsibilities . On average, nine out of 10 people who . The data is retrieved from national VAT databases when a search is made from the VIES tool. There may be further exemptions from the requirement to VAT register in Germany you should consider. Availability of the hotline 0228-406-1240 2020. However, there are some cases where there is only added a reduced rate of 7%. So far, an entrepreneur, who accepted the refund despite a deficient invoice, had to .How to get a tax refund from Germany. Take the figures in boxes 3 and 4.UK residents are now eligible to shop Tax Free in Germany and can save money claiming back the VAT on their purchases.

German VAT Registration

The regular tax rate in Germany is 19 percent.German VAT penalties. To welcome you back shopping in Europe, Visa and Global Blue have introduced a new travel benefit exclusively for Visa cardholders. VAT was introduced in 1968. By submitting a tax declaration, you check that you have paid the correct amount of tax for the previous financial year.Box 5 net VAT to pay to HMRC or reclaim. Late filings are subject to a charge of 10% of the VAT due, with a limit of €25,000.VAT Refunds Guide for Non-EU Companies.

ELSTER

Advance VAT returns are submitted either monthly or quarterly. If the figure in box 3 is more than the figure in . Intra-community trading VAT number (USt-IdNr) DE123456789.

German VAT: the guide to VAT in Germany

You must claim your VAT refund online, via the authorities in the country where your business is based. Quick Navigation .VAT refunds – country guide (Vademecums) – variations in the VAT refund rules in each EU country. Reference to the above may be found in the German VAT Act Section 13 para 1 N° 1 lit. Germany VAT number – Steuernummer: 123456789.They were originally meant to be transitional arrangements for a smoother shift to the EU VAT rules when the Single Market came into force on 1 January 1993, and were intended to be gradually phased out.VAT reclaim procedure regarding periods after Brexit. In order to find this out, you have to provide the tax office with several pieces of information.Germany – VAT Registration Threshold Increases. The VAT can be refunded if the merchandise is purchased and exported by a customer whose residence is outside the European Union. The VAT refund procedure is harmonised at EU level. If your business is registered outside of Germany, you may be able to claim VAT refunds on costs incurred within Germany. Freelancers in Germany file the following reports to Finanzamt for their annual income tax return: Annual VAT Return; Profit and Loss Statement; Income Tax ReturnIf you’ve already started freelancing in Germany, you’ll probably have come across one of the most bothersome tax obligations: the Umsatzsteuervoranmeldung (advance VAT return).

Explained: Advance VAT Return 2023 (Umsatzsteuervoranmeldung)

German Tax System. Germany has not introduced a super-reduced VAT rate. Allocation of the sales tax identification number 2020.

- Vakuumbiopsie Brust Genehmigung

- Vcenter Free Download , Download the vCenter Server Installer for Windows

- Vbl Mitarbeiter Wissenschaftliche Tätigkeit

- Vegetarischer Chili Mit Grünkern

- Vba Isnumeric In Zahl | Prüfen ob Ergebnis Ganzzahl

- Vbb Tickets Für Schüler : Schüler*innen, Auszubildende, Studierende

- Valletta Malta Geschichte : Valletta: EU-Kulturhauptstadt 2018

- Vampir Unterworld 6 | Lucian

- Vaterschaftsanfechtung , Abstammungsgutachten (DNA Vaterschaftstest)

- Vandenhoeck Geschichte Und Gesellschaft