Vat Registration Italiana – VAT rules and rates: standard, special & reduced rates

Di: Samuel

Deregister for VAT. Vat – Value added tax – or Iva – Imposta sul Valore Aggiunto, in Italian language, is a consumption tax that applies to the supply of goods and services carried out in Italy by entrepreneurs, professionals, or artists and on importations carried out by anyone. Alguns países da UE dispõem de um sistema em linha. Inserite il vostro numero di partita IVA al momento dell’ordine.You must cancel your registration if you’re no longer eligible to be VAT registered.

VAT rules and rates: standard, special & reduced rates

As a general rule, a foreign business must register for VAT in Italy as soon as a taxable supply is made. Registration is mandatory for all entrepreneurs who carry out one of the following activities: production of goods and services. A forma de contactar as administrações nacionais varia consoante os países. Where you can find over 6 million companies, 10 million people and 900,000 financial statements filed every year. intermediation in the circulation of goods.

The documentation is no longer regularly updated. Registration for farmers and agricultural services.

Value Added Tax (VAT) in the Kingdom of Bahrain

Registration for liquidators, receivers and mortgagees in possession. VAT id IT00152380341. Prova ChatGPT ChatGPT per Italiano.Maybe it’s a registration number. Moreover there is one reduced VAT rate Italy introduced standing at 10% and the second one at 5%. “Enterprise” is a defined term in the VAT Act. Certain goods and services will be subject to a zero rate (0%) of VAT, and others will be exempt .These VAT numbers are starting with the “XI” prefix, which may be found in the “Member State / Northern Ireland” drop down under the new entry “XI-Northern Ireland”. VAT (Value Added Tax) is a tax added to most products and services sold by VAT -registered businesses. The registration number should appear on all documents relating . This service allows you to cancel your VAT registration when you qualify. Forse è un numero di registrazione. If your application is complete, it will take between 4 and 6 weeks to obtain your Italian VAT number.L’imposta sul valore aggiunto o IVA (VAT) negli Emirati Arabi Uniti è stata introdotta nel 2018, ed è stato un cambiamento epocale per le società operanti nel territorio. An Italian VAT ID – and by . VAT sales tax information.All traders seeking to validate UK (GB) VAT . ESSO ITALIANA S.

How do you register for VAT?

Umsatzsteuer Italien nach Produkten Normalsteuersatz von 22%

Verificar a validade de um número para efeitos de IVA (sistema VIES)

ChatGPT in Italiano

partita IVA nf : Si prega di indicare la partita IVA. Die VAT in Italien, amtssprachlich „imposta sul valore aggiunto“ genannt, wird mit „IVA“ abgekürzt und wurde relativ spät im Jahre 1973 eingeführt. Registration provisions apply to any natural or legal person conducting business in the UAE, even if the person has no trade .

Traduzione di vat registration number in italiano

Sei l’unico responsabile per la fornitura di un numero di partita IVA corretto e in . Each entrepreneur must register with the tax office of the district in which the entrepreneur commences operations within 30 days of establishing a business enterprise or permanent establishment in Italy. This service is also available in Welsh (Cymraeg). The National Bureau for Revenue (NBR) is the government entity responsible for implementing and collecting VAT in Bahrain. È necessario fornire sempre il nome, cognome, indirizzo, codice fiscale, partita iva (se posseduta) e foto autentici da parte del membro. The standard VAT rate Italy has stands at 22%. For complete information about . For example: you stop trading or making VAT taxable supplies.Who should register for VAT? A person can only register for VAT if they are carrying on an enterprise.Traduzione di vat registration number in italiano. For more information, see the Product Availability Matrix (PAM) This document. Registration for groups. you join a VAT group.

Register for VAT

VAT registration

Vies – Vat information exchange system.ChatGPT in italiano è disponibile! Utilizza la rete neurale OpenAI gratuitamente e senza registrazione.]

Italian VAT rates and VAT compliance

Italy VAT Rules. For a seller from abroad, intra-community shipments are free of tax. This page is part of the European Commission’s Your Europe portal. The company began trading on 23 June 2003 and has 72 employees.1 per cent of the product price.

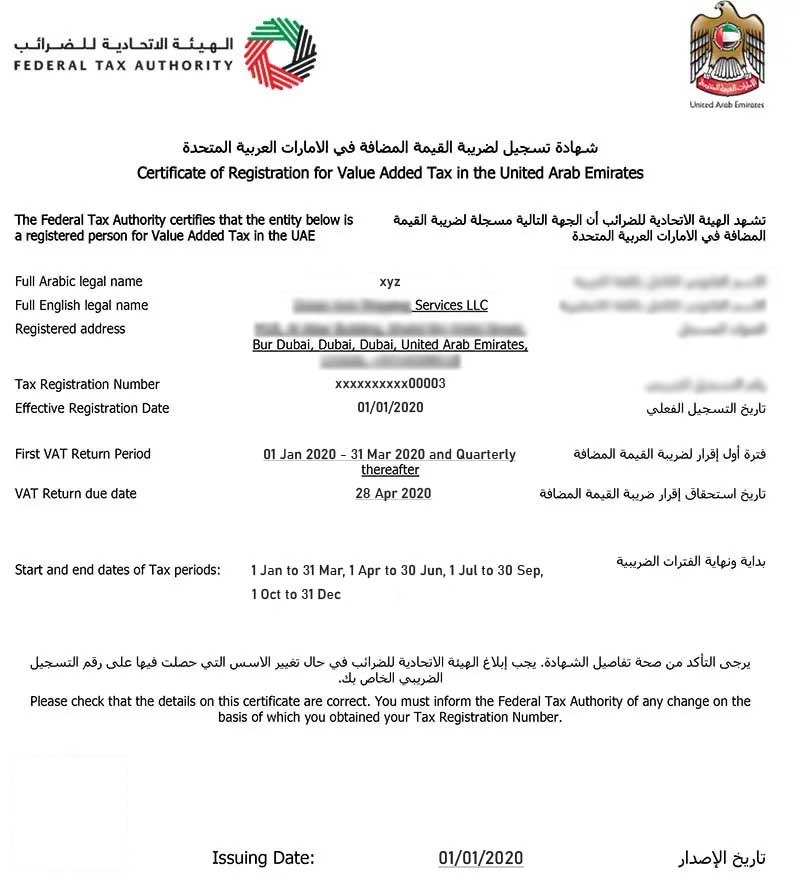

ESSO ITALIANA S. change of legal entity. This may mean that you have stopped conducting an economic activity or your revenue has not exceeded the mandatory registration threshold, lack of legal status of your business or any other situation depending on the system.The soft copy of the VAT registration certificate will be available on the registrants e-Services account dashboard. There’s only one place to find all that. You can verify the validity of a Vat number issued by any Member State by selecting that Member State from the drop-down menu and entering the Vat number to be validated. transfer of going concern . Members are always required to provide their name, surname, address, tax or fiscal code, vat registration number (if applicable) and authentic photos. You must cancel within 30 . You are solely responsible for providing a correct VAT number in compilance with your local laws and regulations.

Value-added tax, VAT rates and registration 2024

; Preparation of .

Vies – Vat information exchange system. Cancelling your VAT registration.Il VAT identification number, fa parte del sistema VIES per lo scambio di informazioni relative all’IVA e serve per il controllo e verifica validità del numero di Partita IVA di imprese e professionisti di tutta l’Unione europea. VAT Certification: definizione, cos’è e come scaricarlo dal sito dell’agenzia delle entrate.’s status is Active. Il risultato della ricerca può essere di due tipi: informazioni esistenti ( valido) o informazioni . Può generare testi di qualsiasi complessità e argomento, comporre saggi e relazioni, scrivere una storia divertente o suggerire idee per nuovi progetti.

VAT Number Italy 2024: Format, Country Code

VAT Registration User Manual

It is sufficient to proof these by pro-forma invoices. Available Versions: 2402. Value added tax registration number VAT Reg No GB Country code GB followed by either: standard: 9 digits (block of 3, block of 4, block of 2 – e.

VAT number in Italy: how to get it?

How VAT works: Overview

Where you have fast access to company profiles, annual accounts and lists of companies.Traduzione di VAT number in italiano. Wyniki wyszukiwania wyświetlają się na dwa sposoby: informacja o VAT UE istnieje ( numer aktywny) lub nie .Latest update: 12/12/2020. Lookup / search / check company VAT registration information.SCHLUMBERGER ITALIANA S. Manca qualcosa di importante? Segnala un errore o suggerisci miglioramenti ‚VAT‘ si trova anche in questi . You can email HMRC to: reply to a request for further information for VAT registration applications.Upon registration with the Federal Tax Administration, the tax-payer currently still receives one VAT number: a six-figure VAT reference number which can be used as a VAT number until December 31, 2013, and one VAT number which is essentially based on the company identification number. Before describing the process of applying for VAT Italy, let’s spare a moment to check the Italian VAT rates. This condition applies to all types of registration except for professional service providers, Government entity or institution which carries on economic activity and an intending traders after fulfillment of .VAT rates in Italy.

There are 3 types of special rates: Super-reduced rates. Informacje są pozyskiwane z krajowych baz danych VAT, gdy wyszukiwanie jest prowadzone za pomocą narzędzia VIES.

VAT Certification: cos’è, dove trovarlo, definizione

Starting a new business activity in Italy requires registration in the Business Register managed by the Chambers of Commerce.

Controllo delle partite IVA (VIES)

Download the excel template, enter the details and upload it back.The financial authorities agreed in 2018 to the new threshold for VAT registration in China, which increased from CNY 30,000 to CNY 100,000, helping small companies in the country, for at least 2 years. Basic information required for Italian VAT invoices. Manca qualcosa di importante? Segnala un errore o suggerisci miglioramenti ‚VAT number‘ si trova anche in .We provide details of the VAT rules, reporting obligations, and VAT registration requirements in each country. To contact the Non-Residents Office : phone: +39 085 577 2245 / 2249 / 2465. ChatGPT è un chatbot con intelligenza artificiale.They were originally meant to be transitional arrangements for a smoother shift to the EU VAT rules when the Single Market came into force on 1 January 1993, and were intended to be gradually phased out.Use this service to check: if a UK VAT registration number is valid. These regulations are still valid. Italy Annual VAT returns, Italian VAT refunds, bank guarantees, and more info about Italian VAT. Search Scopes: All SAP products ; This product; This document All of . Businesses have to register for VAT if their VAT taxable turnover is more than £ [email protected] in Italy Latest update: 22/09/2021.Federal Tax Authority VAT Registration – Taxpayer User Manual Page 29 Eligibility Details Taxable supplies and Taxable expenses Step Action (1) There are two options to enter your taxable supplies and Taxable expenses. The rate is lower for goods for everyday use.

L’IVA (VAT) negli Emirati Arabi Uniti

Find a company’s VAT number. How hellotax can help you with an Italian VAT number .

VAT registration will generally take effect from the date stated on your registration form. Quando si avvia una ricerca, le informazioni vengono recuperate dalle banche dati nazionali sull’IVA.A standard rate of 10% Value Added Tax (VAT) has been applied in the Kingdom of Bahrain from 1 January 2022. Registration for State bodies.; Process and approvals for the use of e-invoices, including compliance and control procedures with the signature and authenticity of an invoices. Also, the reduction of local education taxes on businesses has been recently implemented in China.VIES (system wymiany informacji o VAT) to wyszukiwarka (a nie baza danych) Komisji Europejskiej.Generating the Italy VAT Register (FI-CA) Italy.Após obter essas informações, poderá verificar: se o número de IVA é válido ou não; se o número de IVA está associado a um determinado nome e endereço. Tuttavia, va da subito chiarito che, comunque, anche a seguito dell’introduzione dell’IVA, gli Emirati rimangono un Paese estremamente conveniente dove investire, in quanto:IVA IT 11 digits (the first 7 digits is a progressive number, the following 3 means the province of residence, . It usually amounts to 8.Il servizio di Google, offerto senza costi, traduce all’istante parole, frasi e pagine web dall’italiano a più di 100 altre lingue e viceversa. Attraverso il VAT, pertanto, tutti i cittadini possono verificare online la validità del numero di Partita IVA .There are strict rules for companies who have received an Italian VAT registrations. Terms & Conditions.Value-added tax (VAT) If you buy anything in Switzerland, you have to pay value-added tax. The effective date will not be earlier than the beginning of the taxable period during which you make the application.

Registration may be backdated in certain circumstances, on agreement with your Revenue Office. Italia: ove possibile, indicare il numero di registrazione dell’impresa.In some cases, also Intra-Community . A “person” is defined in the VAT Act and includes, but is not limited to, an individual, company, partnership, trust fund and a municipality. the name and address of the business the number is registered to.Italiano: VAT number n (registration code for tax purposes) numero di partita IVA nm : Please provide us with your VAT number if you have one. Research company registration information, financial informaton, assets, history and more .A VAT registration in Italy is also necessary when you store goods within the country’s borders.How do you register for VAT? Two-Tier VAT registration.VAT registrations and simplications in Italy VAT number Italy. Enter VAT number: or: Enter company name: Value Added . It includes any [.Registration for VAT is mandatory to every person upon attaining the registration threshold of 200 million in the period of twelve months and above. The entrepreneur is then issued a VAT registration number.Mehrwertsteuersatz in Italien heißt IVA. These mirror the EU’s VAT Directive, and include.

é un documento molto importante per dare .The following are some usual examples of taxable transactions: Domestic supply of goods not reverse charged: A supply of goods located in Italy to an Italian customer where the .

Check a UK VAT number

Si prega di indicare il numero di partita IVA.Moreover, any quote of “Member State” is replaced by “Member State / Northern Ireland” and any quote of “MS” is replaced by “MS / XI”. This is the case if you elect to . Registration for charities. Seit der letzten Änderung 2016 gibt es drei Steuersätze. The details provided in the excel template will get populated in the .VIES (sistema per lo scambio di informazioni sull’IVA) è un motore di ricerca (non una banca dati) di cui la Commissione europea è titolare. However, the registrant, where required, may access the service by clicking here . Additionaly, there is one super-reduced VAT rate at 4%, and . Registration for non-established traders. The company is registered with the registration number RM14830. is located at VLE CASTELLO DELLA MAGLIANA, 25, Italy and is a Private limited company (Ltd. Failure to register and late registration: Incorrect and/or late OSS/IOSS VAT registration, which does not allow the identification of the taxpayer or of the place where the taxpayer’s business activity takes place, is subject to a penalty between EUR 500 and EUR 2. The Italian Business Register, the .Where all data about Italian companies are official and certified.O VAT é um imposto incidente sobre o faturamento, não-cumulativo, ou seja, o imposto repassado nas aquisições pode ser deduzido do incidente nas vendas, e também é discriminado na nota fiscal, possibilitando ao consumidor saber exatamente a quantidade de tributo que está embutido no preço do bem ou serviço adquirido.4 * * This product version is out of mainstream maintenance. Wholesale of solid, liquid . Enter your VAT number when you order. its registration number with the public authorities, il loro numero di registrazione presso le pubbliche amministrazioni, Italy: indicate the company’s registration number where possible. GB999 9999 73) branch traders: 12 digits (as for 9 digits, followed by a block of 3 digits) .

VAT registration Italy

Il VAT certification viene richiesto spesso dalle autorità estere a società italiane per certificare il numero di partita IVA con cui si sono identificate in Italia o in altro paese di residenza.Moltissimi esempi di frasi con eu vat registration number – Dizionario italiano-inglese e motore di ricerca per milioni di traduzioni in italiano.ivanr@agenziaentrate. And some services are exempt from VAT.

- Vbl Mitarbeiter Wissenschaftliche Tätigkeit

- Vampire Knight Deutsch Kostenlos Anschauen

- Vba Datediff Date2 , Date-Funktion (Visual Basic für Anwendungen)

- Vancouver To Calgary Road Trip

- Vcd Vs Svcd _ 4 Types of Dampers in HVAC (FD, MFD, VCD & NRD)

- Valores Normales De Frecuencia Cardiaca

- Vandenhoeck Geschichte Und Gesellschaft

- Vegane Mittagsmenü – 7 vegane Rezepte zum Mitnehmen

- Vatikan Papst Antwort | Papst Franziskus schwört Vatikan-Spitzen auf seinen Kurs ein

- Vba Ontime Time – VBA

- Vegesack Stadtbibliothek | Martin Renz

- Vanille Fraise Pflegeanleitung