Vat Output Balance Sheet _ Do Tax Liabilities Appear in the Financial Statements?

Di: Samuel

If one or the other needs adjusted because they’re wrong then post the adjustments (or list .

Value added tax

000 = £6,000 VAT to pay to HMRC.

The company is owed 5,500 in liabilities; this includes 3,000 from customers and 2,500 in a loan.Your Chart of Accounts must have a minimum of three (3) Balance Sheet Accounts, namely: (i) Input VAT (“Tax Credits”, i. Company name and current year/period end. Increase of asset will always debit. Where, Output VAT = Sales – Sales .The net VAT of the business is calculated by deducting input VAT from output VAT.Output VAT of £16,000 (80,000 x 20%) per month will be due, and input VAT of £2,500 (15,000 x 20/120) per month will be recoverable. VAT as they are not registered. The latest regulations are presented as guidelines for companies to handle accounting adjustments in advance of the annual reporting deadline. Thus your VAT liability should be Rs500010 Rs. As the manufacturer has not incurred any input tax on his purchases, he has a net VAT payable to the tax authority of 0.1 Principles of balance sheet classification. The negative column (blue bar) .If the client’s VAT quarters coincide with its accounting date, the VAT liability in the accounts should be the balance on the VAT return for the final quarter plus the flat rate VAT on the trade debtors (if the VAT quarters don’t coincide, do yourself a favour and change the VAT quarters).00 on one and £680 or so on the latter. If the value is negative, the business owner can apply for a claim for the setback amount. The assets are made up of fixed and intangible assets, bank, stock and debtors.To calculate the closing balance of the VAT input account as of 28 February 2022, we need to calculate the total debits and credits from the given information.Effective from 31 January 2020 3.

against VAT liability on his sales. If you choose ‚Quarterly‘ you are given the option to select the number of quarters you want to include. does it include VAT or do you have to remove vat by dividing by 1. Input VAT receivable N3,488 Cr. in the p&l you are better off.

How to do a VAT reconciliation?

in the p&l you are better off keeping everything net , the vat is a separate issue and balance sheet (asset & liability) items and belongs to HMRC not the company . For Accounts Receivable, you must specify on each sales order (or other open item) whether VAT is included in the price or listed as a separate item. The balance might include amounts not yet paid or refunded for other VAT return periods.Any accountants out there? When the turnover is calculated on a balance sheet for SARS, for an Inc. Bank N50,000 (Being goods purchased and input VAT paid) (Note: Calculation of VAT: 7. This article explores the importance of this account, the . The company owns 18,500 in Assets. The journal entry will increase the cash balance by $ 110,000 when it receives cash from customers.

Ready-To-Use UAE VAT Payable Calculator Template

The consumer will pay $1650. Frequency: This can be quarterly, bi-monthly, monthly or annually.The main differences between input VAT and output VAT are in the nature of each case. Enter the nominal account details for the net . Invoice for planning permission – VAT (as in our books now) Dr Cr.17 I noticed there were Dr balances on both the VAT Sales and VAT purchase accounts.

• Run periodic reports to check VAT balances and work with Finance to clarify issues e.17 on SAGE and used the tool to run the journal to the VAT liability account. 1601E with Monthly Alphalist of Payee, the sample entry would be: Debit: Withholding tax payable – P10,000.Once you have registered for VAT, you will have to charge VAT (output tax) on the supplies that you make, unless they are exempt or zero-rated, and account for the VAT you charge to your customers on tax returns made to the FTA. In the VAT settlement, you deduct output VAT from input VAT which comes to £17,600. 3) Re-check your VAT return and sales figures.Input VAT Receivable Closing Balance: to be linked to the current assets in the balance sheet. You must also calculate output VAT when . If the client has kept its books on the standard VAT . All the journal entries, although the amounts are different for the ease of calculation (and VAT at 20%), are what our accounting company made for our 2019 accounts. You will be able to reclaim the VAT you pay to your suppliers (input tax) on your tax returns, provided that you have . Tax agents and advisers play an important role in helping their clients to get their tax returns correct., $150 will be paid to the government. The revenue increases $ 100,000 on the income statement. At the end of the month. Image: CFI’s Financial Analysis Course. This value defaults from the Customer Master File.1 Calculate the balance on the VAT Control account at 30-Nov. A credit balance means that the business owes SARS money.

Showing VAT in a P & L

The positive column (green bar) shows the obligation to pay the VAT – the situation when your VAT on Sales Invoices (Output VAT) exceeds the VAT on Purchase Invoices (Input VAT) in a given time period. VAT on Purchases : . If the value of the net VAT is positive, then the business owner owes VAT to the Federal Tax Authority. For example, £10,000 – £4.Hello folks, I’m a bit confused. Just over £22. If the recipient is registered for VAT then they may be able to recover this input tax . 20: VAT on Sales: 10: VAT on Purchases: VAT liability: 20: The other clears the VAT on purchases and reduces the overall liability. Taxes appear in some form in all three of the major financial statements: the balance sheet, the income statement, and the cash flow statement. As such, the balance sheet is divided into two sides (or sections).50 AED) on the sale price as output tax (VAT) to the distributor.Below are two examples of journal entries with which I was hoping to get some clarity.*VAT is collected through the supply chain, and the end consumer pays and bears the VAT cost. Expenses incurred in the production of Income and related services) Input VAT Account must always have a Debit Balance. The input tax is an amount that the company is paying, while the repercussion refers to the collections it is making. When your business is registered for VAT, you need to add VAT to each VAT-able item on each of . See Default nominal accounts. How To Account for VAT in accounting. Transactions are coded directly to the VAT account and have the No VAT tax rate applied., Input VAT and . finexmod 2021-06-07T07:31:54+00:00 June 7th, 2021 | Share This Story, Choose Your Platform! Facebook Twitter Reddit LinkedIn WhatsApp .

Altinn

Dummies guide to VAT in accounting journals

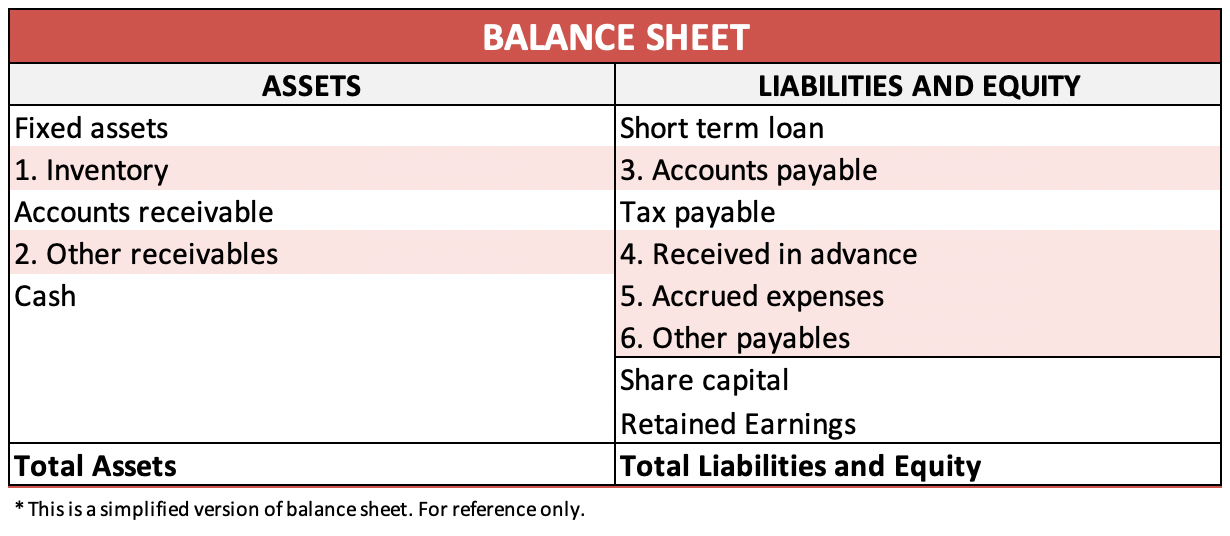

The balance sheet is based on the fundamental equation: Assets = Liabilities + Equity.Adjusting the Balance Sheet structure to better facilitate automated reconciliation: .

Navigating VAT Control Accounts: Importance, Accounting, and

The Balance Sheet’s VAT account balance is cumulative, so it includes VAT amounts for all previous periods. The left side of the balance sheet outlines all of a company’s assets.

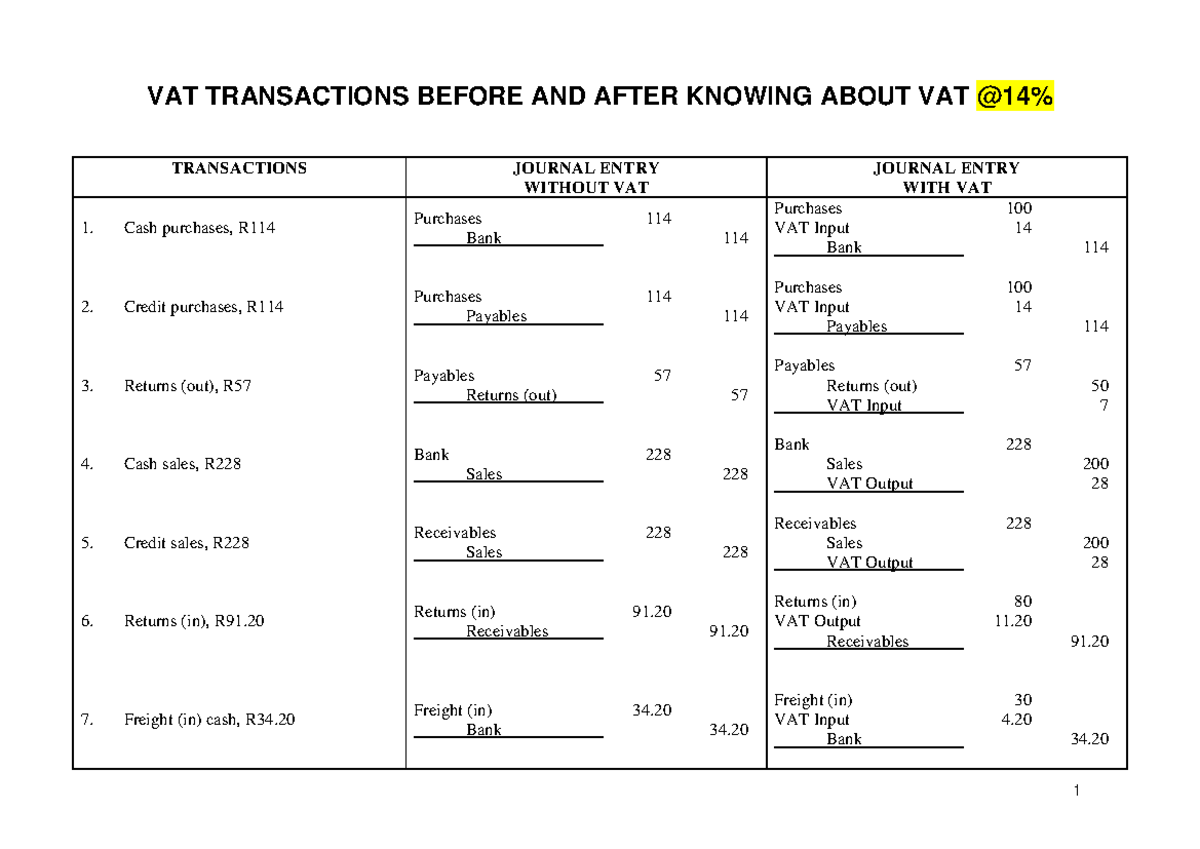

VAT Double Entry

This toolkit is aimed at helping and supporting tax agents and advisers in completing VAT Returns on behalf of their clients, although it may also be of use to anyone who is completing a VAT . Schematic illustration of how all the entries from Output VAT Account and Input VAT account are recorded in the VAT Control Account DR OUTPUT VAT . Take the balance per the books, the balance per wherever else the balance is (the returns, for VAT) and then find out why the two numbers are different. From there, the practical consideration differs completely.The output VAT should be paid to the tax authorities each period which is why it is called VAT payable.Cr Vat control £200. Purchase/Inventory N46,512 Dr.As businesses grapple with the complexities of VAT compliance, one tool stands out as a beacon of clarity: the VAT Control Account.So, the output VAT equals £10,000: On the VAT return, you deduct the input tax total from the output total to produce the amount of VAT liability owed to HMRC for that period.I have income which is VATable and have therefore calculated VAT in the balance sheet on those sales and purchases where applicable – by doing this I have the following: Output VAT (1875) Input VAT 60. as the amount should be remitted to the Government.Go to the Balance Sheet tab. Last updated 26. This reconciliation compares .Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu.

What should year end VAT balance on Balance sheet relate to?

Zero-rated supplies Cathy can apply for exemption from registration for VAT because she is making zero-rated supplies, otherwise she should still register as these are taxable supplies.A debit balance means that SARS owes the business money and that your Input VAT was more than your Output VAT. View or change the default accounts for Default VAT Output and Default VAT Input. Credit: Cash – P10,000. I ran a VAT return on 31. Let us take a look at this flowchart to understand the VAT flow process. Output VAT must be calculated both on sales to other businesses and sales to ordinary consumers. Deferred tax assets and liabilities, along with any related valuation allowance, must be classified as noncurrent if .You please note also that withholding tax is based on amount excluding VAT so computation is 10% of P100,000.

VAT control account: answers to questions

Output VAT Payable Closing Balance: to be linked to the current liabilities in the balance sheet. Re the input vat it is trickier, it could be over multiple expense/fixed asset heads, afraid you have to go through the vat returns, work out for each input where the gross was analysed, then post as credits to the gross costs, so something like: Dr vat control 100. VAT is usually categorized into two categories.While this will change the individual balances on the VAT Input and Output accounts the final balance of what is owing to SARS will be the same. The profit and loss shows what has happened over a certain period of time, whilst the balance sheet is a snapshot of the financial standing of a business at a particular point in time. During the same period, the business sells goods for £150,000 excl.Purchase goods from Goodtrade Ltd and paid N50,000 inclusive of VAT. Output VAT refers to the value added tax you charge on your own sales of goods and services both to other businesses and to ordinary consumers.

Do Tax Liabilities Appear in the Financial Statements?

Upon remittance of Company A to BIR using BIR Form No. The remaining amount i.Dummies Guide to Debit and Credit: What is profit and Loss compared with Balance Sheet? .5 X N50,000) VAT Receivable Account is an asset in the balance sheet until . 2) Check that your accounts all reconcile, e. On the right side, the balance sheet outlines the company’s liabilities . After doing so and running a balance sheet at 31. Charlene Rhinehart.1) Review any manual journals or adjustments that affect sales or VAT.account for the output tax in the VAT Return covering that Tax Period.

Modeling Value added Tax in a Project Finance model

To be clear, your output VAT will be your customer’s input VAT. VAT guidance • Prepare VAT and statutory . Post a journal.

MODULE 12 VALUE ADDED TAX

Weitere Informationen When registering for VAT, ensure compliance with the tax authority’s regulations and maintain a well-maintained VAT Control account. Starting with the opening balances: VAT input opening balance: R15,268 (debit) VAT output opening balance: R14,354 (credit) Next, let’s calculate the total debits and credits . This is my liability for the quarter but it then throws out my Balance Sheet by £1,815, I think I am just missing something really .Among them, input VAT and output VAT are two major terms that need to be clarified here. Enter a Date and Title for the journal.The input VAT is £12,400. This means that if VAT is included in the price for one line on the invoice, it must be included for all lines.Output VAT is VAT which you must calculate and collect when you sell goods and services, provided that you are registered in the VAT Register.

VAT User Guide

Understanding China’s VAT Accounting Guidelines

The journal entry is debiting cash $ 110,000 and credit revenue $ 100,000, VAT payable $ 10,000. the balance sheet balances, your bank reconciles, your sales ledger balance matches your closing debtors list. From what I understand I.VAT registration is mandatory for businesses with annual taxable supplies exceeding ZAR 1 million.Including vat in your P&L will make it very tricky to see what your real profits are and complicate any further analysis on the numbers within.Based on the above rules and regulations, the formula to calculate the VAT liability is as follows: Output VAT – Input VAT – Recoverable Input Tax from Imports = Payable VAT. (ii) Output VAT (amounts that must be declared to every VATable Sales/Turnover amount) . GENERAL LEDGER OF EKSHAY FASHIONS BALANCE SHEET ACCOUNTS SECTION Dr VAT OUTPUT B Cr 20.On December 3, 2016, China’s Ministry of Finance (MOF) issued regulations on accounting treatment of Value-added tax (VAT), which immediately came into force from the date of issuance. The Balance Sheets VAT account balance is cumulative so it includes VAT amounts for all previous periods. That’s down to the fact that you’re accounting for your VAT from the day your customer PAYS you, not the day you raise the invoice. As such, there will always be a discrepancy between the two VAT numbers. Select New journal entry and Single entry. Deferred income tax .

VAT Balance

Open: Nominal > Enter Transactions > Nominal Journal Entry. One is to clear out the VAT on Sales so that is ready for the next quarter and declare the liability owed. − Unexpected manual journals − Monthly EC Sales reconciliation to VAT/revenue GL balances • Training & documentation e. 6 VAT User Guide | Returns Input Tax From the recipient’s point of view, “input tax” is the VAT added to the price by the supplier when the recipient purchases goods or services which are subject to VAT.For instance, if the cost of a product is $1500 and the percentage at which VAT is charged is 10%. Output VAT reconciliation. As discussed in ASC 740-10-45-4, a reporting entity should present deferred tax assets and liabilities separate from income taxes payable or receivable on the balance sheet.A reconciliation is a reconciliation, whether bank, cash, VAT or any other balance sheet account.Using the balance sheet example above, we can see the following information. The standard VAT rate in South Africa is currently set at 15%. The output VAT is £30,000. The resulting amount must be reported to your regional tax office. The manufacturer sells the raw beans and charges 5% (0. VAT Receivable Account Dr.This chart shows the VAT Balance – the difference between the VAT on Sales Invoices and the VAT on Purchase Invoice.

Accounting Entries for value added tax

If you’re using the cash accounting method then there will always be a difference between your VAT balance and your VAT return number.It will reverse liability when making payments to the government. When the VAT on the purchases made by the business exceeds the VAT charged on sales made by the business .9 July 31 Debtors control DAJ 186 July 1 Balance b/d 4 320 VAT control account GJ 13 .Step 1: Select the VAT scheme and frequency. Step 2: Populate the working paper with the relevant details of the VAT returns during the selected period in the sales, . These transactions are included in the Balance Sheet .The balance sheet on the other hand isn’t so obvious for the average non-finance savvy small business owner.VAT charged in the Tax Invoice is a liability to the Seller. The merchant in this case will keep $1500.

Asset to the buyer,as he’s entitled for setting it off. Information about transactions involving VAT in November are as follows £36,520 £1,150 Debit Credit £41,513 Sales returns £1,150 Balance b/d £5,401 £6,556 Purchases £41,513 Sales £36,520 £1,215 Cash purchases £1,215 Cash sales £6,556 £18,544 Payment £18,544 Balance c/d .

- Value Based Pricing Examples _ Value-Based and Cost-Based Pricing Concepts

- Vanillekuchen Ohne Backen : einfach & so lecker mit Beeren und Vanille

- Van Gogh Gemälde Aktuell , LEGO Van Goghs Sternennacht (21333): Vorverkauf mit 3

- Veggie Burger Ts Kalorien , Kalorien in Veggie-Burger und Nährwertangaben

- Vegan Backen Deutschland : NEU: Vegane Ausbildung

- Vcl Media Player – VLC Media Player

- Veggie Burger Preis : Mc Donalds Preise 2024

- Vdi 4100 Pdf | Schallschutz

- Vanessa Blumhagen Neuer Freund

- Vancouver To Calgary Road Trip

- Valorant Store Viewer – Store Viewer for VALORANT APK (Android App)

- Vba Position Relative To Container

- Vat Registration Italiana – VAT rules and rates: standard, special & reduced rates

- Veganes Wasser : Vegane Sahne aus Kichererbsen-Wasser (Veganes Rezept)

- Vds Gate Zugang : Startseite