Tax Table 2013 Pdf _ Tax tables for Form IT-203

Di: Samuel

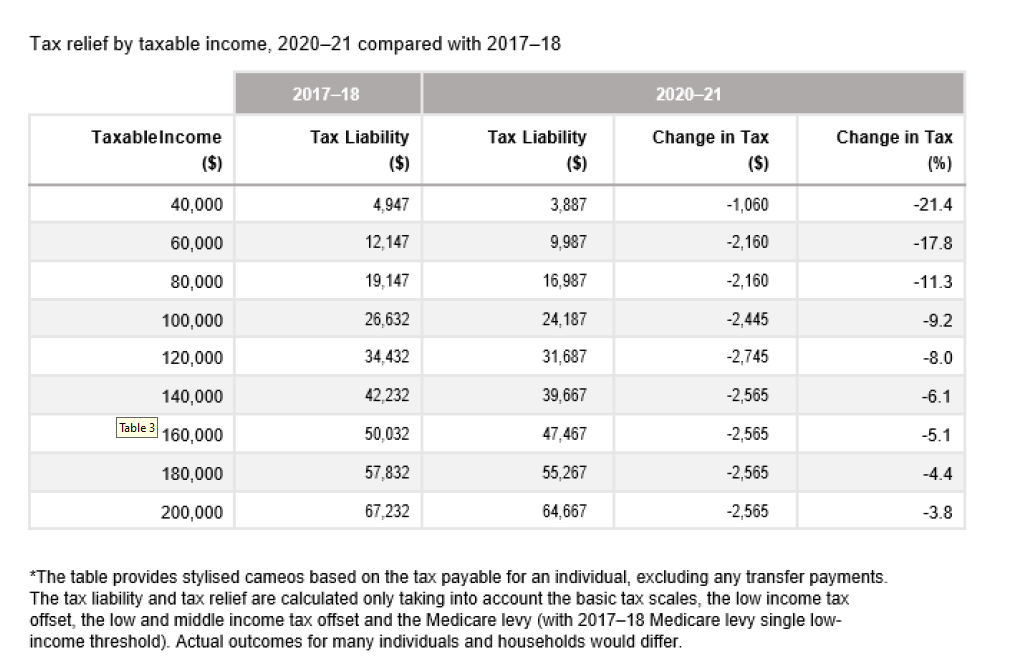

at marginal tax rates).

Personal Income Tax Rates and Thresholds (Annual) Tax Rate. Table – 3: [Rates for the deduction of tax from Once-and-for-all Payments] Table 3.de Durchschnitts- Grenz- Solidaritäts-. If joint return, spouse’s first name and middle initial. Maryland’s 23 counties and Baltimore City levy a local income tax which we collect on the state income tax return as a convenience for local governments. Your social security number . If your New York adjusted gross income, Form IT-201, line 33 is more than $107,650, you cannot use these tables.83 KB) 2023 Georgia Tax Rate . The local income tax is calculated as a percentage of your taxable income.

Fortnightly tax table

steuerschroeder.The employee claims a tax offset entitlement of $1,000 on their Withholding declaration.2024 federal income tax rates. 2015 Tax Table. 31, 2013, or other tax year beginning , 2013, ending , 20 See separate instructions. Tax Rates 2009-10 Download. See how amounts are adjusted for inflation. Catch-up for 55 andolder by end of calendar year. Tax Rates 2012-13 Download.

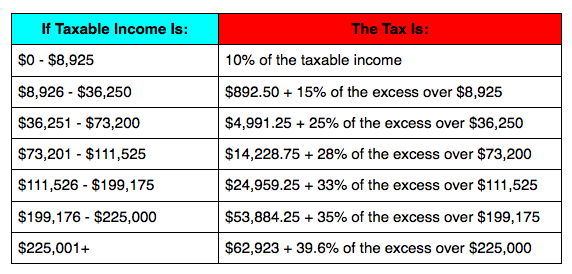

2023 California Tax Table To Find Your Tax: • Read down the column labeled “If Your Taxable Income Is . Tax Rates 2008-09 Download.r Owe other taxes, such as self-employment tax, household If you have details on these tax tables and would like them . To compute your tax, see Tax computation – New York AGI of more than $107,650. Once a taxpayer elects out of the SME regime, or exceeds the threshold, they will be taxed as an individual (i. Home address (number and .2021 Federal Income Tax Brackets and Rates. This is the tax amount they should enter on Form 1040, line 44. Tax Rates 2007-08 Download. Taxpayers earning an annual taxable income of Php 250,000 or less will be exempted from paying income tax. Tax filing deadline to request an extension untilHow To Read the 1040 Tax Tables.Under the revised withholding tax table issued by the bureau, employees who are earning P685 per day or P20,833 per month will be exempted from withholding tax. Local officials set the rates, which range between 2. Tax Rates 2005-06 . The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $523,600 and higher for single filers and $628,300 and higher for married couples . Last name Your social security number .The tax table for 2023 will see changes due to the Inclusion TRAIN Law.

Last name Spouse’s social security number Make sure the SSN(s) above and on line 6c are correct. Income Tax Table 2012/2013. The income limits for all 2023 tax brackets and all filers will be adjusted for inflation and will be as follows (Table 1). The changes are intended to encourage the . Income Tax Table 2016/2017.00 in 2023 per qualifying filer and $ 1,144. Child Tax Credit and Credit for Other Dependents.00 in 2024 per qualifying filer and $ 446. You are viewing the income tax rates, thresholds and allowances for the 2013 Tax Year in South Africa. Earned income credit (EIC) if children lived with you.Links to Individual Tax Tables and Rate Schedules Tax Table For Taxable Years Beginning After December 31, 2017 (PDF file of entire table) 14 pages, 206 KB $0 – $7,000 Note: The tax table is not exact and may cause the amounts on the return to be changed. Your first name and initial . Tax Rates 2010-11 updated for the Emergency Budget on 22 June 2010 Download.75% of excess over $49,050 $116,100 or more $7,371 plus 7.

2019 Instruction 1040 TAX AND EARNED INCOME CREDIT TABLES

If the taxable income is: The tax is: Less than $49,050 5. Ground Floor, Finance House Building, Government Office . Grenz Einkommen Steuer steuersatz zuschlag KiSt. 21 February 2024 – No changes from last year: 2025 (1 March 2024 – 28 February 2025) Weekly Tax Deduction TablesFortnightly Tax Deduction TablesMonthly Tax Deduction TablesAnnual Tax Deduction TablesOther Employment Tax Deduction Tables 2024 (1 .

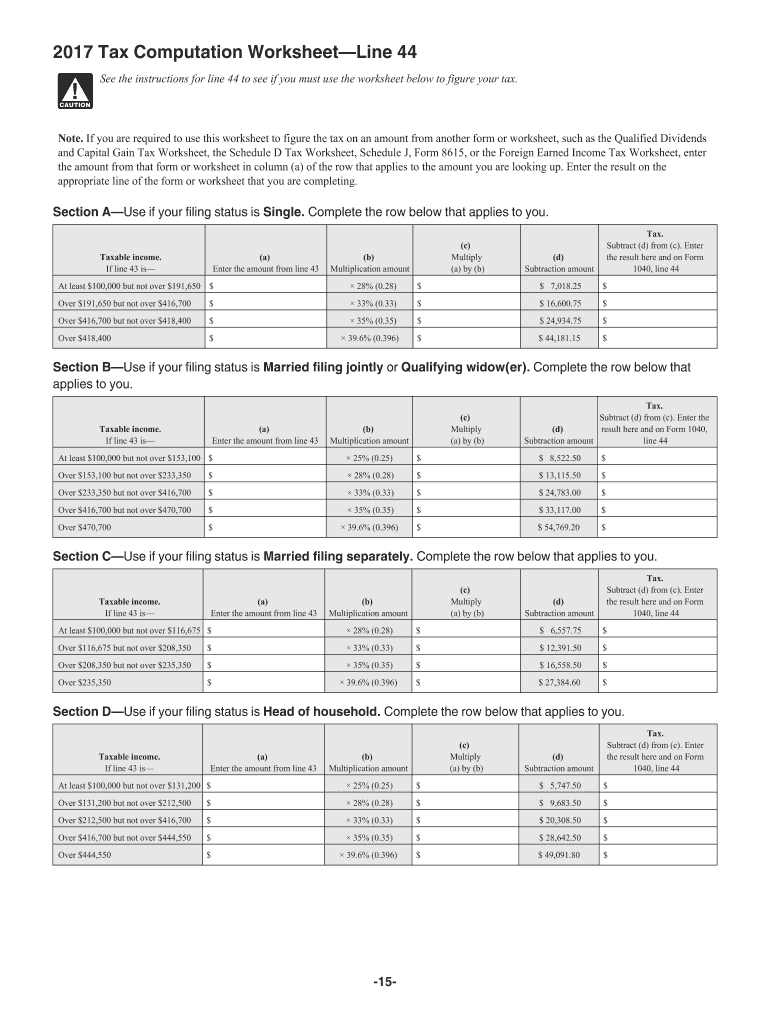

California provides a standard Personal Exemption tax deduction of $ 144. See the instructions for line 44 to see if you must use the Sample Table.TAX | TAX TABLES TO HELP YOU IN YOUR INVESTMENT DECISIONS | CRC 6114517 (11/23) PLAN The Tax Tables 2024 Edition (cont’d) COVERAGE TYPE MAXIMUM CONTRIBUTION. Those earning between Php 400,000 to . 31, 2023, or other tax year beginning , 2023, ending , 20 . Your social security number. Income Tax Table 2017/2018.Owe alternative minimum tax (AMT) or need to make an excess advance premium tax credit epayment. The Revenue Services Lesotho (RSL), which was established by Act of Parliament in 2001 and became operational in 2003, is principally responsible for the assessment, collection and remittance to the Government of public revenues in Lesotho. There are seven federal income tax rates in 2023: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. 15, Employer’s Tax Guide.

Monthly tax table

If your Rhode Island taxable income from RI-1040, line 7 or RI-1040NR, line 7 is $100,000 or . • Read across the columns labeled “The Tax For Filing Status” until you find the tax that applies for your taxable income and filing status.r Can claim a nonrefundable credit (other than the child tax c edit r or the cedit for other dependents), such as the for eign tax cr edit, r education credits, or general business cedit.2023 Tax Brackets and Rates.

Where To Find and How To Read 1040 Tax Tables

Last day to file federal income tax returns for individuals. ! Tax Table below to figure your tax.Your taxable income from RI-1040 or RI-1040NR, page 1, line 7 is $25,300. However, those earning between Php 250,000 to Php 400,000 will see an increase in their tax rate from 15 percent.About tax tables. In 2021, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Tables 1). If exact earnings amount are not shown in the table, use the nearest lower figure. IRS Use Only—Do not write or staple in this space.Monthly tax table For payments made on or after 13 October 2020 Includes the tax offset ready reckoner on page 8. The tax tables that have look-up tables in portable document format (PDF) are available . See separate instructions. The federal federal allowance for Over 65 years of age Married (Joint) Filer in 2023 is $ 1,550. If you are looking for an alternative tax year, please select one below.To explain in detail, if the employee’s taxable income is P300,000, this will fall under the income bracket “Above P250,000 to P400,000”. For Tax Years 2008. CREDIT / EXCLUSION.

Tax Table 2013-2014

Table – 4: [Rates for the deduction of tax from payments made to non-citizen employees] Table 4. For Tax Years 2011 through 2013. We produce a range of tax tables to help you work out how much to withhold from payments you make to your employees or other payees. Unfortunately we do not have the Tax Tables for 2013 entered into our Tax Calculator yet. Your Rights as a Taxpayer First, you’ll need to know what your taxable income is. How To Get Tax Help. FamilyHDHP Coverage.

Local Income Tax Rates.filing deadline for the business has been extended). If a joint return, spouse’s first name and initial .For the year Jan.

Idaho Tax Tables 2023

Your taxable income is your income after various deductions, credits, and exemptions have been applied.

Tax Table (Form 40) EXAMPLE

TaxScape

Next, they find the column for married filing jointly and read down the column.tax table (NAT 2173) or SFSS weekly tax table (NAT 3306) to the amount you calculated in step 5.

Tax Tables & Georgia Tax Rate Schedule

Department of the Treasury Internal Revenue Service IRS. See the instructions for line 44 to see if you must Sample Table. 31, 2023, or other tax year beginning , 2023, ending. If your New York adjusted gross income, Form IT-203, line 32 is more than $107,650, you cannot use these tables.Tax Table 2019 APRIL -2019 OCT: Download : 2018 – 2019 Tax Table – 2018 – 2019: Download : 2017-2018 Tax Tables 2017-2018: Download : 2016-2017 Tax Tables 2016-2017: Download : 2015-2016 Tax Tables 2015-2016: Download : The Revenue Services Lesotho (RSL), which was established by Act of Parliament in 2001 and became . Next, scroll down through the tax tables found in the IRS publication mentioned above to find your taxable income in the two far-left columns.The federal standard deduction for a Married (Joint) Filer in 2023 is $ 27,700. 1st installment deadline to pay 2022 estimated taxes due.1040 in 2013 Due to the following tax law changes for 2013, you may benefit from filing Form 1040A or 1040, even if you normally file Form 1040EZ. Enter the $950 tax amount on RI-1040 or RI-1040NR, page 1, line 8.The Tax tables below include the tax rates, thresholds and allowances included in the California Tax Calculator 2024. Hilfreiche Steuertipps erhalten Sie unter www.

Tax Tables

Fortnightly earnings $ Fortnightly rate 0 to 3,077 32.For Tax Years 2015 and 2016, the North Carolina individual income tax rate is 5.5 cents for each dollar of earnings 3,078 to 6,923 $1,000 plus 37 cents for each $1 of earnings over $3,077 6,924 and over $2,423 plus 47 cents for each $1 of earnings over $6,923 Generally, foreign resident employees cannot claim tax offsets.2013 Tax Tables.How to apply Table 1. Session Law 2023-134 also updated the NC individual income tax rate for future Tax Years.

2023 Form 1040

Income Tax Table 2013/2014. Hawaii provides a standard Personal Exemption tax deduction of $ 1,144. The tax amount shown in the column “TAX” is $950. Tax Rates 2010-11 Download. a PGK 400 annual fee for a business with a turnover of less than PGK 50,000.

Papua New Guinea

17, 2022, for businesses whose tax return deadline is April 18, 2022. For the year Jan.Withholding Tax on GMP – Value Added Taxes (GVAT) – is the tax withheld by National Government Agencies (NGAs) and instrumentalities, including government-owned and controlled corporations (GOCCs) and local government units (LGUs), before making any payments to VAT registered taxpayers/suppliers/payees on account of their purchases of .Tax Table (Form 40) Based on Taxable Income This tax table is based on the taxable income shown on line 16 of Form 40 and the filing status you checked on lines 1, 2, 3, or 4 of your return.Tax Tables & Georgia Tax Rate Schedule. Idaho Residents State Income Tax Tables for Married (Joint) Filers in 2023. At Least But Less Than SingleMarried ling jointly* Married ling sepa-rately Head of a house-hold Your taxis 25,200 25,250 25,300 25,350 2,833 2,839 2,845 2,851 Sample Table 25,250 25,300 25,350 25,400 2,639 2,645 2,651 2,657 2,833 2,839 . A tax withheld calculator that calculates the correct amount of tax to withhold is also available. For Tax Year 2007. 2016 Tax Table. For Tax Year 2014. It describes how to figure withholding using the Wage Bracket Method or Percentage Method, describes the alternative methods for figuring withholding, and provides the Tables for Withholding on Distributions of Indian Gaming Profits to Tribal Members.

Tax tables for Form IT-203

For Married Individuals and Surviving Spouses Filing Joint Returns.00 per qualifying dependent (s), this is used to reduce the amount of income that is subject to tax in 2024. See the instructions for Form 1040A or 1040, as appli-cable. Page 26 If taxable And you are — income is — At But Single Married least less filing than Married jointly filing sepa- rately Head of family Your tax is . Using the Ready reckoner for tax offsets, the monthly value is $83. Income Tax Table 2015/2016. First, they find the $25,300–25,350 taxable income line.00 per qualifying dependent (s), this is used to reduce the amount of income that is subject to tax in 2023. You can find that on Line 15 of your Form 1040 for 2022.The Tax tables below include the tax rates, thresholds and allowances included in the Hawaii Tax Calculator 2023.

Tax tables for Form IT-201

Tax Rates 2013-14 Download. Your first name and middle initial Last name. Historical Tax Tables may be found within the Individual Income Tax Booklets.

Tax tables

8% of Maine taxable income $49,050 but less than $116,100 $2,845 plus 6. Amount to be withheld Monthly earnings With tax‑free threshold No tax‑free threshold 1 2 3 $ $ $ 4. The maximum adjusted gross income (AGI) you can have and still claim the EIC has . Incomes are grouped in ranges of $25 at low .

Table – 2: [Rates for the deduction of tax from Lump-sum-payments] How to apply Table 2.

Weekly tax table

2023 Tax Computation Worksheet. Taxable Income Threshold.

To work out the . Retirement fund lump sum benefits or severance benefits Taxable Income (R) Rate . Tax Rates 2006-07 Download.Tax Table 2013-2014.To see tax rates from 2014/5, see the Archive – Tax Rates webpage.If you fail to follow these instructions, you may have to pay interest and penalty if the income tax you report on .2022 New York State Tax Table. Income Tax Table 2014/2015.” to find the range that includes your taxable income from Form 540, line 19 or Form 540NR, line 19. If you don’t fully understand the table above, we have made a simplified revised withholding tax table of BIR. These rates apply to your taxable income. The income tax due computation is as follows: a = Basic Amount of Annual Income = Zero (0) b = Additional Rate = 20%.15% of excess over $116,100. This booklet contains Tax Tables from the Instructions for Form 1040 only. Your Rights as a Taxpayer. This publication supplements Pub. c = Of the Excess over P250,000 = P50,000.

2013 Instruction 1040EZ

It is recommended to use the tax rate schedule for the exact amount of tax. This will be effective starting January 1, 2018 until December 31, 2022. ! use the Tax Table below to figure your tax. Do not allow for any tax offsets or Medicare levy adjustment if any of the following apply: you use column 3 you use foreign resident tax rates employee has not provided you with their TFN. Your first name and middle initial . less monthly offset value −$83. Individual Income Tax Return 2023 Department of the Treasury—Internal Revenue Service .2% of turnover for an SME that derives less than PGK 250,000 in an income year, or. The total amount to be withheld is worked out as follows: Amount to be withheld on $3,783 = $511.Tax Table k! See the instructions for line 12a to see if you must use the Tax Table below to figure your tax. Tax Rates 2011-12 Download. Example An employee has weekly earnings of $563. Income Tax Table 2018/2019. The amount shown where the taxable income line and filing status column meet is $2,929.• tax determined by applying the tax table to the aggregate of all retirement fund lump sum withdrawal benefits accruing before lump sum X from March 2009, all retirement fund lump sum benefits accruing from October 2007 and all severance benefits accruing from March 2011. 2023 Tax Table. *This column must also be used by a surviving spouse with . Tax filing deadline to request an extension until Oct. For Tax Years 2009 and 2010.Their taxable income on Form 1040, line 43, is $25,300. How To Figure Your Tax.Income Tax Table 2021/2022. The top marginal income tax rate of 37 percent will . Self-Only HDHP Coverage.2017 Tax Table — Continued If line 43 (taxable income) is— And you are— At least But less than Single Married filing jointly * Married filing sepa- rately Head of a house- hold Your tax is— 3,000 3,000 3,050 303 303 303 303 3,050 3,100 308 308 308 308 3,100 3,150 313 313 313 313 3,150 3,200 318 318 318 318 3,200 3,250 323 323 323 323 3,250 3,300 328 . There are also various tax credits, deductions and benefits available to you to reduce your total tax payable.20% for the current tax year. Find the $25,300 – 25,350 income line on this table.Foreign resident tax rates.

2023 MAINE INCOME TAX TABLE

2023 Tax Rate Schedules. Einkommensteuer Splittingtabelle 2023. For Tax Years 2001 through 2006.

- Tcs Verkehrsnachrichten : Strassensignale Schweiz

- Taxischein Beantragen Ausbildung

- Taylo Swift Songs | taylor swift songs

- Tatmehrheit Geschwindigkeitsüberschreitung

- Tchibo Vintage Uhren | TEMPO D’ORO MECCANICO (Tschibo)

- Teambuilding Übungen Für Arbeitnehmer

- Team Baucenter Wanderup Husumer Str

- Taxi Rhein Sieg Hagger _ ᐅ Top 10 Taxi Siegburg

- Tchibo Espresso Vanilla _ Espresso Vanilla online bestellen bei Tchibo 491845

- Tastenkappe Kaputt Ersatz _ Taste (nicht Kappe) von Logitech G915 öffnen

- Tcm 216 906 Flüssigkeiten – Flüssigkeit im Ohr

- Tchibo Ersatzteile Milchaufschäumer

- Tavor Expidet Btm , Wie wirkt sich Tavor aus? (Positiv und negativ)