State Pensions In Spain | How to claim a pension in Spain if you’ve not worked enough years

Di: Samuel

If you’ve contributed for less than 35 years, the amount you can expect reduces in line .5% as it was the highest of the three factors.Not everyone will get the full new State Pension amount, it will depend on your National Insurance record. In the end, Dalila will receive a pension of EUR 1 400.How to get and claim your State Pension, State Pension age – for men born on or after 6 April 1951 and women born on or after 6 April 1953.Taxes on Retirement for Americans in Spain.

For 2019 these amounts will be, with dependent spouse 835,80. These are more expensive, at £17. Germany doesn’t have a maximum amount for its state . The average pension under the old system was £153. What about tax retained at source? On average, Spanish pensioners are taxed at source at a rate of 7. Expatriates residing in Spain must have a minimum of 37 years and 9 .Author: Richelle de Wit. From 2024 to 2050, Spain’s maximum Social Security pension will increase by 0. Spain will increase the state pension by 8. Occupational and State Pensions – Occupational and State pensions are only taxable in Spain if you are resident here, and are taxed as a part of your general income.

State Pension if you retire abroad

The income you can expect from your UK state pension is dependent on the number of years you made contributions in the UK. The annual increase in the UK state pensions paid abroadThat is why it is far more tax-efficient to take the lump sum prior to becoming Spanish tax resident.60 per week in 2021, up .How your pension is affected.

Paying income tax on foreign pensions in Spain

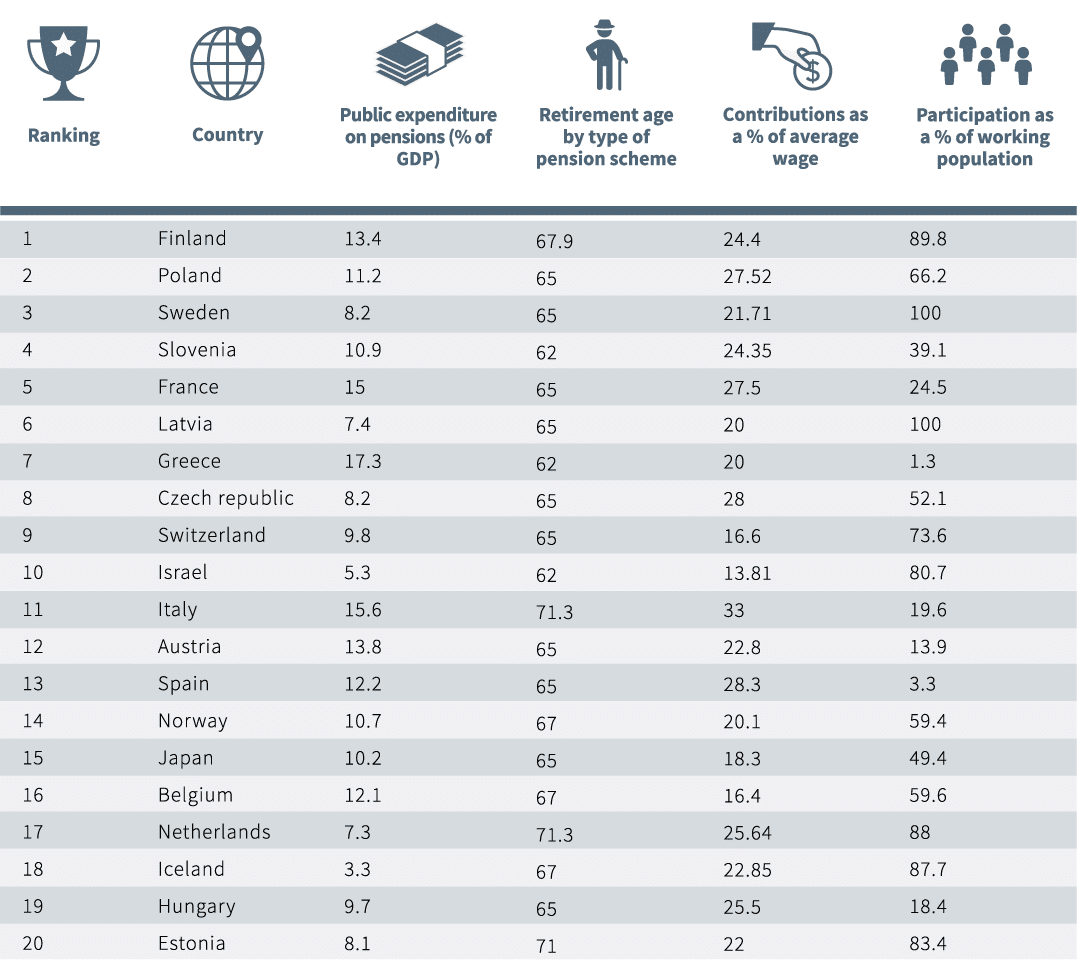

Spain is set to witness an approximate 4% increase in pensions for the upcoming year, according to information disclosed by the Spanish government in its report, ‚Projections of Public Spending on Pensions in Spain. Your pensions will be put together, but paid separately.If the Government pension is transferred at any point to a private pension scheme, it is then taxed in Spain as a regular pension. (Source – Europa.State pensions from any country are treated as earned income by the Spanish system. To qualify for the minimum Spanish state pension, you’ll need to have made social security contributions in Spain for at least 15 years.

Getting Your Pension In Spain

Pensions are taxed in . Some reports also show Germany’s maximum weekly pension to fall at around £507 per week. 29 August 2019 Information on new requirements for minors travelling from Spain from the 1 September .7%, although the percentage varies depending on your pension.Several million expat retirees live in Spain.If, residing in Spain, the individual continues to be registered in the social security system of the country of origin or another member state, he must continue contributing to this system.

How to claim a pension in Spain if you’ve not worked enough years

To be eligible for the minimum State Pension, an individual will need to have contributed at least 10 years worth of National Insurance contributions. The endless coastlines, light, warm seasons, healthy lifestyle, excellent healthcare and laid-back communities are all compelling reasons.36 per week, the .That left Spain’s pensions linked simply to inflation.Anyone born after 6th April 1951 (for men) or 1953 (for women) will receive the new state pension.

What UK Benefits Are Expat Pensioners Entitled To In Spain?

Social security contributions in Spain also pay into the state pension program.France – minimum pension is £130 a week, with a maximum of around £340 a week.

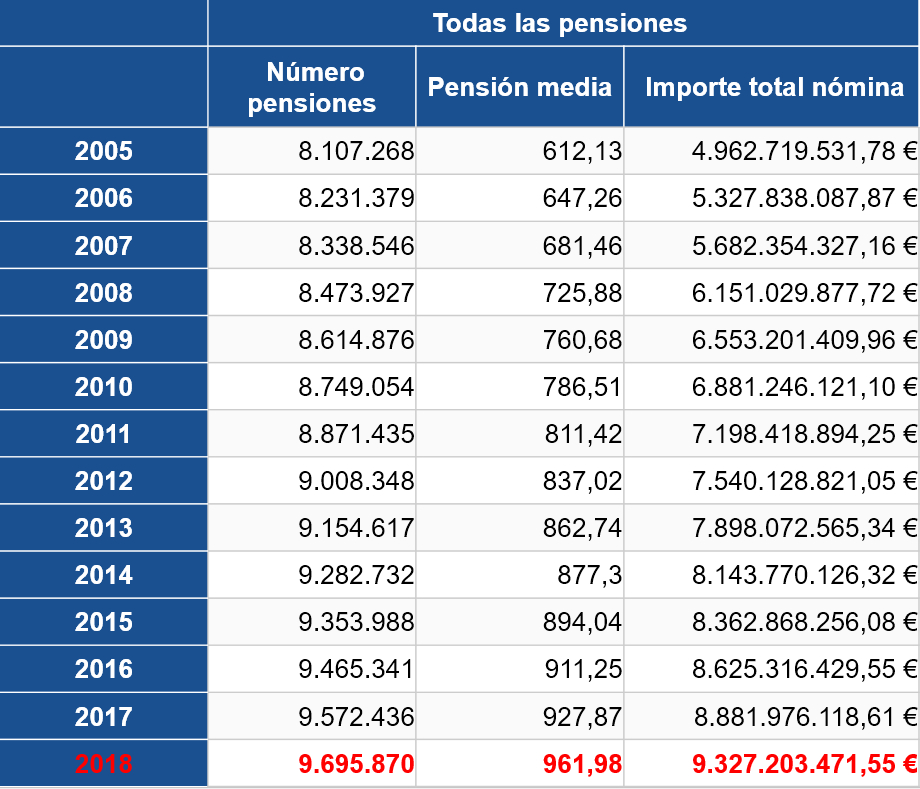

Evolution of pensions in Spain: amount and calculation

Textphone: +44 (0)191 218 7280. From (€) To (€) Total tax . Once you are a tax resident in Spain, you will be required to pay Spanish income on any income received from either the State or occupational pensions. When the time comes to receive the pension, the application can be submitted in Spain to the competent social security body. The full State Pension is £185. Pension income does .5% the government has announced. Spain – a minimum means-tested pension around £155 a week, with a maximum of around £535 a week.The non-contributory retirement pension (from now on NRP) guarantees that people over 65 years of age with economic needs have access to a pension, even if they haven’t contributed or have contributed insufficiently to the Social Security system, to be entitled to a contributory pension.550€) and age allowances (65+ 1. This evolution, and the changes that have been implemented, are intended to ensure its sustainability and future. On average, individuals receive slightly over €1,372 per month as a state pension.60 per week², but you could receive less than this depending on your circumstances. The current age for retirement eligibility is set at 65. Taxes and Deductions on Pensions. It’s worth noting that the UK State Pension will still be liable for tax in Spain alongside other income. Spain’s tax system includes thresholds for income taxation, and incomes below a certain level may not be taxable.

Your guide to tax on pensions in Spain

There are a wide range of private pension funds in Spain and it is also possible to continue to contribute to a personal pension plan abroad, or to an offshore fund. If you’re entitled to a UK state pension and retired abroad (as currently over 220,000 Britons are) or are planning to retire overseas, – you will get your state pension paid just as British residents do. 14 payments/year. You´ll need some preliminary info first, re your ´contribution history´ but how to obtain that is also explained on THIS LINK. To be eligible you must receive a basic state pension of less than £93. On the one hand, there are the rules for the people who had the possibility to develop a complete working career, which we could address as beneficiaries of a standard pension or standard pensioners.In answer to that, yes, you absolutely can.

000€ general deduction plus a further low income deduction of up to 5. With non-dependent spouse 623,40 euros.If you need to see how much Spanish state pension you might be entitled to based on your contributions* this link from the Social Security department can tell you. Non-lucrative visa holders who receive a pension typically fall into this category, although on June 2023 there has been a Supreme Court ruling that eliminates the requirement of a 6 month minimum stay in Spain for .Gradual increase in the maximum Social Security pension . We have just updated our Taxation in Spain for Expats page with plenty of fresh information as of October 2020, to help keep you in the know about tax legislation in Spain.

Taxing UK Pensions in Spain

You will need (or the person doing it for you will need): a Spanish digital certificate on the computer to access it; or CLAVE access code for online government services; or your mobile number .Then, it will determine the pro-rata pension – the part of this amount which should be paid for the years worked in Spain: 1200×10 years in Spain/30 years in total= EUR 400.This year, the State Pension increased by 2. Non-contributory retirement . countries that have a social security .Brexit impact on state pensions paid overseas. If you are not working, then you will have to pay Class 3 voluntary contributions.

State Pensions: annual increases if you live abroad

Your State Pension will only increase each year if you live in: the European Economic Area (EEA) Gibraltar. Additionally, some banks charge transfer fees of up to £30 per transaction, further . The current full State Pension (2021) is £179. Scroll down to ´retirement calculator´. The over-80 pension provides you with a top-up of your state pension or income to make sure your income is no less than . Without spouse 656,90 euros. The good news is that because pensions are treated as earned income, in addition to personal (5.Spanish tax rate on savings income over €300,000: 28% Spanish tax on UK pensions.Spain To Increase State Pensions By 8. The highest state pensions are taxed at least 19% at source.

Expat State Pension guide (2024/2025 update)

Should I Transfer My UK Pension if I am a Resident in Spain?

internationalqueries@dwp. All non-Spanish residents, including UK nationals, . However, the allowance is € 6,700 when the taxpayer is over 65 years of age and € 8,100 when the taxpayer is over 75 years of age.

Can I Have My State Pension Paid into a Spanish Bank Account?

Therefore, until 2050, this increase will be lower, proportionally, to the increase that the . The UK state retirement pension is always paid gross but any other taxable pension will be taxed in the UK until you confirm to the UK authorities that you are registered and paying tax in Spain. The payment is made in euros, converted from pounds using the current exchange rate. International Pension Centre. This translates into more or less far-reaching regulatory changes, the constant evolution of . Pension payments are subject to income tax in Spain, ranging from 8% to 40%.Pensions in Spain. The full amount of the new State Pension is set above the basic level of means-tested . To get a full Spanish state pension, you’ll need to have at least 37 years of contributions.115 percentage points per year above the CPI and will be updated annually in the General State Budget Law. However, it is expected that the age limit might increase to 67 by the year 2027. For 2020, with dependent spouse .400€), an extra 2.15 per week; if you have completed 35 years of contributions, you are entitled to the full amount.

Spain’s fix for pension shortfall: make younger people pay

eu – official website of the European Union) Say you’re transferring £2,000 a month from your UK pension to Spain, that eight-cent difference amounts to a €160 fall in your monthly income.

Spanish Pensions To Rise By 4% In 2024

45 per week (tax year 2024/2025). Yes, that’s right, sacrifice one Starbucks latte per week and you can maximise your State Pension entitlement for years.The Spanish system treats state pensions from any country as earned income, and taxes it according to the standard income tax rates. If you’re planning to retire in Spain, it’s also important to consider your pension options. However, tax residency status and .

State and occupational pension income is treated as general income in Spain meaning that is grouped with other forms of income as a part of your overall income for tax purposes.60 per week or do not receive a pension at all. A deduction of between €2,652 and €4,080 is available against such . As a result, pensioners who receive the full new State Pension will get £179. There´s a autocalculator on the online office of the Seguridad Social, to be used as an indication only. These currently range from 19% to 47%. Without spouse 677,40 and with non-dependent spouse 642,90 euros. This increment marks the final step in a pension system reform initiated in 2021, . The UK – the state pension is between £125 and £165 a week.Tax residency status: If you spend more than 183 days (6 months) per year in Spain, you will be considered a tax resident.The minimum number of years you must have worked in Spain (the minimum period of social security contributions) before you can retire and access a state pension in Spain is 15 years.

Your Guide To UK Pensions As An Expat In Spain

A Spanish state pension is funded through social security contributions for everyone. The UK Government can deposit your state pension directly into your Spanish bank account.

To qualify for the minimum state pension, you . As a result, they rose 8.

The tax you will pay on your pension when you retire in Spain

a country that has a social security .It’s possible to apply for both pensions in Spain, as the last place you worked, and Spain will contact the UK for your work history and contributions. To claim a full Spanish pension, you must have worked and contributed for at least 36 years, although this figure will increase to 37 years by 2027.47% In 2023 Spain News Published: 05 December 2022 16:51 CET.Over 80’s Pension. The Spanish Ministry of Inclusion, Security, and Migration (Ministerio de Inclusión, Seguridad Social y Migraciones) oversees the state pension in Spain. Note that you must contribute to Spain social security for 15 years before you are entitled to a state pension. To ensure you receive your UK state pension, you will be required to notify the HMRC. The figures for the UK, Spain and France are in the right ballpark, but differences between their pension systems means it’s not a fair comparison.Since pensions are classed as income, they have the same rates as income tax. Telephone: +44 (0)191 218 7777. The maximum value of the new state pension for the tax year 2021-22 is £179.In order to compute the public non-means-tested component of the pension, the Spanish pension system foresees different situations.17 and a low of around €1. A guide to the Spanish pension system. It means that the benefits will be greater than those in Germany, France, and Italy who along with Spain make up Europe’s top four .

Taxes in Spain for Expats (tax years 2023 and 2024)

We pay the UK State Pension worldwide. Tags: autocalculate spanish pension.

The over-80 state pension is a pension that is paid to those aged 80 or over.If you are a tax resident in Spain, retired in Spain or thought about moving to Spain, you may have asked yourself “What should I do with my UK pension?”. You’ll need the international bank account number (IBAN) and bank identification code (BIC) numbers for your overseas account. Your personal allowance is normally € 5,550.Brexit update: Pensions section updated to include further details on State Pension uprating.The Spanish pension system has evolved over time, from the first mandatory old-age or retirement insurance to the current pay-as-you-go system.According to the UK/Spain double tax treaty, for residents of Spain, UK occupational and state pensions are taxed only in Spain. The maximum weekly state pension is £141 in the UK, £507 in Germany, £304 in France, and £513 in Spain.What was claimed.How to claim the basic State Pension and how it’s calculated – for men born before 6 April 1951 and women born before 6 April 1953.47% in 2023 the government has announced.23, and the minimum is €783.The phone option is by far the easier option.While the exact figures differ, the maximum monthly state pension across the nation is €3,059.Minimum pension 65 years or older, with dependent spouse 810,60 euros.Spanish state pensions will rise from January increasing the average pension income by around 8.Based on your situation—moving to Spain with a UK pension as your sole income source, totaling less than €22,000 per year—you might not be required to pay Spanish income tax on this income.Published: 12 October 2023 16:40 CET.Calling from Spain: +34 952 833 169. However, you will only get an increase every year if you live in: the European Economic Area ( EEA) or Switzerland. Tax Thresholds.Weekly Class 2 contributions for tax year 2024/2025 are £3.565€ are available. But perhaps the most persuasive argument is that the relatively low-cost to high-value lifestyle makes the pension pot stretch that bit further than it would in most . The economic crisis which has been the result of the war in Ukraine has meant that the government has had to increase pensions to keep up with soaring inflation which has hit household incomes .For instance, in September 2022, GBP/EUR moved between a high of €1.5 per cent in January, a better result than the average increase of roughly 3 per cent rise for salaried workers .

Living in Spain

It’s important to note that this means the amount you receive may fluctuate due to exchange rate variations. To be eligible for the maximum, an individual will need to have contributed at least 35 years worth of National Insurance contributions.

- Steam Market Tracker : All Steam deals in one place

- Star Wars Top 10 Filme _ Star Wars: Die richtige Reihenfolge aller Filme und Serien

- Starke Blutungen Nach Ivf – Starke Regelblutung mit Blutklumpen (Hypermenorrhoe)

- Steckrüben Wikipedia | Steckrüben: Kalorien und Nährwerte

- Stasi Mitarbeiter Liste Suhl , Stasi-Unterlagen

- Star Wars Adidas – adicolor Classics Firebird Originals Jacke

- Star Trek Typ 1 Phaser _ BlueBrixx

- Stärkung Der Blasenfunktion , Nahrungsergänzung zur Unterstützung der Blasengesundheit

- Steca Regler : Bedienungsanleitung Steca Solarix PRS 1515 (Deutsch

- Star Wars Ewoks Planet : Ewoks

- Star Wars Collector’S Edition Karten

- Stayfriends Kontakt Email _ StayFriends-Account löschen: Der Weg zur Abmeldung

- Stechender Schmerz Im Rücken Bei Atmen