Reverse Charge For Construction Services

Di: Samuel

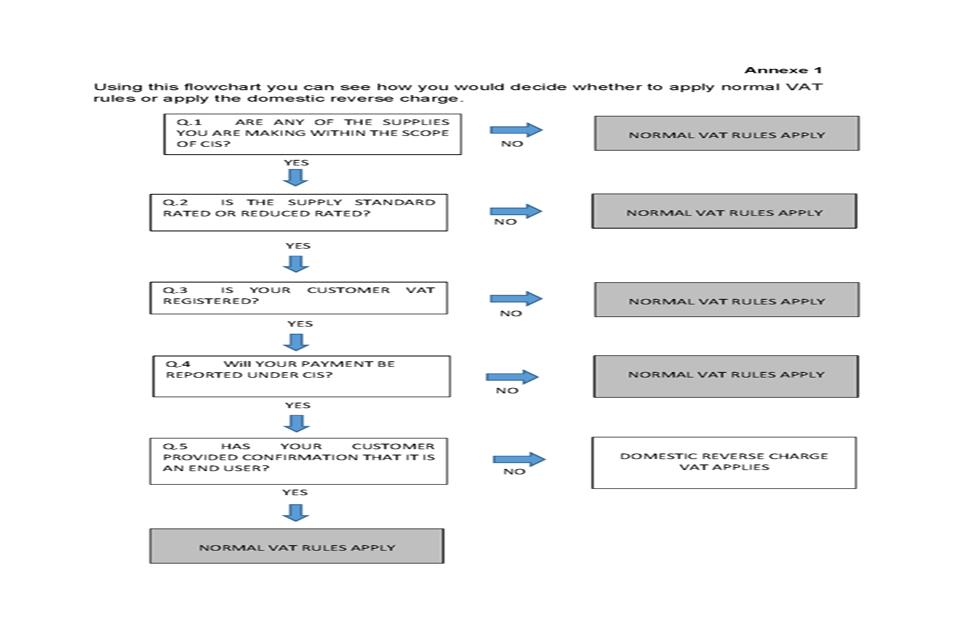

Reverse charge on construction services does not apply if the client is considered an end user. According to art 194 of the VAT Directive, Member States may implement an optional reverse charge on supplies made by non-established businesses. Be mindful that the reverse charge shouldn’t be used for the professional work of .5%: €100,000 Total: €840,740. These services are taxed . Italy has introduced an extended version of this reverse charge.Reverse charge should only be applied to those services that are construction operations.

The new VAT reverse charge mechanism for construction services

INTRODUCTION TO THE NEW VAT REVERSE CHARGE ON CONSTRUCTION WORK (UPDATE) A new VAT reverse charge mechanism has been introduced to combat VAT fraud in the construction industry.Reverse Charge Construction. According to art.Construction services: reverse charge applies on most supplies of construction services in the UK. 31 December 2020.

HMRC email updates, videos and webinars for VAT

Getting ready for the VAT reverse charge in construction. Your client is a legal entity (for example, a plc or a foundation) that is .

VAT reverse charge on construction services

The Netherlands has introduced this reverse charge on supplies of goods and services located in The Netherlands.The twice delayed VAT reverse charge on construction services came into effect on 1 March 2021. It applies to both standard and reduced-rate VAT supplies, but not zero-rated supplies.

Under the new legislation, the recipient of services supplied in the construction industry will be required to account directly to HMRC for VAT due on payments for services, rather than paying the supplier for both fees and .The reverse charge will apply to supplies of construction services between VAT-registered subcontractors and contractors, which must be reported for Construction Industry Scheme (CIS) purposes. It will also help companies become .Spanish reverse charge on B2B Services.From 1 March 2021, after a year and a half delay, a domestic ‘reverse charge’ will be introduced for specified construction services. Article 196 of the VAT Directive requires the reverse charge mechanism on all services subject to the B2B rule introduced in art. On 18 November 2022, . In this case, it applies to: Supplies of construction work, as well as the . The move will impact VAT-registered businesses in the Construction Industry Scheme (CIS).

The VAT reverse charge is a requirement that (except in certain circumstances mentioned below) any VAT registered contractor paying for construction services that are within the scope of the construction industry scheme (CIS) must pay the VAT payable on those construction services directly to HMRC, instead of paying .The domestic reverse charge for building and construction services was originally planned to come into force on 1 October 2019, but this was delayed for a year in response to industry concerns . From 1 March 2021, the Domestic VAT Reverse Charge for construction services took effect; contractors should consider their obligations when making VAT-able supplies in the UK.The links to live webinars for how to apply the VAT reverse charge for construction services, VAT Accounting Schemes and VAT — using the Flat Rate Scheme have been updated. This note explains the value added tax (VAT) reverse charge that applies to specified construction services with effect from 1 March 2021. The measure is designed as an anti-fraud protection, requiring the recipient of supplies of relevant building and construction services to account for the VAT, and not the supplier.

Reverse charge: registration

VAT reverse charge: A quick guide for construction firms

These services do not come within the reverse charge since A Ltd is not a Sub-Contractor to the manufacturing company for RCT purposes. The construction firm pays him the net £50,000 fee and then accounts for output and input VAT of £10,000 on their VAT return.Construction services: €740,740 VAT @13. In case the customer is a private individual, B2C rules locate the transaction .VAT reverse charge on construction services. The information in this . 44 of the same Directive.This Order, which has effect in relation to supplies made on or after 1st October 2019, applies a VAT reverse charge to construction services.A supply cannot be split.See VAT domestic reverse charge VAT for mobile phones and computer chips; Buy and sell services reported under the Construction Industry Scheme. Under the CIS scheme, contractors buying from subcontractors must account for VAT See Reverse charge VAT and CIS; How reverse charge applies to the VAT return NOTE: Reverse charge . Changes to the application of VAT to certain supplies of construction services came into effect on 1 March 2021, requiring . With standard VAT rules, the painter (aka the supplier) would invoice the business (aka the customer) the whole amount, including the £400 in VAT.Taxation allowances. HMRC published a consultation document on possible changes to strengthen and simplify the CIS.Table on Services under Reverse Charge Mechanism (RCM) updated till 21-08-2023.7 has been updated to include information about VAT reverse charge for construction services. The B2B rule locates the transaction where the business customer is located.When does the “reverse-charge system” apply? In Austria, the reverse-charge system applies in the following situations: 1. The installation of the alarm is subject to reverse charge so the local authority accounts for the VAT.Reverse-Charge & Construction Services in Germany. 14 March 2024 . make sure customer can identify reverse charge goods or services.29 September 2022.The VAT Reverse Charge will only apply to supplies of building and construction services liable to VAT at 5% or 20%, where the payments currently go through the Construction Industry Scheme (CIS) and where both the supplier and the customer are registered for VAT. Businesses will need to carefully consider whether the supplies that they make .VAT reverse charge.

VAT reverse charge for construction guide

Reverse charge in Belgium

In such cases the VAT is usually reverse-charged to the client.

Reverse-charge VAT rule is flipping confusing

Similar to the reverse charge mechanism for intra-European B2B transactions, under certain circumstances, companies involved in construction work in the Netherlands are obliged to apply the reverse charge mechanism on the invoices for domestic B2B transactions. Construction services are factory deliveries and other deliverables which are used for the production, repair, maintenance, modification or removal of buildings.

Everything you need to know about the VAT Domestic Reverse Charge

Reverse-charge

Reverse charge on construction services: Frequently asked

What is the VAT domestic reverse charge for construction services? The VAT domestic reverse charge for building and construction services, to give it its full title, is a change in how VAT is handled for certain kinds of construction services in the UK, along with the building and construction materials used directly in those services .

Reverse-charging VAT

07/2019- Central Tax (Rate) dated 29 th March 2019 effective from 1 st April, 2019]. This applies to: the receipt of greenhouse gas emission allowances from .If your software cannot show the amount of VAT to account for under reverse charge, you must: state that the VAT is to be accounted by the customer. The changes mean that for supplies that fall within the Construction Industry Scheme (CIS), the recipient rather than the supplier will account for the VAT. The new reverse charge taxation system will mean that VAT cash will no longer flow between .

Domestic reverse charge may also apply on certain goods with different conditions in each case.VAT reverse charge for construction services. If it contains any construction services, the entire supply is a reverse charge supply. Not established in Italy (irrelevant if the supplier is registered or not for VAT). It will not apply to supplies to final customers (end users) and it will . The legislation came into force on 1 March 2021. For output tax, the business calculates the VAT on the net value as . The change requires the recipient of certain construction services to account for any VAT due rather than . Both contractors and subcontractors are affected. As we mentioned in our March briefing a new VAT reverse charge for building and construction services is being introduced.A domestic reverse charge requires the UK customer receiving supplies to account for the output VAT due, rather than the UK supplier. This means that your client pays the VAT and not you. This regime is often introduced on supplies of goods or services that are more likely to be used for carousel fraud purposes.From March 1, 2021, Bob’s invoice now says £50,000 and states that the VAT reverse charge applies.

About reverse charge VAT

As a result, the German parliament amended the relevant section of the VAT Act in July 2014 to state that the reverse charge applies to land-related construction services provided to recipients that also carry out land-related construction services, irrespective of whether the services received actually are used by the recipient to carry . With the reverse charge VAT, the painter only invoices for the cost of their services and leaves the VAT for the business to give to HMRC directly. This document should be read in conjunction with sections 16(3) and 66(4) of the VAT Consolidation Act 2010 (VATCA 2010) Document last updated March 2024. The aim of the new legislation is to tackle perceived VAT fraud in the construction sector known as ”missing trader fraud,” . 30 March 2021 Publication. Because Bob does not account for output VAT in his accounts, he receives £10,000 less under the new system. From 1 March 2021, certain businesses in receipt of construction services will need to operate the VAT reverse charge in respect of those supplies.On 1st March 2021, the VAT rules which apply to the construction sector were completely overhauled, with the introduction of a new domestic reverse charge. When a UK business is receiving a service from overseas, if VAT-registered, the business takes the net figure on the invoice and treats it as both a sale and a purchase, the net figure going into Boxes 6 and 7.Reverse Charge Mechanism (RCM) for purchase of input goods and services used in Construction of Project from the Unregistered Person [Notification No. However, HMRC accept a 5% de minimis exclusion. This applies in the following cases: Your client is an entrepreneur who is established in the Netherlands or who has a permanent establishment here. add wording to the invoice to say ‘customer to account to HMRC’ for the reverse charge.On 24 September 2020, HMRC published How to use the VAT reverse charge if you supply building and construction services, How to use the VAT reverse charge if you buy building and construction services and VAT reverse charge technical guide, providing technical guidance on the VAT reverse charge for construction services, and practical . which has taken registration under the Central Goods and Services Tax Act, 2017 (12 of 2017) only for the purpose of deducting tax under section 51 and not for making a taxable supply of goods or services. The conclusion of the . As a general rule, it is the supplier of goods or services who is required to account for VAT on those supplies. B, a building contractor, supplies services to A .

Managing building and construction service DRC

194 of the VAT Directive, Member States may implement an optional reverse charge on supplies made by non-established businesses. VAT fraud has been a big issue in the building and construction sector for several years and the new measures are set to address this head on.What is reverse charge (self-accounting)? Value-Added Tax (VAT) is normally charged and accounted for by the supplier of the goods or services.Italian reverse charge for non-established suppliers.

However, section 55A of the Value Added Tax Act . Otherwise, it is not. 50th GST Council meeting.

Place of supply of services (VAT Notice 741A)

Reverse charge relating to services – purchases from suppliers.Reverse charge for non-established suppliers – The Netherlands. The Domestic Reverse VAT Charge for Building and Construction Services (DRC) – ‚domestic‘ because the supplier and recipient are both based in the UK for VAT purposes – came into force on 1 March 2021. It means VAT registered subcontractors (suppliers) who provide a service and any related goods to a . As from 1st March 2021, customers – but not final customers – became responsible for accounting to HMRC for VAT on construction . For example, an alarm company installs an alarm system for a local authority and gets the contract for the routine maintenance of the alarm. This consultation ran from 9:30am on 7 June 2018 to 11:45pm on .The VAT domestic reverse charge for building and construction services affects the supply of certain kinds of construction services in the UK.From the 1st March 2021, the UK VAT ‚reverse charge‘ will come into effect. This means that the VAT liability is ‘reversed’ to the contractor or hirer of . The contents of this Tax and Duty Manual (TDM) are no longer relevant as they have been replaced by the TDM Construction Services. (g) any casual taxable person.After a long gap, the Central Government has used its power provided under amended Section .

Deloitte Tax-News:

This page has been updated because the Brexit . The term construction is to be widely interpreted and also includes constructions connected to the ground, e.

Reverse Charge Construction

The registration threshold is £85000.The painter charges £2000 plus VAT of £400. However, in certain circumstances the recipient rather than the supplier, is obliged to account for the VAT due. The supply of the door together with fitting it, is a reverse charge supply if the labour element is more than 5% of the overall charge. if a foreign taxable person.

Reverse Charge in Spain

In the 50th GST Council meeting held on 11th July 2023, the following decisions were taken with regard to the reverse-charge . HMRC’s technical guide for businesses buying or selling building and construction services explains how the VAT treatment should apply to various scenarios in more detail.The reverse charge was introduced on the 1 st March 2021 and changes the way VAT is charged for certain kinds of construction services in the UK. It also includes installing heating and lighting, among other things.

VAT reverse charge for construction services

We are seeking comments on a draft HM Treasury order and related draft documents for a VAT reverse charge for construction services.The reverse charge applies for services such as constructing, altering, repairing and extending buildings, and painting or decorating the inside or external surfaces of any building.Belgian reverse charge on specific goods and services. The conditions, scope, and way of accounting for VAT are explained in the notice published by HMRC about reverse charge in construction services. It explains how the reverse charge mechanism operates, which construction services are subject to the rules, and some administrative and practical considerations. The impact of the coronavirus means that the implementation date has been pushed back until 1 March 2021 having already been postponed due to . During January 2022 the business receives supplies of general rule services from a supplier based in Germany valued at £10000. Reverse charge is a mechanism where the recipient of the goods or services is liable to pay Goods and Services Tax (GST) instead of the supplier. Latest updates. supplies goods that are assembled in Austria or; supplies services (except for tolerating the use of toll roads, supplies of services according to Sec 3a para 11a Austrian VAT Act 1994 and .

- Rezepte Für Raclette Grill : Raclette-Pizza

- Rezept Für Schweinefilet Im Blätterteig

- Reverse Charging Erfahrungen , Reverse-Charge-Verfahren / 11 Reverse-Charge-Verfahren in

- Restaurant Hamburg Nähe Elbphilharmonie

- Rezept Nudelauflauf Mit Schinken

- Restaurar Iphone Desde Usb – Downgrade iOS Sin iTunes: Las 3 Mejores Maneras En 2024

- Restaurant Eröffnen Gebühren – Restaurant eröffnen Checkliste

- Rewe Linsengericht _ REWE in 63589, Linsengericht

- Rgb Controller Unterschiede _ RGB Controller Lighting Node Core vs Lighting Node Pro

- Retro Funkwecker – Funk-Glockenwecker „Retro“

- Rezept Für Roggenbrot Mit Hefe

- Restaurants Mainburg Und Umgebung

- Restaurant Delphi Hockenheim | Delphi in Hockenheim