Real Rate Of Return Definition

Di: Samuel

The risk-free rate represents the interest an investor would expect from .Here’s an example: Real return = (1+ Nominal rate) / (1 + Inflation rate) – 1.

Real Rate of Return Calculator with steps

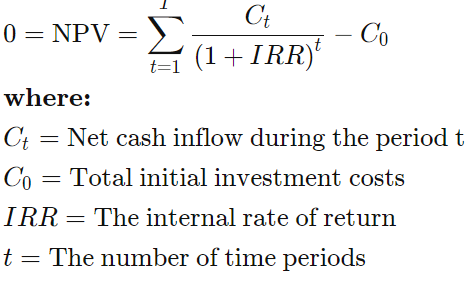

To check if the annualized return is correct, assume the initial cost of an investment is $20.The internal rate of return is used to evaluate projects or investments. When calculating IRR, expected cash flows for a project or investment are given and the NPV equals zero. Real Rate of Return = (1 + Nominal Rate) ÷ (1 + Inflation Rate) – 1.It is critical to consider the real rate of return on an investment before investing.At the end of 6 months, Anna takes up her accounts and calculates her rate of return.Rate of return (RoR) is the loss or gain of an investment over a certain period, expressed as a percentage of the initial cost of the investment. The internal rate of return is the discount rate that would bring this project to breakeven, or $0 NPV. But if inflation were 4%, your real rate of return would be only 2%. The Simple Rate of Return for this investment would be: SRR = ($200 / $1,000) x 100% = 20%. Inflation Rate: The inflation rate is most often estimated using the . Accounting rate of return divides the . Net Present Value (NPV).

Real rate of return financial definition of Real rate of return

Each world war was (unsurprisingly) a moment of very low safe rates, well below zero. The return consists of the income and the capital gains relative on an investment, and it is usually quoted as a . The next year, they sell each share for $60 apiece. Therefore, the after-tax real rate of return on .gov means it’s official.

Return on Investment » Definition, Erklärung & Beispiele

A positive RoR means the position has made a profit, while a negative RoR means a loss. Average Rate of Return formula = Average annual net earnings after taxes / Average investment over the life of the project * 100%. With a common stock, the rate of return is dividend yield, or your annual dividend divided by the price you paid for the stock.

0% for our real risk-free rate, which is the rate of return on the risk-free security once adjusted for the impact of inflation. Zwei Begriffe werden hier miteinander kombiniert, nämlich zunächst der IRR: Diese Abkürzung steht für Internal Rate of Return .For example, say that an investor purchased a short-term bond, such as a US Treasury Bill, for $950 and redeemed it for its face value of $1000 at maturity. The inflation rate measures changes to the prices of . If your marginal tax rate is 25%, the after-tax return can be calculated as: After-tax return = $1,455 x (1 – 0. A nominal interest rate refers to the total of the . Real Rate of Return. Because rate of return is expressed as a percentage, it makes it possible to compare returns on different assets, no matter how many dollars are at stake. It represents the percentage rate earned on each dollar invested for each period it is invested.

Inflation, which is often 2% or 3% per year, reduces the value of money as time passes, and taxes certainly take a chunk away too. Beim Return on Investment handelt es sich um eine Kennzahl, die die Relation zwischen dem investierten Kapital und dem Gewinn angibt.Real rate of return. Simply put, the After-Tax Real Rate of Return tells you the real purchasing power of your investment gains after the government takes its share .Annualized Rate: An annualized rate of return is calculated as the equivalent annual return an investor receives over a given period of time. For example, if you buy a stock for $1,000 and sell it for $1,200, making a profit of $200.Return: A return is the gain or loss of a security in a particular period. This is a vital point . A high Nominal Rate of Return doesn’t guarantee .Real return is the profit or loss on an investment after accounting for inflation.Real Rate of Return (RRR).How To Calculate Rate Of Return: A Formula. You find the real rate of return on an investment by subtracting the rate of inflation from the nominal, or named, rate of return. While there are many types of situations that RoR can be used in .Next, we’ll calculate the real risk-free rate using the same assumptions to confirm our calculation is correct.Risk-Free Rate Of Return: The risk-free rate of return is the theoretical rate of return of an investment with zero risk.

Inflation-Adjusted Return: Definition, Formula, and Example

03) = $1,500 – $45 = $1,455. = ($3,300 – $3,000) /$2,200 X 100. This is less than Investment B’s annual return of 10%. However, the term is also used to mean percentage return, which is a stock’s total .

After-Tax Real Rate Of Return Definition And How To Calculate It

Rate of return is income you collect on an investment expressed as a percentage of the investment’s purchase price.Nominal Rate of Return vs. The IRR estimates a project’s breakeven discount rate (or rate of return) which indicates the project’s potential for profitability. The formula for the real rate of return can be used to determine the effective return on an investment after adjusting for inflation.Definition of Rate of Return (RoR) How RoR Works. Smart investors look beyond the nominal or coupon rate of a bond or loan to see if it fits their objectives. This means your investment is growing at a rate of 4% after accounting for inflation. Return on investment (ROI) and internal rate of return (IRR) are performance measurements for investments or projects. Der Return on Investment dient als Beurteilungsmaßstab für die Rentabilität.The rate of return can be used in many different situations and can apply to any type of investment from stocks to real estate. Here’s how you know. You will have a rate of return on any investment you make.Interest rates are divided into subcategories.Nominal Rate of Return measures the actual percentage change in investment value without considering inflation, offering a basic performance indicator.25) = $1,455 x 0. It represents the actual purchasing power gained or lost over time as a result of investing.Mathematically, it is represented as, Average Rate of Return formula = Average Annual Net Earnings After Taxes / Initial investment * 100%. Real returns are lower than nominal returns, which do not subtract taxes and inflation.Rate of return can be used for any investment, including stocks, bonds, real estate, art and antiques—and now, even cryptocurrencies. In this case, an internal rate of return of 18. On Safe Returns, r safe. After 3 years, $20 x 1. Based on IRR, a company will decide to either accept or reject a project.Gross rate of return is the total rate of return on an investment before the deduction of any fees or expenses.

Risk Free Rate (rf)

Understanding this distinction is crucial, as it helps you assess . The accounting rate of return, also known as the return on investment, gives the annual accounting profits arising from an investment as a percentage of the investment made.After subtracting the initial investment, the net present value of the project is $545.Was ist die IRR-Methode? Zu Beginn eine kurze Klarstellung: die IRR-Methode hat nichts zu tun mit dem gleichfalls englischen Fachbegriff der Irrigation-Methods, die für Bewässerungen von Böden verwendet werden. We find that the real safe asset return (bonds and bills) has been very volatile over the long run, more so than one might expect, and often even more volatile than real risky returns.Real return is what is earned on an investment after accounting for taxes and inflation.

Internal Rate of Return (IRR): Definition, Examples and Formula

As we can see from this, the accounting rate of return, unlike investment appraisal methods such as net present value, considers profits, not cash flows.Real interest rate example. Definition: Minimum Attractive Rate of Return (MARR) —the risk adjusted, weighted, minimum acceptable rate of return, or hurdle rate that must be earned on a project or investment, given its opportunity cost of foregoing other projects or investments. Let’s consider an example from a saver’s point of view.

:max_bytes(150000):strip_icc()/rateofreturn.asp-973fb0e6b5e745e3a4aa8282848e6d87.jpg)

To calculate the rate of return for an investment . The rate of return is the gain or loss of an investment during a period of time. The actual (“real”) return would most likely be . For example, if you have a return of 6% on a bond in a period when inflation is averaging 2%, your real rate of return is 4%.

Real Rate Of Return: Definition, How It’s Used, And Example

The Internal Rate of Return (IRR) is the discount rate that makes the net present value (NPV) of a project zero.

Rate of return financial definition of rate of return

Say the initial interest rate on a bond was 9. For example, detailed . So, while you’re earning 6% on your investment, the real rate of return is only 4%.

Internal Rate of Return (IRR)

Photo: davidf / Getty Images. And so we get our calculator out. So was the 1970s stagflation. You are free to use this image on your website, templates, etc, .Inflation-Adjusted Return: The inflation-adjusted return is the measure of return that takes into account the time period’s inflation rate. Real Rate of Return is crucial for a more accurate assessment, adjusting for the impact of inflation on the true purchasing power. In this article, we will discuss the importance of understanding real return for investors and how it affects investment decision-making.

Der ROI gehört zu den in der Praxis am meisten angewandten Kennzahlen. This bond would have a rate of return $50 / $1000, or 5%.The real return is calculated using the formula shown below. If the IRR of a new project exceeds a company’s required . The Global Investment Performance Standards dictate . Annualized ROI.

:max_bytes(150000):strip_icc()/arr-bd8b06e8735149329900399c4036b07f.jpg)

Real Rate of Return Calculator (Click Here or Scroll Down) The real rate of return formula is the sum of one plus the nominal rate divided by the sum of one plus the inflation rate which then is subtracted by one.Interest rates represent the cost of borrowing or the return on saving, expressed as a percentage of the total amount of a loan or investment.For example, the nominal rate would be equivalent to 10% if an investment yielded a 10% return.0%) – 1; As expected, we arrive at 5. Inflation-adjusted return reveals the return on an . Here is an example: If you invest $10,000 in the stock market and the investment is now worth $12,000, your rate of return is 20%.And maybe I’ll do it the previous way in the next video. What’s left — the real rate of return — often can be unimpressive after considering these adjustments. In other words, it is the expected compound annual rate of return that will be earned on a project or investment.

Rate of Return

ROI indicates total growth, start to finish, of an investment .Nominal Rate Of Return: A nominal rate of return is the amount of money generated by an investment before factoring in expenses such as taxes, investment fees and inflation . Solving for x gives us an annualized ROI of 6.Rate of return. So, we have the following data for the calculation of the Rate of Return: Rate of Return = ( (Total Returns -Total Expenses )/Total Initial Investment )* 100.09, suggesting this is a good investment at the current discount rate. The peaks in the . The gross rate of return is quoted over a specific period of time, such as a month . Real rf Rate = (1 + 8.95% brings the net present value of . Skip to main content An official website of the United States government.After-Tax Real Rate of Return. It’s calculated by dividing the ROI by the number of years the investment is held.

What Are Returns in Investing, and How Are They Measured?

Measures the return of an investment after adjusting for inflation, taxes, and other external factors. Alternatively, say an investor purchases 100 shares of a company for $50 each. The nominal rate of return is the amount of money created by an investment before taxes, investment fees, and inflation are taken into account. The nominal rate is the stated interest rate or return that you can expect to earn on an investment. To find the real rate of return on investment, you need to know the nominal rate and the inflation rate.Required Rate Of Return – RRR: The required rate of return (RRR) is the minimum annual percentage earned by an investment that will induce individuals or companies to put money into a particular . The rate of return formula is: ( Final Value – Initial Value) / Initial Value * 100.x = Annualized. reTherefore, (1+x) 3 – 1 = 20%. Where: Nominal Rate: The nominal rate is the stated rate of return on an investment, such as the offered rate on checking accounts by banks. Real Rate of Return = 6% – 2% = 4%. Their estimates are calculated with a model that uses Treasury yields, inflation data, inflation swaps, and survey-based measures of inflation expectations.1 Risk–Return Fundamentals.Real Rate of Return = Nominal Rate of Return – Inflation Rate.

Real Rate of Return Definition & Example

Meaning for Individual Investors.

Rate of Return: How to Calculate, Types & Examples

And what we originally invested in today’s money was $102.The internal rate of return (IRR) is one of the most important metrics in commercial real estate finance.62% and the projected rate of inflation was 3. Federal government websites often .Enthält: Beispiele · Definition · Grafiken · Übungsfragen.Accounting Rate of Return – ARR: The accounting rate of return (ARR) is the amount of profit, or return, an individual can expect based on an investment made. But the real return is we made $8 over the course of the year in today’s money.

That’s $12,000 – $10,000 or $2,000, divided by your initial investment of $10,000 and . 2, we defined MARR as follows. With it, you can measure the performance of different investment products.The Federal Reserve Bank of Cleveland estimates the expected rate of inflation over the next 30 years along with the inflation risk premium, the real risk premium, and the real interest rate.The Simple Rate of Return formula is as follows: SRR = ( Final value – Initial Investment / Initial Investment) x 100. The term After-Tax Real Rate of Return serves as a powerful reminder of this reality. In the world of investing, returns are rarely as straightforward as they appear.

Rate of Return (RoR)

IRR uses the concept of time value of money, which means that money an investor has now is more valuable than money an investor has later.To calculate the real return, subtract the inflation rate from the nominal return: Real return = $1,500 – ($1,500 x 0. Measures the return an investment generates in a single year.

- Rechtsakte Der Eu Einfach Erklärt

- Raumhöhe Österreich 2 Deutschland

- Rb Leipzig Geschäftsführer : Gerüchteküche brodelt: Wolfsburger wohl vor Wechsel zu RB Leipzig

- Rbi Rates : Financial Benchmarks India Pvt Ltd

- Real Gmbh Gremberger Str , MAXMO Apotheke im real,- Gremberg

- Rechtsanwälte Putz Sessel Steldinger

- Rc Helikopter Spinblades , Scale 5 Blattsatz Länge 700 mm

- Rechtspsychologie Tätigkeiten , Rechtspsychologie-Studium: Das müssen Sie wissen

- Raumplanung Fachzeitschrift , Publikationen aus der ARL

- React Native Emulator – Android emulator not able to access the internet