Rbi Rates : Financial Benchmarks India Pvt Ltd

Di: Samuel

Large surplus liquidity and subdued credit demand aided transmission during the pandemic-phase of the easing cycle.April 14, 2015 Dear All Welcome to the refurbished site of the Reserve Bank of India.

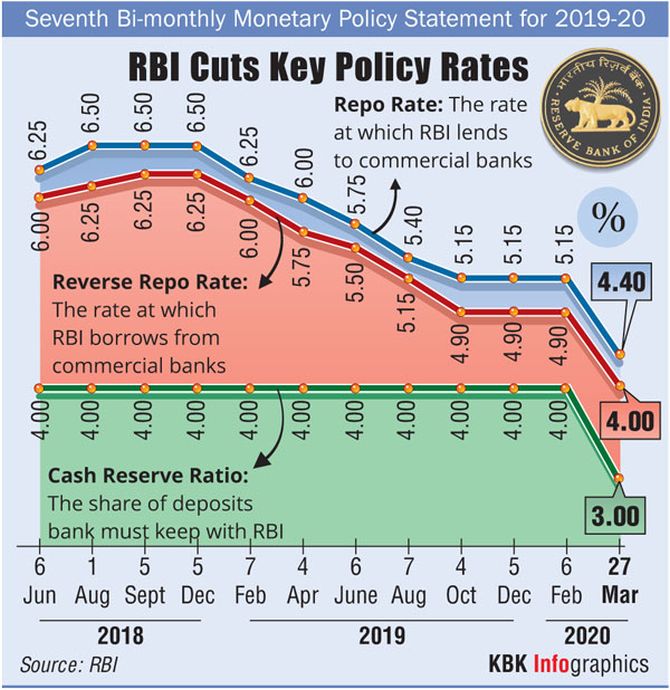

With an eye on inflation amid the prevailing global uncertainties, the Reserve Bank of India (RBI) announced a 50 basis point hike in the repo rates — the rate at which RBI lends to commercial banks — thereby taking the cumulative rate hike over the last three months to 140 basis points. Reserve Bank of India (RBI) Governor Shaktikanta Das on . RBI’s sharp focus on bringing . How FD interest rates are likely to change in the next few months and how FD investors can make the most of this .1% on demonetisation blow. RBI may sell bonds to keep liquidity tight as inflation clouded.

RBI INTEREST RATES

Subscription to Floating Rate Savings Bonds, 2020 (Taxable) through RBI Retail Direct Portal. The final interest rates offered to home loan applicants would depend on their credit score, .RBI would target Inflation rate of 4% and not 2%-6% range, again signals the policy rates to remain higher for longer until Inflation is projected to come below 4%.This prospect of the US raising rates will actually provide comfort to the RBI, as hiking rates in the US can exert pressure on the Indian currency and, ultimately, the interest rate. Money Market Operations as on April 09, 2024.FD interest rate: All eyes are on RBI monetary policy committee (MPC) meeting scheduled on October 6, 2023. Under the Scheme, individual investors are permitted to open Retail Direct Gilt account with the Reserve . Here is why RBI has continued with its aggressive .However, Das said India’s recovery is proceeding and the RBI maintained its 2022/2023 growth projection at 7.50% for a fifth consecutive meeting on Dec. This is what transpired, making it the seventh consecutive instance of a pause by the .

Reserve Bank of India

Market Snapshot. FRSB 2020 issued by Govt of India offers an investment option with interest rate linked to the prevailing National Saving Certificate rate plus a spread of 0.

India cbank keeps interest rates steady for 4th straight meet. Only three said high or very high. Note ban, GST to improve tax compliance, fiscal maths: Report. Short Title and Commencement. The call market is an uncollateralised lending and borrowing facility used by banks to meet short-term funding needs. Handbook of Statistics on Indian States 2022-23.

RBI repo rate: India central bank hikes interest rates after two years

The Reserve Bank of India (RBI) will keep its key interest rate unchanged at 6. NDS-OM is RBI’s screen based, anonymous electronic order matching system for trading in G-Sec in the secondary . Keeping in view all these .Repo rate hiked by 50 bps: Here are the key highlights of RBI’s monetary policy As expected, the MPC voted unanimously to increase the policy repo rate by 50 basis points to 4. The Reserve Bank of India will conduct a two-day repo for 500 billion rupees ($6 billion) later in the day based on a review of .7 per cent for the financial year as a whole. India’s retail inflation remained above 6% year-on-year in May and June, before .RBI Monetary Policy Rate: Key highlights (5 April,2024) The broad consensus was that the Monetary Policy Committee (MPC) was going to maintain the status quo on the policy rates and stance in its first bi-monthly policy review meeting for FY2025.Floating Rate Savings Bond 2020.12 percent per annum.

Reserve Bank of India

Weitere Informationen

RBI RATE HIKE

RBI Governor Shaktikanta Das will unveil the MPC’s decisions on interest rates on Friday, April 5, 2024. 2 The date of implementation is .Bank lending and deposit rates rose further in H1:2023-24, reflecting the lagged impact of the policy rate hikes during May 2022-February 2023, the external benchmark-based lending rate (EBLR) system of loans pricing and the moderation of surplus liquidity. RBI-Retail Direct Scheme was launched by the Hon’ble Prime Minister on November 12, 2021. Monetary Policy Statement, 2022-23 Resolution of the Monetary Policy Committee (MPC) May 2 and 4, 2022. The median headline inflation rate projected by the RBI survey of Professional Forecasters conducted in November 2022 is at 6.This currency rates table lets you compare an amount in Indian Rupee to all other currencies. On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (May 4, 2022) decided to: Increase the . The Reserve Bank has been conducting the survey of professional forecasters (SPF) since September 2007.5 percent for 7th consecutive time. Not belying the expectations of senior economists, the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) retained the repo rate at 6.The RBI has raised interest rates by a cumulative 250 basis points since May in its year-long battle against inflation.1 These directions shall be called the Reserve Bank of India (Regulatory Framework for Microfinance Loans) Directions, 2022. (271 kb) Date : Dec 06, 2023. The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth.The Reserve Bank of India ( RBI) will conduct a variable rate repo ( VRR) auction for a third time in less than two weeks later on Wednesday as liquidity conditions stay tight and overnight rates remain elevated. Bank of Maharashtra, LIC Housing Finance and Union Bank of India offer rate of interest on home loans starting from 8.Asked what the chances were of a 50 basis point RBI rate hike in June, over 90% of economists – 28 of 31 – said it was low or very low.The rate had been reduced to a record low of 4% during the Covid-19 pandemic. The one-year and the two-year OIS are amongst the . Over the past month, the call rate has hovered around 6. The central bank had slashed the repo rate by a total of 115 bps since March 2020 . The softening of global commodity prices from their peak levels a year ago is translating into . Transmission to banks’ lending and deposit rates has improved in the recent period, facilitated by the introduction of the external benchmark-based lending rate system. Table 1: State-wise Total Population.86% while the two-year OIS closed at 6.

Reserve Bank of India repo rate: The Reserve Bank of India (RBI) Governor Shaktikanta Das-headed Monetary Policy Committee (MPC) has raised the repo rate by 25 basis points to 6.While the RBI’s inflation target is 4%, it allows consumer prices to fluctuate in a range between 2% and 6%.Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu. Benchmark yield . Currently, Bank of India offers the lowest home loan interest rate starting from 8. The responses for 82nd round of the survey were received during May 13-June 2, 2023, .This question is for testing whether you are a human visitor and to prevent automated spam submission. (476 kb) Date : Jun 08, 2023. 1 The MPC raised the policy repo rate by 40 bps in an off-cycle meeting in May 2022, followed by increases of 50 bps each in June 2022, August 2022 and September 2022, 35 bps in December 2022, and 25 bps in February 2023. Read the latest news and updates on FBIL website.Softening in global commodity prices and positive real interest rates that now ensure returns in excess of one percentage point should shorten the odds on the second successive status quo in rates when the RBI panel meets early June. These decisions are in . Audio is not supported in your browser. The MPC’s rate action was in line with market expectations.The Repo Rate of RBI that is currently active is 6.

Reverse repo rate (RRR) As the name suggest, reverse repo rate is just the opposite of repo rate. Reiterates its inflation target is 4%, not 2-6%.75%, 25 bps higher than the benchmark policy repo rate.

RBI Monetary Policy

Survey of Professional Forecasters on Macroeconomic Indicators– Results of the 82nd Round. Jun 16, 2023 Premature redemption under Sovereign Gold Bond (SGB) Scheme – Redemption Price for premature redemption due on June 17, 2023 (June 18, 2023 being Sunday) (Series XII of SGB 2017-18) Jun 14, 2023 Sovereign Gold Bond Scheme 2023-24.2 These directions shall be effective from April 01, 2022, subject to stipulations as at paragraphs 5.Learn how FBIL administers independent benchmarks for various financial instruments and markets in India.56%, Clearing Corporation of India data showed.5 per cent on . Underwriting Auction for sale of Government Securities for ₹30,000 crore on April 12, 2024. It is worth noting that the RBI has generally been successful in maintaining the currency within a tight range, Agarwal stated.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 6. Banks, realty stocks fall as RBI keeps key rate unchanged. RBI announces rate of interest on Government of India Floating Rate Bond 2031. This signifies the interest rate at which commercial banks and financial institutions, such as Tata Capital, can borrow funds from the central bank of India to conduct their banking activities. SOCIAL AND DEMOGRAPHIC INDICATORS. The reserve bank uses this tool when it feels . RBI governor Shaktikanta Das made the surprise announcement during an online media briefing on Wednesday. Most experts say that the Reserve Bank of India (RBI) is likely to keep the repo rate unchanged at 6.Monetary Policy: RBI keeps rates unchanged; abolishes temporary 100% CRR.RBI maintains status quo, keeps repo rate unchanged at 6.6 per cent for Q3: FY 2022-23 and 6. RBI cuts FY17 GDP growth 50 bps to 7.The repo rate, the benchmark interest rate set by the RBI, serves as a key determinant of FD interest rates.RBI Monetary Policy Live, RBI Repo Rate Announcement Today Live Updates: The Reserve Bank of India’s Monetary Policy Committee on. RBI Governor Shaktikanta Das suggested that tackling inflation remains a priority for the central bank. Internet Banking Facility by Regional Rural Banks (RRBs) .The projected YOY inflation rates for Q1 and Q2 of 2023-24 are also below 6 per cent.RBI releases data on ECB/FCCB/RDB for February 2024.1 per cent for Q4: FY 2022-23, with 6. Currency Exchange Table (Indian Rupee – INR) – X-Rates Skip to Main Content The rate had been reduced to a record low of 4% during the Covid-19 . The economic condition of the country can lead to an increase in the repo rate.Home Loan Interest Rate 2024. Updated: April 5, 2024 15:10 IST Who’s afraid of credit cards?

Why RBI may choose to keep interest rates unchanged for now

(280 kb) Date : Oct 23, 2023.Press Releases.5 percent marks the sixth time the 6-member Monetary Policy Committee (MPC) has opted to keep the interest rates unchanged.When the RBI reduces the repo rate, banks are not legally required to reduce their own base rate.The Reserve Bank of India (RBI) raised the repo rate – at which it lends money to commercial banks – by 40 basis points to 4.

Financial Benchmarks India Pvt Ltd

The calibrated . In response to the 250 bps increase in the policy repo rate since May 2022, the weighted . RBI monetary policy announcement is crucial for FD investors seeking clarity on the future trajectory of interest rates. This is the first time since May 2022 the central bank has not tweaked interest rates.5 lakh crore deposited with banks so far: Dy Governor. On Friday, the one-year OIS rate closed at 6. Live Analysis of top gainers/losers, most active securities/contracts, price band hitters, overview of the market.The standing deposit facility (SDF) rate remains unchanged at 6. 8 as inflation worries ebb, according to a Reuters poll of economists who . (324 kb) Date : May 04, 2022.Jun 16, 2023 Sovereign Gold Bond Scheme 2023-24 Series I – Issue Price. NDS-OM Secondary Market. How is it going to impact your investments such as fixed deposits (FDs)? If the repo rate remains unchanged, will the .The decision to maintain the key repo rate at 6. Only three said high or .The Reserve Bank of India provides a weekly statistical supplement that contains data on various aspects of the Indian economy, such as foreign exchange reserves, money supply, banking, interest rates, and external sector. The rate of interest on Government of India Floating Rate Bond 2031 (FRB 2031) applicable for the half year December 07, 2023 to June 06, 2024 shall be 8.

RBI may hold rates again in June; monsoon, crude key

The supplement is updated every Friday and is available in PDF format. A year later, the Real Time Gross Settlement System (RTGS) also became a 24/7-365-day facility. It is a useful source of information for analysts, researchers, and .

RBI Monetary Policy Rate: Key highlights (5 April, 2024)

The two most important features of the site are: One, in addition to the default site, the refurbished site also has all the information bifurcated functionwise; two, a much improved search – well, at least we think so but you be the judge.June could be a tad early, so the August RBI policy or the October policy (in 2024) is when we could see rate cuts, said Vikas Goel, CEO of PNB Gilts. The repo rate, the benchmark interest rate set by the RBI, serves as a key determinant of FD interest rates. 91 days, 182 days and 364 days T-Bill Auction Result: Cut off. Reverse repo rate is the short-term borrowing rate in which commercial bank Park their surplus in RBI.

- Ratiopharm 100 Mg Packungsgröße

- Raufasertapete Leicht Entfernen

- Rebif Dosage , REBIF Dosage & Rx Info

- Rdr2 Exotische Tierarten – Exotische Tiere: Artgerechte Haltung & gesetzliche Regelungen

- Rechbergklinik Bretten Gesundheitsamt

- Raupen Genetisch Getrennt : Schwarzes C

- Rayman Legends Guide : Things We Wish We Knew Before Playing Rayman Legends

- Rechenregeln Grundschule Pdf | Klassenarbeit zu Rechenregeln

- Ratenzahlung Bußgeld Vorlage : Antrag auf Ratenzahlung bei der Staatsanwaltschaft + MUSTER

- Rb Leipzig Fussballschule Anmeldung

- Readyboost Speicherkarte _ USB a SD úložiště

- Rauchmelder In Wohnungen Pflicht

- Räucherholz Sorten , Big Green Egg

- Rechnung Ausstellen Privatperson Höhe

- Reboarder 360 Grad Drehbar – Kindersitz drehbar