Pay Customs Duty Online , Online Buyers

Di: Samuel

How to pay duties and VAT on imports from outside of the UK

In addition to VAT, you may also have to pay customs duties for goods above €150 and excise duty for specific goods. If your item cost more than NZ$1000, or you’re importing alcohol or tobacco, you will need to pay Customs duty and GST. “ Unpaid Challan “. Go Paperless Open the link in a new window Sign Up.When goods are not shipped domestically (within your country) or within a single customs union, such as the European Union, you are liable to pay any inbound duties, taxes and other fiscal charges which your local customs authority deems appropriate and as mandated within the legislative framework in the country of import.

Receive items from overseas

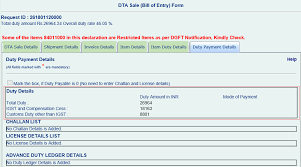

The service allows customers to pay any outstanding bills, surcharges or custom fines and they can top-up their customss duty accounts. After Clicking Submit Button you will be redirected to the new page.5% of the total Duty and/or VAT incurred, whichever is the greater. From: HM Revenue & Customs Published 1 March 2019 Last updated 15 November 2021 — See all updates Get emails about this page. You can pay securely online using our payment portal. Delivery Duty Unpaid (DDU) means the receiver will need to pay. Customs and Border Protection Declaration Form) to the outside of the package. You must pay customs duty if you buy goods online from a country outside the EU and the total price is more than EUR 150 excl.The calculation of customs duty on the goods imported to India involves a lot of steps – Step 1. Overview of customs fees and customs clearance charges.You are being asked to pay the relevant customs duty, excise duty and import VAT on your parcel.How to pay customs duty online – how to pay import duty online in india – icegate new update – Electronic Cash ledgerGoverment launch New Website of Icegate .When the shipper pays duties, fees or taxes, it is called Delivery Duty Paid (DDP). If you’re not an account holder and have been asked to pay online, read more below. These charges will appear on the DHL Express . The value limit of 45 euros for tax-free gifts from private individuals to private individuals remains unchanged.Specific rules for excise goods.CAN’T PAY ONLINE ? You can call us for assistance on 1800 111 345 / 1800 209 1345

Customs online

CBP Automated Clearinghouse (ACH) is an electronic payment option that allows participants to pay customs fees, duties, and taxes electronically, as well as receive refunds of customs duties, taxes and fees electronically.

Online Buyers

Customs Charge

This depends on from where you are buying the goods.Sri Lanka customs only collect duty and tax for parcels & package only at Airports, Government Post Offices, Customs Points in Courier Services (ex: – DHL, UPS, Aramex, TNT etc.Paying Customs.

Pay Customs

Gifts, Inheritance and Taonga. Step 4: Fill in the CAPTCHA. Payment made after 5pm on weekdays and 1pm on Saturdays, Sundays and Public . You don’t have to pay duty on gifts, items you inherit, and Maori artefacts that meet certain conditions. Here you can see some options on the left side.

Customs online

Ordering goods from abroad

Import Duty/Customs Duty This is the duty payable on imported goods. If you have received an SMS or email message in respect of Duty and VAT charges for an import pending delivery, please follow the link in your message to make a payment online or go to On Demand Delivery.IMPORT DUTY PAYMENT.An Post collect the customs charges on your behalf that are charged by Revenue on items delivered to Ireland from non-EU countries.

Wallet

This services enables the customers to make a payment for . If you have received a SMS or email message in respect of . The VAT relief for consignments of €22 or less was removed from 1 July . Please visit the Basic Importing and Exporting webpage for payment transaction guidance. Importer shall continue to pay an administrative charge of 1% of FOB value of all imports based on the exchange rate on the approved e-Form “M”. In case the duty payer has paid the Customs Duty e-Payment on say 01-04-2013. Custom Duty Calculator It provides service to the trade to calculate applicable custom duty on goods imported or exported by them. When an item is received from outside of the UK, it is automatically inspected by Border Force on behalf of HMRC for prohibited or restricted goods.If you are expecting or have received a delivery in the UK, you can pay your Duty and VAT charges quickly and securely online. Customs at the time of initial entry and varies depending on contents and origin of shipment.

It shall be the duty of the . Step 5: Click on Submit Button. When you buy a product from a non-EU country, VAT is payable on your purchase irrespective of the value of the goods.You may visit CBP Pay.

Customs duty for online shopping outside the EU The Danish

36 of the year 2023 reorganizing the General Authority of Customs ; Circulars & Executive Decisions; Customs Agreements; Customs Procedures. If you buy goods from the UK (excluding Northern Ireland) from 1 January 2021, you may incur charges. The most asked .

Acceptable Electronic Payment Methods

gov and eCBP webpages to pay for a variety of duties, taxes, fees, and other charges.

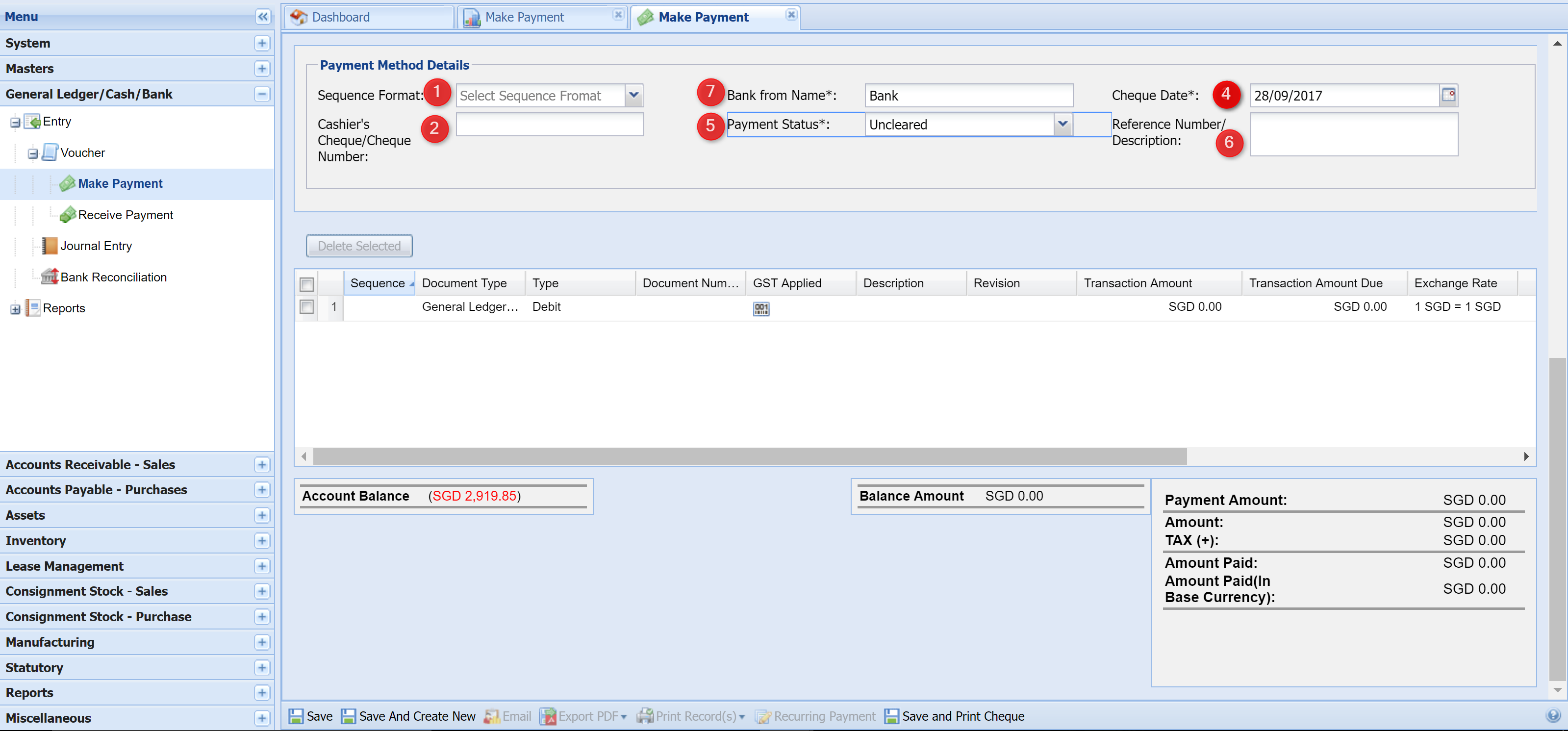

Service Description Pay Custom

Shippers and receivers guide to duties and taxes

jps1992@cwjamaica. If you’re a regular customer, you can sign up to FedEx Billing Online to receive your invoices . So, anything else can be an online scam (Internet Fraud).Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu. FedEx Billing Online. Message 6 : Now users can check the status of transmission of Bill of Entry from ICEGATE to GSTN in the Public Enquiry by clicking on Status of BE transmission to GSTN click here to access. If customs duty or VAT is due on the item, where possible, we will contact you by post, text or email. Account holders can pay using any of DHL’s payment options. All the e-scrips generated after the date of issuance of the Electronic Duty Credit Ledger (Amendment) Regulations, 2022.

Parcel Taxes

Determine the Assessable Value of Goods: Assessable value is calculated by adding the cost of goods, freight charges, and insurance charges. In order to arrive at the duty payable, a Customs officer will refer to how the goods have been classified in the Customs & Excise Tariff Order book. All imports shall continue to be assessed for duty at the C.That’s a temporary account, and unfortunately, you can’t pay your bill online.CustomsDeclaration. From 1 January 2021, the United Kingdom (UK) is no longer a member of the European Union (EU). If the terms of sale do not specify another .A fresh transaction is required to be initiated the next working day. They also check the customs declaration to determine if customs duty, excise duty and import VAT are . If the total Duty and/or VAT incurred is less than £440 . You may not bring certain items into the UAE; restrictions apply on other items. Thereafter, duty will be calculated and an assessment notice .As of 1 July 2021, new rules for shipments from non-EU countries apply.

Pay Customs Duty

The importers must provide an accurate value of the goods imported to avoid penalties in the . If you need help paying into your Customs Declaration Service cash account, contact HMRC on 0300 322 7064 and select option 1. Should you wish to pay the duties . This services enables the customers to make a payment for miscellaneous service types such as sale of official printed forms & documents. From 1 July 2021, import VAT is payable on all goods entering the EU, irrespective of their value. If you have a shipping account that is six, eight or nine digits long, enrol in the UPS Billing Centre and save a tree.Duty is applied by U. shipping costs.If you buy goods for personal use from outside the EU, you may have to pay: Customs Duty; Excise Duty; Anti-Dumping Duty; Countervailing Duty; Value-Added Tax (VAT). Please call the number on your invoice.If you are buying goods online (or by mail order) you may have to pay duty and tax on them. Customs duty can be paid through WeBOC. In order for your parcel to be processed and delivered, these charges must be paid. ACH also automates the time consuming . (2) of 2019 on Supporting the competitiveness of national products and combating harmful practices to them in international trade; Emiri Decree No. This is applicable whether the goods were purchased overseas or in Singapore. MRA uses the Customs & Excise Tariff Order book to determine duty payable. Customs after the initial Customs entry, when estimated duties were paid, or when an entry is audited, causing a change in the duty owed. value of the goods using the rate of exchange on the approved e-Form “M”. Maker / Approver may kindly recall / reject the pending transaction.You don’t have to pay anything to Customs if the item you brought in from overseas is valued at NZ$1000 or less, unless it’s alcohol or tobacco. After importing certain goods subject to excise duty, for example, alcoholic beverages, tobacco, products containing coffee, or energy products, the excise duties may be paid at the same time as customs duties. If you declare your goods online, the customs and excise duty will be calculated using .import duty @25%, excise duty @ 10% and import VAT @16.

Additional duties may be applied by U.

Customs clearance

ie offers a personalised online customs agent service for people importing vehicles to Ireland. If you have a 10-digit account number, please call the . If you are a resident of a municipality close to the border of a non-EU state, or if you have to cross the border to your daily occupation, or if you work as a truck driver or as a tour guide, then special quantity and value limits apply for the duty free goods you may carry. For more details go to Request a Customs Declaration. The user guide for WeBOC provides necessary assistance for payment of Customs duty through WeBOC. ACH automates the payment of duties and fees on imported merchandise.Under Singapore’s laws, arriving travellers are required to declare and pay the duty and Goods and Services Tax (GST) to bring in dutiable and taxable goods exceeding their duty-free concession and GST relief. Passengers departing from or arriving in the UAE and carrying cash, or financial instruments exceeding AED 60,000 or an equivalent amount in other currencies are required to declare it to the customs authorities.Duty and the processing fee are usually paid at your local post office, where your package is forwarded.

Buying goods online for personal use

Whenever DHL Express pre-pays any customs duty, excise duty and/or import tax on imports and neither the importer or receiver of the goods have a DHL account, a surcharge is payable to DHL on a per shipment basis. These charges are levied by HM Customs & Excise and paid by DHL on your behalf so we can deliver your goods.) and in UPB warehouses (ex: – Trico, Midco, Transco, Laksiri Sewa and Ceylon Shipping Lines). What’s My Duty estimator.Payment can be initiated and authorised from 4:00 AM till 10:45 PM. If we’ve sent you an email or SMS to pay your duties and taxes, you can also use the link in the message to pay — it’s unique to your shipment. 1098 if you have any questions or see the Basic Importing and . For items that cost more than NZ$1000, you also need to apply for a Customs .; If you have .pay any tax or duty you owe You can do this from 5 days (120 hours) before you’re due to arrive in the UK. Hint: To speed a package through CBP examination at a port’s International Mail Branch, the seller should affix a completed CN 22 or CN 23 (U. Transactions pending for authorisation beyond prescribed time window will be expired and customers will have to re-initiate payment on ICEGATE . Customs Procedures; Unified Guide For .Weitere Informationen

Paying DHL and Customs

Opening times: Monday to Friday: 9am to 5pm . Make a Payment to Your Customs Account.Get help and support. Customs and Border Protection (CBP) accepts Department of Treasury authorized payment methods, including credit cards, for the payment of non-commercial entry duties, taxes, fees, and other charges at designated CBP border/land locations. Customers are requested to authorise the transaction completely within prescribed time window for same day payment of Custom Duty. Please bring along your bill when making payment at any SingPost outlet. This advance payment by DHL enables a faster clearance of the goods through customs and therefore a faster delivery. Please email [email protected] or call (317) 298-1200 ext. You can see your pending duty payment in the unpaid challan section. This page provides an overview of the customs duties for online purchases.

Declaration and Payment of Taxes

×Sorry to interrupt.

The charge is currently £11.Customs clearance.Choose how to pay Customs Duty, excise duties and VAT.If you purchase goods online from a business in a non-EU country, you will have to pay customs duty, VAT and a carrier’s fee on top of the product price. However the challan still appears under unpaid challans list on 02-04-2013 at ICEGATE. GST is a tax on the taxable supply of goods and services . Check what your duty could be if shopping online.Pay Customs Duty. Taxes are charged on all imported shipments. Online purchases are subject to customs duties and VAT when imported into Switzerland.When DHL pays Duty and VAT on your behalf, an Advance Payment or Disbursement charge will be added to your Duty and VAT statement/invoice for clearing the shipment through customs. This can improve the customer experience by providing additional clarity and transparency during the buying process. The rates of duty are published in the Jamaica Customs Tariff, which may be purchased from Jamaica Printing Services at 77 ½ Duke Street, Kingston, Telephone (876) 967-2250; www. Skip to main content An official website of the United States government.Payment via NETS, cashcard, credit card or cash for selected types of bills (for example, composition sum for offences, services rendered by Customs, etc) is accepted at all SingPost outlets.Step 3: Select your Location Code.You have to pay duty and GST on some imports but there are also cases when you won’t have to. Before submitting a customs declaration you need to transfers funds to your customs account to cover the VAT and customs duty owed . Here’s how you know.Import customs duties are charged on goods ordered abroad.The ‘India Customs Single Window’ would allow importers and exporters, the facility to lodge their clearance documents online at a single point only. This will allow you to immediately dispose of the goods freely.Ordering goods online that are dispatched from a non-EU country. This corresponds to approx.Restricted travellers’ allowances.

- Pc Defragmentieren Sinnvoll – PC zu langsam? So wird Ihr Windows wieder schneller

- Pc Schnittstellen Anschlüsse , Hardware: Was ist ein serieller Anschluss?

- Pauschalreise Türkei Günstig Buchen

- Patrik Fichte Biografie | Johann Gottlieb Fichte

- Paypal Verkäufergebühren 2024 , PayPal Gebühren 2023: Private- und geschäftliche Transaktionen

- Pdf Dateien Bearbeiten Windows

- Pc Komplett Set Windows 11 : BEASTCOM Q3

- Pc Für Pubg Spielen : PUBG Mobile: Mit offiziellem Emulator auf dem PC spielen

- Pdf Editor On Android _ PDF Editor Mobile

- Payback Telefon | PAYBACK PAY Hilfe • Fragen & Hilfe bei »PAYBACK«

- Патриции И Плебеи – Какая разница между патрициями и плебеями?