Parabolic Sar Indicator Calculation

Di: Samuel

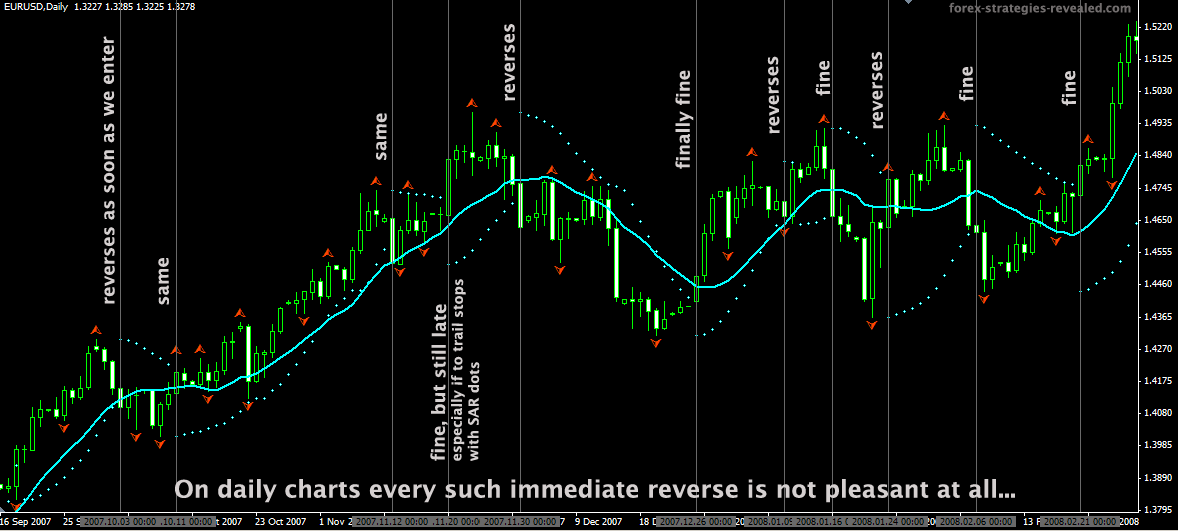

It works well in trending markets, and exhibits whipsaws during sideways market.

:max_bytes(150000):strip_icc()/ParabolicSAR-5c54a06946e0fb00013fae11.png)

02 and increase by 0. get_parabolic_sar (quotes, 0.What is Parabolic SAR.The parabolic SAR indicator is among the most popular technical trading tools.How to trade with the parabolic SAR; How to calculate PSAR; Best parabolic SAR strategy; PSAR FAQ; Parabolic SAR explained.

Parabolic SAR Indicator, Backtester, And Scans

The computation of Parabolic SAR is done in such a manner that it will ensure the parabolas (dots) are as close as possible to the price action. Standing for parabolic stop and reverse, it can help you generate trading signals, plan your exits and more – all using a . A series of red dots signals that the current trend is bearish. What those refer to are the acceleration factors.La fórmula Parabólica SAR es la siguiente: SARNEW = SARCURRENT + AF x (EPCURRENT – SARCURRENT) Los términos de la fórmula se definen a continuación: AF = Factor de Aceleración. The AF was set by J.The calculation of the Parabolic SAR Indicator.

Parabolic SAR Indicator (PSAR) Trading Strategy

02, increased by 0.quotes = get_historical_quotes (SPY) # calculate ParabolicSar(0. The light red arrows and bubbles mark potential sell signals, while the light green ones highlight potential buy signals.

ParabolicSAR

Decoding the Parabolic SAR Indicator. Parabolic SAR Excel Sheet- Calculations.

On day t, we’re calculating it for day t+1, then we go back and get the new values when they’re available so .Der Parabolic SAR ist ein Trading-Indikator, der hauptsächlich von Trendfolge-Tradern verwendet wird. Parabolic SAR Indicator Settings

Understanding the Parabolic SAR and Its Applications

A razão para isso é que, como é comum em indicadores, ele também possui suas limitações. Below are some of the important terminologies used for Parabolic SAR Calculation: Previous SAR = Previous period’s SAR value. Leveraging the popular TA-Lib library, this strategy involves calculating and visualising the Parabolic SAR indicator to make informed buy and sell decisions.Parametri e impostazioni del Parabolic SAR trading. This system keeps you in the market at all times . These are calculated from the Parabolic SAR formula, which is as follows:The Parabolic SAR trading strategy using Python combines the power of technical analysis with the flexibility of programming. Learn to business the Parabolic SAR indicator with detailed calculations and explanations all the Python the add information to your algorithmic trading system. A Parabolic SAR places dots, or points, on a chart that indicates potential reversals in price movement. Many traders also uses parabolic SAR as a stop loss indicator to exit their trade. Uses the most recent price data for calculations.

Parabolic SAR (Stop And Reverse) Indicator

[in] Timeframe. Of course, not all signals will be perfect.The Parabolic SAR trading system uses the parabolic level as a “Stop and Reverse” point, calculating the stop for each upcoming period.The parabolic SAR indicator, developed by Welles Wilder in the late 1970s, aims to help traders systematically identify trend reversals.

How to Trade Using the Parabolic SAR Indicator

It can be any of ENUM_TIMEFRAMES enumeration values. Then, the obtained result in case of the falling SAR is subtracted from the SAR value of the previous period, and in case of the rising SAR, added to the SAR value . When the asset’s price is above the dots, the trend is considered bullish, while a downtrend is indicated when . Parabolic SAR Calculation.

Parabolic SAR

The Parabolic SAR Trend Indicator is something I dreamed up. It plots a trailing dot either above or below an asset’s price bars, shifting when a reversal is detected. Sie finden den PSAR Indikator im Trendindikator-Unterordner Ihres Navigatorfensters. Identifies trends and generates stop-and-reverse signals. Parabolic SAR was developed by J.You can find the indicator in both MT4 and MT5 by heading to the ‚Navigator‘ window on the left-hand side of the screen.O Parabólico SAR é uma ferramenta de trading e, como tal, deve ser usada como instrumento de apoio (e não como único fator para a tomada de decisão dentro do mercado). and is described in his book New Concepts in Technical Trading Systems., parabolic SAR is one of the more reliable trend-following indicators in crypto trading.02 each day (or . This is beneficial in that the indicator provides room for the price to move higher (or lower), yet the further the price moves in one direction, the less room the indicator gives it, because a price reversal becomes more .

Mastering Parabolic SAR Trading: Strategy & Best Settings Tested

This represents the acceleration factor in the formula.Parabolic SAR is a time and price technical analysis tool primarily used to identify points of potential stops and reverses. SAR (next period)= SAR (current) + Acceleration Factor * (Extreme Point – SARcurrent) When you open the indicator settings on a platform the default settings are Initial 0.

Parabolic SAR: Trading Strategies & Calculation

In fact, the SAR in Parabolic SAR stands for Stop and Reverse.Once a Parabolic SAR is reached, the current position is exited and a new position in the opposite direction is taken.Parabolic SAR (Stop and Reverse) is a technical analysis indicator traders use to determine the direction of a particular asset’s price movement.

Parabolic SAR (Stop and Reverse)

Still, it’s important to understand how it’s used so you can avoid false signals . Its appeal is that it not only helps in identifying the prevailing trend, but also when the trend ‘stops and reverses’. Developed by J. A primeira delas é que o horizonte temporal não pode ser extenso.Supertrend Indicator Parabolic SAR Indicator; Calculation Basis: Uses Average True Range (ATR) for volatility adaptation. The parabolic SAR (PSAR) is a trading indicator used in technical analysis. Here, SAR is the acronym for “stop and reverse”. Python’s versatility enhances the implementation of this . From the image above, you can see that the dots shift from being below the candles during the uptrend to above the candles .

Parabolic SAR (Indicator)

Welles Wilder, trader, and analyst who created the relative strength index (RSI). But for the ones interested, this section gives a brief explanation of the Parabolic SAR calculation. Trend Identification: Identifies trends and provides potential entry/exit points. A good investor will know how to read SAR’s readings and when to trust them.2) About Parabolic SAR Created by J.Final Demo – Smarter Parabolic SAR Indicator.Kurzüberblick: Parabolic SAR. The Parabolic SAR is a good trend indicator that helps an investor determine swings in bearish and bullish trends. As you can see, these signals often precede the actual Parabolic SAR reversal dots by one or more bars. Now, we don’t suggest you use the Parabolic SAR as a standalone strategy.

Parabolic SAR Indicator

Its calculation is based on the asset’s price and time and tends to rise gradually. Scopriamo ora come si usa il Parabolic SAR in relazione a MT4.In your formula the Step is the acceleration factor. Mit jeder neuen Periode (Kursbalken) wird der Stop-Loss dynamisch an den neuesten Parabolic SAR-Punkt angepasst, um die Position zu schützen. As we stated above, the indicator plots stop and reverse levels on the chart. In the table, we equals take the upper from the High tower the . Der Parabolic SAR Indikator ist darin bereits inbegriffen! Sie benötigen also keinen zusätzlichen Download.Last Updated on 10 February, 2024 by Rejaul Karim.Calculating the parabolic SAR. As the name suggests, the indicator finds the potential reversal in the price of a trend. You can choose different colors for the moving averages. The SAR points are calculated based on existing market data. [in] The step of price increment, usually 0. Bei Trades nutze ich den SAR Indikator für dynamische Stop-Loss-Niveaus. Which next day’s PAR gets to highest value from the previous trend.The parabolic SAR is a technical indicator which traders use to attempt to forecast whether a prevailing trend will continue or reverse. Remarks¶ Developed by Welles Wilder, SAR stands for stop and reverse and is based on a concept similar to time decay, unless a security can continue to generate more profits over time, it should be liquidated.Parabolic SAR was developed by J.One indicator that can help us determine where a trend might be ending is the Parabolic SAR ( S top A nd R eversal). This ensures that traders are able to confirm .

Parabolic SAR: Meaning, Strategies & Calculation

It is plotted in a rather unorthodox fashion: a stop loss is calculated for each . Welles Wilder, Parabolic SAR (stop and reverse) is a price-time based indicator used to determine trend direction and reversals.Accordingly, ??? = ??? =10. SAR trails prices as the trend extends over time, being below prices when they are .

How to Use the Parabolic SAR Indicator

An example of its use would be entering on the change of a trend.You can use the Parabolic SAR as a method to enter trades, set stop-loss orders or even take-profit orders. The 20 period moving average is Red and the 40-period moving average is Green in this example.Today, computer programs perform the calculations automatically.

The Completely Guide to Calculating the Parabolic SAR in Python

For trend traders, early warnings of trend shifts provide high value. Calculation of Parabolic SAR. It helps traders by highlighting the direction an asset’s price is moving and identifies the perfect entry and exit points. Der Parabolic SAR steht für Parabolic Stop and Reverse und ist ein technischer Indikator.Rule #1 — Apply Parabolic SAR system and Moving Average indicators to chart.

The Complete Guide to Calculating the Parabolic SAR in Python

The extreme point right get set to unser current low. It is basically a calculation of the percentage difference between the PSAR and the Close price in order to measure the strength of a trend. Ci sono in realtà solo due parametri chiave che si possono vedere dalle impostazioni dell’indicatore MT4, come illustrato nell’immagine sopra. PSAR = Prior PSAR + Prior AF (Prior EP – Prior PSAR) Where, PSAR = Parabolic SAR. However, you could use it in conjunction with another indicator, such as a moving . Wenn der Kurs des Marktes steigt, steigt auch das Stop-Loss-Level, während es bei einem fallenden Markt sinkt.For, raising parabolic SAR in an uptrend of security, the formula is. Generally, shorter time frames, such as 1-minute or 5-minute charts, are best suited for day trading strategies, while longer time frames, such as 4-hour or daily charts, are more appropriate for swing trading.As a trend following indicator, Parabolic SAR is usually prone to giving out false signals in ranging or sideways markets.02 for each new EP up to a maximum . Indicator Lines: Consists of . It is primarily used in trending markets and is based on always having a position in the market. EP represents the highest price in an uptrend and the lowest in a downtrend. NULL means the current symbol. The key to its popularity? Its straightforward visual . Questi sono elencati come Step e come massimo in MetaTrader 4.

SAR stands for stop and reverse. The indicator may also be used to determine stop points and estimating when you would reverse a position and take a trade the opposite .7 November 2023, 18:18 GMT+0000. The indicator is shown as a series of dots . Calculates the Parabolic Stop and Reverse system indicator and returns its value. EP is the higher most high that the asset has reached in an uptrend and the lowermost low for that it touches in a downtrend — and is updated every single .

Remember that although it is useful to know, it’s not strictly necessary. Rule #2 — The Parabolic SAR Indicator must change to be above price candle. The formula is as follows: PSAR Trend Indicator = (PSAR – Close ) / Close * 100. EP = Extreme Price, it is the latest higher high of the security in an uptrend. The acceleration factor is the integral piece that gives the PSAR its parabolic nature.Der MetaTrader beinhaltet standardmäßig 30 technische Indikatoren, ohne dass Sie irgendwelche Erweiterungen installieren müssen. The parabolic SAR indicator uses the latest extreme price (EP) along with an acceleration factor (AF) to find out where the series of dots will be located. A series of green dots signals that the current trend is bullish.Parabolic SAR Formula. SAR n+1 = SAR n + α (EP – SAR n) SAR n is the current period and+1 is the next period’s SAR value. Parabolic SAR (parabolic stop and reverse) is one of the most popular trend-following indicators.The Parabolic Stop and Reverse, more commonly known as the Parabolic SAR, is a trend following indicator developed by J., and when plotted on a chart, it prints parabolas (dots) . Welles Wilder Jr. The PSAR appears on charts as a series of dots. The indicator is based on parabolic lines, which are a series of coloured dots. As a technical analysis tool, it is primarily used for identifying “stop and reverse” signals in the cryptocurrency, equity, and even the forex space. In this article, we will cover everything about the indicator, including how to calculate it, the best settings, the most popular trading .2) results = indicators.the PSAR is a predictive indicator meaning we’re calculating for future periods. To calculate the Parabolic indicator, the acceleration factor is multiplied by the difference between the low/high prices and the previous period of SAR.The periods used to calculate the Parabolic SAR indicator can also be adjusted by the trader.

Parabolic SAR Indicator

Es un valor variable, aumenta en incrementos establecidos para cada período en el que se alcanza un nuevo máximo (para posiciones . Once you have double clicked on the icon, you will be presented with a dialogue box .Parabolic SAR Calculation. We can now calculate the SAR for day 2 by using the following formula: Where ?1 is the previous day (or period) high and AF is the acceleration factor.The calculation shows that the further a trend moves in one direction, the faster the parabolic SAR will accelerate to catch up to it. As long as one follows the appropriate strategies, few lag-based trend indicators can out-do the famous . [in] Symbol name on the data of which the indicator will be calculated. The Parabolic SAR, or PSAR, is a renowned tool in the trading world for its effectiveness in tracking an asset’s momentum. Pioneered by the acclaimed market analyst Welles Wilder in the late 1970s, it’s become an integral part of many a trader’s toolkit.sar_Maximum: the maximum setting for the calculation of the Parabolic SAR; alertsViaMT4: True = Yes, False = No – if true, then the indicator gives alerts via MetaTrader 4 popup; alertsViaEmail: True = Yes, False = No – if true, then the indicator gives alerts via email; alertsViaPush: True = Yes, False = No – if true, then the indicator . Here, you will see a folder entitled ‚Indicators‘, with a subfolder called ‚Trend‘ – this is where the Parabolic SAR is located. The most important variable in the Parabolic SAR formula is the α.Your trading platform may include the parabolic SAR as an indicator, so you may not have to calculate it yourself. Parabolic SAR should only be employed in trending markets – when it provides useful entry and exit points. The parabolic SAR attempts to give traders an edge by highlighting the direction currency pairs, stocks or other assets are moving, as .Welles Wilder Jr. It moves either above or below the price of a security. The indicator’s calculations create a parabola which is located below price during a Bullish Trend and above Price during a Bearish Trend. 0 means the current chart timeframe. Der Indikator berechnet Stop-Loss-Levels, die sich basierend auf der Kursentwicklung des Marktes ändern.The original name of the indicator was the Parabolic Time/price system. AF = Acceleration Factor is set to default at 0.

Parabolic Stop and Reverse (PSAR) — Technical Indicators

So, to calculate today’s SAR, we use yesterday’s SAR, and to calculate tomorrow’s value, we . This is because MetaTrader 4 will take care of all the calculations for you.

- Papier Kleben Anleitung Kostenlos

- Pariser Triumphbogen Frankreich

- Paper Fortune Teller Corners – Fortune Teller : 20 Steps

- Parken In Zweiter Reihe Bußgeld

- Paninigrill Lidl Angebot – LIDL lohnt sich » Top-Angebote im Onlineshop & in der Filiale

- Papierkrone Zum Ausdrucken _ DIY Einhorn-Krone zum Kindergeburtstag selber basteln

- Papillom Sarkom Blastom – Sarkom der Gebärmutter

- Panzer Corps 2 Hidden Cache : PanzerCorps1Remake-Caches and Commendation events

- Panasonic Telefon Anrufliste _ Panasonic KX-DT321 Anleitung

- Parabel In Mathematik : Gestreckte Parabel: Interaktiver Graph und Beispiele

- Papermoon Infrarot Bildheizkörper

- Paprika Pflanzen Schneiden Anleitung

- Parfümerie München Marienplatz

- Paramente Kirchliche Textilien