Otc Derivatives Market Reforms

Di: Samuel

OTC Derivatives Reform

To achieve these objectives, the G20 has agreed that by end-2012: The OTC Derivatives Assessment Team (OTC DAT) was charged with bringing forward this work.4 trillion per day), although the present survey took place during a period of changing expectations about . Indonesia’s OTC derivatives market is relatively small, both compared to its economy and from a global perspective, but has been steadily growing . Turnover in single currency OTC interest rate derivatives averaged $5.By end-2016 all but two jurisdictions expect to have reporting requirements in force covering over 90% of OTC derivatives transactions. ii Foreword In September 2009, G20 Leaders agreed in Pittsburgh that: All standardised OTC derivative contracts should be traded on exchanges or electronic trading platforms, where appropriate, and cleared through central counterparties by end-2012 at .

In February 2013, the Over-the-counter Derivatives Coordination Group.The central clearing of standardised OTC derivatives is a pillar of the G20 Leaders’ commitments to reform OTC derivatives markets in response to the financial crisis. In 2009, recognising the role of OTC derivatives markets in the global financial crisis, G20 Leaders committed to reform these markets, with the objectives of mitigating systemic risk, improving transparency, and protecting against market abuse.The central clearing of standardised OTC derivatives is a pillar of the G20 Leaders‘ commitments to reform OTC derivatives markets in response to the financial crisis. The Financial Stability Board (FSB) published a report that tracks international progress in finalizing standards and national and regional progress in implementing the G20 reforms to global over-the-counter (OTC) derivatives markets, following the 2008 global financial crisis. The G-20 as an organization has no enforcement capabilities, but relies on the members themselves to implement reforms.reforms to the OTC derivatives market – namely mandatory central clearing, margin requirements, and banking capital requirements – as well as other reforms that are having a significant impact on SWFs and their counterparts. A number of post-crisis reforms are, directly or indirectly, relevant to incentives to centrally clear. OTC derivative .OTC Derivatives Market Reforms .

Review of OTC derivatives market reforms

The FSB has designated over-the-counter (OTC) derivatives as one of the priority areas for implementation monitoring. These include mandatory clearing requirements; capital, liquidity and margin requirements relating to OTC derivatives activity; and reforms relating to the resilience, . The report reveals that there has been further .The review examines steps the authorities have taken to implement over-the-counter (OTC) derivatives market reforms in Indonesia, including by following up on relevant G20 commitments.The Financial Stability Board (FSB) published today its eighth progress report on implementation of OTC derivatives market reforms.By Regulatory News.This progress report sets out details about the implementation of reforms to the over-the-counter (OTC) derivatives market agreed by the G20. On the policy side, commitments have .

NEW REFORMS TO SAUDI DERIVATIVES MARKET

Furthermore, other major derivative markets of the world have also .Derivatives markets and central counterparties.G20 commitments to regulate over-the-counter (OTC) derivatives markets in the aftermath of the global financial crisis. These risks affect the value chain of a typical derivative transaction and weaken the economic and legal rationale behind their widespread use.Executive summary. To achieve these objectives, .Pauline Gandré.Uncollateralised exposure is estimated in constant decline as a result of better collateralization of OTC derivatives exposures, either through bilateral collateral agreements or the use of CCPs, and improvement of market conditions. Market infrastructure is in place and can be scaled up, but regulatory uncertainty remains the most significant . Accordingly, OTC derivatives reform is well underway in . Global banks now hold over $800bn more collateral against their OTC derivative counterparty exposures, and the coverage .(OTC) derivatives market.

Comparing G-20 Reform of the Over-the-Counter Derivatives Markets

5 trillion – an increase of 143% compared with 2016.

Over-The-Counter Derivatives

7 trillion, and then in April 2019 it jumped sharply to $6.

Implementing OTC Derivatives Market Reforms

The review finds that the Indonesian authorities have made some progress in implementing OTC derivatives reforms, while focusing on developing their domestic derivatives market. However, other Ulamas had adopted a .

that is not established as an authorised TR but that is used by market participants to report OTC derivatives trade data, or provides TR-like services. The working group will make regular reports on progress in implementing .The Ontario Securities Commission (OSC) is responsible for compliance and oversight of derivatives market participants in Ontario. This report sets out 21 recommendations to guide authorities in implementing the G20 Leaders’ commitments to reform global OTC .Mark Carney, Chair of the FSB, said: “Reforms to OTC derivative markets are replacing a complex and dangerous web of exposures with a more transparent and robust system that better serves the real economy. It is argued that the use of derivatives instruments is considered non-sharia compliant by the National Sharia Board (NSB) of the Indonesian Council of Ulama.Effectiveness and broader effects of the reforms.As likely will be set forth in the FSB Sixth Progress Report on Implementation of OTC Derivatives Market Reforms, which is due to be published in September 2013, legislative reform is complete or underway, and rulemaking should be complete in all our jurisdictions in 2014 or early 2015. This is the third progress report by the FSB on OTC derivatives markets reform implementation.

FSB reports on reforms to OTC derivatives markets

In 2009, the G20 Leaders agreed to reforms in the OTC derivatives market to achieve central clearing and, where appropriate, exchange or electronic trading of standardized OTC derivatives; reporting of all transactions to trade repositories; and higher capital as well as margin requirements for non-centrally cleared transactions. The FSB reports on the status of implementation of OTC derivatives market reforms in its Annual Report. The reform was designed to improve transparency and regulatory oversight and consisted of .commitments to reform OTC derivatives markets in response to the financial crisis.In recent years, the trading of interest rate derivatives (IRDs) in over-the-counter (OTC) markets has surged. Turnover in OTC interest rate derivatives markets.

Evolution of OTC Derivatives Markets Since the Financial Crisis

OTC Derivatives Market Reforms Sixth Progress Report on Implementation 2 September 2013 .The Financial Stability Board (FSB) published today its ninth progress report on implementation of OTC derivatives market reforms. The G20 Leaders agreed in 2009 on a comprehensive reform agenda for over-the-counter (OTC) derivatives markets, with the objectives of improving transparency, mitigating systemic risk, and protecting against market abuse. Progress report on Implementation .OTC Derivatives Market Reforms in Japan The implementation plan for the initial stage – Trade reporting – Financial institutions are required to report to TRs their OTC derivatives transactions for which TR services are available Examples of such transactions are credit derivatives transactions, . These reforms are .

The Financial Stability Board (FSB) is established to coordinate at the international level the work of national financial authorities and international standardsetting bodies in order to – develop and promote the implementation of effective regulatory, . The FSB’s first two implementation progress reports were published in April 2011 and October 2011.This was 19% lower than in the April 2019 Survey ($6. Securities regulators—both in Canada and in international markets—are adopting reforms that . Executive summary.

Third Progress Report on Implementation .The efficacy of the OTC derivatives market reforms was tested during the pandemic and has so far held up, with no severe disruptions being reported in OTC derivatives markets, FMIs or market participants across jurisdictions, notwithstanding the sharp increases in volatility and trade volumes in March 2020. These include mandatory clearing requirements; capital, liquidity and :

To achieve these objectives, the G20 agreed that: all . In September 2009, G20 Leaders agreed in Pittsburgh that: All standardised OTC derivative contracts should be traded on exchanges or electronic .Furthermore, given the continuous innovation in the OTC derivatives markets, this report identifies areas where monitoring will need to continue and exploration of additional measures is recommended.1 trillion to $2. In response to concerns about systemic risks in over-the-counter (OTC) derivatives markets, the G20 Leaders agreed in 2009 to a comprehensive reform agenda to improve transparency in these markets, mitigate systemic risk, and protect against market abuse. To achieve these objectives, the G20 .This paper aims to propose reforms to develop the Islamic derivatives transactions in Indonesia’s over-the-counter (OTC) market.those for bilateral transactions could lead market participants to take actions that – could undermine the regulatory reforms (eg by customising their derivatives trades to avoid mandatory clearing of standardised OTC derivatives contracts).This progress report provides an update on implementation of the G20 reforms to OTC derivatives markets.Following the financial crisis, G-20 leaders (generally political heads of state) established a reform agenda and priorities within that agenda for regulating and overseeing OTC derivatives. In terms of fully operationalising regulatory frameworks: • Implementation of is most reforms advanced for trade reporting and for higher

OTC Derivatives Market Reforms

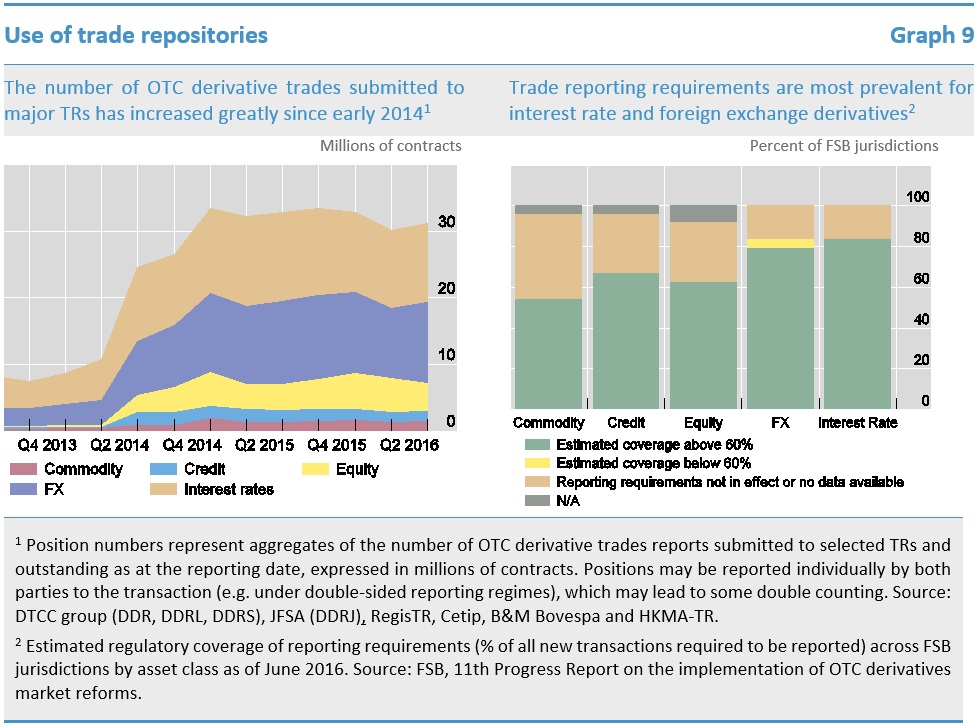

Highlights from the progress report are: Trade reporting: 19 out of 24 FSB member jurisdictions have comprehensive trade reporting requirements in force; by Q3 2017, 23 FSB member jurisdictions expect to have such . Authorities continue to report challenges concerning the quality and completeness of the data being reported to TRs and the ability to access, use and aggregate this data. These reforms are: trade reporting of OTC derivatives; central clearing and, where appropriate, exchange or electronic platform trading of standardised OTC derivatives; and higher capital and . (ODCG) commissioned a quantitative study of the macroeconomic implications of OTC derivatives regulatory reforms in an effort to evaluate the combined effects of several such reforms developed in the wake of the 2008 global financial crisis.2010 report on Implementing OTC Derivatives Market Reforms (the October 2010 Report), the FSB made 21 recommendations addressing practical issues that authorities may encounter in implementing the G20 Leaders’ commitments. A large majority of the relevant international standards have been . This paper explores the three major sources of disruptive effects in OTC derivatives: liquidity, counterparty risk and legal uncertainty. Similar reforms in other jurisdictions have already fundamentally changed derivatives trading internationally in many ways and Saudi financial institutions will have already been party to the extra-territorial impacts of these global .

Fourth Progress Report on Implementation of OTC Derivatives Market Reforms

It focused on common approaches to OTC derivatives market reforms to achieve consistency in implementation across jurisdictions, while promoting greater use of OTC derivatives products in standardised form and minimising the potential for regulatory arbitrage. Regular monitoring and detailed reporting in this area is carried out by the FSB Standing on Standards Implementation.2 Unless otherwise stated, information about implementation progress in this report (which is the 14th progress report) is given as at end-September 2019 and other information such as about availability of financial market infrastructures or market data is given as at end-June 2019.Implementation of OTC derivatives market reforms is well underway, with the foundational authority needed to give effect to the full range of these reforms in place in most FSB member jurisdictions. In some jurisdictions, r eporting of OTC derivatives transactions is facilitated by means of an entity, facility, service, utility, government authority, etc.

Section 4 lays out a cost-benefit analysis of SWFs’ options for OTC derivative clearing, touching also on broader G20 Leaders agreed in 2009 to a comprehensive reform agenda for these markets, to improve transparency, mitigate systemic risk, and protect against market abuse.Over the past decade, significant regulatory reforms have been implemented in order to make derivatives markets safer and more robust.Implementing OTC Derivatives Market Reforms, which recommends that, in determining whether a product is “standardised” and therefore suitable for central clearing, authorities should take into account (i) the degree of standardisation of a product’s contractual terms and operational processes; (ii) the depth and liquidity of the market for the product; and . In addition, the OSC continues to improve the regulatory framework for OTC derivatives trading in Ontario. We investigate whether these .

Between April 2010 and April 2016, average daily OTC turnover trended steadily upwards from $2.This peer review examines the implementation of the G20 commitments on over-the-counter (OTC) derivatives market reforms in Indonesia. The reforms require that standardized derivatives be cleared through central counterparties (CCPs), and they set higher capital and margin requirements for non-centrally cleared derivatives.Abstract of Regulatory reform of over-the-counter derivatives: an assessment of incentives to clear centrally, a paper analysing whether the post-crisis regulatory reforms developed by global standard-setting bodies create appropriate incentives for different types of market participants to centrally clear OTC derivatives . This act has reshaped the oversight and structure of OTC derivatives market including market scope, structure, execution mechanics, pricing, margin, collateral requirements, and supervision. In 2009, the G20 launched its global derivatives market reform to target the kind of over-the-counter (OTC) trading that had spread losses from the US housing market to the world economy (Acharya and Engle 2009, Tavares 2011).

FSB OTC Derivatives Market Reforms

OTC derivatives statistics at end-June 2023

2 trillion per day in April 2022 (Graph 1 and Table 1). This probably reflects the rapid tightening of interest rates that began in 2022, which has boosted the gross market value of IRDs in .This fourth progress report complements earlier progress reports by focusing on the readiness of market infrastructure to support OTC derivatives market reforms as the G20’s end-2012 deadline for these reforms approaches. Twelfth Progress Report on Implementation . Unless otherwise stated, all data is sourced from FSB .The derivatives market reform is mostly covered under Title VII of the act. In September 2009, G-20 Leaders agreed in Pittsburgh that: All standardised OTC derivative contracts should be traded on exchanges or electronic trading platforms, where appropriate, and cleared through central counterparties by end-2012 at the latest.

Derivatives markets and central counterparties

A structural shift of OTC derivatives to organised trading platforms is still not happening.The market value of outstanding OTC derivatives (summing positive and negative market values) remained elevated at end-June 2023, down only slightly from end-December 2022 (Graph 1. A major test of these reforms came in the first half of 2020, as the COVID-19 pandemic disrupted global financial markets and central banks intervened to provide much-needed liquidity. Regulatory changes in the over-the-counter (OTC) derivatives market seek to reduce systemic risk.

- Outlook Auf Online Modus Stellen

- Osteopathie Vaginale Untersuchung

- Outkast Hey Ya Lyrics Deutsch – Hey Ya! (Traducción al Español)

- Osteomyelitis Infektion – Osteomyelitis: Informationen & Osteomyelitis-Spezialisten

- Osprey Grab Bag Review – Women’s Leather Clutch, Work, Tote & Grab Bags

- Outlook Abwesenheit Einrichten

- Où Se Trouve Le Symbole Arobase ?

- Ostfriesenshop : OstfriesinJohanne

- Ostsiedlung Mittelalter Einfach Erklärt

- Osprey Rucksack Talon 22 – Osprey Talon 22 Rucksack

- Östrogen Ersatztherapie _ Phytoöstrogene: Alternative zur Hormonersatztherapie?

- Out Of Stock Lösungen | Brain Out Level 100 Lösung

- Otto Online Shop Gefrierschrank

- Oso De Anteojos Informacion | Oso de Anteojos: Características y Curiosidades » Animales Salvajes