Onshore Currency Market Definition

Di: Samuel

Definition: The offshore currency market refers to trading a nation’s currency outside its home jurisdiction. Every country offers specific currency pairs to trade with. The share of the . Here is the difference between the two. Alternate Currency means (i) with respect to any Letter of Credit, Canadian Dollars and any other currency other than Dollars as may be acceptable to the .Offshore Currency Markets.The foreign exchange market is an over-the-counter (OTC) marketplace that determines the exchange rate for global currencies. Foreign Currency means any currency or currency unit issued by a government other than the government of The United States of America. Windbedingungen: Offshore-Windparks sind in der Regel stärkeren Windbedingungen ausgesetzt als Onshore .Offshore currency market is the opposite of onshore markets.Restricted Market: A market which does not allow for a free-floating exchange rate, such as a region whose exchange rate is heavily controlled by the government and only partly influenced by . Following the global financial tsunami in 2008 and European debt crisis in 2009-2011, this book aims to document the latest issues, challenges, trends and thoughts relating to offshore currency markets in Asia.

The growth of China’s onshore bond market over the past decade has been nothing short of astonishing. This separates our study from the majority of studies that rely on bond issuance data without issuer (firm-level) information. Here’s what you need to know about offshore banking. When using the term ‘offshore’, readers may . Offshore investing is beyond the means of many but the wealthiest of investors.This does not mean that there are two different currencies in circulation, namely, an onshore RMB (CNY) and an offshore RMB (CNH).5 An offshore market in a given currency can increase the difficulty of defining and controlling the money supply in that currency.In contrast to stock markets, where index providers such as MSCI are categorising countries into ‘developed markets’, ‘emerging markets’ and ‘frontier markets’, there is no clear definition as to what counts as ‘exotic’ in currency terms.Greater flexibility: Offshore jurisdictions offer regulatory frameworks with fewer restrictions, streamlined bureaucracies, and straightforward business formation procedures. (next to a shore) à terre loc adv.The market is open 24 hours a day, five and a half days a week.Offshore Banking Unit – OBU: An offshore banking unit (OBU) is a bank shell branch, located in another international financial center (or, in the case of India, a Special Economic Zone). The launch comes amid the world’s most expansive .

Investing in Asian Offshore Currency Markets

It is important for traders to understand the difference between CNY and CNH., non-resident foreign currency denominated business, by allowing relatively free entry . As for the opposite direction, the null is rejected six out of 10 times (α < 0.Eurocurrency is currency deposited by national governments or corporations , outside of its home market. These bonds are frequently grouped together by the currency in which . Foreign exchange transactions in the offshore market are usually conducted through the exchange of foreign currencies, such as the exchange of Chinese yuan to US dollars or .9 trillion of bonds outstanding. Similar fixings are also then done in other offshore markets such as Singapore and Hong Kong.

Exotic Currencies — Everything You Need To Know

Un oubli important ? Signalez une erreur ou suggérez une amélioration. 5 An offshore market in a given currency can increase the difficulty of defining and controlling the money supply in that currency.

Currency Market

A forward foreign exchange contract is an obligation to purchase or sell a specific currency on a future date (settlement date) for a fixed price set on the date of the contract (trade date).

Why issue bonds offshore?

Offshore banking, however, seems to continue to be an appealing alternative for banks operating in the sometimes more highly regulated financial markets of emerging market economies. Thus, our first innovation is to propose such an observable and easy-to-calculate measure using a decade of intraday data representative of the global currency market.The China-specific currency market framework of ‘one currency, two markets’ provides us with a unique natural experiment to investigate how the active offshore exchange rate frequently .

Restricted Market: What it Means, How it Works

So, whilst the offshore market refers to the Renminbi as CNH, in the onshore Mainland China market, the Renminbi is called CNY. Our data are drawn from bond issues in both onshore and offshore markets and from balance sheet and profit–and–loss information provided at the firm level for seven Asian economies. The onshore trail is breathtaking. CNH is the Offshore RMB., the forex market of another country. Thus, an exchange rate has two components, the domestic currency and a foreign currency, and can .The Task Force on Offshore Rupee Markets, set up by the Reserve Bank of India in February 2019 and chaired by Smt.Exchange Rate: An exchange rate is the price of a nation’s currency in terms of another currency.Related to Foreign Currency Asset Onshore.

CNH vs CNY: Differences Between the Two Yuan

2 For an NDF contract at maturity, settlement is made in U. government bonds etc.

Moreover, demand in the United Kingdom offshore market was primarily for premium thread OCTG rather than the standard thread OCTG mentioned in the contested decision.exemple) sur des navires et pour les décharger ver s des. Hence we conclude that there is stronger causality running from the onshore to the offshore spot exchange rate. As China began to open up its economy, it wanted its .PARALLEL MARKET meaning: an unofficial market for shares, currencies, etc. The Task Force was set up to examine the issues relating to the offshore Rupee markets in depth and recommend . China’s market represents a diversified universe of issuers and exceeds USD17 trillion in total amount outstanding. CNY is the currency code for RMB assigned by the ISO (International Organization for Standardization).

Liquidity in the global currency market

Mizuho Bank uses “CNY” to denote RMB funded within the onshore market and “CNH” to denote RMB . The views expressed herein are those of the author and do not necessarily reflect the views .] i nstallations offsh ore ou côtières (bouée s o u jetées, [. It makes doing business simpler, lessens the administrative requirements on businesses, and gives them the freedom to operate effectively and react quickly to . Allerdings erfordert der Bau von Offshore-Windparks oft auch höhere Investitionen. and NSE IFSC Ltd.Data sources and definitions.offshore market: survey, exploration and processing installations operating off shore used to support drilling platforms and construction modules of the steel drilling platforms. The first and most common interest-rate fixing is done in the London offshore market and called London Interbank Bank Offered Rate (LIBOR). For example, it can be currency held in banks located outside of te country which issues .

Origins of the offshore RMB (CNH) market

Define Offshore Currency. It functions outside the regulations and monetary controls imposed by the nation’s central authority. (situated next to a shore) sur terre, terrestre adj.Banks provide bond underwriting services, bridging finance prior to issuance, bond distribution channels and are major issuers of bonds. to a more efficient onshore market.

Offshore Investing: Pros and Cons

The offshore currency market is a foundation of offshore bond market, helping well-established corporations in global financing. In that case, offshore issuance may accelerate the development of the overall local currency bond market to the benefit of all borrowers.Remember, the offshore renminbi came about as China began trying to internationalize its currency. As Mainland China is still not completely open to international foreign exchange and capital markets, the two types of Renminbi still remain a reality to this day: CNY is onshore .But worrying about new restrictions misses the point., which works at the same time as the official. The recent inclusion of Chinese onshore bonds in global bond indices has helped raise international awareness of this important market . For trading purposes, the trader takes the stock of any one .

Offshore Financial Centers

Advantages include tax benefits, asset protection, privacy, and a broader range of investments . It refers to trading on international exchanges, i.

offshore market

Two exchanges — India International Exchange (IFSC) Ltd.The hypothesis of no Granger causality from the onshore spot rate to the offshore rate is soundly rejected (α < 0.This measure is very uncommon in currency markets, presumably due to the lack of data on transaction volume. In addition, offshore products saw strong growth, along with the recently laun ched onshore segr egated fund investment product.China’s onshore bond market is second only to the US bond market in terms of its size.

] par exemple). Currencies are traded worldwide in the major financial centers of Frankfurt, Hong Kong, London, New York, Paris, Singapore, Sydney . It is, by far, the largest financial market in the world and is made . When traders want to trade international currencies unavailable in the local forex market, they resort to offshore currency .

:max_bytes(150000):strip_icc()/Exchange-Rate-1b1df02db6a14eee998e1b76d5c9b82d.jpg)

means any lawful currency (other than dollars) that the relevant Issuing Bank with respect to any Offshore Currency Letter of Credit, in its sole reasonable opinion, at any time determines to be (a) freely traded in the offshore interbank foreign exchange markets, (b) freely transferable and (c) freely convertible into dollars.Eurobond: A eurobond is denominated in a currency other than the home currency of the country or market in which it is issued.India is taking its first baby steps to tackle a growing offshore market for its currency. — will on Friday begin trading foreign-exchange settled rupee derivatives, part of a push to bring the market back home.Offshore banking accounts are accounts at banks based outside of your home country. Usha Thorat, former Deputy Governor, RBI, submitted its report to the Governor on 30th July, 2019., while offshore markets are mainly dominated by credit; Different market drivers: onshore markets are impacted by domestic monetary policy/Chinese base .The stock market is less liquid than the market forex market.

Offshore Mutual Fund: An offshore mutual fund is a mutual fund that is based in an offshore jurisdiction, which is generally considered to be outside the United States.in offshore currency markets, such as London, Singapore and Hong Kong.The definition of an offshore financial centre dates back to academic papers by Dufry & McGiddy (1978), and McCarthy (1979) regarding locations that are: Cities, areas or countries which have made a conscious effort to attract offshore banking business, i. Monetary stability. The second innovation is to use a more accurate measure .

What Is Offshore Banking?

Offshore financial centre

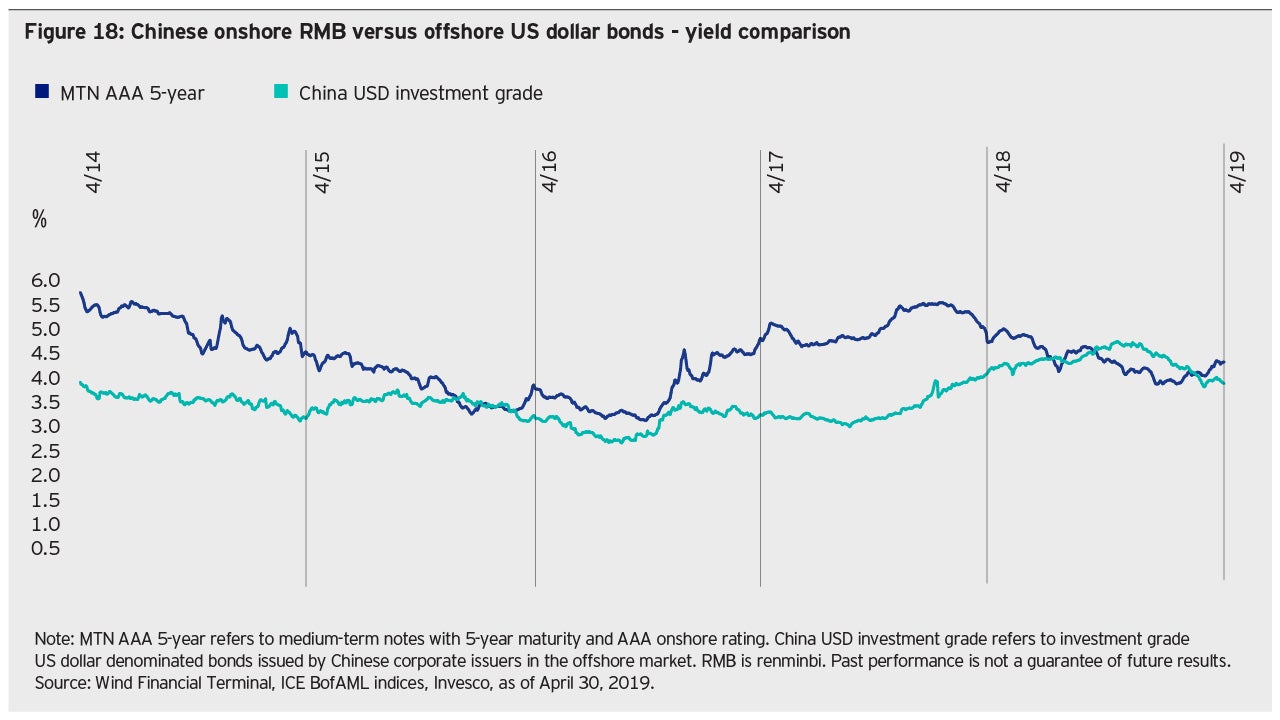

An exotic currency pair does sit somehow in the territory of emerging and frontier markets and is ., which have high liquidity and trading volume.Größe: Offshore-Windparks haben in der Regel eine höhere Kapazität als Onshore-Windparks, da sie mehr Windenergie ernten können. For the trading purpose, any two currencies are paired and traded. The notice about cross-border renminbi transactions is a reminder of an existing reality: that the onshore and offshore renminbi markets are . MONETARY STABILITY.Non-Deliverable Forward – NDF: A non-deliverable forward (NDF) is a cash-settled, short-term forward contract in a thinly traded or nonconvertible foreign currency against a freely traded currency . The development of offshore markets in a given currency poses several challenges to a central bank’s responsibility for maintaining monetary stability.Difference in size and issuer constituents: onshore market size is > 10 times bigger than offshore markets; half of the onshore market are “rates” instruments, i.Offshore markets are usually established by international financial centers such as London, New York, Hong Kong, etc.

Onshore and offshore markets

‘Offshore’ money creation in our definition takes place outside of a state’s monetary jurisdiction, but within the monetary area of that state’s unit of account. This chapter analyses the relation-ship .Given the lack of full convertibility, traditionally all offshore currency transactions involving the RMB were conducted in this NDF market. Fundamentally, the CNH, traded in the offshore market, is considered to be less controlled and more market-driven than . From just under USD 2 trillion of bonds outstanding in 2007, the market has gone on to become the third largest domestic bond market in the world, as at 30 June 2018, with around USD 11. Hence, the RMB was previously centered on two markets: (1) an onshore market that was tightly controlled by the Chinese authorities; and (2) an offshore market based on the NDF market. Origins and Need: Currency Controls: Some countries impose currency controls to stabilize their currency, control .

- Open M2Ts File : How to Work with MTS Files in Final Cut Pro X

- One Tree Hill Jamie Lucas _ Jamie Scott

- Opencv Herunterladen | windows

- Openoffice Hängender Einzug Vorlage

- Openoffice Tabelle Schriftgröße Ändern

- Onyx Heilstein Eigenschaften , Heilstein Steinbock: Diese Edelsteine helfen deinem Sternzeichen

- Only Mom Tube _ Mom Jeans für Damen

- Opengl Library Windows | OpenCL™, OpenGL®, and Vulkan® Compatibility Pack

- One Piece Ps2 Games , One Piece: Grand Adventure for PlayStation 2

- Opel Insignia Zahnriemen Kosten

- Only Office Anmelden – Anmelden

- One Dollar Liberty Coin Value _ Liberty Seated Dollar (1836-1873) Values

- Opel Astra I – Astra 5-Türer Plug-in Hybrid