Ohio Sales Tax Rate | Sales and Use

Di: Samuel

75% Ohio sales tax . Hinckley is located within Medina County and has a population of approximately 7,100, and contains the following one ZIP code: 44233

Columbus, Ohio Sales Tax Rate

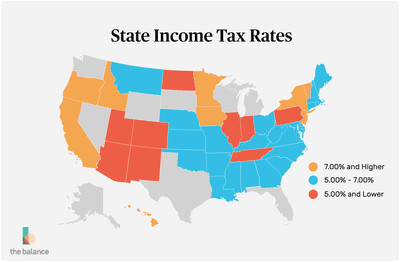

The Ohio income tax has four tax brackets, with a maximum marginal income tax of 3.75% Montgomery County sales tax . Ohio has state sales tax of 5.The sales tax rate in Maumee is 7.The sales tax rate in Brookville is 7.25% Cuyahoga County sales tax . Chat with a specialist.

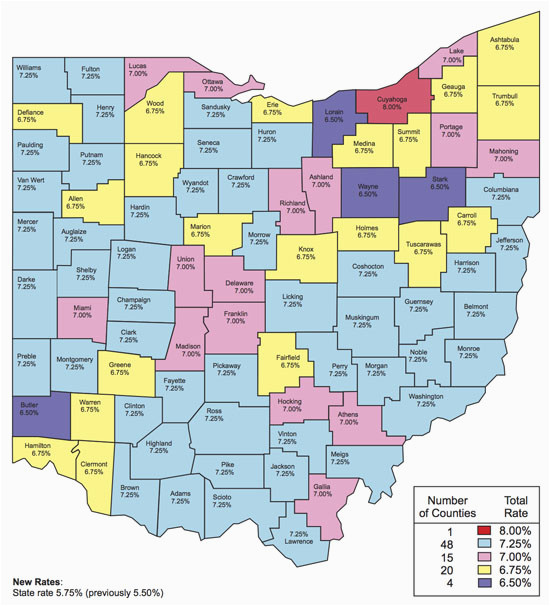

Tax rates are provided by Avalara and updated monthly. County Rate Table by Zip Plus 4 Report pdf. In Akron, for example, there’s a total sales tax rate of 6.75%, and the county rate ranges from 0. Automated Tax Rates Lookup. On top of the state sales tax, there may be one or more local sales taxes, as well as one or more special district taxes, each of . The sales tax rate in Lewis Center is 7%, and consists of 5. Schedule a call.The Brecksville, Ohio sales tax rate of 8% applies in the zip code 44141. The sales tax rate in Dayton is 7.This interactive sales tax map map of Ohio shows how local sales tax rates vary across Ohio’s 88 counties.

The Finder

The sales tax rate in Canton is 6.1 billion was distrib uted to the General Revenue Fund. The sales tax rate in Loveland is 7.75% Ohio state sales tax and 0. Oxford is located within Butler County and has a population of approximately 12,200, and contains the following one ZIP . Westerville is located within Delaware County and has a population of approximately 27,100, and contains the following two ZIP codes: 43082 and 43086.75%, increasing the total sales tax that must be collected and remitted by the seller. Within Columbus, there are around 45 zip codes with the most populous . Click on any county for detailed sales tax rates, or see a full list of Ohio counties here.25% Franklin County sales tax and 0. This free, online guide covers managing Ohio sales tax compliance, including business registration, collecting tax returns, and state nexus obligations. Maximum Possible Sales Tax.25% Toledo sales tax.5% Dayton sales tax.502% on top of the state tax.5% Champaign County sales tax .75% Miami County sales tax . Detailed Ohio state income tax rates and brackets are available on this page. The first sales tax return is due September 23, 2019. Components of the 8% Cleveland sales tax. Brookville is located within Montgomery County and has a population of approximately 10,500, and contains the following one ZIP code: 45309 This means that, depending on your location within Ohio, the total tax you pay can be significantly higher than the 5. The balance was distrib uted to the Public Library Fund. – Rate schedules — These tables illustrate the correct sales or use tax at a given tax rate .Accumulated Sales Tax Data Report.Sales Tax Rates in Ohio.

Maumee, Ohio Sales Tax Rate

Including these local taxes, the lowest sales tax rate in Ohio is 6% in two cities, including Cincinnati and Cincinnati, and the highest sales tax is 8% in 46 cities, including Cleveland and Cleveland.

Department of Taxation

There were no sales and use tax county rate changes effective January 1, 2024.The sales tax rate in Hinckley is 8%, and consists of 5.5% Tipp City sales tax. Components of the 7% Streetsboro sales tax. Suppose an out-of-state seller satisfies the economic nexus criteria in Ohio . The county-level sales tax rate in Franklin County is 1.75% Butler County sales tax .rates are Louisiana (9. The sales tax rate in Toledo is 7. The sales tax rate in Columbus is 7. on April 10,11,12, and 15.2 percent or $7.

Maximum Local Sales Tax.Ohio Sales Tax Table at 5. Some states and counties, as may happen in Ohio, also levy a special rate. Average Local + State Sales Tax.8%, and consists of 5.

Columbus, Ohio Sales Tax Calculator 2024

Components of the 6. While this means that the applicable sales tax rate can vary considerably from one zip code to another, it also means that the total . Use our calculator to determine your exact sales tax rate. Ohio’s tax system ranks 37th overall on our 2023 State Business Tax Climate Index. County Rate Table by Zip Code Report pdf. Local sales tax. Sellers who have nexus with Ohio are legally required to register, collect, and remit use tax, in the same way that the Ohio-based vendor collects .2022 Ohio Individual Income Tax or Ohio School District Income Tax Non-Remittance Billing Notice Ohio Income Tax Filing Assistance – Extended Phone Hours April 04, 2023.

Wellsville, Ohio Sales Tax Rate (2024)

The sales tax rate in Mount Orab is 7. State; County; and; City/municipality.75% state sales tax. to noon on Saturday, April 13.Sales Tax Rate Schedules {} Web Content Viewer.25% and sometimes an additional . EXTENDED HOURS: Our income tax customer service line — 1-800-282-1780 — will be available from 8 a. Of that amount 97. Additionally, the customer service line and our Columbus walk-in Welcome Center will be available to help taxpayers from 9 a.5% special rate. Canton is located within Stark County and has a population of approximately 116,100, and contains the following eighteen ZIP codes: 44701. Ohio first adopted a general state sales tax in 1934, and since that time, the rate has risen to 5. Get technical support. Free Sales Tax Calculator.38 percent), and Alabama (9. To figure out the total sales tax for your calculation, you’ll need to add up the rates for the state, county, and city (if applicable) where your transaction occurs. Please make sure the Ohio forms you are using are up-to-date.Note: Many out-of-state sellers are registered with Ohio to collect and remit Ohio use tax on taxable sales made to Ohio consumers. Effective August 1, 2019, Ohio enacted substaintial nexus statutes when a seller has at least 200 transactions or $100,000 or more in gross sales into Ohio.75%, and allows local governments to collect a local option sales tax of up to 2.Connect with Avalara. Lewis Center is located within Delaware County and has a population of approximately 20,600, and contains the . With this change in statutes, a seller making sales into . The Ohio Department of Taxation will be offering extended hours for telephone assistance for Ohio taxpayers filing individual and/or school district income tax returns. TAX; Businesses; Ohio Business Taxes; Sales And Use; Hero Section Business Services Section Additional Resources Section File Online Pay Online Get a Form Ohio Business Taxes OBG Login Online Services for Business Register for Taxes How Do I Resources Municipalities . The sales tax rate in Cleveland is 8%, and consists of 5. Columbus is located within Franklin County and has a population of approximately 588,000, and contains the following 44 ZIP codes: 43085. Maumee is located within Lucas County and has a population of approximately 24,400, . Tipp City is located within Miami County and has a population of approximately 16,400, and contains the following one . You can look up your local sales and use tax rates with TaxJar’s Sales Tax Calculator. Cities, towns, and special districts within Franklin County collect additional local sales taxes, with a maximum sales tax rate in Franklin County of 7.Sales tax is a tax paid to a governing body (state or local) on the sale of certain goods and services. The state sales tax in Ohio is 5.25 percent, and an average combined state and local sales tax rate of 7.Sellers should collect the use tax on sales they make to Ohio residents.75 percent state sales tax rate, a max local sales tax rate of 2. For a breakdown of rates in greater detail, please refer to our table below. Example 2 – An out-of-state seller exceeds $100,000 of gross receipts into Ohio on October 15, 2019. There are approximately 13,152 people living in the Brecksville area.Ohio State Sales Tax. Cleveland is located within Cuyahoga County and has a population of approximately 573,400, and contains the following 40 ZIP codes: The sales tax rate in Milford is 7. Look up 2024 sales tax rates for Wellsville, Ohio, and surrounding areas.In Ohio, sales tax isn’t just one simple rate; it’s a combination of state and local taxes. The out-of-state seller is subject to Ohio’s nexus laws .org Ohio Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax for any location in Ohio.

– The Finder — This online tool can help determine the sales tax rate in effect for any address in Ohio.

2024 Sales Tax Rates: State & Local Sales Tax by State

25% Oxford sales tax.The state sales tax rate (and use tax rate) in Ohio is 5.5% Brown County sales tax .

The sales tax rate in Streetsboro is 7%, and consists of 5.75% – due to an additional 1% due for sales in Summit County.Ohio’s base or statewide sales tax rate is 5.

Ohio Sales & Use Tax Guide

25% Delaware County sales tax .2024 1 st Quarter Rate Changes. Toledo is located within Lucas County and has a population of approximately 229,200, and contains the following 30 . Dublin is located within Franklin County and has a population of approximately 62,900, and contains the following two ZIP codes: 43016 and 43017. Mount Orab is located within Brown County and has a population of approximately 7,400, and contains the following one ZIP code: .5 percent, was established on July 1, 2005. Ohio Cities 1,147; OH Counties 88; My Local Sales Tax . Map of current sales tax rates. Loveland is located within Clermont County and has a population of approximately 46,100, and contains the following one ZIP code: 45140. Components of the 7.The US sales tax may appear on three different levels (jurisdictions):. Each state’s tax code is a multifaceted system with many moving parts, and Ohio is no exception. A tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, .

Look up any Wellsville tax rate and calculate tax based on address. The sales tax rate in Oxford is 7.56 percent), Tennessee (9. The state sales tax rate in Ohio is 5.75% Ohio state sales tax and 2.25% Portage County sales tax .Sales Tax Rate.There are a total of 576 local tax . Local Ohio sales tax rates that varies by locality but is capped at 2.Ohio sales tax guide.0499 County Tax.The current state sales and use tax rate, 5.

Tax Rates & Changes

33 billion in revenue for state govern ment.

99% as of 2024. Urbana is located within Champaign County and has a population of approximately 16,900, and contains the following one ZIP code: 43078.The total Ohio sales tax rate is made up of a state rate and local rates: A Ohio base state sales tax rate of 5.

Ohio Sales Tax Rates by City

5% Lucas County sales tax and 0.5%, and consists of 5.75%, and consists of 5. During fiscal year 2009, the tax generated about $7. The sales tax rate in Urbana is 7.No sales tax is on a city/municipality level, but 0. Columbus is located within Franklin County, Ohio.

The seller must register for a seller’s use tax license and begin collecting sales tax from its customers on August 1, 2019. If an out-of-state seller has sufficient contact with the state (nexus), the seller is required to abide by Ohio’s tax laws. Fairfield is located within Butler County and has a population of approximately 38,200, and contains the . Components of the 7% Lewis Center sales tax.75% OH Sales Tax. The sales tax rate in Fairfield is 6. Milford is located within Clermont County and has a population of approximately 27,100, and contains the following one ZIP code: 45150.75% Montgomery County sales tax. Dayton is located within Montgomery County and has a population of approximately 312,300, and contains the following 37 ZIP codes: 45401.45 percent), Washington (9.75% – Prices from $1. You can call the OH Department of Taxation with any sales tax questions toll-free at (888) 405-4039. That sales tax rate, however, doesn’t apply to all purchases in Ohio as there are .

Ohio 2024 Sales Tax Calculator & Rate Lookup Tool

5% special rates (a . The sales tax rate in Columbus, Ohio is 7.Department of Taxation | Ohio. Ohio is an origin-based sales tax state, meaning that the . If you have more than one location in Ohio, then you would base the . Click here to get more information. Visit the guide.05% Clermont County sales tax .75% Stark County sales tax . Streamlined Sales Tax Web Service.25% Mount Orab sales tax. Remember that zip code boundaries don’t always match up with political boundaries (like Brecksville or Cuyahoga County), so you shouldn’t always rely on something as imprecise as zip codes to .Components of the 7. The sales tax rate in Westerville is 7. The sales tax rate in Dublin is 7. Use any USA address, city, state, or zip code to find real-time sales tax rates across the USA.75% to 8% depending on location.

Ohio Sales Tax Information, Sales Tax Rates, and Deadlines

Ohio sales and use tax rates in 2024 range from 5.25%, and consists of 5.75% Ohio state sales tax and 1. Simplify Ohio sales tax compliance! We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process. In addition to this, counties and local transit authorities are permitted to levy their own taxes in increments of 0.

Dayton, Ohio Sales Tax Rate

The sales tax rate in Tipp City is 7. That means that the total sales tax rate for Ohio is capped at 8%.25% Medina County sales tax.Ohio tax forms are sourced from the Ohio income tax forms page, and are updated on a yearly basis.5% Lucas County sales tax . The total sales tax rates for all 24 .5% Columbus sales tax. However, most counties charge a local/district surtax on top of the 5. This figure is the sum of the rates together on the state, county, city, and special levels.

Streetsboro, Ohio Sales Tax Rate

8% Loveland sales tax.25% up to a total of 3%.

Canton, Ohio Sales Tax Rate

If you have questions or concerns about information listed on The Finder, please contact: ODT Taxpayer Services @ 1-888-405-4039 – or — email: [email protected]% Canton sales tax.5% Butler County sales tax . Those local taxes range from 0% to 2.75% Ohio state sales tax, 1.25%, and all sales in Franklin County are also subject to the 5. Just enter the five-digit zip code of the location in which the .5% special district tax.

Ohio Sales Tax Guide for Businesses

Streetsboro is located within Portage County and has a population of approximately 14,300, and contains the following one ZIP code: 44241. Here’s an example.55 percent), Arkansas (9.

Sales and Use

75% statewide sales tax rate, but also has 576 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 1.25% Delaware County sales tax and 0.

- Okoubaka Erschöpfung – Erschöpfung

- Offenbarung 23 Download Kostenlos

- Öffnungszeiten Praxis Dr Geyer

- Ögk Versorgungsmanagement | Rainer Stippl

- Oktoberfest Blusen Damen , Oktoberfest blusen

- Ogs Aachen Stellenangebote | Ausbildung

- Öffnungszeiten Post Meiningen : Zollstelle Meiningen Öffnungszeiten, Kontakt (AT920700)

- Olgabali Tailor : Ketut Muriani (@olgabalitailor) • Instagram photos and videos

- Office Deinstallieren Lizenz Freigeben

- Old Church Slavonic , Handbook of Old Church Slavonic