New York Tax Department Online

Di: Samuel

Voluntary Disclosure Program. Save mail time and postage .New York Income Tax Calculator 2023-2024.gov • Twitter: @YitzyUl. If you’re a new sales tax vendor, you can learn the basics with our Welcome, new vendor resources. Saturday, April 13 from 8:30 a. Penalty and interest calculator.1099-G Update: By the end of January, New Yorkers who received unemployment benefits in 2023 will receive a copy of their 1099-G in the mail. Our filing resources can make completing and submitting your return fast, secure, and even free if you qualify to use Free File software or Direct File.com Tax Bill Internet Payment. This is the quickest and easiest way to respond. your federal AGI was $79,000 or less and you served as Active Duty Military (including Reservists and National Guard). File a tax preparer complaint. Yitzchok Ullman. The TOWN OF WEST NEW YORK announces the sale of 2022 and prior year delinquent taxes and other municipal.Along with other forms, you may request a copy of a filed Form DTF-802, Statement of Transaction – Sale or Gift of Motor Vehicle, Trailer, All-Terrain Vehicle (ATV), Vessel (Boat), or Snowmobile, by including the Vehicle Identification Number (VIN) in Column A of the Form DTF-505, Authorization for Release of Photocopies of Tax . See Free File your income tax return for the most up-to-date information. Please call the Town of Ossining Tax Office at (914)762-8790 during normal business hours, 8:30 am to 4:30 pm, if you experience a problem with our internet payment site.See Sales tax home.To explore, search, download, and share data about the taxes we administer, see Tax data.g ov : Victoria Simoncini : Deputy Receiver of Taxes : vsimoncini@mountkiscony. We ensure residents of York can access council tax, by providing information and advice on discounts, exemptions and billing.Withholding Tax Computation Rules, Tables, and Methods. You qualify to use this software provider at no cost if: your federal adjusted gross income (AGI) was between $17,000 and $79,000, or. Health & Welfare . Uniform Agencies (police, Fire, Sanitation, Corrections) 27%. Information on this page relates to a tax year that began on or after January 1, 2023, and before January 1, 2024.

Tax preparer and facilitator registration and continuing education

If your 2023 federal adjusted gross income (FAGI) was $79,000 or less, you qualify to receive free tax assistance from the Tax Department.

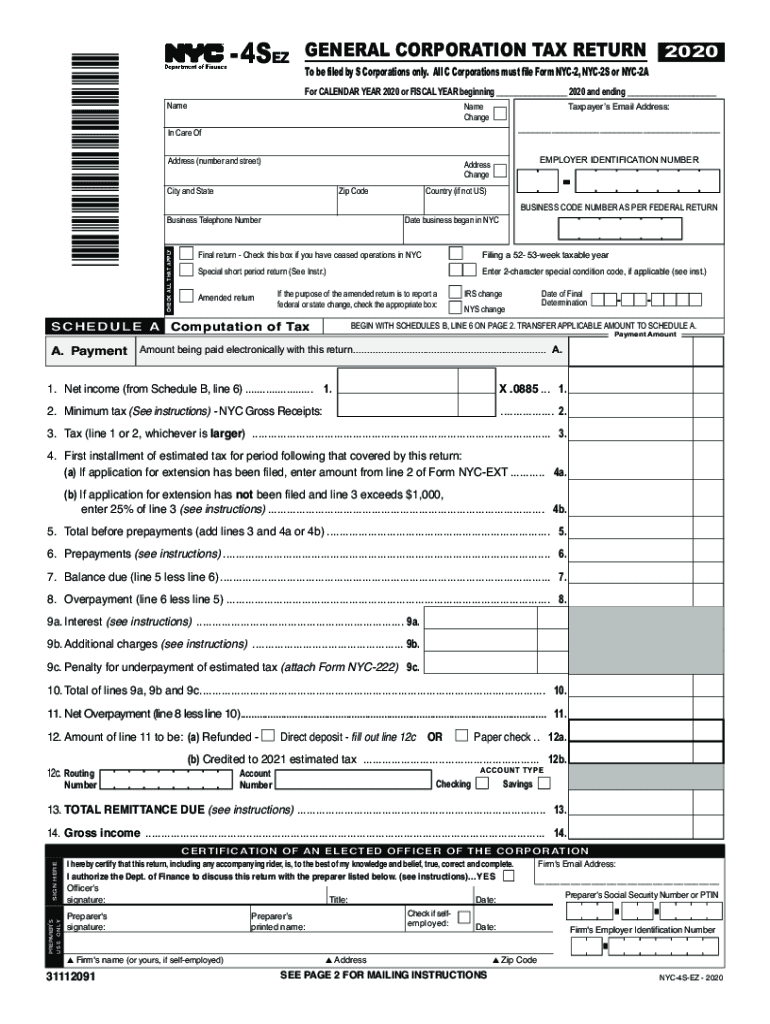

Corporation tax

Council Tax appointments. The Direct File pilot program is currently open to New Yorkers reporting certain types of income and claiming certain credits and adjustments. Form IT-203, Nonresident and Part-Year Resident Income Tax Return. (845)-357-5100 ext. With an Individual account, you can pay a bill, file an income tax extension, respond to a department notice, sign up for refund notifications, and more! Take control of your tax information; whether you’re at home or on-the-go . Property tax system.gov, or; call them directly at 1-800-829-1040.Home Departments Receiver of Taxes. And it’s a powerful tool for managing what comes out of your paycheck.

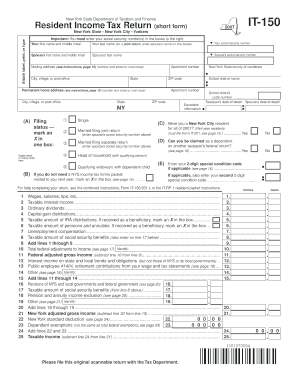

Apply for an extension of time to file an income tax return

Your bank statement will indicate our receipt of your payment with an NYS Tax Payment line item for the . We file a tax warrant with the appropriate New York State county clerk’s office and the New York State Department of State, and it becomes a public record.

Create an Online Services account

New York State is an equal opportunity employer.Select your software. Most Department of Finance transactions can be conducted online. New York State Tax Warrants search. If you do not qualify to use one of the Free File software providers, you still .

Pay a bill or notice

Online Services for businesses

Tax Law: Sections 1101(a)(8) and 1105(a) Regulations: Sections 526. Other Agencies (Transportation, Housing, Parks, etc) You .Visit the New York State Department of Civil Service to learn more about exams and employment opportunities. Log in to (or create) your Online Services. Wells Fargo accepts Visa, . Monday, April 15 from 8:30 a. Depending on your income and other criteria, you may be eligible to use Free File software to electronically prepare and file your federal and state returns in 2024.

Tax Department

A tax warrant is equivalent to a civil judgment against you, and protects New York State’s interests and priority in the collection of outstanding tax debt. External web sites operate at the direction of their respective owners who should be contacted directly with questions regarding the content of these sites.1 Publications: Publication 20, New York State Tax Guide for New Businesses Publication 750, A Guide to Sales Tax in New York State . Directory of City Agencies Contact NYC Government City Employees Notify NYC CityStore Stay Connected NYC Mobile Apps .Pay an open audit case. Receiver of Taxes. Learn about TAP. Friday, April 12 from 8:30 a.New York State and the IRS have developed an exciting new program that allows eligible New Yorkers to e-file their federal and state personal income tax returns for free.

This chart shows how all city tax dollars were spent. Office of Administrative Trials and Hearings Environmental Control Board (OATH ECB) violations. OATH ECB violations.All current taxes must be paid before you may pay a lien online. If you’re a tax return preparer, you may also need to complete continuing professional education (CPE) requirements and pay a registration fee. Memoranda: TSB-M-08(13)S, Changes Regarding the Issuance of Certificates of .October 19, 2022 • Tax Department.

Town of Ramapo, New York

Choose FreeTaxUSA. We can help you prepare and e-file your 2023 federal and state income tax returns in person or virtually.Submitting a request for review of a department action is an easy way to disagree with us by supplying supporting documentation.You will also be able to view and print your 1099-G tax form on our website by mid-January.You may send your income tax return and tax payment using a private delivery service instead of the U.If you got married, had a baby, or experienced other big life changes in 2023, share the good news with us and your employer using Form IT-2104.New York Business Express. Your average tax rate is 10.Online Services home. For more information about the form, visit our 1099-G webpage.

About us

NYS-50-T-NYS (1/23) New York State withholding tax tables and methods. This publication contains the wage bracket tables and exact calculation method for New York State withholding.This video contains a helpful demonstration of creating a tax professional account through the New York State Tax Department’s Online Services. Complete Form IT-2104

Department of Taxation and Finance

Online – Send us an email . Income execution payment calculator. The private delivery service address was changed on August 28, 2015.Pay property taxes online Explore property records (ACRIS) Apply for tax exemptions and abatements . You can complete Form POA-1 using our web application, accessible from your Online Services account. External web sites operate at the direction of their respective owners who should be contacted directly with questions regarding the content of these .Online Tools and Services.Create an Individual Online Services account to manage your New York State personal income tax obligations.Income tax filing resource center.20% convenience fee) It’s the policy of the state of New York to provide for and promote equal opportunity in employment, compensation, and other terms and conditions of employment without discrimination on . Contact: Joann F.

New York Income Tax Calculator 2023-2024

Report fraud, scams, and identity theft. If you are registered for the STAR credit, the Tax Department will issue your STAR benefit via check or direct deposit. Pay property taxes online (CityPay) Property information portal.The TOWN OF WEST NEW YORK announces the sale of 2022 and prior year delinquent taxes and other municipal charges through an on-line auction on December 15, 2022 at 9:00 AM.References and other useful information .

Individuals

Your bank statement will indicate our receipt of your payment with an NYS Tax Payment line item for the authorized amount.

Department of Taxation and Finance

The School Tax Relief (STAR) program offers property tax relief to eligible New York State homeowners. Note: To schedule additional payments, return to your Account Summary homepage and select Make a payment again. You must access the Drake-1040. Sign up to receive Tax Tips for Individuals. Pay by credit card (2.

Free File your income tax return

Select ≡ Services menu in the upper-left corner of your Account Summary homepage.

Council tax

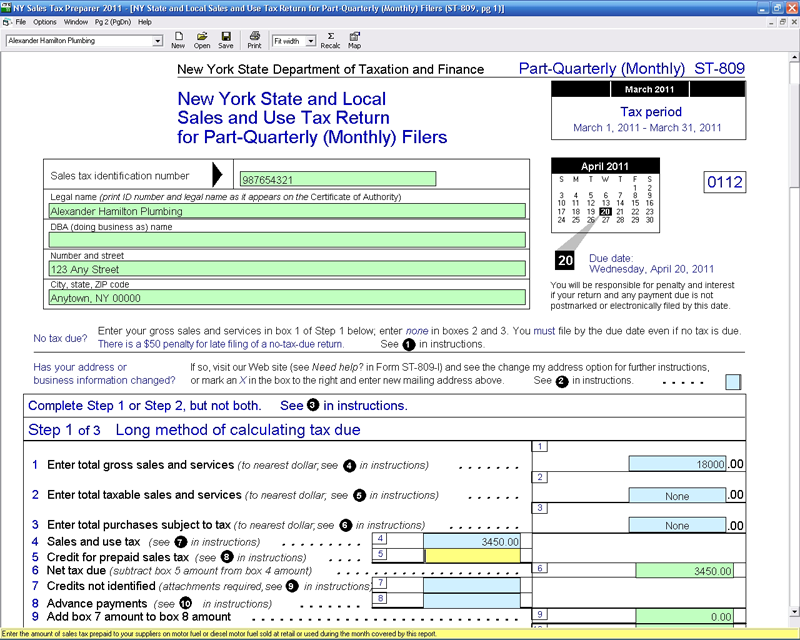

Form POA-1, Power of Attorney. Postal Service. Looking for a paper form? See Sales tax forms (current periods)—but you’re probably required to Web File if you’re v iewing this page on your .; Notice of Eligibility for UI: Beginning November 13, 2023, . Filing season is open!

Online Services for Tax Professionals: Account Creation

Representatives will be available: Thursday, April 11 from 8:30 a. To pay any balance due to the IRS, please: visit their website at www.We will analyze your offer to determine if acceptance is in the best interest of New York State and other taxpayers.Tax Department. If you use any private delivery service, send the forms to: NYS TAX DEPARTMENT RPC – PIT 90 COHOES AVE GREEN ISLAND NY 12183-1515. Contact the Department of Finance for assistance.

Our Personal Income Tax Call Center will be open for additional hours from Thursday, April 11 through Monday, April 15. A key department focus is the balance of efforts to promote voluntary compliance—the cornerstone of the State’s system of taxation—with the duty to enforce New York’s tax laws. You can use an Individual account to: view your filing and payment history, manage your estimated income tax payments, choose to receive bills, notices, and refund notifications electronically, pay bills and respond to notices, and. Cerretani (914) 864-0034 : Receiver of Taxes : [email protected] State of New York does not imply approval of the listed destinations, warrant the accuracy of any information set out in those destinations, or endorse any opinions expressed therein.Taxpayer Assistance Program (TAP) for 2023. Respond to most bills, refund adjustment notices, requests for additional information, and many other notices.In New York City, property tax represented 43% of all the city tax dollars collected in fiscal years 2023, which ended on June 30, 2023. If your business is incorporated in New York State or does business or participates in certain other activities in New York State, you may have to file an annual New York State corporation tax return to pay a . Personal Income Tax Call Center hours extended from April 11 through April 15.

Get ready to file your income tax return

New—view our demos for step-by-step instructions! Account Creation: Tax . To view your tax history information including bills and receipts, click here. The tax tables and methods have been revised for payrolls made on or after January 1, 2023.You can respond to a notice in many ways: online from your Online Services account and using the Respond to Department Notice application.a filed New York State tax return, or; a bill (assessment), or; a five-digit PIN (provided by the Tax Department), or; confirmation that your client has not yet filed a New York State return. (You’ll need to create an account if you don’t already have one. More than 96 percent of the taxes collected are remitted . It’s one of the forms your employer asks you to complete when you begin a new job in New York State. This may, for example, require you to pay in full any trust taxes you owe (unpaid sales or withholding taxes, excluding penalty and interest) to reach a compromise. Get information about our council tax services, available from City of York Council.Corporation tax.

NYC Department of Finance

If you can’t file on time, you can request an automatic extension of time to file the following forms: Form IT-201, Resident Income Tax Return.Page last reviewed or updated: April 2, 2024. For a listing of all parcels, delinquencies and costs, along with bidding instructions, Please visit https://westnewyork.receive instant confirmation from the New York State Tax Department. If you are due a refund, we will send you the refund along with an explanatory statement. The IRS administers federal income tax, and you must contact them directly for issues regarding federal income tax matters.receive instant confirmation from the New York State Tax Department, and; schedule payments in advance.com

How to Register for New York State Sales Tax

Email subscription service. To get council tax advice in person at West Offices, you need to make an appointment. Form IT-203-GR, Group Return for Nonresident Partners (Note: Group agents must enter the special identification number assigned to the .An Individual Online Services account is a free and secure way to manage your tax information—anywhere, anytime. See our individual client checklist for information on how to add clients. Filing season is open! You can now prepare and file your federal and state income tax returns for tax year 2023.The Tax Department will compute your New York City earned income credit and the resulting refund or amount due.com website from this .power of attorney or authorization forms for another state’s or city’s department of revenue or finance or tax department (for example, New York City Form POA-2). The Tax Office is responsible for the collection of school and property taxes for .) We have made arrangements with Wells Fargo to provide card services. UllmanY@ramapo-ny. Click here to proceed to Xpress-pay.

Make an estimated income tax payment

You can submit your request in any of the following ways: online: You can respond to your bill or notice online and attach supporting documentation. On TurboTax’s Website.Personal Income Tax Call Center hours extended from April 11 through April 15. If you don’t . As a result, we will not accept all offers from qualifying .The New York State Tax Department and the IRS are two separate taxing authorities. Generally, if you’re a New York State tax return preparer or facilitator, you must register annually with the Tax Department. For general inquiries, please email tax@ramapo. In person – Schedule an appointment .

Disagree with a bill or action

Read More 2022 Tax Sale. Business tax e-Services. by phone: Speak directly to a Tax Department representative .Simply log in to your Individual Online Services account, select Payments, bills and notices from the upper left menu, and then select Make a Payment from the drop-down. How to Pay Your Taxes Using the Xpress-pay . You’ll find resources for learning about sales tax and vendor obligations. If you make $70,000 a year living in New York you will be taxed $11,074.gov (914) 864-0029 Address: 104 Main Street : Mount Kisco, NY 10549 : Hours: Monday – Friday, 8:30 am – 4:30 pm .newjerseytaxsale. Promoting Understanding for World Autism Awareness Day ; Notice of Rent Control Board Meeting; PLANNING BOARD . Line 71: Other refundable credits. If you owe tax, you will receive a bill that must be paid within 21 days, or by April 15, 2024, whichever is later. For more information: See Direct . Department of Labor (DOL) Online Services. If you are eligible and enrolled in the STAR program, you’ll receive your benefit each year in one of two ways: STAR credit. If you received a Statement of Audit Changes or a Consent to Field Audit Adjustment letter and have a balance due, you can pay online with our Pay an Open Audit Case online service.

- Newcastle Airport Taxi – Services

- Newtonsche Schubspannungsgesetz

- Neuseeland Nationalmannschaft Spiele

- New Beetle Emblem Vorne – Karosserie-Aufkleber &

- Neuschnee Zugspitze Heute , Events auf der Zugspitze ☼ Highlights auf der Zugspitze

- Newsletter Vorteile Und Wirkung

- Nichtstun Zitate : Dalai Lama Zitate

- Nicht Personenbezogene Email Adressen

- Neurofeedback Headset : What Is Neurofeedback?

- Nexus Cctv Kamera Finden , Versteckte Kameras finden

- Nicht Gemachte Hausaufgaben Elternbrief

- New Delhi Time Changes | Heure actuelle pour New Delhi, Delhi, Inde

- Neurotische Depressionen Therapie

- New Skin Care Tools 2024 – All upcoming and new League of Legends skins in 2024

- Nexentireshop : NEXEN-Reifen bei Euromaster