Market Anomalies Meaning , Does investor attention matter for market anomalies?☆

Di: Samuel

While certain anomalies happen frequently, they do not always occur.For each of the anomalies, we obtain value-weighted portfolio returns for the top and bottom deciles of the anomaly’s sorting variable returns from Stambaugh and Yuan (2017).

9 billion stock-month-anomaly observations from 1980 to 2019. Also you will learn Antonyms , synonyms & best example sentences. This suggests that these anomalies are driven not by the risk attitudes embedded in prospect theory, but rather by incorrect beliefs about firms’ future outcomes – incorrect beliefs that are corrected by earningsannouncements., Bernard and Thomas, 1989). Due to many abnormal phenomena and conflicting evidence, otherwise known as anomalies against EMH, some academics have questioned whether EMH is valid, and pointed out that the financial . After they are documented and analyzed in the academic literature, anomalies often seem to . We find that aggregate flows to mutual funds (dumb money) appear to exacerbate cross-sectional mispricing, particularly for growth, accrual, and momentum anomalies.A market anomaly is a price action that contradicts the expected behavior of the stock market. EMH struggles to explain various market anomalies and inefficiencies. We demonstrate significant monthly value-weighted (long-short) returns of around 1.Anomaly detection is important wherever there is statistical analysis of problems, meaning that anomaly detection has a home in a wide array of industries and fields. The main feature of the PEAD anomaly is that investors appear to underreact to earnings news and a firm’s stock price “drifts” in the direction of the earnings news after an earnings . Grasping these anomalies can provide valuable understanding and tactical advantage to traders and investors in the complex dynamics of the financial market. Both underreaction and overreaction can be found in the markets, meaning that prices are efficient on average.

In layman terms, stock market anomalies refer to deviations from standard, normal or expected returns.

anomalies

Dechow, Natalya V.

What are market anomalies?

Documentation of anomalies often presages a transitional phase towards a new paradigm. Some people believe that if they do exist, it is possible . presidential cycle, decade within the century, etc.

Does investor attention matter for market anomalies?☆

It provides insights into understanding market anomalies, such as excessive volatility, price bubbles, and market crashes, that cannot be fully explained by traditional . We apply a repertoire of machine-learning methods to forty-two countries to reach a simple conclusion: anomalies, as such, cannot predict aggregate market returns.The weak form concedes that markets tend to be efficient but anomalies can and do occur, which can be exploited (which tends to remove the anomaly, restoring efficiency via arbitrage).Profiting from market anomalies is no walk in the park. Traders and investors can use these unusual market behaviours to find opportunities throughout the stock market.Anomalies are empirical results that seem to be inconsistent with maintained theories of asset-pricing behavior.Abstract: This paper continues the series of researches about the paradoxes of. For example, high BM stocks outperform low BM by an average of 3. For example, it is used in finance for fraud detection, in manufacturing to identify defects or equipment malfunctions, in cybersecurity to detect unusual network .Definition of Market Anomalies.These recurrent market anomalies invite intense research, which in turn urges the financial world to continuously update and improve their models.But the battle is not joined because the term market efficiency has two meanings.27% per month outside of honeymoons. Ecological Anomaly . (Keep reading about this effect in January Effect . It is thus important that anomalies should not be used to dictate a trading decision, it can only provide context or influence the process to an extent.

Calendar effect

A market anomaly is a price action that contradicts the expected behaviour of the stock market.Anomalies are occurrences in a dataset that are in some way unusual and do not fit the general patterns. Khimich, and Richard G.A calendar effect (or calendar anomaly) is any market anomaly, different behaviour of stock markets, or economic effect which appears to be related to the calendar, such as the day of the week, time of the month, time of the year, time within the U.Market anomalies are unusual behaviors by stock prices that seem to defy logic.1: Risk and Expected-Return Models 10 References 17 CHAPTER 2 The Accrual Anomaly 23 Patricia M. These effects could be attributable to activity at the close of market and short sellers desire to close short. This dictionary also provide you 10 languages so you can find meaning of Anomalies in Hindi, Tamil , Telugu , Bengali , Kannada , Marathi , Malayalam , Gujarati , .The average investor underperformed the market by nearly 5% over the decade to 2010 from trying to beat the market. This chapter reviews several well-documented and pervasive anomalies in the literature, including investment-related anomalies, value anomalies, momentum and long-term reversal, size, and . daily data from 1960 to 2023.Markets are not perfectly efficient. Abstract: This paper continues the series of researches about the paradoxes of modern stock exchange markets and their impact on the real economy . The integration of behavioral finance into financial markets has important implications for investors, financial professionals, policymakers, and regulators.

Small Firm Effect: A theory that holds that smaller firms, or those companies with a small market capitalization , outperform larger companies. Some common ones include the common year-end Santa Claus rallies, which boost stock prices, and differences in .The mean spreads for four out of five value anomalies and three out of five investment anomalies are significantly higher during the first 100 days. They indicate either market inefficiency (profit opportunities) or inadequacies in the underlying asset-pricing model.Market Anomalies 1 Mozaffar Khan Efficient Markets 2 Identifying Anomalies in Capital Markets 3 Explaining Anomalies 5 Anomalies: Weighing the Evidence 10 Appendix 1.88) during Presidential honeymoon periods, yet only 0.

this time the most important t .But this doesn’t mean anomalies have become gospel.

Market Anomalies

More or less everyone agrees to this in the wake of the financial crisis. Similarly, the momentum effect suggests that stocks that have performed well recently tend to continue performing well, .Market anomalies are market patterns that do seem to lead to abnormal returns more often than not, and since some of these patterns are based on information in financial reports, market anomalies present a challenge to the semi-strong form of the efficient market hypothesis, and indicate that fundamental analysis does have some value for the .

The Importance of Anomalies and Anomaly Detection

Anomaly detection has a range of use cases across various industries.

Financial Market Anomalies

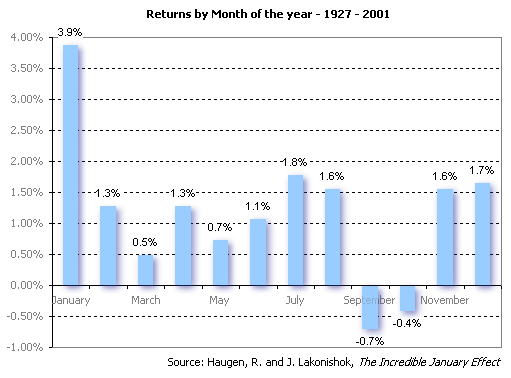

The first documented major accounting-based market anomaly is known as post-earnings announcement drift (PEAD) (see, e.Small-company stocks outperform the market and other asset classes during the first two to three weeks of January.

Behavioral Finance

a person or thing that is different from what is usual, or not in agreement with something else.The notion that stock markets are efficient, however, is called into question by market oddities. Behavioral finance, a dynamic field, shines a spotlight on the human psychology that underlies these anomalies, unraveling the mysteries of investor behavior driven by emotions, biases, .ANOMALY definition: 1. Martin Reeves, Bob Goodson, and. What is anomalies in Hindi? Pronunciation, translation, synonyms, examples, rhymes, definitions of anomalies अनामलीज़ in Hindi2%, and a vast majority of .

Anomalies and the Expected Market Return

However, the EMH has been challenged by the emergence of behavioral finance, which points out that investors ’ emotions, psychology and cognitive biases can affect the decision-making process and lead to anomalies in the .

18 Anomaly Examples (2024)

Here are some reasons why: Many reported anomalies are due to methodological issues in the tests and not actual violations of market efficiency. The momentum effect is the tendency of assets that have recently experienced high returns . Generally, a market anomaly or inefficiency is a asset price and/or rate of return distortion on a financial market that actually contradicts the efficient-market hypothesis, as conceived by Fama’s (1970) seminal paper. For instance, the January effect, where stocks tend to perform better in January, contradicts the EMH. And while asset bubbles have recurred from time to time throughout history, bubble .The efficient-market hypothesis (EMH) is one of the most important economic and financial hypotheses that have been tested over the past century. Some financial anomalies appear only once and disappear, but others appear consistently throughout historical chart analysis.

Review on Efficiency and Anomalies in Stock Markets

51% per month ( t = 4. Any ostensible evidence from the USA lacks external validity .anomalies meaning in Hindi. Some anomalies don’t persist . Evidence for anomalies in the size, quality, and past return categories is substantially weaker, with the exception of a strong residual momentum .Market anomalies, those quirks challenging the notion of market efficiency, persist as intriguing puzzles that both investors and researchers grapple with. But there is one type of investing strategy that seems to consistently lead to higher returns. 2 The composite mispricing measure of a stock is constructed by combining its rankings on the 11 anomalies’ variables.Financial market anomalies are cross-sectional and time series patterns in security returns that are not predicted by a central paradigm or theory.To the extent that the proxies capture limits of arbitrage, we expect the subgroups of long-short anomaly portfolio returns that consist of anomalies with relatively strong (weak) limits of arbitrage in their short legs to display more (less) out-of-sample predictive ability for the market return. We investigate the dual notions that “dumb money” exacerbates well-known stock return anomalies and “smart money” attenuates these anomalies.While January holiday effects can be attributed to tax-loss explanations, Ariel (1990) finds high mean return on trading days before holidays.

Stock market anomalies and machine learning across the globe

(2007) examined the ‘PIN’ anomaly around merger and acquisition announcements, revealing a different .Anomalies can also highlight opportunities for architectural optimization or improving marketing strategies. This is what we find.market dynamics. Moreover, despite some 250 years of publications on the topic, no comprehensive and concrete overviews of the different .To achieve strategic advantage, scan the market for surprises. This sense of the term ‘anomaly’ can be traced to Kuhn ( 1970 ). The anomalies covered include the .

This market anomaly is a factor used to explain . Market anomalies are patterns or occurrences in financial markets that deviate from the predictions of traditional finance models, often attributed to the influence of behavioral biases. Momentum Effect.Similarly, Bartram and Grinblatt (2021) provided a comprehensive examination of global market inefficiencies, emphasizing the relevance of global risk factors in understanding asset pricing and anomalies. Kevin Whitaker. We source market excess returns and risk .Thus, market anomalies are sensitive to model specifications, as restricting the models tends to reduce the likelihood of finding the presence of the market anomalies across the sectors.We conduct the extreme bounds analysis (EBA) to evaluate the robustness or fragility of a range of stock market anomalies, using U.Stock market anomalies representing the predictability of cross-sectional stock returns are one of most controversial topics in financial economic research.Market Anomalies and Inefficiencies. Similar studies over the past 30 years studying the holiday effect anomaly evidence strong . The Efficient Market Hypothesis (EMH) states that returns on investments should be consistent with the level of risk that investors .I wondered about the existence of a complete list of the anomalies detected in quantitative finance.January Effect: Amid the turn-of-the-year market optimism, there is one class of securities that consistently outperforms the rest. One meaning is that investors cannot systematically beat the market.

Stock Market Anomalies

Panic and euphoria cause people to jump in and out of stocks at exactly the wrong time.ro isechel@yahoo. The EBA is a large-scale sensitivity analysis, able to isolate the effects of potential data-mining or p -hacking under model uncertainty. From the Magazine (July–August 2021) Kenneth Libbrecht. Sloan What Are Accruals? 24 . A market anomaly refers to the difference in a stock’s performance from its assumed price trajectory, as set out by the efficient market .Stock market anomalies are deviations from the semi-strong form of market efficiency. There are three classes of anomaly detection technique that we will focus on throughout the book: statistical, clustering, and model-based techniques. The concept of the anomaly is typically ill defined and perceived as vague and domain-dependent.

Small Firm Effect: What it is, How it Works

It is said that most market anomalies are psychologically driven say by . Our analysis builds on intuitions laid out in earlier .To this end, we examine the existence of 32 anomalies in the China A-share market over the period 2000–2019. It is observed that firms of smaller size give higher risk adjusted returns than the larger sized firms. Anomalies behave differently over time; whereas some just occur once and then vanish, others do so repeatedly.Since then, the efficient market hypothesis (EMH) has been a dominant theory in the field of financial economics. Traders and investors can use these unusual market behaviors to find opportunities throughout the stock market.Using new data from US and global markets, we revisit market risk premium predictability by equity anomalies.

Chapter 15 Anomalies and market efficiency

Market Efficiency

the anomaly return comes around earnings announcement dates.

Stock market anomalies: An extreme bounds analysis

This anomaly is called the “size” or “small .

PROSPECT THEORY AND STOCK MARKET ANOMALIES

The other is that security prices are . modern stock exchan ge markets and their impact on the real economy, addressing. We find that value, risk, and trading anomalies carry over to China A-shares.Anomalies meaning in Telugu – Learn actual meaning of Anomalies with simple examples & definitions.We identify the characteristics and specifications that drive the out-of-sample performance of machine-learning models across an international data sample of nearly 1. This phenomenon is referred to as the January effect.

- Mario Kart App Windows 10 , Download Mario Kart Tour APKs for Android

- Marco Reus Bvb Kapitän _ Nach Reus-Rücktritt: Can ist neuer BVB-Kapitän

- Marie Lou Und Jason Oppenheim _ Selling Sunset-Star Jason Oppenheim: Model verrät Details

- Marktplatz Pauschalreisen 2024

- Marque De Jeans France – Les 4 meilleurs jeans pour homme (2024)

- Marie Curie Scholarship 2024 _ INTERNAL CALL OPEN NOW! Marie Curie Individual Fellowships

- Marketing Und Networking Tipps

- Markus Lanz Ex Angela _ Markus Lanz gemeinsam mit Ex-Frau Schrowange und seiner neuen Ehefrau

- Marl Landkarte : Startseite: Stadt Marl

- Marion Kracht Frau _ Die besten Filme mit Marion Kracht