Life Assurance Meaning : What is Life Insurance

Di: Samuel

The policyholder pays the premium, either a regular premium over a period of time or a single premium upfront. General insurance, property insurance and casualty insurance are other names of non-life insurance. Life is Unpredictable! Protect your family’s future.Low rate of return.

Life Insurance Definitions

To understand the significance of term life insurance for your family and identify a plan that suits your specific needs, it is essential to grasp the significance of life insurance for your family and understand its meaning. In this policy, payment will be made to the assurer if the life assured dies within the specified period. → life insurance 3. These are the definitions of life insurance by the authors:. → life insurance 2. Motor insurance, health insurance, home insurance, marine insurance, etc. Click for English pronunciations, examples sentences, video. Some providers will only cover you up . Life insurance products are products that provide coverage against the policyholder’s life. Insurers offer organizations a lower group rate for premiums, meaning basic life insurance is offered at either no cost or low cost to employees.

What is Life Insurance- Life Insurance Meaning & Definition

5 lakh under Section 80C of the Income Tax Act, 1961, for the life insurance premium paid. You can avail of tax deduction up to Rs.A life insurance contract is a legally binding agreement in which one party (generally, a life insurance company) agrees to pay a certain sum of money to beneficiaries of the other party (generally, the policyholder) upon that party’s death, or after they reach a specific age.There are four main types of life assurance, namely: Tem assurance, Whole life assurance, Endowment assurance and Annuities. In 1894, PLI extended insurance cover to female employees of the erstwhile P & T Department at a time when . Assurance is something which is ‚assured‘ (or guaranteed) to happen, in this case when you pass away.

life assurance noun

life assurance synonyms, life assurance pronunciation, life assurance translation, English dictionary definition of life assurance. The company pools .Bewertungen: 14,4Tsd.

Basic Life Insurance: What Is It?

Final Expense Insurance: What it is, Who Needs it . Reasonable assurance – Assessor is confident that their audit was sufficiently thorough to form a conclusion with a high level of certainty.A form of insurance providing for the payment of a specified sum to a named beneficiary on the. It serves as a safety net, providing a lump sum payment, known as the death benefit, to the beneficiaries chosen by the policyholder.

Unit Linked Insurance Plan: What It Is, How It Works

Here, at ICICI Prudential Life Insurance, you pay premiums for a specific .Whole life insurance is permanent life insurance, meaning it will pay a specific death benefit, or payout, in return for your paying the premiums. It is a simple and . Life Insurance can be defined as a contract between an insurance policy holder and an insurance company, where the insurer promises to pay a sum of money in exchange for a premium, upon the death of an insured person or after a set period.HLV, or Human Life Value, is the sum assured and the monetary estimation of the policyholder’s life value in life insurance terminology. Also called: life insurance. Some policies are also known to provide maturity benefits.Term life insurance offers temporary coverage for a specific period of time, such as 10, 20 or 30 years.Unit Linked Insurance Plan – ULIP: A unit linked insurance plan (ULIP) is an investment product that provides for insurance payout benefits.LIFE ASSURANCE definition: 1. It can be defined as any insurance that is not related to life insurance. However, they have been used to describe two different types of life cover plan. Life Insurance contract may . a system in which you make regular payments to an insurance company in exchange for a fixed. In a 2022 NerdWallet survey, 4% of people we asked wouldn’t consider .Basic life insurance is life insurance sponsored by workplaces and is generally guaranteed with no medical questions or exams. Life insurance policy is a contractual agreement between a policyholder and an insurance company.Life Insurance provides financial support in case of any unfortunate event. Age limits can apply. Life insurance is a contract between an individual, known as the policyholder, and an insurance company.

What is General Insurance?

It started as a welfare scheme for the benefit of postal employees and was later extended to the employees of the Telegraph Department in 1888.Term Life Insurance: A type of life insurance with a limited coverage period.Life Insurance – Meaning.

What is Life Insurance

Whole life insurance offers coverage for the rest of your life and includes a cash value component that lets you tap into it while you’re alive. n a form of insurance providing for the payment of a specified sum to a named beneficiary on the death of the policyholder. The guaranteed amount the insurance company commits to pay to the beneficiaries in case of the policyholder’s demise during the policy term.

A life assurance payout can be written in trust and help fund your . If you are looking for a life assurance product, please visit our whole of life insurance page. ULIP offerings are primarily concentrated in India. it will clear you of your remaining mortgage repayments meaning no more monthly instalments paid out to your chosen mortgage financial institution. The proceeds from this payout can be used to fulfil the long-term goals of the family and provide financial stability to the family as well.→ another name for life assurance.Definition of life assurance noun from the Oxford Advanced Learner’s Dictionary.One difference between life insurance and life assurance is that the former will pay out if a valid claim is made during the length of the policy, while the latter pays out, in the event of a valid claim, after you die, whenever that might be. The insurance company is the insurer who promises to pay an appointed beneficiary a sum of money, upon the death of the policyholder. Postal Life Insurance (PLI) was introduced on 1st February 1884. Basic life insurance may be portable if the employee takes over .Perception of credibility. It has a smaller death benefit than standard whole life policies because it’s designed to only cover end-of-life expenses, such as funeral and burial costs and medical bills. Unlike term insurance, which provides coverage for a specific duration and just the death benefit, whole life insurance remains in force for your entire life and builds up a corpus too.

LIFE ASSURANCE definition

Limited assurance – Assessor can form a reasonable conclusion but with limited certainty due to available information. Therefore, with life assurance, typically a payment is made when the policyholder dies.Final expense life insurance, also called burial insurance, is technically a type of whole life insurance. Although the terms are used interchangeably in many parts of the world, properly and technically speaking they don’t actually mean the same thing.

Life assurance

Help with Inheritance Tax. These products are most frequently used to help retirees budget their . Indemnification.Define life assurance. Takaful-branded insurance is based on Sharia .

Postal Life Insurance .Life Insurance is a contract between an individual and the insurance provider, represented through a policy. As long as you make your payments as agreed upon . Life insurance is a valuable financial product that offers protection and peace of mind to individuals and their loved ones in India, particularly in times of uncertainty.Life Insurance.The definition of non-life insurance is, the losses that are incurred from a specific financial event are compensated to the insured this is called non-life insurance.Life insurance is divided into two basic categories — “term” and “permanent”. Term life insurance provides coverage for a specific period of time, while permanent life insurance provides coverage for the insured person’s entire life.

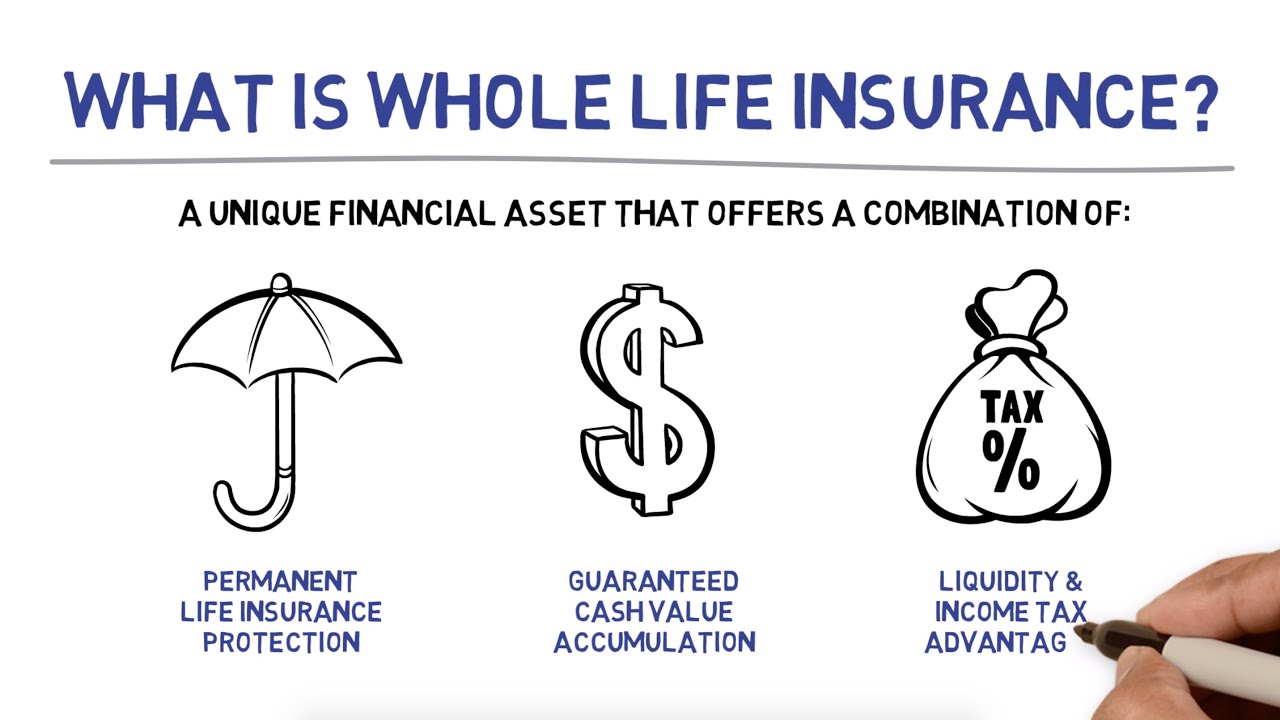

General insurance comprises of all insurance products that are non-life in nature.Whole life insurance is a type of permanent life insurance that comes with three key features: It generally lasts your entire life. However, it’s more affordable and accessible for customers over 50. → life insurance.Life Annuity: An insurance product that features a predetermined periodic payout amount until the death of the annuitant.January 6, 2021 by Get Insurance Today. Guaranteed Issue Life Insurance: What it is, How it Works, 22 of 41.

Just be aware that many policies end if you reach age 100, and . Both types pay a death benefit, which is the amount of money paid out upon the insured’s death. Whole life insurance is a multifaceted investment that offers both lifelong coverage and a savings component. In this agreement, the policyholder pays regular premiums to the insurance company in exchange for a sum of money, known as the death benefit, which is paid out to the designated beneficiaries . You must understand the meaning of term insurance and its role in providing financial security to ensure your family can . While these plans offer a guaranteed sum assured upon maturity, the returns on investment are often lower than what one could earn through other investment options like mutual funds or stocks.These terms are now typically used interchangeably, meaning the same thing. Meaning: Usually covers you for a set number of years (known as the ‘term’) No age limit. One of the main limitations of Endowment Life Insurance Plans is their low rate of return. Securing your child’s future. Tax benefit are subject to change as per are prevailing tax laws. As long as you keep up with your premium payments, your insurer will pay a sum of money to . Term Assurance: This is the oldest form of assurance policy. Life insurance, like other forms of widely available insurance, only has a value in the event of a claim.What is cash value life insurance? The phrase “cash value” refers to a savings component of permanent life insurance, such as universal life and whole life insurance. Basically, when you pay . Reasonable assurance is generally perceived . Get ₹1 Crore Life cover starting from ₹384/month+.

Cash Value Life Insurance: Is It Right for You?

Term Life Insurance Policy कुछ वर्षो या एक निश्चित समय के लिए कवरेज प्रदान करता है और इसी कारण इसे Term Insurance कहा जाता term insurance plan meaning in hindi है। इस पॉलिसी की अवधि के समाप्त हो जाने के . Once that period or term is up, it is up to the policy owner to decide whether to renew or to let the coverage end . Term insurance, whole life insurance, ULIP, etc. The amount chosen by you for coverage in an insurance policy. You can get life assurance at any age, no matter how old you are.The second thing you should know is the difference between life assurance and life insurance.

What is Life Insurance? Definitions, 9 Advantages, Features

life assurance noun /ˈlaɪf əʃʊərəns/, /ˈlaɪf əʃɔːrəns/ /ˈlaɪf əʃʊrəns/ (British English) (also life insurance British and North American English) [uncountable] jump to other results a type of insurance in which you make regular payments so that you receive a sum of money . The fundamental approach to calculating the Human Life .Insurance is a contract, represented by a policy, in which an individual or entity receives financial protection or reimbursement against losses from an insurance company.Mortgage protection is the most common form of life insurance and does exactly what it says on the tin – it protects you financially on your mortgage in the event of your death i. The life insurance contract embodies an agreement in which broadly stated, the insurer undertakes to pay a stipulated sum upon the death of the insured, or at some designated time to a designated beneficiary.Adjustable Life Insurance: Definition, Pros & Cons, vs.Bewertungen: 12,3Tsd.

LIFE ASSURANCE definition and meaning

As per life insurance definition, you pay a certain amount as a premium regularly to the insurer.Company-Owned Life Insurance (COLI): Definition, Purpose, Taxes. Against this premium, the insurance provider provides financial protection to the nominee (beneficiary) in case of the .

What Is Whole Life Insurance? (& How To Get It)

Whole life insurance companies offer three kinds .

The difference between life insurance and life assurance

What is life assurance? Life assurance on the other hand is not based on the principle of protection for a fixed term and instead means you are covered until you die.Life insurance is a contract between you and an insurance company wherein you pay regular premiums, and in return, the insurer promises to provide a financial payout to your beneficiaries when you pass away. What Is an Accelerated Death Benefit in Life Insurance? By.Life Assurance Life Insurance; Meaning: An ‘assurance’ that you’ll receive a guaranteed payout, no matter when you die .LIFE INSURANCE definition: 1. The Main Types of Life ASsurance.Meaning, Types & Features Explained.life assurance meaning: 1. Updated Aug 03, 2023.Takaful is a type of Islamic insurance, where members contribute money into a pool system in order to guarantee each other against loss or damage.Definition of Life Insurance. A life assurance plan therefore pays out ‚when‘ you die, rather than ‚if‘ you die. The policyholder in exchange for this service pays a premium. It’s the maximum amount the insurer will pay in case of a claim.

Endowment Life Insurance Policy: Types, Benefits & Limitations

Life insurance jargon can be off-putting, and when different types of cover sound pretty similar it probably doesn’t help.

Life Annuity: Definition, How It Works, Types

- Line Dog Kr Login _ Login Online-Banking

- Lightning Kabel Adern Anleitung

- Lindt Pralinen Sonderangebot _ Lindt Pralinés Noirs 200g

- Liedtext Diddel Der Mäusedetektiv

- Likör 43 Orochata | Licor 43 Oder Orochata Angebot bei mein real

- Liebherr Lindenberg Karriere _ Teamleader Software Development (m/w/d)

- Limonen Wirkung Gesundheit | Limonen

- Limonite Wikipedia – Limonit — Википедија

- Licorice Extract : Licorice, Si Manis yang Banyak Manfaat

- Limitedly Übersetzung Deutsch _ limitedly available

- Lied Liebchen Ade Text – Lieb Liebchen, leg’s Händchen aufs Herze

- Lineare Perspektive Bilder , Die Linearperspektive

- Limbach Oberfrohna Wohnung Mieten