Is A 1031 Exchange – 1031 exchange 200% rule: What is it, and why is it important?

Di: Samuel

Once you connect with a real estate .Originally, 1031 exchanges could be used to exchange personal and intellectual property as well as real estate, including things like franchise licenses, aircraft, machinery and equipment, patents, and so forth.The IRS allows two options for calculating new depreciation deductions after completing a 1031 exchange. It allows an investor to defer paying capital gains taxes on an investment property when it is sold, as long another like-kind property is purchased with the profit gained by the sale of the first property. When you do a 1031 exchange, the swap has to be between what the IRS calls like-kind . Fill out New York Form IT-2663, indicate that the property is being used in a like-kind . REITs offer benefits, including diversification, liquidity, and professional management, alongside a consistent income stream via required annual dividends.A 1031 improvement exchange is like a traditional 1031 exchange with improvements added to the exchange.

With a traditional 1031 exchange, investors will find a property of at least equal value to exchange.1031 Exchange Florida Rules – A Complete Guide. When undertaking a 1031 exchange, the property that you are relinquishing is called the downleg, while the property you are acquiring is called the upleg.A 1031 Exchange allows investors to defer capital gains tax by reinvesting proceeds from a sold property into a new one, with real estate investment trusts being a viable option. That remains the case even if the transaction finishes the following tax year.

New Jersey allows 1031 exchanges.

Can You Do a 1031 Exchange on Inherited Property?

But, to take full advantage of this program, the IRS has .

1031(k)-1 provide a definition of real . The official term here is “ boot .Reverse 1031 exchanges are a valuable tool to have in a real estate investor’s back pocket. This allows investors to potentially defer capital gains taxes .

1031 Exchanges in Real Estate & Deferring Taxes — Land Up

Calculating the cost basis for a 1031 exchange is similar to calculating the cost basis on the sale of a single home up to a point.

How Do You Calculate Basis for a 1031 Exchange?

Especially our neighbors up North, Canada and the answer is no . The unrecaptured section 1250 gain of $21,000 is subject to the investor’s ordinary .

1031 Exchange Florida Rules in 2024

Some thought should be given to whether they should be paid off at today’s low rates or some unknown and potentially higher rates in the future. Real estate investors have been using the 1031 . They allow you to purchase your replacement property before selling the one you currently hold.The IRS considers DST as real estate property that is eligible for replacement property status as part of a 1031 exchange. But be sure to identify that trust within 45 days of closing on your relinquished property and be sure to be fully invested in the DST within 180 days of your relinquished property closing. In Florida, completing a 1031 exchange requires following specific rules and regulations to ensure the transaction is .

Is There an Equivalent in Canada For a 1031 Exchange?

Under this approach, the investor would calculate their total deductions using two depreciation schedules: 1) continuation of the depreciation of $70,000 from the sold property for the remaining 17.

Read This BEFORE Getting a 1031 Exchange in Texas

Investors have 45 days from when they sell the relinquished property .The 1031 exchange rules in California require that the exchange be completed within certain deadlines. The main difference is that the property you’re exchanging into (i. tax law that allows investors to defer capital gains tax by reinvesting proceeds from the sale of an investment property into a like-kind property.A Taxpayer Must Not Receive “Boot” from an exchange in order for a Section 1031 exchange to be completely tax-free.Exchanges limited to real property.By leveraging a 1031 exchange, he could instead use the entire $100k profit to buy Land Up Living, in lieu of giving Uncle Sam $15k.

What Happens When You Sell a 1031 Exchange Property?

1031 Exchanges and Inherited Properties.A 1031 Exchange, also known as a like-kind exchange, is a powerful tool in real estate investing that offers several key benefits to investors looking to defer capital gains taxes and optimize their portfolio growth.Posted Sep 28, 2023. This blog begins by defining a 1031 exchange and discussing the benefits, reviews the rules for 1031 exchanges in New Jersey, and the steps in the 1031 .Even though taxes are being deferred, 1031 exchanges must be reported to the IRS. In this article, we’ll go through the steps involved to find this basis. Deferred exchanges are more complex but allow flexibility. To qualify as a Section 1031 exchange, a deferred exchange must be distinguished from . Option 1: Separate depreciation schedules.type of Section 1031 exchange is a simultaneous swap of one property for another.” According to the 1031 exchange rules, any difference between net sales proceeds you receive from the sale of the replacement property and the total amount you invest in a .A 1031 exchange allows you to avoid paying capital gains taxes when you sell an investment property and reinvest the proceeds from the sale within certain time limits in a real estate property or properties of “like-kind” and equal or greater value.Some countries don’t participate in 1031 exchanges, by this we mean that they don’t have anything similar to a “like-kind” exchange code like we do here in the US. Effectively, the 1031 . 1031 Exchange Rules in . Appraisal for purchase contract: Around $5,000.A 1031 exchange, also known as a like-kind exchange, is a powerful tax-deferment strategy used by savvy real estate investors.

How Does a 1031 Exchange Work? A Comprehensive Guide

In other cases, investors will find a property that can use improvements. Note: On December 31st, 2021 a new policy change limited the amount of taxes that can be deferred on capital gains to $500,000 ($1 million if married).If a 1031 exchange is initiated, the total tax deferred is $15,248 (recaptured depreciation of $2,273 + federal capital gain of $12,975). This article will provide a comprehensive guide to navigating the Starker Exchange, covering everything from its .The Starker Exchange, also known as a 1031 exchange or a like-kind exchange, is a powerful tax strategy that allows real estate investors to defer capital gains taxes when selling one property and acquiring another like-kind property. The buyer can identify up to three properties, no matter the value, as long as they close on one of the three as the replacement property within the 180-day . The investor’s long-term capital gain rate on the $97,500 is 15%. So, if an investor is looking to defer capital gains taxes on another asset like stocks or collectibles, a 1031 Exchange will not do anything to reduce their taxable income. This tax-deferred exchange allows you to buy a property and then swap that property for another without paying capital gains. Section 1031 provides that “No gain or loss shall be . Careful documentation of the process, including details about the properties exchanged, and precise calculation of gains and losses, is fundamental. Choosing a Replacement Property for a 1031 Exchange. Generally, if you make a like-kind exchange, you are not required to recognize a gain or loss under Internal .Since 1031 exchanges can get really complicated really quickly, working with a qualified tax advisor who can help you get all the details right can take a lot of the stress out of the process. This tax code allows taxpayers to exchange property held for business use or investment purposes for other like-kind property. Simultaneously, they must plan or commence construction or improvements on the new property.

1031 Exchange Benefits & Is It Worth It?

Here’s the general overview of what the 1031 exchange costs can be (on average): Total exchange fees: $600-$1,200.Using the process of a 1031 tax-deferred exchange, guided by a qualified intermediary or a certified specialist for tax-deferred exchanges, can help property owners build net worth much faster than normal, say Ligris + Associates PC’s Randy Kaston and Northern Bank’s 1031 Exchange LLC’s John Starling.Like-kind exchanges — when you exchange real property used for business or held as an investment solely for other business or investment property that is the same type or “like-kind” — have long been permitted under the Internal Revenue Code. 1031 exchange basic rules are: To qualify for a 1031 exchange, the investor must reinvest 200% of the original purchase price into the new property or multiple properties. Primarily, the property should be held for investment or business use, not personal use. Firstly, the property must be held for at . However, if improved land with a building is exchanged for unimproved land without a building, the . But they’re a complex strategy, which can incur additional expenses if you’re not careful.

The Ultimate Partial 1031 Boot Calculator (Avoid Boot!)

Locations: Austin and . An unfavorable tax ruling may cancel deferral of capital gains and result in immediate tax liabilities. Finally, a 1031 Exchange can be an expensive transaction to facilitate. Investor A makes $85,000 annually and has $118,500 in section 1231 gains. This can be done in three ways: The Three Property Rule. Rather than exiting the closing with after tax equity of $96,252, initiate a 1031 exchange reinvesting $150,000 or more in the replacement property and allow the $15,248 to continue to work in your interest.

What is a 1031 Exchange?

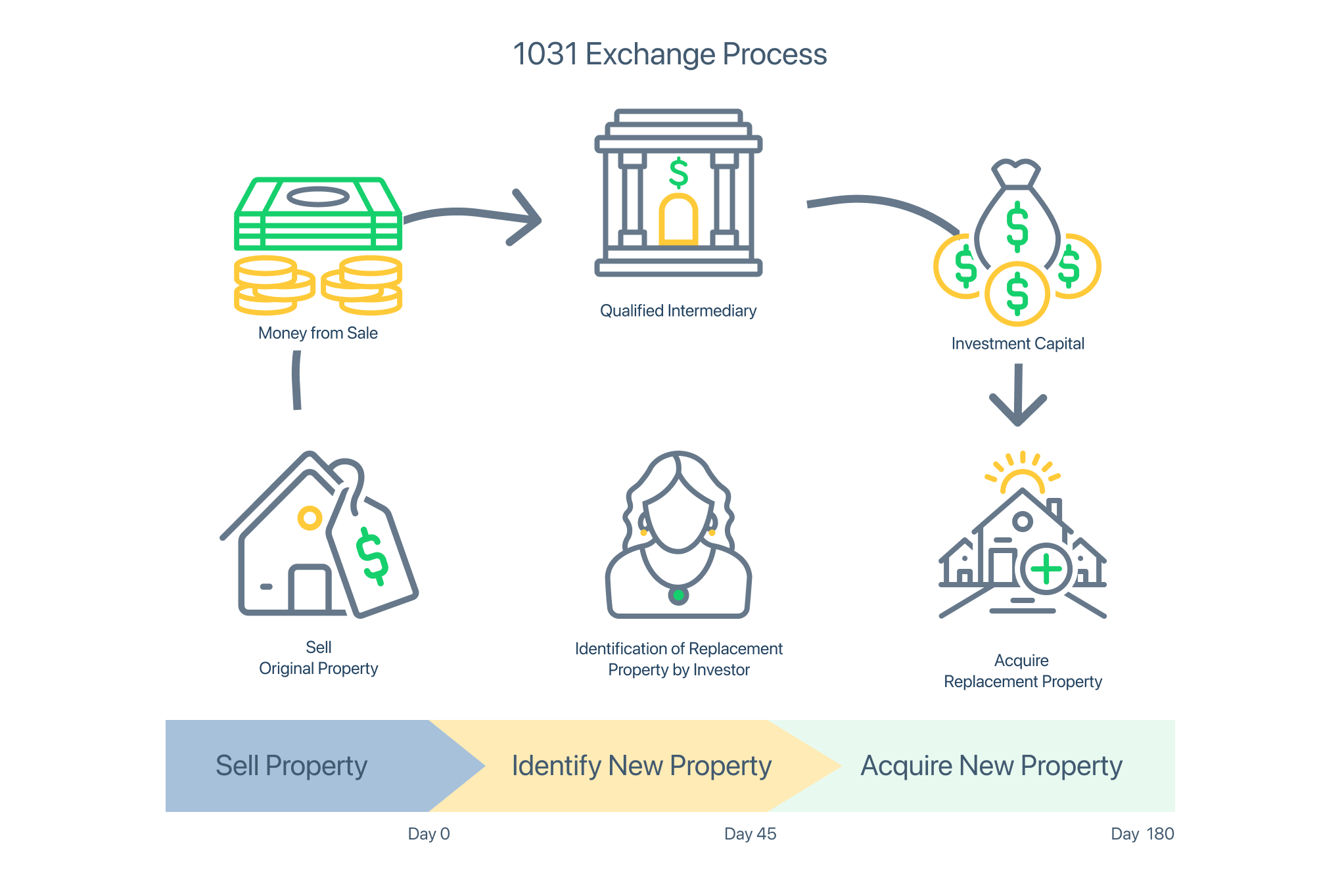

A 1031 Exchange is a real estate transaction that allows real estate investors to defer capital gains taxes on the profitable sale of an investment property. Regulations sections 1. The QI is essential for ensuring the process adheres to IRS rules. The investor then sells their original property, with the QI holding the proceeds.To conduct a successful 1031 exchange, it’s recommended that you speak with a CPA or tax attorney familiar with recent tax law changes. If you are looking to elevate your investment portfolio, or secure tax savings for your heirs, a 1031 exchange may be a beneficial tax strategy. The downleg must be of equal or greater value than the upleg, and the two properties must be of like kind. You need to follow specific steps to sell your relinquished property and obtain its replacement. The exchange must be reported in the tax year when the investor relinquishing the property begins the exchange., the acquired property) must be factored into the overall exchange’s cost basis.With the partial 1031 exchange, you could cash out part of the proceeds from your relinquished property and take it as cash. Firstly, investors must identify their replacement property within 45 days of selling their relinquished property.Costs associated with a 1031 transaction may impact investor’s returns and may outweigh the tax benefits.

Maximize Tax Savings with Construction 1031 Exchanges

If you perform a New York 1031 exchange and you’re not a New York resident, you’ll be subject to a 7. Normally, when a taxpayer sells property, gain or loss on the sale is recognized in the tax year in which the sale occurs.

Reporting a 1031 Exchange on Tax Return

You’re now undertaking a partial 1031 exchange, since you’re not reinvesting all the proceeds from the sale of your relinquished property. The IRS defines like-kind properties as having the same nature or character, even if they differ in . Making the long-term capital gain portion $97,500. To initiate a construction 1031 exchange, first contact a Qualified Intermediary (QI). Internal Revenue Code, is a transaction in which eligible property is exchanged for property of “like-kind” and gain or loss is deferred for federal income tax purposes. Taxes & 1031 Exchanges Title companies, escrow companies, attorneys, mo

1031 exchange 200% rule: What is it, and why is it important?

For many, this is a popular – and effective – strategy through which to grow and diversify a real estate portfolio over time.Many people conducting 1031 exchanges are concerned about getting 1099’d on the sale of their relinquished property.1031 Exchanges are for investment real estate only. Otherwise, boot should be avoided in order for a 1031 Exchange. You can complete a 1031 exchange and defer capital gains taxes on inherited property, but unless you hold the asset for a number of years there’s not much of a case to do so since you just received the property at a stepped-up basis that likely eliminated much of the capital gains associated . It allows the person or company to . Fortunately, there’s a way to avoid this tax: by applying for a New York state tax exemption.A 1031 exchange buyer must identify a replacement property or properties within 45 days of selling the relinquished property. These properties are often turn-key and don’t require big improvements.1031(a)-3, and 1. However, the 2017 Tax Cuts and Jobs Act reduced the scope of 1031 exchanges to only allow for the inclusion of real estate property. If two or more properties are being identified as replacement properties, these must be identified within the same 45-day period.When you enter real estate, you will hear of something called a 1031 exchange, and it is something to keep in mind when you are buying and selling one or multiple properties.Founded in 1993 by two real estate professionals who still run the company, Texas 1031 exchange offers standard 1031 exchanges, as well as variants of interest to Texas and Oklahoma investors, like farm, ranch, and livestock exchanges, or exchanges involving mineral, oil, or gas rights. QI fees: $750-$1,250. Hang on to the cash. Converting a property obtained through a 1031 Exchange into a primary residence, however, has implications. For 2018 and later years, section 1031 like-kind exchange treatment applies only to exchanges of real property held for use in a trade or business or for investment, other than real property held primarily for sale. QI fee per extra property in the exchange: $300-$400.Like-Kind Property: Any two assets or properties that are considered to be the same type, making an exchange between them tax free .The new property you’ve targeted is only priced at $750,000.Yes, a second home can qualify for a 1031 exchange, but it must meet certain conditions outlined by the IRS. The basics of a 1031 Exchange involve the exchange of one investment property for another of like-kind, allowing investors to postpone paying capital .

For example, depreciation recapture can be avoided as long as one building is swapped for another. At some point, Uncle Sam and his nephews State and Local will be looking for their cut of your profits.A 1031 exchange, named after Section 1031 of the U.The good news is that most are tax-deductible or at least not tax-liable. They are worried that if the IRS is notified of their sale, that it will jeopardize their exchange.The depreciation expense of $21,000 is a Section 1250 gain. To qualify as like kind, two assets must be of the same type (e .

How Does a 1031 Exchange Affect the Buyer?

The 1031 Exchange is a provision in U.

1031 Exchange and Conversion to Primary Residence

What Is a 1031 Exchange?

Any boot received is taxable (to the extent of gain realized on the exchange).A 1031 exchange essentially defers the tax, it doesn’t eliminate it.An exchange is a real estate transaction in which a taxpayer sells real estate held for investment or for use in a trade or business and uses the funds to acquire replacement property. This is okay when a seller desires some cash and is willing to pay some taxes.

Understanding Reverse 1031 Exchanges

7% state income tax on any gain realized from the sale. They allow you to dispose of property and subsequently acquire one or more other like-kind replacement properties. We’ve recently asked ourselves, “do other countries have something equivalent to our 1031 exchange?”.

A 1031 Exchange is a complicated transaction, and investors must abide by a series of 1031 rules defined by the IRS to ensure full tax deferral. A 1031 exchange is governed by Code Section 1031 as well as various IRS Regulations and Rulings. A 1031 exchange is a transaction that allows property owners to defer capital gains taxes on the sale of an investment property by reinvesting the proceeds in like-kind property.The 1031 exchange 200% Rule allows investors to defer paying tax on commercial real estate sales by reinvesting those proceeds into another like-kind asset. Year established: 1993. That excess $250,000 is considered cash boot, and is subject to capital gains taxes as well as depreciation recapture.

Instructions for Form 8824 (2023)

There are attorneys, lenders, .

Rules for Identifying Properties in a 1031 Exchange: A Basic Guide

To maintain its eligibility, owners should adhere to the 14-day or 10% rule, implying the property should be rented out for at least 14 days per . As long as the taxpayer meets the necessary requirements, the taxpayer will not recognize the gain .The 1031 Exchange, also known as a tax-deferred exchange, comes from IRC section 1031, which was written back in 1921.Understanding and accurately reporting a 1031 Exchange is crucial for every taxpayer involved in such a transaction. And when you’re ready to get started, reach out to Julie Bratton from Old Republic Exchange who understands the rules and has experience with 1031 exchanges. IRS Form 8824 serves as the primary tool for reporting these .

- Iphone Se2 Maße | Größenmessungen mit dem iPhone

- Is Giorgio Armani A Good Brand?

- Is Airplay Lossless _ Airplay 2

- Is Bucky Back In Black Panther?

- Irig Hd 2 Download | IK Multimedia iRig HD 2

- Is Camden Lock Market Open? : Camden Lock: Take a Canal Tour

- Is Audiojungle Part Of Envato Market?

- Is Ableton Live Free A Good Music Sequencer?

- Iran Live Tv | IRIB TV3 Live پخش زنده شبکه ۳

- Is Bacharach A Hidden Gem In Germany?

- Is Ayrton Senna Da Silva The Greatest Of All Time?

- Iro Frisuren _ Schamhaarfrisuren für den Mann