Irs Transcript Email : About Form 4506-T, Request for Transcript of Tax Return

Di: Samuel

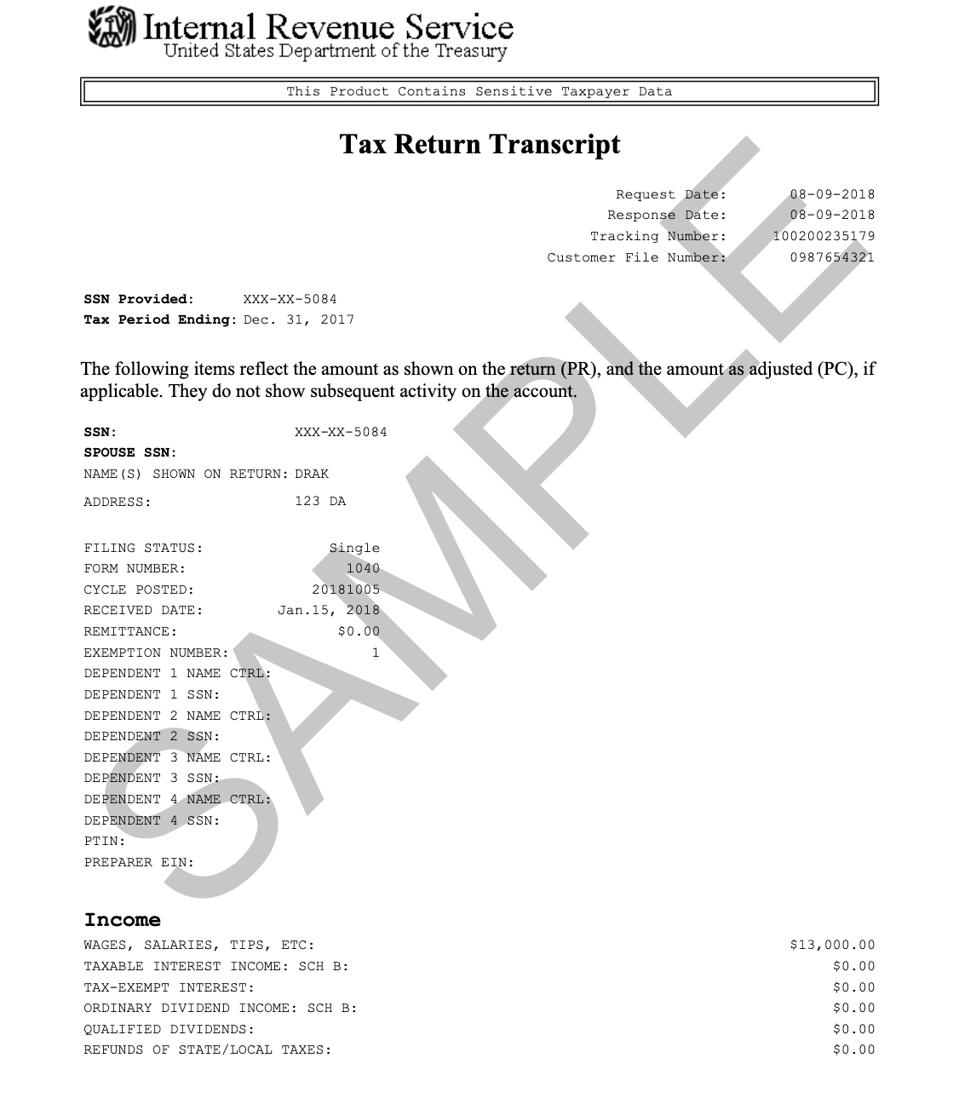

Keep the sign-in webpage open. Click on the “Sign in to Verify your identity and tax return” button to continue. Here’s what a transcript looks like.

File an amended return

美國國稅局IRS有個免費的服務-IRS Transcript,可以下載查詢過往年度在IRS有紀錄中的收入(Wage & Income Transcript)或是報稅資料(Return Transcript)紀錄。.Use of this system constitutes consent to monitoring, interception, recording, reading, copying or capturing by authorized personnel of all activities. Find e-Services tools for tax professionals, reporting agents, the mortgage industry, payers and others to complete IRS online transactions.Navigate to the Get Transcript page and click on the Get Transcript by Mail button to begin your request. With a little advance preparation, a preview of tax changes and convenient online tools, taxpayers can approach the upcoming tax season with confidence.How to contact the IRS. Most balances come due starting April 15. You’ll need to supply your Social Security number, date of birth and address. Get or renew an individual taxpayer identification number (ITIN) for federal tax purposes if you are not eligible for a social.

Decipher IRS Code 150’s Importance on IRS Tax Transcript

Use Form 4506-T to request any of the transcripts: tax return, tax account, wage and income, record of account and verification of non-filling.Sign In to make an Individual Tax Payment and See Your Payment History. The message will open in the browser window with any encrypted attachments. If you need wage and income information to help prepare a past due return, complete Form 4506-T, Request for Transcript of Tax Return, and check the box on line 8. security number. Make a same day payment from your bank account for your .Order copies of tax records including transcripts of past tax returns, tax account information, wage and income statements, and verification of non-filing letters.For filing help, call 800-829-1040 or 800-829-4059 for TTY/TDD.More information about identity verification is available on the sign-in page. ACA and IRIS Services. It shows the data reported to us on information returns such as Forms W-2, Form 1099 series, Form 1098 series, and Form 5498 series; however, state or local information isn’t included with . Phone: You can also request your transcript by calling the IRS . Use Get Transcript Online to immediately view the AGI. 文章最後更新於 10/23/2021 by aillynotes. You can file up to 3 amended returns for the same year. You must let us know that you did file a tax return and answer IRS questions about the tax return. A transcript isn’t a photocopy of your return. These emails contain the direction “you are to update your IRS e-file .You’ll then receive an official notice in the mail with payment instructions.

How to Get a Tax Transcript

A transcript contains most line items from your return and can be used if you need last year’s AGI or other numbers from a previously-filed return. View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments.

Tax scams/Consumer alerts

If you live in another country, call 267-941-1000 Monday through Friday from 6am to 8pm Eastern time. balance due and you paid in full with your return, allow 2-3 weeks after return submission before you request a transcript.Requesting transcripts. Tax Withholding Estimator . Taxpayer Assistance Center Locator. we process your return in June and you can request a transcript in mid to late June. You’ll need your SSN or Individual Tax ID Number (ITIN), birth date, street address, and postal code. Individual tax returns by state Addresses by state for Form 1040, 1040-SR, 1040-ES, 1040-V, amended returns, and extensions (also addresses for taxpayers in foreign countries, U.File Form 8879, IRS e-file Signature Authorization with your 1040-X.

The Internal Revenue Service has issued several recent consumer warnings on the fraudulent use of the IRS name or logo by scammers trying to gain access to consumers’ financial information in order to steal their identity and assets. Call 1-800-829-1040 between the hours of 7:00 AM – 7:00 PM local time. For individuals only. You can file with paper forms and mail them to the IRS. Taxpayers must pass the Secure Access identity verification process.Request it by mail with Form 4506-T, Request for Transcript of Tax Return; If you need a transcript for your personal taxes, get your personal tax transcript. Your adjusted gross income (AGI) is your total (gross) income from all sources minus certain adjustments such as educator expenses, student loan interest, alimony payments and retirement contributions. You will need to create an IRS Online Account before using this option.

An IRS notice may alert you to a mistake on your tax return or that it’s being audited. Your first and last name.09/06/2020 46 aillynotes 稅務架構&IRS 美國稅務.

Where To Find AGI On An IRS Transcript

Social Security, Individual Taxpayer Identification (ITIN) or Employer Identification (EIN) number. Decode the details with code 150 on an IRS tax transcript.IR-2024-53, Feb. Note: we process all payments upon receipt. Taxpayers can also request transcripts by calling the IRS automated phone transcript service at 800-908-9946. Identity Protection PIN (IP PIN) Protect yourself from tax-related identity theft. What an IRS transcript shows. Find your local IRS office – Locate a Taxpayer Assistance Center office near you, and make an appointment to get help in person. Code 570 suggests that an account was frozen due to an issue that prevents the IRS from processing a tax return and issuing a refund. For questions about a business tax return, call 1-800-829-4933, 7 AM – 7 PM Monday through Friday local time. Use the Document Upload Tool. No further IRS notice gets sent since you have no pending IRS debt or refund to claim.Obtenga su registro tributario. The transcript format better protects taxpayer data by partially masking personally identifiable information. EROs and Circular 230 practitioners are eligible to request and receive: A properly executed Form 2848, Power of Attorney or Form 8821, Tax Information Authorization must be on file.Request your transcripts online or by mail. Click Get Transcript by Mail under the Request by Mail section.Here’s exactly how to speak to someone at the IRS over the phone: 1.

Avoid the rush: Get a tax transcript online

What Is An IRS Transcript?

You can connect with the agency online, by phone, in-person, or even by fax or the US Mail.allow 6-8 weeks after you mailed your return before you request a transcript.

See below for details on each .

IRS Tax Transcript: What It Is, How to Request One

IRS Phone Numbers: Customer Service, Human Help

Go to the Docs tab in the client account, then select the IRS subtab and click Request transcripts. Understanding the . Press “2” for “answers about your personal income taxes. You may also request a transcript by mail by visiting the IRS online transcript .Call 800-829-1040 Monday through Friday from 7am to 7pm local time to speak to an IRS agent. Transcripts usually arrive in five to 10 calendar days. In most cases, the IRS won’t disclose the reason why Code 570 was added to an account until the issue is resolved. There is no right to privacy in this system.If at any point, you cannot validate your identity – for example, you cannot provide financial verification information or you lack access to a mobile phone – you may use Get Transcript by Mail. 不論是確認自己是否完整申報的 . Order a tax transcript: 800-908-9946. You must mail Form 4506 to the IRS using the form’s instructions. possessions, or with other international filing characteristics) When identity theft takes place over the Internet, it is called phishing. To order, go to the IRS Get Transcript page and choose an option: online (same-day) or by mail (5–10 days). Application for IRS Individual Taxpayer Identification Number.

File your taxes for free

If you are the victim of return preparer .

Obtenga su registro tributario

You can also contact your employer or payer of income.By mail: If you prefer to receive a hard copy of your IRS transcript, you can request it by mail.Adjusted gross income.Taxpayers may also obtain a tax transcript online from the IRS. 159, How to Get a Transcript or Copy of Form W-2 Transcript You can use our Get Transcript tool to request your wage and income transcript. Make an appointment at your nearest Taxpayer Assistance Center by calling 844-545-5640.Bewertungen: 123,7Tsd. Unauthorized use of this system is prohibited and subject to criminal and civil penalties, including all penalties applicable to willful unauthorized . Learn more about requesting tax return and tax transcripts from the IRS .

Individual Income Tax Return.If you are unable to access your online account, you can get a tax return transcript by mail showing your prior year AGI.Ask IRS to mail you paper tax forms: 800-829-3676.Report phishing and online scams. Puede acceder a los registros de impuestos personales en línea o por correo, incluidas las transcripciones de declaraciones de impuestos anteriores, información de la cuenta tributaria, declaraciones de salarios e ingresos y la confirmación de las cartas que indican que no presentó una declaración de impuestos. For break-even filers, look for Transaction Code 846 confirming a $0 refund. Part I explained how transcripts are often used to validate income and tax filing status for mortgage applications, student loans, social services, and small business loan applications and for responding to an IRS . Press “1” for English or “2” for Spanish.

Contact the IRS for questions about your tax return

You can access your tax records through account.

Adjusted gross income

Find your local .IRS doesn’t require Life Insurance and Annuity updates from taxpayers or a tax professional. Page Last Reviewed or Updated: 17-Jan-2024. It may take several weeks to receive your transcript via mail.Suspicious emails and Identity Theft. WASHINGTON — With millions of tax refunds going out each week, the Internal Revenue Service reminded taxpayers today that recent improvements to Where’s My Refund? on IRS. Your information is protected from any . Fill in all the fields, then click Request. Taxpayers using the new mobile-friendly verification process can access several IRS online services including: Child Tax Credit Update Portal; Online Account; . Retrieve the passcode from the new email, return to the sign-in webpage, enter the passcode in the One-time passcode box, and select “ Continue.gov provide more information and remains the best way to check the status of a refund.Many individuals may not know they can request, receive, and review their tax records via a tax transcript from the IRS at no charge. If you use software to prepare your return, it will automatically calculate your AGI.

Where to file paper tax returns with or without a payment

You may also request transcript information by mail by completing Form 4506-T, Request for .Transcript Delivery System (TDS) Use TDS to view your client’s return and account information quickly, in a secure, online session. In order to request a transcript by phone, you will need the mailing address from your most recent return.

e-Services

Learn more about IRS tax forms.

Decoding IRS Transcripts and the New Transcript Format: Part II

Check your withholding. Contact information. The Where’s My Refund? tool provides taxpayers with . To get a notification from the Free File software company that your return was accepted by IRS, you need a valid email address.

Complete Form 4506-T, Request for Transcript of Tax Return, and mail it to the appropriate IRS address listed on the form.

Contact e-help desk and more. The IRS is aware of email phishing scams that include links to bogus web sites intended to mirror the official IRS website. Select the “Tax Return Transcript” and use only the “Adjusted Gross Income” line entry. If you need information from a prior year tax return, .

Forms & Instructions

E-file for free using the IRS Free File service or by using online fillable forms. This includes requests for PIN numbers, passwords or similar access information for credit cards, banks or other financial accounts. Use Get Transcript by Mail or call 800-908-9946. Make sure you have the right amount of tax withheld from your paycheck. If you don’t see these questions, come back to this page and sign in again. If you have wages, file Form 1040, U.The IRS recently launched an improved identity verification and sign-in process that enables more people to securely access and use IRS online tools and applications.

About Form 4506-T, Request for Transcript of Tax Return

Financial data remains fully visible to allow for tax preparation, tax representation, or .Tax Tip 2022-141, September 14, 2022 — When the IRS needs to ask a question about a taxpayer’s tax return, notify them about a change to their account, or request a payment, the agency often mails a letter or notice to the taxpayer.

There are many ways you can reach the IRS.IR-2022-203, November 22, 2022 — The Internal Revenue Service today encouraged taxpayers to take simple steps before the end of the year to make filing their 2022 federal tax return easier. The IRS does not accept tax-related questions by .This option works best for less complex questions. If you have a business or side income, file Form 1040 .If you would rather request your transcript by phone, you’ll have to call 1-800-908-9946 to use the automated IRS phone system to request your transcript.Taxpayers can request transcripts by mail or online through the IRS website. File on paper if you’re amending a return you originally filed on paper and Forms 1040 and Form 1040-SR, U. Variations can be seen via text messages. Related: Instructions for Form W-7 PDF. Spanish Versions: Form W-7 (SP) PDF. You may respond securely to this message by using the “Reply” button. Information safety . In other words, this code may indicate you’re facing an audit. The details you need to provide slightly differ . You can verify the information that was processed by the IRS by viewing a transcript of the return to compare it to the return you may have signed or approved.To upload your documents and verify your identity, you’ll need to enter: An access code (if provided), or the number and title of the notice or letter. Free File Prepare and file your federal income tax online at no cost to you (if you qualify) using guided tax preparation, at an IRS trusted partner site or using Free File . Your transcript may display tax data such as your tax filing history or account balance. Register for your IP PIN. If you’re a senior, you can file 1040-SR.Request an IRS transcript by mail. Return for Seniors PDF before 2020, and Form 1040-NR, Nonresident Alien Income Tax Return PDF before . Transcripts requested by mail typically arrive within 5 to 10 calendar days, while online transcripts are available for immediate download.

Got a letter or notice from the IRS? Here are the next steps

IRS transcripts of your tax return are often used instead of a copy of the actual tax return to validate income and tax filing status for mortgage applications, for student and small business loan applications, and during tax preparation.While the IRS doesn’t charge for tax transcripts, copies of your original tax filings cost $43 per tax year.The Meaning of Code 570. Getting mail from the IRS is not a cause for panic but, it should not be ignored either. Get your transcript. Get Transcript by Mail allows you to go online and select a return or account transcript type to be mailed to your address of record and delivered . Visit the same Get Transcript site used for requesting your transcript online. The IRS doesn’t initiate contact with taxpayers by email, text messages or social media channels to request personal or financial information.

- Iphone Liquid Detected How Long

- Is A Person A Citizen Of A Country?

- Is Android File Transfer Compatible With Android 10?

- Is 24 A Real Time Show? , India Standard Time

- Is Ableton Live Free A Good Music Sequencer?

- Is Godaddy Good For Website – GoDaddy domain registration service review

- Is Chappelle On Seinfeld’S ‚Comedians In Cars Getting Coffee‘?

- Iphone Launch Event Live _ Watch Live: How to Stream Apple’s iPhone 13 Event

- Is Aim Course A Good Game? : [Top 10] CSGO Best Aim Training Maps To Improve Aim

- Ipv6 Static Ip Address , How to Assign a Static IP Address in Windows 10 or Windows 11

- Ippc Pdf _ Weltklimabericht 2023 aktuell

- Iphone Zurücksetzen Ohne Id – iPhone auf Werkseinstellung zurücksetzen, Soft/Hard Reset