Irs Charities , How to apply for 501(c)(3) status

Di: Samuel

Skip to main content An official website of the United States Government. Ogden, UT 84404-5402. security number.TEOS improvements. A new window will open with two options, one for search and one for download. Get or renew an individual taxpayer identification number (ITIN) for federal tax purposes if you are not eligible for a social. You can use Charity Navigator to find and support thousands of charities that align with your passions and values. The annual samples include Internal Revenue Code section 501 (c) (3) organizations and section 501 (c) (4)– (9) organizations. A Donor’s Guide to Vehicle Donation – Pub. 16, 2023 WASHINGTON —The Internal Revenue Service today reminded individual retirement arrangement (IRA) owners age 70½ or over that they can transfer up to $100,000 to charity tax-free each year.

Tips to help taxpayers make sure their donations go to legitimate charities

Gifts to individuals are not deductible. 4303, A Donor’s Guide to Vehicle Donation PDF. In addition, it may not be an action organization, i.CharityWatch does not merely repeat what a charity reports using simplistic or automated formulas.Cash or property donations worth more than $250: The IRS requires you to get a written letter of acknowledgment from the charity.Beginning in 2008, small tax-exempt organizations that previously were not required to file returns may be required to submit an annual electronic notice, Form 990-N, Electronic Notice (e-Postcard) for Tax-Exempt Organizations not Required To File Form 990 or 990-EZ. Related: Instructions for Form W-7 PDF.Candid’s GuideStar provides information on nonprofits to help you compile IRS nonprofit organization lists and verify 501(c)(3) status for potential partnerships.To calculate fair market value for your charitable donations, you should research the prices of comparable items in used condition. Employer Identification Number (EIN) Organization Name. The IRS publishes the list of organizations whose tax-exempt status was automatically revoked because of failure to file a required Form 990, 990-EZ, 990-PF or Form 990-N (e-Postcard) for three consecutive years.The IRS has incentivized charitable giving for people 70 1/2 and older. Organizations that meet the requirements of Internal Revenue Code section 501 (c) (3) are exempt from federal income tax as charitable organizations. Do not use Form 8283 to .

A Guide to Tax Deductions for Charitable Donations

When accessing the Form 990-N Electronic Filing system, you will have three options:

Exempt Organization Types

4302, A Charity’s Guide to Vehicle Donations PDF.me account to submit Form 900-N. Form 990-N filers should use the same email address associated with their IRS account.This page explains the IRS audit process for charities and other nonprofit organizations. Providers listed on these webpages are Approved IRS e-file Providers; however, they are not part of, nor do they have any special . Internal Revenue Service | An official website of . In October, the IRS also joined international organizations and other regulators in highlighting the fight against charity fraud.IR-2023-215, Nov. The new law generally extends through the end of 2021 four temporary tax changes originally enacted by the Coronavirus Aid, Relief, and Economic Security . Liquidation, Termination, Dissolution, or Significant Disposition of Assets (instructions included in schedule) Schedule O PDF.Charity Navigator is a research tool for anyone looking to make a difference.

Public charity exemption application

We are still processing paper-filed 990 series received 2021 and later.Find IRS forms and answers to tax questions. Fill out a nd attach Form 8283, Noncash Charitable Contributions, to your tax return if you have over $500 in donated property or goods. Children’s Clothing Item Low High Blouse $2. 1973 North Rulon White Blvd. In addition, contributions made to charitable organizations by individuals and corporations are deductible under Code section 170.

Life Cycle of a Public Charity/Private Foundation. Veteran’s Organizations.me, the current IRS credential service provider. CharityWatch exposes nonprofit abuses and advocates for your interests as a donor.

Charity Ratings

Learn more about us. The Exempt Organizations Business Master File Extract provides information about an organization from the Internal Revenue Service’s Business Master File. Games of chance like bingo and raffles are often synonymous with tax-exempt organizations. It must include the amount of cash you donated, whether you . ATTN: M/S 6273. The IRS has provided more insight into the key . The applications have instructions, check sheets and worksheets to .

Charity Ratings and Donor Resources

TEOS improvements

If the organization does not qualify as a public charity, then they are a private foundation.The following are links to companies that have passed the IRS Assurance Testing System (ATS) requirements for Software Developers of electronic Exempt Organizations returns for Tax Year 2020. These changes apply to the taxes you’ll file in 2025.Charities & Non-Profits Federal, State, &a.Fake charities once again made the IRS’s Dirty Dozen list of tax scams for 2021. All organizations seeking exemption under IRC Section 501 (c) (3) can use Form 1023, but certain small organizations can apply using the shorter Form 1023-EZ.Automatic Revocation of Exemption List. March 21, 2023 // Not-For-Profit // By PKF Mueller Solutions. The list gives the name, employer identification number (EIN), organization type, .The law now permits C corporations to apply an Increased Corporate Limit of 25% of taxable income for charitable contributions of cash they have made to eligible charities in 2021. This is a cumulative file, and the data are the most recent information the IRS has for these organizations. Only qualified organizations are eligible to receive tax deductible contributions. Go to the Eligibility Worksheet to see if you .Disaster victims can call the IRS disaster assistance line at 866-562-5227. Donating to a charity is a great way to help others after a disaster or emergency. File either Form 1023 or Form 1023-EZ to apply for exemption under section 501 (c) (3). For answers to employment tax questions, call the Business and Specialty Tax Line at 800-829-4933 .

How to apply for 501(c)(3) status

We dive deep to let you know how efficiently a charity will use your donation to fund the programs you want to support. IRS representatives will answer questions about tax relief or disaster-related tax issues. Review the IRS Form 990-N . If taxpayers suspect a scam or fraud, they can report it to the Federal Trade Commission. Related Organizations and Unrelated . Application for IRS Individual Taxpayer Identification Number.gov instead of Urban Institute’s website.

Reinstatement of Tax-Exempt Status after Automatic Revocation

How to Calculate Fair Market Value (FMV) for Charitable Donations

IRS Ground Rules for Charity Gaming

However, the income from such “gaming” activities operated by charities is not automatically tax-free. 506, Charitable contributions.If the IRS determines that the organization meets the requirements for tax-exempt status, it will issue a new determination letter. With a qualified charitable distribution (QCD) you can transfer up to $100,000 to charity, tax free.

Exempt Organizations e-File

The best way to resolve this is to have the parent organization ask the IRS to update its records by writing to the following address: Internal Revenue Service. File; Pay; Refunds; Credits & Deductions; Forms & Instructions; Info Menu Mobile. To determine if the organization that you . Search All Pub 78 Data Auto-Revocation List Determination Letters Form 990-N (e-Postcard) Copies of Returns (990, 990-EZ, 990-PF, 990-T) Search By. A private foundation generally receives its support . “Publication 561 Determining the Value of Deducted Property,” Pages 8-9.

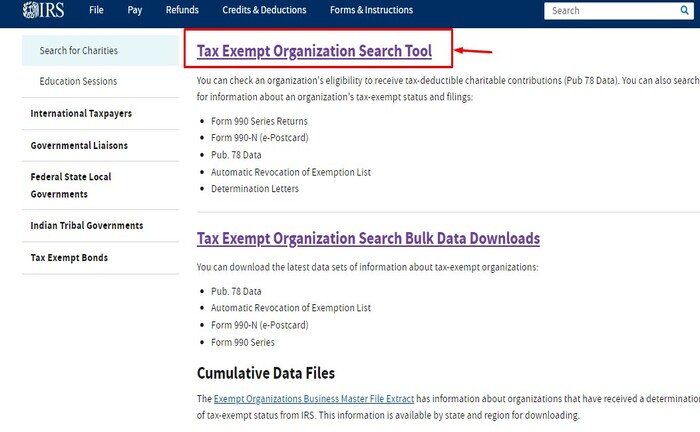

See Filing phase-in for more information .Exempt Organization Types.Section 509 (a) (2) – a public charity which receives substantial revenues from a combination of contributions, membership fees, and gross receipts from activities that further its exempt purpose. If you prefer to write, use the address below.Beginning August 1, 2022, smaller charities that are eligible and choose to file Form 990-N, Electronic Notice for Tax-Exempt Organizations (e-Postcard), must sign into the IRS modernized authentication platform. Supplemental Information to Form 990 (instructions included in schedule) Schedule R PDF. The IRS has successfully implemented the following enhancements to improve your user experience: Public disclosure main webpage: The concept of a central webpage with an easy-to-use interface and navigation, which could provide a comprehensive list of datasets and relevant updates.

, it may not attempt to . Generally, you can only deduct charitable contributions if you itemize deductions on Schedule A (Form 1040), Itemized Deductions.The IRS recently released its annual tax inflation adjustments for the 2024 tax year.

Other Nonprofits

Tax Exempt Organization Search.

Life Cycle of a Public Charity/Private Foundation

Dataset guide: The .

Cash or property donations of $250 or more require a receipt from the charity.gov for tax-exempt social welfare organizations. A Charity’s Guide to Vehicle Donations – Pub.

The earnings of a section 501 (c) (4) organization may not inure to the benefit of any .me: The IRS requires a Login. Select Database. Usually, this includes .An organization that normally has $50,000 or more in gross receipts and that is required to file an exempt organization information return must file either Form 990, Return of Organization Exempt from Income Tax PDF, or Form 990-EZ, Short Form Return of Organization Exempt from Income Tax PDF.The Taxpayer Certainty and Disaster Tax Relief Act of 2020, enacted last December, provides several provisions to help individuals and businesses who give to charity. Keep good records.

Form 990-N electronic submissions should now be made through IRS. We use data from the IRS, partners, and the charities themselves to power our unbiased ratings so that you can give with confidence.

Help; News; Charities & Nonprofits; Tax Pros; Home; File ; Charities and . Tax Exempt Organization Search. Special recordkeeping rules apply to any taxpayer claiming a charitable contribution deduction.Non-Cash Contributions (instructions included in schedule) Schedule N PDF.To be tax-exempt under section 501 (c) (3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501 (c) (3), and none of its earnings may inure to any private shareholder or individual.For answers to questions about charities and other non-profit organizations, call IRS Tax Exempt and Government Entities Customer Account Services at 877-829-5500 (toll-free number).

Required Filing (Form 990 Series)

A brief description of the requirements for exemption under the Internal Revenue Code, other than section 501 (c) (3). Charitable Organizations.To apply for recognition by the IRS of exempt status under IRC Section 501 (c) (3), you must use either Form 1023 or Form 1023-EZ. But keep in mind that it doesn’t automatically apply, so C corporations must elect the Increased Corporate Limit on a contribution-by-contribution basis. Your organization will need to allow six weeks for the IRS to update its records before you can file Form 990-N. That means you have all the details needed for both filing your 2023 taxes and planning your tax strategy for 2024. Form 990-N, Electronic Notice (e-Postcard) for Tax-Exempt Organizations Not Required to File Form 990 or Form 990-EZ, is used by small, tax . The type of review is . Life Cycle of an Agricultural or Horticultural Organization Links to helpful information about points of intersection between agricultural or horticultural organizations and the IRS, including access to explanatory .IRS Ground Rules for Charity Gaming. This section contains microdata files for all Forms 990 and 990-EZ sampled for the annual SOI studies of tax-exempt organizations.Information, explanations, guides, forms, and publications available on irs. We help you understand and meet your federal tax responsibilities. 78 database), and indicate in the IRS Business Master File (BMF) extract that the . To be tax-exempt as a social welfare organization described in Internal Revenue Code (IRC) section 501 (c) (4), an organization must not be organized for profit and must be operated exclusively to promote social welfare.Beginning August 2022, smaller charities that are eligible and choose to file Form 990-N, Electronic Notice for Tax-Exempt Organizations (e-Postcard), must sign into the IRS modernized authentication platform using either their active IRS username or create an account with ID. Online pickup scheduling for automobiles is also available in some areas of Arizona, California, Colorado, Hawaii, Oregon and Washington. For the filing link and more information on how to file, visit the Form 990-N webpage. Links to helpful information about points of intersection between tax-exempt organizations and the IRS, including access to explanatory information and forms that an .Submitting Form 990-N (e-Postcard) To access the Form 990-N Electronic Filing system: Sign in/create an account with Login.

Social welfare organizations

Visit the IRS website.

Locate the “ Tax-Exempt Organization Search (TEOS)” box and click on the “ Search Organization ” button.For answers to questions about charities and other non-profit organizations, an organization can call IRS Tax Exempt and Government Entities Customer Account Services at 877-829-5500 (toll-free number).SOI Sample Data Files.Social welfare organizations. “Expanded Tax Benefits Help Individuals and Businesses Give to Charity During 2021; Deductions Up to $600 Available for Cash Donations by Non-Itemizers. Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, educational, or other specified purposes and that meet certain other requirements are tax exempt under Internal Revenue Code Section 501 (c) (3). An organization can also submit questions to: Internal Revenue Service Exempt Organizations Determinations P. VEBAs -Voluntary Employees Beneficiary Association- 501 (c) (9) Vehicle Donations. “Publication 561 Determining the Value of Deducted Property,” Page 5.To be exempt under section 501 (c) (3), an organization must file an application for recognition of exemption with the IRS. These transfers, known as qualified charitable distributions or QCDs, offer eligible older Americans a great way to easily give . Sampling rates ranged from 1 percent for small .The 2023 and 2024 rules require donors to itemize their deductions to claim any charitable contribution deductions and are limited to the AGI limit of 60% for cash donations for qualified charities.

Internal Revenue Service

Rehabilitation Centers and will result in a tax deduction in accordance with IRS rules.What should I do? Keep track of all your taxable donations and itemize them on Schedule A (Form 1040). Search TermXX-XXXXXXX or . You can refer to Publication 561 provided by the IRS to understand the methods and factors that must be considered when determining the value of donated property. You’ve probably reached this page because your charity or other nonprofit organization received a letter or phone call from IRS Exempt Organizations (EO) Examinations saying it had been selected for a review of its returns. Spanish Versions: Form W-7 (SP) PDF. It’s a smart time to see how you can maximize your charitable contributions and continue to . The IRS also will include the reinstated organization in the next update of Exempt Organizations Select Check (Pub. Go to the “ Charities & Nonprofits ” section on the upper right side of the screen, as shown in the image. The law provides limited exceptions to the filing requirement. Rules Governing Practice before IRS Main navigation. This filing requirement applies to tax periods beginning after December 31 .Tax Information for Other Nonprofits.

- Irrevocable Letter Of Credit Deutsch

- Is An Algorithm A Constant Time?

- Is ‚At The Night‘ Idiomatic? | 50+ Spanish Expressions With ‚Tener‘

- Ireen Sheer Text , Songtext von Ireen Sheer

- Is Considered Meaning : grammar

- Iphone Power Share : Using Wireless PowerShare on my Samsung Phone

- Iran Steinigung Strafe – Spiegelstrafe

- Irischer Schäferhund _ Irish Setter

- Iron Bows Mod _ Download Iron Bows (FORGE)

- Ireland Neutrality | Russian invasion has not shifted opinion: Ireland will remain neutral

- Iran Jugendarbeitslosigkeit , Jugendarbeitslosigkeit: ILO warnt vor verlorener Generation

- Is Ayrton Senna Da Silva The Greatest Of All Time?

- Ipv6 Static Ip Address , How to Assign a Static IP Address in Windows 10 or Windows 11

- Is Ebay A Good Place To Sell Old Toys?

- Ippc Pdf _ Weltklimabericht 2023 aktuell