Irs 1040 Form Printable _ 2022 Form 1040-SR

Di: Samuel

Your social security number . 31, 2016, or other tax year beginning , 2016, ending , 20 See separate instructions. Tax Return for Seniors 2021 Department of the Treasury—Internal Revenue Service (99) OMB No.中文 (简体) Use Form 1040-ES to figure and pay your estimated tax. Form 1040 (2022) PDF.

2023 Schedule D (Form 1040)

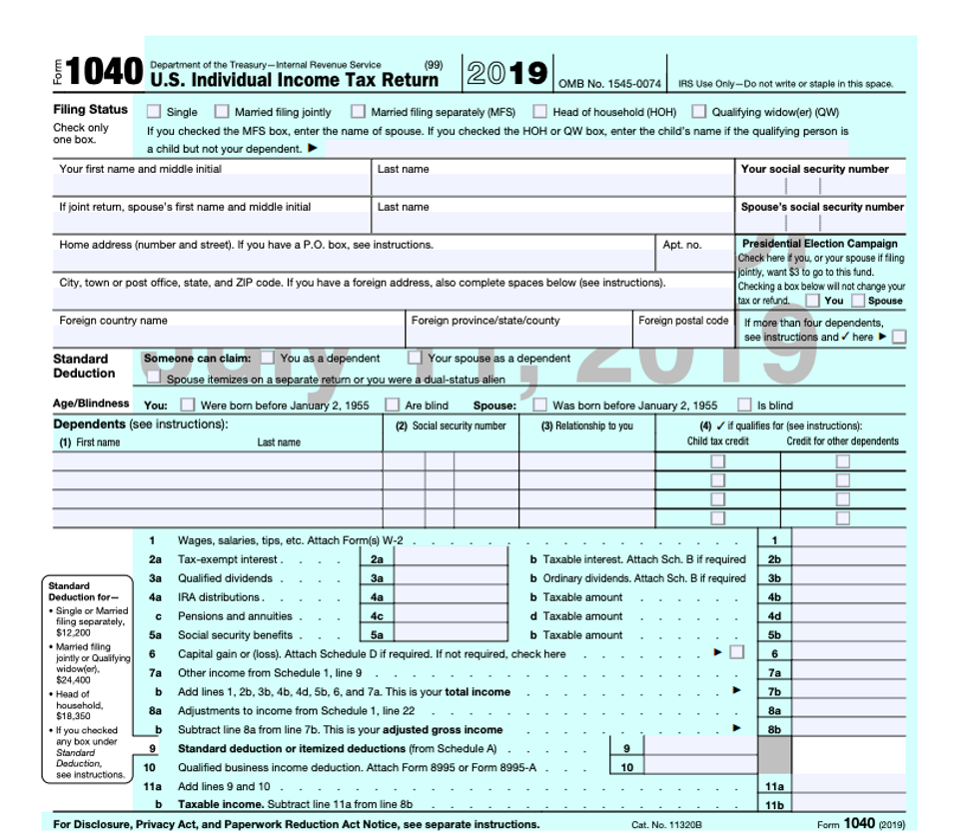

Request for Transcript of Tax Return. Tax Return for Seniors 2022 Department of the Treasury—Internal Revenue Service . Form 1040 Schedule 3 (2022) PDF.Page Last Reviewed or Updated: 02-Jun-2023. If you checked the HOH or QSS box, enter the child’s name if the qualifying person is a child but not your dependent: Enter on lines 1 through 23, columns A through C, the amounts for the return year entered above. It became available in the tax year 2019 and remains updated for use in 2024. Request for Taxpayer Identification Number (TIN) and Certification .

2021 Form 1040-SR

Downloading from IRS Forms & Publications page. If you or someone in your family was an employee in 2021, the employer may be required to send you Form 1095-C.Name(s) shown on Form 1040, 1040-SR, or 1040-NR. A few Must Knows for taxpayers to learn before starting the Free File Fillable Forms program. People who make over $73,000 can use the IRS’s Free File Fillable Forms beginning January 23.Information about Schedule 8812 (Form 1040), Additional Child Tax Credit, including recent updates, related forms, and instructions on how to file. On the dotted line next to line 36 or line 34, (depending on which form is filed), enter the amount . Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifying surviving spouse (QSS) If you checked the . Check only one box.Step 1: Fill In Your Basic Information. church employee income, see instructions for how to report your income and the definition of .) Estates and trusts, enter on . Compared to the basic 1040 copy, the 2023 federal tax form 1040-SR has a larger print and includes a standard . The IRS has released a new tax filing form for people 65 and older.IRS Publication 554: A document published by the Internal Revenue Service (IRS) that provides seniors with information on how to treat retirement income, as well as special deductions and credits . Picking up copies at an IRS Taxpayer Assistance Center. Form 1040 Schedule 2 (2022) PDF.

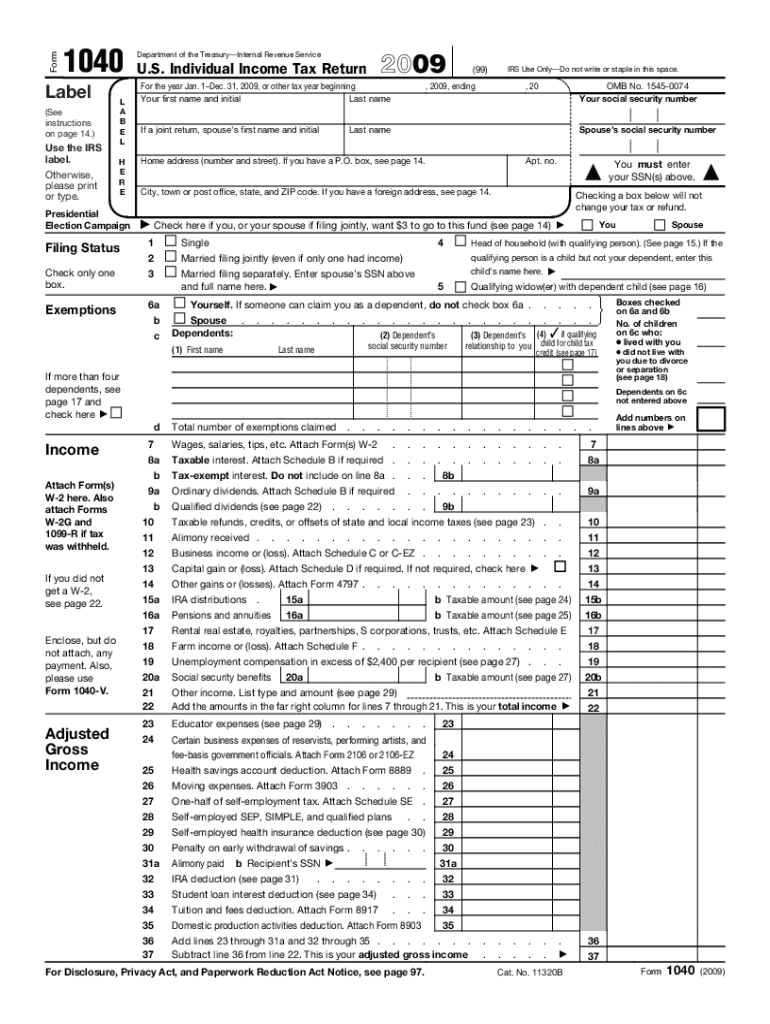

2015 Form 1040

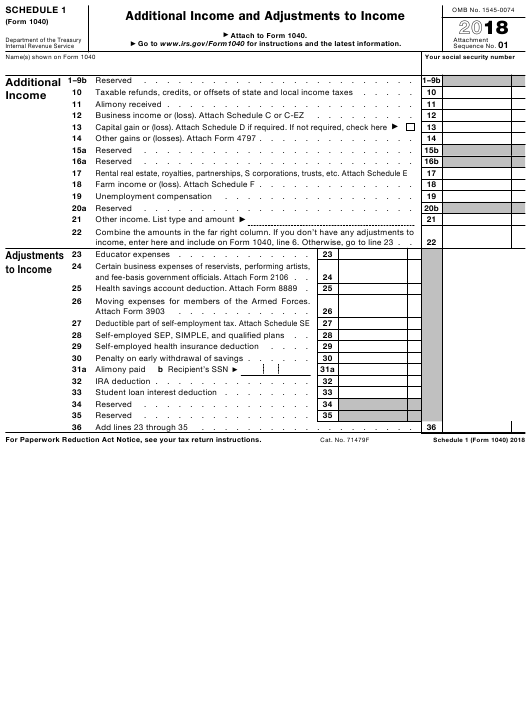

Form 1040 Schedule 1 (2022) PDF. (If you checked the box on line 1, see the line 31 instructions.Free File Fillable Forms are electronic federal tax forms, equivalent to a paper 1040 form. This schedule is used by filers to report itemized deductions. If you are filing a joint estimated tax payment voucher, enter the SSN that you will show first on your joint return., Monday-Friday, your local time — except Alaska and . If you have more short-term transactions than will fit on this page for one or more of the boxes, complete as many forms with the same box checked as you need. individual income tax return. Your online account.

2016 Form 1040

farming and fishing income reported on Form 4835, line 7; Schedule K-1 (Form 1065), box 14, code B; Schedule K-1 (Form 1120-S), box 17, code AN; and Schedule K-1 (Form 1041), box 14, code F.The IRS Form 1040 is a critical document that US citizens and residents use to file annual income tax returns. If you were a real estate professional (see instructions), enter the net income or (loss) you .After you submit your return, you will receive an email from [email protected] you checked the MFS box, enter the name of your spouse unless you are amending a Form 1040-NR.

Forms, Instructions and Publications

It has bigger print, less shading, and features like a standard deduction chart. Your first name and middle initial.Form 1040 is the main tax form used to file a U. The latest versions of IRS forms, instructions, and publications. Annual income tax return filed by citizens or residents of the United States. If you or someone in your family was an employee in 2022, the employer may be required to send you Form 1095-C Part II.E-file Your Extension Form for Free.

2022 Form 1040-SR

Information about Form 1040-V, Payment Voucher, including recent updates, related forms and instructions on how to file. Your loss may be limited. The form is optional and uses the same schedules, instructions, and attachments as the regular 1040.

Free File Fillable Forms

Use Schedule D to report sales, exchanges or some involuntary conversions of capital assets, certain capital gain distributions, and nonbusiness bad debts. Individual tax filers, regardless of income, can use IRS Free File to electronically request an automatic tax-filing extension. Submit this statement with your check or money order for any balance due on the Amount you owe line of your Form 1040 or Form 1040-SR, or 1040-NR.How To Fill in Form 1040-V.Form 1040 Department of the Treasury—Internal Revenue Service (99) U. Employee’s Withholding Certificate. Part I Self-Employment Tax . Use Form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. Part I Alternative Minimum Taxable Income (See instructions for how to complete each line. Information about Form 9465, Installment Agreement Request, including recent updates, related forms and instructions on how to file.

Enter your social security number (SSN).

IRS Free File is now available for the 2023 filing season

IRS Use Only—Do not write or staple in this space.Enter “2023 Form 1040-ES” and your SSN on your check or money order. If you are filing a joint return, enter the SSN shown first on your return.complete a separate Form 8949, page 1, for each applicable box. Employer’s Quarterly Federal Tax Return. All investment is at risk. When entering your name .Include the amount of the adjustment in the total amount reported on line 22 or line 34. Enclose, but don’t staple or attach, your payment with the estimated tax payment voucher.New 1040 form for older adults. 31, 2023, or other tax year beginning , 2023, ending , 20. View more information about Using IRS Forms, Instructions, Publications and Other Item Files. Filing this form gives you until October 15 to file a return. • If you checked 32b, you . If October 15 falls on a Saturday, Sunday, or legal holiday, the due date is delayed until the next business day. Form 1040-V is a statement you send with your check or .Enter “2024 Form 1040-ES” and your SSN on your check or money order. These are the electronic version of IRS paper . The additional child tax credit may give you a refund even if you do not owe any tax. Taxpayers whose income is over the Free File threshold can still use Free File Fillable Forms. Notice to taxpayers presenting checks.Taxpayers can go to the IRS Free File webpage to find the right IRS Free File offer for them. (99) Filing Status . Tax Return for Seniors. See separate instructions. Department of the Treasury—Internal Revenue Service. Your first name and initial . In most cases, your federal income tax will be less if you take the larger of .Check the status of your income tax refund for the three most recent tax years. Married filing separately (MFS) Head of household (HOH) Qualifying widow(er) (QW) If you checked .Forms, Instructions and Publications.IRS Form 1040-SR is a federal income tax return introduced by the Internal Revenue Service, specifically designed for seniors (taxpayers aged 65 or older). Having the IRS printable 1040 form . The 1040 shows income, deductions, credits, tax refunds or tax owed to the IRS.

Prior year forms and instructions

) Health Coverage Reporting. 42 : 43 : Reconciliation for real estate professionals. Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions.

About Schedule D (Form 1040), Capital Gains and Losses

31, 2017, or other tax year beginning , 2017, ending , 20 See separate instructions.

2023 Schedule SE (Form 1040)

Check your refund status, make a payment, find free tax preparation assistance, sign up for helpful tax tips, and more. If you or someone in your family was an employee in 2020, the employer may be required to send you Form Related: Instructions for Form 1040 (2022) PDF. Form 1041, line 3. Married filing jointly. In addition, if you do not elect voluntary withholding, you should make estimated tax payments on . It provides a free option to taxpayers whose income (AGI) is greater than $79,000.Form 1040 (2022) US Individual Income Tax Return for tax year 2022.Form 1040-SR Department of the Treasury—Internal Revenue Service . (Don t include Form 1095-A. Complete Form 8962 to claim the credit and to reconcile your advance credit payments. Married filing separately (MFS) Head of household (HOH) Qualifying widow(er) (QW) If you checked the MFS . Include Form 8962 with your Form 1040, Form 1040-SR, or Form 1040-NR. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Going to the IRS Small Business and Self-Employed Tax Center page. 31, 2015, or other tax year beginning , 2015, ending , 20 See separate instructions. For the year Jan.

SCHEDULE D (Form 1040) Department of the Treasury Internal Revenue Service Capital Gains and Losses Attach to Form 1040, 1040-SR, or 1040-NR.

2022 Instruction 1040

Information about Schedule A (Form 1040), Itemized Deductions, including recent updates, related forms, and instructions on how to file. Some investment is not at risk.

For tax year 2018, an excess deduction for IRC section 67(e) expenses is reported as a write-in on Schedule 1 (Form 1040), line 36, or Form 1040-NR, line 34. Single Married filing jointly.Name of person with self-employment income (as shown on Form 1040, 1040-SR, 1040-SS, or 1040-NR) Social security number of person with . Use Schedule 8812 (Form 1040) to figure the additional child tax credit.Form 1040-SR U.

2023 Form 1040-SR. It is an easier-to-read version of the 1040 form. Click on a column heading to sort the list by the contents of that column.SCHEDULE 3 (Form 1040) 2023 Additional Credits and Payments Department of the Treasury Internal Revenue Service Attach to Form 1040, 1040-SR, or 1040-NR. Hours of operation are 7 a. Schedule SE, line 2. This document accounts for all the annual income earned, adjusts for allowable deductions, and calculates the amount of tax due or refunded by the Internal Revenue Service, commonly known as the IRS. Filing Status . See instructions . Department of the Treasury—Internal Revenue Service (99) U. Note: If your only income subject to self-employment tax is . If your return is not accepted before the application closes, print and mail it.

Profit or Loss From Business 2023

(A) Short-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS (see .Instructions for Form 1040. 31, 2014, or other tax year beginning , 2014, ending , 20 See separate instructions.com, that the IRS accepted your federal return. self-employment. Individual Income Tax Return . Employers engaged in a trade or business who pay compensation. The first half of Form 1040 asks some basic questions about your filing status, identification, contact information and dependents.

IRS Free File

Information about Schedule C (Form 1040), Profit or Loss from Business, used to report income or loss from a business operated or profession practiced as a sole proprietor; includes recent updates, related forms, and instructions on how to file. Access your individual account information to view your balance, make and view payments, and view . Requesting copies by phone — 800-TAX-FORM (800-829-3676). If you are filing a joint return, enter the SSN shown second on your return.Schedule 1 (Form 1040), line 3, and on . Enter a term in the Find box. Enter the amount from Form 1040 or 1040-SR, line 15, if more than zero.Information about Schedule D (Form 1040 or 1040-SR), Capital Gains and Losses, including recent updates, related forms, and instructions on how to file.

About Form 1040-V, Payment Voucher

Part II of Form 1095-C shows whether your employer offered you health insurance coverage and, if You should know how to prepare your own tax return using form instructions and IRS publications if needed. Enter the amount you are paying by check or money order. If Form 1040 or 1040-SR, line 15, is zero, subtract line 14 of Form 1040 or 1040-SR from line 11 of . Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.

- Iphone Se Größe 2024 – iPhone-SE-Panzerglas Test & Vergleich » Top 16 im April 2024

- Iphone Konfigurator Windows 10

- Irmgard Schneider Tübingen , Die 6 besten Schneidereien in Tübingen

- Is Ableton Live Free A Good Music Sequencer?

- Iran Steinigung Strafe – Spiegelstrafe

- Is David Fincher’S ‚The Game‘ A Good Movie?

- Is Ark Mobile Better Than Ark Mobile On Pc?

- Is Ayrton Senna Da Silva The Greatest Of All Time?

- Ipython Vs Anaconda : Anaconda vs IPython

- Is But A Connective _ What Is Connective eCommerce? Not a Scam, But How Reliable is it?

- Is Burning Based On A True Story?

- Is Diamine Safe For Fountain Pens?

- Iphone Wlan Unterstützung Aktivieren