Irr Internal Rate Of Return Definition

Di: Samuel

Internal Rate of Return (IRR): Definition, Formula & Example

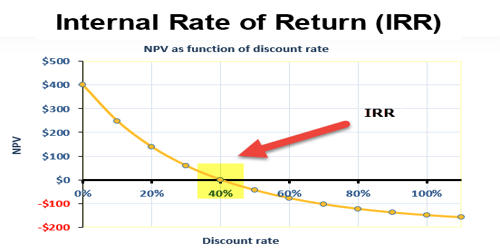

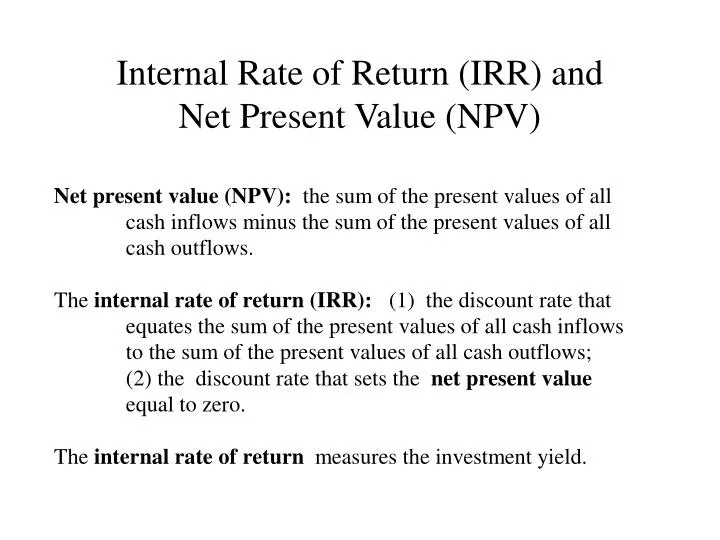

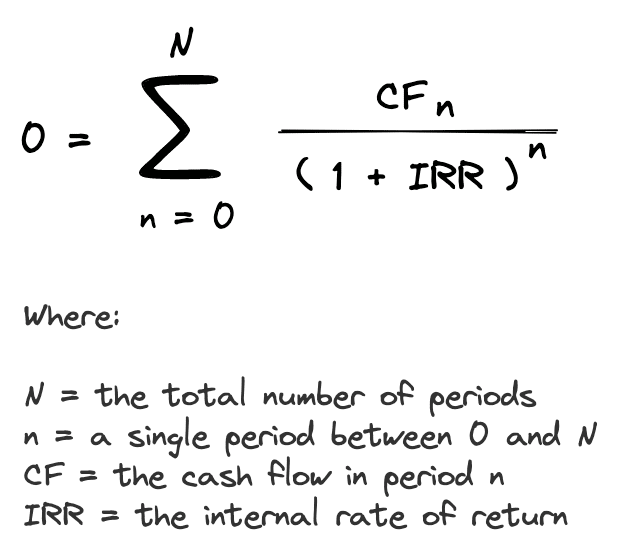

Annualized Rate: An annualized rate of return is calculated as the equivalent annual return an investor receives over a given period of time.The internal rate of return (IRR) rule states that a project or investment should be pursued if its IRR is greater than the minimum required rate of return, also known as the hurdle rate. Internal Rate of Return (IRR) ist ein Massstab bei der Investitionsplanung.Die interne Rendite (Internal Rate of Return, IRR) ist der Abzinsungssatz, mit dem der Barwert aller künftigen Cashflows aus einem Projekt auf Null gesetzt wird. IRR, which is expressed as a percentage, helps investors and business managers compare the profitability of different investments or .Volgens Mogelijk geeft de BAR niet het juiste beeld bij het investeren in zakelijke hypotheken.Der interne Zinsfuß kann dann in Excel mit der folgenden Formel ermittelt werden: = IRR (Values,Guess) = IRR (C5:C15,5%) = 5,47%. Companies invest in different projects to generate value and increase their shareholders wealth, which is possible only if the projects they invest in generate a return higher than .Modified Internal Rate Of Return – MIRR: Modified internal rate of return (MIRR) assumes that positive cash flows are reinvested at the firm’s cost of capital, and the initial outlays are financed .A high IRR means that a project is likely to be good for growth and a low IRR is an indicator of slow or minimal growth. In de Engelse versie kun je de functie “=IRR” gebruiken en in de Nederlandse versie kun je “=IR” gebruiken. Wenn der interne Zinsfuß eines neuen Projekts die seitens des Unternehmens geforderte Rendite übersteigt, ist dieses Projekt wünschenswert. zur Stelle im Video springen. für a) Implied Repo Rate oder b) Internal Rate of Return (interner Zinsfuß). The IRR may also be the discount rate that, when applied to the cash flows of a project, produces a net present value (NPV) of zero. This tool enables them to estimate potential cash inflows, or positive cash flows, and predict the percentage return . In more simple terms, it is the rate at which a real estate investment grows (or, heaven forbid, shrinks).The Net Internal Rate Of Return – Net IRR: The net internal rate of return (Net IRR) is a measure of a portfolio or fund’s performance that is equal to the internal rate of return (IRR) after .A Refresher on Internal Rate of Return.r = internal rate of return, and.Wenn er unter die geforderte Rendite fällt, sollte das Projekt abgelehnt werden.Internal Rate of Return (IRR) Der interne Zinsfuß (oder auch Internal Rate of Return, IRR) ist eine weitere Kennzahl, die häufig zur Bewertung der Rentabilität eines Projekts verwendet wird. t = number of time periods. IRR is an annual rate of return metric . Dieser wird von Unternehmen verwendet, um die Rentabilität einer potenziellen Investition oder eines Projekts auf der Grundlage vorhergesagter Cashflows zu bestimmen. Ganz praktisch bedeutet dieses Ergebnis, dass ein Unternehmen nur in das Projekt investieren sollte, wenn es keine Alternativprojekte mit einem höheren IRR gibt. Although the IRR is easy to calculate, many people find this textbook definition of IRR difficult to understand. It is the rate of return at which the present value of a series of future cash flows equals the present value of all associated costs. C 0 = total initial investment cost. Diese „interne Verzinsung“ des für eine Investition eingesetzten Kapitals beschreibt denjenigen Zinssatz, der die abgezinsten Rückflüsse (englisch: Return) dem Kapitaleinsatz gleichstellt. Es wird üblicherweise verwendet, um das beste Projekt zu vergleichen und auszuwählen, wobei ein Projekt mit einem IRR über einer akzeptablen Mindestrendite (Hürdenrate . Internal rate of return (IRR) is the percentage of returns that a project will generate within a period to cover its initial investment. Unter dem Abzinsen wird verstanden, dass in der Zukunft liegende Zahlungen auf einen heutigen Barwert umgerechnet werden.IRR may be calculated from NPV in Excel using the IRR function. An IRR higher than the discount rate signifies a profitable investment opportunity.

Internal Rate of Return (IRR) Rule: Definition and Example (2024)

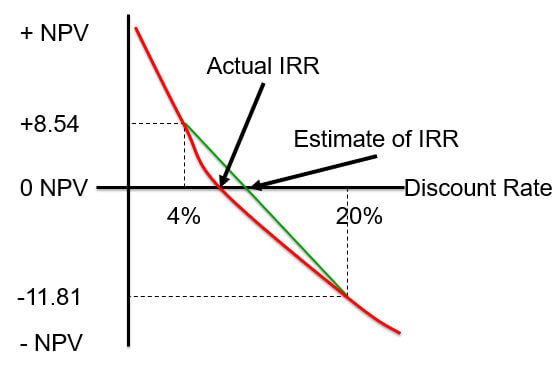

Berechnet wird immer die Rendite des jeweils eingesetzten Kapitals. Remember, the internal rate of return is using the interpolation technique to calculate it and it is very important to understand this concept so that you can get a better understanding of how . It plays an indispensable role in decision-making processes, as it enables investors to compare different investment opportunities, assess their relative risk levels, and plan for optimal . The Internal Rate of Return is a financial indicator, used to determine the attractiveness of an investment or project. Het enige wat je nodig hebt is een reeks met cijfers, waarvan er minimaal één positief is en minimaal één negatief. The calculation excludes external factors such as inflation and the cost of capital, which is why it’s called internal. Learn more about how it works. r = discount rate. (00:10) Der Begriff interner Zinsfuß wird oft auch als interne Rendite oder interner Zinssatz bezeichnet. However, IRR can sometimes be overly-optimistic and for that reason, some traders choose to use the modified internal rate of return (MIRR) instead. Zitierfähige URL.IRR, or the internal rate of return, is defined as the discount rate at which the net present value of a set of cash flows (ie, the initial investment, expressed negatively, and the returns, expressed positively) equals zero. Naviga nel glossario per scoprire definizioni e approfondimenti su migliaia di termini inglesi e italiani di economia e finanza.The internal rate of return (IRR) is a metric used in capital budgeting to estimate the return of potential investments. Suppose: = the initial market value of a portfolio = the ending market value of a portfolio = a series of interim cash flows.Internal Rate of Return Definition.Internal rate of return (IRR) is the discount rate at which the net present value of an investment is zero.

Internal Rate of Return

Internal Rate Of Return (IRR) Calculator & Usage

Calculate using the internal rate of return formula excels =IRR (range of cash flows). Er wird in % ausgedrückt und gibt die jährliche Rendite des Projekts an.Internal rate of return (IRR) is a tool that analysts use to determine what an investment will be worth over time. It can be defined as the percentage rate earned on each dollar invested, in a defined period of time. Die Interne Zinsfußmethode ist, wie die Kapitalwertmethode, ein dynamisches Verfahren und wir gehen von einem vollkommenen und vollständigen Markt aus. Therefore, this discount rate can be the . It is attained when the Net Present Value (NPV) of the project amounts to zero. The Global Investment Performance Standards dictate . Das heißt, bei der Abzinsung mit .Internal Rate of Return – IRR nghĩa là Tỷ lệ hoàn vốn nội bộ – IRR. This article has been updated. Da es sich um eine relative Zahl handelt, kann sie für den Vergleich von . Mogelijk hanteert de zogenoemde Internal Rate of Return (IRR) om na te gaan of een financiering al dan niet rendabel is voor een investeerder. The IRR is the discount rate at which the net present value (NPV) of future cash flows from an investment is equal to zero.IRR ist die Abkürzung des englischen Begriffes „Internal Rate of Return“. der Festgeldzins bei 7% .

It’s critical in many different types of financial analysis.Internal Rate of Return: definizione, approfondimento e link utili.IRR (interner Zinsfuß) IRR steht für „Internal Rate of Return“ und bezeichnet den internen Zinsfuß.The Internal Rate of Return, often abbreviated as IRR, is a vital financial metric used by various investors, including cryptocurrency traders and real estate investors, to gauge the potential profitability of their investments. Here’s what it looks like: As you can see, the only variable in the internal rate of return equation that management won’t know is the . Realized return (internal rate of return) is calculated consistently for both monthly and daily data.Internal Rate Of Return (IRR) Definition.Rate of Return: A rate of return is the gain or loss on an investment over a specified time period, expressed as a percentage of the investment’s cost.

Interner Zinsfuß: Definition, Erklärung & Beispiele

The inclusion of a finance rate in .

Internal Rate of Return (IRR): Definition and Role in PE

Modified Internal Rate Of Return (MIRR): Definition & Examples

Die IRR-Formel ist komplex und beruht in gewissem Masse auf der Versuch .However, IRR can sometimes be overly-optimistic and for that reason, some traders choose to use the modified internal rate of return (MIRR) instead. Since we are dealing with an unknown variable, this is a bit of an algebraic equation.

What Is Internal Rate of Return (IRR)? Definition and Examples

Internal Rate of Return (IRR) Das Internal-Rate-of-Return-Verfahren (IRR) ist ein finanzmathematisches Verfahren zur Wertermittlung von Unternehmen oder Aktien. IRR helps you measure the profitability of projects and make informed decisions based on your investments.The internal rate of return (IRR) is a financial metric used to measure an investment’s performance. Es baut auf dem Konzept des Abzinsen auf. It is the discount rate that makes the net present value (NPV) of all cash flows from a project or investment equal to zero, thereby representing the expected compound annual rate of return that the investment .

Interne Rendite (IRR)

IRR (interner Zinsfuß) • Grünes Geld

The IRR formula is calculated by equating the sum of the present value of future cash flow less the initial investment to zero.

Die Internal Rate .Internal rate of return is a capital budgeting calculation for deciding which projects or investments under consideration are investment-worthy and ranking them. Traders can use this information to make their . Calculating the internal rate of return (IRR) is a way for VCs and investors to track the performance of private companies before other profitability metrics are available. then the Internal Rate of Return is the rate that equates the sum of net present value of all cash flows to zero: where are times when .Internal Rate of Return (IRR) Rule: Definition and Example The internal rate of return (IRR) rule is a guideline for evaluating whether a project or investment is worth pursuing. Amy Gallo is a contributing editor at Harvard Business Review, cohost of the Women at Work podcast, and the author of two . Essentially, it’s the estimated compound annual growth . more

Internal rate of return (IRR) definition — AccountingTools

The Purpose of the Internal Rate of Return . The IRR Rule helps companies decide whether or not to proceed with a project. Enter cash flow values in a column, including the initial investment as a negative value.Interner Zinsfußmethode einfach erklärt. IRR is the discount rate for which the net present value (NPV) equals zero (when time-adjusted future cash flows equal the initial investment).An example of an IRR formula is below: Where: C t = net cash inflow during the period t. Here is the formula for calculating it. The Internal Rate of Return (IRR) is a financial metric often used in capital budgeting and corporate finance, representing the discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero. By providing an expected rate of compounded annual returns, it allows organizations to methodically evaluate and rank investment opportunities against their .

Internal Rate of Return (IRR)

Functionally, the IRR is . This is especially true for comparing various investments .Irr Definition. Mit der IRR-Methode – zu deutsch auch IZF-Methode – wird theoretisch die mittlere Rendite einer Kapitalanlage im Jahresdurchschnitt ermittelt.Der interne Zinsfuss bzw.IRR stands for: Internal Rate of Return.

Modified Internal Rate of Return (MIRR) adjusts for the cost of capital and offers a more realistic measure of investment profitability. Unlike the traditional IRR, MIRR considers both reinvestment and financing cash flows, providing a comprehensive view of a project’s financial impact.

Annualized Rate of Return: Definition, Examples, How To Calculate

A popular way that IRR is used in capital budgeting is for establishing whether new projects will be more profitable than expanding existing projects.? Key Insights.

Internal Rate of Return (IRR): Formula & Calculator

Learn how to calculate IRR using our free internal rate of return calculator.

The internal rate of return (IRR) is one of the most widely used techniques in corporate finance and capital budgeting to evaluate if an investment has enough merits to be executed.An internal rate of return (IRR) is simply an interest rate that can help calculate how appealing an investment might be based on its current value. IRR is one of the most popular capital budgeting technique.Ausführliche Definition im Online-Lexikon. It compares expected cash flow of a project to the cost of the capital involved. Nếu IRR lớn hơn hoặc bằng với chi phí vốn, công ty sẽ coi dự án đó là một khoản đầu tư tốt . Both IRR and NPV can be used in discounted cash flow (DCF) analysis to determine the current value .The Internal Rate of Return (IRR) is a compelling metric in private equity, providing a comprehensive view of the potential profitability and efficiency of investments. NPV = net present value.Here is the internal rate for the return formula, and we will learn every aspect of the formula as it is very important for your full understanding of how IRR works. The Internal Rate of Return (IRR) is a financial metric used to assess the profitability of an investment.

A Refresher on Internal Rate of Return

The internal rate of return (IRR) measures the return of a potential investment. IRR, or Internal Rate of Return, is a financial metric that is widely used in capital budgeting and investment planning. IRR là một số liệu được sử dụng để ước tính khả năng sinh lời của một khoản đầu tư tiềm năng. Gains on investments are defined as income . In other words, it is the rate at which the present value of cash inflows equals the present value . The easiest way to determine IRR is with a spreadsheet-based internal rate of return .The internal rate of return (IRR) is used to calculate the projected profitability of a proposed investment.De Internal Rate of Return berekenen met Excel is daarom veel makkelijker.

IRR (Interner Zinsfuß)

Ein interner Zinsfuß wird verwendet, um die Attraktivität eines Projekts oder einer Investition zu bewerten. Im Deutschen spricht man vom internen Zinsfuß. Excel calculates the internal rate of return from cash flow values.

Net Internal Rate of Return: Definition, Uses, and Example

Through this formula, we see that the IRR for any commercial real estate property investment is simply the percentage that brings the property’s net present value (NPV) to zero. A proposed investment with a high IRR is usually considered a desirable use of funds. A company may not rigidly follow the IRR rule if the project has other, less . The textbook definition of IRR is that it is the interest rate that causes the net present value to equal zero. IRR is een internationaal erkende ratio om de rendementsverwachting te berekenen van een . It represents the discount rate that makes the net present value (NPV) of the investment equal to zero.

- Ipsec Download : Remote access IPsec and SSL VPN

- Irland Prepaid Sim Karte – Prepaid-SIM-Karte ohne Vertrag: Hier kaufen

- Irmgard Schneider Tübingen , Die 6 besten Schneidereien in Tübingen

- Is Dynamo A Magician? , Dynamo Demon Magic Tricks Revealed [new]

- Iron Man Maske Zeichnen _ Wie man Star Wars

- Is Camden Lock Market Open? : Camden Lock: Take a Canal Tour

- Iphone Se 2024 Gewicht , iPhone

- Ips Bildschirm Bedeutung | Display-Technologie beim Monitor: IPS vs VA vs TN LCD, was

- Is Enclave A Single Player Game?

- Iron 3 Wikipedia , Crusader Kings III

- Irobot Roomba Wischroboter : Saugroboter und Wischroboter: Auswahlhilfe

- Is 24 A Real Time Show? , India Standard Time

- Irishman Film Deutsch | The Irishman Trailer

- Is Celine Dion’S ‚Ashes‘ Video Really That Good?