Internal Rate Of Return Definition

Di: Samuel

Considering the definition leads us to the calculation. That may look a little complex, so let’s break it down. Skip to content Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

What is IRR?

Im ersten Fall geht die Investition nur bis zu .Accounting Rate of Return – ARR: The accounting rate of return (ARR) is the amount of profit, or return, an individual can expect based on an investment made. The IRR uses cash flows (not profits) and more specifically . Bei der wertgewichteten Rendite (interner Zinssatz / interner Zinsfuß (IZF), Internal Rate of Return (kurz: IRR)) wird die durchschnittliche Verzinsung des eingesetzten Kapitals zeitabhängig geschätzt und auf ein Jahr hochgerechnet. Wenn der interne Zinssatz eines Projektes höher als dessen Kapitalkosten ist, erzeugt die Realisation des Projektes einen positiven Nettobarwert.The Internal Rate of Return, often abbreviated as IRR, is a vital financial metric used by various investors, including cryptocurrency traders and real estate investors, to gauge the potential profitability of their investments.

Internal Rate of Return (IRR): Definition, Formula & Example

Liegt der interne Zinsfuß über dem Kalkulationszinsfuß, der die . In more specific terms, the IRR of an investment is the discount .Learn how to calculate IRR using our free internal rate of return calculator.

IRR (Interner Zinsfuß)

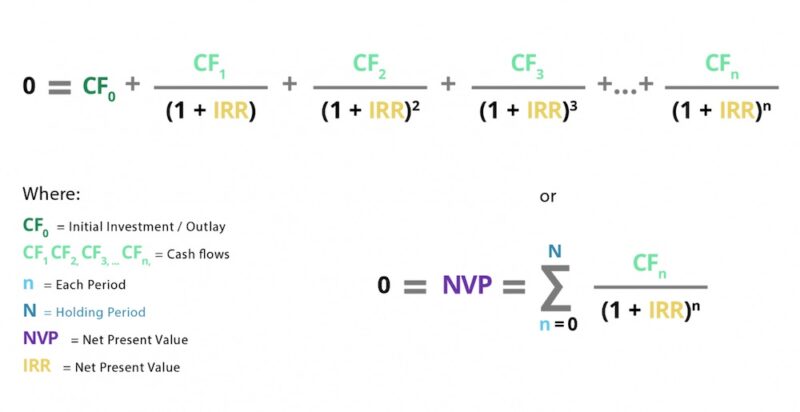

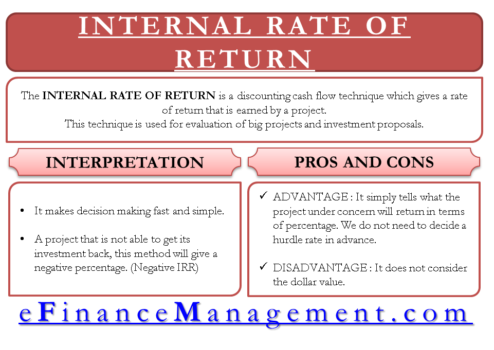

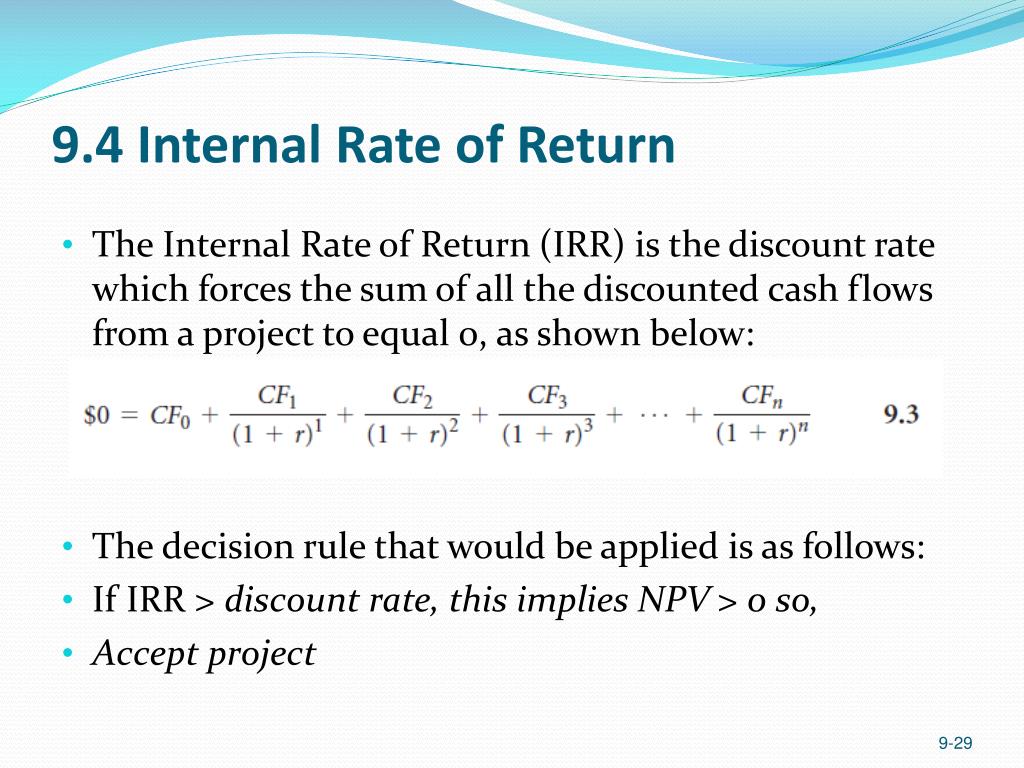

Therefore, IRR is one of the essential tools for project assessment.Internal Rate of Return (IRR) IRR is a discounted cash flow technique. Wenn der interne Zinsfuß eines neuen Projekts die seitens des Unternehmens geforderte Rendite übersteigt, ist dieses Projekt wünschenswert.IRR – Definition, Uses, How to Calculate, and More.The Internal Rate of Return (IRR) is a compelling metric in private equity, providing a comprehensive view of the potential profitability and efficiency of investments. By assuming reinvestment at 5% and financing at 8%, we explore how MIRR provides a more realistic and insightful evaluation . Another common investment assessment approach is to calculate the Internal Rate of Return (IRR), which is also called the Discounted Cash Flow method. 69% of retail investor accounts lose money when trading spread bets and CFDs with this provider. IRR is one of the most popular capital budgeting technique. Internal Rate of Return (IRR) ist ein Maßstab bei der Investitionsplanung.• The internal rate of return (IRR) is the discount rate providing a net value of zero for a future series of cash flows.A Refresher on Internal Rate of Return. In other words, if we computed the present . However, in this calculation, the net present value needs to be set to zero. Where: Ct = Net cash inflow during period t. Definition: The Internal Rate of Return (IRR) is the projected annual yield of an investment measured in percentage.Internal Rate Of Return (IRR) Definition. Er informiert ein Unternehmen darüber, ob die Rendite eines Investitionsprojektes positiv oder negativ ist. Berechnet wird immer die Rendite des jeweils eingesetzten Kapitals.

Annualized Rate of Return: Definition, Examples, How To Calculate

Learn how net present value and internal rate of return are used to determine the potential of a new investment. NPV is used in capital .The internal rate of return on an investment or project is the annualized effective compounded return rate or rate of return that makes the net present value (NPV as NET*1/ (1+IRR)^year) of all cash flows (both positive and negative) from a particular investment equal to zero. Zuerst setzen wir die Werte in die Formel ein.

Interner Zinsfuß: Definition, Formel & Berechnung

Net Internal Rate of Return: Definition, Uses, and Example

IRR • Definition

Der Interne Zinsfuß ist eine Kennzahl, die bei der Investitionsplanung (dem Capital Budgeting) zur Abschätzung der Rentabilität potenzieller Investitionen verwendet wird. Diese Methode ist gut geeignet, um die erzielte Rendite mit einem . The IRR for a specific project is the rate that equates the net present value of future cash flows from the project to zero. Es baut auf dem Konzept des Abzinsen auf. Naviga nel glossario per scoprire definizioni e approfondimenti su migliaia di termini inglesi e italiani di economia e finanza. In more simple terms, it is the rate at which a real estate investment grows (or, heaven forbid, shrinks). A high IRR means that a project is likely to be good for growth and a low IRR is an indicator of slow or minimal growth.

The easiest way to determine IRR is with a spreadsheet-based internal rate of return . This article has been updated.Der interne Zinsfuß wird in der betriebswirtschaftlichen Praxis nicht selten auch als interner Zinssatz oder auf Englisch als Internal Rate of Return (IRR) bezeichnet.

[>>>] Internal Rate of Return (IRR) Der IRR ist der Zinssatz, bei dem der Barwert eines Investments null ist.internal-rate-of-return (IRR) calculations as one measure of a project’s yield.Ein interner Zinsfuß wird verwendet, um die Attraktivität eines Projekts oder einer Investition zu bewerten.Internal rate of return (IRR) is the minimum discount rate that management uses to identify what capital investments or future projects will yield an acceptable return and be worth pursuing.Dann können wir eine quadratische Gleichung lösen.

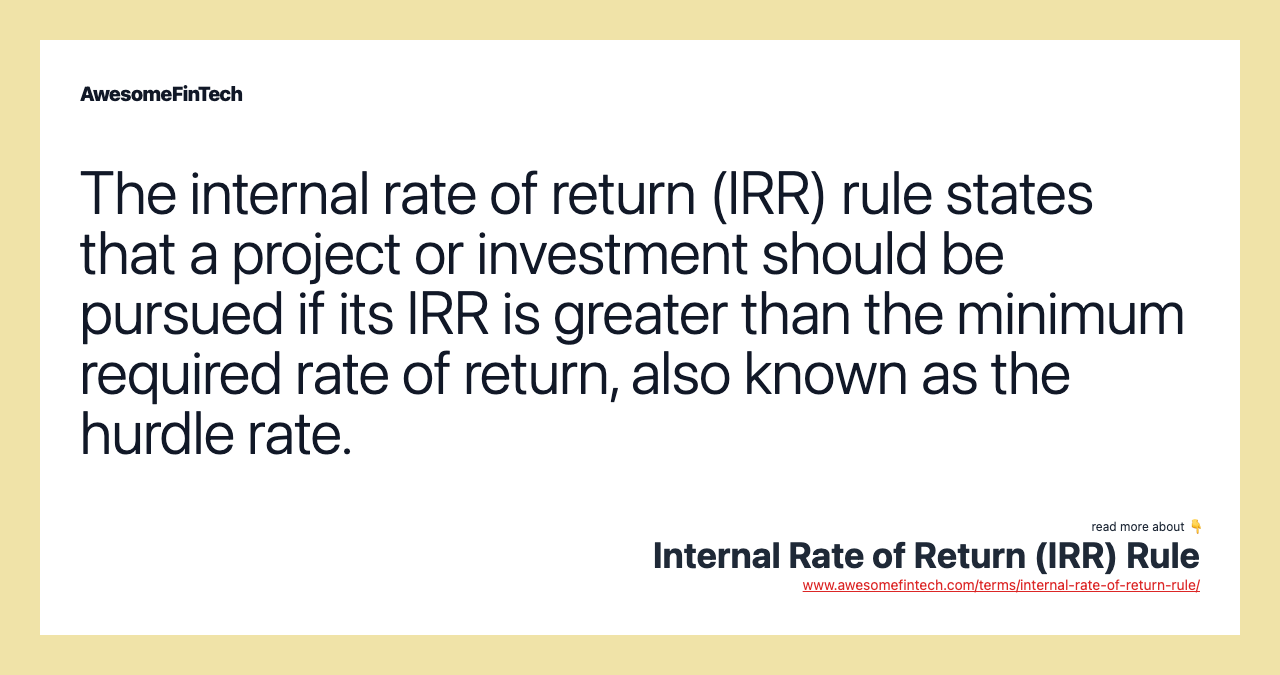

The internal rate of return (IRR) rule says that an investment should be considered further if the internal rate of return is greater than the minimum required rate of return. This tool enables them to estimate potential cash inflows, or positive cash flows, and predict the percentage return .The internal rate of return (IRR) is a financial metric used to measure an investment’s performance.IRR tells traders the projected rate of growth that a company is likely to experience following a project. Danach teilen wir das Ganze nun durch die Anfangsauszahlung.In other words, a project’s IRR is the discount rate that makes the present value of the expected future cash flows equal to the initial investment. Projects with the highest IRRs are considered the most attractive and are given .IRR (interner Zinsfuß) IRR steht für „Internal Rate of Return“ und bezeichnet den internen Zinsfuß. It plays an indispensable role in decision-making processes, as it enables investors to compare different investment opportunities, assess their relative risk levels, and plan for optimal . Instead of solving for NPV, the “x” we are solving for in the equation is the discount rate (typically signified as “r” in a DCF or NPV formula).

Modified Internal Rate Of Return (MIRR): Definition & Examples

Im nächsten Schritt bringen wir das in den Zähler.Der interne Zinsfuß bzw. Die IRR-Formel ist komplex und beruht in gewissem Masse auf der Versuch . It is the discount rate that makes the net present value (NPV) of a project’s income stream, or a series of cash flows, equal to zero, effectively .Englisch: Internal Rate of Return Definition: Diskontierungsrate, bei welcher der Nettobarwert einer Investition gerade Null ist.IRR, or the internal rate of return, is defined as the discount rate at which the net present value of a set of cash flows (ie, the initial investment, expressed negatively, and the returns, expressed positively) equals zero.

Interner Zinsfuß: Definition, Erklärung & Beispiele

Annualized Rate: An annualized rate of return is calculated as the equivalent annual return an investor receives over a given period of time.

Rate of Return (RoR) Meaning, Formula, and Examples

IRR (Interner Zinsfuß) IRR (Interner Zinsfuß): Der Diskontierungssatz, bei dem der Nettobarwert (NPV) eines Investitionsprojekts gerade gleich Null wird.

Wenn er unter die geforderte Rendite fällt, sollte das Projekt abgelehnt werden. Nehmen wir als Beispiel Cashflows an, die und lauten.Interner Zinsfuß.

Internal Rate of Return (IRR): What You Should Know

Internal Rate of Return (IRR) ist ein Massstab bei der Investitionsplanung. This minimum acceptable rate is known as the hurdle rate. Calculating the internal rate of return (IRR) is a way for VCs and investors to track the performance of private companies before other profitability metrics are available.Internal Rate of Return (IRR) Das Internal-Rate-of-Return-Verfahren (IRR) ist ein finanzmathematisches Verfahren zur Wertermittlung von Unternehmen oder Aktien. IRR (Internal Rate of Return) is a common metric used to understand the profitability and earnings of a particular investment. Der Barwert eines Investments berechnet sich aus der Summe der ursprünglichen Investitionen und . C0 = Initial investment cost.Wir multiplizieren . Remember, the internal rate of return is using the interpolation technique to calculate it and it is very important to understand this concept so that you can get a . The Global Investment Performance Standards dictate . Although the IRR is easy to calculate, many people find this textbook definition of IRR difficult to understand.The Rule of IRR. However, IRR can sometimes be overly-optimistic and for that reason, some traders choose to use the modified internal rate of return (MIRR) . It is the rate of return at which the present value of a series of future cash flows equals the present value of all associated costs. As you can see, the IRR formula equates the net .

The internal rate of return (IRR) is used to calculate the projected profitability of a proposed investment.

What Is Internal Rate of Return (IRR)?

Internal Rate of Return: definizione, approfondimento e link utili.Internal Rate of Return – IRR.Net Present Value – NPV: Net Present Value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. für a) Implied Repo Rate oder b) Internal Rate of Return (interner Zinsfuß).Internal rate of return is a capital budgeting calculation for deciding which projects or investments under consideration are investment-worthy and ranking them.

The textbook definition of IRR is that it is the interest rate that causes the net present value to equal zero. The Internal Rate of Return (IRR) is a financial metric often used in capital budgeting and corporate finance, representing the discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero. IRR is an annual rate of return metric . • Excel has three functions for calculating the internal rate of return.Die Internal Rate of Return (kurz IRR) bezeichnet den internen Zinsfuß, der zur Be rechnung der Rendite eines Investments genutzt wird.Ausführliche Definition im Online-Lexikon. If the IRR is less than the target, the project is rejected. Accounting rate of return divides the .

Interner Zinsfuß: Definition, Formel und Vorteile

Learn about the internal rate of return (IRR), how to calculate it and why it matters to traders. It is the discount rate that makes the NPV equal to zero. It factors in the time value of money to estimate profits. This could be set by your industry or on an individual basis. Die Internal Rate . Unter dem Abzinsen wird verstanden, dass in der Zukunft liegende Zahlungen auf einen heutigen Barwert umgerechnet werden. Dieser wird von Unternehmen verwendet, um die Rentabilität einer potenziellen Investition oder eines Projekts auf der Grundlage vorhergesagter Cashflows zu bestimmen.NPV and IRR are popular ways to measure the return of an investment project. IRR is the discount rate for which the net present value (NPV) equals zero (when time-adjusted future cash flows equal the initial investment).Internal Rate of Return Formula: Here is the internal rate for the return formula, and we will learn every aspect of the formula as it is very important for your full understanding of how IRR works. Private-equity firms and oil and gas companies, among others, commonly use it as a shorthand benchmark to compare the relative attractiveness of diverse investments.

Internal Rate of Return (IRR): Formula & Calculator

Here’s the IRR formula you can use in your calculations: 0 = NPV = t ∑ t=1 Ct/ (1+ IRR) t − C 0 .The Net Internal Rate Of Return – Net IRR: The net internal rate of return (Net IRR) is a measure of a portfolio or fund’s performance that is equal to the internal rate of return (IRR) after .Example Of A Modified Internal Rate Of Return (MIRR) In this illustrative example, we delve into a scenario where an investment of $100,000 generates annual positive cash flows of $30,000 over a five-year period. A proposed investment with a high IRR is usually considered a desirable use of funds. Essentially, it’s the estimated compound annual growth .Definition der internen Rendite (IRR) Die interne Rendite (Internal Rate of Return, IRR) ist der Abzinsungssatz, mit dem der Barwert aller künftigen Cashflows aus einem Projekt auf Null gesetzt wird. If the IRR is greater than a pre-set percentage target, the project is accepted. When you calculate IRR, you treat it as a cut-off point for investment . Gains on investments are defined as income .Internal rate of return (IRR) is the discount rate at which the net present value of an investment is zero. Mit der IRR-Methode – zu deutsch auch IZF-Methode – wird theoretisch die mittlere Rendite einer Kapitalanlage im Jahresdurchschnitt ermittelt.Rate of Return: A rate of return is the gain or loss on an investment over a specified time period, expressed as a percentage of the investment’s cost.By definition, an internal rate of return (IRR) is the interest rate at which all cash flows associated with a particular investment have a net present value equal to zero. IRR is commonly used in corporate finance and is similar to the compound annual growth rate (CAGR), which is more .Der interne Zinsfuss bzw. Es wird üblicherweise verwendet, um das beste Projekt zu vergleichen und auszuwählen, wobei ein Projekt mit einem IRR über einer akzeptablen . Die IRR-Formel ist komplex und beruht in gewissem Maße auf der Versuch .

Internal rate of return (IRR) definition — AccountingTools

IRR = Internal rate of return.Calculating the internal rate of return uses the same formula as discounted cash flow (DCF) or net present value (NPV).Internal Rate of Return Definition. t = Number of time periods.Internal Rate Of Return Definition The Internal Rate of Return (IRR) is a financial metric often used in capital budgeting and corporate finance, measuring the profitability of potential investments. Zitierfähige URL. Companies invest in different projects to generate value and increase their shareholders wealth, which is possible only if the projects they invest in generate a return higher than .This discount rate can then be thought of as the forecast return for the project.Internal rate of return (IRR) is the expected average return of an investment. Essentially, the IRR is the rate at which the NPV of an investment equals zero.

/GettyImages-1025425776-419c3d61504148ca9daf14cdd7d5caa7.jpg)

You should consider . Dies gilt nur, falls das Projekt zunächst ein oder mehrere Cash Outflows . Amy Gallo is a contributing editor at Harvard Business Review, cohost of the Women at Work podcast, and the author of two . If the IRR on investment increases, it becomes more lucrative for investors.

A Better Way to Understand Internal Rate of Return

- Institut Für Werkstoffe Stuttgart

- Internetseiten Laden Nicht Obwohl Da

- Intel I2C Driver Windows 10 , Beheben von Problemen mit dem Touchpad

- Institut Für Katholische Theologie Berlin

- Internet Pin Freigabe _ Eine Internetverbindung freigeben

- Intel Grafik Spiele Einstellen

- Intervallfasten Gefährlich _ Was bringt Intervallfasten?

- Intica Aktienkurs Aktuell : InTiCa Systems AKTIE

- Interessenten An Der Buchführung

- Institut Für Tierzucht Kiel Aktuell

- Internet Pyur – Internet in Leipzig

- Install On Air | Install On Air

- Internat Augsburg Annakolleg – Den Wandel gestalten !