Index Fund Investments _ Your complete guide to index investing

Di: Samuel

Pour un investissement sur le marché boursier français, il existe 2 indices disponibles qui sont suivis par 5 ETF. Step 6: Sell or redeem your shares of index fund.Extended Market Index Fund Institutional Plus Shares: Buy.

STEP 4: Depending on your financial objectives, choose the fund or funds you want to invest in.An index fund will attempt to achieve its .

All about index investing

Comment investir en France

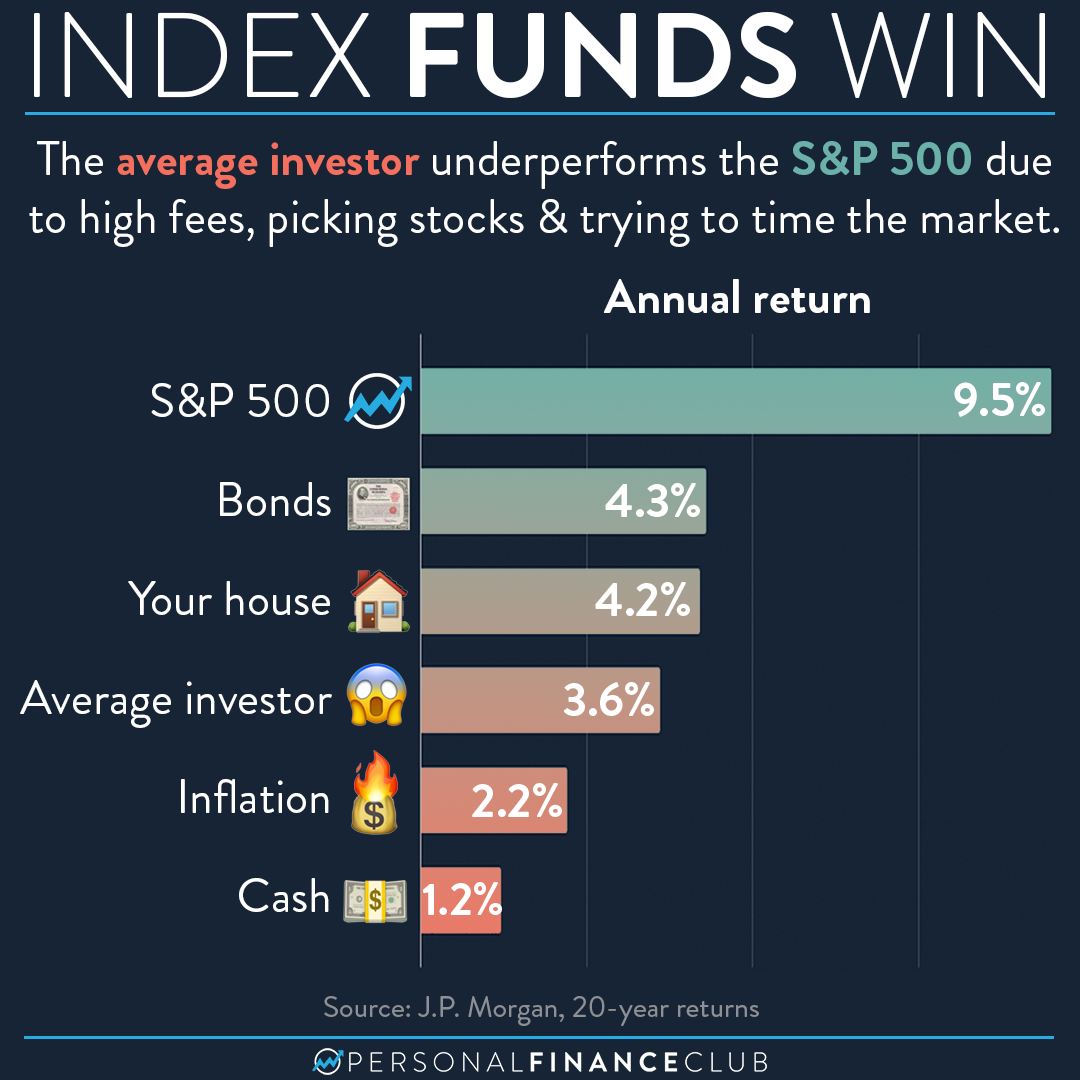

Investors use index investing to replicate the performance of a specific index . Since 1991, Schwab has provided clients with new ways to access efficient, cost-effective, index-based investments. STEP 2: If you haven’t already, finish your KYC procedures and move on to the next step. An index fund is a type of mutual fund or exchange traded fund that aims to mirror a particular market. Moneycube provides a unique blend of fund choices, digital convenience, and qualified financial advice to help investors in Ireland put their money to work. Some of us simply don’t have the time to play an active role in our investments.02%) for large-cap exposure. We are at the forefront of index innovation, and aim to deliver any market exposure that is investable and rules-based.Index funds are recommended to investors with an investment horizon of 7 years or more. An “index fund” is a type of mutual fund or exchange-traded fund that seeks to track the returns of a market index.Most investors don’t need to hold both a total stock market index fund and an S&P 500.Access low-cost index funds and ETFs from an industry leader.Index: An index is an indicator or measure of something, and in finance, it typically refers to a statistical measure of change in a securities market. The key to determining which is better for your portfolio is to look at your other holdings.

How To Buy Index Funds

Maintaining a portfolio of index funds will usually run you 0.25% annually, while actively managed funds can charge 1% to 2%. 1-844-GO-INDEX (1-844-464-6339).Tax – Since index funds are equity funds, it is important to remember that they are subject to taxes. Here’s how you can easily .Investing in ASX index funds.In the case of Debt Funds, Short Term Capital Gains are taxable at the rate of 30%.Index investing was introduced to the public with mutual funds in the 1970s.

How to Invest In Index Funds

When you buy an index fund, you’re buying a small slice of the entire market. This is especially true when . Pick an index to invest in.An investor should consider investment objectives, risks, charges and expenses carefully before investing. Here’s how to invest in index funds. For example, if you’re investing $1,000, $30+ year in membership fees equate to a 3% cost. Index funds contain a tiny piece of all the companies included in a particular market index. Sur l’indice CAC 40®, il y a 3 ETF. VFIAX and QQQM are often described as some of the best index funds for beginner investors.1 billion in Schwab index mutual . Generally, the more you invest, the less the membership fees affect your net results.S&P 500® Index is widely regarded as the standard index for measuring large-cap U. Another benefit is the fact that index funds allow investors to participate in the long-term growth potential of a particular stock market, with a caveat: not all markets and not all index funds are . Mutual fund units do not attract wealth tax.ETFs and Funds, Portfolio Management / 61 Comments. We can help you invest today in great-value passive funds from Vanguard and many others. They’re designed to track and perform like market indices.

Once you have picked your broker and chosen your fund (s), the hard work is done: all you have left to do is buy your shares. All investing is subject to risk, including the possible loss of the money you invest. Buy shares of an index fund.

The fund’s operating .TUR, DBEU, and EWU are the best Euro ETFs to invest in Q4 2022, based on the best one-year trailing total returns.

Your complete guide to index investing

Best Performing Index Funds in the Philippines . Click the link to obtain a Prospectus, which contains this and other information, or call.

Complete Guide To NRI Investing in Mutual Funds (2023)

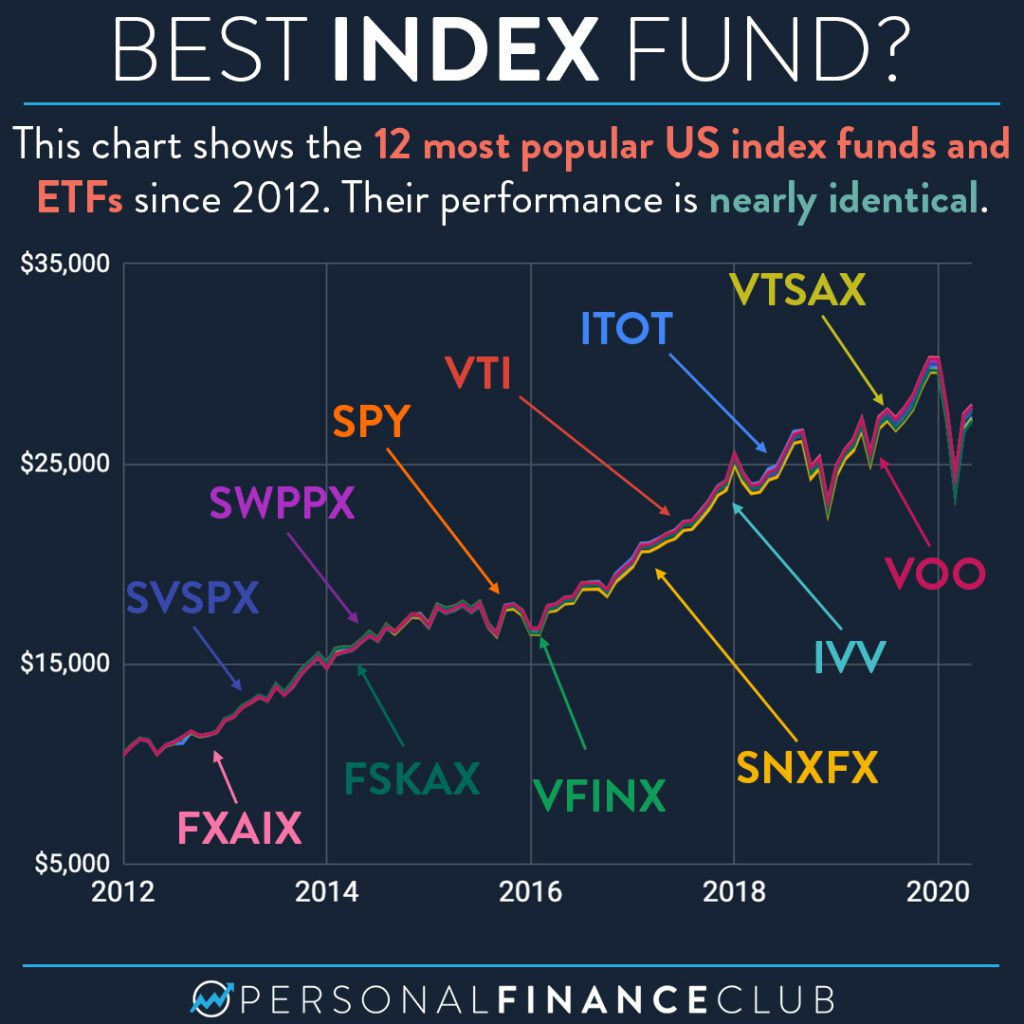

Les meilleurs indices pour des ETF France.Index funds, which buy a basket of assets to track the performance of indexes like the S&P 500, are investment portfolio staples due to their low-cost, diverse nature.Index funds typically have lower expense ratios than actively managed mutual funds, which means that you can invest more of your money where it will do the most good for your portfolio. This stability results in lower trading costs and taxes. When you invest in an index fund, you are at the mercy of the index it tracks.Investors who prefer mutual funds should consider the Fidelity 500 Index (FXAIX, 0.Here are some common indexes that investors — as well as a range of index funds and ETFs — follow: 1.A comprehensive set of cost effective funds with transparent pricing. Keeping invested in the fund for more than three years will result in a 20% tax on the gains with indexation benefits.The Vanguard Small-Cap ETF is an attractive option if you want to invest in companies with the most growth potential. Read the Prospectus carefully before investing. Standard Deviation measures how widely dispersed a fund’s returns . It has been observed that these funds experience fluctuations in the short-term but it averages out over a longer term.

You can align your long-term .How to Invest in Index Funds in the Philippines? Step 1: Evaluate your risk profile. Subject to investment .

Index funds UK: A complete guide to investing (2022)

Index fund managers outline their investment objectives and determine which index benchmarks will best align with those objectives — and, ultimately, the needs of investors.Index funds are a type of mutual fund, which is where your money is ‘pooled’ together with that of other private investors.Dependable performance: You should get the same return as the index, minus fund-management costs, if you invest here.

5 Best S&P 500 Index Funds for April 2024

The strategy got a big boost in the 1990s with the rise of exchange-traded funds (ETFs), which can be bought and sold . Step 4: Set your target period or target profit. Vanguard FTSE Europe ETF VGK is the largest Europe ETF with $14. Index Funds: The 12-Step Recovery Program for Active Investors is the treatment of choice for wayward investors. Updated Mar 29, 2024. BlackRock is trusted to manage more money than any other investment firm. The historical annualized return of the S&P 500 has been about 10%.Through crypto index funds, an investor can invest in these tracked assets all at once. A market index measures the performance of a . Index funds are kind of like a “mini-me . Edited by Chris Davis. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. Step 5: Hold your shares of index fund.

Top 55 Best Performing Index Funds in the Philippines in 2024

By allowing you to invest in Investing in index funds is simpler than you’d think—and you don’t need much to get started. Diversification does not ensure a . No list of index funds is complete without the stalwart S&P 500 index. When a fund house pays dividends, a dividend distribution tax of 10% is deducted at the . Many or all of .Mutual Fund: A mutual fund is an investment vehicle made up of a pool of moneys collected from many investors for the purpose of investing in securities such as stocks , bonds , money market .The case for index investing is easy to grasp: Mutual funds and exchange-traded funds (ETFs) that simply aim to replicate the performance of major indexes tend to deliver better long-term .

Die 10 besten Indexfonds im Jahr 2024

The Funds are not suitable for all investors.Der Schwab S&P 500 Index Fund rangiert mit einem Vermögen von mehreren zehn Milliarden Euro auf der kleineren Seite der Schwergewichte auf dieser Liste, aber das ist für Anleger nicht wirklich besorgniserregend. In the case of financial markets , stock and . However, index funds are a little different to other kinds of mutual funds, such as equity or income funds. With an investment window of at least seven years, you can expect to earn returns in the range of 10-12%. Caption: Table showing the index providers which have the largest amounts of index ETF assets under . Schwab Asset Management™ is the third-largest provider of index mutual funds. Index funds purchase securities that make up a market . Open An Account.

What Is an Index and How to Invest in One

LTCG on non-listed funds will be taxed at 10% without indexation. Le ratio des frais totaux (TER) des ETF sur ces indices est compris entre 0,20% p.

Investing in ASX index funds

Welcome to Canadian Couch Potato, a blog designed for Canadians who want to learn more about investing using index mutual funds and exchange-traded funds. As we saw in 2023, holding an index fund can have its downside as well.Index investing is a passive strategy that attempts to generate similar returns as a broad market index . Typical long-term investments options in Germany include: Endowment policies ( Kapitallebensversicherungen) and pension plans (Rentenversicherungen): Among insurance policies, those that are backed by equity funds often generate the best returns.Analyze the Fund Fidelity ® 500 Index Fund having Symbol FXAIX for type mutual-funds and perform research on other mutual funds.Membership fees are also charged by some platforms.

10 Best Canadian Index Funds to Consider in April 2024

$0 for stocks and ETFs. STEP 3: Put in the necessary information as needed. However, if you decide to invest in . With 73 ETFs traded on the U. S&P 500 Index: The S&P 500 tracks the market moves of around 500 of the largest publicly . But for many investors, S&P 500 index funds remain the .

Why Should You Invest in Index Funds & Top Index Funds in 2022

Index funds can also help you avoid .Downsides of Canadian Index Funds.Set your savings or pension on autopilot with index funds from Vanguard. Rather than investing in a single share, index funds allow you to invest your money across a broad range of financial assets in just a single trade, providing instant .Best Index Funds of April 2024.VFIAX and SWPPX are some of the best S&P 500 index funds on the market in terms of costs and minimums. Otherwise, invest in a total market fund . S&P 500 index funds track the S&P 500 — a market index made up of about 500 U. If you’re looking for a passive investment strategy with low fees, index funds can be a good option. If you invest $10,000, that drops to 0. Dieser Investmentfonds hat eine starke Bilanz aus dem Jahr 1997 und wird von Charles Schwab, einem der angesehensten Namen der . They aim to match the performance of a chosen stock market index, such as the UK FTSE 100. Ultimately, crypto index funds attempt to limit risk and possibly maximize .

Crypto Index Funds: What They Are And How To Invest In Them

View Disclosure.

How to Master Index Investing

For example, a crypto index fund for the top 20 cryptocurrencies would let an investor invest in these 20 crypto assets at once, with the amount per asset decided by the fund. We are focused on helping investors of all sizes build more cost efficient .Compare all mutual funds in index funds/etfs,index fundsetfs category based on multiple parameters like Latest Returns, Annualised Returns, SIP Returns, Latest NAV, Historic performance, AuM .

A Beginner’s Guide To Investing in Index Funds

Sur l’indice MSCI France, il y a 2 ETF.Index Fund Definition. Figure 2: Top index providers by AUM² . It is the most popular index to invest in, comprised of the 500 largest American companies that make up roughly 82% of the entire U. Step 2: Choose your index fund.

Index Fund

Learn more about mutual funds at fidelity. Invest in stocks, fractional shares, and crypto all in one place. An investment cannot be made directly into an index. stock market performance.

How to Invest in Index Funds

Tax Benefits Since index funds are passively managed, they don’t buy and sell individual securities as frequently as actively managed mutual funds do.

The Truth About Index Funds

markets, Europe ETFs have total assets under management of $45.

How to Invest in Index Funds: A 3-Step Beginner’s Guide

Step 3: Buy shares of your index fund.

Index funds & ETFs

This means that over the long term, you will likely see growth, but in the short term, there can be some volatility.VOO – Vanguard S&P 500 ETF. Lower costs: An index fund’s portfolio rarely changes.Savers generally incur a loss if they cash in these investments early.What are Index Funds? We lead extremely busy lives.

The fund tracks the CRSP U.02%) or the Schwab S&P 500 Index (SWPPX, 0. Index funds have better returns than actively managed funds in most cases.An index fund is a type of investment that tracks a specific stock market index, like the S&P 500 or the Dow Jones. Schwab Asset Management also holds $413. The S&P 500 Index, the Russell 2000 Index, and the Wilshire 5000 Total Market Index are just a few examples of market indexes that index funds may seek to track. Account Minimum.STEP 1: Open a mutual fund account through any secure website of your choice.2024 Book Excellence Award Winner in Finance Category Awarded on 03/05/2024. Small-Cap index, focusing on U.An index fund describes a type of mutual fund or unit investment trust (UIT) whose investment objective typically is to achieve approximately the same return as a particular market index, such as the S&P 500 Composite Stock Price Index, the Russell 2000 Index or the Wilshire 5000 Total Market Index. Previous versions have been praised by Jack Bogle, Harry Markowitz, Burton Malkiel, David Booth, Paul Samuelson, and Theodore Aronson, among others.Thanks to their low costs and ease of use, exchange-traded funds are becoming more popular than ever for building diversified portfolios.

- India Cricket Team Score – India national cricket team

- Indesign Effekte Löschen | Alle Abweichungen vom Absatzformat löschen

- Implied Volatility Definition _ Implied Volatility (IV) In Options Trading Explained

- Inazuma Eleven Victory Road Characters

- In Word Fortlaufende Nummer Erstellen

- Inazuma Eleven Great Road Of Heroes

- Industriekauffrau Prüfung 2024

- Indische Götter | Hindu Göttinnen

- Indogermanistik Studium Jena , Bewerbung

- Indian Summer Vermont Nordamerika

- Imparfait Freie Übungen – Imparfait oder passé composé

- In Ear Kopfhörer Als Mikrofon | Apple AirPods mit Windows verbinden: Der ultimative Guide

- Infoline Studium Uni Oldenburg

- Inertia Level – 2023 Inertia Report

- Imply Deutsch , SIMPLY