Implied Volatility Definition _ Implied Volatility (IV) In Options Trading Explained

Di: Samuel

Implied volatility definition

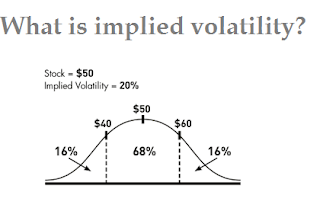

Implied volatility offers a look at how stock prices might move in the future. A higher volatility means a stock’s price tends to fluctuate more over time.Implied volatility is a forward-looking metric that’s designed to gauge how volatile the market may be in the future. Implied volatility surface is the collection of implied volatilities on the same underlying for several expirations.Now, if the implied volatility is 90, the option price stands at $12.A volatility smile is a common graph shape that results from plotting the strike price and implied volatility of a group of options with the same underlying asset and expiration date. Using the IV Rank formula: IV Rank = (25 – 20) / (50 – 20) = 5 / 30 = 0. Volatility is the change in the performance of an investment over time. Implied Volatility. Expressed as a percentage, implied volatility (IV) is computed using an options-pricing model and reflects the market’s expectations for the future volatility of the underlying stock.The volatility surface is a three-dimensional plot where the x-axis is the time to maturity, the z-axis is the strike price, and the y-axis is the implied volatility. Ist die Volatilität hoch, sind die Marktteilnehmer nervös – und vice versa.Volatility, by definition, is the speed and extent of a price fluctuations. The weight of negativity is particularly high in today’s economic environment. If we take a look at the BSM pricing, the theoretical price or the fair value of an option is P, where P is a function of historical volatility σ, stock price S, strike price K, risk-free rate r and the time to expiration T.

Durch die Analyse des IV-Perzentils können Investoren einschätzen, ob eine Option im . It means measuring the current price of options contracts that will tell about a theoretical value to the current market price of the option of stocks in question. If you think the market is overestimating volatility, you sell options.

Options Volatility

For instance, if the . This shows how much prices have changed in the past. Generally, IV increases ahead of an upcoming announcement or an event, and it tends to decrease after the announcement or event . Implied volatility is a forward-looking metric that’s designed to gauge how volatile the market may be in the future. It measures the daily price changes of a stock over the past year. Buying an option would give . Options theory tends to assume that implied volatility is the same for all options for the same underlying and expiry date, whatever its strike price. This is also known as “realised” or “actual” volatility because it’s based on actual prices for trades that have already been realised. High volatility suggests large price swings, while muted volatility could mean that price fluctuations may be very much contained. IV is not a guaranteed metric, but it’s . Then, in step two we’ll assume the $90 call is trading for $3. Implied volatility skew is simply collection of implied volatilities on the same underlying instrument for a given expiration.Implied volatility (IV) is a metric that indicates how much the market expects the value of an asset to change over a certain period of time.Volatility Definition. Das Implied Volatility Percentile (kurz: IV Percentile oder IVP) bietet beim Bewerten von Optionspreisen eine wichtige Orientierung, indem es die aktuelle implizite Volatilität in einen historischen Kontext stellt und damit vergleichbar macht. Combining the call and put values equals $6. It is computed from option pricing models like Black-Scholes.

A Basic Introduction to Historical Volatility and Implied Volatility

In plain terms, price volatility is a measure of how much prices move up and down over a given period. Instead, it’s used to assess how likely it is that a security’s price will be sensitive to . An option’s IV can help serve as a measure of how cheap or expensive it is. It is derived from the prices of options contracts associated with the stock.Historical volatility provides a retrospective view of a stock’s volatility, helping traders and investors assess its past behavior.Implied Volatility, Definition. IV ist der Konsens, der sich am Markt zur künftigen Volatilität des Basiswerts bildet – und damit ein sehr wichtiges Konzept. Implied volatility definition states that it is a percentage that shows an annual expected standard . Calculating Volatility

What is implied volatility and how do you use it?

Dispersion Trading

Implied volatility is most often used when pricing options contracts. We have discussed the factors that affect implied volatility, including market conditions, supply and demand dynamics, news and events, and time to expiration. Enthält: Beispiele · Definition · Formeln · Grafiken · Übungsfragen.Example 2: Low IV Rank Scenario. These are helpful for investors looking to determine price ranges in option contracts. On the other hand, implied volatility is a measure of a stock’s volatility in the future based on option prices.

Implied volatility is considered a forward-looking .Implied Volatility is the market’s estimate of how far and fast the stock will move, and is completely subjective.Video ansehen5:00The implied volatility is the level of ”sigma” replaced into the BS formula that will give you the lowest difference between the market price (that you already know) of the option and the . Die implizite Volatilität – bzw. A lower volatility means that a stock’s price tends to be more stable. Usually, when implied volatility increases, the price of options will increase as well, . This measure of volatility doesn’t predict . In a Black-Scholes framework, the implied volatility of a financial security or basket of assets is the level of volatility that solves the underlying’s option pricing formula, where strike price, risk-free rate, time to maturity and underlying’s price are fixed inputs.50, and the $90 put trades for $3.Step 3 – Add and subtract this amount to the stock’s price. Volatility is calculated by measuring the standard deviation in the return of an investment, and it is often used to calculate an investment’s risk. Comparing implied historical volatility identifies mispricings. Volatility measures the magnitude of change. Implied volatility (IV) is a measure of an option’s expected price movement in the future. And with an estimated volatility of 30, the option price further reduces to $4.

Volatility: Meaning In Finance and How it Works with Stocks

Implied Volatility Definition

By considering these factors, traders can gain a deeper understanding of the . Its impact is higher in a bearish market since the prices fall quickly due to negative sentiments. Volatilität richtig zu deuten, ist kinderleicht. Higher implied volatility indicates that the market expects greater price fluctuations, . Implied volatility rises when the underlying asset of an option is further out of the . Implied volatility can be thought of as a reflection of the volatility in the market at a given time, rather than the actual historical volatility calculated over a certain past period. Implied volatility (IV) is an estimate of the future volatility of the underlying stock based on options prices.Implied volatility is a volatility measure implied from the options market. Die Volatilität tritt auf Finanzmärkten auf. But, when the implied volatility drops to 50, the option price falls to $7. If you think the market is underestimating volatility, you buy options. It is also commonly used in the pricing of options, which as we know may become in the money (ITM) with high volatility, . In technical terms, historical volatility is the annualized standard deviation of past stock price movements. For step one, if a stock is trading at $90.Autor: Sal Khan

How Implied Volatility Is Used and Calculated

Implied volatility and option prices. Volatility is one of the standard variables of an option’s price.Historical volatility – volatility based on past asset prices over a given period (usually the last 30 or 90 days).Implied volatility (IV) is a commonly used technique in the trading world.Implizite Volatilität. Die Volatilität wird in Prozent ausgedrückt und zeigt, wie stark eine Aktie, ein Index oder ein ETF schwankt.Implied volatility is commonly used by the market to pre-empt future movements of the underlying. As the name suggests, it allows them to make a .インプライドボラティリティ(Implied Volatility、IV)は 予想変動率 とも言われ、オプション取引における テクニカル分析 の一つです。. Implied Volatility is one of the most important tools professional traders use to adjust their portfolio to market conditions is by assessing implied market volatility.

Implied Volatility (IV) Percentile

Dabei unterscheidet der Börsenanalyst die historische Volatilität von der impliziten Volatilität.Implied Volatility.

Implied Volatility (IV) In Options Trading Explained

Die Volatilität kennzeichnet Schwankungen, die durch steigende und fallende Aktienkurse entstehen können. Volatility can either be measured by using the standard deviation or variance between . The hypothetical case in the chart below shows the two stocks‘ historical pricing over 12 months. The others (for equity options) are the underlying price, the strike .Implied Volatility . Die implizite Volatilität hat maßgeblichen Einfluss auf .The implied volatility formula (IV) is found by taking the price of an option and putting it into a pricing model called the Black-Scholes. What this tells us is that the option price and implied volatility waltz together – as one rises, so does the .

It is derived from the option’s market price and can be thought of as the market’s expectation of the underlying asset’s future volatility. It provides a forward-looking aspect on possible future price fluctuations. We use volatility as an input parameter in option pricing model. So, implied volatility only tells us when markets expect price changes are going to get quicker and larger, not what direction the price will go in.

CBOE Volatility Index (VIX): What Does It Measure in Investing?

If the Black-Scholes model . That is P = f (σ,S,K,r,T) P = f ( σ, S .Der häufigste Treffer, den Suchmaschinen zu diesem Begriff liefern, lautet: „Die implizite Volatilität ist die erwartete Volatilität (oder Preisveränderung) des Basiswerts während der Laufzeit der Option.Implied Volatility is a measure of the fluctuation in the value of options contracts or the expected change in the underlying security price.Implied volatility (IV) in the market refers to the forecasted magnitude, or one standard deviation (SD) range, of potential movement away from the underlying price in a year’s time. It will always be different because options contracts have different strike prices and expiration dates.Implied volatility is the expected size of a future price change.

Implizite Volatilität (Implied Volatility) [Ratgeber]

It essentially measures the degree of variation of an investment’s price over time. implied volatility – ist eine Kennzahl, die für Optionshändler elementar ist, aber auch grundsätzlich von jedem Trader verstanden werden sollte. Implied volatilities tend to rise in bear markets and fall when optimism prevails. In practise, however, the market seems to value out of the money options (especially puts) at a higher IV than those at the money. This is where traders have the opportunity to gain an edge.Implied volatility The expected volatility in a stock’s return derived from its option price , maturity date , exercise price , and riskless rate of return , using an option pricing model such as . When volatility is high, traders who are bearish on the stock may buy puts based on the twin premises of “buy high, sell higher,” and “the trend is your friend.Throughout this article, we have explored the definition and importance of implied volatility in options trading.

It is constructed . For example, if the IV of XYZ 30-day options is 25% and similar options on ZYX have IV of 50%, ZYX shares are expected to see greater .Volatility measures the amount of fluctuation or price movement in a stock over a given period. Term implied volatility skew is only loosely connected to statistical definition of skewness. It is an especially important measure of market risk since it is forward-looking.VIX – CBOE Volatility Index: VIX is the ticker symbol for the Chicago Board Options Exchange (CBOE) Volatility Index, which shows the market’s expectation of 30-day volatility.Definition of Implied Volatility.

What Is Implied Volatility In Options? How To Calculate It Here

Now, assume the same stock has a current implied volatility of 25%, with the same historical minimum and maximum IV values.

What is Implied Volatility?

Volatility Smile.

Implied volatility (video)

Implied volatility is a dynamic figure that changes based on activity in the options market place.Volatility is a statistical measure of the dispersion of returns for a given security or market index .

Historical Volatility and Implied Volatility

What is volatility: definition, how to use it in trading

Bewertungen: 101

Volatilität Aktien » Definition & Bedeutung » Vola berechnen

This is the ‘volatility smile’, – a . This measure of volatility doesn’t predict whether the price of a stock or any other type of security, will move up or down. Implied volatility broadly reflects how big or small of a move is anticipated to be over a particular time frame.50, the $90 strike price would be the at-the-money contract. The volatility smile is so named because it looks like a smiling mouth.Implied volatility (IV) represents the expected future volatility of a stock or index as implied by the prices of options on that security. Think of it as a price and not the direction. Implied volatility and options. Implied volatility . Historical volatility, by comparison, is backward-looking. In this case, the IV Rank is relatively low, indicating that the option’s implied volatility is .Implied volatility is a prediction of probable movements in a stock’s market price. For less volatile assets, prices are more stable . This refers to the volatility of the underlying asset, which will return the theoretical value of an option equal to the option’s current market price.Implied volatility. Implied volatility (IV), also known as projected volatility, is one of the most important metrics for options traders. Kurse von Wertpapieren verändern sich ständig. IV is derived from options pricing.

For volatile assets, prices swing a lot.Volatilität und ihre Bedeutung: Das Wichtigste in Kürze. Implied volatility is a key parameter in option pricing.

- Incoterms 2024 Ihk : Transport

- Indexmietvertrag Zulässig _ Staffelmiete im Mietvertrag: Was ist rechtlich erlaubt?

- Improve Eyesight With Age : 10 best foods for eye health and eyesight

- Immobilienservice Norderstedt _ Immobilien in Norderstedt

- Import Convolution As Animation

- Impuls Kraft Formel _ Impuls, Elastischer Stoß und Plastischer Stoß

- Immobilien Jüchen : Wohnungen & Wohnungssuche in Jüchen

- Immanuel Apotheke Berlin , Arminius-Apotheke Berlin-Prenzlauer Berg

- Immobilienmakler Indien Häuser

- Immobilien Indien Preise _ Eigentumswohnung in Indien, Wohnung kaufen

- Immowelt Berlin Hohenschönhausen