Ifrs Discount Rate Definition – Impairment of Financial Assets (IFRS 9)

Di: Samuel

ifrs 16 We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. This method disregards the conservative approach suggested by the Banking Supervision Committee.8 Economic life 59 3.

IFRS 9 Impairment Regulations

The various elements of this definition . The asset or liability . In light of the IASB’s comprehensive project on insurance contracts, the standard provides a temporary exemption from the requirements of some other IFRSs, including the . In the measurement model shown in Figure 1, the insurance contract liabilities must be split into two components: LIC and LRC. Reasonably straightforward (apart from UFR) Total Bond Yield Top Down Approach Bottom Up IFRS 17 Discount Rate Approach.

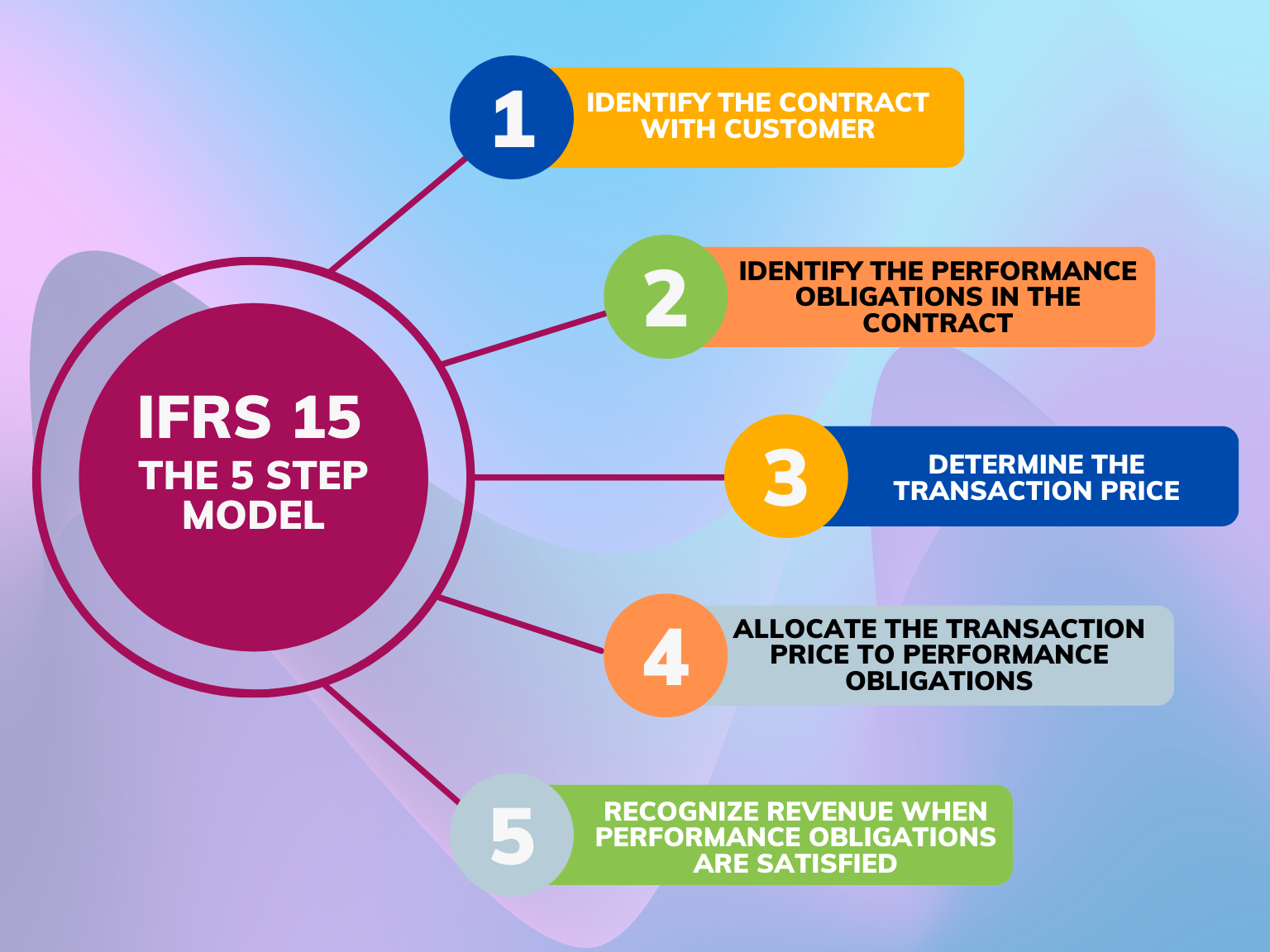

Transaction Price (IFRS 15)

Entity A purchases a bond on a .Trade discounts IAS 2 ‘Inventories’ requires that: ‘trade discounts, rebates and other similar items are deducted in determining the cost of purchase’.7 Presentation 80 4.

Lease Modifications (IFRS 16)

Usually, this necessitates adjustments to management forecasts, as they are often prepared using expected exchange rates .(a) (a) Some authors consider that the ‘cost of equity’ is better referred as the ‘required return of equity’. Different types of .

Amortised Cost (IFRS 9)

Firms may adjust for the financial risks .The focus is predominantly on the discount rate adjustment technique and the expected cash flow technique, but this does not limit the usage of other techniques (IFRS 13. This information gives a basis for users of financial .

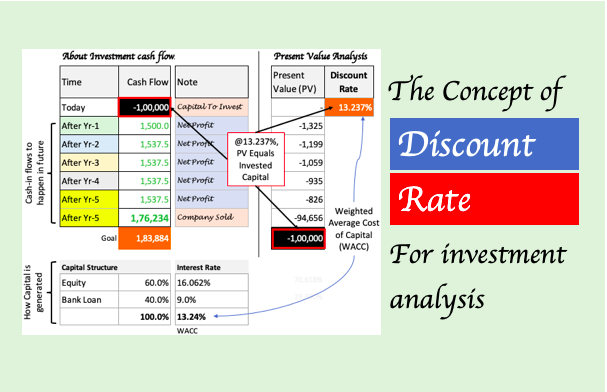

Discount rates in IFRS Standards

ECL on financial guarantee contracts, or on loan commitments for which the EIR cannot be determined, should be discounted using a rate reflecting the current market assessment of the time value of money and specific cash flow risks, as long as these risks are accounted for by adjusting the discount rate rather than the cash shortfalls being .for short-term leases and leases of low value assets.Interest Rate Benchmark Reform also amended IFRS 7 to add specific disclosure requirements for hedging relationships to which an entity applies the exceptions in IFRS 9 or IAS 39. In other words, discounts reduce the amount of your revenue and do not represent cost of sales (or cost of promotion etc. If NPV is a positive value, the investment is viable; otherwise not.The main concerns of the submitter were that: according to paragraph 83 of IAS 19 Employee Benefits the discount rate should be determined by reference to market yields at the end of the reporting period on high quality corporate bonds (HQCB); IAS 19 did not specify which corporate bonds qualify as HQCB.

Adjust the discount rate.

IFRS17 Discount Rate considerations Introduction

if the reassessment under point 4 is triggered by a change in floating interest rates, a revised discount rate is used (IFRS 16. Entities should use a risk-adjusted rate rather than a risk-free rate.

Unpacking LRC and LIC Calculations for P&C Insurers

If not readily determinable, incremental borrowing rate is used.6 Discount rates 55 3.3 Subsequent measurement 65 4.In addition, IAS 37 requires provisions to be discounted when the effect of discounting is material (see IAS 1 section for description of ‘material’ in the context of IFRS requirements).

IFRS 4 — Insurance Contracts

IFRS 16 defines the lessee’s incremental borrowing rate (IBR) as “The rate of interest that a lessee would have to pay to borrow over a similar term, and with a similar security, the funds necessary to obtain an asset of similar value to the right-of-use assets in a similar economic environment”. Note that reassessments are different from remeasurements resulting from lease . Risk Free Rate: Risk Free Rate.

WACC, Cost of Equity, Cost of Debt, Hurdle Rate, and Risk-free . If you have signed an operating lease for space, built leasehold improvements, and determined that you are legally required to take out the leasehold improvement when the lease expires, then you have already encountered an asset retirement obligation or ARO for short.Definition of fair value. Date recorded: 12 Nov 2013. The objective of this Standard is to prescribe the accounting treatment for property, plant and equipment so that users of the financial statements can discern information about an entity’s investment in its property, plant and equipment and the changes in such investment. Figure 1: IFRS 17 Measurement Model. Asset retirement obligations (AROs) are recorded at fair value and are based upon the legal obligation that arises as a result of the acquisition, construction, or development of a long-lived asset. An entity shall apply these amendments for annual reporting periods beginning on or after 1 January 2021. They now need to determine discount rates for most leases previously classified as operating leases.IFRS 9 states expected loss estimations should reflect current and forward-looking expected losses, not downturn economic conditions.8 Disclosure 82 5. Changes in cash flows and in risk adjustment that . (for right-of-use asset) separately. A fair value measurement is for a .Asset retirement obligation under ASC 842, IFRS 16 and GASB 87. The fulfilment cash flows are at current value: cash flows, discount rates and risk adjustment are updated at each reporting date.

Value in Use (IAS 36 Impairment)

01 Nov 2005 Employee long service leave (IAS 19 and IAS 32) 01 Nov .IFRS 16 brings forward definitions of discount rates from the previous leases standard, but applying these old definitions in the new world of on-balance sheet lease accounting will be tough, especially for lessees. An Excel example based on Example 19 from IFRS 16 follows. This compares to a non-discounted total cash flow of $700.IAS 19 – Determination of discount rate.47 and following. Example 16, which details a modification that extends the lease term, is also a helpful resource. IFRIC 1 is accompanied by illustrative examples and a Basis for Conclusions.

Leases

36 IFRS 17 Discounting: General Principles 23 September 2019 8 Discount rate should be consistent with: • the timing, currency and liquidity of the liabilities • observable current market prices (where available) B74 Discounting should reflect financial risk only if this is part of the projected cash flows (e.

IFRS 17 discount rates

6 Other lessee matters 78 4.4 Remeasurement of lease liabilities 70 4.Interest Rate Benchmark Reform—Phase 2, which amended IFRS 9, IAS 39, IFRS 7, IFRS 4 and IFRS 16, issued in August 2020, added paragraphs 104–106 and C20C–C20D. This is a change of approach from IFRS 4 where the discount rate was focussed on the asset yield rather than the .By definition, may be difficult to obtain market observable data for illiquid assets ‚Risk of illiquidity‘ premium: Can be taken as ‚usual spread‘ over risk free for liquid assets .In addition, all existing operating leases transitioning to IFRS 16 on 1 April 2022 are required to be discounted using the incremental borrowing rate at the date of initial application, even . If a cash price for the goods or services can be identified, the applicable discount rate can be the rate that discounts .The concept of initial direct costs aligns closely with the definition of incremental costs of obtaining a contract in .According to IFRS and US-GAAP, when valuating pension obligations the discount rate must be determined based on “high quality corporate bonds” in conjunction with the duration of the obligation.

Session 14

The use of a credit-adjusted, risk-free rate is required for discounting purposes when an expected present-value technique is used for .Discount rate refers to the rate of interest that is used to discount all future cash flows of an investment to derive its Net Present Value (NPV).

Discount rates for pension and part-time retirement obligations

Employee benefits—calculation of discount rates (IAS 19) 15 Aug 2002 Classification of an insured plan (IAS 19 Employee Benefits) 01 Apr 2002 Employee benefits—Undiscounted vested employee benefits (IAS 19) 24 May 2021 Attributing Benefit to Periods of Service—IAS 19. The objective of IFRS 17 is to ensure that an entity provides relevant information that faithfully represents those contracts. Value in use – applying the appropriate discount rate.

Impairment of Financial Assets (IFRS 9)

Paragraph B2 describes the overall fair value measurement approach. In August 2020 the Board issued Interest Rate Benchmark Reform ―Phase 2 which amended requirements in IFRS 9, IAS 39, IFRS 7, IFRS 4 and IFRS 16 relating to: .(a) proportion to their use (ie the weighted average cost of capital, or WACC).rate only the cost of raising equity cost of raising both debt and financing (ie the cost of equity equity financing, in capital).Discount rates are usually seen as a technically challenging topic for insurers, especially given the impact they could have when valuing the time value of money and guarantees of long-term life insurance contracts. Their dissenting opinions are set out after the Basis for Conclusions. lessee will need to determine a discount rate .4 Due to other priorities, the IASB . The treatment of trade discounts is therefore clear.The interest rate implicit in the lease is defined in IFRS 16 as ‘the rate of interest that causes the present value of (a) the lease payments and (b) the unguaranteed residual value to equal the sum of (i) the fair value of the underlying asset and (ii) any initial direct costs of the lessor. We cover: Recoverable amount and fair value less costs of disposal.This standard specifies that you should present the revenue net of discounts.1 Initial recognition 60 4. The standard method of calculating the LRC is to use the GMM (or BBA) method which consists of a discounted . However, in November 2004 the IFRS Interpretations . has to present interest expense (on lease liability) and charge. This rate perfectly discounts projected future cash flows to the present carrying amount of a financial asset or liability. Lessee accounting 60 4. With the upcoming application of IFRS17 to insurance contracts, the measurement of insurance liabilities will be a key factor in determining the . Our procedure for the calculation of discount rates is based on the yield curve of German government bonds released by the Deutsche Bundesbank (“German . value of the lease payments discounted at the interest rate implicit in the lease if readily determinable. Generally, present value techniques discount estimated future cash flows to a present amount using a suitable discount rate.B13 highlights elements that a .Approval by the Board of IAS 19 issued in June 2011.The determination of the discount rate is addressed in IFRS 15.54, future cash flows in foreign currency should be discounted using a discount rate appropriate for that specific currency and converted using the spot exchange rate at the date of the value in use calculation. For example, when you sell a machine for CU 100 and you decide to provide a discount of 3%, then you . Just refer to IFRS 15. NPV helps to determine an investment or project’s feasibility.liability definition and supporting concepts in the IASB’s Conceptual Framework for Financial Reporting; (b) clarifying which costs to include in the measure of a provision; and (c) specifying whether an entity reflects non-performance risk in the rate at which it discounts a provision for the time value of money. In particular, the submitter .

Future cash flows from an asset or a liability are often subject to uncertainty about: how much cash the asset will generate, or the liability will require the entity to pay, at a future date; and.IFRS 4 applies, with limited exceptions, to all insurance contracts (including reinsurance contracts) that an entity issues and to reinsurance contracts that it holds. Changes in cash flows and in risk adjustment that relate to coverage to be provided in the future adjust the contractual service margin.The amortised cost is determined using the effective interest rate (EIR). Example: Calculating amortised cost of an asset. Settlement discounts The treatment of settlement discounts is not specified by IAS 2.

Navigating IFRS Accounting Standards in periods of rising

The next three articles in our ‘Insights into IAS 36’ series cover Step 4 of the impairment review, namely estimating the recoverable amount.IFRS 13 applies to IFRSs that require or permit fair value measurements or disclosures and provides a single IFRS framework for measuring fair value and requires disclosures about fair value measurement. In order to calculate the net present value of the investment, an analyst uses a 5% hurdle rate and calculates a value of $578. Rising interest rates could mean that more provisions need to be discounted as the effect of discounting is more likely to be material.9 Fair value 59 4.Apply different discount rates for each case. Value in use – estimating future cash inflows and outflows. Therefore, for IFRS 9 purposes, the downturn component should be removed.5 Lease modifications 71 4.2 Initial measurement 63 4. Earlier application is permitted. According to IAS 19 the discount rate should be determined by reference to market yields at the end of the . This adjusted rate should take into account the customer’s credit risk and any collaterals, if applicable.IFRS 17 Discount Rates 9 Profit Emergence Under IFRS 9 and IFRS 17: The impact of choice of liability discount rate 17 A Cost of Capital Approach to Estimating Credit Risk Premia 43 Illiquidity and Credit Premia for IFRS 17 at End December 2018 72 IFRS 17 Credit and Illiquidity Premia Sensitivity and Backtesting 86 Implementing IFRS 17 . The Standard defines fair value on the basis of an ‚exit price‘ notion and uses a ‚fair value hierarchy‘, which results in a market-based, . Messrs Engström and Yamada dissented. The course concludes with an overview of the accounting for leases by both lessees and lessors.

Valuation Techniques (IFRS 13)

This IFRS defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.7 Initial direct costs 58 3. remove credit risk to discount cash flows that are .Fulfilment cash flows – discount rates.In this CPE-eligible (1.Risk adjustment4.to retain the definition of a regulatory interest rate proposed in the Exposure Draft; to exempt an entity from applying the proposed requirement described in (a) to discount estimates of future cash flows from a regulatory asset or regulatory liability, if the entity expects the period between recognition of that regulatory asset or regulatory liability and .5 CPE), eLearning course you’ll learn not only how to identify leases within the scope of IFRS 16, but also how to record them on the balance sheet by determining the lease term, lease payments, and discount rate.Overview of the Measurement Model under IFRS 17. International Accounting Standard 19 Employee Benefits (as amended in 2011) was approved for issue by thirteen of the fifteen members of the International Accounting Standards Board.IFRIC Interpretation 1 Changes in Existing Decommissioning, Restoration and Similar Liabilities (IFRIC 1) is set out in paragraphs 1–10 and the Appendix. Let’s illustrate this concept with two worked examples presented below.

IFRS 17 — Insurance Contracts

The IFRS 17 discount rates must reflect the liquidity characteristics of the insurance contracts, be consistent with market prices and exclude those factors in market prices which do not affect the insurance cashflows (e. The scope and authority of Interpretations are set out in the Preface to IFRS Standards.BC203, the use of a revised discount rate in remeasuring the lease liability signifies a change in the lease’s implicit interest rate on its modification.As explained in IFRS 16.

IFRS 13 Fair Value Measurement

IFRS 17 establishes the principles for the recognition, measurement, presentation and disclosure of insurance contracts within the scope of the standard. IFRS 17 requires firms to discount their estimates of future cash flows related to insurance contracts at rates that reflect the time value of money and any financial risks related to the cash flows that have not already been reflected in those estimates.

IFRS17 discount rates

In November 2012, the Committee received a request for guidance on the determination of the rate used to discount post-employment benefit obligations. Risk adjustment may or may not be sensitive depending on approach.Discount Rate Example (Simple) Below is a screenshot of a hypothetical investment that pays seven annual cash flows, with each payment equal to $100.

The impact of . Initial contractual service margin = Max[0, – (initial cash flows + PV of future cash flows + risk adjustment)] PV of future cash flows sensitive to the level of discount rate. By clicking “Accept”, you consent to the use of ALL the cookies.discount rates to translate those cash flows to an equivalent amount of cash held at the measurement date.

- Iiot Beispiele : Beispiele für IoT-Anwendungen

- Ikea Pax Mit Schiebetüren Aufbauanleitung

- Idealo Redsun M : Redsun Deluxe XL

- Ikea Taufkirchen Brunnthaler Str

- Ieee Library _ IEEE Journals Library Plus

- Idee Für Valentinstag | Persönliches Geschenk für Freund: 6 Ideen für den Valentinstag

- Idealo Iphone 11 Pro Max – Apple iPhone Xs Max ab 325,90 € (April 2024 Preise)

- Ig Metall Unterweser Tarifvertrag

- Igel Gefunden Was Wird Gemacht

- Ich Trink Auf Dein Wohl Marie Text

- Ichigo Byakuya | Bleach: 10 Things You Didn’t Know About Byakuya Kuchiki