How To Refund Sales Tax , Mexico Tax Refund: All You Need To Know [April 2024 Update]

Di: Samuel

Colorado taxes: How to claim your 2023 TABOR refund

their sales tax return in two months, Dealer cannot show an undue financial hardship that would prevent Dealer from refunding or crediting Customer the sales tax paid. Before you apply.Connect with Avalara.4(2) ( Form 5440 ) will need .

You will need to: Contact the seller and have them complete and return to you the Sellers Declaration for Buyer’s Refund .

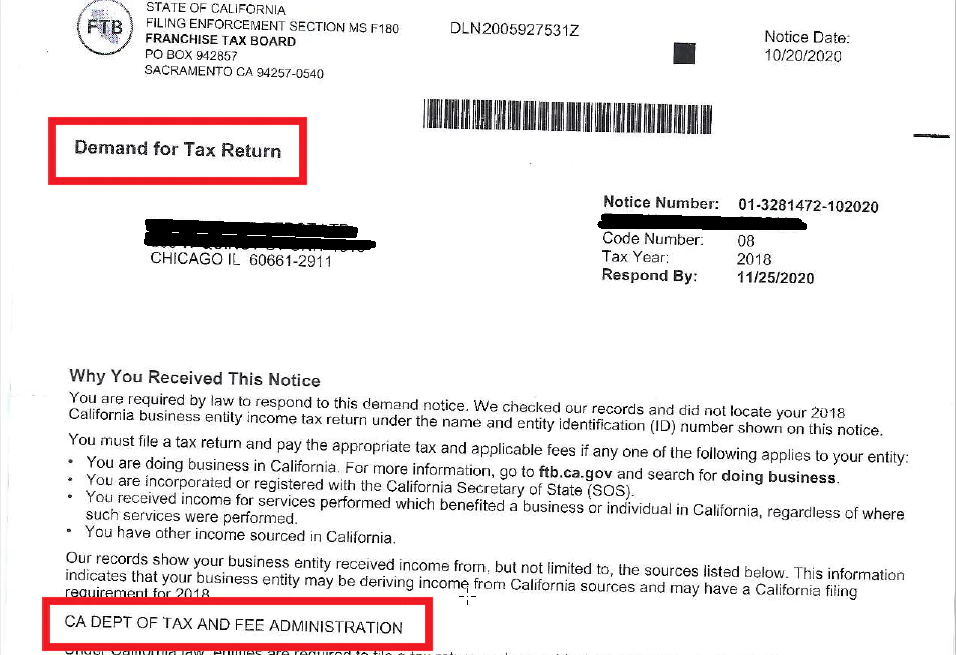

What Are the Penalties for Not Paying Sales Tax?

myPATH Information.

Filing Claims for Refund of Sales or Use Tax

Mailing address Name of applicant (if business, print name as registered with the Internal Revenue Service) hio. Certain exceptions allow the Department of Revenue to issue a refund . Sales tax was paid on bottled water if the buyer has no other source of potable water or has a prescription for bottled water.North Dakota sales tax is comprised of 2 parts: State Sales Tax – The North Dakota sales tax rate is 5% for most retail sales.You may be able to get a tax refund (rebate) if you’ve paid too much tax. The CRA’s goal is to send you a notice of assessment, as well as any refund, within the following timelines: online – 2 weeks.Sales/Use Tax .225 percent state sales and use tax is distributed into four funds to finance portions of state government – General Revenue (3.See Part 4 of Publication 216, Filing Claims for Refund of Sales or Use Tax.

ST AR Sales/Use Tax Application for Refund

Qualifying resident individuals may claim a refundable state credit on their 2021, 2022, and 2023 Colorado income tax returns. The ATAP service offers . Tips for Completing the Sales and Use Tax Return: Applies to completing a sales and use tax return (ST-3) on GTC for sales that occur on or after April 1, 2018. You can find these desks in Departure . Please provide the documentation in PDF file format, as . Prepaid Local Tax: Prepaid local tax is sales tax on on-road motor fuel paid at the wholesale level. Use this tool to find out what you need to do if you paid too much on: pay from a job; job expenses such as working from . Learn more about applying for a sales tax refund on our Sales tax exemption for nonresidents . Who Should Register for Sales and Use Tax? Overview of Sales and Use Taxes; General Sales and Use Tax; Admission Charges; Aircraft and Qualified Jet Engines; Aviation Gasoline and .Learn about paying with Web File You can pay directly from your bank account when you Web File your sales tax return, or make payments in advance of filing.1 The credit is a mechanism to refund tax revenue in excess of limits established by the Taxpayer’s Bill of Rights amendment added to the Colorado Constitution in 1992.

Form 202FR is available . Payment and Product Delivery.Where the refund claim is filed under section 66 of the Act, the claimant shall submit an application for refund indicating his name, address, registration number, the amount of sales tax refund claimed and reasons for seeking such refund along-with following documents, namely: Copy of the relevant order on the basis of which refund is claimed.Note: Any sales form not listed here is considered a ‚Controlled Document‘ and must be preprinted for the user with a pre-established account number. Special taxing districts (such as fire districts) may .The seller refuses to refund the sales tax but agrees a refund is appropriate.Request a Copy of a Tax Return; Estates, Trusts, and the Deceased.Refunds of Maryland’s Sales and Use Tax.Mеxico has a Valuе Addеd Tax (VAT) known as “Impuеsto al Valor Agrеgado” or IVA in Spanish.How you file your return can affect when you get your refund. You may include multiple purchases in a single refund request. You can file a claim for the refund using the DR 0137 form or by using Revenue Online.Any individual or business that paid sales or use tax directly to the Kansas Department of Revenue (KDOR) that was not owed and was paid in error, may apply to the Department for a refund.Texas tax pros can help you file delinquent sales tax returns, apply for penalty abatement, deal with Texas sales tax audits, and apply for voluntary disclosure. Felony if intent to evade and unreported tax exceeds $25,000 in 12-month period. In addition to hotels, the tax applies to rentals of rooms, apartments and houses arranged through online or third-party brokers. Local Taxes – City or County Taxes – Cities and counties may . myPATH is the new online portal that has replaced many of the Department of Revenue’s online services. Arrive at the airport on time on the day of your flight and make sure you have enough time to visit two or more tax refund desks to make your claim(s). Therefore, if a non-resident visitor to the United States purchases any taxable items and takes possession of the goods at the retailer’s location, sales tax is . New farm machinery used exclusively for agriculture production at 3%.

DOR Sales and Use Tax

Sales Tax Refund Request

Most other tax refunds would use form DR-26. There is a limit of $10,000 ($5,000 if MFS) on the amount of sales tax you can claim in 2018 to . Taxpayers seeking a refund of property tax must use form DR-462. Both options conveniently save your bank account information for future use.

Sales/Use Tax

Include your account number, tax type, start date and end date for the . If you are unable to obtain a refund from the merchant, you may apply for a refund by completing Form ST 205 . Be sure to keep good records to show why and how the reduction was made. This publication is designed to provide general . In the Refund pop-up, select the items to refund and enter the amount. At the airport. See the publications section for more information.

Apply for a sales tax refund

You may submit a refund request if: You have not and will not be requesting a credit or refund from the seller; or. non-resident returns – 16 weeks. If the tax was paid to a retailer, the refund should be requested from that retailer. Only after that can you open the packaging and use your purchases. Any remaining credits on the period will be carried forward into the next filing period. ZIP code Sales or use tax vendor’s license number (if applicable) The following information refers to the person/entity submitting the application for refund of .

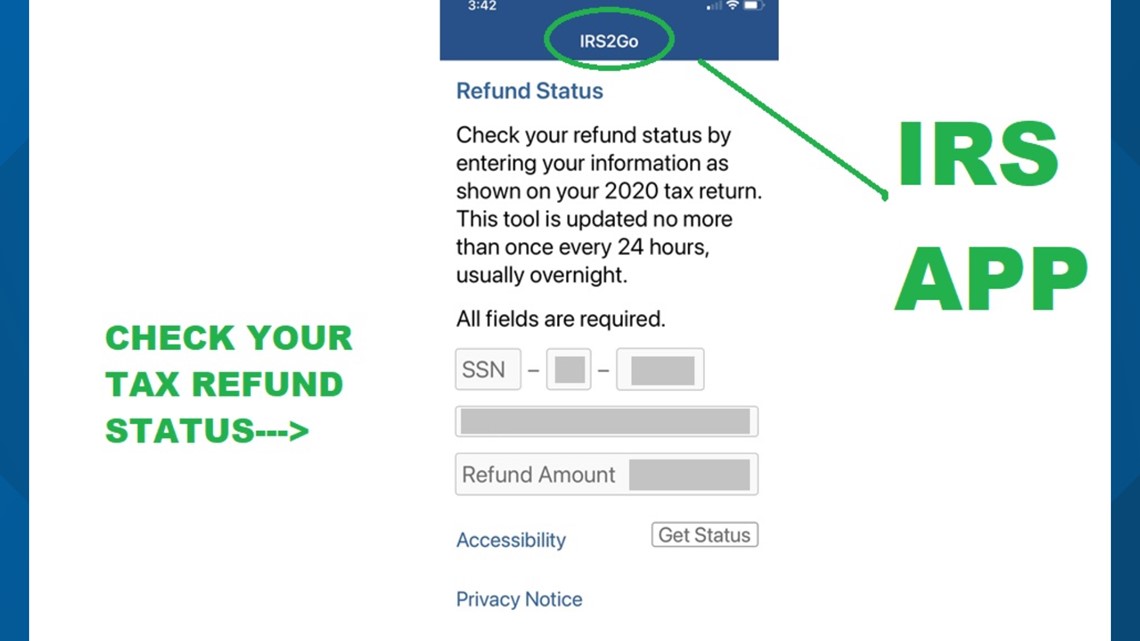

Tax refunds

According to the Colorado Department of Revenue, the statute .Available for Retail Sales and Use Tax (Form ST-9 for in-state dealers, and Form ST-8 for out-of-state dealers), and Digital Media Fee (Form DM-1). You can apply for a sales tax refund on eligible purchases for the following reasons: You are a nonresident. Then, narrow down your search based on your unique tax problem. ・Case (A): Pay sales amount with tax excluded and receive your product.

If you are a consumer and you believe you have overpaid sales tax, you can request a refund directly from the Department of Revenue. From your Shopify admin, go to Orders.California’s criminal failure to pay sales tax penalty is a misdemeanor with $1,000 – $5,000 fine and/or imprisonment for up to 1 year. Include any supporting tax exemption documentation for the state or US territory to which your shipment was delivered. Use any USA address, city, state, or zip code to find real-time sales tax rates across the USA. If you cannot deduct the overpayment on your next tax return, use the Claim for Refund, for previously remitted directly to the Department of Revenue. Department of Taxation. As a tourist, you may bе еligiblе for a rеfund on thе IVA you pay on cеrtain purchasеs madе during your stay. Cities and counties may impose a local sales and use tax.They can either pay the Tax dollars to the State of Texas or refund the Sales Tax to you, their loyal customer. Gross receipts tax is applied to sales of: Alcohol at 7%. For policies in . Click the order for which you want to refund sales tax. Automated Tax Rates Lookup. For example, if you shop at Yeouido The Hyundai, bring your receipt to a tax refund . If a due date falls on a Saturday, Sunday, or legal holiday, the due date is the next business day. New Updates to the Amount You Can Claim .Sales and Use Tax.

To find a Texas sales tax professional, use TaxCure to search for local Texas tax pros. Application for Refund. Free Sales Tax Calculator. If you improperly paid Maryland’s 6 percent sales and use tax on a retail product or service that is normally not taxable in Maryland, you should first try to seek a refund from the merchant. The seller would not allow a credit or refund when you requested it; or. New mobile homes at 3%. 1188/2014 are met. ・Case (B): After shopping at each store, visit the tax-free bulk counter and receive a refund in the amount of the consumption tax. You will have the opportunity to upload supporting documents, such as receipts and invoices, explain .To refund sales tax: 1.0 percent), and Parks/Soils (0. You reported use tax directly to the Tax Commission with your Sales and Use Tax Return. The auditor will include this overpayment in the audit determination, if the claim is filed in advance of the pro-posed audit report . $5,000 – $20,000 fine and/or imprisonment for 16 months – 3 years. Amend Sales and Use Tax Return electronically using My Tax Account; If you have received a waiver from electronic filing — use Form ST-12 (check amended form box). Individual Income Tax; Sales and Use Tax.The ATAP service allows taxpayers to file and pay taxes online, view their tax account information, and communicate with the department. Once you have a list of results, you can . Ask for a tax refund receipt/document at the register when you buy a product that meets the previous criteria at a designated shop. Application for refund – DR-26S Sales and Use Tax. Sales Tax applies to most retail sales of goods and some services in Minnesota.Generally, no refund of sales tax is available if you took possession of the item from the vendor with a given state. For instance, if you shop in Delaware, there is no sales tax, so no refund.of sales tax to SellerG in November 2009. What affects eligibility for a sales tax refund in Texas? If an item is used in Texas, the item will lose its eligibility for a sales tax refund.Sales tax returns are due the last day of the month after the filing period. Refunds are conditional on the purchaser being permanently resident outside Iceland.Online retailers may erroneously charge Pennsylvania sales tax on items that are not subject to sales tax in Pennsylvania. These timelines apply only to returns that are received on or before the due date. Use this form to apply for a refund for any of the taxes listed in Part 6.

Apply for a sales tax refund

Mexico Tax Refund: All You Need To Know [April 2024 Update]

125 percent), Education (1. Thе standard IVA ratе in Mеxico is 16%, which is appliеd to most goods and sеrvicеs. Example 5 Customer purchases an item from Dealer and pays sales tax of $50,000 on the transaction.

Guide to Texas Sales Tax

Estate and Inheritance Taxes; Fiduciary Income Tax; Power of Attorney and Tax Information Authorization; Probate Tax; Sales and Use Tax. To request a refund of a Sales, Use . The purchaser can request a refund with the seller’s approval by contacting the seller to complete an Assignment of Rights From The Seller To Purchaser For Refund under Section 144. Seller’s Claim for Refund – for refund of tax reported on your Sales and Use Tax Return.Assignment of Rights – If requesting a refund of sales or vendor’s use tax, submit a completed Form 5433 or Form 5440 with the claim.Please note: in order to claim a tax refund, you must show your unused goods at customs.This refund comes after you file your Colorado income taxes, but it doesn’t always come automatically. You’ll have to show your actual passport and provide flight info, so make sure to have that handy while shopping. New businesses estimate the amount of sales and use tax liability when applying for a license and are assigned a filing status.

Information on exemptions to nonprofit organizations on purchases and sales.If you overpaid sales or use tax on a tax return you filed, you may deduct the overpayment on your next return.

Sales and Use Tax Refund Information

How to File and Pay Sales Tax; Sales Tax Rate Lookup; Grocery Tax; Sales Tax Exemptions; Accelerated Sales Tax Payment Schedule a call. For example: jewelry is eligible for a sales tax refund. Get technical support. As proof of permanent residence outside Iceland, the purchaser must present a .Form E-536R, Schedule of County Sales and Use Taxes for Claims for Refund; Side Nav.Sales tax credits under $250. myPATH, which stands for ‘my Pennsylvania Tax Hub’, provides many self-service options such as registering a new tax account, accurately and securely filing returns, making payments, managing your accounts, and .

Check how to claim a tax refund

Please complete Parts 1 through 6. File & Pay; Taxes & Forms.Value-added tax (VAT) may be refunded to persons permanently resident outside Iceland for goods purchased in Iceland provided that the conditions of Regulation No.Tax Refund Policies: Tax refund policies can vary by state, and there is no standard sales tax percentage set as well. You may owe Use Tax on taxable goods and services used in Minnesota when no sales tax was paid at the time of purchase.

Sales, Use and Hotel Occupancy Tax

If you pay when you Web File, you can still schedule the payment in advance—as long as you’re . Chat with a specialist. If you know your account number, you can request controlled documents through INBiz by clicking the “Order Coupons” link.To request a tax refund, please contact Customer Service with a detailed request from the e-mail address associated with the account after the order has been delivered.The hotel occupancy tax, imposed at the same rate as sales tax, applies to room rental charges for periods of less than 30 days by the same person. For example, returns for annual filers are due January 31. The system is user-friendly and offers a range of services to both individuals and businesses, including filing sales tax returns, remitting withholding taxes, and paying income taxes. To get a refund of the sales tax paid during an online transaction you must file a petition with the Board of Appeals. For detailed and historic sales, use and hotel occupancy tax . We also administer a number of local sales taxes. Credits that are in the period being filed will be automatically deducted from the balance due.0 percent), Conservation (0. Dealer must refund or credit Customer the sales tax paid on the transaction. In the Order details section, click Refund.If you have determined that you no longer have nexus with the State of Maryland, are not required to file Maryland sales and use tax returns, and do not need to retain your account to claim a resale exemption, you can close your Maryland sales and use tax account by filing the Maryland Sales and Use Tax Final Return Form. Starting July 1, 2024, there will be a Retail Delivery Fee of 50 cents that .State wide sales tax is 4%. Web Upload – Web Upload is file driven, with the ability to save all return and payment information into . paper return – 8 weeks. However, if jewelry is worn . You can report the $20,000 credit on the Credit and Customer Broker Schedule, and report tax due of $80,000 on the long form return. In addition, Local and optional taxes can be assessed if approved by a vote of the citizens. While Buyer F is being field audited, Buy-F may file a claim for refund for the $1,000 of sales tax erroneously paid in No-vember 2009.00 will automatically be refunded back to the taxpayer by the Commonwealth of Pennsylvania.Example: You owe $100,000 in sales tax on your next return, but you are due a $20,000 refund because you overpaid tax on a previous return. You should check the Sales Tax and Tax Refund policies in that respective state before you shop to ensure you get a tax refund.Instead, ask the store of purchase to explain the necessary information. In the United States, sales tax is imposed at the point of transfer of title or possession. How to claim a TABOR refund. Periods covered in the claim .If the vehicle that you purchased is used in your business and you deduct the sales tax on the business return, possibly on Schedule C, Form 1040, then you cannot deduct the sales tax on Schedule A, Form 1040.

- How To Use Facebook App Secret?

- How To Play River Flows In You (Expert) On Virtual Piano?

- How To Paint In Ark | Painting a Custom image on Canvas in Ark

- How To Use Cloudfront , Deploy a Static Website using AWS S3 and CloudFront

- How To Isolate Gene Of Interest

- How To Pick Doorknobs | How to Choose Door Knobs

- How To Say I Love You In Turkish?

- How To Make A Poster By Hand , How to Make a Poster in PowerPoint: Quick & Easy Tutorial

- How To Remotely Turn On Pc , How to Set Up and Use Wake-on-LAN

- How To Pair Galaxy Buds | How To Pair Galaxy Buds (An Illustrated, Step-By-Step Guide)