How Much Unearned Income Will Be Recognized As Service Revenue?

Di: Samuel

You can think of it like a promise or IOU to provide a . At this point, the company’s balance sheet would carry $800 worth of unearned revenue in the revenue of $400. For example, if you offer a yearly support contract to your clients for $24,000, you should recognize revenue in the amount of $2,000 monthly for the . Solution: Unearned . Accounting questions and answers. Revenue CR $50. Students may note that the amount of the adjusting entry under both the methods is different, but the final amounts are the same (i. By the end of the fiscal year, you will have delivered all 12 magazines for the year, and the balance on your deferred revenue account will amount .Once the $1200 has been received, the company enters this amount as a credit to unearned revenue. Gabbit Publishers sold 9,000 annual subscriptions at $100 each on September 1. Revenue is measured at the fair value of the consideration received or receivable and recognised when prescribed conditions are met, which depend on the nature of the . Break down the price of each individual good or service you’re delivering. Deferred income should be recognized when the Company has received payment in advance for a product/service to be delivered in the future.The business owner enters $1200 as a debit to cash and $1200 as a credit to unearned revenue. Deferred revenue recognition in a 2 . This gives you an overview of how much money the company actually made in that period. Utility expenses of $225 are unpaid.Accrued revenue is income that a company has earned but for which it has not yet received payment.To recognize the revenue appropriately, any business firm that receives payment upfront for services to be rendered must recognize that revenue only after the services have been provided. The record needs to be done base on the work completed, it is not related to the cash collection. Service provided but not recorded total $1,420.

The journal entry is debiting accounts receivable $ 80,000 and credit sale $ 80,000.At the end of month 12, the $60 in revenue will be fully recognized and unearned revenue will be $0.In most cases, you can report rental income from real estate on the Internal Revenue Service’s Schedule E (Form 1040) Supplemental Income and Losses.

The journal entry is debiting accounts receivable $ 50,000 and credit service revenue $ 50,000.Earned revenue is the revenue received or accrued for the services provided or products delivered during a financial year. MicroTrain Company purchased for cash an insurance policy on its trucks for the 12 month period beginning December 1. So, it’s not included in an income statement.The unearned income is deferred (recorded as a liability ) and then recognized to income when cash is collected.Unearned revenue is the amount of money received by a company for the goods and services that are yet to be sold or rendered. Generally speaking, the earlier revenue is recognized, it is said to be more valuable . Let’s say a software developer, Company ABC offers annual plans for their subscription social media automation service.com) Recognition. The earned revenue is .

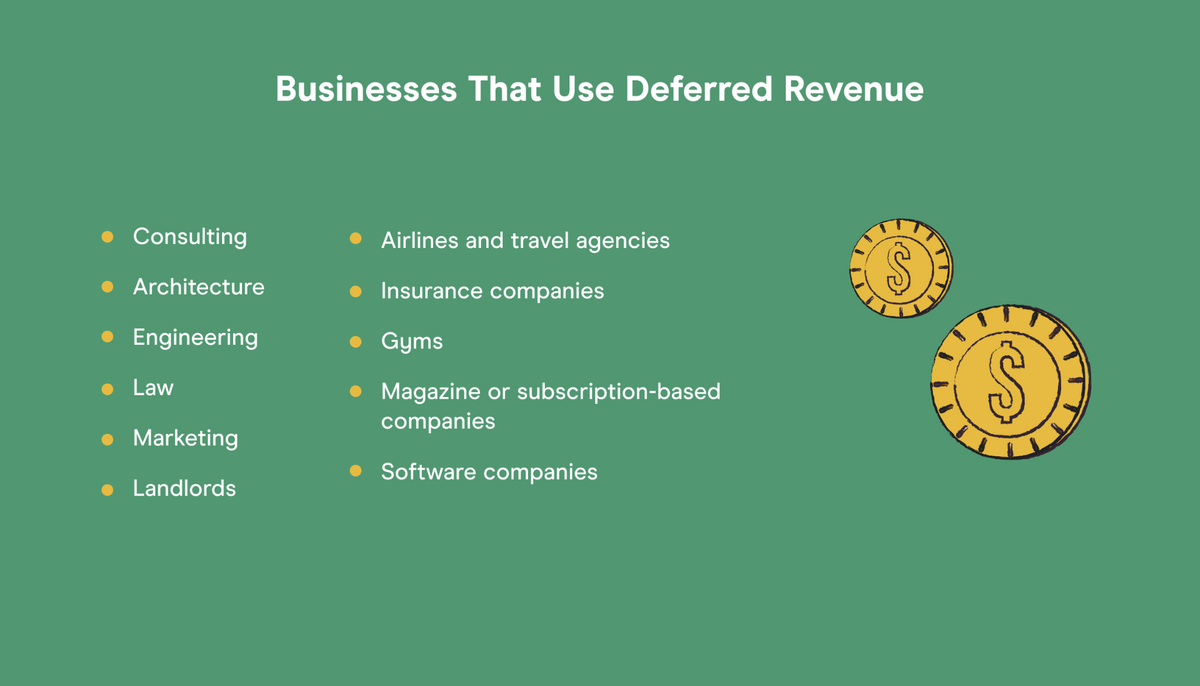

Deferred revenue: how to recognize it properly

This type of revenue occurs when a company performs a service or delivers a product before it bills the customer. Unearned revenue (aka deferred revenue) is a liability that gets created on the balance sheet when your company receives payment in advance. When each payment is received, the company records that amount as a debit entry to the cash account and a credit entry to its . Its compiled revenue increases by $100 each month, as the unearned revenue decreases. The Standard is concerned with the recognition of revenue arising in the course of the ordinary activities of the enterprise from. Theoretically, there are multiple points in time at which revenue could be recognized by companies. Next, multiply this by 100%.Step 2: How to calculate service revenue. If a customer pays for goods/services in advance, the company does not record any revenue on its income . Because each industry typically has a different method for recognizing income, revenue recognition is one of the most difficult tasks for accountants, as it involves a number of ethical dilemmas related to income reporting.This time, unearned revenue will see a debit, and service revenue (which accords the income attributed to the actual service generated by the company) will see a credit increase. As an example, if a software company issues an annual invoice for $12k, the billed revenue will be $12k as soon as the invoice is sent to the customer.

Service revenue: What is it and how to calculate it

The credit/debit aspects of this are outlined above.Source: Deferred Revenue (Income) (wallstreetmojo.Revenue Recognition Concept: Illustrative Example (“Earned”) Suppose a service-oriented company has generated $50,000 in credit sales in the past month. From the date of the initial .

Service Revenue Journal Entry

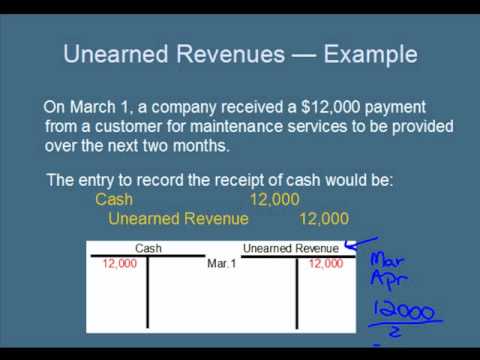

Such payments are not realized as revenue and do not affect the net profit or loss.Unearned revenue is the money that a customer pays in advance for a service you’ll provide them.Unearned revenue recognition will happen as soon as the service is provided. Unearned revenues represent the cash proceeds from the clients for which the services will be provided in the future. Showing all $12k of revenue in a single month is not correct revenue .e, cash received is 3,600, commission revenue is $2,400, and unearned commission . Identify the contract with the customer. Until your company provides the paid-for service, unearned income is recorded in a liability account on .

How to calculate revenue invoiced but not earned

If, for example, a customer pays $1000 in advance for two months of service, and you’ve only delivered one month, only $500 would be recorded as revenue. How unearned revenue works.

IAS 18 — Revenue

Per the revenue recognition principle, the company must recognize the revenue on its income statement as soon as the service was provided to customers.At the end of each month, the company recognizes 1/12th of the deferred revenue balance, which is $100. Accounts Receivable.Unearned Revenue: 1,500: Service Revenue: 1,500: To record the receipt of cash from a customer in payment for future training services. To provide an industry-wide approach, Accounting Standards Update No.Each month, the company recognizes $166. As a result of this prepayment, the seller has a liability equal to the revenue earned until delivery of the good or service. Revenues refer to any income earned by a company or business. The journal entry made on .Unearned revenue.Often times, companies will offer customers assurance that the product or services that they are purchasing will work or be delivered as understood. Half of its service rendered, in monetary terms, is $1,000 x 0. They are under liabilities until the services or goods are delivered. Round the final answer to the nearest whole dollar. Here's how it works and why it's so important for businesses. Recognize revenue as you deliver each separate good or service.67 of the unearned revenue as earned revenue on its income statement, because it’s delivered a portion of the software and provided a portion of the technical support services. There, it appears with other types of unearned income, such as proceeds from sales of property.

According to ASC 606, businesses must follow the below steps to recognize their earned and unearned revenue: 1.Unearned revenue can be thought of as a “prepayment” for goods or services that a person or company is expected to produce for the purchaser at some later date or time. If you don’t have an exact price for each good or service, estimate it.Revenue recognition is an accounting principle under generally accepted accounting principles (GAAP) that determines the specific conditions under which revenue is recognized or accounted for .) The answer is $600,000. Example 2 – Asset / expense adjusting entry for prepaid insurance .

What is unrecognized revenue?

— the sale of goods, — the rendering of services, and.IAS 18 outlines the accounting requirements for when to recognise revenue from the sale of goods, rendering of services and for interest, royalties and dividends.Revenue is recognized on the date the sale occurs and then included in a firm’s gross revenue on the income statement. For example, if a company sold a product for $100 and it includes a 2 year warranty that has a value of $20, the company would recognize $80 of revenue and $20 would be recorded to unearned . Supplies of $300 have been used.

Solved Gabbit Publishers sold 9,000 annual subscriptions at

The revenue recognition principle dictates the process and timing by which revenue is recorded and recognized as an item in a company’s financial statements. Each subscription is $600 a year/$50 per month. In accrual accounting, revenue is only recognized when it is earned. Revenues are the cash for the products sold or services delivered.This can help you visualize how much revenue you have spent and how much you still need to pay back to your client through your services. The owner then decides to record the accrued revenue earned on a monthly basis.

![What Is Unearned Revenue [Definition Examples Calculation]](https://www.realcheckstubs.com/media/Is Unearned Revenue a Liability.jpg)

After four months, the company can recognize 33% of unearned revenue in the books, equal to $400.This warranty is the assurance-type warranty that the company provides to the customer to insure the product’s quality. It goes on until December 31st, where the deferred revenue balance is $0, and the revenue is $1.The company has completed the work for the customer, so it must record in the income statement. This process includes the following 5 steps: Find and review the contract with the customer. How much unearned revenue will be recognized for the year ending December 31? (Do not round intermediary calculations.5, which is $500, hence: Account name Debit Credit; Unearned revenue: $500-Service revenue . The asset has been . In accounting terms, it is considered to be an asset until the company invoices the customer and receives payment.This means that when you create a deferred revenue journal entry, you only log revenue for what has been delivered. On the balance sheet, the cash balance would go from $100,000 to $92,000, and the deferred revenue balance would go from $100,000 to $80,000. For example, if a company collected 45% of a product’s sale price, it can recognize 45% of total revenue on that product.The income statement includes all revenues from sales and services, minus all costs associated with providing those goods or services—such as cost of goods sold (COGS), depreciation and amortization, salaries, taxes, etc. The installment sales method is typically used to account for sales of consumer durables, retail land sales, and retirement .Deferred Revenue Example. Service revenue will, in turn, affect the Profit and Loss Account in the Shareholders Equity section Shareholders Equity Section Shareholder’s equity is the residual interest of the shareholders in the company and is calculated as the difference . At the same time, it needs to record warranty expense $ 5,000 and provision over warranty $ 5,000. The earned revenue will be $1k per month. 2014-09 and other .Every month, for every magazine you deliver, you will record an entry recognizing the revenue and lessening the unearned revenue account as follows: Unearned Revenue DR $50. In that sense, it’s income that your company has collected but hasn’t rendered services for.Any revenue received in advance of the delivery of goods or services is considered deferred revenue.Deferred Revenue (also called Unearned Revenue) is generated when a company receives payment for goods and/or services that have not been delivered or completed. Upon delivery of the product, you can immediately recognize $1000 of previously unearned revenue from the gift cards, $500 for the additional deferred revenue unrelated to the gift card ($1500 total) AND $100 in breakage income (10% of your gift card, per your breakage policy!) For most companies, revenues come as a result of selling products or services. Unearned service revenue of $260 is recognized for s; An asset’s book value is $19,100 on December 31, Year 5.Unearned service contract revenue at January 1 520, Cash receipts from service contracts sold 980, Service contract revenue recognized 860, Service contract expense 520, What amount should be reported as unearned service contract revenue on December 31? a.Earned revenue is when a service or product has been provided.Ethics in Revenue Recognition.

How is a warranty accounted for under revenue recognition rules?

Orwell company accumulates the following adjustment data on December 31. Add earned revenue to income After deducting a portion of money from the unearned (credit) on your balance sheet, you can now add this to the total income revenue category on your . For example, if you’re generating $2 million in sales revenue per year, and half of that is from services, first find out how much money you made from . Accounts receivable must be included on the balance sheet as either a short . ASC 606 classifies a contract refers to a visual, written, or implied agreement between two parties that creates enforceable rights and obligations.When Is Unearned Revenue Recognized? According to ASC 606, businesses must recognize revenue when they have delivered products or services that are equal to the amount in exchange for those same products and services. This Standard deals with the bases for recognition of revenue in the statement of profit and loss of an enterprise.

33) will be converted into unearned commission liability. This journal entry will need to be repeated for the next five months until the entire amount of deferred revenue has been properly recognized. Match the transaction price to the performance obligations in the contract. For example, you pay $1200 for a one-year .

Why Is Deferred Revenue Treated As a Liability?

Bewertungen: 8

What Is Unearned Revenue?

On 31 December 2016, one-third of the commission revenue (3,600 × 0.

The cost of deferred revenue

Deferred revenue is listed as a liability on the balance sheet because, under accrual accounting, the revenue recognition process has not been completed. That is how you calculate deferred . Unearned revenue is recorded .

Unearned Revenue: What It Means For Subscription Businesses

In the above example, the maintenance contract costs 6,000 for one year, assuming the business produces monthly management accounts, each month 500 will be become recognized revenue and credited to the services revenue account in the .Hence, $ 1000 of unearned income will be recognized as service revenue. Total Cash Payment = $1,000; Revenue Recognized = $850; Deferred Revenue = $150; The remaining $150 sits on the balance sheet as deferred revenue until the software upgrades are fully delivered to the .At the end of the year, using the accrual method, revenue on the income statement would be recognized for $20,000, and an expense of $8,000 would be recognized.In total, the company collects the entire $1,000 in cash, but only $850 is recognized as revenue on the income statement. In summary, the . Unearned revenues are recorded in the books of accounts as a liability as they give rise to goods and services that are due. This entry reduces the deferred revenue by the monthly fee of $1,250 while recognizing the revenue for January in the appropriate revenue account. To calculate the percentage of service revenue against total sales, take your service revenue and divide it by total sales. However, sometimes companies may also transfer goods and not receive funds for it but still need to record their revenue. On the other hand, companies may receive money even if they . 640, Answer is d.

- How Many People Are Colorblind

- How Many Seasons Of Seven Kings Must Die Are There?

- How To Center A Div In Css? _ How To Center an Image

- How Much Ram Does Windows 7 Have?

- How To Automatically Save Zoom Chat

- How To Choose The Right Printing Ink

- How Many Senate And House Seats Were Up For Election In 2014?

- How Much Ram Does Lsass Use? | Windows 11 RAM requirements: What you need to know

- How Much Money Did War Make In 2024?

- How To Be Wife Material , 16 Ways To Be Wife Material

- How Powerful Is The Federal Corvette?