How Does Fatf Monitor Progress In Implementing Its Recommendations?

Di: Samuel

The FATF researches how money is laundered and terrorism is funded, promotes global standards to mitigate the risks, and assesses whether countries are taking effective action.The FATF Recommendations set out a comprehensive and consistent framework of measures which countries should implement in order to combat money laundering and terrorist financing, as well as the financing of proliferation of weapons of mass destruction.What Else Does FATF Do? The FATF also monitors progress in implementing its Recommendations through peer reviews of member countries. FATF routinely conducts these evaluations to determine the extent of a country’s technical compliance with global anti-money laundering and counter terrorist financing laws. Jurisdictions under increased monitoring are actively working with the FATF to address strategic deficiencies in their regimes to counter money laundering, terrorist financing, and proliferation financing. This is what the FATF calls mutual evaluations.

United States

They have the scope to make payments easier, faster and .Since the assessment of the effectiveness of Australia’s measures to combat money laundering and terrorist financing, the country has been in an enhanced follow-up process.High-Risk Jurisdictions subject to a Call for Action – February 2021.The risk-based approach is central to the effective implementation of the FATF Recommendations. The country will report back to the FATF on progress achieved in improving the implementation of its AML/CFT .

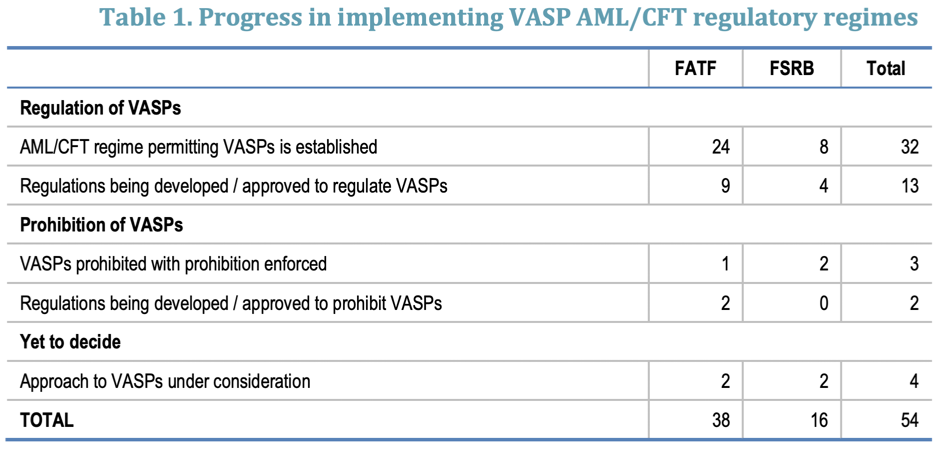

High-Risk Jurisdictions subject to a Call for Action – October 2023 High-risk jurisdictions have .EFFECTIVENESS AND TECHNICAL COMPLIANCE OF FATF MEMBERS. The FATF identified jurisdictions which have strategic AML/CFT deficiencies for which they have developed an action plan with the FATF.The FATF regularly monitors the progress of its members in implementing its Recommendations through the Mutual Evaluation process. Outcomes FATF Plenary, 2-4 March 2022.implementing the revised FATF Standards for VAs and VASPs. The country remains partially compliant on 2 Recommendations. FATF evaluates a country’s performance based on its assessment methodology that covers two elements.Outcomes FATF Plenary, Orlando, 21 June 2019. Outcomes FATF Plenary, 22, 24 and 25 February 2021. A risk-based approach means that countries, competent authorities, and banks identify, assess, and understand the money laundering and terrorist financing risk to which they are exposed, and take the appropriate mitigation measures in .High-Risk Jurisdictions subject to a Call for Action – October 2021.

These reviews found that both public and private sector had made progress in implementing the revised FATF Standards, but that substantial work remained to reach global implementation.17 February 2023 – Overall, Hong Kong, China has made progress in addressing the technical compliance deficiencies identified in its 2019 Mutual Evaluation, relating to Regulation and supervision of DNFBPs.34 have been re-rated to Largely Compliant.In May 2023, the MENAFATF upgraded its assessment score of UAE’s compliance with three of its recommendations (FATF recommendations 1, 19 and 29) to “Compliant” or “Largely Complaint” in response to the positive measures the UAE has taken. Pakistan’s fourth progress report is due 1 February 2022. Malaysia remains in enhanced follow up and will continue to inform the FATF of progress achieved on improving the implementation of its AML/CFT measures.The UAE has made progress in fighting money laundering and terrorist financing, after the FATF included it in its “grey list” – a list of jurisdictions that face increased monitoring – last year.Virtual Assets.

The FATF welcomes their commitment and will closely monitor their progress.Recommendation 33 is re-rated Compliant; Recommendation 37 is re-rated Largely Compliant; Recommendation 38 is re-rated Partially Compliant; Pakistan has 38 Recommendations rated C/LC.

The Financial Action Task Force (FATF) leads global action to tackle money laundering, terrorist and proliferation financing.The FATF will assess countries’ implementation of these requirements during its upcoming round of mutual evaluations. against money laundering (AML) and counter-terrorist financing standard. To monitor and assess the progress of its Members in implementing FATF standards, the FATF conducts a mutual evaluation . Outcomes FATF Plenary, 19-21 October 2021.Nigeria’s measures to combat money laundering and the financing of terrorism and proliferation This report provides a summary of the AML/CFT measures in place in Nigeria as at the date of the on-site visit (25 September to 14 October, 2019).As an FATF Member, the GCC is committed to implementing the anti-money laundering (AML) and counter-terrorist financing (CFT) measures agreed to by the FATF Members – in particular, the FATF Recommendations. In 2017, the FATF conducted a mutual evaluation of South Africa’s anti-money laundering and counter-terrorist financing regime and issued a report outlining areas of improvement.In February 2024, Kenya committed to strengthening its anti-money laundering and counter-terrorist financing regime in partnership with the FATF and ESAAMLG. Virtual assets have many potential benefits and dangers. The FATF adopted this report at its June .

Risk-Based Approach for the Banking Sector

Improving Global AML/CFT Compliance: On-going Process

The FATF welcomes Serbia’s significant progress in improving its AML/CFT regime and as a result, the country is no longer subject to FATF’s . It is based on data from FATF and FSRB mutual evaluation reports since 2013, which assessed the strengths and weaknesses of national frameworks to tackle these crimes. In October 2004, the FATF published a Ninth Special Recommendation on terrorist financing, further strengthening the FATF standards – the 40+9 Recommendations . He is the principal spokesperson for the FATF and represents the FATF externally.The International Monetary Fund staff-led assessment comprehensively reviews the effectiveness of South Africa’s measures to combat money laundering and terrorist financing, and their level of compliance with the FATF Recommendations as at the time of the on-site visit in November 2019.Zimbabwe has made progress in addressing some of the technical compliance deficiencies identified in its MER. The country will remain in enhanced follow-up and will continue to report back to the APG on progress to strengthen its implementation of .

Australia

Jurisdictions under Increased Monitoring

Given the inherently .High-Risk Jurisdictions subject to a Call for Action – 21 February 2020. The FATF Standards do not envisage de-risking, or cutting-off entire classes of customers, but call for the application of a risk-based . It does not include digital representation of fiat currencies.FATF Mutual Evaluation Section.In October 2021, the Financial Action Task Force (FATF) published its Report on South African Anti-money Laundering and Counter Terrorist Financing Measures (Report). Recommendations laundering, terrorist are recognised as the financing the financing anti- money of.The objectives of the FATF are to set standards and promote effective implementation of legal, regulatory and operational measures for combating money laundering, terrorist financing (ML/TF) and other related threats to the integrity of the international financial system. This process consists of a peer review of each member, which provides a detailed description and analysis of their Anti-Money Laundering and Countering the Financing of Terrorism (AML / CFT) framework .

Virtual Assets

Cambodia will work to implement its action plan to accomplish these objectives, including by: (1) providing a broad legal basis for MLA .Since the 2018 assessment of the United Kingdom’s measures to tackle money laundering and terrorist financing, the country has taken a number of actions to strengthen its framework. Japan will report back to the FATF on progress achieved in improving the implementation of its AML/CFT measures in . The FATF does not call for the application of enhanced due diligence measures to be applied to these jurisdictions. Progress since September 2022 includes legislative amendments aligning with FATF recommendations and establishing a case management system for international .Switzerland has 8 Recommendations rated Compliant, 29 Recommendations rated Largely Compliant and 3 rated Partially Compliant.

Frequently Asked Questions

The FATF President is a senior official appointed by the FATF Plenary from among its members on a two-year term. The country will move to regular monitoring and will inform the FATF of the progress made in improving the implementation of its AML/CFT measures as part of its 5 th round mutual . Recommendation 1 is re-rated from Partially Compliant to Largely Compliant Recommendation 24 is re-rated from Non Compliant to Largely Compliant On Recommendations that are being re rated due to the changes made to the FATF . Recommendation 28 is upgraded from Partially Compliant to . Membership: There are currently 39 members of the FATF including 37 countries and 2 regional organizations. The country has been upgraded on one Recommendation.

Financial Action Task Force Charities Regulator

Outcomes FATF Plenary, 21-23 October 2020. These are known as the FATF Standards, which comprise 40 recommendations for countries to implement to demonstrate an effective . In February 2019, Cambodia made a high-level political commitment to work with the FATF and APG to strengthen the effectiveness of its AML/CFT regime and address any related technical deficiencies.South Africa is a member of the FATF and has committed to implementing the organization’s recommendations. When the FATF places a jurisdiction under increased monitoring, it means the country has committed to resolve swiftly . What are the benefits to complying with the FATF Recommendations? There are several benefits to implementing the FATF Recommenda-tions.Paris, 23 June 2023 – Jurisdictions under increased monitoring are actively working with the FATF to address strategic deficiencies in their regimes to counter money laundering, terrorist financing, and proliferation financing.Today, Malaysia is compliant on 20 Recommendations and largely compliant on 18. The FATF will continue to support its Members as well as countries in FATF-Style Regional Bodies, which are committed to change but often need additional technical assistance and training.

Outcomes FATF Plenary, 19-21 February 2020. FATF has issued 40 Recommendations on AML/CFT that its members1 and jurisdictions under FSRBs implement.

22 February 2019

Recommendation 25 is maintained at Partially Compliant; Japan has 4 Recommendations rated Compliant, 29 recommendations rated Largely Compliant and 6 Recommendations rated Partially Compliant.Recommendation 10 has been re-rated to Compliant; Recommendations R. The Emirates issued fines of more than Dh115 million ($31.Starting with its own members, the FATF monitors countries‘ progress in implementing the FATF Recommendations; reviews money laundering and terrorist financing techniques and counter-measures; and . Therefore, the Guidance does not attempt to provide a single model for the risk-based approach, but seeks to provide guidance for a broad framework based . The FATF monitors the progress of its members in implementing necessary . The implications of non-compliance with the .High-Risk Jurisdictions subject to a Call for Action – 23 October 2020.

United Kingdom

Progress achieved to-date is a result of the tireless efforts, active participation and relentless desire to enhance the current system. Virtual assets (crypto assets) refer to any digital representation of value that can be digitally traded, transferred or used for payment. The guidance will be published at the end of February.Myanmar’s progress in strengthening measures to tackle money laundering and terrorist financing In light of the progress made by Myanmar since its MER was adopted, the country has been re-rated on one Recommendation.As of March 2024, the United States is compliant on 9 of the 40 Recommendations and largely compliant on 23 of them. This landmark report gives a comprehensive overview of the state of global efforts to tackle money laundering, terrorist and proliferation financing. Pakistan will remain on enhanced follow-up, and will continue to report back to the APG on progress to strengthen its implementation of AML/CFT measures.In June 2003, the FATF comprehensively revised its Recommendations due to the continued evolution of money laundering techniques. Financial Force (FATF) is an independent inter-governmental that develops and promotes proliferation of weapons of mass to protect destruction. By the end of the 2021-2022 Plenary year, the FATF published the mutual evaluation reports of 31 of its 37 member countries; 84% of FATF members have now been evaluated.The Guidance recognises that each country and its national authorities, in partnership with its financial institutions, will need to identify the most appropriate regime, tailored to address individual country risks. Each report is a snapshot of the situation in the country at the time of the on-site visit.FATF issues a set of international standards to promote effective implementation of legal, regulatory and operational measures for combatting money laundering and terrorist financing. It analyses the level of compliance with the FATF 40 Recommendations, the level of . Today, the United Kingdom is compliant on 24 Recommendations and largely compliant on 15. It remains partially compliant on 5 of the 40 Recommendations and non compliant on 3 of them.

EU and International

As a result of this report, the FATF rerated the country on 7 . The country reported back to the FATF in 2018 on the actions it had taken to strengthen its AML/CFT framework.

These include building a more transparent and stable financ-

The second 12-month review in June 2021 therefore committed FATF to focus on

Myanmar

The United Arab Emirates‘ progress in strengthening measures to tackle money laundering and terrorist financing This follow-up report sets out the progress that the United Arab Emirates has made in improving its level of compliance with the FATF standards, since their 2020 mutual evaluation. Leveraging Digital Transformation: Virtual Assets Many countries have yet to fully implement the FATF’s revised Recommendation 15. Countries have diverse legal, administrative and operational frameworks and different . Following the upgrade, the UAE is compliant with 39 out of 40 . The country remains partially compliant .3 million) in the first quarter of the year to combat money laundering.

- How Do You Get The Cult Of Kosmos In Assassin’S Creed Odyssey?

- How Do You Conceptualize A Qualitative Research Question?

- How Do You Adapt To Emotional Numbness?

- How Do You Prepare For A Military Boot Camp?

- How Long Does Xpresspost Take To Deliver?

- How Do You Clean A Speaker Jack?

- How Does Audyssey Save Profiles?

- How Long Does A Global Entry Application Take?

- How Do You Make A Good Easter Gift?

- How Good Is Love Will Tear Us Apart?

- How Is Terminal Output Emulation Used In A Web Based Ssh Server?

- How Do You Make A Triangular Prism?