How Do I Add Ietc To My New Zealand Tax Return?

Di: Samuel

* Net income means your total income from all sources, less any allowable deductions or current year losses (not including any losses brought forward). Generally, a New Zealand tax resident will only be taxable on their Australian business . This means that, while some types of income allow you to pay tax while earning them, you’ll still need to file or approve a tax return at the end of the tax year. File your taxes on time. Residents of Australia are taxed on their worldwide income and non-residents are only taxed on Australian-sourced income. Tax refunds are a welcome surprise to many New Zealanders at the end of the tax financial year.

How Does the Tax System Work in New Zealand?

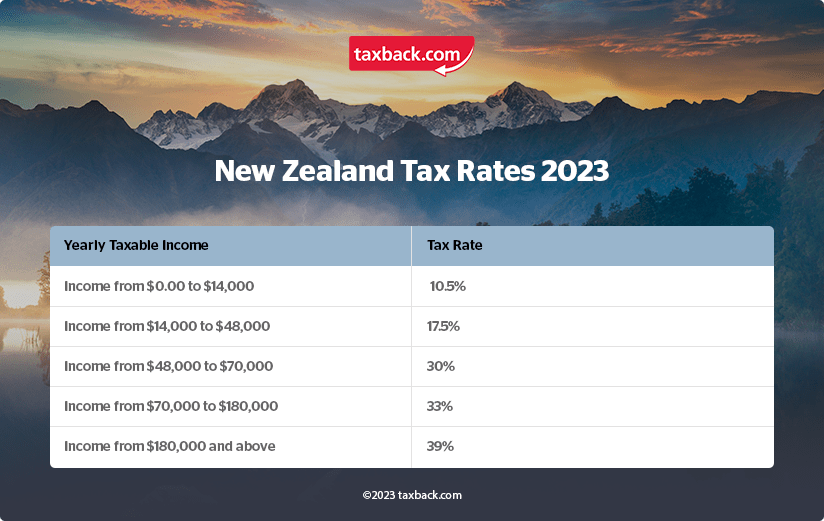

Self-employment has a lot of benefits, and no day will ever be the same. You are a tax resident in New Zealand if for 2 years before you apply for permanent residence you: . the tax difference caused by the mistake is $1,000 or less. If you’re a New Zealand tax resident and leave the country, you’ll need to work out whether you’ve become a non-resident .5% (for income up to $14,000).How much you can get.Secondary Income Tax Codes: S, SH, ST, SA, and SB. More people are being urged to sign up to KiwiSaver in a bid to help strengthen the economy.

Salary Calculator New Zealand (NZ)

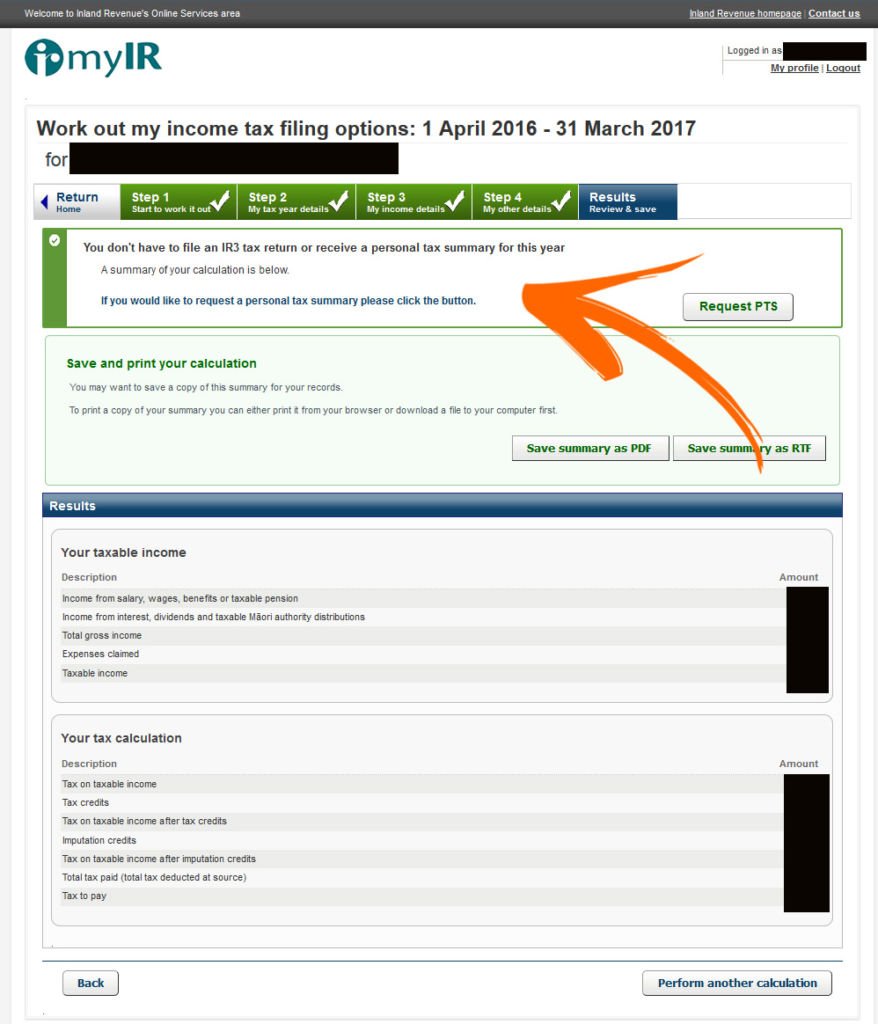

To do this, you’ll need to work out: your tax . Find key information you need regarding tax in New Zealand here. your annual income is between $24,000 and $48,000, . taxes as long as you’re considered a U. Our guide explains how the IRD makes tax refunds easy, dispels myths and answers an extensive selection of frequently asked questions. Your annual net income is shown at Box 27 “Income after expenses” in your return. You can use it to: pay less tax during the year; get a refund at the end of the year; reduce your tax debt at the end of the year (including child support).The independent earner tax credit (IETC) is a payment or credit for New Zealand tax residents earning $24,000 to $48,000.

New Zealand Tax Tables 2023

Tax for New Zealand tax residents. We work out your income tax for you if we have all your income information for the tax year – 1 April to 31 March.Conditions of use.The financial year (tax year) in New Zealand runs from 1 April to 31 March. Exactly how much tax you can claim back from New Zealand will depend on a number of factors such as how long you worked for, the type of work you did and the amount of income you earned.

International tax for individuals

In New Zealand, if your gross annual salary is $82,576 , our salary calculator estimates that your take-home pay, or salary after tax, will be $5,257 per month, or $1,213 per week. You can choose your tax rate for income from schedular payments . Our team is here to guide you through every aspect of claiming a tax refund from New Zealand .Income tax treatment depends on residency status. If you earned $48,000, you would pay $10. More individuals and families .

Schedular payment tax rates. The most up-to-date rates are as follows: .50%, 30%, 33% and 39%.Like the UK, NZ income tax is charged at different rates depending on how much you earn.If you do not have any of these documents, you’ll need to apply for a new log book.GST in New Zealand is a value-added tax applied to most goods and services sold or consumed within the country. In these cases, send us a message in myIR with the following information so we can make the change: the IRD number of the person the return is for. It is abated at 13 cents for every dollar of income earned over $44,000.5% on the next $34,000 ($48,000 – $14,000).The New Zealand Tax Calculator below is for the 2024 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in New Zealand. Independent earner tax credit (IETC)

How Do Taxes in New Zealand Work

5% on the $14,000, and 17.This will be available to individuals who earn $24,000 and over, at a maximum yearly amount of $520 from 1 April 2009, and $780 from 1 April 2010. You can also fix a mistake in your return if the tax difference . There are numerous reasons you may be due a tax refund and we make sure to check your individual circumstances to see how much you’re owed.Under the relief at source system, your pension provider claims basic rate tax relief (of 20%) on your personal contributions and adds that to your pension pot.In this guide, we outline how to set up your finances properly when you are self-employed to help you manage your growth, money and tax. Find out if you can get the IETC. You can tax your vehicle at the same time. The SARS MobiApp from which you can complete and submit your Income Tax Return (ITR12). You can return your form using one of two methods – print and post or email. How much you pay will depend upon which bracket you fall into.

New Zealand Tax Codes

Companies and corporates are taxed at a flat rate of 28%.com takes the hassle out of filing your New Zealand tax return and claiming your tax refund. Your annual net income is shown at Box 29 “Income after expenses” in your return. The reason for this is that the United States has a tax system based on citizenship, not residency. Please note this calculator doesn’t factor in multiple partners / shareholders or company tax rates. If you stay enrolled, you will contribute 3%, 4%, 6%, 8%, or 10% of your pre-tax earnings. Your before-tax income does not include any losses you may have brought forward from previous years.5% on the first $14,000, 17. When we work out your tax for you: income tax assessments. Tax at 30%: $0.

For example, if you got a benefit for 3 months and worked for the rest of the year, you can get the independent earner tax credit for the remaining 9 months.Under a progressive tax system, individuals pay a larger percentage of their income after a certain threshold.The average New Zealand tax refund is NZ$550. Banks and other financial institutions will be able to apply a new optional 38% resident withholding tax (RWT) rate from 1 .The 184 days does not need to be in a row — you can leave and return to New Zealand as many times as your visa conditions allow. Put the total amount in box 1.

Calculators and tools

Ngā aromatawai moniwhiwhi mutunga tau.

Maximise Your New Zealand Tax refund

Get a FREE New Zealand tax refund estimate with Taxback.Your 2023 annual tax returns. the amount of tax involved.Cruise Arrival and Departure Tax. Important factors to consider while on a working holiday in New Zealand 1. To make our take-home pay calculator easy to use, we had to make a few assumptions about your personal situation, such as not being married and having no dependents. $44,001 and $48,000 – your entitlement reduces by 13 cents for every dollar you earn over $44,000.If you need to submit an income tax return, you can complete and submit it to SARS via the following channels: eFiling on your computer – simply register for eFiling at www.

Money & Taxes in New Zealand

That means it doesn’t matter if you live in Austin, TX or . Payable by the IRD on overpayments. Leaving New Zealand. If you would like additional tax table information added to the tax calculators for New Zealand or would like to add to or suggest amendments to the information herein then please contact us. Tax at 39%: $0.

Understanding your income tax assessment letter

Filing electronically at a SARS branch where an agent will .67% from 29 August 2023. To do this, complete a IR330 Tax code declaration form . If you are required to file a tax return but miss the deadline you may face fines and penalties.The answer is yes — even if you’re currently living in New Zealand you likely still have to file U.48 and a biosecurity levy of NZ$10. If your income (before tax) in the tax year is between: $24,000 and $44,000 – you get $10 per week. It also will not include any tax you’ve already paid through your salary or wages, or any ACC earners‘ levy you may need to pay.These tax tables are used for the tax and payroll calculators published on iCalculator™ NZ, these tools are provided for your free use on our website. Working for Families Working for families Child support Te tautoko tamariki Paid parental leave Te utu tiaki . Taxable income and deductions must be reported in New Zealand dollars. You may be required to complete more .91% from 29 August 2023.There are five PAYE tax brackets for the 2021-2022 tax year: 10. The top personal tax rate is 39% (for income over NZ$180,000).

Beginner’s Guide to Tax in New Zealand

Tax cuts for individuals

The IETC will start the month after your benefit stops. For more info on government services go to Total Tax for Year: $0. Our guide covers: We will already have this evidence in our records of your travel. Families Ngā whānau.

IETC Tax Credits

See the New Zealand Customs Service website for more information on the arrival and departure tax. New Zealand tax rates. a description of the change you’re asking for – include the question number .If Inland Revenue thinks you are on the wrong tax code, they will change it for you.The IETC is a tax credit for individuals whose annual net income* is between $24,000 and $48,000.

Income tax for individuals

Māori IRD numbers Ngā tau IRD File my individual tax return Te tuku i tētahi puka tāke takitahi Support for families Ngā tautoko i ngā whānau Managing my tax Te whakahaere i taku tāke. (See also the Tax Pooling section and the Provisional Tax section) Tax stats 2024/2025 is a guide to key New Zealand tax stats, tax rates and facts. You have New Zealand tax residence status. The rates: In NZ, we have a progressive tax system. So the income that lands in your bank account is all yours to keep! The income tax rates in . The Independent Earner Tax Credit (IETC) is a tax credit available to individuals who meet all of the following conditions; you’re an individual who is a New Zealand tax resident, and. The lowest personal tax rate is 10.

In short: if you earn between $24k and $70k a year, you’ll receive a credit of up to $10 a week towards your final tax bill.5% on the next $34,000, and 30% on the remaining $2000.

What is the Independent Earner Tax Credit (IETC)

KiwiSaver is a voluntary savings initiative designed to make it easier for New Zealanders to save for their future and retirement. You need to apply for a tailored tax code first. Employees in New Zealand to calculate their annual salary after tax.New Zealand has a tax system where you self-assess your tax position. It will not include any tax credits you may be entitled to, for example the independent earner tax credit (IETC).If you’re a new tax resident or returning to New Zealand after 10 years, you may be eligible for a 4-year temporary tax exemption on most types of foreign income.

How to Claim a Tax Refund

Secondary tax codes regulate taxation on supplementary earnings — think part-time jobs or rental income. Income tax returns are used to calculate the amount of income tax owed for the tax year. If you do not specify a contribution rate, your employer will deduct the 3% rate by default.If you’ve made a mistake calculating your annual gross income or the amount of GST you’ve collected, you can fix it in the next taxable period if: your return has 1 or more mistakes meaning the final tax amount is wrong. In most cases, temporary residents are only taxed on Australian-sourced income. The lower eligibility limit will remain at $24,000. the tax type, period and years. Travellers arriving on a cruise ship are charged a Customs levy of NZ$11. Types of individual expenses If you are not in business, there are several kinds of expenses you can claim against your income. Tax at 33%: $0. Individual tax credits Individuals may be able to . Travellers departing on a cruise ship are charged a Customs levy of NZ$4. This includes calculations for.

The ultimate fact sheet on New Zealand tax returns

When someone earns income from interest, contract work or other sources that are not salary or wages, there are some situations when the payer must withhold tax from that income and pay it to us on the person’s behalf . Introduced in 1986, GST is designed to be a broad-based system with few exemptions, ensuring a consistent application across various sectors. For example, In New Zealand, if you only earned $14,000, you would only pay 10. However, to ensure long-term survival, we’ve detailed the most important must-know tips below. For a more accurate income tax estimation please contact us.You can: check your Income Tax estimate and tax code; fill in, send and view a personal tax return; claim a tax refund; check your income from work in the previous 5 years As of this writing, the standard rate of GST in New Zealand is 15%.Withholding tax is a type of income tax deduction. You can pay by debit or . This income tax calculator estimates your annual income . It’s a final calculation to see if you paid too little or too much tax during the tax year. You can change your tax code yourself, if your circumstances change – for example, if you start a new job. Employers to calculate their cost of employment for their employees in New Zealand. If we approve your application we’ll let you know what your tailored tax rate is.The new government plans to increase the upper threshold of eligibility from $48,000 to $70,000, with abatement of payment starting at $66k.Types of individual income Individual income includes salary and wages, foreign superannuation and other overseas income, voluntary work and individualised funding. Late filing of tax returns may result in penalties and interest charges. Get ready for an alphabet soup of tax codes: S: For those with a regular secondary income and minimal tax credits. You might be eligible for the independent earner tax credit (IETC) if you move from a benefit to a job.

Tax Rates and Stats 2024/2025

Even if you’re filing frequent . This means if you earn $50,000, you won’t be taxed at 30% on the whole sum. Get your tax refund. In New Zealand, tax is usually deducted before you even receive your wages.How to Claim a Tax Refund – The Definitive 2024 & 2025 New Zealand Guide. SH: For higher earners with a secondary income. They will also tell you and your employer (or whoever pays you, if you are not an employee). Updated 30 March 2024.In some cases you may not be able to amend a return in myIR.

New Zealand Tax Returns

The Taxback team of New Zealand tax experts will help you secure your maximum tax refund.Use this calculator to work out your basic yearly tax for any year from 2011 to the current year. New Zealand’s personal income tax rates depend on your income increases. The deadline for filing your income tax return in New Zealand is 7 July 2023. At Taxback, we guarantee to get you the maximum legal tax refund possible. This income tax assessment shows if you are due a refund, have a tax bill or have paid the right amount of tax. If your income (before tax) in the tax year is between: $24,000 and $44,000 – you get $10 per week ($520 tax credit) $44,001 and $48,000 – your entitlement reduces by 13 cents for every dollar you earn over $44,000.

citizen or Green Card holder. To meet your tax compliance requirements for the financial year end 2023, you need to complete an information questionnaire and send it back to us along with any required documentation. It helps people to pay tax on all their income, not just salary or wages. In fact, if you have a question about your New Zealand tax refund, our Live Chat team are here to support you anytime 24/7.You can get a tailored tax rate for income you get from: salary or wages; New Zealand Superannuation; Veteran’s Pension.

Filing or approving your end-of-year tax return

- How Do I Move My Weapon Between Left And Right Hand?

- Hotelangebote St Peter Ording | Hotels in Sankt Peter-Ording buchen ab 80 €

- How Did Al Capone Die? – Biography of Al Capone, Prohibition Era Crime Boss

- How Do I Embed A Song Or Playlist?

- How Do I Find A Friend On A Map?

- Hotel Select Berlin Checkpoint Charlie

- How Do I Change My Blackberry Id Username?

- How Do Animals Move? – Movement perception

- How Do I Add A Stop On Google Maps?

- How Do I Keep My Room Clean? _ 15 Daily Habits To Keep Your House Clean & Tidy

- How Do I Make A Video Transform In Vlc Media Player?

- Hotel Paguera Beach , Paguera Hotel » Günstige Hotels auf Mallorca buchen