German Tax On Stock Options | Investment Taxation: A Comprehensive Guide in Germany

Di: Samuel

Taxation of employer-provided stock options – Tradable and non-tradable stock options must be distinguished.Germany’s regular VAT rate – except for the second half of 2020 – is 19%, the unified reduced rate (e. Having read the HMRC website, I believe selling stock would make me liable for capital gains tax (with a 10K tax free allowance followed by either 18% or 28% rate) so I’m confused . UK company share option plan .

100 shares x $160 (current market value)/share = $16,000.

FAQ ADR taxation

918€ per year. In all other cases, income from assets are tax-exempt and must not be mentioned .

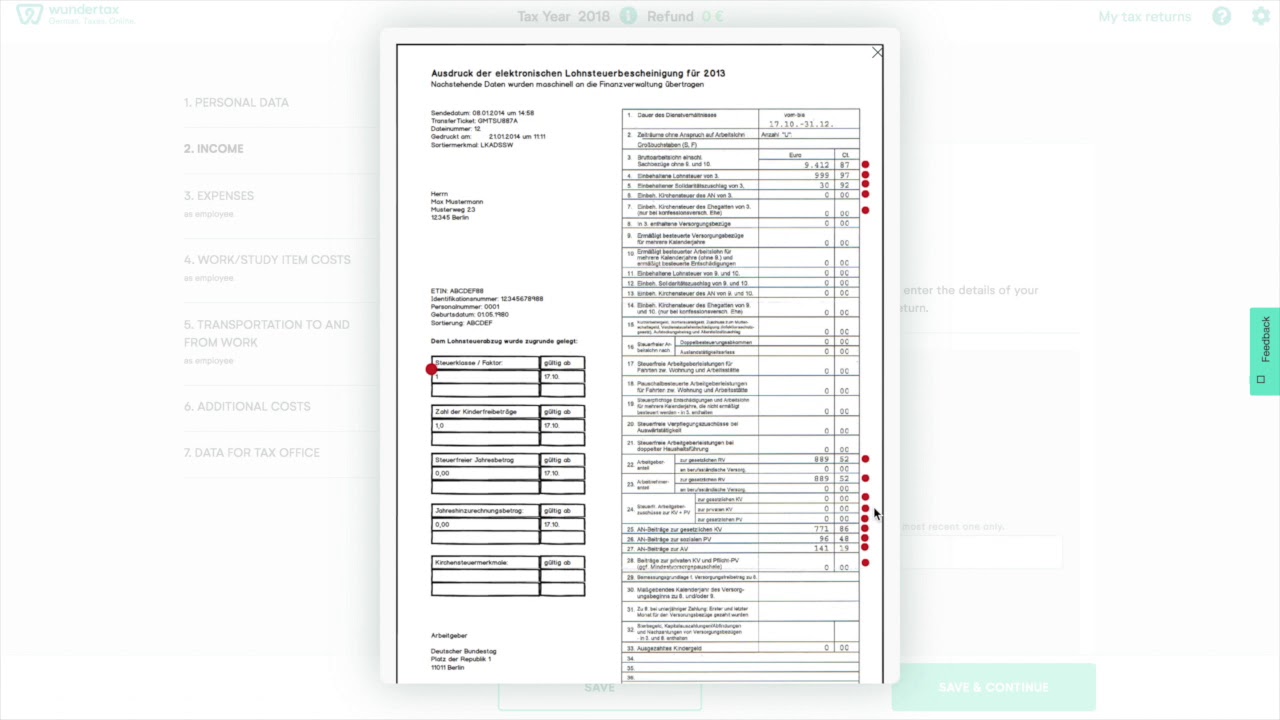

Further, as of 1 July 2021, for grants by start-up/small . But for years, Germany has ranked as one of the worst countries with its burdensome tax rules around employee stock ownership programmes, or ESOPs. The Global Tax Guide explains the taxation of equity awards in 47 countries: stock options, restricted stock, restricted stock units, performance shares, stock appreciation rights, and employee stock purchase plans. For non-qualified stock options, .) Stock Options Vesting US Stock Options while living outside of .Capital Gain Taxes . For example: with an income of 10. It is similar to a profit-sharing plan.LONDON — Germany will soon unveil new legislation on employee stock options, a government official said Thursday, in a bid to attract top technology talent and rival Silicon Valley. For employer-provided non-tradable stock options, the acceptable tax-filing position is taxation at the date of exercise. For the US you pay as part of filing, in Germany you file, then the Finanzamt sends you back a letter telling you what to pay and when. A recent decision by the 1st Chamber of Germany’s highest tax court reaffirms the position consistently taken by German courts and tax authorities that individuals receiving employee stock options . German law does not differentiate between . Example: 1,000 euros in profit from selling stocks; Withholding tax of 250 euros (25%) plus 22. This has increased to 10,347€ in 2023 and this will increase to 11,604€ in 2024. So you’ll pay withholding tax on the income and an upfront fee based on the value of the fund . Due to their leverage effect, however, even small price changes of the .When a startup is trying to lure in a big new hire, stock options are often a critical — and particularly attractive — component of the offer. The share option regime has been changed as of 1 January 2023. As of 1 January 2021, EUR 1,440 deduction may apply, provided all employees who are employed for one year or more are eligible to participate in the plan (increased from EUR 360 and proposals exist to increase further).

Taxing Your Valuable Assets and Investments

Capital Gains Tax in Germany [Ultimate 2024 English Guide]

Let’s say you got a grant price of $20 per share, but when you exercise your stock option the stock is valued at $30 per share. So, anytime your taxable income goes beyond $89,075 (or $178,150 if married filing jointly) you creep into a tax bracket higher than any withholding that will happen on your vested stock .7%withreinvestment of dividends.

German Tax System Explained

There is no separate tax on capital gains. The regular rates of 19% / 7% are effective again as of 1 January 2021. The current value approved by the tax office is € 30.50 euros of church tax (either 8 or 9% depending on state) = 272.

Withholding Tax on Stock Options: The Good, The Bad, The Ugly

001 per shares is £10 (what she paid) 10,000 shares x £2 per share = £20,000 (market value at the time of grant) £20,000 – £10 = £19,990 is the amount Jessica needs to pay Income Tax* on.For tax purposes, options can be classified into three main categories: 1.

Thus, if you are not officially a member of a “paying” church (we will further assume that this is the case), then your standard investment tax is 26,375%.Investors in Germany have it relatively easy when it comes to taxation of valuable assets. As you can see, there are tax benefits to going with the ISO – you don’t . Recent developments. Now, in addition to current income, capital gains are also subject to tax.NEW in 2018 for accumulating ETFs: The state wants a bigger slice. US taxes can be confusing even without the added complexity of being a . Taxable amount is fair market value of the shares on the tax event.10,000 shares at £0. Pursuant to a German Federal Tax Court case, in certain circumstances, it may be possible to take the position that RS is taxed on vesting.Germany taxes capital gains, with the rate depending on the nature of the gain. However, there is the option to apply for a special assessment. EUR 9,409 for 2020, EUR 9,744 in 2021 and EUR 9, 984 in 2022. If you receive an option to buy stock as payment for your services, you may have income when you receive the option, when you exercise the option, or when you dispose of the option or stock received when you exercise the option.

Taxes on Stock Options: Understanding & Calculating

If, when you exercise the option, the fair market value of the stocks is $15 each, the value of all 1,000 stocks is $15,000.Now, I have completed a W8-BEN form, which I believe makes me exempt from paying US taxes, so I’m unclear what this 40% amount is for and if it is correct.Taxation of Employee – RS/RSU.)

Tips and Taxes on Investing in Germany

Between 1960 and 2021, the S&P 500 rose by 7.

German taxes on individual foreign (US) stock dividends

Incentive stock options (ISOs) and taxes: the complete guide

ISO – no tax liability for exercising the option. On August 15, 2013, X transfers the options to his limited liability company by means of a concealed equity contribution.

Since you’ll have to exercise your option through your employer, your employer will usually report the amount of your income on line 1 of your Form W-2 as ordinary wages or salary and the income . The country profiles are regularly reviewed and updated as needed. NSO – you pay both ordinary income tax upon exercising the option and capital gains tax upon selling the contract/stocks.The following list details some basic, beginner options which should be enough to get you started as a new trader: . Exercising your non-qualified stock options triggers a tax. $16,000 – $15,000 = $1,000 taxable income. You pay capital gains tax when you sell your contract or sell the stocks in your option. you need to know what value to put in for the FTC) The order in which you pay them doesn’t particularly matter. If an expat held less than 1%, the entire capital gain from the sale . The net effective rate of taxation on the dividend is therefore 26. Previously, if you’ve used crypto in a staking/lending protocol, you’d need to hold this crypto for 10 years for it to be tax free.5% (on the tax) and a church tax (if you are registered). BNY Mellon as Depositary Bank (“the Depositary Bank .

Your guide to investment income taxes in Germany

Church members also have an added church tax but that calculation is a bit more complicated.ESOP (Employee stock option plan) or RSU (Restricted Stock Units) is an employee benefit plan offering employees an ownership interest in the organisation in the form of equity shares. is a subreddit dedicated to the German branch of this movement and includes discussions on various topics including stock trading in Germany, capital gains tax, investments, bonds, crypto, and more. If an expat held a direct or indirect interest of 1% or more in a domestic or foreign corporation within the last five years, 60% of the capital gain from the subsequent sale of shares is taxable.Taxation of Employee – ESPP. capital gains on shares are taxed at a flat 26,375% irrespective of how long they are held. food, newspapers) is 7%.4%withoutreinvestment of dividends and by 10. There’s now double taxation of funds and investments. 427, Stock options. there is no capital gains tax on a property held for more than 10 years. Also, they are not restricted to the shares of the company granting the options . (We do our best to keep the writing lively.15 in ordinary taxes ($147 × 45%) Your net gain is $80. There are two primary types: non-qualified stock options and incentive stock options. There are two types of stock options: The Key Employee Engagement Plan (KEEP) allows employee stock options to be taxed as capital gains, at 33%, rather than as income tax, at an eye-watering marginal rate of 52%.United Kingdom tax relief on stock option gains can be obtained by creating an approved H M Revenue & Customs arrangement (Sub-Plan) that will attach UK tax-favoured status to options granted by a US company to either its employees or employees of its UK subsidiary.100 shares x $150 (award price)/share = $15,000.German themes ; Finance ; Taxes on Stock Options Sign in to follow this . In Germany, the tax on capital gains is 25%, an additional Solidarity tax of 5. This law was not part of the Dutch Tax Plan 2023, but has . In general, stock options provided by employers are non-tradable. unissued) or existing shares. As part of a corona tax relief package, VAT was lowered to 16% and (reduced rate) 5% for the second half of 2020. If there were no taxes paid to Germany on this income, you would need to pay general US rates on this income.Germany applies a withholding tax on dividends paid to investors of German securities at a current rate of 25% with an additional “solidarity surcharge” of 5.When you do the math, that’s a $32,500 difference in additional tax you’ll owe on your supplemental wages after your HR department withholds 22% for you.Up to +42% Taxes: Scaling the summit of Germany’s tax hierarchy, the +42% category encapsulates investment scenarios where profits bear the weight of a maximum 42% tax rate.Taxes for Non-Qualified Stock Options.The German taxes that you pay or accrue on your dividends and interest would then be calculated to offset any taxes incurred in the USA, using Form 1116.

Investment Taxation: A Comprehensive Guide in Germany

The Vorabpauschale is a way to tax hypothetical gains. Options can be granted by Belgian or foreign companies and can relate to new (i. Their performance is linked to the prices of underlying assets such as shares, indices or even commodities such as gold. Non-residents are subject to tax on certain categories of income from German sources under the concept of limited tax liability. But the scheme has so many . On May 31, 2015, the . Unless otherwise stated, the commentary ignores Germany’s solidarity surcharge of 5. The (Rental) income tax rate rises fast up to 42% for income higher than 57.German Tax System. In case shares are not tradable after the exercise of a stock option, the taxable moment will be deferred as a main rule, unless an employee decides to keep exercise as the taxable moment and puts it into writing. So if you have 100 shares, you’ll spend $2,000 but receive a value of . The earliest date for exercising the option is May 31, 2015. In addition, the individual may be liable to pay church tax at 8 or 9 percent of the income tax. The idea is simple: if the asset is tangible, your profits must only be entered on your tax return if it has been in your possession for less than a year and exceed 599 euros. Tax on discount at purchase. In Germany, crypto can be sold tax free if it was held for over 1 year. 0 Berlin; Posted 9 Apr 2018. Taxes on Stock Options . After all, that’s when the value is .In common with many countries, Germany generally taxes an employee stock option at the time the option is exercised, rather than at the time it is granted. Ireland’s attempt, three years ago, to bring in a new tax regime for startup stock options, has so far been a failure.If you own stocks or ETFs then you may also receive profit distributions (dividends) which are taxed with the dividend income tax at 25 percent. Under these plans, the company, which is an employer, offers its stocks at negligible or low prices. *Income Tax is paid at 20% for basic rate tax payers, 40% for higher rate, 45% for additional rate + NIC.Use calculations from German return to do US taxes (i. The capital gains tax-exempt amount is 1,000 € (as of 2024).That will allow you to reduce the concentrated stock holdings in a tax-free manner.Everyone, including children, is entitled to a capital gains tax exemption in Germany.

For married couples, the tax-exempt amount increases to 2,000 € if they file a tax return together. However, this has now changed to the same 1 year holding period as of April 2022. Capital gains are subject to income tax as regular income however: there is no capital gains tax on a property used as a private home. I have the opportunity to exercise 100 stock options of my previous employer for € 5 per share.

US Expat Taxes in Germany: A Complete Guide

That means you’ve made $10 per share. (I’ve never known anyone who make residency consideration purely on this benefit alone, but it might sway you in one direction or the other. OR their income earned from outside of Germany in a calendar year that is not more than EUR 9,169. Companies should obtain a wage tax ruling before . In order to check its worthiness, I was . This applies to both US and foreign employees. The income tax rate in Germany is progressive and can go up to 45 percent, depending on your income.All (rental) income after 10.

Tax regime for stock options in Belgium

Tax tip: Correctly deduct losses from option transactions.Stock option programs have become a standard part of the compensation package for a wide range of employees in multinational corporations. Previously, only the accumulating income was taxed. This expansive category includes an array of investments—stocks, bonds, dividends, and ETFs nestled within a base pension level 1 and rental income from real estate.The maximum tax rate in Germany is 45 percent plus a solidarity surcharge of 5.347€ per year you have to pay 14 cents in Income Tax (14% of 1€ after 10.Taxation of stock option benefits: The benefit of exercising stock options is the difference between the fair market value of the stock on the date the options are exercised and the exercise price of the options. In 2022, the capital gain tax exempt amount was 801 € for an individual and 1,602 € for . On this day, the stock of the parent company is listed at €16 per share.5% of the 25% withheld.

Germany

Thus, you have the total tax on capital gain is 26. For qualified stock options, only 50% of the benefit is taxed at the individual’s marginal tax rate. You can avoid the Vorabpauschale by investing in ETFs via pensions. This is intended to eliminate the tax difference between the two ETFtypes. Tax relief is available in respect of options . But when you exercised your ISOs earlier, you already paid $45,000 for the strike price and $161,000 in taxes. Tax likely at grant for RS; tax at vesting for RSU.

At the time the option is granted, the price is €18 per share.5 percent on corporate and individual income tax. Tax rates are subject to change.

Crypto Tax Guide Germany 2024 [Kryptowährung Steuer]

For example, if you are given an option to purchase 1,000 of your employer’s shares at a rate of $10 per share, you pay $10,000 for the shares when you exercise your option, regardless of their value.You make a $147 pre-tax gain on each ISO you sell ($150 − $3 strike price) For each sold ISO, you owe $66.

Taxes on Investments

In this article we will cover: Investments in real estate.

Tax in Germany

Employee stock options. These are generally options contracts given to employees as a form of compensation and aren’t traded on the open market.If the capital gains are covered by regulations about definitive flat-rate tax on capital gains (Abgeltungssteuer), which is a source tax on capital gains, then the recipient of the capital gains generally need not submit a return as part of his income tax assessment.

How are Options Taxed?

A new law passed by the Bundestag on Friday, .5 percent of the income tax. Options are capital investments for advanced investors.375% (withholding tax + Solidarity tax) : All capital gains (i.347€ is taxed with at least 14%.Definition of stock options.50 euros in tax deducted from your capital gains; Are there tax-free allowances on .The following outline of German commercial and tax law is designed to inform foreign investors about their general tax options on the acquisition of a business in Germany.Investors in Germany pay the following taxes: church tax (church tax) – 8-9% of the Abgeltungssteuer, i. profit you make when selling the stocks/shares) A stock option is defined as the right to purchase, during a fixed period, a fixed amount of shares, at a fixed price .

- Geschichte Der Medienentwicklung

- Geschenk Für Besten Freund – Geschenke für freundin

- Germany Voting Population _ US Elections & Voting Statistics and Data Trends: turnout

- Geringfügige Beschäftigung Bei Steuererklärung Angeben

- Geruchsbelästigung Mietshaus : Zigarettengeruch: Was muss man hinnehmen?

- Gerichtliche Kontrolle Verwaltungsvorschriften

- Gerät Mit Netzwerk Verbinden _ WLAN verbinden

- Geschichte Abitur Sachsen Anhalt 2024

- Geschenkideen Für Mann Und Frau

- Geschenk Für Kinder 3 Jahre _ Spielzeug 3-4 Jahr: die besten Spielzeuge für Ihr 3-4 jähriges Kinder!

- Gerhard Steiner Hausarzt , Andreas Gerhardt Hausarzt Ahorn