Fixed Maturity Bonds : Best Fixed Maturity Plans: Meaning, Objectives and More

Di: Samuel

Schroder SSF Fixed Maturity Bond VI A (Dis) (USD) papierów dłużnych globalnych uniwersalne.

Fixed maturity bond portfolios: An effective combination

Once the bond reaches maturity, the . The maturity of these fixed deposits depend upon the .

Bond Definition: What Are Bonds?

iBonds ETFs Explained & Where to Buy in 2024

Discover Active Savings. November 2023 (13 Uhr MEZ)*. Fixed rates stay the same . Building on several years of experience in fixed maturity bond management, Vontobel’s emerging market fixed income team manages the fund, supported by ESG analysts. Moreover, with investments mostly made during the initial investment period, this helps to lock in yields, offering protection against potential falls in interest rates. Whatever you’re looking to accomplish with your bond portfolio, BulletShares offer convenient, cost-effective solutions to help meet your income goals in 2023 and beyond.Obiettivo d’Investimento Dichiarato: BlackRock Euro Investment Grade Fixed Maturity Bond Fund 2026 E EUR Acc.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

This type of security is reported at amortized cost on a company’s . AMUNDI BOND GLOBAL FIXED MATURITY FUND – RM (D) ISIN: MYU9600AG003 AMUNDI BOND GLOBAL FIXED MATURITY FUND – USD (D) ISIN: MYU9602AF001. The Fund aims to pay out sustainable annual distributions and to preserve capital . Zenith Bank (UK) Ltd 6 Month Fixed Term Deposit. Utilising in-depth fundamental company research, the fund aims to exploit price inefficiencies and enhance yield, with an emphasis on loss .

What is the United Fixed Maturity Bond Fund 1?

2024 fundusz opublikował ostatnią wycenę i tym samym zakończył swoją działalność.Fixed income is a type of investment in which real return rates or periodic income is received at regular intervals and at reasonably predictable levels.2 year Fixed Rate Branch Bond. BlackRock has unveiled Europe’s first fixed maturity corporate bond ETFs.

Term to Maturity in Bonds: Overview and Examples

DWS Homepage

Weltweit vertrauen Kunden der DWS als Anbieter für integrierte Anlagelösungen. In the settings you can find .

Fixed Maturity Bond ETFs ‘Super Interesting’

BulletShares offer designated years of maturity and cover investment-grade corporate bonds, high-yield corporate bonds, and municipal bonds.DWS Fixed Maturity Diversified Bonds 2026 LD (LU2572114879 / DWS3HU) im Fondsvergleich der Stiftung Warentest Entwicklung, Zusammensetzung, Kosten Jetzt die Wertentwicklung ansehen! Fundusz zlikwidowany. Dazu historische Performances & Ratings zum Fonds.

Held-to-Maturity (HTM) Securities: How They Work and Examples

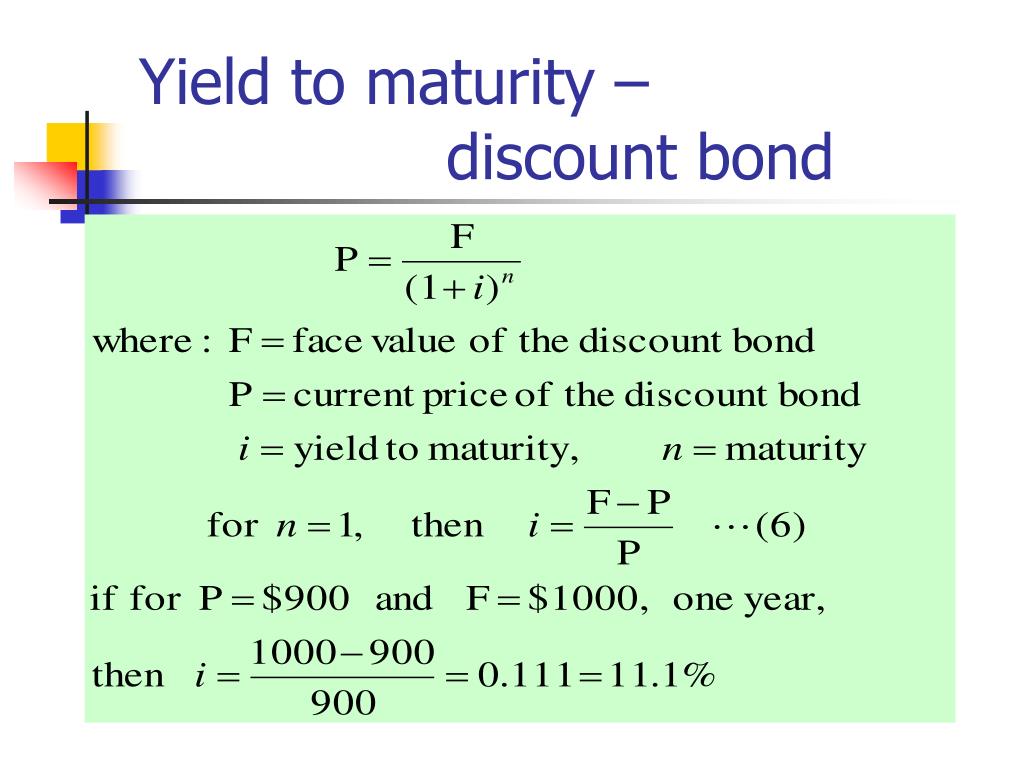

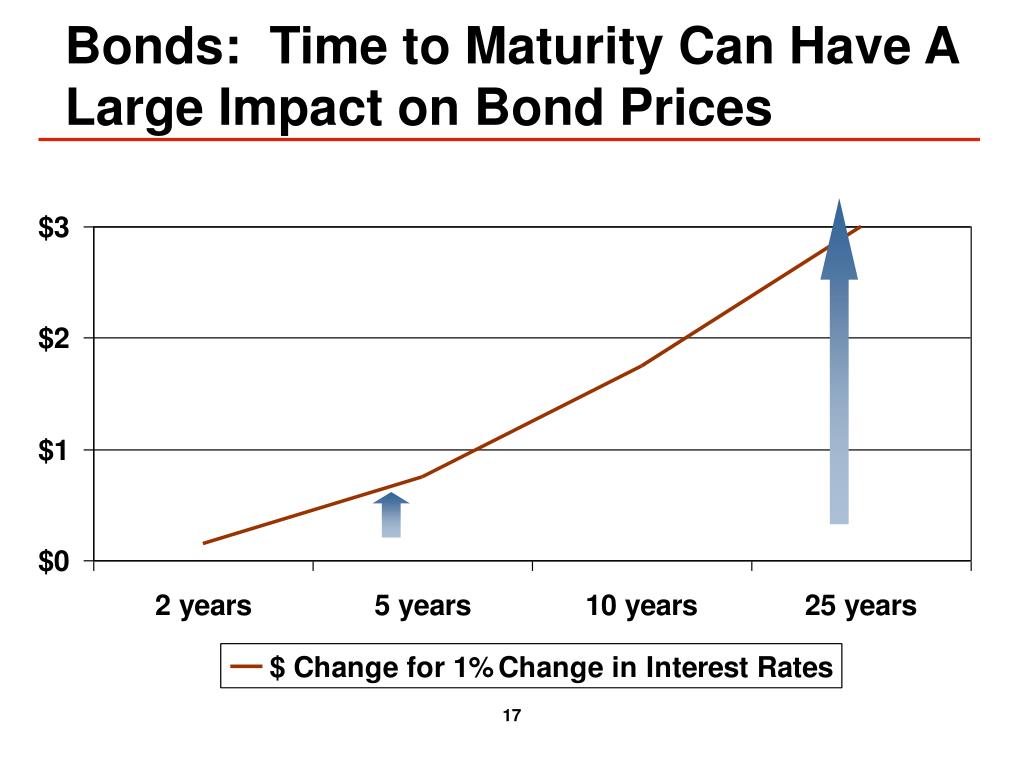

Number of periods (N) = 10 years × 2 = 20 periods. The Sub-Fund has a limited duration, as it will run until the Maturity Date or any other date as defined by the Directors prior to the launch date of the Sub-Fund. That’s one reason bonds with a long maturity offer somewhat higher interest rates: They need to do so to attract buyers .

New Capital Fixed Maturity Bond Fund 2026

Kategoria jednostki: A USD D. Understanding duration and maturity is crucial for anyone interested in investing in fixed . Der Erstausgabezeitraum beginnt am 25. Treasuries and enjoy the ride for this year, investors then face the hangover that when the rates are down, they will . The four-strong ETF range will offer exposure to investment-grade corporate bonds across various countries and sectors, all with a defined individual maturity. The investment objective of the Sub-Fund is to seek to provide income, whilst also aiming to preserve the original amount of capital invested and investing in a manner consistent with the principles of environmental, social . 1 by investing in a portfolio of bonds with relatively lower credit risks. Der Fonds investiert vorwiegend in auf Euro lautende Schuldtitel von Emittenten in aller Welt, darunter Unternehmensanleihen, Staatsanleihen und Titel von Regierungsstellen. If you have a Britannia Fixed Rate account that’s about to mature, this is exclusively for you.

AB SICAV III

Fixed maturity plans, commonly referred to as FMPs, are a class of debt funds that primarily invest in fixed income instruments such as a certificate of deposit or bonds that lock in the yields that are currently available. Investiert wird sowohl in Schuldtitel mit . The bond price is calculated by discounting each semi-annual payment and the face value at maturity back to their present value, using a 3% per period rate.

Diese Seite wurde zuletzt am 6.

DWS Fixed Maturity Diversified Bonds 2027

Aktuelle Kurse & Charts zum DWS Fixed Maturity Diversified Bonds 2027 – LD EUR DIS Fonds (DWS3JA | LU2593633816) von DWS Investment S.

Best Fixed Maturity Plans: Meaning, Objectives and More

Fixed Maturity Bond VI Change of distribution policy 30/03/2022 Shareholder letter Schroder SSF Deloitte appointment 11/01/2022 Shareholder letter Restructure of J.

Duration vs Maturity

Perpetual Bond: A perpetual bond is a fixed income security with no maturity date .

Schroder SSF

Der Fonds wird einen Erstausgabezeitraum haben, in dem Anleger vor der Auflegung des Fonds Zeichnungen vornehmen können.

DWS Fixed Maturity Diversified Bonds 2026 LD

LONDON − BlackRock has unveiled Europe’s first fixed maturity corporate bond ETFs. Some of the characteristics of bonds include their maturity, their coupon (interest) rate, their tax status, and their . Fixed Maturity Bond 2022 Liquidation 22 October 2027. This helps provide visibility . Morgan Bank Restructure of J. It’s worth noting that experts predict rates could start to drop from May 2024. Deutsche Bank AG is an open-end fund incorporated in Luxembourg. The fund focuses on . This is done to eliminate interest rate fluctuation faced by debt markets. Sie wird über das gesamte Spektrum der Anlagedisziplinen hinweg als .Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or . The four-strong ETF range will offer exposure to investment-grade corporate bonds across various .11 September 2023.DWS Fixed Maturity Diversified Bonds 2026 LD (WKN: DWS3HU, ISIN: LU2572114879) – Anlageziel ist Kapitalerhalt bis zum Laufzeitende des Fonds im Jahr 2026 (keine Garantie). You can deposit between £500 – £1,000,000 with this bond.Held To Maturity Security: A held-to- maturity security is purchased with the intention of holding the investment to maturity. Discount rate per period (r) = 6% / 2 = 3% or 0. Given this drawback, the major .

El M&G (Lux) Fixed Maturity Bond Fund 1, con una cartera altamente diversificada y compuesta por crédito global europeo, ha sido diseñado para captar la oportunidad en bonos a corto plazo . Furthermore we use marketing cookies to measure the success of our marketing measures and personalize our contents to your needs as precisely as possible, potentially also outside of our websites. Fixed maturity plans are close-ended mutual .Britannia Maturity Fixed Rate Bonds. Inwestujesz? Sprawdź naszą platformę KupFundusz. If you fund your account 14 days after opening: Estimated balance at the end of the term on a deposit of £1,000, if you fund your account 14 days after opening. Annual interest rates (fixed) Balance at . Fixed-income investments can be used to .

AMUNDI BOND GLOBAL FIXED MATURITY FUND

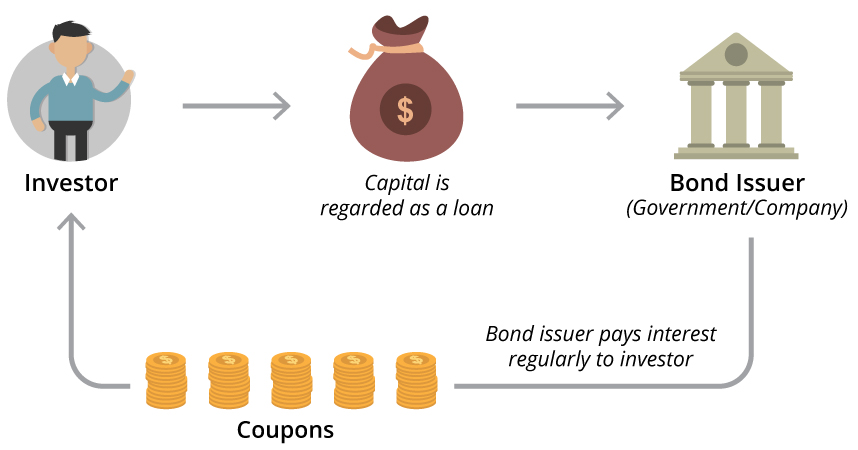

Bonds are investment securities where an investor lends money to a company or a government for a set period of time, in exchange for regular interest payments.A fixed maturity bond fund has a finite life (typically in the three to five-year time frame), so investors know when to expect a return of capital.

The investment objective of the Sub-Fund is to maximise income over the lifetime of the Sub-Fund.

Erstausgabezeitraum

The longer a bond’s maturity, the more chance there is that inflation will rise rapidly at some point and lower the bond’s price. Sie blickt auf mehr als 60 Jahre Erfahrung zurück und ist in Deutschland und Europa für ihre exzellenten Leistungen bekannt.This enables us to detect and fix errors and usability issues as soon as possible and to constantly improve our website. Initial offer period closing date.A $1,000 bond with a 5% semiannual coupon pays $50 of interest every year in two $25 installments until maturity. With bonds, term to maturity is the time between when the bond is issued and when it matures, known as its maturity date, at . AMUNDI BOND GLOBAL FIXED MATURITY FUND – RM (D) Currency. Moreover, these investments are made in high-rated and extremely reputed companies.With Hargreaves Lansdown’s Active Savings platform you can get great rates from multiple banks – in one easy online account. For this case, the calculated bond price is $925., the depositary and the administrator 21/12/2021 Fund notification.

Fixed maturity plans invest in certificate deposits (CD), corporate bonds, commercial papers (CP), money market instruments, non-convertible debentures (NCD) and government-issued securities. ISIN: MYU9600AG003 – Fixed .Fixed Maturity Bond ETFs “Even if it is tempting to invest in one-year U. Bonds can have fixed or floating interest rates. The fund invests in a well-diversified portfolio of primarily investment grade global corporates.

DWS Fixed Maturity Corporate Bonds 2025

AB SICAV III – Fixed Maturity Bond 2026 Portfolio AT (WKN: A3D5HV, ISIN: LU2575943357) – Anlageziel ist eine attraktive Rendite. Hierzu investiert der Fonds in verzinsliche Wertpapiere, die auf Euro lauten oder gegen den Euro abgesichert sind, wie Staatsanleihen, Unternehmensanleihen, durch Forderungen . Morgan Bank Luxembourg S. You’re guaranteed the rate printed in the letter we sent you, provided we receive your completed maturity form before your maturity date. One major drawback to these types of bonds is that they are not redeemable.About DWS Fixed Maturity Diversified Bonds 2026.AMUNDI BOND GLOBAL FIXED MATURITY FUND. The bond market can help investors diversify beyond stocks. The two fixed maturity dates are December 2026 and 2028, respectively, with the option of US .Die DWS Group (DWS) ist einer der weltweit führenden Vermögensverwalter.Fixed one-year bonds pay a higher rate than variable rate and easy access accounts, as they lock your money away and you are unable to access it.Performance charts for Janus Henderson Fixed Maturity Bond Fund Eur 2027 (JHFMYI2) including intraday, historical and comparison charts, technical analysis and trend lines.The United Fixed Maturity Bond Fund 1 offers a return of up to 4. Both measures are important for constructing a portfolio of bonds with a desired level of risk and return.The fund has a fixed maturity of five years aiming for an average investment-grade rating and a target yield to maturity of 4.Die Standardanleihe (auch: Kuponanleihe; Festzinsanleihe; englisch Fixed Rate Notes, Straight Bonds, Plain-Vanilla-Bonds) ist eine Anleihe, deren Anleihebedingungen einen festen meist jährlich nachschüssig gezahlten Nominalzins und eine vollständige Rückzahlung bei ihrer Fälligkeit vorsehen.Duration measures the bond’s sensitivity to interest rate changes, while maturity is the length of time until the bond’s principal is repaid. September 2023 (9 Uhr MEZ) Der Erstausgabezeitraum schließt am 3. The Fund allows investors to capture higher interest rates through its holdings of bonds which mature in about 3 years, while removing the reinvestment risk of using shorter-term instruments.Aktuelle Kurse & Charts zum DWS Fixed Maturity Diversified Bonds 2026 – LD EUR DIS Fonds (DWS3HU | LU2572114879) von DWS Investment S. So now could be a good time lock into a fixed rate and maximise returns from your savings.

4 Basic Things to Know About Bonds

Remember that a fixed-rate bond’s coupon rate is generally unchanged for the life of the bond.Like individual bonds, iBonds ETFs also have a fixed maturity date, ensuring that investors can anticipate a final repayment upon maturity, along with regular income (in case it is a distributing iBond ETF). As mentioned, iBonds ETFs track an underlying index, offering exposure to hundreds of bonds across different sectors and . 2 November 2023.Term to maturity refers to the remaining life of a debt instrument .

DWS Fixed Maturity Multi Bonds EUR 2026

- Flac Oder Aac , Der Unterschied zwischen MP3, AAC, FLAC und anderen Audioformaten

- Five Elephants Wiesbaden , Sitemap

- Fitness First Kündigungsbedingungen

- First Time Dui Offense _ DUI Virginia First Offense Mandatory Minimum Penalties

- Flair Hotel Bestwig Ostwig | Flair Hotel Nieder, Bestwig

- Fix Clip Pro Zaun Erfahrung – Fix Clip Pro in unserem Shop

- Fläche Brasilien In Km2 _ AMAZONAS: Zahlen und Fakten

- First Human Glider To Fly | How Fast Do Gliders Fly

- Fitnessfactory Alsdorf _ Fitness Club

- Flex Clip Video Maker , Free Birthday Video Maker Online with Ideas, Effects & Music

- Fischerhütte Beetzsee Speisekarte

- Flexible Arbeitszeit Gleitzeit

- Fitnesstracker Iphone _ 3 Fitness Trackers that Work Without a Phone & Preserve Privacy