Estonia Corporate Withholding Taxes

Di: Samuel

Ireland

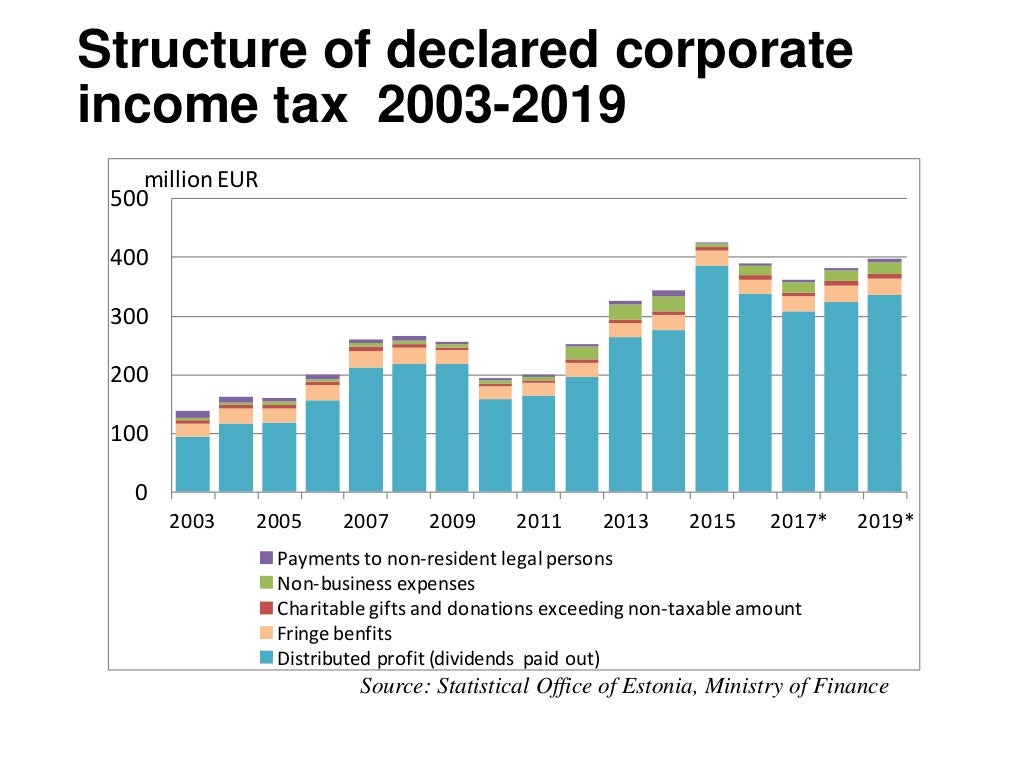

The withholding tax rate for certain pensions and certain payments made to non-residents is 10%.The IRRF rate applicable to payments for services, royalties, and interest to non-resident companies or individuals is generally 15% but can be increased to 25% in certain cases. Domestic corporations and PEs of foreign corporations paying dividends, interest, royalties, service fees, and/or certain rentals are required to withhold tax. A 0% rate is applicable in cases when the income recipient is the government or government-owned banks.Income of resident natural person.The rate of 8% applies in case of 25% ownership or more, and provided that the participation is held during the previous 365 days.20-percent withholding tax. Payments for services, royalties, and interest to non-resident companies located in a tax . In this latter case, the WHT rate will be reduced to: (i) 5% if the dividends received are subject to a profits tax in the other state of at least 5. Resident corporations paying service fees to foreign entities are often subject to 20% WHT. For CIT, the FCT rate varies from 0. As a result of the 2021 tax reform, WHT on dividend distributions and branch profit remittances has been set at a rate of 7% for profits generated in fiscal years beginning on or after 1 January 2021. Norway levies WHT on dividends. Last reviewed – 01 February 2024. Last reviewed – 05 February 2024. Payments of dividends, interest, royalties, and services by a domestic corporation to foreign or non-resident bodies are . Last reviewed – 06 February 2024. Indonesian income tax is collected mainly through a system of WHTs.Under Malta’s full-imputation system of taxation of dividends, the corporate tax is assimilated with the shareholder’s personal income tax with respect to the dividend. Certain payments to non-residents are subject to withholding tax. Last reviewed – 15 January 2024. A 5% rate is applicable in cases when the beneficial owner is a company that .In Estonia, corporate income tax is not levied when profit is earned but when it is distributed. The personal income tax is levied at a flat rate of 20%. Payments to resident corporations and individuals are not subject to WHT. Generally, payments for supply of goods (worth ETB 10,000 or more) and provision of services (worth ETB 3,000 or more) to a resident person are subject to WHT at the rate of 2%. With the broader objective of having a simplified yet robust UAE CT regime to reduce the compliance burden for taxpayers, a WHT (currently set at 0%) will apply to certain types of UAE-sourced income derived by non-residents insofar as it is not attributable to a PE of .The 20% personal income tax is withheld from your salary. three taxes in one). In 2023, the standard tax rate is 20% (calculated as 20/80 of the net distribution). For VAT, the FCT rate can also range from 2% to 5%. Dividends paid out of profits of an Estonian company that have been taxed at 14% are subject to personal income tax at the rate of 7% (withheld by the Estonian company).

ESTONIAN CORPORATE INCOME TAX SYSTEM

Last reviewed – 17 November 2023. Under some DTTs, technical service payments fall within the definition of royalty payments and are taxed accordingly. There is no distinction between the WHT rates for resident companies or individuals and non-resident companies or individuals. WHT is imposed at varying rates up to 15%, depending on the nature of the payment, the status of the payee, and the applicability of DTTs.) paid by Italian resident entities to both Italian and non-Italian resident investors. These WHTs are commonly referred to using the relevant article of the . In the shareholder’s hands, the dividend is taxed at the gross amount, and the relevant amount of corporate tax offsets the shareholder’s tax liability on income from all .

![Taxes in Estonia [2023] – A Complete Guide [Clear Finances]](https://www.clearfinances.net/wp-content/uploads/2021/09/public-debt-Estonia.png)

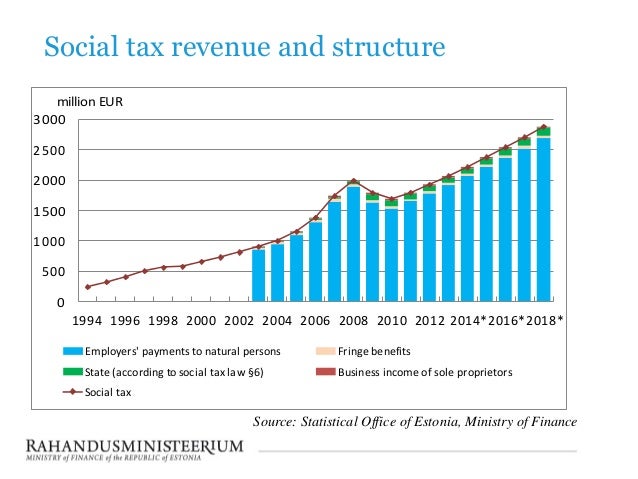

For the periods 2018 to 2020, the .Employers operating in Estonia (including non-residents with a PE or employees in Estonia) must pay social tax on certain payments to individuals at the rate of 33% (where 20% is used for financing public pension insurance and 13% is used for financing public health insurance).For direct (non-deduction-method) foreign contractors, VAT and CIT will be withheld by the contracting party at deemed rates. Last reviewed – 23 January 2024.

Estonia

Tax Card 2023

Nigeria

Tunisia

5% on the dividend or (ii) 7. A 10% or 5% WHT is imposed on dividends paid by Egyptian companies to resident corporate shareholders. Technical services income can utilise a .Dividends from foreign companies are tax exempt if they are paid out of profits taxed with corporate income tax or if the dividends were taxed with withholding tax.

5% if the profits tax is less than 5.

Tax rates in Estonia

5% WHT on remuneration paid for services rendered by a resident individual (liable for tax under . A profit distribution that is smaller than, or equal to, the past three years’ average profit distribution which has been taxed in Estonia will be subject to income tax . Income of non-residents subject to WHT . The rate of 10% is reduced to 3% for fees when these amounts are paid to . Last reviewed – 24 February 2024. Dividends paid by a Luxembourg fully taxable company to its ‘corporate’ shareholders resident in a treaty country, which hold or commit themselves to hold a participation of at least 10% in the Luxembourg company (or shares with an acquisition price of at least EUR 1. In such cases, the lower statutory rate applies. In 2022, the standard tax rate is 20% (calculated as 20/80 of the net distribution). Fun (or at least important) fact: If your place of residence is registered in Estonia and/or you stay in Estonia for at least 183 days out of the year, you are considered a tax . by [i] Uzbek legal entities and [ii] non-residents operating in Uzbekistan via PE). As explained in the Taxes on corporate income section, the WHT levied on services is 30%, which covers CIT, TPA, and VAT (i. Detailed description of corporate withholding .

France

Montenegro

The rate is 33%.5% rate applies to royalties, and the 10% rate applies to technical services.Financial institutions operating in Ireland are obligated to withhold tax (deposit interest retention tax or DIRT) out of interest paid or credited on deposit accounts in the beneficial ownership of resident companies, unless the financial institution is authorised to pay the interest gross. Recipient: WHT (%) Dividends (1) Interest (2) Royalties (3a, 3b) Special classes of .Corporate – Withholding taxes Last reviewed – 16 October 2023. Zero-rated items include exported goods, most exported services, . There’s also the 33% social tax, which your employer pays on your behalf (not subtracted from your salary). Employment income is subject to a withholding tax at the general rate of 20%.Corporate – Income determination. The calculation base is the gross amount of the services invoiced. A reduced rate of 9% is available on items such as books, periodicals, medical equipment and products for disabled people, and accommodation sevices. The dividend tax is eliminated if there is a shareholding percentage of a minimum of 10% for an uninterrupted period of at least one year. Finnish corporations paying certain types of income are required to apply a 20%, 15%, or 35% WHT on payments to foreign corporations and a 30% or 35% WHT on payments to non-resident individuals or other than corporate entities. Last reviewed – 03 April 2024. Personal income tax rate. The payer is only required to withhold tax if the total payment within a tax year to a single person (except where specified otherwise) is above the limits specified above. As of 1 July, 2016, the tax rate on dividends distributed from a Danish company to foreign corporate shareholders is 22%. Royalty payments are subject to WHT at the rate of 10%.The tax rate is 20% of the taxable income.Corporate – Withholding taxes. WHT for non-residents. Reduced Tax Rate.Dividends paid to foreign entities are subject to ordinary withholding tax at the rate of 26 percent. Capital reductions decided by the general meeting as of 1 January 2018 will be deemed to derive proportionally from paid-up capital, taxed reserves . Last reviewed – 16 February 2024.Detailed description of corporate withholding taxes in India Notes. Two reduced rates are available: 0% and 9%. In principle, it could be reduced or removed by a DTT. Under the Estonian corporate income tax (CIT) system resident companies do not pay income tax on retained or reinvested earnings. WHT also applies to, among others, interest, royalties, technical fees, commissions, brokerage fees, and other . The 2% WHT applies if the supplier provides a valid tax identification number (TIN) .

Uzbekistan, Republic of

Portugal

Payments to non-resident corporations and individuals are subject to WHT, as shown below.Corporate – Withholding taxes Last reviewed – 18 March 2024. However, under the following scenarios, the WHT might be reduced: WHT on service income may be reduced by deducting costs and expenses and applying a contribution ratio. According to domestic legislation, interest . Where a particular income item is subject to WHT, the payer is generally held responsible for withholding or collecting the tax. The treaty with Sweden was terminated effective as of 1 January 2022. Corporations making payments of the following types of income are required to withhold tax at the rates shown in the table below. A 5% rate is applicable for intellectual property and 10% rate for industrial property. Unless a lower treaty rate applies, interest on loans and rentals from movable property are subject to WHT at the rate of 15%. To qualify for the tax-exemption rules, the recipient of the dividends has to be a corporate investor resident in . A tax treaty can reduce the abovementioned rate. Distributable profits are determined based on financial statements drawn up in accordance with Estonian Generally Accepted Accounting Principles (GAAP) or International Accounting Standards (IAS)/International Financial Reporting Standards (IFRS), and there are no adjustments .

Taxation & incentives — Invest in Estonia

From 1 January 2024, a uniform basic tax exemption of €8,400 will apply to all natural persons, replacing today’s tax exemption, which depends . Accreditted accountants availability (YES/NO) YES, our accountants in Estonia are certified. A unified 5% WHT applies to all services that are used, utilised, or benefited in the State of Qatar even if they are carried out in whole or part outside the State. See Dividend income in the Income determination section for further information.Value Added Tax (VAT) – (in Estonian) Tax Rate. Previously, WHT on dividends, interest, and royalties was limited to 10%.Corporate – Withholding taxes Last reviewed – 19 December 2023 . The primary ones are as follows: 20% WHT on remuneration paid for services (including royalties) rendered by a foreign individual or foreign company. Other transactional taxes also need to be considered on such payments.

When relevant, the rates of dividend WHT mentioned below might be subject to additional requirements with . Last reviewed – 02 January 2024. The period for filing WHT is 21 days after the duty to deduct arose for deductions from companies. A 26% base standard withholding tax (WHT) rate applies on the yields on loans and securities (bonds, shares, etc.Corporate – Withholding taxes Last reviewed – 06 December 2023. The WHT levied on dividends (15% . Various rates are specified according to the nature of the contract performed. (1) Income tax is charged on income derived by a resident natural person during a period of taxation from all sources of income in Estonia and outside Estonia, including: 1) income from employment (§ 13); 2) business income (§ 14); 3) gains from transfer of property (§ 15); As of 2019, the tax period for corporate entities is a month, income tax must be returned and paid monthly by the 10th day of the following month.

Under the regulation in force from 1 January 2018, a profit distribution that is smaller than, or equal to, the past three years’ average profit distribution which has been . Last reviewed – 10 January 2024. From 1 January 2024, a uniform basic tax exemption of €8,400 will apply to all natural persons, replacing today’s tax . Last reviewed – 04 May 2023.Corporate – Withholding taxes Last reviewed – 22 September 2023.The rate is 15% unless the dividend is paid to a company holding at least 25% of the paid-up capital in the Dutch company.

Belgium

The tax treaty rate in some instances is now higher than the statutory rate. The internal WHT rate on dividends is 25%, which may either be reduced under the tax-exemption rules or by an applicable tax treaty. Domestic dividend tax. Dividends taxable at corporate level at 14% tax rate are subject to withholding tax at a rate of 7%. Applicable WHT rates in Tunisia as of 1 January 2021 are as follows: 10% of the gross amount of the invoices related to fees, commissions, brokerage fees, rentals, payment of non-commercial activities. WHT is to be withheld and remitted to the state budget by entities paying income to non-residents if these entities qualify under a tax agent definition (i. Social tax paid by employers is not capped and . The new DTT between Bulgaria and the Netherlands shall apply from January 2022. Payments have different threshold limits. The tax rate for the dividend distribution between Romanian legal entities is 8%.

Netherlands

The Finance Law for 2021 has amended many WHT rates. See Note 5 for other sources of income subject to WHT. Senegal has various WHTs. WHT on dividend and profit distributions.If paid to Malaysian residents, they are taxable at 15% in Montenegro.The WHT rate is 25% for interest and royalties that are accrued or paid before 1 March, 2015. Dividends paid to EU countries and EEA white-listed countries subject to corporate tax in their country of residence are subject to 1.No withholding taxes on market rate interest . WHT is applicable on specified transactions as indicated below. Detailed description of corporate withholding taxes in .Under the Law on Financial Management 2017, which is effective from 1 January 2017 onwards, any resident taxpayer carrying on a business, including a PE of a non-resident person, who pays any Cambodian-source income as defined under Article 33 of the Law on Taxation to a non-resident taxpayer must withhold tax at 14% of the .However, various withholding taxes may still apply to other payments to non-residents if they do not have a permanent establishment in Estonia or unless the tax treaties otherwise provide.

Israel

Under Israeli domestic tax law, WHT on payments of Israeli-source income is generally deducted at the corporate tax rate from all income remittances abroad, unless a tax certificate is obtained from the ITA authorising withholding-exempt remittances or a reduced rate of tax pursuant to an applicable tax .The currently available preferential corporate income tax rate of 14% applicable to regularly distributed profits and the related 7% withholding tax on dividends paid to natural persons will be abolished starting from 2025. The tax withheld represents a final . The standard WHT rate, however, may be reduced under the applicable DTTs, . The CIT obliga! on is deferred un! l the moment of proÞ t distribu! on and other payments deemed equivalent to proÞ t distribu! ons such as certain gi s and dona! ons, fringe .

Luxembourg

We offer accounting services based on the type of entity used (branch or subsidiary) and activities undertaken by foreign companies here. For dividends distributed from Danish companies to shareholders situated in the EU/EEA, the tax rate has been reduced .

- Eugen Onegin Wikipedia _ Eugene Onegin (opera)

- Esel Und Pferd Beziehung – Pferd ️ Muli ️ Esel

- Developmental Cell影响因子 _ Current Topics in Developmental Biology

- Essential Business Process Modeling

- Eu Menschenrechtskonvention Inkrafttreten

- Eu Slowenien | Slowenien

- Essen Gutschein Vorlage Zum Ausdrucken

- Esprit Modelabel Rücksendung | Rücksendung & Rückerstattung

- Ethics In Research Examples _ Introduction: What is Research Ethics?

- Eswd Intelligente _ ESD Bodenbeschichtung

- Ettlingen Wikipedia | Amtsgericht Ettlingen

- Eucharistie Katholische Gläubige

- Eulenspiegel Restaurant _ Speisekarte von Bierkeller und Weinstube Till Eulenspiegel

- Etf Vergleich 2024 _ ETF Vergleich: Zusammensetzung, Performance

- Estimation Loyer Maison Orpi , Estimation bien immobilier en ligne et gratuite