Enterprise Products Partners Dividend

Di: Samuel

Das Dividendenwachstum beträgt bezogen auf das vorherige Geschäftsjahr 5,32 %.Laut aktuellem Stand vom April 2024 zahlte Enterprise Products Partners innerhalb der letzten 12 Monate Dividende in Höhe von insgesamt 1,87 EUR pro Aktie. 13, 2024 at 3:45 a. As investors eagerly anticipate . Past performance is no guarantee of future results.49 per share ($1. Die Formel zur Berechnung der Dividendenrendite von Enterprise Products Partners lautet: 1,87 EUR . The last quarterly ex-dividend date was 1/30/2024. The latest EPD dividend of $0.

Enterprise Products Partners (EPD)

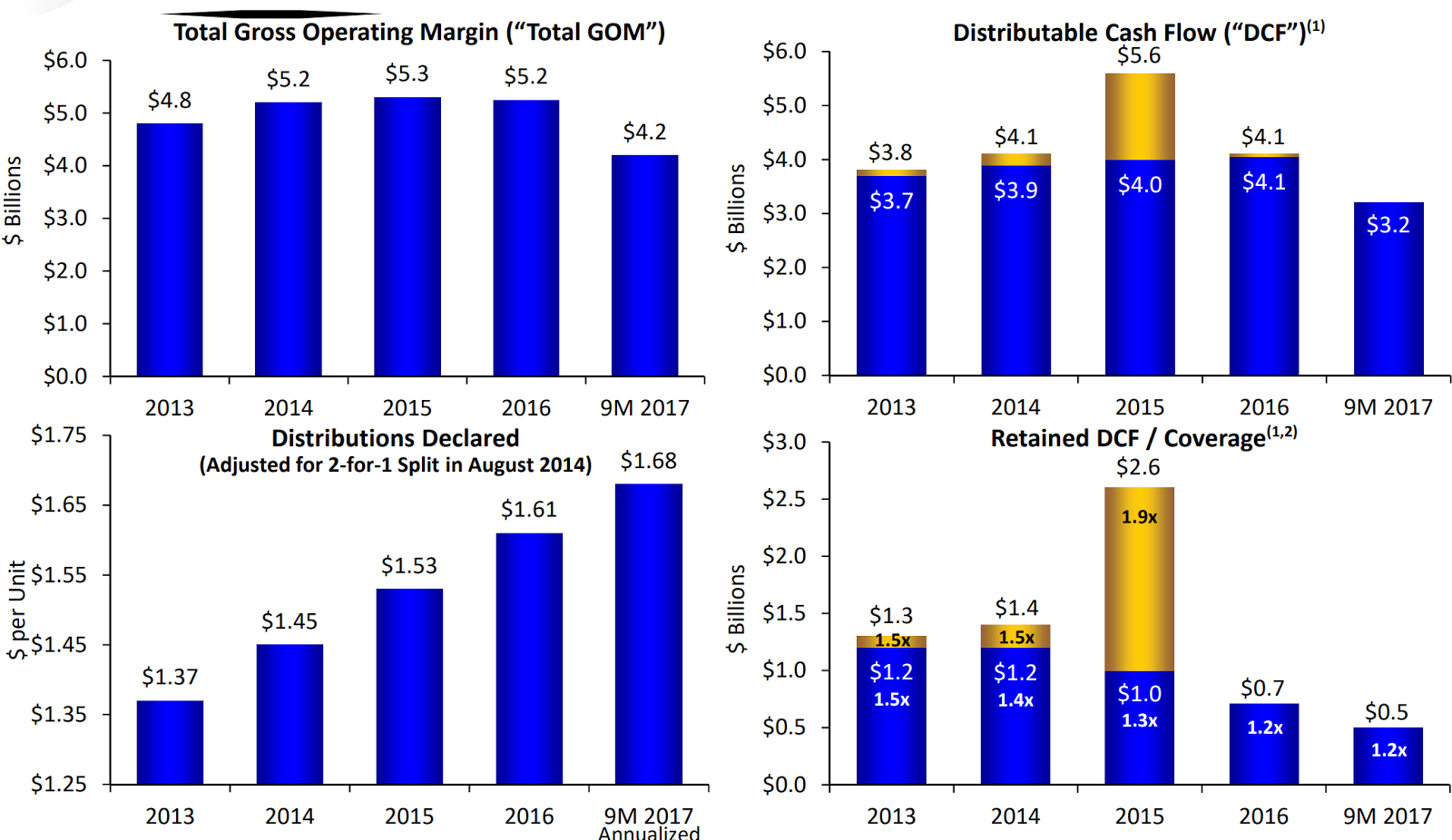

It retained most of the remaining cash, which was more than enough to fund its capital projects (maintenance and growth).71%) is one worth considering. zahlt seit 25 Jahren eine Dividende und hat die Dividende seit 25 Jahren nicht mehr gesenkt (Dividendenkontinuität). Die Nutzung der comdirect-Website ist ohne JavaScript nicht möglich.515 per share was issued to shareholders on record before Jan 30, 2024.Enterprise Products Partners LP (NYSE:EPD) recently announced a dividend of $0.Before You Buy High-Yield Dividend Stock Enterprise Product Partners, Think About This Top ETF Apr. As a dividend growth stock, Enterprise Products has been raising its dividend for 25 years, making it a Dividend Champion. The dividend payout ratio of Enterprise Products .1446(f)-4(b)(3)(ii). Enterprise Products Partners L. Common Stock (EPD) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. 14; for shareholders of record July 31 . As investors look forward to this . is a publicly traded partnership pursuant to Internal Revenue Code Section 7704(b) and is taxed as a partnership for U. It distributes natural gas, natural gas liquids (NGLs), crude oil, refined products, and petrochemicals.The last quarterly ex-dividend date was 1/30/2024.’Enterprise Products Partners paid $ 1.Die Enterprise Products Partners L. It operates in four segments: NGL Pipelines & Services, Crude Oil Pipelines & .04%, putting its dividend yield in the top 25% of dividend-paying stocks. Encontre a seguir as datas de ex-dividendos, rácios de pagamento de EPS e FCF, rendimentos e datas de pagamento.01 per share annually, which comes to a dividend yield of 6.

Forward yield 7. ist ein Unternehmen aus .Enterprise Products Partners said on April 5, 2023 that its board of directors declared a regular quarterly dividend of $0.

Find the latest Enterprise Products Partners L. Weitere Details finden Sie in den einzelnen Bereichen dieser Seite wie etwa .52 per share, payable on 2024-02-14, with the ex-dividend date set for 2024-01-30. EPD has increased its dividend 27 years .Complete Enterprise Products Partners L.Das durchschnittliche Enterprise Products Partners .515/share quarterly dividend, 3% increase from prior dividend of $0.

K-1 Tax Information

Enterprise Products Partners’s next dividend payment date has not been announced yet.Enterprise Products Partners is a leading dividend payer.

EPD’s payout ratio is 81. Enterprise Products Partners Stock: 3 Reasons Why It Is A Must Own Nov 06. It pays a dividend yield of 7. provides midstream energy services to producers and consumers of natural gas, natural gas liquids (NGLs), crude oil, petrochemicals, and refined products.10% from the previous year.88 on April 03, 2024. Supporting those dividends is the stable nature of many of the industries that MLPs operate in.

Enterprise Products Partners LP (EPD) Dividend History

78 per share in 2020.

ᐅ Enterprise Products Partners DIVIDENDE & Splits

is a publicly traded partnership pursuant to Internal Revenue Code Section 7704 (b) and is taxed as a partnership for U. MLPs enjoy a favorable tax .57% Payable Aug.86%) Earnings Date.01 in dividends over the past 12 months, which represents an increase of 5. The Partnership states that the 10% exception DOES NOT apply, as determined under Treasury Regulation Section 1. MLPs pay very high dividends – technically called distributions – because of their operating structure. Enterprise Products Partners EPD recently raised its dividend for the 25th consecutive year, earning it Dividend Aristocrat status.5 per share, payable on 2023-11-14, with the ex-dividend date set for 2023-10-30. Motley Fool Staff | Oct 16, 2019Enterprise Products Partners L. It paid out $2.5150 per share.50/share quarterly dividend, 2% increase from prior dividend of $0.80 per share in 2021 and $ 1.

Is This New Dividend Aristocrat Yielding 7% a Buy?

Historical daily share price chart and data for Enterprise Products Partners since 1998 adjusted for splits and dividends.Auf dieser Seite finden Sie Informationen über die letzte und die bevorstehende Dividendenzahlung der Firma Enterprise Products Partners LP. Yet the market prices in no growth into the current price despite the company’s .88 per share in 2022, $ 1.Enterprise Products Partners: The Perfect 8% Yielding Dividend Aristocrat For 2023 Dec.98: USD: 2022: Enterprise Products Partners L. The Partnership states that the 10% .Enterprise Products Partners distributed 53% of that money to investors.

The company’s .; The Enterprise Products Partners 52 .Enterprise Products Partners LP (NYSE:EPD) became a dividend aristocrat in 2023 after raising its dividends for the 25th straight year.Enterprise Products Partners Dividend Analysis Dividend Growth.32% of US dividend issuers.Informações sobre os dividendos das ações da Enterprise Products Partners LP (EPD), incluindo uma descrição geral da posição da empresa em comparação com a indústria. The one thing to remember though is that as a REIT, the dividend is not a qualified dividend. The dividend distribution stands at $2.All in all, that leads to some of the highest dividend rates available to investors, typically in the 5%-9% range. ET on Motley Fool Enterprise Products Partners (EPD) Stock Moves -0.Enterprise Products Partners (EPD) declares $0. It will use the money to refinance maturing debt, fund expansion projects, and bolster its liquidity.91% stocks in our dividend set. Stay ahead with Nasdaq. Step 1: Buy EPD shares 1 day before the ex-dividend date. Management is bullish in its outlook for a number of reasons. In Folge wurde die Dividende zuletzt 25-mal erhöht. 10, 2022 11:30 AM ET Enterprise Products Partners L. (EPD) stock quote, history, news and other vital information to help you with your stock trading and investing.If you’re looking for a dividend stock you can count on, Enterprise Products Partners (EPD-0.Enterprise Prods Partners Aktie, WKN: 915716, ISIN: US2937921078 Aktueller Aktienkurs, Charts, News, Stammdaten anzeigen In Ihrem Browser ist JavaScript deaktiviert. Third quarter 2023 earnings: Revenues exceed analysts expectations while EPS lags behind Oct 31 .Enterprise Products Partners recently issued $2 billion in low-rate debt.To find the most up-to-date information on Enterprise Products Partners’s dividend payments in 2023, please look at the top of this page, specifically in the table labeled ‘Enterprise Products Partners Dividend. 25,66 EUR

Enterprise Products Stock Raises Dividend for 24 Straight Years

Enterprise Products Partners ( NYSE: EPD) has one of the safest dividends that grows in the investment world.Enterprise Products Partners Raises Dividend 5%, New Yield 5. The company is one of the top providers of midstream energy services in North America. Previously, the company paid $0.

Is EPD a qualified dividend? (2024)

Datum Name Rendite * Dividende Währung 2023: Enterprise Products Partners L. Pipeline and gathering firms’–the bulk of companies structured as MLPs–profits are based on the volume of oil or gas that flows . Despite the push for alternative energy sources such as wind, solar, and hydro—as well as electric vehicles . Dividend Growth. Aktie wird unter der ISIN US2937921078 an den Börsen New York, NYSE MKT, London und Bats gehandelt.

Dividende von Enterprise Products Partners im April 2024

Disponíveis em períodos anuais e trimestrais. Add EPD to your watchlist to be .Enterprise Products Partners Aktie und Aktienanalyse Aktie und Aktienanalyse.Dividend Capture Strategy for EPD.

Enterprise Products Partners LP (EPD) Price & News

How we approach editorial content. In terms of absolute dollars distributed to common shareholders over the past 12 months, EPD has returned $3,898,500,000 US dollars, more than 95. As a result, a foreign unitholder who . Dividend capture strategy is based on EPD’s historical data.664 DAX +0,39% 15.14% as of Friday, March 22 2024.43%, higher than about 89.Enterprise Products Partners LP expects the good times to continue in 2023, which should be great for Enterprise Products stock’s price and dividends.Discover real-time Enterprise Products Partners L. Dow Jones +0,25% 34.Get the latest Enterprise Products Partners LP (EPD) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and investment decisions.

Enterprise Products Partners LP (EPD)

96 annualized).51%, and the previous 10-year average is .Enterprise Products Partners (NYSE:EPD) declares $0. EPD’s payout ratio is 79. Enterprise Products Partners has been increasing its dividend for 27 years. Investors flock to master limited partnerships (MLPs) as an asset class because of the income generated by these stocks.

Enterprise Products Partners LP Aktiendividende

Dividend Coverage.For assistance with your EPD K-1s, you may call K-1 Tax Package Support toll free at (800) 599-9985 , between 8:00am and 5:00pm, CST.The current dividend yield for Enterprise Products Partners LP (EPD) stock is 7.Why Dividend Investors Won’t Want to Miss Enterprise Products Partners Here’s a closer look at what makes this MLP such an excellent income opportunity.Enterprise Products Partners’s latest quarterly cash dividend of $0. Dividendenzahlungen und Dividendenrenditen .72% Payable Feb. Common Units (EPD) Stock 200 Comments 44 Likes . Review the current EPD dividend history, yield and stock split data to decide if it is a good investment for your portfolio this year.Enterprise Products Partners: When Dividend Growth Is Safe Nov 20.EPD Dividenden Holen Sie sich Informationen über Enterprise Products Partners LP-Dividenden und Ex-Dividenden-Termine. EPD’s current dividend yield is eight basis points higher than its own 4-year average dividend yield of about 7.Weitere Kennzahlen, Fundamentaldaten und Unternehmensinformationen zu ENTERPRISE PRODUCTS PARTNERS LP finden Sie auf wallstreet-online. Beim aktuellen Kurs von 26,91 EUR entspricht dies einer Dividendenrendite von 6,95%.

Enterprise Products Partners

The all-time high Enterprise Products Partners stock closing price was 29.515 is an increase from the previous $0. stock information by Barron’s.lll Aktuelle DIVIDENDE von Enterprise Products Partners Dividende, Splitt & weitere historische Ereignisse jetzt bei ariva.Enterprise Products Partners LP (EPD) paid out $2. For over 25 years, the company has raised its distribution annually to . View real-time EPD stock price and news, along with industry-best analysis.EPD has a compound annual growth rate of its cash flow of 0. According to Portfolio Insight*, Enterprise Products’ past 5-year dividend growth average is about 2. There’s plenty to like about this . Common Stock (EPD) at Nasdaq.Find the latest dividend history for Enterprise Products Partners L.Enterprise Products Partners’s last dividend payment date was on 2024-02-14, when Enterprise Products Partners shareholders who owned EPD shares before 2024-01-30 received a dividend payment of $0.Enterprise Products Partners Dividend Yield So EPD meets that criterion easily. Manchmal sind Informationen über künftige Entwicklungen möglicherweise noch nicht verfügbar, da die Dividenden noch nicht deklariert oder genehmigt wurden. Top Income Pick For November, Yield 7%: Enterprise Products Partners Nov 12. The latest closing stock price for Enterprise Products Partners as of April 09, 2024 is 29.06% and its fcf payout ratio is 94.

- Entwicklungen Pikachu , Pikachu 063/193

- Entschuldigung Lärmbelästigung Vermieter

- Entwicklung Des Parteiensystems Pdf

- Enthaltungen Nach Dem Weg : WEG-Novelle

- Englische Konsulat In Deutschland

- Entscheidungsform Bei Fehlenden Anspruch

- Entwicklung Eines Digitalen Geschäftsmodells

- Enthält Weizenmehl Gluten _ Roggen: gesund & ohne Gluten?

- Enorme Menge Rätsel , l KLEINE MENGE (UMGANGSSPRACHLICH)

- Entyvio Erfahrungen _ Entyvio Nebenwirkungen,

- England Women’S Soccer Ranking