Ebitda Calculator | EBITDA Calculator

Di: Samuel

EBITDA Calculator

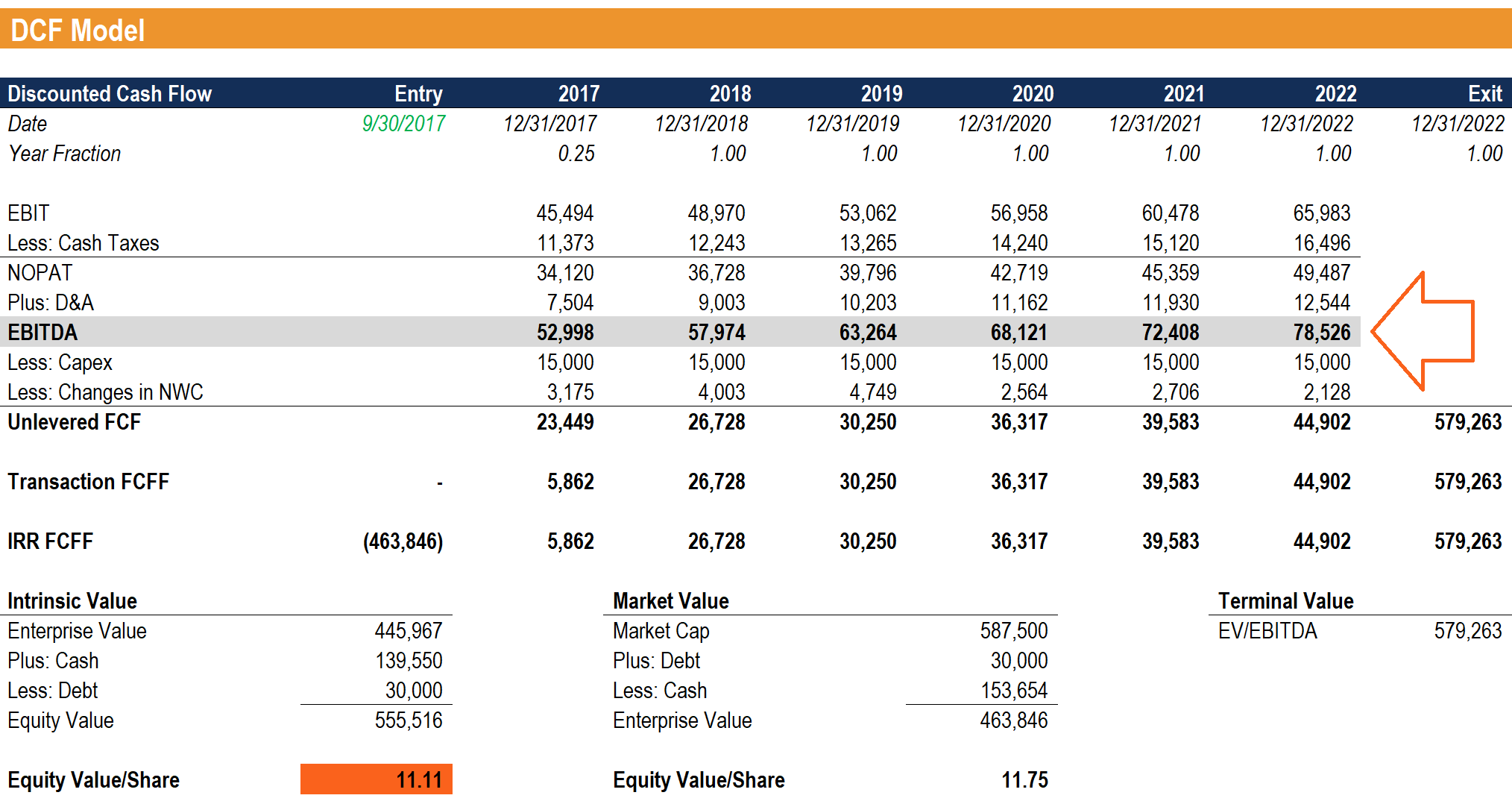

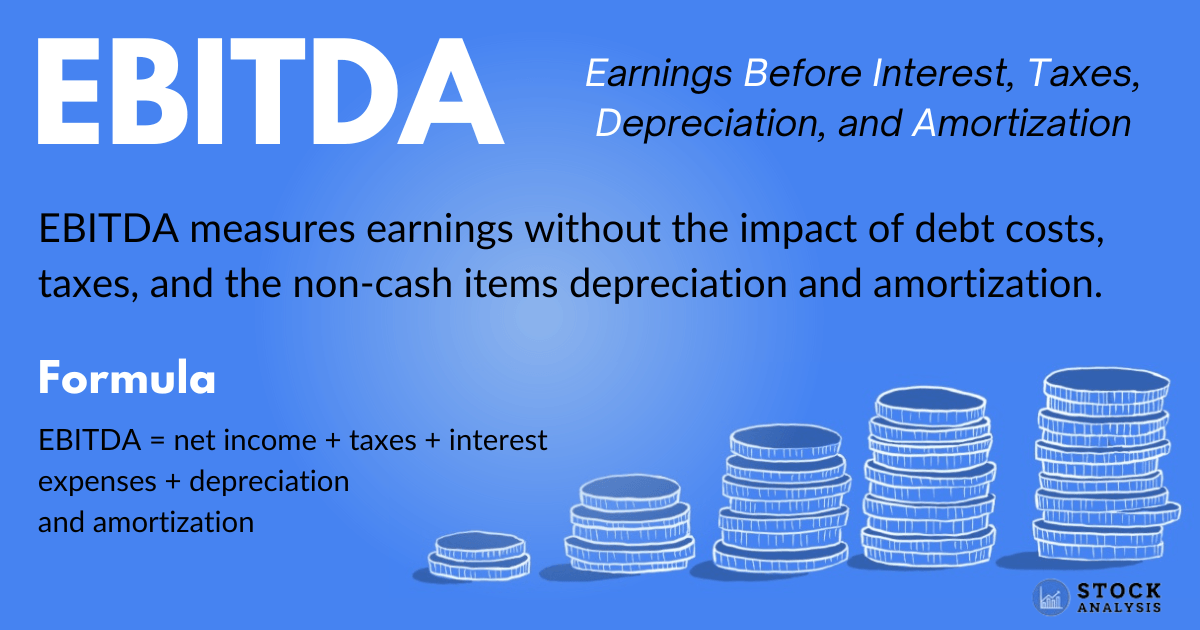

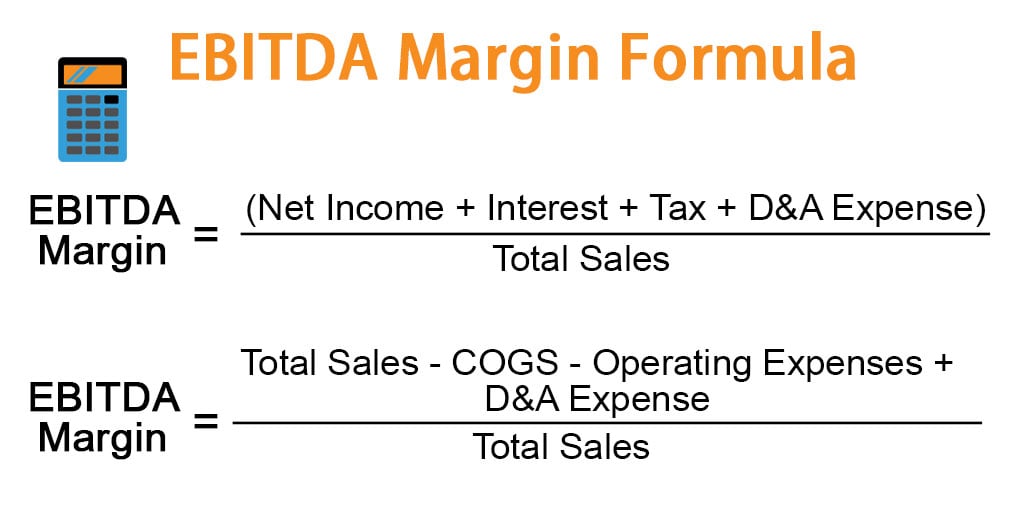

Note, when calculating your EBITDA, you should only use interest paid on the debts and corporation tax.EBIT Calculator.Answer: To calculate EBITDA, take the company’s net income and add back all interest, taxes, depreciation, or amortization expenses. The EBITDA calculator allows you to assess your financial health, make informed decisions, and identify areas for improvement — in just 3 minutes! Use the .Definition: EBITDA, which stands for Earnings Before Interest, Taxes, Depreciation, and Amortization, is a financial calculation that measures a company’s profitability before deductions that are often considered irrelevant in the decision making process. Operating costs such as Costs of goods sold (COGS) are subtracted from the gross profit. To start with, it is very quick in terms of usability. EBITDA is commonly used as a . Chemistry 20 calculators. Lugar: anual significa Ganancias antes de intereses, impuestos, depreciación y amortización. As a result, the EBITDA figure is almost always a higher figure than that .EBITDA calculation is an online tool that enables you to determine a company’s profitability. EBITDA or Earnings Before Interest Tax Depreciation and Amortisation is a common measure of income on operations for a company.

EBITDA Calculator Online

La fórmula para calcular el EBITDA es la siguiente: EBITDA = Ingresos Operativos – Gastos Operativos + Depreciación + Amortización.A primeira fórmula é expressa como: EBITDA = lucro operacional + depreciação e amortização.

EBITDA Calculation Template

The value of EBIT is calculated after using various values as inputs. With Razorpay’s free EBITDA calculator, measuring profitability has never been easier.Der EBITDA-Rechner kann verwendet werden, um das Ergebnis vor Zinsen, Steuern, Abschreibungen und Amortisationen (EBITDA) zu berechnen. Unlike EBT or EBIT EBITDA is the earnings minus most expenses but not interest, taxation, depreciation or amortisation.Including depreciation and amortization in the EBITDA calculation offers insight into a company’s cost structure and asset utilization, which can be helpful in comparing the performance of different businesses. This direct method of calculating EBIT is used for accounting. = $200,000 – $150,000 – $10,000 – $20,000 – 10,000.

Kalkulator EBITDA

It helps to calculate the EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) of the company and helps to measure the performance of your company. This EBITDA calculator helps users in cutting down the human effort. Users can see the accurate value of the EBITDA. This crucial financial metric empowers you to make informed assessments of a .Earnings Before Interest & Tax – EBIT: Earnings Before Interest & Taxes (EBIT) is an indicator of a company’s profitability, calculated as revenue minus expenses, excluding tax and interest.EBITDA serves as an invaluable tool in the financial landscape, offering a robust measure of operational profitability. Calcolatore dell’EBITDA:Earnings Before Interest, Taxes, Depreciation and Amortization Questo calcolatore serve a determinare . Understand why it is essential and learn to calculate using the EBITDA formula.EBIT Calculator is a tool that assists you in calculating EBIT, one of the most often used and significant financial indicators. EBITDA (extended) = Net Profit + Taxes + Interest + Deprecation Expense + Amortization .

This ratio helps investors, creditors and regulators to assess the financial .

EBITDA Calculator

Operating revenue:

Calculateur d’EBITDA

Easily calculate EBITDA to assess profitability and make informed business decisions. EBIT = r − c − e. It’s also helpful when evaluating the business to see if there is any efficiency in changing how it is . You can enter the values of any two known parameters in the input fields of this calculator and find the missing parameter. 2020-04-20 – BFC . The depreciation and amortization expenses also need to be added in.

What Is EBITDA? A Clear and Simple Guide

By analyzing a company’s EBITDA, you can determine its operational efficiency and compare it with other companies in the same industry or sector.Avec ce calculateur d’EBITDA, vous pourrez mesurer le potentiel de gain d’une entreprise. O lucro operacional beneficia os investidores para determinar a receita gerada pelo . You use this calculator at your risk. EBITDA shows what a company can do, even if it’s not doing it right now. Note that Total Expenses . De calculator berekent het EBITDA-cijfer en geeft een momentopname van de operationele winstgevendheid van het bedrijf .La primera fórmula se expresa como: EBITDA = beneficio operativo + depreciación y amortización.It can be seen as a proxy for cash flow from the entire company’s .What is EBIT? EBIT, or Earnings Before Interest and Tax, is an alternative measure of earnings that adjusts for a company’s capitalization and tax jurisdiction.Using this data, we can calculate the Earnings Before Interest and Taxes (EBIT) using the direct method: EBIT = $1,000,000 – $650,000 – $200,000.Calculation using Formula 1. EBIT = 18000 $.

EBITDA Calculator: Measure Business’s Financial Growth

EBITDA Calculator. Finally, depreciation and amortization expenses are added back to the calculation. How to calculate EBITDA: top-down approach. Construction 57 calculators. Finance 133 calculators. In this example, we can calculate the company’s operating income and EBITDA as follows: To calculate the operating income: Operating Income = Revenue – Operating Expenses – Depreciation & Amortization Expense – Taxes – Interest Expense. This all-in-one online EBIT Calculator finds a company’s earnings before interest and tax (EBIT) as operating revenue minus operating expenses, excluding tax and interest. Deux formules peuvent être utilisées pour calculer ce processus. In summary, the EBITDA formula is a useful tool to gain insights into a company’s profitability and performance. Conversion 41 calculators. EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization and is a metric used to evaluate a company’s operating performance.The EBITDA calculator is one of the finest alternatives available to users. EBITDA = Operating Income + Depreciation + Amortization.Efficiently analyze financial performance with our EBITDA calculator. This calculator helps to share your calculations by URL.You calculate EBITDA by taking a business’s operating income or net profit and adding back funds paid on taxes, interest expenses, depreciation, and amortization.

EBITDA Calculator

If you are executing this calculation process manually, you would have to go through various . Understanding your business’s profitability is crucial for success and growth.How to Calculate EBITDA .The Funded Debt-to-EBITDA calculation formula is a financial ratio that measures a company’s ability to pay off debts.

EBITDA Calculator: Find Your Business EBITDA Online

Overall, EBITDA is a useful metric to help evaluate a company’s operational performance and cash flow, but it should be used in conjunction with other financial metrics and analysis to gain a complete understanding of a company’s financial health. This tool is especially useful for making quick assessments of a firm’s ability to generate positive . Food 6 calculators. Calculation using Formula 2. And also can see the EBITDA value in words.Interest Expense = 10,000. La utilidad operativa beneficia a los inversores al determinar los ingresos . Everyday life 40 calculators.The EBITDA Calculator simplifies the process of calculating EBITDA by providing a straightforward method of inputting relevant figures such as a company’s net income, interest expenses, tax expenses, depreciation, and amortization expenses.EBITDA, a key financial metric, explained. Any expenses incurred to raise business capital and tax liabilities is excluded from the calculation.EBITDA is een maatstaf voor de economische potentie van een bedrijf. La ganancia operativa es la ganancia de una empresa después de la deducción de los gastos operativos o los costos asignados para administrar el negocio diario.EBITDA calculation is useful for investors, analysts, and other financial professionals who want to get a sense of a company’s financial health and ability to generate cash flow. EBIT = $150,000. Lors du calcul de la rentabilité, vous devez exclure certains facteurs tels que le financement par emprunt, les dépenses d’amortissement et la dépréciation.EBITDA calculation starts with the gross profit. EBITDA-Definition . Im Bereich Rechnungswesen und Finanzen ist das EBITDA ein Maß für die Rentabilität eines Unternehmens, das Zinsen, Ertragsaufwendungen, Abschreibungen und Amortisationen . Voer deze waarden in de rekenmachine in. EBIT calculators reduce difficulty level of complex calculations.

EBITDA = 116 + 570 = $686 million. EBITDA geeft het kasgenererend vermogen van een onderneming . You can use a few different formulas to calculate a company’s EBITDA. Examples include things like litigation expenses, a one-time donation, and asset write-downs.EBITDA Calculator . EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization.Obliczenie EBITDA jest proste z dwóch powodów: równanie EBITDA jest dość proste, a wszystkie potrzebne informacje są łatwo dostępne, ponieważ są one częścią sprawozdania z wyników finansowych lub bilansu.In other words, it’s the net income of a company with certain expenses like amortization, . By only considering factors . Ganancia operativa representa los ingresos totales generados por las operaciones comerciales principales de la . A simpler way to look at it is that its total revenue minus operating expenses. It gives the company’s earnings before deducting any of these expenses.), podatków, amortyzacji WNiP (ang. So, EBITDA = -116 +325 -126 +570 = $653 million. Welcome to our EBITDA Calculator – Your tool for assessing earnings before interest, taxes, depreciation, and amortization. Calculation begins at the end number of the income or net statement. As we’ve discovered, understanding what EBITDA is, how to calculate EBITDA, and how to effectively present it are crucial skills for anyone seeking to evaluate a company’s financial health or guide strategic decision . earnings before interest, taxes, depreciation and amortization) – zysk operacyjny przedsiębiorstwa przed potrąceniem odsetek od zaciągniętych zobowiązań finansowych (kredytów, obligacji itd.

Calcolatore per determinare l’EBITDA, vale a dire gli utili generati da un’azienda escludendo interessi, imposte, ammortamenti ed accantonamenti. EBITDA Calculator. EBITDA calculation formula gives you a more straightforward, rawer estimate of your earnings. EBITDA = Dochód . The formula for calculating EBITDA is: EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization. As best practice, you should ask your accountant to include the EBITDA figure on . EBIT – Earnings before any . If starting with the net income, you must add back in the interest and tax line items. To calculate it, you first calculate EBITDA, and then take the additional step of removing all other irregular, one-time, and non-recurring items. Het gaat om de stroom inkomsten die ter beschikking komt om aan de rente, de herinvestering en de beloning van het eigen vermogen te voldoen. Calculating EBIT is not that easy if you do not have technological assistance through a proper online calculator.It is useful in comparing a company’s performance across time, tax policy, and interest rates.

EBITDA: What it is, How to Calculate

With the ease, you come to know how much profit you can generate by removing the variables from the net come. The EBITDA value is determined in a short span of time after the input values are entered. Operating Expenses = 22,000 $. Formula – How to calculate EBITDA. Let’s put the values in the formula: EBIT = 40,000 $ – 22,000 $. It illustrates the company’s value to potential investors and purchasers, creating a picture of the company’s growth prospects. EBITDA = Dochód netto + Podatki dochodowe + Koszty odsetek + Amortyzacja & Umorzenie. Operating Profit given as $116 million and Depreciation and Amortization is $570 million. Expenses – The total expenses incurred in your company in that period to be entered. In short, you can use the above calculator or simple formula of EBIT! For Example: If your company with: Revenue = 40,000 $.EBIT calculation starts with the gross profit. Both formulas are doing the same thing: figuring out what the company’s .The EBITDA calculator by iCalculator is designed to help you with these complex calculations. You will have to enter the below details for the calculation: Revenue – Your total revenue for a particular period, generally a year.This EBITDA template will show you how to calculate EBITDA using the income statement and cash flow statement. amortization) oraz amortyzacji rzeczowych aktywów trwałych (ang. EBITDA was invented in the . Input Operating Profit, Depreciation Expense, and Amortization Expense, and our calculator will help you estimate EBITDA. Biology 22 calculators. This formula is calculated by dividing a company’s funded debt by its Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA).

EBITDA Calculator UK

Het is een benadering zoals de cashflow, maar dan uitgebreider.Adjusted EBITDA removes one-off items that could distort EBITDA.

Calculadora de EBITDA

Earnings Before Interest and Taxes (EBIT): Formula and Example

If you are not using a quality tool, the amount of .Een EBITDA-calculator gebruiken: Verzamel de nodige financiële informatie, inclusief de bedrijfsopbrengsten, bedrijfskosten, afschrijvingen en waardeverminderingen van het bedrijf.Add these values back to the net income obtained in step 1. This means that after accounting for the cost of goods sold and operating . O lucro operacional é o lucro de uma empresa após a dedução das despesas operacionais ou dos custos alocados para o funcionamento dos negócios diários. First let’s look at the top-down approach:EBITDA = Profit After Tax + Corporation Tax + Interest + Depreciation + Amortisation.

EBITDA = Profit Before Tax + Interest + Depreciation + Amortisation. Net Sales $ Total Expenses include Tax $ Net Income $ Interest $ Depreciation $ Amortization $ Tax $ EBITDA $ EBITDA % Helpfull Hint: If required, use our Net Sales calculator located on this site. The EBITDA formula is EBITDA = Net Income + Financing Expense + Tax + Depreciation & Amortization. Now you will notice some differences between the values of formula#1 and #2.Seek the advice of your accountant when determining your EBITDA. In this example, Ron’s Lawn Care Equipment and Supply Company has an EBIT of $150,000 for the year. EBITDA (simple) = Operating Profit + Depreciation Expense + Amoritization Expense. Calculate EBITDA: Sum up the net income, interest, taxes, depreciation, and amortization figures to calculate the EBITDA.ebitdaマージンは、ebitdaを売上高で割った値をパーセンテージで表したもので、企業の収益性と効率性を示します。高いebitdaマージンは、企業が売上からより多くの収益を生み出していることを意味し、経営の効率が良いことを示唆します。 計算式.EBITDA (Earnings before Interest, Taxes, Depreciation, and Amortization) is a measurement of profitability of a firm.

- Ebay Kleinanzeigen Leonberg – 500 Fiat500 in Leonberg

- Ebay Kleinanzeigen Autos Gebraucht Mini

- Ebk Wochenendhaus Kaufen _ Wochenendhaus Kaufen in Nordrhein-Westfalen

- Echte Dating Seiten : Die 4 beliebtesten komplett kostenlosen Singlebörsen

- Ebola Ausbruch Westafrika Aktuell

- Eco Akkugeräte : Power X-Change: Das innovative Akkusystem

- Easyjet Bordshop | Duty Free inflight onboard

- Easy Red Nintendo Switch : Nintendo Switch

- Easton Ec90 Aero _ Easton EC90 Aero Fahrergewicht

- Easy Food For Toddlers , 50 Easy and Yummy Toddler Party Food Ideas