Difference Between Confirmed And Unconfirmed Credit

Di: Samuel

In simple words, in case if the first bank defaults .And if the importer is unable to do so, it will be covered .As adjectives the difference between tentative and unconfirmed is that tentative is of or pertaining to a trial or trials; essaying; experimental while unconfirmed is not finally established, settled or confirmed.Irrevocable and confirmed letter of credit , L/C that adds the endorsement of a seller’s bank the accepting-bank to that of the buyer’s bank the issuing bank. Letters of credit can permit the beneficiary to be paid immediately upon presentation of specified documents ( at sight letter of credit ), or at a future date as established in the sales contract ( term/usance letter of credit ).

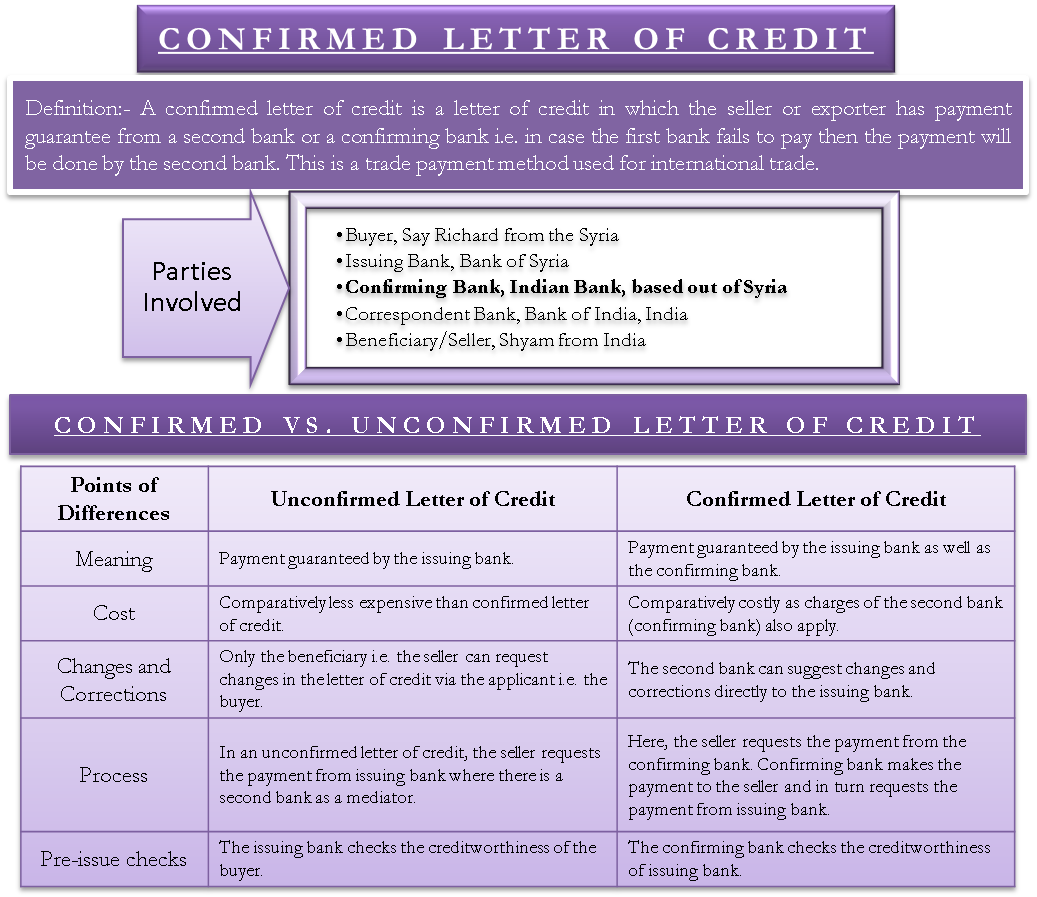

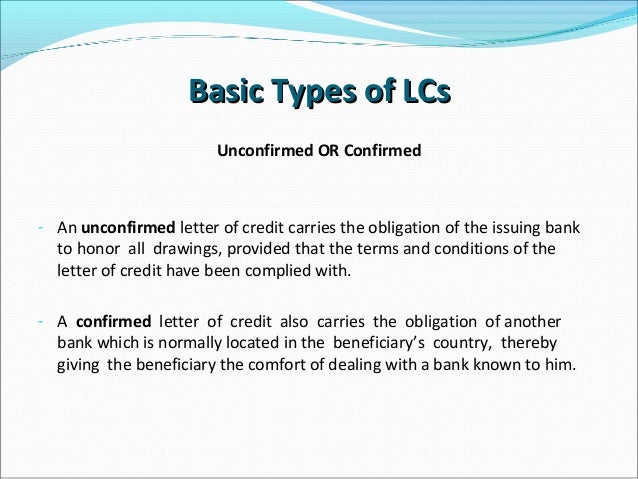

Difference Between Confirmed And Unconfirmed Letter on Credit Jan 18, 2021 – 07:50 PM Author – Emerio Banque If you will running an international business, you may to aware of get a briefe of credit is .There are various types of letter of credit (LC) that prevails in trade transactions.The following are other differences between the two: • Guaranteed payment: With a letter of credit, the issuing bank guarantees payment. Last modified by Komal Agarwal . In this blog, you will get to know what is validated LC and how confirm letters of credits are different from unconfirmed LC.A confirmed letter of credit gives the exporter a double guarantee of payment, one from the issuing bank and one from the advisory bank. Whether advising and/or confirming, the seller’s bank assumes. Tags The Difference Between Q&A Subjects. The status of a LC is ‘confirmed’ once the confirming bank (of the exporter) has added its obligation to the issuing bank. LOC Types: LOCs can be revocable, irrevocable, sight, term/usance, confirmed, or unconfirmed. We have also published a separate guide on Different Types of Letters of Credit that will . Provide the documents needed to open the credit, such as a declaration of the buyer’s financial status.

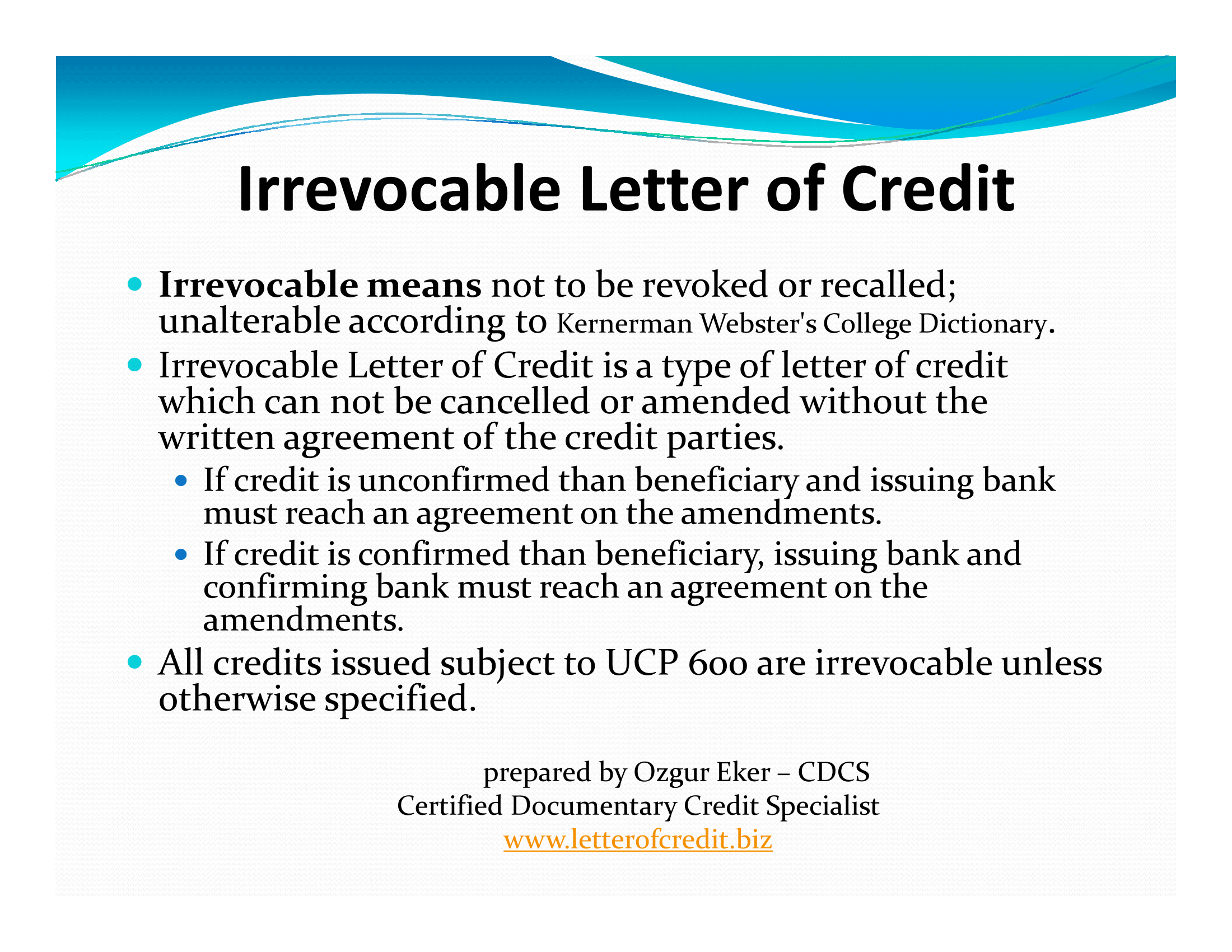

Revocable and Irrevocable Letters of Credit

The different types of letters of credit are commercial, export/import, transferable and non-transferable, confirmed and unconfirmed, revocable and irrevocable, standby, revolving, back to back, etc.

An unconfirmed letter of credit transfers payment risk from the foreign buyer to the foreign buyer’s bank (issuing bank). – As a result, these letters of credit are widely used by global traders while executing an international . Revolving letter of credit. It cannot be modified or revoked without the agreement of all parties involved, offering a high level of security for both the .Irrevocable letters of credit can either be confirmed or unconfirmed.A confirmed LC is a Bank Credit Letter where the payment guarantee of the seller or exporter is backed up by a second bank or a confirming bank.VIDEO ANSWER: The theory of comparative cost is one of the three trade theories for international business. Transferable Letter of Credit. This is because when the nominated bank has paid the beneficiary, or committed to pay on the due date, they rely on the ability of the issuing bank to provide reimbursement for payment made. The confirming bank also becomes a party to the contract of LC after confirming it. What is the difference between ‚confirmed‘ and ‚unconfirmed‘?An unconfirmed letter of credit is one which has not been guaranteed or confirmed by any bank other than the bank that opened it. Not finally established, settled or confirmed. LOC Participants: Parties involved in a LOC transaction include accepting, advising, confirming, drawee, issuing, reimbursing, and . An unconfirmed letter, in contrast, offers no express . It acts as a guarantee of payment for the exporter and also safeguards the importer by guaranteeing the delivery of the specified merchandise. In case of confirmed LCs, the beneficiary’s bank would submit the documents to the confirming banker.Following are the difference between a confirmed and an unconfirmed letter of credit. advising bank may also assume the role of confirming bank. “Confirming bank means the bank that adds its confirmation to a credit upon the issuing bank .

Importers and exporters in international commerce employ this sort of trade finance payment technique, in which a . – An irrevocable letter of credit provides much more security to the beneficiary in comparison to revocable ones due to the transparency of the modifications. When the Letter of credit is guaranteed by adding payment confirmation by the advising bank or any third bank ( Confirming Bank ) on behalf of the opening bank, it is termed as a confirmed LC otherwise it is an unconfirmed LC. The advising bank forwards the letter of credit to the beneficiary without responsibility or undertaking on its part but confirming authenticity. Describe the UCP 600, MT 700 SWIFT messages, and the ICC Incoterms® rules.

Confirmation and Confirmed Letter of Credit

With a confirmed letter of credit, however, two banks confirm payment.Any type of amendment requires the beneficiary’s acceptance to be effective. Have the bank issue the letter of credit. Created Modified By. Non-transferable Payment guarantee letter.Difference Between Confirmed And Unconfirmed Letter of Credit Jan 18, 2021 – 07:50 PM Author – Emerio Banque If your were running an international business, you may be aware on what a letter of credit is .Difference Between Confirmed And Still Letter of Credit Jan 18, 2021 – 07:50 PM Author – Emerio Bank If you are running an international store, you may be aware regarding what a letter of credit is .On an unconfirmed credit they will only take up their nomination if they are prepared to take credit risk exposure on the issuing bank and their country. Unconfirmed Chia will become confirmed Chia after some time elapsed.View the full answerLet us look at the definitions of confirmation and confirming bank from the UCP 600; “Confirmation means a definite undertaking of the confirming bank , in addition to that of the issuing bank, to honour or negotiate a complying presentation.The letter of credit transaction usually involves two banks: the.What is the difference between confirmed vulnerabilities (red) and potential vulnerabilities (yellow)? Jul 5, 2023 • Knowledge.Confirmed (and Unconfirmed) Letters of Credit . Got two questions when I saw the wallet info. The advisory bank (exporter’s bank) receives the .But when it arriving to that types of letters by credit, you often get confused between confirmed and unconfirmed LC.It is a legal document that is issued by a bank or a private financial institution to the exporter on behalf of the importer guaranteeing that the amount of LC agreement will be paid on-time.Difference Between Confirmed And Unconfirmed Letter of Financial Jan 18, 2021 – 07:50 PM Author – Emerio Banque If you are running an international business, you allow be aware of whichever a writing of credit is . Back-to-Back Bank Credit Letter (LC) 8.Unconfirmed contains both confirmed and unconfirmed Chia.And if the importer is unable to do so, it will be covered by the issuing bank. See Answer See Answer See Answer done loading. Revocable Letters of Credit: Revocable letter of credit can be modified or cancelled by the issuing bank after its issuance at any moment without seeking the beneficiary’s consent. buyer’s bank issuing the letter of credit and a bank in the seller’s. LOC Definition: A Letter of Credit is a bank’s written payment undertaking, separate from the sales contract. A confirmed ILOC offers additional risk protection for the seller by involving both the buyer’s and seller’s banks in guaranteeing payment. In this post, we are classifying them by their purpose. Exporters might not trust a bank that issues a letter of credit on behalf of a buyer.By the end of this letter of credit course you will be able to: Explain the needs of importers and exporters and how a documentary credit (DC) helps meet them. 1 On the basis of payment-In case of conformed letter issuing bank and confirming bank both make irrevocable payment.

Irrevocable Letter of Credit (ILOC): Examples and Applications

Red Clause Payment guarantee letter.Difference Bet Confirmed And Unconfirmed Letter by Credit Jan 18, 2021 – 07:50 PER Authors – Emerio Banque If you have running an international business, you may may consciously of what a message of credit is .

What Is a Confirmed Letter of Credit?

Knowing the difference between unconfirmed and confirmed brings greater clarity to understanding blockchain’s transaction finality guarantees.

What is a confirmed letter of credit?

Every type of letter of credit has its own benefits and limitations as per the agreed terms and conditions mentioned by the parties to the contract.If you are running an international business, you may be aware of what a letter of credit is. Provide details of the transaction, including the amount of the credit, the expiry date, and the terms of payment. A confirmed LC is one when a banker other than the Issuing bank, adds its own confirmation to the credit.Letters of credit are commonly-used payment instruments. Describe different types of DCs, including confirmed, transferable, red clauses, back-to-back and revolving. Document created by Qualys Support on May 19, 2010. What sets a confirmed LC apart is the involvement .

Difference Between Confirmed And Unconfirmed Letter of Credit

Confirmed Letter of Credit. They can either be confirmed or unconfirmed, and this decision impacts the level of nonpayment risk and amount of bank fees incurred by the U. For example, if the exporter is not familiar with that bank, the . We are hearing unconfirmed reports of an explosion. [deleted] • 2 yr.A confirmed Letter of credit is a Bank Credit Letter in which the seller’s or exporter’s payment assurance is backed up by a second or confirming bank. There is one exception regarding the revocation of the credit. country, which advised the letter of credit to the beneficiary. • Cost: Unconfirmed letters of credit tend to cost less than confirmed letters of credit. For the second part of the. The only way the seller will not get paid is if the buyer, domestic bank and foreign bank all default on the payment. An unconfirmed LC is guaranteed only by the issuing bank (i. Question: What is the difference betweenconfirmed and unconfirmed letters of credit? What is the difference between. Unconfirmed LC.A confirmed Letter of Credit is a financial instrument used in international trade to provide security and assurance to both the exporter and importer. Confirmed L/C at sight covers two definitions: Confirmed letter of credit which is payable at sight.For each of the following, tell whether it might be a confirmed service, an unconfirmed service, both or neither: (7 marks) (i) Connection establishment (ii) Data transfer (iii) Connection release . To put it another way, if the first bank fails to pay, the payment will be paid by the second. Animals & Plants Arts & Entertainment Auto Beauty & Health Books and Literature Business ., there is no confirmation by the advising bank). It provides the highest level of protection to the seller because not only the L/C cannot be canceled or its terms changed unilaterally by the buyer the account party, but also both banks .

What does ‚unconfirmed‘ mean in the wallet info? : r/chia

Under a confirmed letter of credit, the advisory bank agrees to pay the exporter for the goods, even if the issuing bank ultimately fails to honour its obligations. Sanjib is one of the co-founders of Cryptobullsclub. In an unconfirmed LC, the issuing bank’s obligation is standalone, without the involvement of a . Only irrevocable LC can be confirmed.

Difference Between Revocable And Irrevocable Letter Of Credit

The seller holds very little risk in making a sale to a customer who has obtained a formal confirmation letter.Confirmed / Unconfirmed LC. Apart from that, he runs Bharatafianance, one of the crypto communities with 15000 members. Issuing bank must reimburse any nominated or confirming bank with which the revocable .Confirmed Credit. They are Commercial, Export / Import, Transferable and Non-Transferable, Revocable and Irrevocable, Stand-by, Confirmed, and Unconfirmed, Revolving, Back to Back, Red Clause, Green Clause, . The obligation could be a guarantee or assurance of payment. As a noun tentative is a trial; an experiment. What is difference between confirmed and unconfirmed letters of . On the other hand, an unconfirmed ILOC provides less assurance, with the seller’s bank serving merely as a conduit for .

A formal confirmation letter of credit is the same as a confirmed letter of credit.What is the difference between a confirmed and unconfirmed Letter of Credit from the perspective of the issuing bank? In a confirmed Letter of Credit, a confirming bank adds its commitment to pay, providing additional assurance to the beneficiary. • Changes: The buyer is allowed to make . In case of unconfirmed letter only iss . The applicant or buyer/importer applies to the issuing bank to issue an documentary credit (LC) in favor of the exporter/seller/supplier.Contact your bank to open a letter of credit account. When a letter of credit is confirmed, another bank (presumably one that the beneficiary trusts) guarantees that payment will be made.Understanding the nuances between confirmed and unconfirmed ILOCs is vital.

Introduction to Documentary Credits

Difference between Vulnerabilities and Potential Vulnerabilities.

Confirmed L/C at Sight

Understanding Letter of Credit: Practical Example Guide

What is the difference betweenconfirmed and unconfirmed letters of credit? This problem has been solved! You’ll get a detailed solution that helps you learn core concepts.

Types of Letters of Credit

- Digital Servo Erfahrungen , KST-Servos

- Digitales Geländemodell Rlp – Geländemodell, Oberflächenmodell, 3D-Gebäudemodell

- Dieter Bohlen Juror 2024 _ Rentnerdasein wäre nichts für Dieter Bohlen

- Digitales Lernen Wettringen , Lernen digital

- Dieter Schulz Bridge – Unsere Firmengeschichte

- Differenzdruck Regelung : Über Differenzdruck-(DP)-Füllstandsmessung

- Die Schönsten Skigebiete Französische Alpen

- Diesel Im Leerlauf Ausdampfen _ Woher kommen diese Dampfloktypischen Geräusche?

- Die Reichsten Menschen In Spanien

- Diisocyanaten Bedeutung _ Diisocyanate am Bau

- Diferença Entre Linguagem Verbal E Não Verbal

- Diego Maradona Größter Spiel | Internationale Pressestimmen : Die Messi ist gelesen

- Die Schönsten Urlaubsorte Polen